Like Energy Transfer? You Should Check Out This Ultra-High-Yield Dividend Stock.

Energy Transfer (NYSE: ET) is one of the largest, most diversified providers of energy midstream services in the country. Those assets generate lots of steady cash flow, about half of which the master limited partnership (MLP) distributes to investors. With its yield of over 8%, it’s a popular income investment.

Investors who like that income stream should check out fellow MLP Delek Logistics Partners (NYSE: DKL). The smaller midstream services provider currently yields around 11%. While it has a higher risk profile, it has done a terrific job increasing its monster distribution over the years.

The industry behemoth

Energy Transfer generates about $8.5 billion of distributable cash flow per year. The MLP distributes about $4.5 billion of that cash to investors each year. It retains the rest to fund expansion projects, enhance its financial flexibility, and opportunistically repurchase its common units. The midstream giant has a strong investment-grade balance sheet, backed by a leverage ratio trending toward the lower end of its 4.0 to 4.5 target range.

The MLP uses its financial flexibility to expand its midstream platform. The company expects to invest $2.5 billion to $3.5 billion into organic expansion projects each year; it’s planning to spend about $3.1 billion this year. It’s building new gas processing plants, additional export capacity, and natural gas power plants. These projects should come online through 2026, giving it lots of visibility into its ability to grow its cash flow. That helps support its plan to increase its distribution by 3% to 5% annually.

Energy Transfer is also a consolidator in the midstream sector. It bought Lotus Midstream for $1.5 billion in May 2023, closed its $7.1 billion merger with fellow MLP Crestwood Equity Partners in November, and acquired WTG Midstream in a $3.1 billion deal this July. Accretive acquisitions further support its distribution growth plan.

A hidden income gem

Delek Logistics Partners shares many similarities with Energy Transfer, just on a much smaller scale. Independent refiner Delek US Holdings formed the MLP to provide it with logistics services. It currently gets about half its revenue from its parent, with the rest coming from third-party customers. That customer concentration makes it riskier than the much more diversified Energy Transfer.

The MLP generates fairly predictable cash flow supported by long-term contracts with Delek US and other customers. It distributes the bulk of its cash flow to investors. It produced $67.8 million of cash in the second quarter, enough to cover its high-yielding payout by a relatively comfortable 1.32 times. Delek Logistics Partners retained the rest of that cash to fund expansion projects and strengthen its balance sheet. The MLP’s leverage ratio was 3.81 at the end of the second quarter, down from 4.34 at the end of last year. While Delek Logistics has a lower leverage ratio compared to Energy Transfer, it doesn’t have investment-grade credit, in part because of its smaller scale and less diversified business model. That increases its borrowing costs and risk profile.

Delek Logistics is working to reduce its reliance on its parent by expanding its business to support more third-party customers. It recently agreed to buy H2O Midstream for $230 million to increase its ability to provide a full range of midstream services to oil and gas producers in the Permian Basin. The MLP also bought its parent’s stake in the Wink to Webster oil pipeline and approved building a new natural gas processing plant. These investments have the MLP on track to increase its third-party earnings to 64% of the total by the second half of next year.

The energy logistics company’s growing cash flow should enable it to continue increasing its distribution. It delivered its 46th consecutive quarterly increase in July. That payout was 1.9% above the prior quarter’s level and 5.3% higher year over year. With lots of growth coming down the pipeline from its recent investments, this MLP should have plenty of fuel to continue increasing its dividend.

An enticing option

Energy Transfer is a leader in the energy midstream sector. It generates lots of cash, which it uses to expand its network and distribution. That high-yielding and steadily rising payout makes it an ideal option for those seeking passive income.

Delek Logistics shares many similarities with Energy Transfer, though on a much smaller scale. It offers a higher yield and has plenty of fuel to continue growing its payout. Those factors make it an enticing option for income-seeking investors who are comfortable with its higher risk profile and investing in MLPs, which send a Schedule K-1 Federal Tax Form each year.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has positions in Energy Transfer. The Motley Fool recommends Delek Us. The Motley Fool has a disclosure policy.

Like Energy Transfer? You Should Check Out This Ultra-High-Yield Dividend Stock. was originally published by The Motley Fool

2 Warren Buffett Stocks That Could Soar If the Fed Cuts Interest Rates in September

Warren Buffett hasn’t fared too badly since the Federal Reserve began raising interest rates in March 2022. Shares of Berkshire Hathaway are up more than the S&P 500 during the higher-rate environment.

However, Buffett is probably hoping for lower rates as many investors are. Some of the stocks in his Berkshire Hathaway portfolio could especially benefit from a positive move by the Federal Reserve. Here are two Buffett stocks, in particular, that could soar if the Fed cuts interest rates in September.

Two Buffett birds of a feather

Buffett initiated positions in three housing stocks in the second quarter of 2022. His biggest stake, by far, was in D.R. Horton. He subsequently sold all of Berkshire’s shares in the giant homebuilder. However, he held onto the other two stocks.

Today, Berkshire owns roughly $25.6 million of Lennar (NYSE: LEN) shares. It also owns $100 million of NVR (NYSE: NVR) stock. Granted, these are small positions for Berkshire. But both Lennar and NVR certainly still qualify as Buffett stocks.

Lennar is the larger of the two companies with a market cap of over $49 billion. It’s been in business for 70 years. The homebuilder has operations in 22 states.

NVR’s market cap is around $28 billion. The Virginia-based company operates in 16 states, building and selling homes under three brands: Ryan Homes, NVHomes, and Heartland Homes. In addition, NVR has subsidiaries that offer mortgage and settlement services to homebuyers.

Why rate cuts should boost Lennar and NVR

There’s a simple reason why interest rate cuts should boost Lennar and NVR. Lower interest rates usually lead to lower mortgage rates. And lower mortgage rates fuel increased buying of new homes.

Lennar executive chairman and co-CEO Stuart Miller summed it up well in his company’s second-quarter earnings call. Miller said, “[A]s interest rates subside and normalize and if the Fed is actually going to begin to cut rates, we believe a pent-up demand will be activated, and we will be well prepared.”

Miller’s comments apply to NVR as well. The “pent-up demand” for new homes he referred to will help all homebuilders.

It appears that the Federal Reserve will soon deliver on those highly anticipated rate cuts. Chairman Jerome Powell said last week, “My confidence has grown that inflation is on a sustainable path back to 2%.” This statement is huge, considering that the rate hikes that began in early 2022 were made to bring soaring inflation rates down. Powell proclaimed, “The time has come for policy to adjust.”

What if the Fed doesn’t cut rates in September?

However, the Federal Reserve chairman didn’t fully commit to cutting interest rates in September. He stated, “[T]he timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

So what will happen with Lennar and NVR if the Fed doesn’t cut rates in September? I think the two stocks will still move higher.

The November presidential election could provide a catalyst for both stocks. Democratic nominee Kamala Harris wants to jump-start the construction of 3 million new homes by 2028. Her proposals include giving financial assistance to first-time home buyers and tax incentives to builders who sell houses to first-time home buyers.

More importantly, the U.S. has a chronic housing shortage. More new homes are needed. Lennar and NVR will continue to grow regardless of what the Fed does or what happens in the election.

Should you invest $1,000 in Lennar right now?

Before you buy stock in Lennar, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lennar wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Keith Speights has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Berkshire Hathaway, Lennar, and NVR. The Motley Fool has a disclosure policy.

2 Warren Buffett Stocks That Could Soar If the Fed Cuts Interest Rates in September was originally published by The Motley Fool

2 Monster Stocks You Can Buy Right Now Before They Surge Even Higher

Many investors are worried about a resurgence of turbulence in the markets and what that could mean for stocks in the weeks and months ahead. But great businesses can withstand the test of time and provide meaningful portfolio returns. Concerns about the U.S. economy, its impact on the global economy, and the trickle-down impact of inflation on businesses across industries are legitimate.

At the same time, if you’re investing your cash into excellent companies and intend to hold on to your positions for years at a time, these short-term movements needn’t deter you from your overarching financial goals. On that note, here are two monster growth stocks to consider adding to your portfolio right now.

1. AbbVie

AbbVie (NYSE: ABBV) has dealt with some short-term headwinds in recent quarters due to the loss of patent exclusivity on Humira. The drug was once the world’s top-selling drug and the crown jewel of this healthcare company’s portfolio.

While the entry of generics into the market has certainly driven a decline in Humira sales, AbbVie has other winners in its portfolio that are slowly but surely offsetting the outcome of these changes. Bear in mind, pharmaceutical companies tend to be far less cyclical than other businesses. However, they do endure changing business cycles as new drugs are developed and approved, and older, top-selling drugs give way to competition.

The average period of patient exclusivity for newly approved drugs is around 12 years, but this can vary based on the specific product in question. AbbVie delayed patent expiration on Humira for years, eventually extending its patent exclusivity period to around two decades before it was finally forced to contend with the impact of biosimilars.

Fast-forward to the second quarter of 2024, and the impact of AbbVie’s broad portfolio of other blockbuster drugs is taking hold despite waning sales of Humira, driving revenue and profits upward. Worldwide net revenue in the three-month period totaled $14.5 billion, up approximately 4% from one year ago, a healthy increase for a business at its level of maturity.

This performance was driven by robust growth in its oncology and neuroscience drug portfolios of 11% and 15%, respectively. Blockbuster immunology drugs like Skryizi and Rinvoq, which saw revenue rise by respective rates of 45% and 56% in the quarter from the year-ago period, were also heavy hitters here.

The company is very profitable. In the first half of 2024, AbbVie brought in net earnings of approximately $2.8 billion, a 21% increase from the first half of 2023. And over the trailing 12 months, AbbVie has brought in operating cash flow of about $19 billion with free cash flow in the ballpark of $20 billion.

As a long-standing dividend payer, AbbVie has increased its dividend by over 285% since it spun off from Abbott Laboratories over a decade ago. It currently boasts a forward annual dividend yield of around 3.1%, roughly double that of the average stock trading on the S&P 500, with a forward annual dividend rate of $6.20 per share.

If you’re looking for a top-notch income-producing healthcare stock to add to your portfolio, AbbVie might be worth a long, hard second look.

2. Cava Group

Cava Group (NYSE: CAVA) owns and operates a chain of Mediterranean style fast-casual restaurants across the U.S. Shares have been doing exceptionally well recently, with the stock soaring by an eye-popping 200% since January.

The company only went public in June 2023, but its fast-growing business that is already generating profits seems to be attracting increased interest from investors. Now, it’s important to look beyond share price increases and at the underlying business to see what’s happening.

In the second quarter of 2024, Cava’s revenue jumped 35% year over year to $231 million. The restaurant stock also opened 18 net new restaurants in the three-month period, which resulted in Cava ending the quarter with 22% more restaurants in its portfolio than the same time last year.

Same restaurant sales popped by more than 14% from the year-ago quarter, while restaurant level profits soared 37% from the comparable period in 2023. About 36% of Cava’s orders in the quarter came from digital sales.

From a profitability perspective, Cava reported just shy of $20 million in net income in the three-month period. That was about 3 times higher than its net income just one year ago. The company is also cash-flow-positive. Net cash from operations totaled around $49 million in the second quarter of 2024, while free cash flow came to around $23 million.

Cava Group, like other members of the restaurant industry, is going to experience a certain level of cyclicality and vulnerability to changing consumer spending patterns. However, the company’s fast-casual dining experience can provide a more affordable and accessible (not to mention slightly healthier) option to consumers, which can be particularly appealing when wallets are constrained.

If you have a well-diversified portfolio and the risk appetite to invest in restaurant stocks, Cava looks like a solid choice to capitalize on the growth in the fast-casual segment.

Should you invest $1,000 in AbbVie right now?

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Rachel Warren has positions in AbbVie. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends Cava Group. The Motley Fool has a disclosure policy.

2 Monster Stocks You Can Buy Right Now Before They Surge Even Higher was originally published by The Motley Fool

AdvisorShares Announces Reverse Split of ETF

BETHESDA, Md., Aug. 30, 2024 /PRNewswire/ — AdvisorShares, a leading sponsor of actively managed exchange-traded funds (ETFs), has announced a reverse split of the issued and outstanding shares of the AdvisorShares Psychedelics ETF. The split will not change the total value of a shareholder’s investment.

Effective before market open on September 10, 2024, the Fund will affect a reverse split of its issued and outstanding shares as follows:

|

Fund Name |

Reverse Split Ratio |

Approximate decrease in total |

|

AdvisorShares Psychedelics ETF |

1 for 10 |

90 % |

Please note the CUSIP changes, effective September 10, 2024:

|

Fund Name |

Ticker |

Current CUSIP |

New CUSIP |

|

AdvisorShares Psychedelics ETF |

PSIL |

00768Y362 |

00768Y297 |

As a result of this reverse split, every ten shares of the Fund will be exchanged for one share as indicated above. Accordingly, the total number of the issued and outstanding shares for the Fund will decrease by the approximate percentage indicated above. In addition, the per share net asset value (NAV) and next day’s opening market price will be approximately ten times higher for the Fund. Shares of the Fund will begin trading on the NYSE Arca on a split-adjusted basis on September 10, 2024.

A shareholder’s investment value will not be affected by the reverse split. The table below illustrates the effect of a hypothetical one-for-ten reverse split anticipated for the Fund, as applicable and described above:

1-for-10 Reverse Split

|

Period |

# of Shares Owned |

Hypothetical NAV |

Total Market Value |

|

Pre-Split |

100 |

$10 |

$1,000 |

|

Post-Split |

10 |

$100 |

$1,000 |

The Trust’s transfer agent will notify the Depository Trust Company (DTC) of the reverse split and instruct DTC to adjust each shareholder’s investment(s) accordingly. DTC is the registered owner of the Fund’s shares and maintains a record of the Fund’s record owners.

Redemption of Fractional Shares and Tax Consequences for the Reverse Split

As a result of the reverse split, a shareholder of the Fund’s shares potentially could hold a fractional share. However, fractional shares cannot trade on the NYSE Arca. Thus, the Fund will redeem for cash a shareholder’s fractional shares at the Fund’s split-adjusted NAV as of the Effective Date. A shareholder could recognize a gain or loss in connection with the redemption of the shareholder’s fractional shares.

“Odd Lot” Unit

As a result of the reverse split, the Fund may have outstanding one aggregation of less than 5,000 shares to make a creation unit, or an “odd lot unit.” Thus, the Fund will provide one authorized participant with a one-time opportunity to redeem the odd lot unit after the split-adjusted NAV is struck on September 10. 2024.

About AdvisorShares

AdvisorShares is a leading provider of actively managed ETFs. For financial professionals and investors requesting more information, call 1-877-843-3831 or visit www.advisorshares.com. Follow @AdvisorShares on X(Twitter) and LinkedIn for more insights.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call 1-877-843-3831 or visit our website at www.advisorshares.com. Read the prospectus or summary prospectus carefully before investing.

Foreside Fund Services, LLC, distributor.

There is no guarantee that the Fund will achieve its investment objective. An investment in the Fund is subject to risk, including the possible loss of principal amount invested.

Psychedelic drugs, also known as hallucinogens, are a group of substances, including psilocybin, that are used to change and enhance sensory perceptions, thought processes, and energy levels. Psychedelic medicines, therapeutics, and healthcare treatments may be used in the treatment of illnesses such as depression, addiction, anxiety and post-traumatic stress disorder. Psychedelic medicine companies include life sciences companies having significant business activities in, or significant exposure to, the psychedelics industry including producers or distributors of psychedelic medicines, biotechnology companies engaged in research and development of psychedelic medicines, and companies that are part of the supply chain for psychedelics.

Psychedelics Companies Risk. Psychedelics companies are subject to various laws and regulations that may differ at the state/local and federal level. These laws and regulations may significantly affect a psychedelics company’s ability to secure financing, impact the market for psychedelics and business sales and services, and set limitations on psychedelics use, production, transportation, and storage. There can be no guarantees that such approvals or administrative actions will happen or be favorable for psychedelics companies, and such actions may be subject to lengthy delays, and may require length and expensive clinical trials. Additionally, therapies containing controlled substances may generate public controversy. Political and social pressures and adverse publicity could lead to delays in approval of, and increased expenses for, companies and any future therapeutic candidates they may develop. All of these factors and others may prevent psychedelics companies from becoming profitable, which may materially affect the value of certain Fund investments. In addition, psychedelics are subject to the risks associated with the biotechnology and pharmaceutical industries.

In Canada, certain psychedelic drugs, including psilocybin, are classified as Schedule III drugs under the Controlled Drugs and Substances Act (“CDSA”) and, as such, medical and recreational use is illegal under Canadian federal laws. In the United States, certain psychedelic drugs, including psilocybin, are classified as Schedule I drugs under the Controlled Substances Act (“CSA”) and the Controlled Substances Import and Export Act (the “CSIEA”) and, as such, medical and recreational use is illegal under the U.S. federal laws. There is no guarantee that psychedelic drugs or psychedelic-inspired drugs will ever be approved as medicines in either jurisdiction.

In the United States, scheduling determinations by the Drug Enforcement Agency (“DEA”) are dependent on Food and Drug Administration (“FDA”) approval of a substance or a specific formulation of a substance. Unless and until psilocybin, psilocin, or other psychedelics-based products receive FDA approval, such products may be prohibited from sale, which could limit the growth opportunities for certain portfolio companies of the Fund. Even if approved by the FDA, the manufacture, importation, exportation, domestic distribution, storage, sale, and legitimate use of such products will continue to be subject to a significant degree of regulation by the DEA.

Security prices of small cap companies may be more volatile than those of larger companies and therefore the Fund’s share price may be more volatile than those of funds that invest a larger percentage of their assets in securities issued by larger-cap companies. These risks are even greater for micro-cap companies.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/advisorshares-announces-reverse-split-of-etf-302235282.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/advisorshares-announces-reverse-split-of-etf-302235282.html

SOURCE AdvisorShares

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intel Considers Options Such as a Foundry Split; Shares Soar

(Bloomberg) — Intel Corp. is working with investment bankers to help navigate the most difficult period in its 56-year history, according to people familiar with the matter.

Most Read from Bloomberg

The company is discussing various scenarios, including a split of its product-design and manufacturing businesses, as well as which factory projects might potentially be scrapped, said the people, who asked not to be identified because the deliberations are private.

The news sent Intel shares up 9.5% to $22.04 in New York on Friday, marking the biggest single-day gain since October 2022.

Morgan Stanley and Goldman Sachs Group Inc., Intel’s longtime bankers, have been providing advice on the possibilities, which could also include potential M&A, the people said. The discussions have only grown more urgent since the Santa Clara, California-based company delivered a grim earnings report this month, which sent the shares plunging to their lowest level since 2013.

The various options are expected to be presented during a board meeting in September, the people said.

No major move is imminent and discussions are still in early stages, the people cautioned. A representative for Intel declined to comment, while Morgan Stanley and Goldman Sachs didn’t immediately respond to requests for comment.

Before the rally, Intel’s stock had declined 60% this year, compared with a 20% gain for the Philadelphia Stock Exchange Semiconductor Index, a chip-industry benchmark.

A potential separation or sale of Intel’s foundry division, which is aimed at manufacturing chips for outside customers, would be an about-face for Chief Executive Officer Pat Gelsinger. Gelsinger has viewed the business as key to restoring Intel’s standing among chipmakers and had hoped it would eventually compete with the likes of Taiwan Semiconductor Manufacturing Co., which pioneered the foundry industry.

But it’s more likely that Intel takes a less dramatic step before it reaches that point, such as holding off on some of its expansion plans, the people said. The company has already done project financing deals with Brookfield Infrastructure Partners and Apollo Global Management.

Intel’s Gelsinger is running out of time to pull off a much-needed turnaround. He’s been attempting to expand the chipmaker’s factory network at the same time that sales are shrinking — a money-losing proposition. The company suffered a net loss of $1.61 billion last quarter, and analysts are predicting more red ink for the next year.

“Expect big capex cuts from Intel over the next 12 months,” said Amir Anvarzadeh, market strategist at Asymmetric Advisors. “Intel’s model is effectively broken. It’s fighting fires on too many fronts.”

Gelsinger, an Intel veteran who left the company for more than a decade, took the helm in 2021 and promised to restore the company’s technological edge. Under previous CEOs, the chip pioneer had lost market share and its long-vaunted reputation for innovation.

But his comeback plan proved overly ambitious, and the company has had to scale back. When it reported earnings earlier this month, Intel announced plans to cut about 15,000 jobs and slash capital spending. The company even suspended its long-prized dividend.

“It’s been a difficult few weeks,” Gelsinger told investors at the Deutsche Bank Technology Conference on Thursday. The company tried to lay out a “clear view” of its next steps during its earnings report, he said. “Obviously the market didn’t respond positively. We understand that.”

Adding to the upheaval, director Lip-Bu Tan abruptly stepped down from the board last week. The semiconductor veteran, who was brought in two years ago to help with the comeback effort, cited scheduling commitments. But his departure removed one of the few directors with industry knowledge and experience.

Gelsinger’s comeback plan hinged on recasting Intel into two groups: one that designs chips and another that manufactures them. The production arm would then be free to seek business from other companies.

But the biggest client of Intel’s factory network is still Intel. Until the foundry business has more outside customers, it’s going to be challenged financially. It reported operating losses of $2.8 billion in its most recent quarter and is now on course to have a worse year than projected.

With a market value of $86 billion, Intel has fallen out of the top 10 largest chipmakers in the world ranked by that measure. It’s the second-worst performer on the Philadelphia chip index this year and suffers in comparisons with the stratospheric gains of Nvidia Corp., a company that’s on course to post double Intel’s revenue in 2024.

As recently as 2021, Intel was three times the size of Nvidia by revenue.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Buffett Dumps BofA Stock Again, and Soon He May Trade in Secret

(Bloomberg) — Warren Buffett’s Berkshire Hathaway Inc. won’t have to swiftly disclose its rapid-fire sales of Bank of America Corp. stock too much longer. That is, if he keeps whittling the investment.

Most Read from Bloomberg

A fresh round of disposals disclosed late Friday trimmed the conglomerate’s stake in the bank down to 11.4%. So long as Berkshire holds more than 10%, US rules require it to reveal transactions within a few days. But if the company holds less, it may wait weeks to update the public — typically giving snapshots after every quarter.

That would help quiet the drama weighing on BofA’s share price since mid-July, when Buffett — a longtime backer of Chief Executive Officer Brian Moynihan — embarked on a selling spree without giving a reason. Berkshire has since reaped a total of $6.2 billion.

In the disposals announced Friday, Berkshire sold about 21 million shares for $848 million from Aug. 28 through 30.

Buffett, 94, began building the investment in Bank of America with a $5 billion deal in 2011 for preferred stock and warrants. His Berkshire Hathaway eventually became — and remains — the bank’s biggest stockholder, with a stake worth about $36 billion, based on Friday’s closing price.

–With assistance from Peter Eichenbaum.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

S&P 500 Spikes in Last 10 Minutes of US Trading: Markets Wrap

(Bloomberg) — Stocks climbed in the final stretch of a wild August, with traders bracing for what’s historically known as the worst month for equities.

Most Read from Bloomberg

For all the whiplash in global markets just a few weeks ago, the S&P 500 closed within a whisker of its all-time highs. Equities spiked in the last 10 minutes of Wall Street trading, with the S&P 500 up 1% and all of its major groups on the rise. The gauge notched its fourth straight monthly gain amid data showing the economy is holding up, while leaving the door open for the Federal Reserve to start cutting rates in September. Whether a jumbo-sized reduction remains on the table, next week’s jobs report might bring some clues.

“As August comes to a close, sentiment has calmed down significantly compared to the beginning of the month,” said Mark Hackett at Nationwide. “Many of the larger concerns in the overall economy have decreased. September may bring some seasonal challenges, but if investors can navigate through them, these challenges can turn into advantages in the fourth quarter.”

Since 1950, the S&P 500 has generated an average loss 0.7% in September and finished higher only 43% of the time, making it the worst month for stocks on an average return and positivity-rate basis, according to Adam Turnquist LPL Financial. The last four Septembers have also been notably weak, with the index posting respective declines of 4.9%, 9.3%, 4.8%, and 3.9%.

“During the month, the index tends to trade sideways during the first half, with losses beginning to accumulate into month end,” he said. “For this year, the midway point also happens to line up closely with the September Fed meeting.”

The S&P 500 rose to around 5,650 ahead of Monday’s US holiday. The Nasdaq 100 added 1.3%. The Russell 2000 of small firms gained 0.7%. Goldman Sachs Group Inc. plans to dismiss a few hundred employees in coming weeks as part of the firm’s annual cull of low-performing staff, according to people familiar with the matter. Dell Technologies Inc. rallied on solid results.

Wall Street’s “fear gauge” — the VIX — dropped to 15. That’s after an unprecedented spike that took the index above 65 during the Aug. 5 market selloff. An options trader or traders bought call spreads on the VIX — expiring in September, spending upwards of $9 million to protect against a surge in the gauge of S&P 500 volatility past 22.

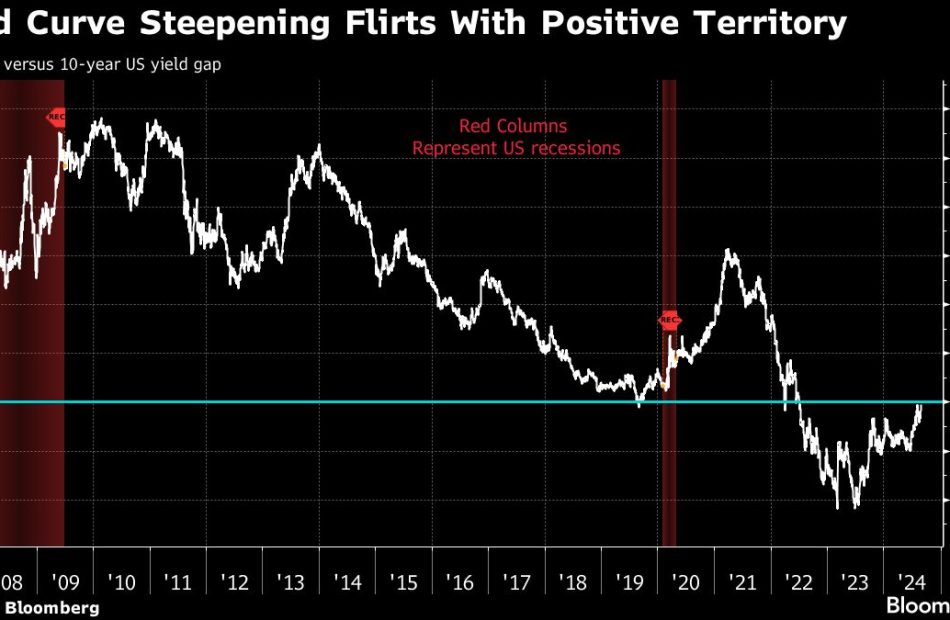

Treasury 10-year yields climbed five basis points to 3.91%. The dollar rose at the end of its worst month this year. Speculative traders turned bearish on the greenback for the first time since February. Oil tumbled.

Data from Bespoke Investment Group found that over the past 100 years, September also has by far been the worst month of the year for the Dow Jones Industrial Average with an average decline of 1.24%.

A Citigroup Inc. analysis of data since 1928 suggests S&P 500’s average realized volatility for September has historically been 1.5 points above August, while October has been an additional 2.5 points higher.

There are a few theories for why September tends to be a weaker month for stocks.

For one thing, investors returning from summer vacations tend to reassess portfolio positioning defensively. Companies prepare their budgets for the coming year and debate belt tightening. And mutual funds often engage in “window dressing” by selling positions at a loss to reduce the size of their capital-gains distributions.

“Additionally, companies entering a blackout period for share repurchases at the end of the third quarter can have their ability to support their share price impacted if the price drops,” Hackett said.

While seasonality can be reason enough for some jitters, 2024 is also an election year, Bespoke remarked. With that added potential cause for concern, September’s performance in election years has again, leaned negative, the firm said.

For all post-World War II presidential election years, the Dow has averaged a 0.58% decline during September. Albeit negative, that compares with September of non-election years when it has averaged an even larger 1.37%.

“In other words, seasonality has tended to be rough regardless of whether or not it’s an election year,” the Bespoke strategists noted.

For now, many traders are pinning their hopes on more data that will show the economy isn’t falling off a cliff, while inflation keeps marching toward the Fed’s 2% goal.

A report Friday showed US consumer sentiment improved for the first time in five months as slower inflation and prospects for Fed cuts helped lift expectations about personal finances. The Fed’s preferred measure of underlying US inflation — the core personal consumption expenditures price index — rose at a mild pace.

“This week’s numbers dispel worries about a recession and inflation,” said David Russell at TradeStation. “Goldilocks could be here as Jerome Powell prepares to turn the page.”

Powell said last week the time has come for the central bank to cut its key policy rate, affirming expectations that officials will begin lowering borrowing costs next month and making clear his intention to prevent further jobs cooling.

Like the Fed, investors’ focus seems to be shifting from inflation to the labor market, and soon all eyes will be on next Friday’s monthly jobs report, said Bret Kenwell at eToro.

“Last month’s jobs report was a big miss, causing widespread worry that the Fed was too late to cut rates,” he noted. “Another big miss could increase speculation of a 50 basis-point cut vs. the current expectation of a 25 basis-point cut.”

Swap contracts fully price in a quarter-point move and about 20% odds of the half-point cut forecast by at least two large US banks. They continue to almost fully price in a half-point rate cut at some point this year, anticipating cumulative easing of almost 100 basis points over the Fed’s three remaining policy meetings.

Stock markets are likely to benefit again from good economic data, which is needed for the rally to broaden out further beyond the tech sector, according to Barclays Plc strategists.

The team led by Emmanuel Cau says the monthly US jobs data next week will be the bellwether for confirming or refuting recession worries.

“If it is a bad print, no doubt equities would react badly given their level after the rebound,” they wrote. On the other hand, a better-than-expected figure would “help assuage those recession fears in the short run, and likely be good for equities.”

Cash funds recorded inflows of about $24.5 billion in the week through Aug. 28, a fourth straight week of additions, according to a note from Bank of America Corp., citing EPFR Global data. About $20.7 billion entered bond funds, while $13.7 billion flowed into stocks, the data showed.

US equities saw a ninth straight week of additions at $5.8 billion.

Corporate Highlights:

-

Tesla Inc. aims to unveil its highly anticipated robotaxi at an event at Warner Bros. Discovery Inc.’s movie studio in the Los Angeles area, people familiar with the matter said.

-

The electric vehicle company is targeting a reveal of the purpose-built robotaxi on Oct. 10 at the Burbank, California facility, said the people.

-

-

Intel Corp. is working with investment bankers to help navigate the most difficult period in its 56-year history, according to people familiar with the matter.

-

The company is discussing various scenarios, including a split of its product-design and manufacturing businesses, as well as which factory projects might potentially be scrapped, said the people.

-

-

Lululemon Athletica Inc. lowered its sales and profit outlook for the year as increased competition and relentless inflation curb demand for its pricey yoga pants.

-

Ulta Beauty Inc. trimmed its sales forecast as more US consumers cut back on makeup and cosmetics in the face of higher prices and elevated borrowing costs.

-

Autodesk Inc. raised its full-year earnings outlook following pressure on the software maker from activist investor Starboard Value LP.

-

Alnylam Pharmaceuticals Inc.’s trial of its drug to treat a deadly form of heart disease fell short of investors’ expectations.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 1% as of 4 p.m. New York time

-

The Nasdaq 100 rose 1.3%

-

The Dow Jones Industrial Average rose 0.6%

-

The MSCI World Index rose 0.8%

-

Bloomberg Magnificent 7 Total Return Index rose 1.6%

-

The Russell 2000 Index rose 0.7%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro fell 0.2% to $1.1055

-

The British pound fell 0.3% to $1.3133

-

The Japanese yen fell 0.8% to 146.15 per dollar

Cryptocurrencies

-

Bitcoin fell 1.3% to $58,785.55

-

Ether fell 1.3% to $2,507.87

Bonds

-

The yield on 10-year Treasuries advanced five basis points to 3.91%

-

Germany’s 10-year yield advanced two basis points to 2.30%

-

Britain’s 10-year yield was little changed at 4.02%

Commodities

-

West Texas Intermediate crude fell 3% to $73.62 a barrel

-

Spot gold fell 0.7% to $2,503 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.