10 Reasons to Buy Nvidia Stock Like There's No Tomorrow

One of the biggest investing developments of the past couple of years has been the opportunity represented by artificial intelligence (AI), and arguably no company is better positioned to profit from this secular tailwind than Nvidia (NASDAQ: NVDA). The chipmaker has become the poster child for the AI revolution, giving it the pole position in a large and growing opportunity.

Generative AI is expected to add between $2.6 trillion and $4.4 trillion to the global economy over the coming decade, according to McKinsey & Company, and Nvidia is at the leading edge of the trend. That massive opportunity is one of many reasons that investors should be buying Nvidia stock like there’s no tomorrow. Let’s look at a few others.

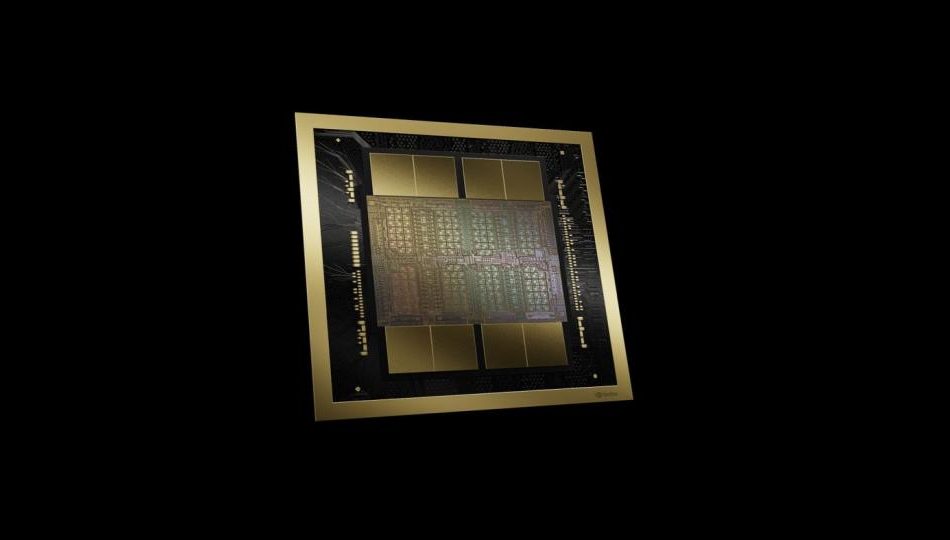

1. Nvidia dominates the data center market

There’s little argument that Nvidia has the inside track when it comes to graphics processing units (GPUs) in data centers, but some investors may not realize the extent of the company’s dominance.

Nvidia controls an estimated 92% of the market for data center GPUs, according to IoT Analytics, though that estimate may be conservative. TechInsights goes further, claiming Nvidia controlled 98% of the data center GPU market in 2023. While estimates vary, the indication is clear.

The competition is intent on chipping away at its dominance. However, given Nvidia’s early lead and sustained momentum, it should remain the clear leader for years to come.

2. It’s the undisputed leader powering earlier versions of AI

While generative AI has made a splash since early last year, AI has been around for decades, and Nvidia has been helping to power those advanced algorithms. For example, Nvidia controls 95% of the market for GPUs used in machine learning — an earlier version of AI — according to estimates provided by New Street Research. This experience would soon come in handy.

3. The inside track for generative AI

Nvidia’s wealth of expertise in the field and dominance in earlier versions of AI made it the clear choice for developers when generative AI exploded onto the scene. Developments in the space are moving at warp speed, so it is even more difficult to pin down Nvidia’s market share. Analysts from Mizuho suggest it’s somewhere between 70% and 95% for AI models. That aligns with an estimate by Fortune, which puts Nvidia’s market share at 80%.

4. The platform factor

Nvidia’s dominance in the AI and data center markets was years in the making, but it isn’t just the result of the company’s chip process. In 2007, Nvidia launched Compute Unified Device Architecture (CUDA), an architectural framework and parallel computing platform that helps developers by dramatically accelerating computing applications built on its GPUs.

According to Nvidia, CUDA provides developers with more than 300 libraries and 600 AI models, and supports more than 3,700 GPU-accelerated applications. This ecosystem includes more than 5 million developers at 40,000 companies, which helps explain why it will be so difficult to “chip” away at Nvidia’s dominance, given that it’s developers’ preferred development platform of choice.

5. It isn’t just about chips anymore

While its processors form the foundation of Nvidia’s empire, it isn’t just about chips anymore. The company has been gradually expanding into adjacent markets and also provides ancillary products that help its GPUs perform even better. These other opportunities could help fuel the next leg of Nvidia’s growth.

For example, Nvidia supplies InfiniBand networking solutions, including switches and adapters that reduce latency and help speed network connections. Then there’s the NVLink and NVLink Switch, used to connect multiple GPUs in a daisy chain, accelerating the resulting connections to unleash their full power. The company also offers its own line of turnkey AI servers and supercomputers.

6. Robust research and development (R&D) spending

It’s no accident that Nvidia has maintained its position atop the AI chip heap. The company has a long track record of spending heavily on the research and development (R&D) necessary to maintain its technological lead. For its fiscal 2024 (ended Jan. 28), Nvidia spent nearly $8.7 billion on R&D, up 18% and amounting to 14% of the company’s total revenue.

Besides maintaining its technological edge, increased spending has also helped the company innovate faster. Earlier this year, Nvidia announced that it would no longer keep to its historical two-year cadence for unveiling new processors, but rather release new chips every year.

It was already difficult for rivals to keep up with Nvidia’s frantic development pace, but it will be even harder now.

7. Let’s not forget gaming

At this point, it almost seems like a footnote, but Nvidia began its journey as a pioneer in video games. It was parallel processing, or the ability to conduct a magnitude of complex calculations simultaneously, that revolutionized the gaming industry, turning boxy figures into lifelike images.

Nvidia is still the undisputed leader, with an 88% share of the discrete desktop GPU market, according to industry analyst Jon Peddie Research. This leaves scraps for the competition. Don’t expect that to change anytime soon.

8. An explosion of profitability

The advent of generative AI early last year and the resulting rapid adoption has been a boon to Nvidia. For fiscal 2024, revenue of $60 billion surged 126% year over year. This brought with it a flood of increasing profitability, as diluted earnings per share (EPS) of $11.93 soared 586%.

That trend continued into the current year. In its fiscal 2025 first quarter (ended April 28), revenue of $26 billion grew 262% year over year, while EPS of $5.98 surged 629%.

Management is forecasting that its growth streak will continue. The company is guiding for second-quarter revenue of $28 billion when Nvidia reports on Aug. 28. Analysts’ consensus estimates are even higher, expecting revenue of $28.6 billion. In either case, that’s phenomenal sales growth, and profits will likely follow suit.

9. Returns to shareholders are increasing

Nvidia’s recent run has been a windfall for shareholders, as the stock has skyrocketed more than 500% over the past three years, as of this writing. Yet there have been other benefits for investors.

In conjunction with the company’s quarterly report and 10-for-1 stock split revelation in May, Nvidia announced that it was increasing its dividend by 150% from $0.04 to $0.10. The dividend hasn’t been a priority for the company until now, as growth has taken center stage. However, given its newfound wealth, I wouldn’t be surprised if there were additional increases on the horizon.

10. It isn’t as expensive as you might think

Nvidia’s skyrocketing stock price has brought with it a commensurate increase in its valuation, causing some investors to keep their distance. That’s understandable, given the stock is currently selling for 74 times earnings and 39 times sales, but that only tells part of the story. While the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio are among the most widely used valuation metrics, they also have their limitations. They tend to label most high-growth stocks as expensive or overvalued by default.

However, Nvidia’s forward price/earnings-to-growth (PEG) ratio, which takes into account its impressive growth trajectory, clocks in at 0.7, when any number lower than 1 indicates an undervalued stock. So the stock isn’t as expensive as it appears at first glance.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

10 Reasons to Buy Nvidia Stock Like There’s No Tomorrow was originally published by The Motley Fool

Leave a Reply