Should You Buy CrowdStrike Stock Before Aug. 28?

CrowdStrike Holdings (NASDAQ: CRWD) stock was battered badly last month, losing close to 40% of its value in July after it emerged that the cybersecurity specialist’s defective software update caused a massive outage. While CrowdStrike moved speedily to correct its mistake, the negative press and threats of lawsuits seem to have largely kept investors from buying the dip.

However, the fast-growing cybersecurity company is set to release its fiscal 2025 second-quarter earnings report (for the three months ended July 31) on Aug. 28. Will the report be solid enough to spark a turnaround in its fortunes? In other words, should investors consider buying CrowdStrike stock before Aug. 28 in the hope of better-than-expected results and guidance?

CrowdStrike’s upcoming results could reveal the extent of the damage it faces

The CrowdStrike incident that occurred on July 19 reportedly cost $5.4 billion of losses for Fortune 500 companies. Microsoft-based IT systems went down across the globe, while Delta Air Lines reportedly took a $500 million hit. Wall Street analysts believe that CrowdStrike is likely to undertake a long damage-control exercise to win back customer confidence.

As a result, CrowdStrike may have to offer its solutions at discounts, provide compensation to customers who lost revenue because of the outage, or even offer credits to customers. The details of the real extent of the damage that CrowdStrike may face should be evident in the earnings report.

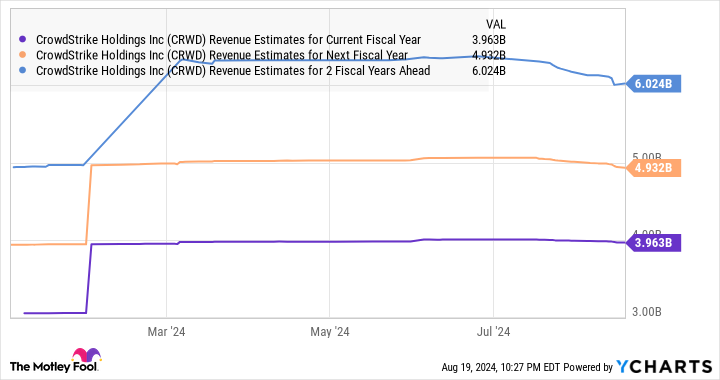

It’s worth noting that CrowdStrike previously guided for fiscal Q2 revenue of almost $960 million (at the midpoint), or a year-over-year increase of 31%. The company’s full-year revenue guidance stands at $3.99 billion, up 30% from the previous year. However, analysts have slightly lowered their fiscal 2025 revenue estimates and expect CrowdStrike to fall short of its full-year guidance. Their revenue estimates for fiscal 2026 and 2027 fell even further.

Adding to this uncertainty, the stock’s valuation isn’t exactly cheap.

The stock remains richly valued despite the pullback

CrowdStrike stock is currently trading at 20.5 times sales. That’s well above the U.S. technology sector’s average price-to-sales ratio of 7.8. For a company that’s coming off a major incident that could negatively impact its balance sheet and growth for years, timing an investment in CrowdStrike before the earnings report is too risky a move.

Investors would do well to stay away from this cybersecurity stock until the real extent of the damage it faces due to last month’s events emerges on Aug. 28.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $19,939!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,912!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,348!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 22, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and Microsoft. The Motley Fool recommends Delta Air Lines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Should You Buy CrowdStrike Stock Before Aug. 28? was originally published by The Motley Fool

Leave a Reply