Prediction: 1 Semiconductor Stock That Will Catch Up to Nvidia Within 10 Years

Semiconductor stocks have captivated Wall Street since the start of 2023. Advances in the chip market have allowed dozens of other industries to take their technologies to the next level. Sectors like artificial intelligence (AI), cloud computing, virtual/augmented reality, consumer tech, self-driving cars, and more have all benefited from new chip designs from companies like Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD). As a result, semiconductor companies have become some of the best options for investing in tech.

Nvidia’s and AMD’s stocks have climbed 782% and 132% since the start of 2023, when a boom in AI kicked off. Nvidia managed to get a headstart in the industry and was able to immediately begin supplying its chips to AI developers worldwide. Meanwhile, AMD required more time to produce competitive hardware.

However, AMD has made promising strides in AI in 2024 and could be on track to deliver significant gains in the coming years. It’s one semiconductor stock that I predict will catch up to Nvidia’s market cap of $3 trillion within 10 years.

AMD is scaling up to better meet AI demand

AMD stock has popped 12% since its second quarter of 2024 earnings were released on July 30, rallying investors with a win in AI that proves the market has become its biggest growth driver.

Total revenue increased 7% year over year to just under $6 billion, mainly fueled by a 115% spike in its AI-driven data center segment and a 49% increase in its client division. The quarter benefited from a ramp-up in AI graphics processing unit (GPU) and central processing unit (CPU) sales.

Over the last year, AMD has gone full force into AI, expanding into multiple areas of the industry that will likely pay over the next decade. The company has unveiled its most powerful GPUs to date and announced plans to purchase server builder ZT systems for $5 billion. Both moves make the company more competitive against Nvidia, with the acquisition allowing AMD to more quickly roll out its AI GPUs at a scale necessary for cloud providers.

AMD’s chips have already attracted some of AI’s biggest players, with the company signing on Microsoft‘s Azure, Meta Platforms, and Oracle as clients. These cloud giants are in steep competition with each other, requiring powerful hardware to stay competitive. As a result, AI chip demand is only likely to continue rising for the foreseeable future, with AMD well-positioned to enjoy major gains.

AI opportunities outside of GPUs

In addition to GPUs, AMD is planting seeds throughout the AI market to diversify its positions and profit from growth catalysts far into the future.

The company has a massive opportunity in AI central processing units. CPUs have been AMD’s specialty for years, with its CPU market share rising from 18% in 2017 to 34% this year, as it has consistently taken market share from Intel. Meanwhile, data from Verified Market Reports shows that the AI CPU sector was valued at $15 billion last year and is projected to hit $410 billion by the end of the decade, expanding at a compound annual growth rate (CAGR) of 29%.

Expertise in CPUs also grants AMD a potentially lucrative role in the quickly expanding AI-capable PC market. As demand for AI services has risen, so has the need for more powerful hardware. As a result, AI-enabled PCs are projected to make up about 40% of all global PC shipments in 2025, with the market developing at a CAGR of 44% through 2028.

Nvidia’s market cap was $359 billion at the start of 2023. Yet, it hit $3 trillion in June 2024, just 18 months later, after a rally that boosted its stock by 738%. The company’s success was primarily fueled by a massive spike in its AI GPU sales. Nvidia has shown what is possible with success in one facet of AI. Meanwhile, AMD has laid the foundation in multiple areas of the industry that could deliver significant stock gains.

AMD’s market cap is currently about $251 billion. The company’s stock would need to rise 1,200% to hit $3 trillion over the next 10 years. It’s a lofty target, but not an unreachable one. Since AMD’s stock is up more than 3,000% since 2014, it might not be too far a reach.

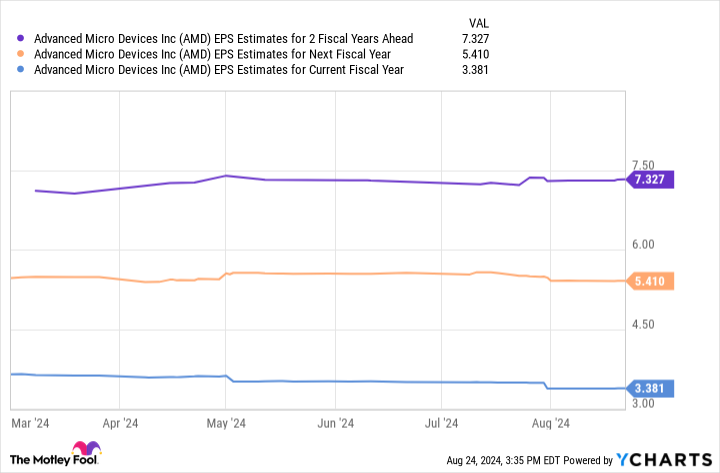

The chart above projects AMD’s earnings to hit just over $7 per share by fiscal 2026. Multiplying this figure by the company’s forward price-to-earnings ratio of 46 yields a share price of $336, projecting potential stock growth near 115% by 2026.

Yet, Nvidia’s spectacular rise in AI and AMD’s performance over the last 10 years suggest that growth could be conservative. As a result, AMD could be on a growth path to achieve that coveted $3 trillion market cap over the next decade. The company is expanding quickly, and you won’t want to miss out.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: 1 Semiconductor Stock That Will Catch Up to Nvidia Within 10 Years was originally published by The Motley Fool

Leave a Reply