Is Palantir Stock a Buy Before Sept. 20?

Each quarter, the S&P 500 index rebalances. This means new companies are added to the index, replacing existing members that are no longer eligible.

One company that has been eligible for S&P 500 inclusion for quite some time but is yet to be added to the index is Palantir Technologies (NYSE: PLTR). With the next rebalance scheduled for Sept. 20, is now the time to load up on Palantir stock?

How do companies become eligible for the S&P 500?

Eligibility criteria for S&P 500 inclusion varies among factors such as market cap, profitability, stock float, and corporate structure. In this article, I’m going to primarily focus on the profitability criteria. To become eligible for the S&P 500, a company must be profitable over the previous four quarters while specifically generating a profit in the most recent quarter.

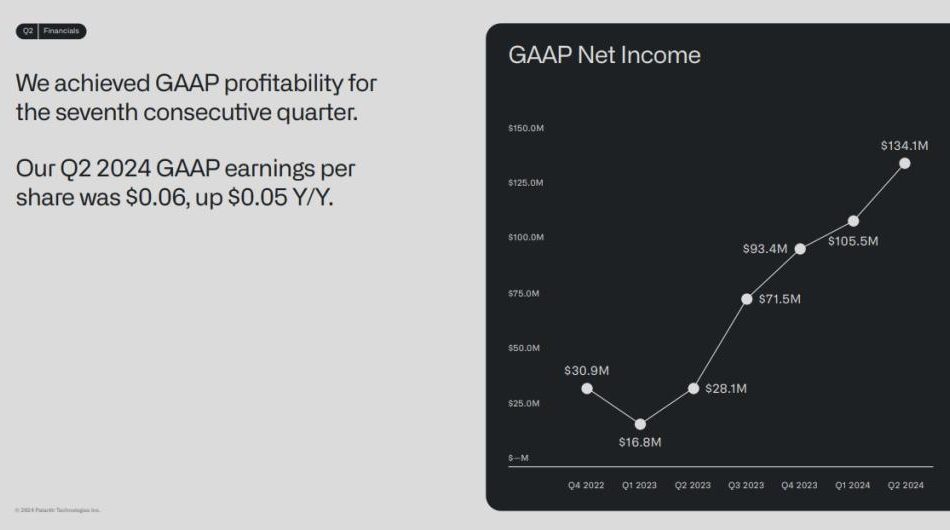

To be clear, this means your business could burn cash for three straight quarters but then generate a profit in the fourth quarter that’s massive enough to make the net sum over the last 12 months a positive figure. The chart below illustrates Palantir’s profitability over the last several quarters.

Palantir has generated positive net income on a generally accepted accounting principles (GAAP) basis for seven consecutive quarters. The company has clearly demonstrated an ability to operate in a consistently profitable way. However, there may be a couple of big reasons why Palantir hasn’t been chosen for the S&P 500 despite its rising profit levels.

Why hasn’t Palantir been added to the S&P 500 yet?

Just to be upfront, I cannot definitively say why Palantir hasn’t been chosen for the S&P 500 yet. However, my fellow Fool Jake Lerch made an astute observation back in March as to what may be the driving decision.

It’s no secret that artificial intelligence (AI) has served as a big catalyst for the technology sector over the last two years. Palantir’s enterprise software platforms specialize in big data analytics and have witnessed soaring demand thanks to hefty investments in AI.

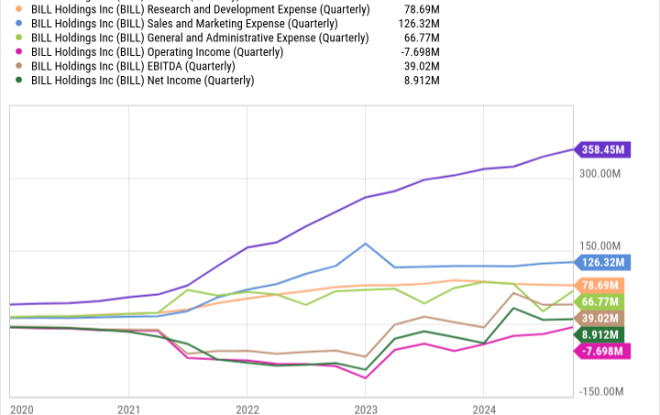

As the charts below clearly illustrate, Palantir’s revenue really started to kick into gear over the last two years. Moreover, this newfound AI-driven growth helped fuel sustained profitability.

Another concern could be that Palantir relies heavily on large government contracts. Generally speaking, government deals can be lumpy and unpredictable. These dynamics make it challenging to assess what a company’s future growth may look like.

At the end of the day, there is an argument to be made that Palantir’s current growth is fleeting and that the company is only benefiting from the AI hype. While I understand that thesis, I think it’s shortsighted.

Should you buy Palantir before Sept. 20?

Earlier this year, IT architecture specialist Super Micro Computer was added to the S&P 500. Just like Palantir, Supermicro has entered a new phase of growth largely driven by hefty investments in AI infrastructure, such as data centers.

Yet, unlike Palantir, Supermicro’s gross margin and profit levels are very much inconsistent — and yet, the company still earned a spot in the S&P 500 before Palantir. Additionally, investments in capital expenditures (capex) should continue to rise, according to management at mega-cap tech stalwarts such as Amazon, Alphabet, and Microsoft.

To me, concerns over the long-run sustainability of Palantir’s growth are overblown and should be put to rest. Whether you should invest in Palantir before the next S&P 500 rebalancing boils down to your risk appetite. Candidly, I would not be surprised to see shares of Palantir witness a bit of momentum as Sept. 20 draws closer.

However, investing in momentum stocks can be a real risk and leave you as a bag holder if you’re not careful. It’s important to keep in mind that Palantir is a growth stock and experiences outsize volatility compared to blue chip opportunities. Furthermore, Palantir stock is far from a bargain, considering its forward price-to-earnings (P/E) ratio of 89.5.

Should Palantir finally earn its spot in the S&P 500, you very well may see some gains in your portfolio. However, I think a more prudent strategy is to invest in Palantir using dollar-cost averaging over a long-term horizon — allowing you to buy in at different price points over time and mitigate timing risks. Investors shouldn’t weigh too much on specific dates when buying a stock but rather consider the long-term outlook.

And to me, Palantir’s future looks bright as the AI revolution continues to take shape. I think the company’s growth is only just beginning, and I see more significant gains to come.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is Palantir Stock a Buy Before Sept. 20? was originally published by The Motley Fool

Leave a Reply