Top Truth Social execs—including the CEO—are shedding stock before Trump even can

Donald Trump is in need of a massive payday to cover his legal expenses and presidential campaign, but he can’t tap into his Truth Social stock. At least not quite yet.

In late March, the former president’s social media company started trading on Nasdaq when Trump Media & Technology Group. Corp. merged with a blank-check company called Digital World Acquisition Corp. Truth Social launched in February 2022 after Trump was banned from Facebook and X as a consequence of the Jan. 6, 2021 insurrection at the Capitol. While he’s since been reinstated on both platforms, he’s stuck to his own although his company isn’t performing as well as when it first launched.

Since its inception, Truth Social’s share price has largely plummeted. After soaring to $57.99 per share at launch, it’s worth just $19.60 per share, valuing the company at just over $3.8 billion. That means Trump’s payday—if he chooses to sell off his majority stake—will be much smaller than anticipated earlier this year.

“Truth Social is tanking because it is essentially a meme stock,” Robert R. Johnson, a finance professor at Creighton University and author of The Tools and Techniques Of Investment Planning, Strategic Value Investing and Investment Banking for Dummies, told Fortune. “The stock price of Truth Social is unconnected to the reality of the financials of the firm. In the first quarter of 2024, the firm lost $327 million on revenues of only $770,500. These aren’t numbers that remotely support the current stock price, much less the atmospheric values—nearly $80—that the stock hit in late March.”

How much Truth Social stock does Trump own and when can he sell it?

Trump owns a $2.3 billion stake in Trump Media & Technology Group, which trades as under ticker DJT (also his initials), but he can’t liquidate any of it until Sept. 25, according to SEC filings. That’s due to a lock-up period rule, which prevents insiders from immediately selling once a company goes public.

But Trump could sell off his shares five days if Trump Media’s share price equals or exceeds $12 for any 20 trading days within a 30-day trading period starting Aug. 22. If the stock price stays steady, that means Trump’s restrictions could lift as soon as Sept. 20.

While Trump isn’t able to start selling his shares yet, some other insiders have started shedding their stake in the company. Trump Media’s chief financial officer and treasurer, Phillip Juhan, disclosed last week he’s selling $1.9 million worth of stock, according to SEC filings. Trump Media’s general counsel Scott Glabe, chief operating officer Andrew Northwall, and chief technology officer Vladimir Novachki each also sold shares, according to Aug. 22 SEC filings. Devin Nunes, a former Republican congressman and Trump Media’s CEO and president, also sold off $632,000 worth of stock last Thursday.

While it’s not necessarily uncommon for executives to sell some of their stake in a company, selling at a loss—which they did—can be an indicator for trouble ahead.

“Since selling a stock at a loss is painful, an investor who sells at a loss must have particularly negative information,” Peter Kelly, a finance professor at the University of Notre Dame, wrote in a 2018 paper published by Oxford Academic. “And what you see is when stocks are sold at a loss, it predicts negative returns.”

Would Trump really sell his DJT shares?

While Trump is still sitting on a nice chunk of change, it’s somewhat unlikely that he’d sell his entire stake in the company for some cash flow. That’s largely because it could end up tanking the stock even further.

“Speculators in Truth Social would likely see a sizable loss in wealth as Trump sells off some of his position in the firm,” Johnson said.

And that wouldn’t be in Trump’s interest since many shareholders are also his political supporters who could get burned by a massive sell-off.

“If Trump were to sell a large number of shares and the stock price tanks, to some degree he would be burning his own supporters who bought the stock,” Jay Ritter, a finance professor at the University of Florida’s Warrington College of Business, told CNN. “Politically, that may not play out real well for him.”

While all eyes will be on Trump come late September in terms of whether he’ll choose to sell any stock, the time to really watch Trump Media stock will be around the time of the election.

“The case for speculating—note, I say speculating and not investing—in Truth Social is that Trump wins the presidency and the social media platform gains popularity and is able to create a sustainable business model,” Johnson said. “The stock is under pressure as those prospects have dimmed with the recent surge in popularity of the Democratic ticket.” As of Friday, Democratic presidential nominee Kamala Harris held a slim margin over Trump, according to a Wall Street Journal poll.

This story was originally featured on Fortune.com

Is Palantir Stock a Buy Before Sept. 20?

Each quarter, the S&P 500 index rebalances. This means new companies are added to the index, replacing existing members that are no longer eligible.

One company that has been eligible for S&P 500 inclusion for quite some time but is yet to be added to the index is Palantir Technologies (NYSE: PLTR). With the next rebalance scheduled for Sept. 20, is now the time to load up on Palantir stock?

How do companies become eligible for the S&P 500?

Eligibility criteria for S&P 500 inclusion varies among factors such as market cap, profitability, stock float, and corporate structure. In this article, I’m going to primarily focus on the profitability criteria. To become eligible for the S&P 500, a company must be profitable over the previous four quarters while specifically generating a profit in the most recent quarter.

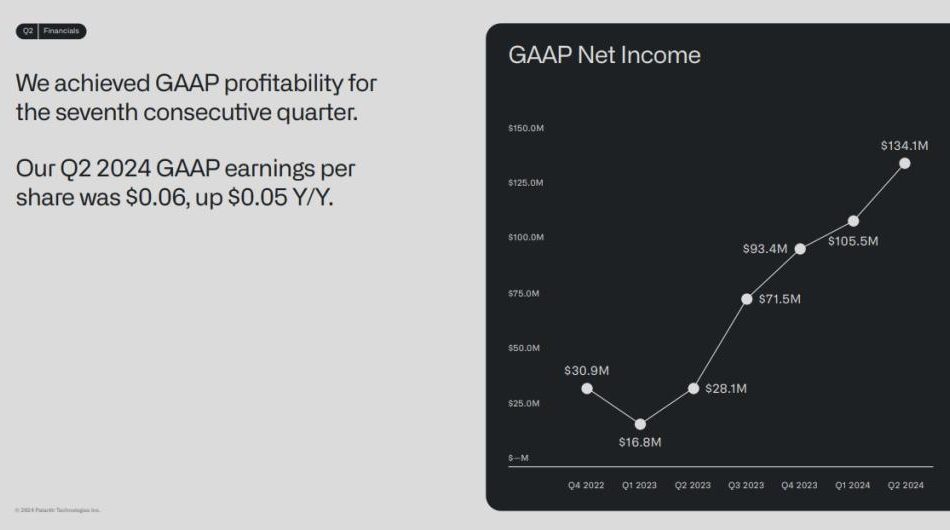

To be clear, this means your business could burn cash for three straight quarters but then generate a profit in the fourth quarter that’s massive enough to make the net sum over the last 12 months a positive figure. The chart below illustrates Palantir’s profitability over the last several quarters.

Palantir has generated positive net income on a generally accepted accounting principles (GAAP) basis for seven consecutive quarters. The company has clearly demonstrated an ability to operate in a consistently profitable way. However, there may be a couple of big reasons why Palantir hasn’t been chosen for the S&P 500 despite its rising profit levels.

Why hasn’t Palantir been added to the S&P 500 yet?

Just to be upfront, I cannot definitively say why Palantir hasn’t been chosen for the S&P 500 yet. However, my fellow Fool Jake Lerch made an astute observation back in March as to what may be the driving decision.

It’s no secret that artificial intelligence (AI) has served as a big catalyst for the technology sector over the last two years. Palantir’s enterprise software platforms specialize in big data analytics and have witnessed soaring demand thanks to hefty investments in AI.

As the charts below clearly illustrate, Palantir’s revenue really started to kick into gear over the last two years. Moreover, this newfound AI-driven growth helped fuel sustained profitability.

Another concern could be that Palantir relies heavily on large government contracts. Generally speaking, government deals can be lumpy and unpredictable. These dynamics make it challenging to assess what a company’s future growth may look like.

At the end of the day, there is an argument to be made that Palantir’s current growth is fleeting and that the company is only benefiting from the AI hype. While I understand that thesis, I think it’s shortsighted.

Should you buy Palantir before Sept. 20?

Earlier this year, IT architecture specialist Super Micro Computer was added to the S&P 500. Just like Palantir, Supermicro has entered a new phase of growth largely driven by hefty investments in AI infrastructure, such as data centers.

Yet, unlike Palantir, Supermicro’s gross margin and profit levels are very much inconsistent — and yet, the company still earned a spot in the S&P 500 before Palantir. Additionally, investments in capital expenditures (capex) should continue to rise, according to management at mega-cap tech stalwarts such as Amazon, Alphabet, and Microsoft.

To me, concerns over the long-run sustainability of Palantir’s growth are overblown and should be put to rest. Whether you should invest in Palantir before the next S&P 500 rebalancing boils down to your risk appetite. Candidly, I would not be surprised to see shares of Palantir witness a bit of momentum as Sept. 20 draws closer.

However, investing in momentum stocks can be a real risk and leave you as a bag holder if you’re not careful. It’s important to keep in mind that Palantir is a growth stock and experiences outsize volatility compared to blue chip opportunities. Furthermore, Palantir stock is far from a bargain, considering its forward price-to-earnings (P/E) ratio of 89.5.

Should Palantir finally earn its spot in the S&P 500, you very well may see some gains in your portfolio. However, I think a more prudent strategy is to invest in Palantir using dollar-cost averaging over a long-term horizon — allowing you to buy in at different price points over time and mitigate timing risks. Investors shouldn’t weigh too much on specific dates when buying a stock but rather consider the long-term outlook.

And to me, Palantir’s future looks bright as the AI revolution continues to take shape. I think the company’s growth is only just beginning, and I see more significant gains to come.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is Palantir Stock a Buy Before Sept. 20? was originally published by The Motley Fool

Is It Smart to Buy Stocks With the S&P 500 at an All-Time High? History Has a Clear Answer

Trying to determine the best time to invest your hard-earned money can be a daunting task.

When the stock market hits a new high, it seems like there’s nowhere to go but down. After all, every bear market begins, by definition, just after the S&P 500 hits a new all-time high. But when stocks fall, it can be equally scary. There’s no telling how much further stock prices will drop.

After a sharp pullback in the S&P 500 in early August, the index has roared back toward its all-time highs. You might be kicking yourself for not buying on the dip. But even if you missed out on that short-lived opportunity, history suggests it’s still a great time to invest right now, even as the market pushes to new all-time highs.

Stocks usually keep going up after hitting an all-time high

Every investor knows stocks increase in value over the long run. Why else would you invest if you didn’t expect your investment to increase in price?

So, even when stocks are trading at an all-time high, the expectation from investors is stocks will eventually reach even higher highs. The question is how quickly will stocks reach that new higher high? Some investors may worry that it may take a long time for those new highs to come because every investor also knows the stock market doesn’t go up in a straight line.

But new all-time highs tend to cluster together. Once the market reaches a new high, it often keeps going up for some time. In 1995, for example, the S&P 500 closed at a record high 77 times, which comes out to approximately 30% of all trading days in that year. The S&P 500 has closed at a new all-time high 38 times so far in 2024 since setting a new high on Jan. 19.

While the S&P 500 has already moved more than 16% higher since hitting its first new all-time high in over a year in January, the long-term returns could be even greater. The average bull market lasts 46 months with a median total return of 110%. We’re only 22 months out from the lows of October 2022 and up 62%. If it holds to the average, this bull market could have another 2 years to go, rising an additional 30% from here.

In fact, investing when the S&P 500 hits a new all-time high has historically led to stronger results than investing on days when it doesn’t hit a new all-time high. Since 1970, in the 12 months following a new all-time high, the S&P 500 has produced an average return of 9.4%. In the following 24 months, it returned 20.2% on average. That includes investing at the very peak of the market before a new bear market. By comparison, investing at any other time resulted in average returns of 9% and 18.5% for 12-month and 24-month periods, respectively.

All this is to say, now is a great time to invest in the stock market.

How to invest when the stock market is trading at an all-time high

It can be difficult to find good individual stock investments as the overall market climbs higher. There simply aren’t as many companies whose stocks are trading at an attractive value compared to the middle of a bear market. Still, there are plenty of great opportunities for dedicated investors to find if they put in the work.

However, digging into financial reports and studying the inner workings of various industries and the economic factors that could influence them isn’t for everyone. One of the most effective ways to invest, particularly at an all-time high, doesn’t require deep knowledge and understanding of multiple companies. You can buy a simple index fund that tracks a broad index like the S&P 500.

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is one of the best available. Its low expense ratio and strong record of tightly tracking the index ensure you’ll earn returns very close to the S&P 500. And, as history shows, those returns can be quite strong, especially after setting a new all-time high.

There are dozens of ways to invest your money when stocks trade near an all-time high. It rarely pays to sit on cash and hope for a pullback in prices before investing. More often than not, stocks will continue to push higher. That said, when there is a pullback like we saw in early August, it usually works out well if you can seize the opportunity with any excess cash you have to invest. There’s no telling how long the opportunity will last, but it’s virtually guaranteed that the stock market will keep setting new all-time highs over the long run.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Is It Smart to Buy Stocks With the S&P 500 at an All-Time High? History Has a Clear Answer was originally published by The Motley Fool

Intel Stock Is Soaring. Can a Breakup Plan Save the Company?

Shares of Intel (NASDAQ: INTC) were on the move Friday in the wake of news reports that the company was considering the possibility of spinning off its manufacturing arm from its core chip design operation in order to rehabilitate itself and create value for shareholders.

That news came after a disastrous earnings report earlier this month that included weak results, disappointing guidance, the elimination of the stock’s dividend, and a restructuring plan that will cut at least 15% of its workforce.

Investors, who have been eager for any signs of change at Intel, cheered the news, sending the stock up by 7.6% as of 1:10 p.m. ET.

Is it time to break up Intel?

According to Bloomberg, Intel is discussing strategic options with investment bankers — options that could include splitting its two primary business segments or ditching some of the planned factory expansions that have been the cornerstone of CEO Pat Gelsinger’s transformation strategy.

Intel’s board is expected to review a range of options in September.

It shouldn’t come as a big surprise that Intel is considering such major changes, as it’s clearly flailing, and the stock is hovering around 20-year lows.

Is Intel stock a buy on the news?

At this point, Friday’s gains look more like a dead cat bounce for the stock than anything fundamentally meaningful. Cleaving the manufacturing business from the rest of the company could be a win for investors as the foundry operations have been a drag on its overall results, but doing so would also undermine Gelsinger’s long-term strategy. Such a change might even call for a new CEO.

While the issue is worth watching, and investors should pay attention to any news coming out of next month’s board meeting, Friday’s jump seems like more of a sign of desperation from investors than a real reason to buy the stock.

Expect the volatility in Intel shares to continue as its restructuring still has a long way to go.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Intel Stock Is Soaring. Can a Breakup Plan Save the Company? was originally published by The Motley Fool

Housing Market In 'Biggest Bubble Of All Time,' Warns Reventure CEO: 'This Situation Is Not Sustainable'

The U.S. housing market is under renewed scrutiny, as some experts warn of an unsustainable bubble that could rival or surpass the infamous crash of 2006.

Nick Gerli, CEO of Reventure Consulting, sounded the alarm on X, formerly Twitter, pointing to inflation-adjusted home prices that have soared to nearly double their 130-year average. “We are in the biggest housing bubble of all time,” Gerli said in a tweet thread, highlighting a disconnect between home values and historical norms.

Don’t Miss:

Gerli’s analysis paints a troubling picture. Only twice in U.S. history have housing prices reached such dizzying heights relative to long-term averages – in 2006 and now.

The implications, he argues, are clear. “This situation is not sustainable. Home prices must crash, or inflation needs to skyrocket out of control. Or perhaps some combination thereof.”

Trending:

Gerli’s assessment comes when the housing market appears at a crossroads. Recent data from the S&P CoreLogic Case-Shiller Home Price Index shows that while price increases are slowing, with a 5.9% annual gain in May compared to 6.4% in April, home values continue to set records.

Lisa Sturtevant, chief economist at Bright MLS, told Forbes that she sees the strain on buyers. “Affordability is the main constraint on the housing market,” she said, predicting a move toward a more balanced market later this year, with continued competition among prospective homeowners.

According to Gerli, the crux of the issue is the relationship between home prices and incomes. Current home prices stand at a multiple of 4.5 times income, a level seen only twice before – during the 2006 bubble and in the early 1950s. He points out that the resolution in the 1950s came through a decade of stagnant home prices coupled with robust income growth – a scenario he views as unlikely in today’s economic climate.

See Also:

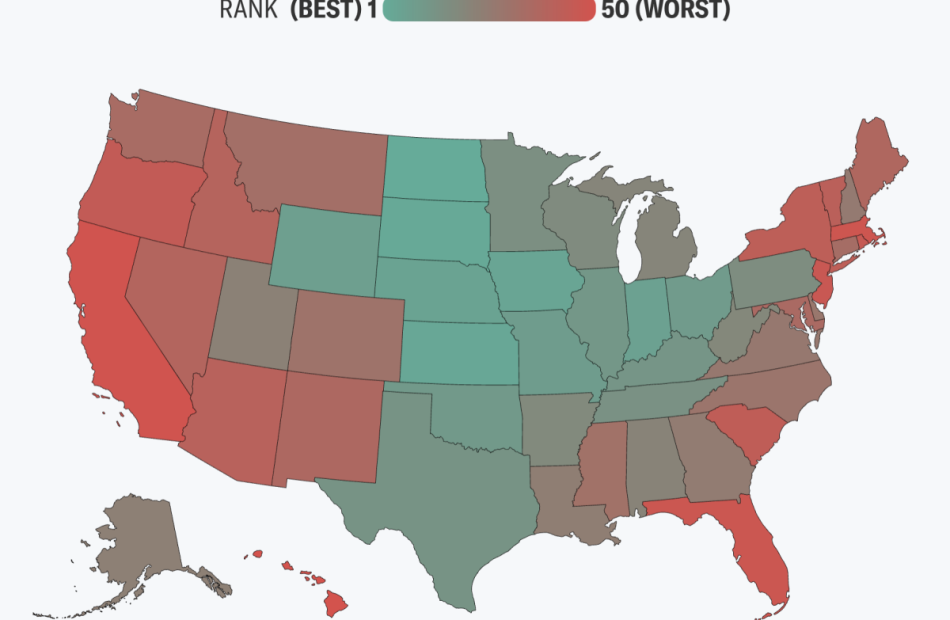

Not all regions are equally affected, however. Gerli said states like Florida, Tennessee, and Texas are epicenters of the bubble. Those areas have seen home values dramatically decoupled from local incomes. On the other hand, states like New York and Illinois show more modest overvaluation, resulting in tighter inventory as more buyers can participate in those markets.

The path forward is uncertain. Keith Gumbinger, vice president at HSH.com, an online mortgage company, told Forbes that a housing recovery would require an increase in inventory and a gradual cooling of mortgage rates. “Better that rate reductions happen at a metered pace, incrementally improving buyer opportunities over a stretch of time, rather than all at once,” he said.

Trending:

Still, according to a Zillow analysis, the inventory shortage persists, with levels 33% below pre-pandemic averages.

Whether it represents a bubble on the brink of bursting or a new era in homeownership, the average American is still priced out of many housing markets.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Housing Market In ‘Biggest Bubble Of All Time,’ Warns Reventure CEO: ‘This Situation Is Not Sustainable’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These are America’s best and worst states for saving money in 2024

Does saving money feel like a challenge, even if you earn a decent income or keep a tight budget? It may have something to do with where you live.

Factors such as how much you earn, the price of daily essentials, housing costs, taxes, and more can impact your ability to save, some of which may be out of your control — and depend on the state you live in.

Curious about how your state aids or impedes your ability to save? We evaluated seven key metrics across all 50 states to determine the best and worst states for savers. (See our full methodology here.)

5 best states for saving money

1. North Dakota

North Dakota scored the top spot on our list as the best state for saving money. This state has one of the lowest costs of living, combined with a strong median annual household income of $78,720.

The state also has a significantly lower top marginal state income tax rate than some of the other states on our list. Finally, less than 40% of North Dakota renters and less than 23% of homeowners are housing cost burdened (defined as spending 30% or more of household income on housing costs).

Read more: What percentage of your income should go to a mortgage?

2. South Dakota

South Dakota came in second place with a median household income of $67,180 and the lowest combined percentage of housing-cost-burdened renters and homeowners across the country.

South Dakota also has the ninth-lowest household debt-to-income ratio across all states. Another perk: South Dakota is one of nine states with no income tax, making it easier for residents to allocate more of their paychecks toward savings.

3. Kansas

Kansas took the third spot on our list, with a median household income of $73,040 and one of the lowest percentages of housing-cost-burdened homeowners across the country.

Kansas also has the third-lowest cost of living. Further, the sales tax rate in Kansas is 6.50%, which is a bit higher than some states on our list, but its top marginal income tax rate sits at 5.70%, which is about the median point across all states.

4. Iowa

Fourth on our list is Iowa, which has the lowest percentage of housing-cost-burdened homeowners in the nation, at 18.7%. The median annual household income in Iowa is a substantial $76,320. Residents also pay modest taxes, with the top marginal state income tax rate of 5.70% and a state sales tax of 6%.

5. Nebraska

Nebraska took the fifth spot on our list of the best states for saving money. The annual median household income is an impressive $78,360. Further, the sales tax rate in Nebraska sits at 5.50%, along with an effective property tax rate of 1.63%. Nebraska was also one of the states with a lower percentage of housing-cost-burdened renters and homeowners — 42% and 21.2%, respectively.

5 worst states for saving money

1. Hawaii

The worst state for saving money is Hawaii. This state has the second-highest individual income tax rate and the highest cost of living in the country. It also has the highest household DTI, despite the median household income being a whopping $91,010.

Renters and homeowners in Hawaii face higher housing costs as well, with over 56% of renters and 36% of homeowners burdened by housing costs.

2. California

It may come as no surprise that the state known for high taxes and cost of living is the second-worst state for saving money. With the highest top marginal income tax rate of all the states (13.30%), the highest sales tax rate (7.25%), and the second-highest score for cost of living, savers may not have much income left over to put in their savings accounts.

The median household income in California is $85,300, but even a higher salary isn’t enough to cover California’s housing costs in many cases. As it stands, 53% of renters and 37% of homeowners are burdened by housing costs.

3. Massachusetts

Massachusetts is the third-worst state for saving money, according to our data. It has the second-highest median household income out of all the states we compared at $93,550. Still, nearly half of all renters and close to 30% of homeowners in Massachusetts are burdened by housing costs. Massachusetts also had the third-highest cost of living across all states.

4. Florida

Florida came in fourth place among the worst states for saving money. The median household income in Florida is $65,370 and it’s one of a handful of states with no state income taxes. Even so, the majority of Floridians are burned by their rent (56.8%). Plus, this state had a higher cost of living compared many other states we evaluated.

5. New Jersey

New Jersey took the fifth spot on our list of the worst states for saving money. Despite an impressive median household income of $92,340, more than half of all renters and 33% of homeowners in New Jersey are housing cost burdened.

New Jersey also has one of the highest top marginal state individual income tax rates on our list at 10.75%. These factors, paired with a higher cost of living and DTI than most other states, make the Garden State a tough place to live for Americans hoping to boost their savings.

How to maximize your savings

Even if you don’t live in one of the best states for savers, there are still ways you can maximize your savings. Here are a few tried-and-true savings strategies that work regardless of your ZIP code:

Choose the right type of savings account

Where you keep your savings is just as important as the amount you’re contributing. The national average interest rate for a savings account is only 0.46%, according to the FDIC. However, there are savings options out there that can help your savings grow faster.

For instance, putting your money in a high-yield savings account or certificate of deposit (CD) could help you earn as much as 5% APY or more on your savings. This can help you earn a significant amount of interest over time and hit your savings goals faster. And keep in mind that online banks, which are known for offering competitive rates and low fees, allow you to open an account from anywhere in the U.S.

Lower your tax bill

There are several tax credits and deductions that you may qualify for that can lower your tax liability in April. For example, making extra contributions to your 401(k), IRA, and/or health savings account (HSA) can help lower your taxable income. There are also write-offs related to caring for dependents, working from home, medical expenses, student loan payments, and more.

However, unless you’re a tax expert, you may not know about all of the deductions and credits available to you. Tax software programs are fairly reliable when it comes to finding potential write-offs. But if you’d like the help of a human expert, consider speaking with a tax professional who can help you identify which credits and deductions you can take advantage of at the federal and state level to lower your overall tax bill or increase your refund.

Read more: Wondering what to do with your tax refund? 5 ways to spend it wisely

Pursue a raise

Saving more money isn’t just about trimming your costs — it can also be helpful to look for ways to increase your income. One of the easiest ways to do that is to ask for a raise.

But before you meet with your manager, you’ll need to do some preparation. Begin documenting your accomplishments and concrete ways you’ve contributed to your company’s bottom line. Then present your case for getting a raise when the time is right (such as during a yearend review or following a strong sales quarter).

If a raise isn’t an option, set a date to revisit this conversation with your manager at a later time. You may also want to consider whether it makes sense to look for a new position; strategic job hopping can be an effective way to increase your salary over time.

Downsize your home

Housing costs can place a major financial strain on American households, especially for those in higher cost of living areas.

Whether you’re a renter or a homeowner, downsizing to a more modest home can help trim your monthly rent or mortgage payment, as well as reduce the amount you spend on utilities and maintenance. If it makes sense for your situation, relocating to a new neighborhood or even a new state with a lower cost of living or tax rate can also help you save significantly.

Make saving part of your budget

Contributions to your savings should be considered a monthly expense in your budget. This ensures saving remains a priority and that your savings account grows consistently over time. You may also consider setting up automatic contributions from your checking account to your savings account so you don’t even have to think about it.

Read more: Your complete guide to budgeting for 2024

Look for ways to trim your expenses

The less you spend on unnecessary expenses, the more you can afford to set aside for future savings goals. Take some time to review your monthly budget and your most recent bank statements. Be honest with yourself about which expenses are non-negotiables and which ones you can probably scale back (think: unused subscriptions, takeout orders, shopping, etc.).

Every dollar counts when it comes to saving money and shaving a few dollars of your bottom line each month can make a big difference in your savings account balance.

Read more: How to save money in 2024: 44 tips to grow your wealth

Focus on paying off high-interest debt

Debt can be a drag on your budget, especially your savings account contributions. Carrying debt costs money in interest over time. Prioritize paying off high-interest debt such as credit cards to free up room in your budget. There are many debt repayment strategies you can use to tackle your debt — so find one that works for you.

Read more: What’s more important: Saving money or paying off debt?

Methodology

Our grading system, collected and carefully reviewed by our personal finance experts, comprised more than 400 data points to develop our list of the best and worst states for saving money.

We evaluated all 50 states according to several key metrics, using the most recent data available:

-

Household debt-to-income ratio (DTI): We used publicly available data from 2023, provided by the Federal Reserve, to determine the household DTI for each state. States with a lower DTI ranked higher on our list.

-

Percent of renters and homeowners experiencing housing cost burden: “Housing cost burden” is defined as spending 30% or more of household income on housing costs. We used information from the Population Bureau, sourced from the U.S. Census Bureau’s 2020 ACS Public Use Microdata Sample to determine which states had more housing cost burdened renters and homeowners.

-

Median household income: The median household income is the true “middle” income across all residents where half of all households earn more than the median and half earn less. We favored states with a higher median household income based on 2022 data, the most recent available from the Federal Reserve Bank of St. Louis.

-

Cost of living: Cost of living is defined as the amount of money needed to cover your basic living expenses in a particular area. We favored states with a lower cost of living, based on the Missouri Economic Research and Information Center’s cost of living index for Q1 2024.

-

Effective property tax rate: This is defined as the average amount of residential property taxes actually paid, expressed as a percentage of home value. We favored states with a lower tax rate, based on analysis by the Tax Foundation using the U.S. Census Bureau’s 2021 American Community Survey.

-

State sales tax: Sales tax is a tax imposed on the sale of goods and services. We favored states with a lower sales tax rate, based on analysis by the Tax Foundation.

-

Top marginal state individual income tax rate: We relied on analysis from the Tax Foundation to determine the current maximum statutory income tax rate in each state, based on individual income tax rates, brackets, standard deductions, and personal exemptions for single and joint filers in 2024.

Walgreens sued by shareholder amid plummeting stock price

Dive Brief:

-

Walgreens and its top executives are being sued for allegedly breaching their duty to shareholders by inflating the financial outlook for its pharmacy business, in yet another challenge for the beleaguered retail health giant.

-

Starting last fall, Walgreens CEO Tim Wentworth and CFO Manmohan Mahajan “overstated the Company’s expected revenue for the 2024 Fiscal Year … [and] falsely and materially claimed confidence in the brand inflation, volume growth, cost execution, discipline, and overall contributions of [Walgreens’] pharmacy division,” reads the lawsuit filed on Tuesday in Illinois district court. The lawsuit also names 10 other high-level executives — and Walgreens board chairman Stefano Pessina — as defendants.

-

The suit was filed by Mark Tobias, who has held shares in Walgreens since late 2022. Tobias lodged the lawsuit on behalf of shareholders and the company itself, given its directors are not acting in Walgreens’ best interests, according to the complaint. Tobias is asking that Walgreens be awarded damages from the executives, and take steps to improve corporate governance like increasing board oversight.

Dive Insight:

Walgreens is one of the largest retail pharmacy and healthcare companies in the world, but has struggled amid weakening front-of-store sales and lower reimbursement in its core pharmacy business.

The Deerfield, Illinois-based company tried to resuscitate its flagging financial health through offering more direct healthcare services, including by building out its primary care capabilities, but ran into challenges making the initiative profitable.

Tobias’ lawsuit is rooted in comments and earnings guidance Walgreens published in mid-October last year, during the retailer’s shift to care delivery.

On Oct. 12, Walgreens issued 2024 adjusted earnings per share guidance of $3.20 to $3.50.

On a call with investors the same day, Mahajan said Walgreens’ U.S. retail pharmacy business would be able to improve its operating income thanks to “immediate actions to improve the cost base and modest underlying growth in both retail and pharmacy.” Along with cost cuts, Walgreens’ healthcare delivery business should improve profitability by bringing on new patients, among other actions, Mahajan said.

Those statements were misleading, the lawsuit alleges. With them, “defendants veiled the reality: that [Walgreens’] pharmacy division was not actually equipped to adapt to ongoing hurdles within the industry and the Company would instead require significant restructuring in order to create a sustainable model,” Tobias’ complaint reads.

The price of Walgreens’ stock became artificially inflated as a result, the lawsuit alleges.

Then, on June 27, Walgreens slashed its 2024 adjusted earnings per share guidance to $2.80 to $2.95 when announcing its third quarter results.

Walgreens cited “challenging pharmacy industry trends” as the reason behind the cut.

“The current pharmacy model is not sustainable,” Wentworth said during the company’s call with investors. Following the call, Walgreens’ stock fell more than 22% by the end of the day. It has fallen further since.

Walgreens’ stock has reached its lowest value since the late 1990s

$WBA price at close, Aug. 29, 2014 – Aug. 29, 2024

From October to June, Walgreens misrepresented its operational success to the public, the lawsuit alleges. In addition, during that time the company repurchased millions of shares of common stock at the inflated price, overpaying by $31.5 million — a breach of their fiduciary duties, according to the complaint.

Walgreens is also facing another federal securities fraud lawsuit pending in front of the same Illinois court. The company did not respond to a request for comment for this story.

This story was originally published on Healthcare Dive. To receive daily news and insights, subscribe to our free daily Healthcare Dive newsletter.

Recommended Reading

Nvidia Is No Longer 'Perfect,' But These 18 Stocks Are Still Golden

Before a volatile July, Nvidia (NVDA) earned “perfect” status on this screen highlighting companies sporting the highest possible 99 Composite Rating. But following the artificial intelligence juggernaut’s highly anticipated earnings report, Nvidia stock has seen that rating slip to 96 as it clings to support at its 10-week moving average.

Meanwhile, 18 stocks, including miners Alamos Gold (AGI), Eldorado Gold (EGO), Iamgold (IAG) and Idaho Strategic Resources (IDR), all glow golden with a 99 Composite Rating. Agnico-Eagle Mines (AEM), Newmont (NEM), Silvercorp Metals (SVM) and Harmony Gold Mining (HMY) have also dug their way onto that list.

They are joined by defense stocks Howmet Aerospace (HWM) and Heico (HEI).

↑

X

AI Levels Up: Inside The Chips Driving Nvidia Stock

How Nvidia Is Building A Competitive Moat To Fend Off AI Challengers

Miners And Gold Stocks Lead Top Stocks In Top Groups

All the names on this stock screen hail from the top-ranked industry groups — a factor worth noting because winning stocks tend to come from the top-ranked groups among the 197 industries that IBD tracks. This screen highlights the Top 20 industries.

For example, driven by gold prices, the Mining-Gold/Silver/Gems group ranks a lofty No. 7 among the 197 groups IBD tracks, according to MarketSurge.

Stock Screener Highlights Top-Rated Industry Leaders

| Company | Symbol | Comp Rating | Ind Group Rank | EPS Rating | RS Rating | SMR Rating | A/D Rating |

|---|---|---|---|---|---|---|---|

| Agnico-Eagle Mines | AEM | 99 | 7 | 97 | 95 | B | B+ |

| Alamos Gold | AGI | 99 | 7 | 93 | 92 | A | B+ |

| Bank7 | BSVN | 99 | 15 | 93 | 95 | A | B |

| Eldorado Gold | EGO | 99 | 7 | 87 | 93 | B | A- |

| First Bank (NJ) | FRBA | 99 | 9 | 93 | 88 | A | A- |

| GE Aerospace | GE | 99 | 18 | 84 | 95 | B | B- |

| Heico Corp | HEI | 99 | 18 | 91 | 92 | A | A |

| Heico Cl A | HEIA | 99 | 18 | 91 | 90 | A | A- |

| Harmony Gold Mining | HMY | 99 | 7 | 99 | 97 | A | D+ |

| Howmet Aerospace | HWM | 99 | 18 | 93 | 96 | A | B |

| IamGold | IAG | 99 | 7 | 81 | 97 | B | B+ |

| Idaho Strategic Resources | IDR | 99 | 7 | 81 | 97 | B | A- |

| M-tron Industries | MPTI | 99 | 18 | 99 | 81 | A | C+ |

| Newmont | NEM | 99 | 7 | 88 | 93 | B | B |

| Pennant | PNTG | 99 | 2 | 87 | 98 | A | B+ |

| Silvercorp Metals | SVM | 99 | 7 | 85 | 91 | B | B+ |

| Third Coast Bancshares | TCBX | 99 | 15 | 94 | 92 | A | A- |

| Universal Health | UHS | 99 | 10 | 91 | 95 | B | B+ |

Data as of Aug. 30

Miners Among Best Stocks To Watch

To make this screen of top stocks to watch in the top-ranked industries, each company must meet the following criteria:

However, ratings of course are just one part of the equation when evaluating a stock. Be sure to always check the stock chart to gauge when to buy, sell or hold.

Stock Screener: Build Your Watchlist With Stock Ratings And Stock Lists

Running stock screens with the IBD Stock Screener or MarketSurge is an effective way to streamline your research to find top-rated stocks to watch.

You can also zero in on the best stocks to watch using IBD stocks lists based on a wide range of preset filters. You’ll find top-rated stocks meeting the criteria of the IBD 50, IBD Sector Leaders, IBD Big Cap 20, IPO Leaders and more.

Once you’ve put together potential stock picks for your watchlist, you’ll want to evaluate your ideas with IBD Stock Checkup. With pass, neutral or fail ratings for each of your stocks, IBD Stock Checkup provides a detailed look at both the fundamental and technical health of the companies on your watchlist.

Additionally, based on The IBD Methodology, the Composite Rating provides an overall score that takes into account each of the IBD ratings. The single score considers how a company and its stock are performing in terms of annual and quarterly earnings growth as well as its relative strength vs. the rest of the market. The score also accounts for sales, profit margins and institutional demand.

However, note that you should not buy a stock solely on its ratings or placement on one of IBD’s stock lists. No matter how compelling a company’s story may seem, savvy investors will always check the technical action in the stock chart before buying.

Check The Chart To Know When To Buy Nvidia, Arm And Others

Using stock lists helps you zero in on the best stocks to watch. Stock ratings look under the hood to diagnose a company and its stock’s fundamental and technical health. Both stock lists and stock ratings help you understand what to buy. But to fully understand when to buy stocks, take a look at the stock chart.

Meanwhile, it’s also critical to understand what type of environment you’re currently in. Is it a bull market, when most stocks go up? Or a bear market, when most stocks go down? Or is it a volatile, choppy and uncertain time when the market indexes tend to fail to make any sustained headway?

Use stock charts to evaluate both the market indexes and individual stocks. Charts will help you pinpoint the best time to buy stocks by identifying support and resistance, as well as buy points and buy zones. Using charts also helps you identify warning signs and when to sell stocks.

So when searching for potential stock picks and stocks to watch, always check the charts. They provide the most unbiased diagnosis of a stock’s health.

Follow Matthew Galgani on Twitter at @IBD_MGalgani.

YOU MAY ALSO LIKE:

As Gold Prices Reach Record Highs, Is It Time To Buy Or Sell Gold Stocks, ETFs?

Nvidia Stock Slips Ahead Of Earnings Report (Live Coverage)

One Major Stock Smokes Nvidia — And You Probably Don’t Own It Yet

Generate New Stock Ideas With IBD Stock Screener

Identify Bases And Buy Points With This Pattern Recognition Tool

U.S. stock rally broadens as investors await Fed

By David Randall

NEW YORK (Reuters) – A broadening rally in U.S. stocks is offering an encouraging signal to investors worried about concentration in technology shares, as markets await key jobs data and the Federal Reserve’s expected rate cuts in September.

As the market’s fortunes keep rising and falling with big tech stocks such as Nvidia and Apple, investors are also putting money in less-loved value stocks and small caps, which are expected to benefit from lower interest rates. The Fed is expected to kick off a rate-cutting cycle at its monetary policy meeting on Sept. 17-18.

Many investors view the broadening trend, which picked up steam last month before faltering during an early August sell-off, as a healthy development in a market rally led by a cluster of giant tech names. Chipmaker Nvidia, which has benefited from bets on artificial intelligence, alone has accounted for roughly a quarter of the S&P 500’s year-to-date gain of 18.4%.

“No matter how you slice and dice it you have seen a pretty meaningful broadening out and I think that has legs,” said Liz Ann Sonders, chief investment officer at Charles Schwab.

Value stocks are those of companies trading at a discount on metrics like book value or price-to-earnings and include sectors such as financials and industrials. Some investors believe rallies in these sectors and small caps could go further if the Fed cuts borrowing costs while the economy stays healthy.

The market’s rotation has recently accelerated, with 61% of stocks in the S&P 500 outperforming the index in the past month, compared to 14% outperforming over the past year, Charles Schwab data showed.

Meanwhile, the so-called Magnificent Seven group of tech giants – which includes Nvidia, Tesla and Microsoft – have underperformed the other 493 stocks in the S&P 500 by 14 percentage points since the release of a weaker-than-expected U.S. inflation report on July 11, according to an analysis by BofA Global Research.

Stocks have also held up after an Nvidia forecast failed to meet lofty investor expectations earlier this week, another sign that investors may be looking beyond tech. The equal weight S&P 500 index, a proxy for the average stock, hit a fresh record this week and is up around 10.5% year-to-date, narrowing its performance gap with the S&P 500.

“When market breadth is improving, the message is that an increasing number of stocks are rallying on expectations that economic conditions will support earnings growth and profitability,” analysts at Ned David Research wrote.

Value stocks that have performed well this year include General Electric and midstream energy company Targa Resources, which are up 70% and 68%, respectively. The small-cap focused Russell 2000 index, meanwhile, is up 8.5% from its lows of the month, though it has not breached its July peak.

Next Friday’s non-farm payrolls report could help bolster the case for a broader market rally if it shows the labor market is cooling at a steady, though not alarming pace, said David Lefkowitz, head of U.S. Equities for UBS Global Wealth Management.

The jobs report “tends to be one of the more market moving releases in general, and right now it’s going to get even more attention than normal.”

Investors are unlikely to turn their back on tech stocks, particularly if volatility gives them a chance to buy on the cheap, said Jason Alonzo, a portfolio manager with Harbor Capital.

Technology stocks are expected to post above-market earnings growth over every quarter through 2025, with third-quarter earnings coming in at 15.3% compared with a 7.5% gain for the S&P 500 as a whole, according to LSEG data.

“People will sometimes take a deep breath after a nice run and look at other opportunities, but technology is still the clearest driver of growth, particularly the AI theme which is innocent until proven guilty,” Alonzo said.

(Reporting by David Randall; Editing by Ira Iosebashvili and Richard Chang)

GM must face big class action over faulty transmissions

By Jonathan Stempel

(Reuters) – General Motors (GM) was ordered by a federal appeals court to face a class action claiming it violated laws of 26 U.S. states by knowingly selling several hundred thousand cars, trucks and SUVs with faulty transmissions.

The 6th U.S. Circuit Court of Appeals said a lower court judge had discretion to let drivers sue in groups over Cadillac, Chevrolet and GMC vehicles equipped with 8L45 or 8L90 eight-speed automatic transmissions, and sold in the 2015 through 2019 model years.

Drivers said the vehicles shudder and shake in higher gears, and hesitate and lurch in lower gears, even after repair attempts. They also accused GM of telling dealers to provide assurance that harsh shifts were “normal.”

GM did not immediately respond on Thursday to requests for comment. The decision was issued on Wednesday by a three-judge panel of the Cincinnati-based appeals court.

Class actions can result in greater recoveries at lower cost than if plaintiffs were forced to sue individually.

The GM litigation covers about 800,000 vehicles, including 514,000 in the certified classes.

Vehicles include the Cadillac CTS, CT6 and Escalade; Chevrolet Camaro, Colorado, Corvette and Silverado; and GMC Canyon, Sierra and Yukon, among others.

In opposing class certification, GM said most class members never experienced problems and therefore lacked standing to sue.

It also said there were too many differences among class members to justify group lawsuits.

Circuit Judge Karen Nelson Moore, however, said overpaying for allegedly defective vehicles was enough to establish standing.

She also said “exactly how, and to what extent, each of the individual plaintiffs experienced a shudder or shift quality issue is irrelevant” to whether GM concealed known defects, and whether drivers would have found that information material.

The court also rejected GM’s argument that many potential claims belonged in arbitration.

It returned the case to U.S. District Judge David Lawson in Detroit, who certified the classes in March 2023.

“We look forward to holding GM accountable before a Michigan jury,” Ted Leopold, a Cohen Milstein Sellers & Toll partner representing the drivers, said in a statement.

The case is Speerly et al v. General Motors LLC, 6th U.S. Circuit Court of Appeals, No. 23-1940.

(Reporting by Jonathan Stempel in New York; Editing by Nick Zieminski)