The Market Just Made a Big Mistake About SoFi. Here's Why

SoFi Technologies (NASDAQ: SOFI) stock’s decline has got to be one of the biggest disappointments of the year. It came into 2024 on a high, having more than doubled last year and with the company sporting profitability for the first time.

It continues to report strong growth, and it posted its third straight quarterly profit, but SoFi stock is down more than 20% this year. The market is making a mistake, and you can benefit from the stock drop before the market gets clued in.

SoFi is disrupting traditional banking

SoFi is a full financial services platform that offers lending services, banking products, and more on its digital app. It has no physical branches, and it targets the student and young professional population. This cohort appreciates a digital, consumer-focused experience. SoFi is attracting millions of members who are looking for a better product, and since these customers skew younger, it has a long growth runway as this market matures and increases engagement with SoFi’s platform.

The Q2 earnings update was chock-full of positive news. Members increased 41% year over year to nearly 8.8 million, adjusted net revenue increased 20%, and it produced net income of $18 million in accordance with generally accepted accounting principles (GAAP). Management raised its outlook for 2024 adjusted net revenue and earnings per share (EPS), and it’s expecting positive net income for the third quarter and the full year.

SoFi is more than a lender

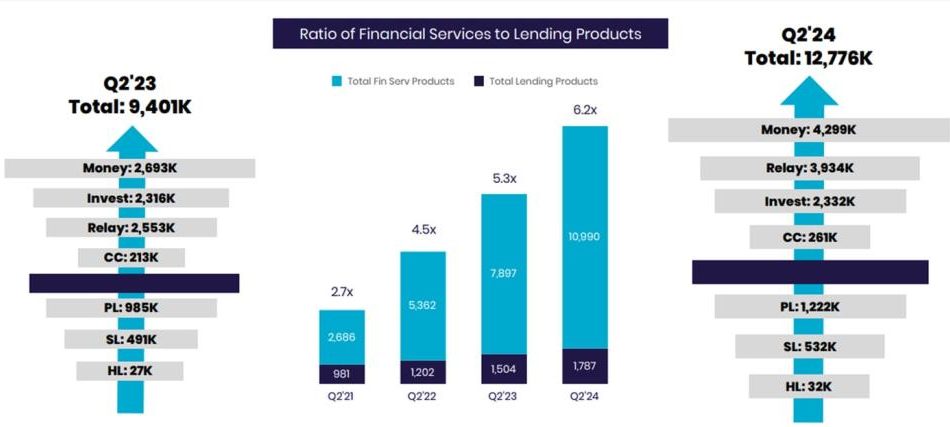

It’s not obvious at first glance exactly what’s bugging the market, although concerns about slowing loan growth probably figure in the share price decline. But what it looks like is that while SoFi is eager to show off its newer segments and how they hedge against pressure in lending, they’re not yet taking over for the credit business yet.

SoFi has been expanding its business to encompass a wider array of services. Outside of its core lending segment, it now has two other segments: Tech platform, or the white-label financial infrastructure services under the Galileo brand, and financial services, which are the non-lending services.

These two business are growing at a much faster rate than lending, and they appeal to a large population even during challenging conditions when the lending business is under pressure. They add more revenue and ease the lending pressure, but what they really accomplish is creating a wider service base from which members can increase engagement. The positive results of this model are already in, but they’ll be even more beneficial over time as more members join the platform.

However, the lending segment remains much bigger. It accounted for 55% of revenue in Q2, so while the other segments are booming, the core segment isn’t growing very much. Lending segment revenue was $341 million in Q2, a 3% increase from last year. The other two segments increased 46% year over year in Q2, but they’re still much smaller.

Lending contribution profit was $198 million, or 8% more than last year. Together, financial services and tech platform contribution profit was $86 million. That’s where you really see the value of the lending platform for SoFi’s business. So when the lending contribution is up only 8%, that looks concerning, even though the tech platform’s contribution increased 82% and financial services switched from a loss to a gain.

Overall, the company reported a profit. But that profit is largely coming from a slowing lending business. Until these other segments take over a larger portion of the business and contribute more to the consolidated results, the market senses trouble.

Wake up before the market does

Fortunately for SoFi and its shareholders, the pessimism that the market is pricing in looks unwarranted when you consider the long-term opportunity. The market isn’t ready to be confident about SoFi’s new business potential, even though it’s already demonstrating results. This is a visual representation of how the non-lending segments are growing.

SoFi’s expansion plan is working, and the new members and increased engagement should eventually eclipse the short-term weakness in the lending segment. However, interest rates are probably going to be cut before that, and when that happens, SoFi’s lending segment should rebound. Together, that makes for a dynamite long-term investment.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Market Just Made a Big Mistake About SoFi. Here’s Why was originally published by The Motley Fool

Leave a Reply