Want Decades of Passive Income? Buy This ETF and Hold It Forever

There is so much to love about dividends, the cash payments investors receive when a company shares its profits with them. Dividends help shareholders realize an investment return without having to sell the stock.

You can reinvest the cash or do whatever else you want. A large enough dividend portfolio can grow into a wealth machine, pumping out thousands of dollars in annual passive income.

Building such a portfolio requires high-quality stocks in companies that can grow their earnings and dividend payments year after year.

Fortunately, you don’t need to spend time and work determining which companies to own. Instead, consider this well-rounded exchange-traded fund (ETF) that will pay you decades of growing passive income.

Here are three reasons to buy and hold the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD).

1. It’s an all-in-one blue chip stock portfolio

Dividend investing is pretty straightforward, but there are two essential tips.

First, investors should avoid excessive dividend yields. Most healthy dividend stocks yield somewhere between 0.5% and 4%. There are exceptions, but stocks with very high yields are often risky; they are high because the market doesn’t trust that the company can afford its payout.

Second, investors should build a diversified portfolio so as not to rely on a few stocks for their dividend income. A diverse portfolio of blue chip dividend stocks will almost certainly keep the passive income flowing.

Schwab’s U.S. Dividend Equity ETF consists of 103 dividend stocks trading under one ticker symbol. Its top positions include established blue chips like Lockheed Martin, AbbVie, BlackRock, Home Depot, Coca-Cola, and Texas Instruments. Many of these have already raised their dividends for decades.

The beauty of an ETF like this is that you can have instant portfolio diversification. The fund managers balance the ETF and add and remove stocks for you. Investors pay a 0.06% expense fee for these services — just $0.06 for every $100 invested in the ETF. That seems like a fair price for easy access to a hands-off dividend machine.

2. A generous and growing dividend

The ETF also delivers plenty of passive income. It pays distributions (dividends) and yields 3.4% at its current price. Remember, most healthy blue chip stocks will yield up to around 4%, so this is toward the high end of that. For reference, the S&P 500 currently yields 1.3%, so investors are getting far more income than your broader market funds.

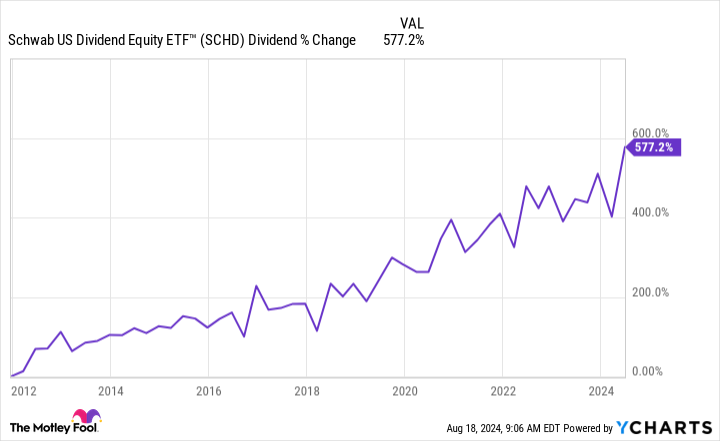

Sometimes, high yield means low growth, but that’s not the case here. The ETF has grown its dividend by more than 577% since late 2011:

That’s roughly 13 years with an annualized growth rate of over 16%! Want to build up loads of passive income? This ETF is how: Take a high starting yield and grow the payout by double digits every year. It turns out that investors can have their cake and eat it, too, with Schwab’s U.S. Dividend Equity ETF.

3. Future total return potential

The biggest knock on the ETF is that its total returns have trailed those of the S&P 500 in recent years. But that could change in the future.

You can see below that recent history is a bit of an outlier. In reality, the fund has tracked the S&P 500 pretty closely:

So, what happened?

The emergence of artificial intelligence (AI) has fueled a strong rally in technology and growth stocks, which generally exclude the types of stocks in this ETF. Most stocks in the Schwab U.S. Dividend Equity ETF are value stocks. Market conditions change over time; sometimes, growth stocks will do well, and other times, value stocks will have the spotlight.

Today, the Schwab U.S. Dividend Equity ETF trades at a price-to-earnings ratio (P/E) of 17 versus the S&P 500’s current P/E of 27. The S&P 500 is currently above its average over the past several decades.

In other words, AI stocks have stretched the broader market to a higher valuation than usual. This probably won’t last forever. Eventually, value stocks will gain favor in the market as these high-flying tech stocks come back down to earth. The ETF should perform better, and maybe even outperform the market when that happens.

You’re probably not buying the Schwab U.S. Dividend Equity ETF for potential share price gains. However, dividend investors who want competitive total returns should feel confident that it can deliver over the long term.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot and Texas Instruments. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? Buy This ETF and Hold It Forever was originally published by The Motley Fool

Leave a Reply