Nvidia earnings highlight a busy end of August: What to know this week

Federal Reserve Chair Jerome Powell told investors on Friday “time has come for policy to adjust.”

In response, stocks finished the week near record highs. The S&P 500 (^GSPC), the Nasdaq Composite (^IXIC), and the Dow Jones Industrial Average (^DJI) all rose more than 1% on the week. The S&P 500 is now within 1% of a record closing high.

But the market’s rebound from August lows will be put to the test this week with a highly anticipated earnings release from AI leader Nvidia (NVDA) after the bell on Wednesday.

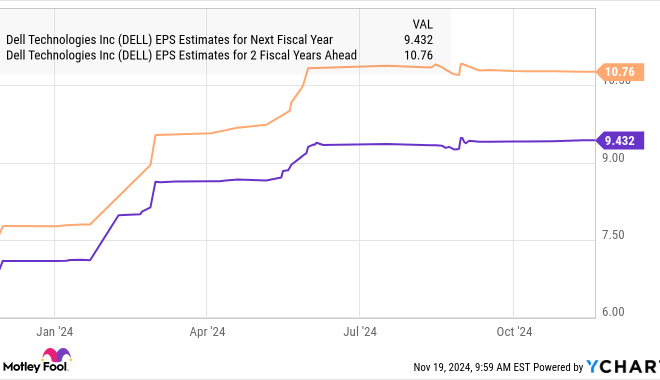

Earnings from Salesforce (CRM), Best Buy (BBY), Dell (DELL), and Lululemon (LULU) will also be in focus, while a key reading of the Fed’s preferred inflation gauge will highlight the economic calendar.

A done deal

On Friday, Powell made clear to investors that interest rate cuts are coming in September.

But he did not explicitly signal how aggressively the central bank will slash rates as it gets this easing cycle underway.

Powell noted the timing and pace of cuts will “depend on incoming data,” and markets quickly moved to fully price in four rate cuts of 0.25% by the end of 2024 on Friday morning after the Fed chair said the central bank has “ample room” to maneuver as policy enters its next phase.

With only three Fed meetings left in 2024, the looming question remains when the Fed would cut rates by 0.50% in a single meeting to reach current forecasts.

“We continue to think that if instead the August [jobs] report is weaker than we expect, then a 50bp cut would be likely [on Sept. 18],” Goldman Sachs’ economics team led by Jan Hatzius wrote in a note to clients.

As of Friday afternoon, markets were pricing in a 38.5% chance the Fed cuts by 50 basis points by the end of its September meeting, up from a roughly 24% chance seen the day prior, per the CME’s FedWatch Tool.

Capital Economics’ deputy chief markets economist Jonas Goltermann argued the Fed cutting deeper than 0.25% because of weakness in the labor market may not be a welcome sign for investors.

“Investors may reasonably worry that if the FOMC feels the need to front-load policy easing … it may be because the economy is slowing by more than the still very rosy outlook discounted in equity and credit markets implies,” Goltermann wrote in a note to clients on Friday.

“As such, it may well be that a 25bp cut in September is in fact the preferable outcome for equity markets.”

While Powell spent a large part of his Friday speech emphasizing the downside risks to the labor market, the Fed will still have its eyes on an important inflation update on Friday.

Economists expect annual “core” PCE — which excludes the volatile categories of food and energy — to have clocked in at 2.7% in July, up from the 2.6% seen in June. Over the prior month, economists project “core” PCE rose 0.2%, in line with the month-over-month increase seen in June.

Powell said on Friday his confidence has “grown that inflation is on a sustainable path back to 2%.”

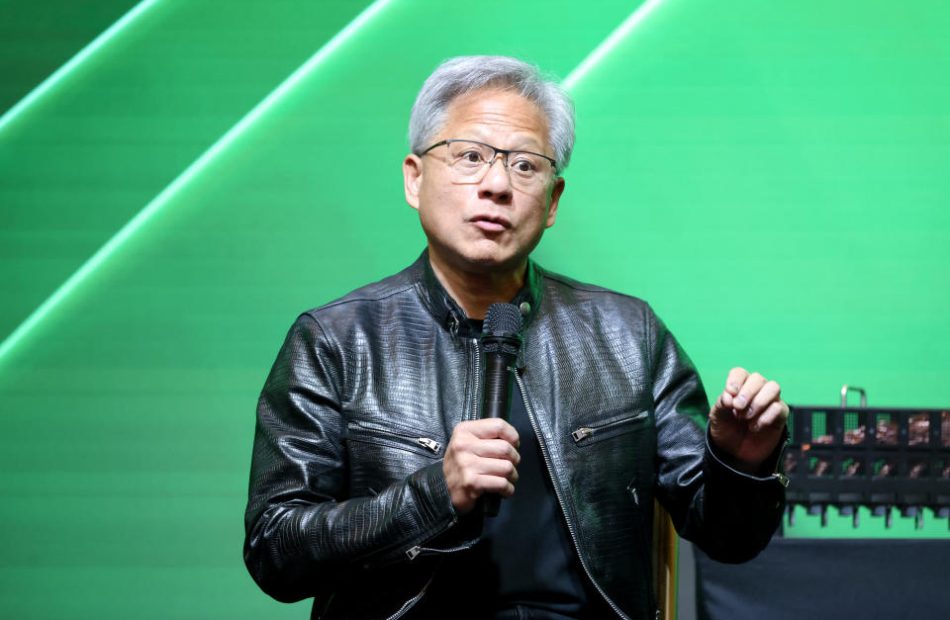

All eyes on Nvidia

With nearly all members of the S&P 500 done reporting earnings, one massive report has been looming: Nvidia.

As has been the case since the chip giant supercharged an AI-driven stock market rally with its earnings report back in May 2023, expectations for Jensen Huang’s company are sky-high.

Wall Street expects Nvidia grew earnings by roughly 109% year over year with revenue also jumping 99% compared to the same quarter a year ago. Updates on any potential delays for Nvidia’s new Blackwell chip will be in particular focus.

The stock enters the print up roughly 160% year to date.

“We believe modest expectations for Blackwell shipments in FQ3 have been backfilled with higher Hopper bookings,” KeyBanc analyst John Vinh wrote in a recent note.”We expect NVDA to report beat/raise results, in which upside will be driven by strong demand for Hopper GPUs.”

Vinh, who has a $180 price target on Nvidia, told Yahoo Finance on Thursday that the stock still looks attractive even after a recent 30% rally.

“Being one of the best-positioned semiconductor companies, obviously levered to one of the strongest product cycles in AI right now, we think it’s still attractively valued at these levels,” Vinh said.

Charles Schwab Asset Management CEO and chief investment office Omar Aguilar said the release will be a “very anticipated” release for the broader market too.

“What I think is going to be expected by the market is to hear what is the outlook for AI and what is the demand for chips going forward as people continue to spend money in AI technologies,” Aguilar told Yahoo Finance on Friday.

Tech volatility could be ‘behind us’

Whipsaw movements in Nvidia and the other “Magnificent Seven” tech stocks have been a feature of the market’s recent drawdown and subsequent bounce back.

Goldman Sachs equity strategist Ben Snider told Yahoo Finance this week that the back-and-forth action could be primed to settle down.

“I think most of the short-term volatility in [the Magnificent Seven] stocks is behind us,” Snider said.

The rally in this group — which consists of Apple (AAPL), Alphabet (GOOGL, GOOG), Microsoft (MSFT), Amazon (AMZN), Meta (META), and Tesla (TSLA), along with Nvidia — between Aug. 5 and Aug. 19 added more than $1.4 trillion to their collective market cap.

“The trajectory of sales and earnings growth has been resilient, more resilient than a lot of investors feared coming into the second quarter,” Snider added. “Valuations are by no means low compared to history, but they’re lower than they were several weeks ago, and we won’t get another earnings report for a few months now.”

For the first time since the start of 2022, hedge funds trimmed exposure to many Magnificent Seven tech stocks to end the second quarter, according to Snider’s recent analysis of securities filings for the end of the second quarter. Amazon and Apple were exceptions.

Snider said this move “speaks to the anxiety we were hearing from investors heading into the second quarter earnings season.”

He added that investors felt the stocks had benefited from the excitement around AI but also expressed “some concern that that AI investment boom was coming to an end.”

“In my conversations with investors, including hedge fund clients, there was very clearly excitement at the opportunity to buy some stocks that they already liked at lower valuations given the sell-off,” Snider said.

Now, after the snapback in tech stocks, investors aren’t as convicted as they were when buying the dip in early August. “I would call sentiment [around megacap tech] cautiously optimistic,” Snider said.

Nothing like price to change an investor’s feelings.

Weekly Calendar

Monday

Economic data: Durable goods orders, July preliminary (+4.2% expected, -6.7% previously); Dallas Fed manufacturing activity, August (-16 expected, -17.5 previously)

Earnings: Trip.com (TCOM)

Tuesday

Economic data: Conference Board Consumer Confidence, August (100.1 expected, 100.3 previously); S&P CoreLogic Case-Shiller, 20-City Composite home price index, month-over-month, June (+0.3% expected, +0.34% previously); S&P CoreLogic Case-Shiller 20-City Composite home price index, year-over-year, June (+6.81% previously); Richmond Fed manufacturing index, August (-17 previously)

Earnings: Bank of Montreal (BMO), Box (BOX), Nordstrom (JWN)

Wednesday

Economic data: MBA Mortgage Applications, week ending Aug. 23 (-10.1% prior)

Earnings: Nvidia (NVDA), Abercrombie & Fitch (ANF), Affirm (AFRM), Bath & Body Works (BBWI), CrowdStrike (CRWD), Chewy (CHWY), Foot Locker (FL), Five Below (FIVE), HP (HPQ), Kohl’s (KSS), Okta (OKTA), RBC (RBC), Salesforce (CRM), The J.M. Smucker Company (SJM)

Thursday

Economic data: Initial jobless claims, week ended Aug. 24 (235,000 expected, 232,000 previously); Personal income, month-over-month, January (+0.5% expected, +0.3% previously); Second quarter GDP, second estimate (+2.8% expected, +2.8% prior); Wholesale inventories, month-over-month, July preliminary (+0.2% prior); Pending home sales, month-over-month, July (+0.4% expected, +4.8% prior)

Earnings: American Eagle Outfitters (AEO), Best Buy (BBY), Birkenstock (BIRK), Burlington Stores (BURL), Campbell’s (CPB), Dell (DELL), Dollar General (DG), Gap (GAP), Lululemon (LULU), Marvell Technology (MRVL), MongoDB (MDB), Ulta Beauty (ULTA)

Friday

Economic news: Personal spending, month-over-month, July (+0.5% expected, +0.3% previously); PCE inflation, month-over-month, July (+0.2% expected, +0.1% previously); PCE inflation, year-over-year, July (+2.6% expected, +2.5% previously); “Core” PCE, month-over-month, July (+0.2% expected, +0.2% previously); “Core” PCE, year-over-year, July (+2.7% expected; +2.6% previously); MNI Chicago PMI, August (44.5 expected, 45.3 prior); University of Mich. consumer sentiment, August final (67.9 expected, 67.8 prior)

Earnings: No notable earnings.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Leave a Reply