Pfizer's Stock Turnaround Stalls On Covid/Flu Misstep — Is It A Buy Or A Sell?

Pfizer‘s (PFE) stock turnaround has stalled somewhat in August despite an unexpectedly strong June-quarter report, on a misstep for its combination Covid and flu vaccine.

↑

X

How Novo Nordisk, Wegovy And Ozempic Are Changing The Weight-Loss Game For Patients And Investors

Shares topped out in December 2021 and largely tumbled for several years. Pfizer stock looked ready to reverse its fortunes from April through July. But shares skidded after Pfizer said its BioNTech (BNTX)-partnered Covid and flu combination shot generated a low number of antibodies that can handle influenza B strains.

Though it protected against influenza A and Covid, the companies say they may now have to adjust the vaccine. That puts Pfizer behind Moderna (MRNA), which had more promising results for its combination shot.

Promisingly, Pfizer won approval for a hemophilia B gene therapy in the U.S. and Europe, unveiled positive results for a hemophilia A gene therapy and posted a second-quarter beat. In response to the latter, Pfizer hiked its guidance for the year by $1 billion at the midpoint.

Is Pfizer stock a buy or a sell today?

Pfizer Stock Fundamentals

In the June quarter, Pfizer earned an adjusted 60 cents per share on $13.3 billion in sales. Both beat expectations. Earnings declined 11% while sales rose 3% operationally. It was the first quarter since December 2022 that sales increased year over year.

Sales of heart disease treatment Vyndaqel surged 71% to $1.32 billion and easily topped forecasts. Padcev, a cancer drug Pfizer acquired with Seagen, brought in $394 million in sales, coming in above projections for $352.6 million.

Revenue from the Covid vaccine Comirnaty plummeted and missed expectations. But Covid treatment Padcev topped the Street’s call and soared 79%.

For the third quarter, analysts project 60 cents earnings per share and $14.98 billion in sales. Profit would reverse from a year-earlier loss and sales would climb more than 13%.

This year, Pfizer expects adjusted earnings of $2.45 to $2.65 a share and $59.5 billion to $62.5 billion in sales. At the midpoints, earnings would surge 39% as sales pop more than 4%.

Obesity Treatments In Focus

Investors have zeroed in on Pfizer’s efforts in obesity treatment. The company says it plans to send a drug called danuglipron into additional testing. Danuglipron is a daily pill, compared to leading shots from Eli Lilly (LLY) and Novo Nordisk (NVO).

But Leerink Partners analyst David Risinger doesn’t expect Pfizer to have effectiveness and safety test results until 2026. Danuglipron is one of three obesity treatment candidates Pfizer has in testing. The company has a similar drug that mimics GLP-1 — a hormone tied to satiety and stomach emptying — and a third with an undisclosed mechanism.

The field for oral weight-loss drugs is becoming increasingly crowded. Roche (RHHBY), Viking Therapeutics (VKTX), Structure Therapeutics (GPCR), AstraZeneca (AZN) and others are all in this space.

Pfizer Stock And Recent News

Outside of obesity treatment, Pfizer recently launched PfizerForAll, a digital platform to help people connect with health care providers for migraine, Covid or flu. It also connects people with vaccines for Covid, flu, respiratory syncytial virus and pneumonia.

Earlier this month, the Food and Drug Administration signed off on updated Covid vaccines from Pfizer and Moderna. These shots aim to block against the KP.2 strain and are recommended for people age 6 months and older.

Technical Analysis: PFE Stock Tops 50-Day Line

Pfizer stock is trading in line with its 50-day moving average, and remains above its 200-day line. The stock broke out of a flat base with a buy point at 29.73 on July 17, MarketSurge shows. But shares are now well below their buy zone.

In fact, Pfizer stock tiptoed close to a sell zone on Aug. 16, falling more than 6% below its entry. Savvy investors are encouraged to cut their losses when a stock falls 7% to 8% below is entry.

(Related: Keep tabs on chart patterns by visiting IBD’s MarketSurge.)

Pfizer stock has an IBD Digital Composite Rating of 42 out of a best-possible 99. The CR is a measure of a stock’s fundamental and technical measures. Shares also have a Relative Strength Rating of 28, a measure of 12-month performance.

Is PFE Stock A Buy Or A Sell?

Based on savvy rules of investing, Pfizer stock is neither a buy nor a sell. Shares are below their chase zone, but haven’t entered a sell zone. Further, the stock hasn’t made a definitive move below its 50-day or 200-day lines.

But Pfizer stock still has to prove its fundamental and technical merit.

Pfizer is trying to shore up its pipeline to return to the growth it saw at the height of the pandemic. The RSV vaccine and a potential approval in obesity treatment could be key.

To find the best stocks to buy and watch, check out IBD Stock Lists. Make sure to also keep tabs on stocks to buy or sell.

Follow Allison Gatlin on Twitter at @IBD_AGatlin.

YOU MAY ALSO LIKE:

Biotech Stocks To Watch And Pharma Industry News

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

Watch IBD’s Investing Strategies Show For Actionable Market Insights

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

The biggest challenge for Nvidia stock in one chart

Nvidia’s (NVDA) growth metrics aren’t impressing Wall Street like they used to.

Nvidia reported earnings on Wednesday which showed the company’s earnings and revenue grew more than 100% from the prior year. But it also marked the company’s slowest year-over-year revenue growth, 122%, in a year, and the rate of growth compared to the prior year was less than half what Nvidia reported in the first two calendar quarters of 2024.

Shares were down as much as 3.5% early Thursday morning.

And this growth slowdown, D.A. Davidson managing director Gil Luria told Yahoo Finance, is the chief concern with the stock right now and why he maintains a Neutral rating on the AI juggernaut.

“Next year we’re going to have, at the very least, decelerating growth and possibly at some point, revenue declines,” Luria said.

“Where if you look at consensus estimates, sell-side estimates, they are for the growth to continue at very, very high rates that are very hard to justify considering Nvidia’s revenue is these other companies margins.”

At some point, Luria argued, the big tech hyperscalers like Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL, GOOG), and Meta (META) are going to slow their spending. And given they represent the lion’s share of Nvidia’s current AI chip sales, that’d likely be a headwind to future revenue growth.

“The estimates for next year and the year after that are starting to get way, way out of control,” Luria said.

Nvidia’s earnings call was still rather upbeat. CEO Jensen Huang described the demand for the AI leader’s new Blackwell chip as “incredible.” And plenty of Wall Street analysts remained bullish on the stock as fears about delays on the Blackwell chip were somewhat eased during the earnings call.

But for investors assessing a stock that has rallied more than 1000% since the start of the current bull market in October 2022, slowing growth appears to be a sticking point. As Jefferies analyst Blayne Curtis wrote in a note to clients, Nvidia’s guidance for current quarter revenue of $32.5 billion — plus or minus 2% — appeared to be “good but not good enough.”

Nvidia’s results also didn’t surprise Wall Street at the same pace that they had been.

The company posted its slimmest upside surprise to Wall Street’s revenue expectations since the start of 2023. Its roughly 5% beat on earnings per share was the narrowest surprise since before the AI revolution kicked off in 2023, too.

“The size of the beat this time was much smaller than we’ve been seeing,” Carson Group chief markets strategist, Ryan Detrick wrote in reaction to the earnings release.

“Even future guidance was raised, but again not by the tune from previous quarters. This is a great company that is still growing revenue at 122%, but it appears the bar was just set a tad too high this earnings season.”

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Trump Media shares sink below $20 for the first time since going public

-

Shares of Trump Media have tumbled this week, hitting a new record low under $20 per share.

-

The stock has sunk since Kamala Harris entered the race and reshuffled election odds.

-

The stock also took a hit this month when Trump returned to rival platform, X.

Trump Media continued its recent downward spiral this week, hitting a record low.

The Truth Social owner’s shares fell below $20 each in Wednesday’s session, a first since the company went public in March.

The stock has been sliding since mid-July, fueled by President Joe Biden dropping out of the race and Democrats uniting around Vice President Kamala Harris as the Democratic nominee last month, shaking up the election odds in the process.

Betting market PredictIt currently forecasts a 47% chance of a Trump win, down from 69% in mid-July after a failed assassination attempt on the former president.

In the weeks since its mid-July surge of $40.58, Trump Media has lost 51% of its value amid falling odds of a win for the Republican presidential nominee.

The shares also saw swift declines following Trump’s return to X, a Truth Social competitor, earlier this month ahead of an interview with the platform’s CEO Elon Musk. The stock dropped 5% the day after he made his first post on the platform in three years.

Investors are also likely feeling skittish ahead of the expiration of a lock-up agreement that could allow Trump and other company insiders to start selling shares. The agreement could expire as early as September 20.

The former president has a nearly 60% stake in the company, amounting to over $2.2 billion and accounting for over half his net-worth, according to data from Forbes.

Read the original article on Business Insider

Roth Conversion Ladder 101: Your Guide to Tax-Free Withdrawals

A Roth conversion ladder can be a smart strategy that allows you to move funds gradually from one account (traditional IRA) to another (Roth IRA) without triggering any tax penalties. This conversion takes place over several years, and is carefully planned out in advance. In simpler terms: A Roth conversion ladder could let you bypass the 10% early withdrawal penalty. Let’s break down how it works.

If you’re interested in a Roth conversion ladder, a financial advisor can walk you through the steps and tax requirements.

How a Roth IRA Works

A Roth IRA is a retirement savings account that can offer significant tax advantages.

Here’s how it works: You put in post-tax dollars (the money you’ve already paid taxes on) and let it grow over time. Then, when you’re ready to retire, the money you withdraw can be tax-free.

Roth IRAs are particularly alluring to those who anticipate being in a higher tax bracket when they retire.

These accounts also do not mandate minimum distributions per year and allow you to keep contributing no matter your age.

Roth IRA Contribution and Income Limits

There are, however, some rules involved with how much you can contribute to a Roth IRA. For 2024, the contribution limit is $7,000, or $8,000 if you’re age 50 or older.

But, take note: Contributions get phased out in 2024 for high earners or individuals with incomes above $146,000-$161,000 for single filers and $230,000-$240,000 for married couples filing jointly.

What happens if you accidentally exceed these limits? Over-contribution can carry a 6% penalty, and if your income surpasses the limit and you keep contributing, you also face a 6% penalty on those contributions.

Thus, understanding these restrictions can help you sidestep unnecessary penalties and ensure that you capitalize on your Roth IRA.

What Is a Roth IRA Conversion?

A Roth IRA conversion allows you to move funds from a traditional IRA or a 401(k) to a Roth IRA. You typically do this to gain tax advantages, specifically your money will continue to grow tax-free after you pay taxes on the conversion upfront.

This strategy could benefit retirement savers who expect to move into a higher tax bracket in their golden years, want to decrease the amount of required minimum distributions (RMDs) or aim to leave tax-free income for their heirs.

Keep in mind, that just like other financial moves, you will incur costs. And, converting your IRA also carries tax implications.

The amount transferred to a Roth IRA will be taxed as ordinary income in the year of your conversion. But, it offers potential growth and withdrawal benefits afterward.

In addition to tax-free growth, qualified withdrawals in retirement can also be tax-free, which can offer you greater flexibility to manage your retirement income.

How a Roth IRA Conversion Ladder Works

A Roth IRA conversion ladder is a strategy that allows you to access retirement savings early. To do this, you convert a portion of your traditional IRA funds to a Roth IRA over a number of years.

By spacing out conversions, you can effectively access your retirement savings early without restrictions. But you’ll have to wait five years before you can access your retirement savings early without penalty (more information in the section below).

This strategy could benefit you potentially because it offers tax diversification and flexibility in managing retirement income, in addition to penalty-free access to your retirement funds.

Roth IRA conversion ladders are also used commonly by early retirees who want to make the most of their retirement in their 50s, and those with other sources of income who want to optimize their tax situation in retirement.

Understanding the 5-Year Waiting Period

While Roth IRAs allow you to take money out without taxes or penalties, conversions work differently.

For each conversion, you’ll have a five-year waiting period, which means that if you take the money out before this time, you’ll have to pay a 10% early withdrawal penalty.

If you take the money out within the five years, you’ll only have to pay the 10% withdrawal penalty since you already paid income taxes upfront when you made the conversion.

There is some good news: Certain circumstances, such as being a first-time homebuyer, accruing education-related expenses or significant medical costs, can exempt you from this rule.

When using this strategy, make sure not to overlook other tax implications as well. For example, if you convert a large amount in a single year, you could shift into a higher tax bracket. And this can lead to an unexpectedly large tax bill.

For a clear understanding, consider working with a financial advisor to ensure that you’re completing the transfer correctly and don’t incur any penalties.

Bottom Line

A Roth IRA conversion strategy is not a one-size-fits-all solution. Your financial situation is as unique as you are. Navigating the landscape of Roth IRAs and Roth IRA conversion ladders can be complex, but with personalized advice, you can be well-equipped to make savvy decisions for your financial future.

Tips for Retirement Planning

-

Understanding how much you need to save for retirement is a number that can change over time based on inflation or growing needs. Having a financial advisor in your corner can help protect against potential changes by always maximizing your potential to reach your long-term financial goals. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

You may want to frequently use a retirement calculator to help you know if you’re still on track to save enough money for the retirement you want.

Photo credit: ©iStock.com/Pekic, ©iStock.com/izusek, ©iStock.com/vorDa

The post How a Roth IRA Conversion Ladder Works appeared first on SmartReads by SmartAsset.

Move Over, Nvidia: Billionaires Have a New Favorite Artificial Intelligence (AI) Stock

Over the last 30 years, no shortage of next-big-thing investment trends have graced Wall Street. Since the advent of the internet in the mid-1990s, no innovation, technology, or trend has come close to having the impact on corporate growth rates as the internet… until now.

According to the analysts at PwC, the artificial intelligence (AI) revolution has the ability to increase global gross domestic product by more than $15 trillion in 2030. This is a mammoth addressable market that can support multiple big-time winners.

Yet in spite of the euphoria surrounding AI on Wall Street, quarterly filed Form 13Fs with the Securities and Exchange Commission point to mixed feelings for artificial intelligence-inspired stocks. A 13F provides investors with a concise snapshot of which stocks the smartest and most-successful money managers have been buying and selling.

In the June-ended quarter, billionaire investors sent shares of AI leader Nvidia (NASDAQ: NVDA) to the chopping block and decisively piled into what can be considered their new favorite artificial intelligence stock.

Nvidia had billionaires running for the exit for a third consecutive quarter

What’s particularly interesting about the selling activity in Nvidia is it marks the third straight quarter of selling by at least a half-dozen prominent billionaires. The June-ended quarter saw seven billionaire investors lighten their load, including (total shares sold in parenthesis):

-

Ken Griffin of Citadel Advisors (9,282,018 shares)

-

David Tepper of Appaloosa (3,730,000 shares)

-

Stanley Druckenmiller of Duquesne Family Office (1,545,370 shares)

-

Cliff Asness of AQR Capital Management (1,360,215 shares)

-

Israel Englander of Millennium Management (676,242 shares)

-

Steven Cohen of Point72 Asset Management (409,042 shares)

-

Philippe Laffont of Coatue Management (96,963 shares)

Profit-taking and the need to diversify are two possible answers as to why some or all of these billionaires felt the need to reduce their stakes in Nvidia.

Since 2023 began, Nvidia’s market cap has grown by $2.75 trillion, as of the closing bell on Aug. 23, 2024, which led to the company’s largest-ever stock split (10-for-1) in June. This increase is due to the company’s H100 graphics processing unit (GPU) becoming the standard in AI-accelerated data centers, as well as Nvidia possessing jaw-dropping pricing power, which is reflective of enterprise demand for its AI-GPUs overwhelming supply.

But there are far more reasons than just profit-taking that might explain this ongoing billionaire exodus from Nvidia.

One of the more logical conclusions to draw is that at least some of these billionaires are concerned about competitive pressures following its parabolic climb. Advanced Micro Devices (NASDAQ: AMD) is ramping up production of its MI300X AI-GPU and doesn’t have the same chip-fabrication supply constraints as Nvidia. Further, AMD’s chip typically sells for $10,000 to $15,000, which is far below the $30,000 to $40,000 Nvidia is commanding for the H100.

Competitive pressures can manifest from within, as well. Nvidia’s four largest customers by net sales — Microsoft, Meta Platforms, Amazon, and Alphabet — have developed in-house AI-GPUs for use in their data centers. Even though these in-house chips won’t have the same computing capacity as Nvidia’s H100, they’re going to take up valuable data center “real estate” and minimize Nvidia’s opportunities moving forward.

These seven billionaire sellers might also be concerned about history. At no point over the last three decades has there been a hyped innovation, technology, or trend that managed to avoid an early stage bubble-bursting event. Without exception, investors always overestimate the utility and adoption of new innovations.

Despite all the buzz with artificial intelligence, very few businesses have well-defined game plans as to how they’re going to generate a positive return on their data center investment. This is a glaring warning that investors have, once again, overestimated the uptake of this technology. If and when the AI bubble bursts, no company is likely to be hit harder than Nvidia.

Move over, Nvidia: This is now the favorite AI stock of billionaire money managers

But while billionaires were showing shares of Nvidia to the door, they were avidly scooping up shares of what can arguably be described as their new favorite AI stock. A total of seven billionaire money managers were buyers of shares of AI networking solutions specialist Broadcom (NASDAQ: AVGO) during the second quarter, including (total shares purchased in parenthesis):

-

Ole Andreas Halvorsen of Viking Global Investors (2,930,970 shares)

-

Jeff Yass of Susquehanna International (2,347,500 shares)

-

Israel Englander of Millenium Management (2,096,440 shares)

-

Ken Griffin of Citadel Advisors (1,880,740 shares)

-

John Overdeck and David Siegel of Two Sigma Investments (1,332,230 shares)

-

Ken Fisher of Fisher Asset Management (865,090 shares)

Keep in mind that the above share counts have been adjusted for Broadcom’s 10-for-1 stock split, which occurred after the close of trading on July 12.

Just as Nvidia’s hardware has become a staple in high-compute data centers, Broadcom has quickly asserted its dominance as a key AI networking solutions provider. For instance, its Jericho3-AI fabric is capable of connecting up to 32,000 GPUs, with the goal of reducing tail latency and maximizing the computing capacity of these chips.

While AI has undoubtedly been a catalyst, the reason I suspect billionaires have made Broadcom their favorite AI stock is that, unlike Nvidia, it’s not entirely reliant on AI for growth. If the AI bubble bursts, Broadcom has a multitude of other revenue channels it can turn to as a cushion.

For example, Broadcom has a leading position as a provider of wireless chips and accessories used in next-generation smartphones. Wireless companies have willingly spent billions to upgrade their networks to support 5G download speeds. In turn, this has led to a steady device-replacement cycle that’s spurred demand for Broadcom’s products.

Beyond smartphones, you’ll find Broadcom supplying networking solutions to businesses from all sectors and industries, along with cybersecurity solutions and financial software, to name some of its other ventures.

Broadcom has also leaned on acquisitions as a way to expand its product and service ecosystem, promote cross-selling opportunities, and grow its bottom line. Its $69 billion buyout of cloud virtualization software provider VMware, which closed in November, is a perfect example of Broadcom broadening its reach in private and hybrid enterprise clouds.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Move Over, Nvidia: Billionaires Have a New Favorite Artificial Intelligence (AI) Stock was originally published by The Motley Fool

If I Could Only Buy 1 Artificial Intelligence (AI) Semiconductor Stock Over the Next Decade, This Would Be It (Hint: It's Not Nvidia)

Believe it or not, semiconductor chips are used for applications well beyond powering smart devices and electronics. For this reason, it’s not entirely surprising that semiconductor stocks have been particularly big winners as the artificial intelligence (AI) revolution pushes forward.

Among leading chip companies, Nvidia (NASDAQ: NVDA) stands out as the 800-pound gorilla right now. But with shares up 651% since August 2022, investors may want to consider what opportunities exist in the chip realm besides Nvidia.

Let’s dig into how Nvidia propelled itself into being the world’s top chip business, and assess why another stock may be the better buy in the long run.

Nvidia is great, but …

Chips known as graphics processing units (GPUs) are used for a host of AI-powered applications such as training large language models, developing autonomous driving software, and machine learning. Nvidia’s GPU roster includes its highly popular H100 and A100 chips, and the company’s new Blackwell series is already forecast to be a smash hit (but more on that later).

Indeed, Nvidia looks downright unstoppable, with a nearly 80% share of the AI-powered chip market.

Nevertheless, I caution investors about going all-in on one company — even if it is the de facto leader. Below, I’ll break down in detail why Nvidia’s time at the top may be drawing to a close.

The competitive landscape is beginning to intensify

Many of the world’s largest companies are currently customers of Nvidia. In fact, many “Magnificent Seven” companies, such as Microsoft, Tesla, Amazon, Meta, and Alphabet, have been touted as some of Nvidia’s largest customers.

Although a customer roster of that caliber is impressive, I question whether it’s encouraging. Tesla CEO Elon Musk recently explained to investors that his electric vehicle company is exploring ways to compete with Nvidia more directly as Tesla looks to move away from a heavy reliance on H100 chips.

Furthermore, many of the Magnificent Seven companies referenced above have made it clear that they too are investing significantly into capital expenditures (capex) to develop in-house chips.

For example, I see Amazon’s $11 billion data center infrastructure project as a clear sign that the company is looking to increase investment in its Trainium and Inferentia chips.

What’s amazing is that all of the competitors analyzed above are tangential to Nvidia. Designing semiconductors isn’t a core component of any of their businesses.

Perhaps Nvidia’s most direct competitor at the moment is Advanced Micro Devices (NASDAQ: AMD). While AMD’s growth during the AI revolution hasn’t even been in the same universe as Nvidia’s, I think those dynamics may soon change.

Nvidia’s momentum has hit some turbulence following a recent announcement that the new Blackwell chips will be delayed due to a design flaw. Although I suspect Nvidia will still sell out of these chips when they finally do hit the market, I think AMD has an opportunity to capture some new business right now.

With all this said, I think it’s only a matter of time before Nvidia’s growth begins to decelerate. Subsequently, I would not be surprised to see the stock give back some of its record gains.

This company stands to win regardless

Given the sheer number of competitors and the risks that come with commercializing new products and services, you’re probably wondering which chip stock I actually do have full confidence in.

Enter chip manufacturing company Taiwan Semiconductor (NYSE: TSM). You see, Nvidia, AMD, and many others do very little of their own manufacturing. Instead, after designing next-generation hardware, they outsource the actual manufacturing capability to Taiwan Semiconductor.

Taiwan Semiconductor makes products for Nvidia, AMD, Amazon, Broadcom, Intel, Qualcomm, Sony, and many more.

According to data from Market.us, the total addressable market (TAM) for the global AI chip market is expected to grow at a compound annual growth rate (CAGR) of 31.2% between 2024 and 2033 — reaching a size of $341 billion.

To me, Taiwan Semiconductor stands to benefit no matter what company is selling out their chips. Moreover, given the high likelihood of additional GPUs coming to market from big tech and the bullish forecast for the AI chip market more broadly, I see Taiwan Semiconductor as a clear winner over the next several years.

Investors with a long-term horizon who are looking for alternatives to AI’s most obvious opportunities among mega-cap tech may want to seriously consider a position in Taiwan Semiconductor right now.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

If I Could Only Buy 1 Artificial Intelligence (AI) Semiconductor Stock Over the Next Decade, This Would Be It (Hint: It’s Not Nvidia) was originally published by The Motley Fool

Insiders Are Selling These REITs This Week — Cause For Concern?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Investors pay close attention whenever reports emerge of insider transactions on their stocks Some traders may sell the stock if it’s reported that an insider sold numerous shares. However, it’s widely held that insider buys are far more significant than insider sales. Insiders only buy shares because they expect the company stock will go up. On the other hand, insiders may sell for reasons that have nothing to do with present or future company performance.

Perhaps the insider is purchasing a new home, paying for a child’s college or wedding or rebalancing a portfolio. Investors rarely know the motivation for the sale, so assumptions that the company has gone bad may be misleading.

If a shareholder learns that an insider has sold shares of that stock, the transaction can be investigated further by checking the U.S. Securities and Exchange Commission (SEC) Form 4. This is the form that company insiders or their legal representatives must fill out when buying or selling company stock.

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Anyone can access Form 4 from the SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) database at sec.gov. by clicking on search filings and full-text search and supplying the company name. Some brokerage platforms also include the link to Form 4 when reporting an insider transaction.

On Form 4, sometimes an explanation is given for the sale. For example, “This transaction was effected pursuant to a rule 10b5-1 trading plan adopted by the reporting person dated as of July 1, 2024.”

Rule 10b5-1 was adopted in 2000 to provide an affirmative defense to insider trading liability and is intended to show circumstances in which an insider has a written plan in place well in advance to sell shares of the company stock. For example, an insider may have an automatic sell plan twice a year, regardless of the stock price or company performance.

Another situation arises when the insider sells shares to cover the taxes generated by the settlement of vested restricted stock awards. Often, a company may withhold some shares when giving its executive team bonus stock. Those shares are automatically sold to cover the taxes.

This week insiders at three real estate investment trusts (REITs) from different sub-sectors sold a large block of shares. Does this mean those stocks or REITs in general are about to collapse? Take a look.

Prologis

Prologis Inc (NYSE:PLD) is a San Francisco, California-based industrial REIT that owns/manages approximately 1.2 billion square feet in 5,618 industrial logistics properties throughout the U.S. and 18 other countries. Prologis leases space and supplies equipment, robotics and other services to its customers.

On Aug. 26, 2024, Joseph Ghazal, the Chief Investment Officer at Prologis, sold 5,200 shares of Prologis at $129.07 for a total of $671,164. However, Mr. Ghazal still had approximately 13,187 shares remaining following this transaction and there have been no other insider sales of Prologis stock this year, despite it being down year-to-date. Those are positive signs.

Omega Healthcare Investors

Omega Healthcare Investors (NYSE:OHI) is a Hunt Valley, Maryland-based triple-net equity healthcare REIT that provides financing, capital and triple-net leasing to 77 different operators among approximately 900 senior housing, skilled nursing and assisted living facilities across 42 states throughout the U.S. and the United Kingdom.

On Aug. 26, Daniel Booth, Chief Operating Officer at Omega Healthcare, sold 25,000 shares of Omega company stock at a weighted average price of $38.7072, for a total value of $967,680.

This sale is troubling because the same day, Robert O. Stephenson, Omega’s CFO, also sold 30,000 shares at the weighted average price of $38.784 for a total of $1,163,520.

Director Dr. Lisa Egbuonu-Davis, sold 1,352 shares at $38 on Aug. 13, for $51,376. Davis still owns 16,766.

When more than one insider is selling, that does carry additional weight. Omega Healthcare has risen 48.4% since its low in early February, and insiders might be securing profits near a peak.

Read More:

BXP

BXP Inc (NYSE:BXP), formerly Boston Properties, is a Boston-based office REIT that owns and operates 186 properties of 53.5 million square feet in New York, Boston, Los Angeles and San Francisco. In August 2024, 89.1% of in-service properties are presently leased, with a weighted average lease term (WALT) of 7.5 years. BXP is a member of the S&P 500.

On Aug. 26, Peter V. Otteni, the Executive Vice President of BXP, sold 4,785 shares of BXP stock at an average price of $73.4422, for a total value of $351,420.

BXP has had a successful run-up since June, gaining about 33.5%. Company executives often trim positions after such gains. However, one interesting note is that this is the second time Mr. Otteni has sold a significant number of shares in the last three months, and Form 4 shows that he has no remaining shares. However, these are the only recent insider sales so this is likely a personal decision, rather than BXP not doing well.

This summer, there were two insider sales at residential REIT, UDR Inc (NYSE:UDR). One insider sold 90,000 shares at $39.52 per share, and the other sold 45,000 shares at $37.90. However, their timing was off because UDR has since reported excellent Q2 earnings and received several analyst price target increases. It recently traded at $44.

Several other REITs with a recent insider sale include Brixmor Property Group (NYSE:BXR), CBL & Associates (NYSE:CBL), Equity Lifestyle Properties (NYSE:ELP) and AvalonBay Communities Inc (NYSE:AVB).

The National Association of Real Estate Investment Trusts (NAREIT) identifies 171 REITs, so a handful of REITs with insider sales do not make up an entire sector. With the Fed expected to cut interest rates in September, REITs could be poised to make significant gains over the next 12 months.

So, sleep well, investors, and don’t worry when you hear that an insider has sold shares of company stock. It’s best to seek additional information on the SEC’s Form 4 before leaping to conclusions about insider motivation.

Better Yields Than Some REITs?

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through REITs.

Arrived Homes, the Jeff Bezos-backed investment platform has launched its Private Credit Fund, which provides access to a pool of short-term loans backed by residential real estate with a target 7% to 9% net annual yield paid to investors monthly. It paid 8.1% in July. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

As long-term rates go down and short-term rates stay high, there’s a unique chance to invest in fix & flip loans before yields drop. Check out Benzinga’s favorite high-yield offerings.

This article Insiders Are Selling These REITs This Week — Cause For Concern? originally appeared on Benzinga.com

The Market Just Made a Big Mistake About SoFi. Here's Why

SoFi Technologies (NASDAQ: SOFI) stock’s decline has got to be one of the biggest disappointments of the year. It came into 2024 on a high, having more than doubled last year and with the company sporting profitability for the first time.

It continues to report strong growth, and it posted its third straight quarterly profit, but SoFi stock is down more than 20% this year. The market is making a mistake, and you can benefit from the stock drop before the market gets clued in.

SoFi is disrupting traditional banking

SoFi is a full financial services platform that offers lending services, banking products, and more on its digital app. It has no physical branches, and it targets the student and young professional population. This cohort appreciates a digital, consumer-focused experience. SoFi is attracting millions of members who are looking for a better product, and since these customers skew younger, it has a long growth runway as this market matures and increases engagement with SoFi’s platform.

The Q2 earnings update was chock-full of positive news. Members increased 41% year over year to nearly 8.8 million, adjusted net revenue increased 20%, and it produced net income of $18 million in accordance with generally accepted accounting principles (GAAP). Management raised its outlook for 2024 adjusted net revenue and earnings per share (EPS), and it’s expecting positive net income for the third quarter and the full year.

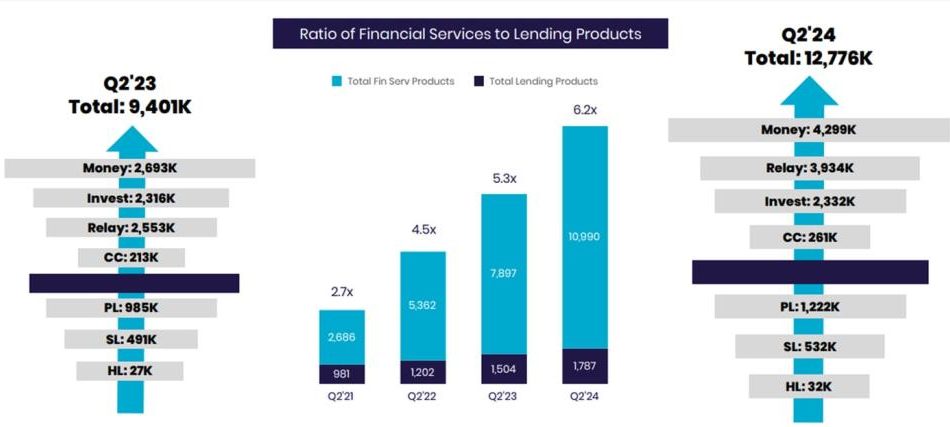

SoFi is more than a lender

It’s not obvious at first glance exactly what’s bugging the market, although concerns about slowing loan growth probably figure in the share price decline. But what it looks like is that while SoFi is eager to show off its newer segments and how they hedge against pressure in lending, they’re not yet taking over for the credit business yet.

SoFi has been expanding its business to encompass a wider array of services. Outside of its core lending segment, it now has two other segments: Tech platform, or the white-label financial infrastructure services under the Galileo brand, and financial services, which are the non-lending services.

These two business are growing at a much faster rate than lending, and they appeal to a large population even during challenging conditions when the lending business is under pressure. They add more revenue and ease the lending pressure, but what they really accomplish is creating a wider service base from which members can increase engagement. The positive results of this model are already in, but they’ll be even more beneficial over time as more members join the platform.

However, the lending segment remains much bigger. It accounted for 55% of revenue in Q2, so while the other segments are booming, the core segment isn’t growing very much. Lending segment revenue was $341 million in Q2, a 3% increase from last year. The other two segments increased 46% year over year in Q2, but they’re still much smaller.

Lending contribution profit was $198 million, or 8% more than last year. Together, financial services and tech platform contribution profit was $86 million. That’s where you really see the value of the lending platform for SoFi’s business. So when the lending contribution is up only 8%, that looks concerning, even though the tech platform’s contribution increased 82% and financial services switched from a loss to a gain.

Overall, the company reported a profit. But that profit is largely coming from a slowing lending business. Until these other segments take over a larger portion of the business and contribute more to the consolidated results, the market senses trouble.

Wake up before the market does

Fortunately for SoFi and its shareholders, the pessimism that the market is pricing in looks unwarranted when you consider the long-term opportunity. The market isn’t ready to be confident about SoFi’s new business potential, even though it’s already demonstrating results. This is a visual representation of how the non-lending segments are growing.

SoFi’s expansion plan is working, and the new members and increased engagement should eventually eclipse the short-term weakness in the lending segment. However, interest rates are probably going to be cut before that, and when that happens, SoFi’s lending segment should rebound. Together, that makes for a dynamite long-term investment.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Market Just Made a Big Mistake About SoFi. Here’s Why was originally published by The Motley Fool

Retiring abroad? Why the best, happiest places to grow older and retire are not where you’d expect.

Those international “best places to retire” surveys typically point to warm, low-cost countries in Central and South America. But, in many ways, beautiful northern places like Norway, Denmark, Finland and Iceland may be even better.

That’s my conclusion after poring over the 2024 World Happiness Report, the Natixis 2023 Global Retirement Index and the Mercer CFA Institute Global Pension Index 2023, as well as speaking to their creators.

Most Read from MarketWatch

And after vacationing in Norway where I talked with an old friend who is a semi-retired U.S. expat married to a retired Norwegian, I came away even more persuaded that you might want to consider the Nordic region if you’re thinking about retiring abroad.

Really.

‘I’m happy to pay my taxes’

“To me, Norway is a magical place,” my pal Nina Berglund, a digital editor and former Californian, said. “We have good pensions and I feel very well taken care of here. But we also have contributed a lot [in taxes] of course.”

Added her husband Morten Most, a retired journalist: “You often hear Norwegians say, ‘I’m happy to pay my taxes,’ and to a certain extent that is true because of the expectation that your taxes will be worth it.”

Those steep Norwegian sales taxes, an annual wealth tax of 1.1% on assets over $160,000 and the national Norwegian Oil Fund help pay for government-provided retirement pensions plus nearly free health care, long-term care and college educations. Employers must provide pensions, too.

In Norway, Berglund said, if you need home care or a nursing home, “everything is covered.” The copay for a doctor’s appointment is around $25, she noted. Hospital stays, X-rays, MRIs and CAT scans are mostly covered by government health care.

Retirees living in Norway only pay taxes on income they earn there (22% to 39%). There’s no inheritance tax and property taxes are low by U.S. standards.

“I don’t feel stressed at all,” said Most. “Time flies very fast. I have a good retirement.”

Read MarketWatch’s Where Should I Retire? column

High rankings for retirement and happiness among people 60+

Indeed, Norway ranked No. 1 in Natixis’ Global Retirement Index for the third straight year. That index measures retirement security by looking at health, finances in retirement, quality of life and material wellbeing.

Norway was also the third happiest country for people 60 and older in the World Happiness Report, based on residents’ assessments of their lives. Denmark topped the World Happiness Report and the U.S. ranked No. 10.

Along with nearby Sweden, Norway scored a B in the Global Pension Index, calculated by crunching data on the adequacy, sustainability and integrity of each nation’s retirement income system. Denmark nailed an A.

Some Nordic countries are remarkably safe, too. In Numbeo’s 2024 Global Safety Index, Iceland ranked 18, Denmark 20, Finland 23, Norway 39; the United States is 88.

What makes the countries score so well

Why do Scandinavian countries of Norway, Denmark and Sweden plus Nordic ones like Finland and Iceland consistently show up so well in these types of surveys?

Countries at the top of the World Happiness rankings, said John Helliwell, a lead researcher for that study, are well-off and people have “good connections, high trust and high caring for each other.”

“I tend to think that it’s the holistic view of things they have,” said David Goodsell, executive director of the global research program, Natixis Center for Investor Insight, which publishes the Global Retirement Index. “If you’re not worried about your healthcare or about wanting to [afford to] go back to school in retirement,” he added, “those things are going to impact how you feel.”

David Knox, who heads up Mercer’s Global Pension Index, cites what he calls the “social compact” of these countries between their residents as well as between the residents and their governments.

“Each generation expects to support, and then receive from, the next generation,” he said. “It’s a less individualistic society” than in the United States, Knox added.

Two other factors Goodsell cited: stable economies and small populations — combined, Nordic countries have fewer people than Canada.

When setting retirement policies, said Knox, “I think it’s easier for a relatively smaller country to say: ‘This is what we are going to do.’”

Employers tend to be paternalistic in Nordic countries, too, which helps in retirement. “In Denmark, more than 80% of the working-age population has a pension account,” said Knox. “That’s much higher than in America.”

Good retirement systems, happy residents

Knox isn’t surprised that many Scandinavian and Nordic countries score so well in both the World Happiness Report and his Global Pension Index.

As people approach retirement, he said, if their government is under pressure financially, “they may worry, ‘Will they cut the state pension and can I afford to retire?’ But if I’m in a system like Norway, which has the confidence of the Oil Fund, there’s an element of ‘I’m happy I’m going to retire here’ and that there will be support from the government, whether it’s in pensions or health care or whatever.”

Absent from ‘best places to retire’ rankings

Interestingly, the annual Best Places to Retire surveys from International Living and Live and Invest Overseas don’t even include Nordic countries in their rankings. I asked their creators why.

Donal Lucey, head of digital content at International Living, cited the cost of living which, he said, “can be prohibitive for retirees.”

It’s true that gasoline and groceries can be high in that part of the world, but rents are significantly lower in Oslo, Copenhagen and Stockholm than New York City, according to Numbeo.

Lucey called visa and residency requirements in Nordic countries “stringent,” since these nations don’t have retirement visa programs like in Portugal and Mexico.

“U.S. retirees would need to navigate complex immigration laws,” said Lucey. “And without significant financial means, securing long-term residency can be difficult,” he said. In Norway, it takes three years to become a resident.

Live and Invest Overseas publisher Kathleen Peddicord said: “My quick, maybe flippant, response is that we don’t talk about that region because the weather is awful and the cost of everything is very high.”

“As a retiree shopping the world map for options for where to live better on whatever budget you’ve got,” she added, “you’ve got many better choices than those cold, dark, overpriced countries in Northern Europe that don’t really want you there anyway.”

That’s something of an overstatement.

Cold? Often, but not in the summer. “I love the change of seasons,” said Berglund. “We’re still very active. We go skiing.” But, she conceded, “winter for many elderly, and a lot of Norwegians, is very hard.”

Dark? Yes, in some parts of the year, but not others.

Don’t want you there? That wasn’t my experience as a tourist, nor what I heard from my expat friend and her husband.

It helps, however, to live by what the Danish call “hygge” — enjoying the simple pleasures in life.

Advice for pre-retirees

World Happiness Report researcher Halliwell said that instead of looking for a great place in the world to retire, visit some of the happiest countries to see what explains that feeling and then try to emulate it after returning home.

“Apply the Nordic lessons where you already live,” he said. “It shouldn’t be about where you can get the most bang for your buck.”