Prominent Billionaires Just Bought the Dip With These 3 Stocks

Hedge funds and investment firms with over $100 million in assets are required to disclose their stock portfolios throughout the year. The updates for the second quarter of 2024 are rolling in now, and this includes updates from the financial vehicles managed by prominent billionaires Warren Buffett and Bill Ackman, as well as by multimillionaire Michael Burry.

This wealthy trio has been busily buying the dips for three value stocks: Ulta Beauty (NASDAQ: ULTA), Nike (NYSE: NKE), and Shift4 Payments (NYSE: FOUR). Here’s why these bargains were too good for these investors to pass up.

1. Ulta Beauty: Down 33%

As of this writing, Ulta Beauty stock is down 33% from its all-time high and down 22% in 2024. Shares started sliding after management warned of slowing sales for cosmetic products, leading it to lower the company’s full-year financial guidance.

It was a dip too good for Warren Buffett to pass up. His Berkshire Hathaway opened a roughly $260 million position in Ulta Beauty stock during Q2. Granted, that’s a small position for a company as big as Berkshire, but it’s still noteworthy nonetheless.

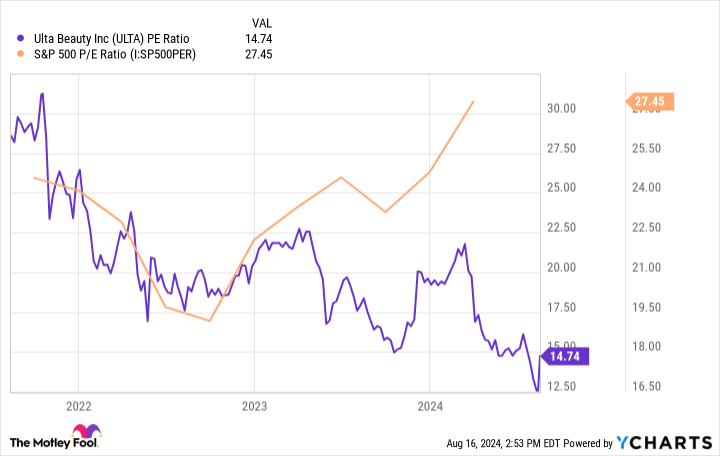

Buffett is a renowned value investor, and he likely sees potential in Ulta Beauty. The stock trades at less than 15 times earnings, which is significantly cheaper than the average price-to-earnings (P/E) ratio for the S&P 500, as seen below.

Sales growth may be slow. However, Ulta Beauty still expects to earn over $1.5 billion in operating profit in 2024, and it plans to return $1 billion to shareholders via share repurchases. Given the stable demand for cosmetic products, I expect strong profits and share repurchases to continue for years to come, providing high chances of positive long-term returns for Ulta Beauty stock from here.

2. Nike: Down 53%

In Q2, Bill Ackman’s Pershing Square bought more than 3 million shares of athletic apparel company Nike — a position worth roughly $229 million. It’s the smallest position in Ackman’s portfolio, but with only eight stocks in the total portfolio, any addition is noteworthy.

Ackman is a value investor who studied Warren Buffett’s style before getting his own start. Nike indeed looks like a value stock, considering it has been trading at its cheapest valuation since 2012.

In short, Nike stock is down because sales are slumping and profits are contracting. The company’s fiscal 2025 started in June, and management is calling it a “transition year.” Management expects its revenue to be down single digits compared to fiscal 2024, but profits could be down more than that.

Ackman is likely betting that a consumer brand as strong as Nike will find its way eventually, making the stock a strong candidate for a rebound once its business stabilizes.

3. Shift4 Payments: Down 20%

Like Ackman, Michael Burry manages a concentrated portfolio of just 10 stocks through his Scion Asset Management. The investor famously made his fortune by shorting the U.S. housing market during the Great Recession. Judging by his portfolio today, I’d say he’s still not very bullish on America.

Three of Burry’s top five positions are Chinese stocks, showing his preference for those companies. However, in Q2, he took a big swing at financial technology (fintech) company Shift4 Payments, making it nearly 14% of the portfolio.

Shift4 stock may not be down as much as the other two in this article. However, shares have gone nowhere for the last three years as the chart below shows, even though its profitable growth during this time has been impressive.

Shift4 has focused on winning large, high-volume customers, which has provided strong revenue growth. Adjusting for network fees (a common adjustment for fintech companies), the company expects to grow its revenue by at least 44% this year. And it expects to generate free cash flow of nearly $400 million.

For perspective, Shift4’s market cap is only $5.4 billion as of this writing, meaning it trades at a cheap forward price-to-free-cash-flow valuation of about 14. Coupled with its impressive top-line growth, I believe Shift4 Payments stock might be the best buy of these three stocks.

To be clear, Ulta Beauty and Nike are cheap based on multiple valuation metrics, which is good. But they’re also more mature companies with limited top-line growth potential. Either stock could have upside, but Shift4 is still growing at a fast pace, in addition to being cheaply valued. That may carry it to bigger gains in the coming years.

Should you invest $1,000 in Ulta Beauty right now?

Before you buy stock in Ulta Beauty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ulta Beauty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Jon Quast has positions in Shift4 Payments. The Motley Fool has positions in and recommends Berkshire Hathaway, Nike, and Ulta Beauty. The Motley Fool recommends Shift4 Payments and recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

Prominent Billionaires Just Bought the Dip With These 3 Stocks was originally published by The Motley Fool

Leave a Reply