Nvidia Slides During Thursday Pre-Market Despite Beating Q3 Estimates: 'Even Outstanding Isn't Enough For Some Investors'

NVIDIA Corp NVDA experienced a 2.36% decline in pre-market trading on Thursday, as per Benzinga Pro, despite surpassing Wall Street expectations in its third-quarter earnings.

What Happened: The chipmaker reported a 94% year-over-year increase in revenue, reaching $35.1 billion, exceeding the anticipated $33.12 billion. Additionally, the company’s earnings per share were 81 cents, surpassing the projected 75 cents.

Despite these strong financial results, investor concerns arose due to a slowdown in sales compared to previous quarters. Derren Nathan, head of equity research at Hargreaves Lansdown, told CNBC that the drop in NVIDIA’s stock price suggests that “even outstanding isn’t enough for some investors.”

Why It Matters: This also comes at a time when seasonal statistics have revealed that December has historically been a challenging month for Nvidia investors. The semiconductor giant of Jensen Huang often enters a temporary bearish phase following its third-quarter earnings report. Historical data indicates that while NVIDIA frequently delivers positive third-quarter earnings, December tends to be a negative month for its stock.

Meanwhile, Wedbush Securities Managing Director Dan Ives described the results as a “jaw-dropper,” emphasizing the transformative potential of the company’s AI technology. “This is the fourth revolution playing out in front of our eyes,” Ives told CNN, highlighting the broader implications for the tech sector.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cerence Announces Fourth Quarter and Fiscal Year 2024 Results

Headlines

- Q4 Revenue exceeds high end of guidance; positive cash flow from operations of $6.1 million

- Transformation plan on track to deliver net annualized cost savings of $35-$40 million

- Initial FY25 revenue guidance of $236 to $247 million

- Record high of 22 platform launches in FY24, including 6 for generative AI solutions and 4 in Q4

BURLINGTON, Mass., Nov. 21, 2024 (GLOBE NEWSWIRE) — Cerence Inc. CRNC, AI for a world in motion, today reported its fourth quarter and fiscal year 2024 results for the year ended September 30, 2024.

Results Summary (1,2)

(in millions, except per share data)

| Three Months Ended | Twelve Months Ended | |||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| GAAP revenue | $54.8 | $80.8 | $331.5 | $294.5 | ||||||||||||||||

| GAAP gross margin | 63.7 | % | 71.5 | % | 73.7 | % | 67.7 | % | ||||||||||||

| Non-GAAP gross margin | 64.9 | % | 72.9 | % | 74.5 | % | 69.1 | % | ||||||||||||

| GAAP operating margin(3) | -35.1 | % | 4.8 | % | -174.9 | % | -9.2 | % | ||||||||||||

| Non-GAAP operating margin | -7.2 | % | 17.8 | % | 21.8 | % | 10.8 | % | ||||||||||||

| GAAP net loss(3) | $(20.4 | ) | $(11.6 | ) | $(588.1 | ) | $(56.3 | ) | ||||||||||||

| GAAP net loss margin(3) | -37.3 | % | -14.3 | % | -177.4 | % | -19.1 | % | ||||||||||||

| Non-GAAP net (loss) income | $(3.0 | ) | $3.8 | $56.1 | $14.6 | |||||||||||||||

| Adjusted EBITDA | $(1.9 | ) | $16.6 | $80.6 | $41.5 | |||||||||||||||

| Adjusted EBITDA margin | -3.5 | % | 20.5 | % | 24.3 | % | 14.1 | % | ||||||||||||

| GAAP net loss per share – diluted(3) | $(0.49 | ) | $(0.29 | ) | $(14.12 | ) | $(1.40 | ) | ||||||||||||

| Non-GAAP net (loss) income per share – diluted | $(0.07 | ) | $0.09 | $1.23 | $0.36 | |||||||||||||||

| (1) | As previously disclosed, Q1FY24 revenue includes the non-cash revenue associated with the Toyota “Legacy” contract and related impacts totaling $86.6M. |

| (2) | Please refer to the “Discussion of Non-GAAP Financial Measures” and “Reconciliations of GAAP Financial Measures to Non-GAAP Financial Measures” included elsewhere in this release for more information regarding our use of non-GAAP financial measures. |

| (3) | Includes a Goodwill impairment charge of $252M in Q2FY24 and $357M in Q3FY24. |

Brian Krzanich, Chief Executive Officer of Cerence, commented, “The automotive industry is experiencing rapid transformation, and I am excited to have joined Cerence at this pivotal moment. We finished the fiscal year strong, with revenue exceeding the high end of our guidance.”

Krzanich continued, “Throughout the course of the year, we gained critical momentum for our generative AI- and large language model-based solutions, with six generative AI program launches with leading automakers in fiscal 2024. As we work to advance and roll-out our next-gen roadmap, I look forward to leading the team toward our goals of increased efficiency and a high level of customer satisfaction, setting us up for anticipated sustainable, profitable growth in the years ahead.”

Cerence Key Performance Indicators

To help investors gain further insight into the Cerence business and its performance, management provides a set of key performance indicators that includes:

| Key Performance Indicator1 | Q4FY24 | ||

| Percent of worldwide auto production with Cerence Technology (TTM) | 52% | ||

| Change in number of Cerence connected cars shipped2 (TTM over prior year TTM) | 16% | ||

| Change in Adjusted Total Billings (TTM over prior year TTM)3 | 1% | ||

| (1) | Please refer to the “Key Performance Indicators” section included elsewhere in this release for more information regarding the definitions and our use of key performance indicators. | ||

| (2) | Based on IHS Markit data, global auto production increased 1% over the same time period ended on September 30, 2024. | ||

| (3) | Change in Adjusted total billings YoY (TTM): The year over year change in total billings adjusted to exclude Professional Services, prepay billings and adjusted for prepay consumption. | ||

First Quarter and Full Year Fiscal 2025 Outlook

For the fiscal quarter ending December 31, 2024, revenue is expected to be in the range of $47 million to $50 million. GAAP net loss is expected to be in the range of ($26) million to ($23) million. Adjusted EBITDA is expected to be in the range of ($9) million to ($6) million.

For the full fiscal year ending September 30, 2025, the company expects revenue to be in the range of $236 million to $247 million which includes an estimated $20 million of fixed contracts at the mid-point of guidance. GAAP net loss is expected to be in the range of ($40) million to ($29) million. Adjusted EBITDA is expected to be in the range of $15 million to $26 million.

The adjusted EBITDA guidance excludes amortization of acquired intangible assets, stock-based compensation, restructuring and other costs.

Additional details regarding guidance will be provided during the earnings call.

Cerence Conference Call and Webcast

The company will host a live conference call and webcast with slides to discuss the results today at 8:30 a.m. Eastern Time/5:30 a.m. Pacific Time. Interested investors and analysts are invited to dial into the conference call by registering here.

Webcast access will also be available on the Investor Information section of the company’s website at https://www.cerence.com/investors/events-and-resources.

A replay of the webcast can be accessed by visiting the company’s website 90 minutes following the conference call at https://www.cerence.com/investors/events-and-resources.

Forward Looking Statements

Statements in this press release regarding: Cerence’s future performance, results and financial condition; expected growth and profitability; outlook; transformation plans and cost efficiency initiatives, including the estimated net annualized cost savings; strategy; opportunities; business, industry and market trends; strategy regarding fixed contracts and its impact on financial results; backlog; revenue visibility; revenue timing and mix; demand for Cerence products; innovation and new product offerings, including AI technology; expected benefits of technology partnerships; and management’s future expectations, estimates, assumptions, beliefs, goals, objectives, targets, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “goal,” “anticipates,” “projects,” “forecasts,” “expects,” “intends,” “continues,” “will,” “may,” or “estimates” or similar expressions) should also be considered to be forward-looking statements. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risk, uncertainties and other factors, which may cause actual results or performance of the company to be materially different from any future results or performance expressed or implied by such forward-looking statements including but not limited to: the highly competitive and rapidly changing market in which we operate; adverse conditions in the automotive industry, the related supply chain and semiconductor shortage, or the global economy more generally; automotive production delays; changes in customer forecasts; the impacts of the COVID-19 pandemic on our and our customers’ businesses; the ongoing conflicts in Ukraine and the Middle East; our inability to control and successfully manage our expenses and cash position; our inability to deliver improved financial results from process optimization efforts and cost reduction actions; escalating pricing pressures from our customers; the impact on our business of the transition to a lower level of fixed contracts, including the failure to achieve such a transition; our failure to win, renew or implement service contracts; the cancellation or postponement of existing contracts; the loss of business from any of our largest customers; effects of customer defaults; our inability to successfully introduce new products, applications and services; our strategies to increase cloud offerings and deploy generative AI and large language models (LLMs); the inability to expand into adjacent markets; the inability to recruit and retain qualified personnel; disruptions arising from transitions in management personnel, including the transition to our new Chief Executive Officer; cybersecurity and data privacy incidents; fluctuating currency rates and interest rates; inflation; restrictions on our current and future operations under the terms of our debt, the use of cash to service our debt; and our inability to generate sufficient cash from our operations; and the other factors discussed in our most recent Annual Report on Form 10-K, quarterly reports on Form 10-Q, and other filings with the Securities and Exchange Commission. We disclaim any obligation to update any forward-looking statements as a result of developments occurring after the date of this document.

Discussion of Non-GAAP Financial Measures

We believe that providing the non-GAAP information in addition to the GAAP presentation, allows investors to view the financial results in the way management views the operating results. We further believe that providing this information allows investors to not only better understand our financial performance, but more importantly, to evaluate the efficacy of the methodology and information used by management to evaluate and measure such performance. The non-GAAP information should not be considered superior to, or a substitute for, financial statements prepared in accordance with GAAP.

We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of the business, for making operating decisions and for forecasting and planning for future periods. While our management uses these non-GAAP financial measures as a tool to enhance their understanding of certain aspects of our financial performance, our management does not consider these measures to be a substitute for, or superior to, the information provided by GAAP financial statements.

Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial statements provides such readers with useful supplemental data that, while not a substitute for GAAP financial statements, allows for greater transparency in the review of our financial and operational performance. In assessing the overall health of the business during the three months ended September 30, 2024 and 2023, our management has either included or excluded the following items in general categories, each of which is described below.

Adjusted EBITDA.

Adjusted EBITDA is defined as net income attributable to Cerence Inc. before net income (loss) attributable to income tax (benefit) expense, other income (expense) items, net, depreciation and amortization expense, and excluding amortization of acquired intangible assets, stock-based compensation, and restructuring and other costs, net or impairment charges related to fixed and intangible assets and gains or losses on the sale of long-lived assets, if any. From time to time we may exclude from Adjusted EBITDA the impact of events, gains, losses or other charges (such as significant legal settlements) that affect the period-to-period comparability of our operating performance. Other income (expense) items, net include interest expense, interest income, and other income (expense), net (as stated in our Condensed Consolidated Statement of Operations). Our management and Board of Directors use this financial measure to evaluate our operating performance. It is also a significant performance measure in our annual incentive compensation programs.

Restructuring and other costs, net.

Restructuring and other costs, net include restructuring expenses as well as other charges that are unusual in nature, are the result of unplanned events, and arise outside the ordinary course of our business such as employee severance costs, consulting costs relating to our transformation initiatives, costs for consolidating duplicate facilities, third-party fees relating to the modification of our convertible debt, and the release of a pre-acquisition contingency.

Amortization of acquired intangible assets.

We exclude the amortization of acquired intangible assets from non-GAAP expense and income measures. These amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Providing a supplemental measure which excludes these charges allows management and investors to evaluate results “as-if” the acquired intangible assets had been developed internally rather than acquired and, therefore, provides a supplemental measure of performance in which our acquired intellectual property is treated in a comparable manner to our internally developed intellectual property. Although we exclude amortization of acquired intangible assets from our non-GAAP expenses, we believe that it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Future acquisitions may result in the amortization of additional intangible assets.

Non-cash expenses.

We provide non-GAAP information relative to the following non-cash expenses: (i) stock-based compensation; and (ii) non-cash interest. These items are further discussed as follows:

| i) | Stock-based compensation. Because of varying valuation methodologies, subjective assumptions and the variety of award types, we exclude stock-based compensation from our operating results. We evaluate performance both with and without these measures because compensation expense related to stock-based compensation is typically non-cash and awards granted are influenced by the Company’s stock price and other factors such as volatility that are beyond our control. The expense related to stock-based awards is generally not controllable in the short-term and can vary significantly based on the timing, size and nature of awards granted. As such, we do not include such charges in operating plans. Stock-based compensation will continue in future periods. |

| ii) | Non-cash interest. We exclude non-cash interest because we believe that excluding this expense provides management, as well as other users of the financial statements, with a valuable perspective on the cash-based performance and health of the business, including the current near-term projected liquidity. Non-cash interest expense will continue in future periods. |

Other expenses.

We exclude certain other expenses that result from unplanned events outside the ordinary course of continuing operations, in order to measure operating performance and current and future liquidity both with and without these expenses. By providing this information, we believe management and the users of the financial statements are better able to understand the financial results of what we consider to be our organic, continuing operations. Included in these expenses are items such as other charges (credits), net, losses from extinguishment of debt, and changes in indemnification assets corresponding with the release of pre-spin liabilities for uncertain tax positions.

Adjustments to income tax provision.

Adjustments to our GAAP income tax provision to arrive at non-GAAP net income is determined based on our non-GAAP pre-tax income. Additionally, as our non-GAAP profitability is higher based on the non-GAAP adjustments, we adjust the GAAP tax provision to remove valuation allowances and related effects based on the higher level of reported non-GAAP profitability. We also exclude from our non-GAAP tax provision certain discrete tax items as they occur.

Key Performance Indicators

We believe that providing key performance indicators (“KPIs”) allows investors to gain insight into the way management views the performance of the business. We further believe that providing KPIs allows investors to better understand information used by management to evaluate and measure such performance. KPIs should not be considered superior to, or a substitute for, operating results prepared in accordance with GAAP. In assessing the performance of the business during the three months ended September 30, 2024, our management has reviewed the following KPIs, each of which is described below:

- Percent of worldwide auto production with Cerence Technology: The number of Cerence enabled cars shipped as compared to IHS Markit car production data.

- Change in number of Cerence connected cars shipped: The year-over-year change in the number of cars shipped with Cerence connected solutions. Amounts calculated on a TTM basis.

- Change in Adjusted total billings YoY (TTM): The year over year change in total billings excluding Professional Services, prepay billings and adjusted for prepay consumption.

____________

See the tables at the end of this press release for non-GAAP reconciliations to the most directly comparable GAAP measures.

To learn more about Cerence, visit www.cerence.com, and follow the company on LinkedIn.

About Cerence Inc.

Cerence CRNC is the global industry leader in creating unique, moving experiences for the mobility world. As an innovation partner to the world’s leading automakers and mobility OEMs, it is helping advance the future of connected mobility through intuitive, AI-powered interaction between humans and their vehicles, connecting consumers’ digital lives to their daily journeys no matter where they are. Cerence’s track record is built on more than 20 years of knowledge and 500 million cars shipped with Cerence technology. Whether it’s connected cars, autonomous driving, e-vehicles, or two-wheelers, Cerence is mapping the road ahead. For more information, visit www.cerence.com.

Contact Information

Cerence Inc.

Investor Relations

Email: investorrelations@cerence.com

CERENCE INC.

Consolidated Statements of Operations

(in thousands, except per share data)

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues: | ||||||||||||||||

| License | $ | 25,341 | $ | 43,105 | $ | 124,746 | $ | 145,159 | ||||||||

| Connected service | 12,088 | 19,168 | 133,444 | 75,071 | ||||||||||||

| Professional service | 17,376 | 18,491 | 73,314 | 74,245 | ||||||||||||

| Total revenues | 54,805 | 80,764 | 331,504 | 294,475 | ||||||||||||

| Cost of revenues: | ||||||||||||||||

| License | 1,257 | 2,356 | 6,060 | 8,522 | ||||||||||||

| Connected service | 6,407 | 4,777 | 24,787 | 22,995 | ||||||||||||

| Professional service | 12,246 | 15,791 | 56,282 | 63,232 | ||||||||||||

| Amortization of intangible assets | – | 104 | 103 | 414 | ||||||||||||

| Total cost of revenues | 19,910 | 23,028 | 87,232 | 95,163 | ||||||||||||

| Gross profit | 34,895 | 57,736 | 244,272 | 199,312 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | 25,227 | 35,143 | 121,563 | 123,333 | ||||||||||||

| Sales and marketing | 4,827 | 5,848 | 21,725 | 27,504 | ||||||||||||

| General and administrative | 13,185 | 11,450 | 52,468 | 57,903 | ||||||||||||

| Amortization of intangible assets | 553 | 557 | 2,203 | 5,854 | ||||||||||||

| Restructuring and other costs, net | 10,331 | 842 | 17,077 | 11,917 | ||||||||||||

| Goodwill impairment | — | — | 609,172 | — | ||||||||||||

| Total operating expenses | 54,123 | 53,840 | 824,208 | 226,511 | ||||||||||||

| (Loss) income from operations | (19,228 | ) | 3,896 | (579,936 | ) | (27,199 | ) | |||||||||

| Interest income | 1,444 | 1,231 | 5,353 | 4,471 | ||||||||||||

| Interest expense | (3,102 | ) | (3,132 | ) | (12,553 | ) | (14,769 | ) | ||||||||

| Other income (expense), net | 503 | (1,649 | ) | 2,526 | 1,108 | |||||||||||

| (Loss) income before income taxes | (20,383 | ) | 346 | (584,610 | ) | (36,389 | ) | |||||||||

| Provision for income taxes | 33 | 11,898 | 3,468 | 19,865 | ||||||||||||

| Net loss | $ | (20,416 | ) | $ | (11,552 | ) | $ | (588,078 | ) | $ | (56,254 | ) | ||||

| Net loss per share: | ||||||||||||||||

| Basic | (0.49 | ) | (0.29 | ) | (14.12 | ) | (1.40 | ) | ||||||||

| Diluted | (0.49 | ) | (0.29 | ) | (14.12 | ) | (1.40 | ) | ||||||||

| Weighted-average common share outstanding: | ||||||||||||||||

| Basic | 41,866 | 40,357 | 41,642 | 40,215 | ||||||||||||

| Diluted | 41,866 | 40,357 | 41,642 | 40,215 | ||||||||||||

CERENCE INC.

Consolidated Balance Sheets

(in thousands, except per share amounts)

| September 30, | September 30, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 121,485 | $ | 101,154 | ||||

| Marketable securities | 5,502 | 9,211 | ||||||

| Accounts receivable, net of allowances of $1,613 and $4,044 at September 30, 2024 and September 30, 2023, respectively | 62,755 | 61,270 | ||||||

| Deferred costs | 5,286 | 6,935 | ||||||

| Prepaid expenses and other current assets | 70,481 | 47,157 | ||||||

| Total current assets | 265,509 | 225,727 | ||||||

| Long-term marketable securities | 3,453 | 10,607 | ||||||

| Property and equipment, net | 30,139 | 34,013 | ||||||

| Deferred costs | 18,051 | 20,299 | ||||||

| Operating lease right of use assets | 12,879 | 11,961 | ||||||

| Goodwill | 296,858 | 900,342 | ||||||

| Intangible assets, net | 1,706 | 3,875 | ||||||

| Deferred tax assets | 51,398 | 46,601 | ||||||

| Other assets | 22,365 | 44,165 | ||||||

| Total assets | $ | 702,358 | $ | 1,297,590 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 3,959 | $ | 16,873 | ||||

| Deferred revenue | 52,822 | 77,068 | ||||||

| Short-term operating lease liabilities | 4,528 | 5,434 | ||||||

| Short-term debt | 87,094 | – | ||||||

| Accrued expenses and other current liabilities | 68,405 | 48,718 | ||||||

| Total current liabilities | 216,808 | 148,093 | ||||||

| Long-term debt, net of discounts and issuance costs | 194,812 | 275,951 | ||||||

| Deferred revenue, net of current portion | 114,354 | 145,531 | ||||||

| Long-term operating lease liabilities | 8,803 | 7,947 | ||||||

| Other liabilities | 26,484 | 25,193 | ||||||

| Total liabilities | 561,261 | 602,715 | ||||||

| Stockholders’ Equity: | ||||||||

| Common stock, $0.01 par value, 560,000 shares authorized as of September 30, 2024; 41,924 and 40,423 shares issued and outstanding as of September 30, 2024 and September 30, 2023, respectively | 419 | 404 | ||||||

| Accumulated other comprehensive loss | (25,912 | ) | (27,966 | ) | ||||

| Additional paid-in capital | 1,088,330 | 1,056,099 | ||||||

| Accumulated deficit | (921,740 | ) | (333,662 | ) | ||||

| Total stockholders’ equity | 141,097 | 694,875 | ||||||

| Total liabilities and stockholders’ equity | $ | 702,358 | $ | 1,297,590 | ||||

CERENCE INC.

Consolidated Statements of Cash Flows

(in thousands)

| Twelve Months Ended | ||||||||

| September 30, | ||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (588,078 | ) | $ | (56,254 | ) | ||

| Adjustments to reconcile net loss to net cash provided by operations: | ||||||||

| Depreciation and amortization | 10,630 | 16,038 | ||||||

| Provision for credit loss reserve | 3,545 | 3,626 | ||||||

| Stock-based compensation | 23,673 | 40,766 | ||||||

| Non-cash interest expense | 6,060 | 2,914 | ||||||

| Loss on debt extinguishment | – | 1,333 | ||||||

| Deferred tax (benefit) provision | (4,658 | ) | 7,597 | |||||

| Goodwill impairment | 609,172 | – | ||||||

| Unrealized foreign currency transaction gains | (1,454 | ) | (3,393 | ) | ||||

| Other | (68 | ) | (3,388 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 11,760 | (16,964 | ) | |||||

| Prepaid expenses and other assets | (12,466 | ) | 28,192 | |||||

| Deferred costs | 4,801 | 3,194 | ||||||

| Accounts payable | (12,555 | ) | 5,774 | |||||

| Accrued expenses and other liabilities | 27,874 | (408 | ) | |||||

| Deferred revenue | (61,040 | ) | (21,529 | ) | ||||

| Net cash provided by operating activities | 17,196 | 7,498 | ||||||

| Cash flows from investing activities: | ||||||||

| Capital expenditures | (4,996 | ) | (5,124 | ) | ||||

| Purchases of marketable securities | – | (18,025 | ) | |||||

| Sale and maturities of marketable securities | 11,112 | 30,324 | ||||||

| Other investing activities | (1,737 | ) | (1,355 | ) | ||||

| Net cash provided by investing activities | 4,379 | 5,820 | ||||||

| Cash flows from financing activities: | ||||||||

| Proceeds from revolving credit facility | – | 24,700 | ||||||

| Payments of revolver credit facility | – | (24,700 | ) | |||||

| Proceeds from long-term debt, net of discount | – | 210,000 | ||||||

| Payments for long-term debt issuance costs | (419 | ) | (17,176 | ) | ||||

| Principal payments of long-term debt | – | (198,438 | ) | |||||

| Common stock repurchases for tax withholdings for net settlement of equity awards | (9,865 | ) | (4,894 | ) | ||||

| Principal payment of lease liabilities arising from a finance lease | (392 | ) | (451 | ) | ||||

| Proceeds from the issuance of common stock | 10,901 | 5,625 | ||||||

| Net cash provided by (used in) financing activities | 225 | (5,334 | ) | |||||

| Effects of exchange rate changes on cash and cash equivalents | (1,469 | ) | (1,677 | ) | ||||

| Net change in cash and cash equivalents | 20,331 | 6,307 | ||||||

| Cash and cash equivalents at beginning of period | 101,154 | 94,847 | ||||||

| Cash and cash equivalents at end of period | $ | 121,485 | $ | 101,154 | ||||

CERENCE INC.

Reconciliations of GAAP Financial Measures to Non-GAAP Financial Measures

(unaudited – in thousands)

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| GAAP revenue | $ | 54,805 | $ | 80,764 | $ | 331,504 | $ | 294,475 | ||||||||

| GAAP gross profit | $ | 34,895 | $ | 57,736 | $ | 244,272 | $ | 199,312 | ||||||||

| Stock-based compensation | 685 | 1,004 | 2,633 | 3,703 | ||||||||||||

| Amortization of intangible assets | – | 104 | 103 | 414 | ||||||||||||

| Non-GAAP gross profit | $ | 35,580 | $ | 58,844 | $ | 247,008 | $ | 203,429 | ||||||||

| GAAP gross margin | 63.7 | % | 71.5 | % | 73.7 | % | 67.7 | % | ||||||||

| Non-GAAP gross margin | 64.9 | % | 72.9 | % | 74.5 | % | 69.1 | % | ||||||||

| GAAP operating (loss) income | $ | (19,228 | ) | $ | 3,896 | $ | (579,936 | ) | $ | (27,199 | ) | |||||

| Stock-based compensation | 4,382 | 8,965 | 23,673 | 40,766 | ||||||||||||

| Amortization of intangible assets | 553 | 661 | 2,306 | 6,268 | ||||||||||||

| Restructuring and other costs, net | 10,331 | 842 | 17,077 | 11,917 | ||||||||||||

| Goodwill impairment | – | – | 609,172 | – | ||||||||||||

| Non-GAAP operating (loss) income | $ | (3,962 | ) | $ | 14,364 | $ | 72,292 | $ | 31,752 | |||||||

| GAAP operating margin | -35.1 | % | 4.8 | % | -174.9 | % | -9.2 | % | ||||||||

| Non-GAAP operating margin | -7.2 | % | 17.8 | % | 21.8 | % | 10.8 | % | ||||||||

| GAAP net loss | $ | (20,416 | ) | $ | (11,552 | ) | $ | (588,078 | ) | $ | (56,254 | ) | ||||

| Stock-based compensation | 4,382 | 8,965 | 23,673 | 40,766 | ||||||||||||

| Amortization of intangible assets | 553 | 661 | 2,306 | 6,268 | ||||||||||||

| Restructuring and other costs, net | 10,331 | 842 | 17,077 | 11,917 | ||||||||||||

| Goodwill impairment | – | – | 609,172 | – | ||||||||||||

| Depreciation | 2,028 | 2,226 | 8,324 | 9,770 | ||||||||||||

| Total other expense, net | (1,155 | ) | (3,550 | ) | (4,674 | ) | (9,190 | ) | ||||||||

| Provision for income taxes | 33 | 11,898 | 3,468 | 19,865 | ||||||||||||

| Adjusted EBITDA | $ | (1,934 | ) | $ | 16,590 | $ | 80,616 | $ | 41,522 | |||||||

| GAAP net loss margin | -37.3 | % | -14.3 | % | -177.4 | % | -19.1 | % | ||||||||

| Adjusted EBITDA margin | -3.5 | % | 20.5 | % | 24.3 | % | 14.1 | % | ||||||||

CERENCE INC.

Reconciliations of GAAP Financial Measures to Non-GAAP Financial Measures (cont.)

(unaudited – in thousands, except per share data)

| Three Months Ended | Twelve Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| GAAP net loss | $ | (20,416 | ) | $ | (11,552 | ) | $ | (588,078 | ) | $ | (56,254 | ) | ||||

| Stock-based compensation | 4,382 | 8,965 | 23,673 | 40,766 | ||||||||||||

| Amortization of intangible assets | 553 | 661 | 2,306 | 6,268 | ||||||||||||

| Restructuring and other costs, net | 10,331 | 842 | 17,077 | 11,917 | ||||||||||||

| Loss on debt extinguishment | – | – | – | 1,333 | ||||||||||||

| Goodwill impairment | – | – | 609,172 | – | ||||||||||||

| Non-cash interest expense | 1,579 | 1,464 | 6,060 | 2,914 | ||||||||||||

| Other | (31 | ) | 500 | (117 | ) | (344 | ) | |||||||||

| Adjustments to income tax expense | 574 | 2,870 | (14,030 | ) | 7,976 | |||||||||||

| Non-GAAP net (loss) income | $ | (3,028 | ) | $ | 3,750 | $ | 56,063 | $ | 14,576 | |||||||

| Adjusted EPS: | ||||||||||||||||

| GAAP Numerator: | ||||||||||||||||

| Net loss attributed to common shareholders – basic and diluted | $ | (20,416 | ) | $ | (11,552 | ) | $ | (588,078 | ) | $ | (56,254 | ) | ||||

| Non-GAAP Numerator: | ||||||||||||||||

| Net (loss) income attributed to common shareholders – basic | $ | (3,028 | ) | $ | 3,750 | $ | 56,063 | $ | 14,576 | |||||||

| Interest on the Notes, net of tax | – | – | 4,473 | – | ||||||||||||

| Net (loss) income attributed to common shareholders – diluted | $ | (3,028 | ) | $ | 3,750 | $ | 60,536 | $ | 14,576 | |||||||

| GAAP Denominator: | ||||||||||||||||

| Weighted-average common shares outstanding – basic and diluted | 41,866 | 40,357 | 41,642 | 40,215 | ||||||||||||

| Non-GAAP Denominator: | ||||||||||||||||

| Weighted-average common shares outstanding- basic | 41,866 | 40,357 | 41,642 | 40,215 | ||||||||||||

| Adjustment for diluted shares | – | 1,101 | 7,727 | 423 | ||||||||||||

| Weighted-average common shares outstanding – diluted | 41,866 | 41,458 | 49,369 | 40,638 | ||||||||||||

| GAAP net loss per share – diluted | $ | (0.49 | ) | $ | (0.29 | ) | $ | (14.12 | ) | $ | (1.40 | ) | ||||

| Non-GAAP net (loss) income per share – diluted | $ | (0.07 | ) | $ | 0.09 | $ | 1.23 | $ | 0.36 | |||||||

| GAAP net cash provided by operating activities | $ | 6,115 | $ | 11,258 | $ | 17,196 | $ | 7,498 | ||||||||

| Capital expenditures | (1,446 | ) | (1,527 | ) | (4,996 | ) | (5,124 | ) | ||||||||

| Free Cash Flow | $ | 4,669 | $ | 9,731 | $ | 12,200 | $ | 2,374 | ||||||||

CERENCE INC.

Reconciliations of GAAP Financial Measures to Non-GAAP Financial Measures (cont.)

(unaudited – in thousands)

| Q1 2025 | FY2025 | |||||||||||||||

| Low | High | Low | High | |||||||||||||

| GAAP revenue | $ | 47,000 | $ | 50,000 | $ | 236,000 | $ | 247,000 | ||||||||

| GAAP gross profit | $ | 27,200 | $ | 30,200 | $ | 158,400 | $ | 169,400 | ||||||||

| Stock-based compensation | 700 | 700 | 2,500 | 2,500 | ||||||||||||

| Amortization of intangible assets | – | – | – | – | ||||||||||||

| Non-GAAP gross profit | $ | 27,900 | $ | 30,900 | $ | 160,900 | $ | 171,900 | ||||||||

| GAAP gross margin | 58 | % | 60 | % | 67 | % | 69 | % | ||||||||

| Non-GAAP gross margin | 59 | % | 62 | % | 68 | % | 70 | % | ||||||||

| GAAP operating loss | $ | (22,900 | ) | $ | (19,900 | ) | $ | (27,100 | ) | $ | (16,100 | ) | ||||

| Stock-based compensation | 6,100 | 6,100 | 22,500 | 22,500 | ||||||||||||

| Amortization of intangible assets | 500 | 500 | 1,600 | 1,600 | ||||||||||||

| Restructuring and other costs, net | 5,600 | 5,600 | 8,100 | 8,100 | ||||||||||||

| Non-GAAP operating (loss) income | $ | (10,700 | ) | $ | (7,700 | ) | $ | 5,100 | $ | 16,100 | ||||||

| GAAP operating margin | -49 | % | -40 | % | -11 | % | -7 | % | ||||||||

| Non-GAAP operating margin | -23 | % | -15 | % | 2 | % | 7 | % | ||||||||

| GAAP net loss | $ | (26,400 | ) | $ | (23,400 | ) | $ | (39,600 | ) | $ | (28,600 | ) | ||||

| Stock-based compensation | 6,100 | 6,100 | 22,500 | 22,500 | ||||||||||||

| Amortization of intangible assets | 500 | 500 | 1,600 | 1,600 | ||||||||||||

| Restructuring and other costs, net | 5,600 | 5,600 | 8,100 | 8,100 | ||||||||||||

| Depreciation | 2,200 | 2,200 | 10,200 | 10,200 | ||||||||||||

| Total other expense, net | (1,700 | ) | (1,700 | ) | (5,100 | ) | (5,100 | ) | ||||||||

| Provision for income taxes | 1,800 | 1,800 | 7,400 | 7,400 | ||||||||||||

| Adjusted EBITDA | $ | (8,500 | ) | $ | (5,500 | ) | $ | 15,300 | $ | 26,300 | ||||||

| GAAP net loss margin | -56 | % | -47 | % | -17 | % | -12 | % | ||||||||

| Adjusted EBITDA margin | -18 | % | -11 | % | 6 | % | 11 | % | ||||||||

CERENCE INC.

Reconciliations of GAAP Financial Measures to Non-GAAP Financial Measures (cont.)

(unaudited – in thousands, except per share data)

| Q1 2025 | FY2025 | |||||||||||||||

| Low | High | Low | High | |||||||||||||

| GAAP net loss | $ | (26,400 | ) | $ | (23,400 | ) | $ | (39,600 | ) | $ | (28,600 | ) | ||||

| Stock-based compensation | 6,100 | 6,100 | 22,500 | 22,500 | ||||||||||||

| Amortization of intangible assets | 500 | 500 | 1,600 | 1,600 | ||||||||||||

| Restructuring and other costs, net | 5,600 | 5,600 | 8,100 | 8,100 | ||||||||||||

| Non-cash interest expense | 1,600 | 1,600 | 5,500 | 5,500 | ||||||||||||

| Other | – | – | (100 | ) | (100 | ) | ||||||||||

| Income tax impact of Non-GAAP adjustments | (1,100 | ) | (1,100 | ) | (4,600 | ) | (4,600 | ) | ||||||||

| Non-GAAP net (loss) income | $ | (13,700 | ) | $ | (10,700 | ) | $ | (6,600 | ) | $ | 4,400 | |||||

| Adjusted EPS: | ||||||||||||||||

| GAAP Numerator: | ||||||||||||||||

| Net loss attributed to common shareholders – basic and diluted | $ | (26,400 | ) | $ | (23,400 | ) | $ | (39,600 | ) | $ | (28,600 | ) | ||||

| Non-GAAP Numerator: | ||||||||||||||||

| Net (loss) income attributed to common shareholders – basic and diluted | $ | (13,700 | ) | $ | (10,700 | ) | $ | (6,600 | ) | $ | 4,400 | |||||

| GAAP Denominator: | ||||||||||||||||

| Weighted-average common shares outstanding – basic and diluted | 42,900 | 42,900 | 43,000 | 43,000 | ||||||||||||

| Non-GAAP Denominator: | ||||||||||||||||

| Weighted-average common shares outstanding- basic | 42,900 | 42,900 | 43,000 | 43,000 | ||||||||||||

| Adjustment for diluted shares | – | – | – | 100 | ||||||||||||

| Weighted-average common shares outstanding – diluted | 42,900 | 42,900 | 43,000 | 43,100 | ||||||||||||

| GAAP net loss per share – diluted | $ | (0.62 | ) | $ | (0.55 | ) | $ | (0.92 | ) | $ | (0.67 | ) | ||||

| Non-GAAP net (loss) income per share – diluted | $ | (0.32 | ) | $ | (0.25 | ) | $ | (0.15 | ) | $ | 0.10 | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Temu-owner PDD misses market estimates for Q3 revenue on weak consumer spending

(Reuters) -China’s PDD Holdings (PDD) fell short of market estimates for third-quarter revenue on Thursday, in a sign that promotional offers and discounts were not enough to lure cost-conscious consumers to its e-commerce platform.

PDD’s US-listed shares fell more than 10% in premarket trading.

Higher unemployment rate among youth and a property sector crisis have taken a toll on consumer confidence, knocking sales at Pinduoduo, PDD’s domestic online shopping site, while e-commerce majors Alibaba and JD.com have also reported tepid quarterly sales growth.

While Pinduoduo has benefited from its low-cost focus, competitive pressure has been increasing with rivals ramping up their own promotions and discounts, resulting in a price war.

PDD’s revenue jumped 44% to 99.35 billion yuan ($13.72 billion) for the three months ended Sept. 30. That compared with the 102.65 billion yuan average of 17 analyst estimates compiled by LSEG.

Net income rose to 24.98 billion yuan from 15.54 billion yuan in the same period a year earlier.

($1 = 7.2409 Chinese yuan renminbi)

(Reporting by Deborah Sophia in Bengaluru and Casey Hall in Shanghai; Editing by Christopher Cushing and Anil D’Silva)

Duluth Holdings Inc. to Report Third Quarter 2024 Financial Results on December 5

MOUNT HOREB, Wis., Nov. 21, 2024 (GLOBE NEWSWIRE) — Duluth Holdings Inc. (dba, Duluth Trading Company) (“Duluth Trading”) DLTH, a lifestyle brand of men’s and women’s casual wear, workwear and accessories, today announced that it will report third quarter 2024 financial results before market on Thursday, December 5, 2024.

A conference call and audio webcast with analysts and investors will be held on Thursday, December 5, 2024 at 9:30 am Eastern Time, to discuss the results and answer questions.

Live conference call: 1-844-875-6915 (domestic) or 1-412-317-6711 (international)

Conference call replay available through December 12, 2024: 1-877-344-7529 (domestic) or 1-412-317-0088

(international)

- Replay access code: 2540359

- Live and archived webcast: ir.duluthtrading.com

- To expedite entry into the call and avoid waiting for a live operator, investors may pre-register at https://dpregister.com/sreg/10193192/fda17fd748 and enter their contact information. Investors will then be issued a personalized phone number and pin to dial into the live conference call.

About Duluth Trading

Duluth Trading is a growing lifestyle brand for the Modern, Self-Reliant American. Based in Mount Horeb, Wisconsin, we offer high quality, solution-based casual wear, workwear and accessories for men and women who lead a hands-on lifestyle and who value a job well-done. We provide our customers an engaging and entertaining experience. Our marketing incorporates humor and storytelling that conveys the uniqueness of our products in a distinctive, fun way, and our products are sold exclusively through our content-rich website, catalogs, and “store like no other” retail locations. We are committed to outstanding customer service backed by our “No Bull Guarantee” – if it’s not right, we’ll fix it. Visit our website at http://www.duluthtrading.com/

Investor Contacts:

Tom Filandro

ICR, Inc.

646-277-1200

DuluthIR@icrinc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

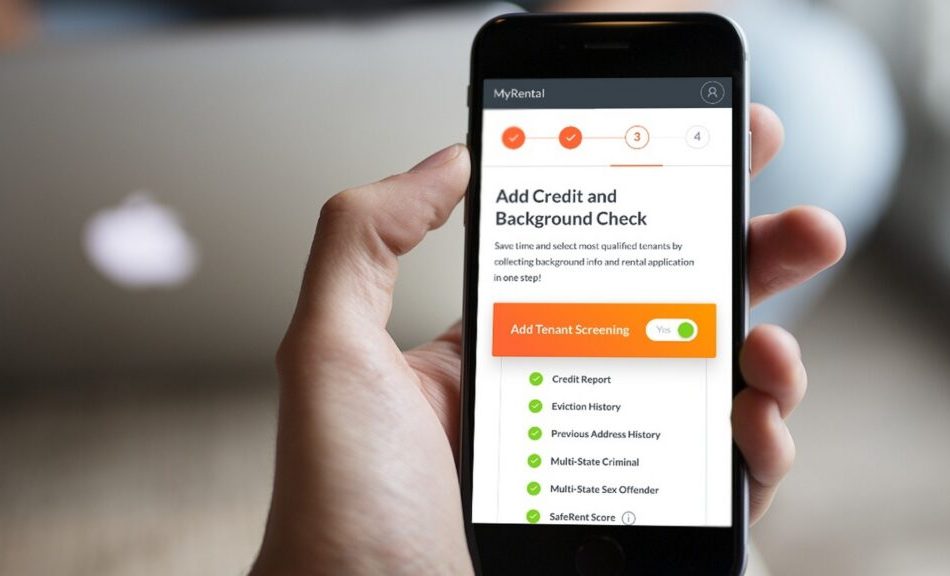

SafeRent Settles $2.3M Discrimination Lawsuit Over Alleged AI Screening Bias Against Low-Income Renters

SafeRent Solutions, an AI-powered tenant screening tool, has reached a settlement to resolve a class action lawsuit filed in Massachusetts.

What Happened: On Wednesday, U.S. District Judge Angel Kelley granted final approval for a settlement of about $2.3 million.

The lawsuit accused SafeRent’s algorithm of disproportionately scoring Black and Hispanic tenants, as well as those using housing vouchers, lower than other applicants.

Tenants with housing vouchers, who are more likely to be low-income, were reportedly more likely to be denied housing based on their AI scores.

See Also: ‘No Grand Family Compound,’ Elon Musk Says Amid Rumors Of $35M Texas Estate

As part of the settlement, SafeRent will stop using AI-generated scores to evaluate applicants who use housing vouchers.

The company will also cease providing any recommendations on whether landlords should accept or deny applicants with vouchers.

SafeRent spokesperson Yazmin Lopez told The Verge, “It became increasingly clear that defending the SRS Score in this case would divert time and resources SafeRent can better use to serve its core mission of giving housing providers the tools they need to screen applicants.”

Why It Matters: SafeRent has joined other property management platforms that are facing legal challenges over algorithmic practices.

This includes RealPage, an American property management software company, which is currently under investigation by the Department of Justice for alleged rent-inflating practices, the report noted.

SafeRent, backed by IA Capital Group, closed its latest funding round on Sept. 1, 2001, securing investment in a Series C round, according to Crunchbase.

The company faces competition from other firms in the tenant screening and property management space, with notable alternatives including Home Buyer Louisiana, PointCentral, and Ivan AI.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: SafeRent

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Coal Mining Market to Surge to US$ 6,431.26 billion by 2034 with Impressive 11.4% CAGR | Fact.MR Report

Rockville, MD , Nov. 21, 2024 (GLOBE NEWSWIRE) — The latest study by Fact.MR reveals that the global coal mining market is estimated to rise from US$ 2,193.39 billion in 2024 to US$ 6,431.26 billion by 2034-end. The market is evaluated to expand at a remarkable CAGR of 11.4% between 2024 and 2034. The need for metallurgical coal is constantly rising because it is an essential element in steel manufacturing.

The steel demand is rising, especially in countries where building and infrastructure development projects are expanding. A significant amount of high-strength steel is needed for these projects. Consequently, the demand for metallurgical coal is consistently high, leading to an increase in coal mining activities. Aside from this, coal mining operations are becoming safer and more effective due to ever-improving technology. Automation, such as autonomous drilling and hauling, lowers labor costs, expedites extraction, and shields workers from hazardous conditions.

Throughout the forecast period, East Asia is forecasted to hold a sizable share of the global market. Due to its substantial use in the production of steel and energy, China is one of the world’s leading producers and consumers of coal.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10484

Key Takeaways from Market Study

Key Takeaways from Market Study

- The worldwide market for coal mining is projected to touch a value of US$ 6,431.26 billion by the end of 2034.

- The market in Western & Eastern Europe is estimated to generate revenue worth US$ 718.89 billion in 2024.

- East Asia is analyzed to achieve a value of 1,651.8 billion by the end of 2034.

- In East Asia, China is estimated to register a turnover of US$ 279.43 billion in 2024.

- The market in North America is projected to reach a size of 154.14 billion by 2034.

- Demand for thermal coal is forecasted to reach US$ 5190.62 billion by the end of 2034.

“Leading coal mining businesses are focusing on improving the efficiency of maintenance, logistics, and extraction processes to reduce operating costs,” says a Fact.MR analyst

Leading Players Driving Innovation in the Coal Mining Market:

BHP Group Limited; China Shenhua Energy Company Limited; Coal India Limited; Yankuang Energy Group Company Limited; Anglo American Plc; NTPC Limited; Yancoal Australia Ltd.; Consol Energy Inc.; Peabody Energy Inc.; Adani Group; Alpha Metallurgical Resources Inc.; Arch Resources Inc.; Ningxia Baofeng Energy Group Co. Ltd.; Sasol Limited; South32 Limited; Teck Resources Limited; Whitehaven Coal Limited; ÇEZ Group

Demand for Thermal Coal Continuously Growing Globally:

The need and demand for thermal coal are increasing due to its vital function in the production of energy. Power plants are widely utilizing thermal coal, which is an important resource for several countries to generate steam and electricity. With the increasing need for energy, thermal coal remains a reliable and cost-effective means of supplying electricity.

Due to advancements in coal technology, including improved combustion efficiency and emissions management, thermal coal is now a more environment-friendly choice. Thermal coal is still in high demand because of the pressing need for dependable and affordable energy sources, despite the global shift toward renewable energy.

Coal Mining Industry News:

- In September 2024, to finance the purchase of an Australian coking coal mining company, JSW Steel Ltd turned to the Japanese lender MUFG Group.

- In September 2024, Aussie miner South32 sold the bulk of Illawarra Coal Holdings to Golden Energy and Resources, which is owned by Indonesia’s Sinar Mas Group, for US$ 1.65 billion. After purchasing another Australian miner, Stanmore SMC, from BHP and Japanese trading business Mitsui in 2022, the company now has more metallurgical coal, also referred to as coking coal.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10484

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the coal mining market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product & service (thermal coal, coking coal) and major market (electricity generators, industrial users), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

Expanding at a CAGR of 6.6%, the global mining pipes market is predicted to increase from a size of US$ 6.85 billion in 2023 to US$ 12.96 billion by the end of 2033.

The global mining pumps market size is valued at US$ 2.49 billion in 2023 and is projected to reach US$ 3.98 billion by 2033-end. Worldwide sales of mining pumps are forecasted to increase at a CAGR of 4.8% from 2023 to 2033.

Based on the analysis by Fact.MR, the global lithium mining market size is valued to be US$ 1.2 billion in 2023 and it is anticipated to grow at a CAGR of 6.4% to reach US$ 2.1 billion by the end of 2033.

As per the latest study by Fact.MR, the global bauxite mining market size is valued at US$ 16.83 billion in 2023 and is projected to expand at a noteworthy CAGR of 6.6% to reach a size of US$ 32.32 billion by the end of 2033.

Mining pipes sales in East Asia have reached US$ 1.48 billion in 2023, according to a Fact.MR research report. The regional market is projected to expand at 7.2% CAGR and reach a value of US$ 2.97 billion by 2033

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Real Matters Reports Fourth Quarter and Fiscal 2024 Financial Results

(all amounts are expressed in millions of U.S. dollars, excluding per share amounts and unless otherwise stated)

TORONTO, Nov. 21, 2024 (GLOBE NEWSWIRE) — Real Matters Inc. REAL (“Real Matters” or the “Company”), a leading network management services platform for the mortgage and insurance industries, today announced its financial results for the fourth quarter and fiscal year ended September 30, 2024.

“Consolidated revenue increased 8% year-over-year to $45.6 million in the fourth quarter, and we posted positive Adjusted EBITDA(A) of $0.6 million. U.S. Title Net Revenue(A) increased 30% sequentially on stronger market volumes and market share increases. This growth in Net Revenue(A) coupled with disciplined cost management allowed us to convert 100% of the increase to Adjusted EBITDA(A),” said Real Matters Chief Executive Officer Brian Lang. “We launched six lenders in the fourth quarter, three of which were new U.S. Title clients, including one Tier 2 lender. Increases in our market share with our clients continue to underpin our performance, offsetting some of the impact of variable mortgage market conditions.”

“Looking back at our fiscal 2024 performance, we delivered Adjusted EBITDA(A) of $1.9 million – a significant improvement from a loss of $2.4 million in fiscal 2023, as we continued to prudently manage our cost base throughout the year in line with the variability in mortgage origination volumes. We grew our market share with our clients across all three segments, launched a total of 16 clients and four new channels during the year, delivering consolidated revenue growth of 5% in a record-low market. Net Revenue(A) was up 8% from fiscal 2023 and we improved Net Revenue(A) margins in all three segments,” added Lang.

“Heading into fiscal 2025, we are optimistic about the potential for growth as pent-up demand continues to build. Today, there are eight million outstanding mortgages with interest rates above 6% which represents a significant pool of potential refinance candidates. According to our Future Plans of Homeowners Survey, 40% of future buyers plan to buy a primary home when rates decline. These tailwinds, coupled with our market leadership in appraisal and the significant potential for expanding our U.S. Title business, position us well for growth. We continue to maintain a readiness posture to flex the business based on market dynamics and lender positioning. As we drive more transaction volumes on our platform, we expect to expand our margins and profitability in line with our long-term operating model,” concluded Lang.

Q4 2024 Highlights

- Consolidated revenues of $45.6 million, up 8% year-over-year

- Consolidated Adjusted EBITDA(A) of $0.6 million and net loss of $0.2 million

- Year-over-year market share gains with 3 of our top U.S. Appraisal clients

- Year-over-year market share gains with Tier 1 lender and launched 3 new clients in U.S. Title

- Launched 3 new clients in Canada and one new channel

Fiscal 2024 Highlights

- Consolidated revenues of $172.7 million, up 5% year-over-year

- U.S. Appraisal Net Revenue(A) margin of 27.6% – in our target operating model range

- Positive consolidated Adjusted EBITDA of $1.9 million up from $(2.4) million in fiscal 2023

- Positive consolidated net income in fiscal 2024, up from a loss of $6.2 million in fiscal 2023

- Year-over-year market share gains in all three segments

- Launched 2 new lenders, 1 new channel in U.S. Appraisal

- Launched 7 new lenders and 1 new channel in U.S. Title

- Launched 7 new clients in Canada and 2 new channels in Canada

- Cash and cash equivalents of $49.1 million and no outstanding debt

Financial and Operational Summary

| Quarter ended |

Year ended |

% | ||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2023 | % Change1 | 2024 | 2023 | Change1 | ||||||||||||||||||||||

| Q4 | Q3 | Q2 | Q1 | Q4 | Quarter over Quarter |

Year over Year |

September 30 |

September 30 |

Year over Year |

|||||||||||||||||||||

| Consolidated | ||||||||||||||||||||||||||||||

| Revenue | $ | 45.6 | $ | 49.5 | $ | 42.2 | $ | 35.4 | $ | 42.2 | -8 | % | 8 | % | $ | 172.7 | $ | 163.9 | 5 | % | ||||||||||

| Net Revenue(A) | $ | 12.0 | $ | 13.1 | $ | 11.5 | $ | 9.7 | $ | 11.2 | -9 | % | 8 | % | $ | 46.4 | $ | 43.0 | 8 | % | ||||||||||

| Adjusted EBITDA(A) | $ | 0.6 | $ | 1.7 | $ | 0.7 | $ | (1.1 | ) | $ | 0.6 | -66 | % | -6 | % | $ | 1.9 | $ | (2.4 | ) | 178 | % | ||||||||

| Net (loss) income | $ | (0.2 | ) | $ | 1.7 | $ | 2.1 | $ | (3.6 | ) | $ | 1.6 | -109 | % | -110 | % | $ | – | $ | (6.2 | ) | 100 | % | |||||||

| Net income (loss) per diluted share | $ | 0.00 | $ | 0.02 | $ | 0.03 | $ | (0.05 | ) | $ | 0.02 | -100 | % | -100 | % | $ | 0.00 | $ | (0.08 | ) | 100 | % | ||||||||

| Adjusted Net income (loss)(A) | $ | 0.9 | $ | 1.7 | $ | 1.3 | $ | (1.2 | ) | $ | 0.8 | -45 | % | 13 | % | $ | 2.7 | $ | (2.2 | ) | 223 | % | ||||||||

| Adjusted Net income (loss)(A) per diluted share | $ | 0.01 | $ | 0.02 | $ | 0.02 | $ | (0.02 | ) | $ | 0.01 | -50 | % | 0 | % | $ | 0.04 | $ | (0.03 | ) | 233 | % | ||||||||

| U.S. Appraisal segment | ||||||||||||||||||||||||||||||

| Revenue | $ | 33.8 | $ | 37.5 | $ | 32.6 | $ | 26.8 | $ | 31.2 | -10 | % | 8 | % | $ | 130.7 | $ | 120.8 | 8 | % | ||||||||||

| Net Revenue(A) | $ | 9.0 | $ | 10.3 | $ | 9.2 | $ | 7.5 | $ | 8.6 | -13 | % | 6 | % | $ | 36.1 | $ | 33.1 | 9 | % | ||||||||||

| Net Revenue(A) margin | 26.7 | % | 27.6 | % | 28.3 | % | 27.9 | % | 27.5 | % | 27.6 | % | 27.4 | % | ||||||||||||||||

| Adjusted EBITDA(A) | $ | 4.1 | $ | 5.5 | $ | 4.4 | $ | 2.7 | $ | 3.9 | -26 | % | 4 | % | $ | 16.7 | $ | 14.1 | 18 | % | ||||||||||

| Adjusted EBITDA(A) margin | 45.2 | % | 53.2 | % | 47.9 | % | 35.8 | % | 46.0 | % | 46.2 | % | 42.8 | % | ||||||||||||||||

| U.S. Title segment | ||||||||||||||||||||||||||||||

| Revenue | $ | 2.4 | $ | 2.1 | $ | 2.0 | $ | 2.0 | $ | 2.3 | 14 | % | 4 | % | $ | 8.6 | $ | 9.6 | -9 | % | ||||||||||

| Net Revenue(A) | $ | 1.2 | $ | 0.9 | $ | 0.9 | $ | 1.0 | $ | 1.0 | 30 | % | 15 | % | $ | 4.0 | $ | 3.9 | 3 | % | ||||||||||

| Net Revenue(A) margin | 49.8 | % | 43.6 | % | 44.0 | % | 47.3 | % | 45.0 | % | 46.3 | % | 40.6 | % | ||||||||||||||||

| Adjusted EBITDA(A) | $ | (1.6 | ) | $ | (1.9 | ) | $ | (1.7 | ) | $ | (1.6 | ) | $ | (1.6 | ) | 18 | % | -1 | % | $ | (6.8 | ) | $ | (8.3 | ) | 18 | % | |||

| Adjusted EBITDA(A) margin | -131.4 | % | -209.8 | % | -184.8 | % | -167.9 | % | -150.4 | % | -170.4 | % | -215.6 | % | ||||||||||||||||

| Canadian segment | ||||||||||||||||||||||||||||||

| Revenue | $ | 9.4 | $ | 9.9 | $ | 7.6 | $ | 6.6 | $ | 8.7 | -5 | % | 8 | % | $ | 33.4 | $ | 33.5 | 0 | % | ||||||||||

| Net Revenue(A) | $ | 1.8 | $ | 1.9 | $ | 1.4 | $ | 1.2 | $ | 1.6 | -5 | % | 14 | % | $ | 6.3 | $ | 6.0 | 5 | % | ||||||||||

| Net Revenue(A) margin | 18.9 | % | 19.0 | % | 18.9 | % | 18.8 | % | 17.9 | % | 18.9 | % | 18.0 | % | ||||||||||||||||

| Adjusted EBITDA(A) | $ | 1.2 | $ | 1.3 | $ | 0.9 | $ | 0.7 | $ | 1.2 | -7 | % | 6 | % | $ | 4.1 | $ | 4.2 | -4 | % | ||||||||||

| Adjusted EBITDA(A) margin | 67.7 | % | 69.3 | % | 62.3 | % | 56.8 | % | 72.9 | % | 64.8 | % | 70.5 | % | ||||||||||||||||

| Corporate segment | ||||||||||||||||||||||||||||||

| Adjusted EBITDA(A) | $ | (3.1 | ) | $ | (3.2 | ) | $ | (2.9 | ) | $ | (2.9 | ) | $ | (2.9 | ) | 2 | % | -8 | % | $ | (12.1 | ) | $ | (12.4 | ) | 3 | % | |||

Note 1 – Percentage change is calculated based on figures disclosed in our MD&A which are rounded to the nearest thousands of dollars.

Conference Call and Webcast

A conference call to review the results will take place at 10:00 a.m. (ET) on Thursday, November 21, 2024, hosted by Chief Executive Officer Brian Lang and Chief Financial Officer Rodrigo Pinto. An accompanying slide presentation will be posted to the Investor section of our website shortly before the call.

To access the call:

- Participant Local (Toronto): (416) 764-8624

- Participant Toll Free Dial-In Number: (888) 259-6580

- Conference ID: 77493257

To listen to the live webcast of the call:

The webcast will be archived and a transcript of the call will be available in the Investor section of our website following the call.

(A) Non-GAAP Measures

The non-GAAP measures used in this news release, including Net Revenue, Adjusted EBITDA and Adjusted Net Income do not have a standardized meaning prescribed by International Financial Reporting Standards and are therefore unlikely to be comparable to similar measures presented by other issuers. These non-GAAP measures are more fully defined and discussed in the Company’s MD&A for the three months and year ended September 30, 2024 under the heading “Non-GAAP measures”, which is incorporated by reference in this Press Release and available on SEDAR+ at www.sedarplus.ca.

Real Matters financial results for the three months and year ended September 30, 2024 are included in the annual audited consolidated financial statements and the accompanying MD&A, each of which are available on SEDAR+ at www.sedarplus.ca. In addition, supplemental information is available on our website at www.realmatters.com.

Net Revenue represents the difference between revenues and transaction costs. Net Revenue margin is calculated as Net Revenue divided by Revenues. The reconciling items between net income or loss and Net Revenue were as follows:

| Quarter ended |

Year ended |

|||||||||||||||||||||

| Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | September 30, 2024 |

September 30, 2023 |

||||||||||||||||

| Net (loss) income | $ | (0.2 | ) | $ | 1.7 | $ | 2.1 | $ | (3.6 | ) | $ | 1.6 | $ | – | $ | (6.2 | ) | |||||

| Operating expenses | 12.6 | 11.8 | 11.2 | 11.6 | 10.9 | 47.3 | 46.8 | |||||||||||||||

| Amortization | 0.8 | 0.8 | 0.8 | 0.8 | 0.9 | 3.2 | 3.9 | |||||||||||||||

| Restructuring expenses | – | – | – | – | – | – | 1.7 | |||||||||||||||

| Interest expense | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 | 0.3 | |||||||||||||||

| Interest income | (0.5 | ) | (0.5 | ) | (0.4 | ) | (0.4 | ) | (0.3 | ) | (1.8 | ) | (0.8 | ) | ||||||||

| Net foreign exchange loss (gain) | 1.3 | (0.9 | ) | (2.2 | ) | 2.0 | (1.8 | ) | 0.2 | 1.0 | ||||||||||||

| (Gain) loss on fair value | ||||||||||||||||||||||

| of derivatives | (1.9 | ) | (0.1 | ) | 0.1 | (0.2 | ) | (0.1 | ) | (2.0 | ) | (0.8 | ) | |||||||||

| Income tax (recovery) expense | (0.2 | ) | 0.2 | (0.2 | ) | (0.6 | ) | (0.1 | ) | (0.8 | ) | (2.9 | ) | |||||||||

| Net Revenue | $ | 12.0 | $ | 13.1 | $ | 11.5 | $ | 9.7 | $ | 11.2 | $ | 46.4 | $ | 43.0 | ||||||||

Adjusted EBITDA represents net income or loss before stock-based compensation expense, amortization, restructuring expenses, interest expense, interest income, net foreign exchange gain or loss, gain or loss on fair value of derivatives and income tax expense or recovery. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by Net Revenue. The reconciling items between net income or loss and Adjusted EBITDA were as follows:

| Quarter ended |

Year ended |

|||||||||||||||||||||

| Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | September 30, 2024 |

September 30, 2023 |

||||||||||||||||

| Net (loss) income | $ | (0.2 | ) | $ | 1.7 | $ | 2.1 | $ | (3.6 | ) | $ | 1.6 | $ | – | $ | (6.2 | ) | |||||

| Stock-based compensation expense | 1.2 | 0.4 | 0.4 | 0.8 | 0.3 | 2.8 | 1.4 | |||||||||||||||

| Amortization | 0.8 | 0.8 | 0.8 | 0.8 | 0.9 | 3.2 | 3.9 | |||||||||||||||

| Restructuring expenses | – | – | – | – | – | – | 1.7 | |||||||||||||||

| Interest expense | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 | 0.3 | |||||||||||||||

| Interest income | (0.5 | ) | (0.5 | ) | (0.4 | ) | (0.4 | ) | (0.3 | ) | (1.8 | ) | (0.8 | ) | ||||||||

| Net foreign exchange loss (gain) | 1.3 | (0.9 | ) | (2.2 | ) | 2.0 | (1.8 | ) | 0.2 | 1.0 | ||||||||||||

| (Gain) loss on fair value | ||||||||||||||||||||||

| of derivatives | (1.9 | ) | (0.1 | ) | 0.1 | (0.2 | ) | (0.1 | ) | (2.0 | ) | (0.8 | ) | |||||||||

| Income tax (recovery) expense | (0.2 | ) | 0.2 | (0.2 | ) | (0.6 | ) | (0.1 | ) | (0.8 | ) | (2.9 | ) | |||||||||

| Adjusted EBITDA | $ | 0.6 | $ | 1.7 | $ | 0.7 | $ | (1.1 | ) | $ | 0.6 | $ | 1.9 | $ | (2.4 | ) | ||||||

The reconciling items between net income or loss and Adjusted Net Income or Loss were as follows:

| Quarter ended |

Year ended |

|||||||||||||||||||||

| Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | September 30, 2024 |

September 30, 2023 |

||||||||||||||||

| Net (loss) income | $ | (0.2 | ) | $ | 1.7 | $ | 2.1 | $ | (3.6 | ) | $ | 1.6 | $ | – | $ | (6.2 | ) | |||||

| Stock-based compensation expense | 1.2 | 0.4 | 0.4 | 0.8 | 0.3 | 2.8 | 1.4 | |||||||||||||||

| Amortization of intangibles | 0.5 | 0.4 | 0.4 | 0.4 | 0.4 | 1.6 | 1.6 | |||||||||||||||

| Restructuring expenses | – | – | – | – | – | – | 1.7 | |||||||||||||||

| Net foreign exchange loss (gain) | 1.3 | (0.9 | ) | (2.2 | ) | 2.0 | (1.8 | ) | 0.2 | 1.0 | ||||||||||||

| (Gain) loss on fair value | ||||||||||||||||||||||

| of derivatives | (1.9 | ) | (0.1 | ) | 0.1 | (0.2 | ) | (0.1 | ) | (2.0 | ) | (0.8 | ) | |||||||||

| Related tax effects | – | 0.2 | 0.5 | (0.6 | ) | 0.4 | 0.1 | (0.9 | ) | |||||||||||||

| Adjusted Net Income | $ | 0.9 | $ | 1.7 | $ | 1.3 | $ | (1.2 | ) | $ | 0.8 | $ | 2.7 | $ | (2.2 | ) | ||||||

Forward-Looking Information

This Press Release contains “forward-looking information” within the meaning of applicable Canadian securities laws. Words such as “could”, “forecast”, “target”, “may”, “will”, “would”, “expect”, “anticipate”, “estimate”, “intend”, “plan”, “seek”, “believe”, “likely” and “predict” and variations of such words and similar expressions are intended to identify such forward-looking information, although not all forward-looking information contains these identifying words.

The forward-looking information in this Press Release includes statements which reflect the current expectations of management with respect to our business and the industry in which we operate and is based on management’s experience and perception of historical trends, current conditions and expected future developments, as well as other factors that management believes appropriate and reasonable in the circumstances. The forward-looking information reflects management’s beliefs based on information currently available to management, including information obtained from third party sources, and should not be read as a guarantee of the occurrence or timing of any future events, performance or results.

The forward-looking information in this Press Release is subject to risks, uncertainties and other factors that are difficult to predict and that could cause actual results to differ materially from historical results or results anticipated by the forward-looking information. A comprehensive discussion of the factors which could cause results or events to differ from current expectations can be found in the “Risk Factors” section of our Annual Information Form for the year ended September 30, 2023, which is available on SEDAR+ at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on the forward-looking information, which reflect our expectations only as of the date of this Press Release. Except as required by law, we do not undertake to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

About Real Matters

Real Matters is a leading network management services provider for the mortgage lending and insurance industries. Real Matters’ platform combines its proprietary technology and network management capabilities with tens of thousands of independent qualified field professionals to create an efficient marketplace for the provision of mortgage lending and insurance industry services. Our clients include top 100 mortgage lenders in the U.S. and some of the largest banks and insurance companies in Canada. We are a leading independent provider of residential real estate appraisals to the mortgage market and a leading independent provider of title services in the U.S. Headquartered in Markham (ON), Real Matters has principal offices in Buffalo (NY) and Middletown (RI). Real Matters is listed on the Toronto Stock Exchange under the symbol REAL. For more information, visit www.realmatters.com.

For more information:

Lyne Beauregard

Vice President, Investor Relations and Corporate Communications

Real Matters

lbeauregard@realmatters.com

416.994.5930

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US airline flight crews confident and angry as unions seek richer contracts

By Rajesh Kumar Singh

CHICAGO (Reuters) – Alaska Airlines flight attendant Rebecca Owens works 10 hours a day but only gets paid for half that time – a legacy of a common U.S. airline policy to pay cabin crew members only when planes are in motion. Owens, and thousands of cabin crew like her, wants that to change.

In August, 68% of Alaska flight attendants in a ratification vote rejected a contract that would have increased average pay by 32% over three years. It was also the first labor agreement that would have legally required airlines to start the clock for paying flight attendants when passengers are boarding, not when the flight starts to taxi down the runway.

Delta Air Lines, the only major U.S. airline whose flight attendants are not in a union, instituted boarding pay for its flight attendants at half of their hourly wages in 2022 when they were trying to organize.

Alaska and union leaders have resumed federally mediated contract negotiations this week.

“I want to be compensated for my time at work and want a livable wage so that you can stand on your own while working this job,” said Owens, 35. She said that without her husband’s income, her family would not be able to afford basic needs.

Negotiations at Alaska are being closely watched because one airline’s contract tends to become an industry benchmark. Cabin crews at United Airlines, Frontier and American Airlines’ regional subsidiary PSA Airlines are also negotiating new labor agreements.

Crews at Southwest Airlines rejected two contract offers before ratifying a deal in April that included a 22% pay raise this year and 3% per year raises through 2027.

Flight attendants have been negotiating with more confidence this year, encouraged by improved airline earnings and bumper pay deals negotiated by pilot unions in the past two years and Boeing factory workers this year, according to interviews with a dozen airline crew and union officials.

Plane crew told Reuters these negotiations are also informed by years of resentment over pay that has lagged inflation while working hours have increased, hurting their quality of life.

Cabin crew at Alaska and United have authorized their unions to call strikes if negotiators cannot reach a contract agreement.

Alaska Airlines responded to a question from Reuters saying its goal is to provide “flight attendants – and all employees – with market-competitive wages and benefits.” United did not respond to a request for comment.

BURN OUT

In previous contract negotiations, airlines secured concessions from workers as the industry was struggling due to economic downturns or fallout from the COVID pandemic.

US Futures Head Lower As Nvidia Earnings Fail To Impress Investors: Expert Says Market Weakness Is 'Perfectly Normal,' But Late November Rally Is Still Possible

U.S. stocks could open on a negative note on Thursday after AI bellwether Nvidia Corp.’s NVDA guidance fell short of some expectations. Futures of all three major indices were down as investors processed the AI giant’s earnings.

Other chip makers like Qualcomm Inc. QCOM, Intel Corp. INTC, Broadcom Inc. AVGO, and Advanced Micro Devices Inc. AMD also experienced pressure in premarket trading.

| Futures | Change (+/-) |

| Nasdaq 100 | -0.33% |

| S&P 500 | -0.24% |

| Dow Jones | -0.08% |

| R2K | -0.22% |

In premarket trading on Thursday, the SPDR S&P 500 ETF Trust SPY fell 0.25% to $589 and the Invesco QQQ ETF QQQ declined 0.34% to $501.46, according to Benzinga Pro data.

Cues From Last Session:

The Dow Jones snapped its two-session losing streak this week to close 100 points higher on Wednesday, while the S&P 500 eked a marginal gain to close in the green.

The tech-heavy Nasdaq, however, fell ahead of the volatility due to Nvidia’s earnings after the bell.

Crude oil prices continued to rise amid growing tensions between Russia and Ukraine but remained under the $70 mark.

Treasury yields eased slightly as investors waited for further economic data.

On the economic data front, mortgage applications in the U.S. rose 1.7% from the previous week in the week ending Nov. 15, compared to a 0.5% gain in the prior period.

Most sectors on the S&P 500 closed on a positive note, with healthcare, energy, and materials stocks recording the biggest gains on Wednesday.

However, consumer discretionary and financial stocks bucked the overall market trend, closing the session lower.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.11% | 18,966.14 |

| S&P 500 | 0.002% | 5,917.11 |

| Dow Jones | 0.32% | 43,408.47 |

| Russell 2000 | 0.03% | 2,325.53 |

Insights From Analysts:

Ryan Detrick, chief market strategist at Carson Group, maintained that despite the weakness in the markets currently, he remains optimistic about the potential of a continued bull run.

“Weakness right around now is perfectly normal. The good news is I wouldn’t give up on a late November rally.”

Despite the volatile movement in Nvidia and other chipmaker stocks, Wedbush analyst Dan Ives maintained optimism about the AI giant’s performance.

“The Godfather of AI Jensen and Nvidia delivered a massive beat and big things ahead for Blackwell,” Ives said.

Nvidia posted third-quarter revenue of $35.1 billion, up 94% year-on-year, beating the Street consensus of $33.12 billion, according to data from Benzinga Pro. This was the ninth straight quarter of Nvidia beating analyst estimates.

Tech bull Ives thinks that this is the “fourth revolution” in technology, and it could help the Nasdaq surge to 25,000.

See Also: How To Trade Futures

Upcoming Economic Data

Thursday’s economic calendar includes the release of initial jobless claims data.

- Initial jobless claims data will be released at 8:30 a.m. ET.

- Philadelphia Fed manufacturing survey will be released at 8:30 a.m. ET.

- Cleveland Fed President Beth Hammack will speak at 8:45 a.m. ET.

- Existing home sales data and leading economic index will be released at 10 a.m. ET.

- Kansas City Fed President Jeff Schmid will speak at 1:10 p.m. ET.

- Fed Vice Chair for Supervision Michael Barr will speak at 4:40 p.m. ET.

Stocks In Focus:

- Nvidia Corp. NVDA shares fell 2.6% in premarket trading on Thursday after the company posted a quarter-on-quarter decline in gross margins.

- Other chip stocks felt the pressure post-Nvidia earnings. Qualcomm Inc. QCOM fell nearly 1%, while Intel Corp. INTC was down 0.6%. Broadcom Inc. AVGO and Advanced Micro Devices Inc. AMD both fell 0.5% in premarket trading.

- MicroStrategy Inc. MSTR stock surged over 10% on Wednesday and rose by another 11% in premarket trading on Thursday after Bitcoin BTC/USD crossed the $95,000 mark. Robinhood Markets Inc. HOOD stock was also up over 3%.

- Snowflake Inc. SNOW shares rose over 21% in premarket trading after the company beat analyst expectations and revised its 2025 revenue outlook upwards.

- Palo Alto Networks Inc. PANW stock fell over 4% in premarket trading after the company’s third-quarter results.

- Alphabet Inc. GOOG GOOGL stock was slightly down in premarket trading after the U.S. Department of Justice (DOJ) said the company needed to sell the Google Chrome browser to end search monopoly.

- Investors are awaiting earnings results from Deere & Company DE, BJ’s Wholesale Club Holdings, Inc. BJ, and Intuit Inc. INTU today.

Commodities, Bonds And Global Equity Markets:

Crude oil futures surged in the early New York session, rising by 1.70% to hover around $69.92 per barrel.

The 10-year Treasury note yield edged lower to 4.394%.

Most of the major Asian markets ended in the red on Thursday, while European markets showed tentativeness in early trading.

Read Next:

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Morning Bid: Nvidia sees past triple-digit growth

A look at the day ahead in U.S. and global markets from Mike Dolan

There’s not too much to worry about at the world’s most valuable company – or the artificial intelligence theme – but just conceding that triple-digit growth can’t last forever has been enough to stall Nvidia’s share price and dampen global tech stocks.

The $3.6 trillion chip giant’s revenue forecast on Wednesday disappointed Wall Street, with its stock down more than 3% premarket – with peers Advanced Micro Devices, Intel and Qualcomm off about 1% in sympathy and European chipmakers down as well.

Although it beat most metrics and consensus estimates yet again, Nvidia forecast its slowest revenue growth in seven quarters and flagged supply chain constraints through next year. Its executives warned investors the company’s margins would sink several percentage points to the low-70% range until production kinks are ironed out.

But don’t shed too many tears. The AI bellwether’s latest earnings report was by most standards still extraordinary – sales in its main data center segment more than doubled and the company’s forecast revenue of $37.5 billion for fourth quarter was above average estimates of $37.09 billion.

And in many respects, the price reaction is modest. After another 20% share surge over the past two months, markets feel most of the ongoing boom is already in the price for now.

More worrying on Wednesday was U.S. retailer Target’s big miss on its profit and holiday-quarter sales forecast – which sent its stock plummeting more than 20% and stood in contrast to the previous day’s beat from the world’s no. 1 retailer Walmart.

The politics of President-elect Donald Trump’s incoming administration still dominated thinking in the background – with no sign yet of his pick for Treasury Secretary – and geopolitical worries rumbled abroad.

One of the few post-election trades to keep on moving was Bitcoin – and the dominant crypto asset zoomed close to a record $98,000 overnight, up more than 40% over the past month.