3 Reasons Nike Stock Can Be a Great Long-Term Buy

Nike (NYSE: NKE) is a top apparel company, and its iconic brand is known around the world. Even though its products are often more expensive than others, the company has managed to grow its business significantly for years. Today, its market capitalization is around $130 billion.

But lately, investors have grown worried about the company’s growth prospects. Business has been slowing down, and inflation isn’t helping. While the short-term headwinds can send it lower this year (it’s already down 22%), this is why I think the stock can still be a winner in the long run.

It has strong brand recognition among teens

Even if you’re not a customer of Nike’s and think its products are too expensive, the data suggests that there’s still a lot of interest from younger people. The company’s brand ranks high among teens, according to a report this year from Piper Sandler.

The report found that Nike’s brand was far and away the favorite among teens polled in a recent semi-annual survey, for both clothing and footwear. What’s particularly noteworthy is that the gap between first and second is considerable. In footwear, Nike was the most popular brand with 59% of teens, with the next closest brands having a mindshare of just 7%. In clothing, it was a bit closer, with Nike’s percentage coming in at 34% versus 6% for the second most popular brand.

While the company’s growth rate may be showing signs of weakness, the brand remains strong, which suggests that it could just be the poor economic conditions weighing down the business as opposed to problems with Nike’s overall brand.

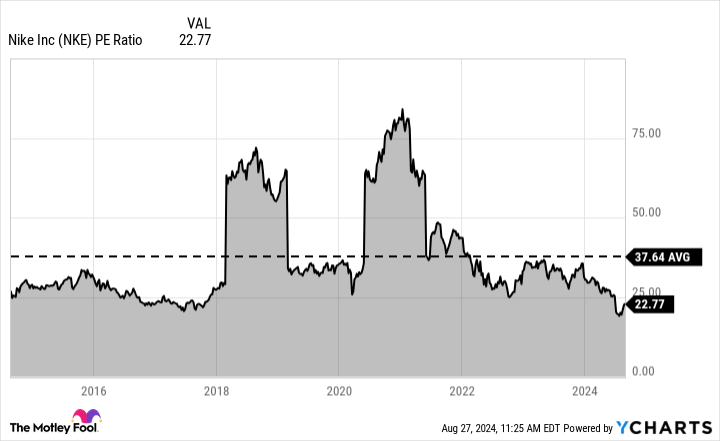

Its low earnings multiple can set up investors for gains down the road

Another reason to consider buying the stock is that it looks really cheap right now. At just 22 times its trailing earnings, Nike is trading at a much lower multiple than it has in the past, and it’s well below its 10-year average.

The counterpoint, of course, is that growth investors aren’t going to want to pay a premium for a business that’s struggling to grow. In its most recent earnings report, covering results until the end of May, Nike’s quarterly revenue totaled $12.6 billion — down 2% year over year. That’s not the type of stock investors are going to be wanting to pay 30 times earnings for right now.

But at its current multiple, the stock could be cheap enough that it makes sense to invest, anyway. The average stock on the S&P 500 trades at nearly 25 times its trailing earnings. And while Nike’s growth rate may be negative today, that doesn’t mean it will stay that way. As economic conditions improve and as the company launches new products, the growth rate could pick up.

Nike’s profit margin is solid

What’s promising is that even amid the current adversity in the market, Nike’s profit margins remain strong at nearly 12% of revenue.

This is important for two reasons. The first is that a high profit margin can give the company room to offer discounts and cut prices to stimulate some growth, while ensuring it stays profitable in doing so. Second, a double-digit profit margin means that once its growth rate does start to pick up, a lot of that incremental revenue will result in stronger earnings numbers, which, in turn, will potentially bring down Nike’s earnings multiples and make the apparel stock a better buy in the process.

If you’re patient, this can be an excellent stock to buy and hold

In the past, Nike’s stock didn’t look like a good buy to me due to its elevated valuation. But now, at a much more tenable price, the stock can make for a potentially solid investment for those who are willing to be patient and hang on for the long term.

There may not be a quick turnaround for Nike’s business, and a lot will inevitably depend on the strength of the economy, but I’m confident it can get back to growing its sales. When that happens, its earnings numbers will improve, and it could look like a bargain buy.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool has a disclosure policy.

3 Reasons Nike Stock Can Be a Great Long-Term Buy was originally published by The Motley Fool

ABR STOCK NEWS: A Securities Fraud Class Action has been Filed Against Arbor Realty Trust, Inc. — Contact BFA Law before September Deadline if You Suffered Losses (NYSE:ABR)

NEW YORK, Sept. 01, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Arbor Realty Trust, Inc. ABR and certain of the Company’s senior executives.

If you invested in ABR, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/arbor-realty-trust-inc.

Investors have until September 30, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in ABR securities. The case is pending in the U.S. District Court for the Eastern District of New York and is captioned Lois Martin v. Arbor Realty Trust, Inc., et al., No. 24-cv-05347.

What is the Lawsuit About?

ABR is a nationwide real estate investment trust (“REIT”) and direct lender, providing loan origination and servicing for commercial real estate assets. The complaint alleges that during the relevant period, ABR misrepresented the health of the Company’s loan book. In truth, ABR used fake holding companies to help conceal that its loan book was distressed, and the underlying collateral was overstated.

On March 14, 2023, NINGI Research published a report which claimed, among other things, that “Arbor has been hiding a toxic real estate portfolio of mobile homes with a complex web of real and fake holding companies for more than a decade.” This news caused the price of ABR stock to decline by $0.87 per share, or almost 7%, to close at $12.12 per share on March 14, 2023.

Then, on December 5, 2023, Viceroy Research published an in-depth study of ABR’s Jacksonville, Florida properties. Viceroy found that the Company’s entire loan book is distressed and the underlying collateral is vastly overstated. This news caused the price of ABR stock to decline by $0.19 per share, or over 1%, to close at $13.67 per share on December 5, 2023.

Finally, on July 12, 2024, Bloomberg reported that ABR was “being probed by federal prosecutors and the Federal Bureau of Investigation in New York.” According to the news report, “[t]he investigators are inquiring about lending practices and the company’s claims about the performance of their loan book.” This news caused the price of ABR stock to decline by $2.64 per share, or almost 17%, to close at $12.89 per share on July 12, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/arbor-realty-trust-inc.

What Can You Do?

If you invested in ABR, you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/arbor-realty-trust-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/arbor-realty-trust-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TipRanks ‘Perfect 10’ List: 2 Top-Scoring Stocks Worth Watching

The key to successful investing lies in choosing the right stocks, though achieving this is no small feat.

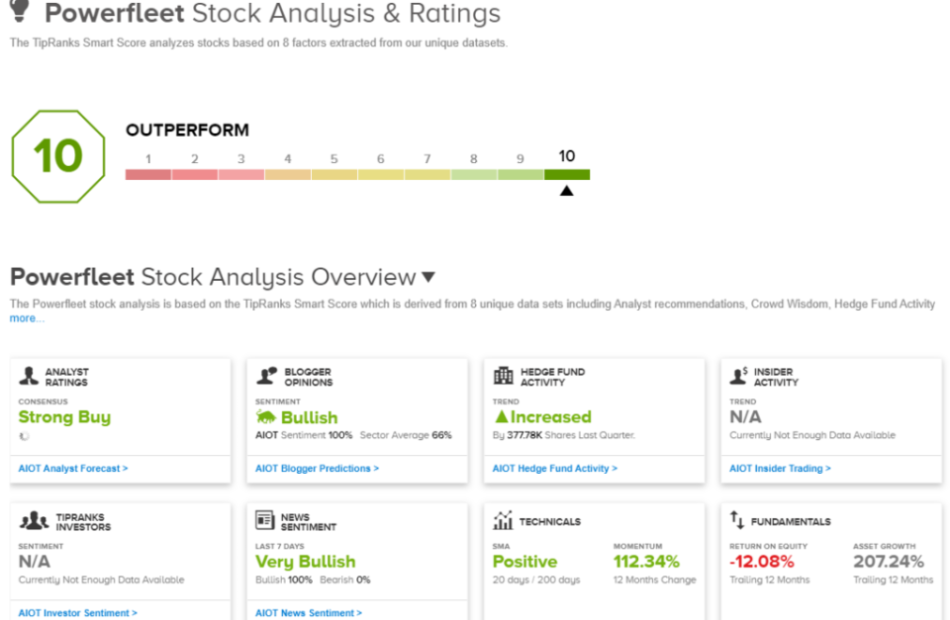

Investors employ a wide array of strategies to select stocks – some trust their instincts, others analyze past performance, and many lean on expert advice. For those seeking a more impartial and data-driven approach, TipRanks’ Smart Score offers an ideal solution. This advanced algorithm leverages AI and natural language processing to sift through vast amounts of data from public trading floors, providing a clear and objective guide for investors.

That data is a treasure trove of stock information, based on the aggregated trades of thousands of investors across thousands of stocks, with tens of millions of transactions every day. It would be the work of several lifetimes to sort and understand it – but the Smart Score automates that, and uses the data to give every stock a simple rating, on a score of 1 to 10, based on a group of factors that are proven to line up with future outperformance. A stock with a ‘Perfect 10’ score deserves a closer look and deeper consideration.

When the Smart Score aligns with Wall Street analyst recommendations, it signals a strong, bullish opportunity for investors. With this in mind, we’ve used the TipRanks platform to explore what analysts think of two top-scoring ‘Perfect 10’ stocks. Here’s a closer look at these stocks and the analyst insights.

PowerFleet (AIOT)

We’ll start with PowerFleet, a company that specializes in combining AI and IoT tech into a unified platform that integrates people, assets, and AIoT data for optimized operations. In practical terms, the company’s platform enables enterprise customers to effectively manage industrial fleets – trucks, tractor trailers, intermodal shipping containers, and other vehicles – ensuring security, tracking, and overall control of these high-value assets.

Among the features that PowerFleet makes available to its customers are regulatory management and compliance, safety and security, fuel management, and maintenance and performance oversight – all vital operations in keeping industrial vehicle fleets in prime operating condition. The company boasts over 7,500 customers around the world and provides top-level support, educational, and implementation services on demand.

In its latest earnings report for fiscal Q1 2025, which ended on June 30, PowerFleet posted a revenue of $75.4 million, reflecting a year-over-year increase of ~10%. Of this total, $56.7 million was generated by the company’s Services segment, with ‘safety-centric product solutions’ contributing significantly to the revenue gain. On the earnings front, the company’s non-GAAP EPS came to $0.00, for a break-even.

For Craig-Hallum analyst Anthony Stoss, PowerFleet stands out as a quality tech company with plenty of potential.

“We continue to believe investors should own AIOT as we see them developing as a strong SaaS play with an interoperable software platform for 130 different 3rd party devices. We note the company continues to see strength around safety applications with safety solutions up 25% Y/Y. Further, we highlight AIOT increased their total subscriber count 11% Y/Y to 1.95M and management is seeing acceleration with their Unity platform,” Stoss opined.

Looking ahead, Stoss lays out a clear path for PowerFleet to keep up its sound performance, adding, “We continue to reiterate our view on a ‘one plus one equals three’ scenario forming from the company’s business from solutions in the warehouse to on the road. We continue to believe investors will find value in AIOT with strong long-term growth prospects, over 7,500 enterprise customers worldwide, driving $20+ ARPU, and with now 75% of revenues recurring.”

These comments back up the 5-star analyst’s Buy rating on AIOT stock, while his $9 price target implies a one-year gain of 80%. (To watch Stoss’ track record, click here)

Overall, AIOT has earned a Strong Buy consensus rating from the Street, based on 6 unanimously positive analyst reviews. The shares are priced at just under $5, and their average price target of $9 matches the Craig-Hallum view. (See AIOT stock analysis)

AngioDynamics (ANGO)

The next stock we’ll look at, AngioDynamics, is a medical device developer and innovator that’s been in the medical-tech business since 1988. The company has a strong portfolio of medical devices and products, designed to put the right tools in the physicians’ hands so that they can provide an elevated standard of care for patients with cardiovascular and oncologic diseases. These two medical categories are leading causes of death worldwide. Globally, 1 in 6 deaths is caused by cancer; AngioDynamics aims to bring those figures down.

AngioDynamics works toward that goal by offering lines of medical devices aimed at multiple medical specialty fields, including interventional radiology, interventional cardiology, and surgery. The devices are used to diagnose various cancers as well as peripheral vascular disease, and are designed to minimize invasive operations.

Several of AngioDynamics’ products deserve special notice. These include the AlphaVac, a therapeutic device used in endovascular procedures; the NanoKnife, which can provide localized treatments for various cancers; and the Auryon, another endovascular treatment tool optimized for peripheral atherectomy technology. These, and many other high-end medical devices, are available in more than 50 markets around the world, across the US, Europe, Asia, and Latin America.

In its most recent fiscal 4Q24 report, for the quarter ending May 31, AngioDynamics exceeded expectations on both the top and bottom lines. The company reported revenue of $70.98 million, a 22% year-over-year decline, yet still managed to surpass estimates by $120,000. On the bottom line, AngioDynamics posted a net loss of 5 cents per share – while negative, this was a significant 23 cents per share better than anticipated.

For Canaccord Genuity analyst John Young, all of this adds up to a sound outlook for the company. He says of this medical device maker’s prospects, “AngioDynamics remains focused on 1) pursuing larger, faster growing markets, 2) driving portfolio transformation, and 3) improving its financial profile and capital structure. Q4’s results show that this strategy is starting to pay off… Looking ahead, we think ANGO has a solid set up with momentum and catalysts in the Med-Tech business across the board — AlphaVac, NanoKnife, and Auryon have opportunities that leave us cautiously optimistic, particularly given ANGO’s current valuation.”

Young goes on to put a Buy rating on ANGO shares, and he complements that with a price target of $13, showing his confidence in a 74% upside potential for the one-year time horizon. (To watch Young’s track record, click here)

Overall, there are 3 recent analyst reviews on file for ANGO shares, and they are all in agreement that this is a stock to buy, making the Strong Buy consensus rating unanimous. The shares are trading for $7.46 and the average price target, at $13.33, is slightly more bullish than the Canaccord view, indicating room for ~79% appreciation in the coming months. (See ANGO stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

2 Top Stocks to Buy Now, According to Wall Street

The stock market’s performance has become more bifurcated this year. While high-flying tech stocks have driven the S&P 500 index to new highs, consumer spending headwinds have weighed on the performance of industry-leading consumer brands.

Two widely held stocks that have delivered subpar performance are Tesla (NASDAQ: TSLA) and Starbucks (NASDAQ: SBUX). However, both stocks recently jumped as new growth catalysts came into focus, and two Wall Street analysts believe now’s the time to buy. Here’s why these top stocks are poised to take off in the coming years.

1. Tesla

Tesla shares delivered phenomenal returns to investors over the last decade, but the stock has been flat over the last few years. It’s been challenging to sell more electric cars, with higher interest rates making financing more expensive, in addition to increasing competition. Despite the headwinds, Tesla stock is up 16% over the last three months as investors have also turned their attention to other promising opportunities in the near term.

Piper Sandler analyst Alexander Potter believes the stock is a buy heading into Tesla’s robotaxi unveiling scheduled for Oct. 10. A robotaxi service should be very profitable for Tesla over time, but it also highlights the opportunity in the company’s battery production, which is intended to reduce manufacturing costs and improve margins.

Tesla’s battery production is ramping up quickly. It produced 50% more 4680 cells in the second quarter than the first quarter. This will support the rapid growth Tesla is experiencing in its energy storage business while also potentially supplying millions of electric cars on the road, especially robotaxis.

Ark Invest believes that Tesla’s operating profit per kilowatt-hour deployed could be $466 for robotaxis compared to just $60 for normal electric cars. This fits into to the firm’s projection that Tesla will increase its profitability and send the stock to as high as $2,600 by 2029.

CEO Elon Musk believes the optimistic projection is possible. The world is shifting toward electric and autonomous transportation. Tesla’s rapidly growing battery production highlights an advantage in manufacturing, which will become quite valuable. Transportation is a $10 trillion market, and Tesla is the disruptor.

2. Starbucks

Starbucks is the top restaurant brand in the world, according to Brand Finance, but like Tesla, the stock is weighed down by sluggish consumer spending. Starbucks’ comp sales declined over the last two quarters, but the stock is up 30% after the company announced it was hiring Brian Niccol from Chipotle Mexican Grill as CEO.

Niccol steered Chipotle to incredible growth over the last five years. It was already a high-performing business, but Niccol was able to squeeze higher margins out of the restaurants, which helped send the stock up 232% over the last five years.

Evercore ISI analyst David Palmer sees a similar opportunity at Starbucks. Palmer recently upgraded the stock to an outperform (buy) rating. The hiring of Niccol increases the probability of a successful turnaround for Starbucks, according to Palmer.

One factor that has benefited Chipotle is its digital ordering capabilities, which make up 35% of Chipotle’s business. Starbucks is also great at implementing mobile ordering, but it should see more enhancements under new management that could reduce wait times and improve store efficiency. Niccol’s previous record of leading similar initiatives at Chipotle should put Starbucks on a profitable growth trajectory.

Palmer sees Starbucks annualized earnings growth reaching 15% or greater over the next three years. Assuming the stock continues to trade at a market average price-to-earnings ratio of 27, investors should see attractive returns on their investment.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Ballard has positions in Tesla. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Starbucks, and Tesla. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

2 Top Stocks to Buy Now, According to Wall Street was originally published by The Motley Fool

RMDs After Death: How Do You Calculate the Required Amount?

Inheriting an IRA or 401(k) can add to your wealth but it can also bring some potential tax headaches. One tricky issue involves required minimum distributions or RMDs. IRA and 401(k) plan owners are required to take minimum distributions from their accounts beginning in the year they turn 72. The IRS has special rules regarding the RMD in the year of death that IRA and 401(k) beneficiaries need to be aware of. A financial advisor can help you through the ins and outs of planning for retirement to put your mind at ease.

When Do RMDs Begin?

Under the tax code, certain retirement account owners are required to begin taking minimum distributions once they turn 72. The types of accounts that are subject to RMDs include:

Roth IRAs are not subject to RMDs during the account owner’s lifetime. You will, however, be subject to RMDs if you inherit a Roth IRA. The IRS is very specific about when these distributions must begin. The required beginning date (RBD) for RMDs is April 1st of the year following the year that the account owner turns 72. That’s important for understanding when an RMD in the year of death is necessary.

When Is an RMD in Year of Death Required?

If you inherit an IRA or another tax-advantaged account that’s subject to RMDs, the timing determines whether you’re required to take an RMD in the year of death.

Here’s how it works:

-

You must take an RMD if the account owner has reached their required beginning date but has not taken a required minimum distribution for the year.

-

You do not have to take an RMD if the account owner passes away before their required beginning date.

Here’s an example of how this works. Say your father turned 72 in March of 2020, making his required beginning date April 1, 2021. He passes away in November 2021 without having taken his RMD for the year. In that instance, you would be responsible for taking the distribution as the account beneficiary.

Now, say your father passed away in March of 2021 instead. Since he has not reached his required beginning date, you would not be obligated to take an RMD in the year of death.

When beneficiaries must take an RMD in the year the account owner dies, the amount is reported on their tax return as income. They must pay taxes on it, the same way that the account owner would have had to if they had taken the distribution themselves.

How to Calculate RMD in Year of Death

If you’re required to take RMDs in the year of death after the account owner passes away, the calculation method is based on the RMD they would have received. Following IRS rules, the RMD for any year is determined using this formula:

Required minimum distribution = account balance as of the end of the preceding calendar year divided by a distribution period from the IRS Uniform Lifetime Table

The Uniform Lifetime Table is designed for unmarried IRA owners, married IRA owners whose spouses aren’t more than 10 years younger than they are and married owners whose spouses aren’t the sole beneficiaries of their IRAs. Table I (Single Life Expectancy) is used when the beneficiary is not the spouse of the IRA owner. Table II (Joint Life and Last Survivor Expectancy) is used for owners whose spouses are more than 10 years younger and the sole beneficiary of the IRA.

If the account owner named multiple beneficiaries and didn’t take their required minimum distribution, each beneficiary shares responsibility for it. Beneficiaries can split the account into multiple inherited IRAs, which would allow them to claim their share of the account balance while also shouldering their part of the tax obligation.

For RMDs in the year following the account owner’s death, distribution calculations will depend on who is the beneficiary of the account. Generally, designated beneficiaries will use the IRS Single Life Expectancy Table to figure the distributions. This table uses life expectancy and the IRA balance to determine RMDs.

What If You Don’t Take an RMD in Year of Death?

The deadline for taking RMDs in the year of death is December 31st of the year in which the original account owner passes away. The IRS imposes a strict penalty when RMDs are required but not taken by beneficiaries. If you inherit an IRA or 401(k) and fail to take the RMD for the year of the account owner’s death, a 50% tax penalty applies.

There’s an exception if the estate is named as the beneficiary of an IRA. In that case, the estate takes the RMD and is responsible for reporting the distribution.

The 50% penalty can substantially reduce what you’re able to withdraw from an inherited IRA or 401(k). For that reason, it’s important to understand when RMDs are or are not required when the account owner passes away. Talking to a tax expert or your financial advisor can help you to prepare for any tax liability that might be created if you stand to inherit an IRA or 401(k) from someone else.

Withdrawing an Inherited IRA

The IRS rule for the year of death RMDs is not the only tax rule to be aware of with inherited retirement accounts. You also have to be aware of your tax liability for managing the account in future years.

Spouses have several options for inheriting an IRA. For instance, they can:

If you are not the account owner’s spouse, you can only set up an inherited IRA. You won’t be allowed to make any new contributions to the account. You also have to fully withdraw all of the money in the account. You have 10 years following the original account owner’s death to do so. If you fail to do so, the IRS can apply a tax penalty.

In terms of how withdrawals are taxed, they follow the same tax rules as the original IRA. So if you inherit a traditional IRA, withdrawals are taxed at your ordinary income tax rate. If you inherit a Roth IRA, RMDs are required but withdrawals are tax-free as long as the account is at least five years old. A financial advisor can help you navigate an inheritance.

The Bottom Line

Inheriting retirement accounts can add a wrinkle to your tax situation and it’s important to be aware of the rules for the year of death RMDs. The main thing to know is when the account owner’s required beginning date is, as that can decide whether you’ll need to take an RMD in the year of death or not.

Tips for Retirement Planning

-

Consider talking to your financial advisor about how to handle an inherited retirement account. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

When rolling over an inherited IRA, give some thought to which brokerage you’d like to use to hold those funds. Brokerages can vary greatly in terms of the fees they charge and the range of investment options they offer. Comparing different online brokerages can help you find the best place to keep inherited retirement funds.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

©iStock.com/dragana991, ©iStock.com/Dean Mitchell, ©iStock.com/shapecharge

The post How to Calculate RMD in Year of Death appeared first on SmartAsset Blog.

What To Expect in the Markets This Week

Coming up: Labor Day holiday, August job numbers and earnings from Broadcom, Zscaler, Dollar Tree

Luke Sharrett / Bloomberg via Getty Images

Key Takeaways

-

Markets will be closed for the Labor Day holiday Monday.

-

While reports on job openings and private-sector hiring will set the stage earlier in the week, August jobs data will capture attention on Friday.

-

This week’s technology company earnings include Broadcom, Hewlett Packard Enterprise, and Zscaler.

-

Retailers Dollar Tree, Big Lots, and Dick’s Sporting Goods also are scheduled to report their financial results.

Markets will be closed for the Labor Day holiday on Monday. After that, investors will be focused on key labor market data, primarily the Friday release of the August jobs report.

Earnings reports this week are again led by a chipmaker, with Broadcom’s (AVGO) financials on Thursday, while Hewlett Packard Enterprise (HPE), Zscaler (ZS), and Samsara (IOT) are other noteworthy tech companies also on deck. Investors will also hear from retailers Dollar Tree (DLTR), Big Lots (BIG) and Dick’s Sporting Goods (DKS).

Monday, Sept. 2

Tuesday, Sept. 3

-

S&P manufacturing PMI (August)

-

ISM manufacturing (August)

-

Construction spending (July)

-

Zscaler and GitLab (GTLB) report earnings

Wednesday, Sept. 4

-

Trade deficit (July)

-

Job openings (July)

-

Factory orders (July)

-

Federal Reserve Beige Book

-

Copart (CPRT), Hewlett Packard Enterprise, Dollar Tree, Dick’s Sporting Goods, and Hormel Foods (HRL) report earnings

Thursday, Sept. 5

-

Initial jobless claims (Aug 31)

-

ADP employment (July)

-

U.S. productivity and costs (Second-quarter revisions)

-

S&P services PMI (August)

-

ISM services (August)

-

Broadcom, Samsara, Guidewire Software (GWRE), and DocuSign (DOCU) report earnings

Friday, Sept. 6

-

U.S. employment report (August)

-

Final day before Federal Reserve officials’ public-speaking blackout period

-

BRP (DOOO) and Big Lots report earnings

Jobs Report Gives Fed Last Look at Labor Market Before Meeting

With the focus turning to jobs, Federal Reserve officials will get one last look at the labor market when the Bureau of Labor Statistics releases August employment and wage numbers on Friday. Last month’s report showed an unexpected jump in the unemployment rate to 4.3%, unsettling the markets and raising questions about whether the Fed missed its opportunity to cut rates at its July meeting.

Since then, jobless claims have been fairly steady and close to expectations. However unexpected movements in the data could raise more questions about how the Federal Reserve will cut rates at its Sept. 17-18 meeting. Wednesday’s job openings report, Thursday’s private-sector ADP employment report, and weekly jobless claims data will set the stage for the Friday labor report.

Chipmaker Broadcom Leads Tech, Retail Earnings

Following the momentum from last week’s market focus on Nvidia (NVDA), another chipmaker will take the spotlight when Broadcom reports its earnings on Thursday. Nvidia slid despite a beat on its earnings, and Broadcom’s report comes after its recent 10-for-1 stock split.

Market watchers will have other tech earnings to study this week, including additional Thursday reports from Samsara, Guidewire Software, and DocuSign. Hewlett Packard Enterprise headlines Wednesday’s report schedule as the server provider looked to continue to stoke results with earnings from its artificial intelligence (AI) products. Cybersecurity provider Zscaler and software platform GitLab report on Tuesday.

A handful of value retailers are scheduled to deliver reports this week, including Dollar Tree, which is coming off a disappointing prior quarter, and Big Lots, whose report comes on the heels of talk of bankruptcy amid a decline in its home and furniture sales.

Read the original article on Investopedia.

3 High-Yielding ETFs I Can't Wait to Buy for Passive Income This September

I want to be able to retire early. It’s not that I don’t want to work (I truly love what I do and hope to keep doing it for a very long time), I don’t just like the stress of having to make money to live. That’s why I’m working hard right now to become financially independent so that I can be in the position to retire early if I ever want to do that.

Generating passive income is a core aspect of my strategy. My goal is to grow my passive income to the point where it covers my routine expenses. I have found that exchange-traded funds (ETFs) can be great passive income investments. Because of that, I routinely invest in ETFs that offer a high dividend yield. Here are three high-yielding ETFs I can’t wait to buy more of this September.

JPMorgan Equity Premium Income ETF

JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI) aims to deliver monthly distributable income to its investors. It also seeks to provide them with lower-volatility equity market exposure. In other words, it tries to provide a bond-like income stream with upside potential.

The dividend ETF lives up to its name. The annualized income yield of its most recent payment was 6.9%. Meanwhile, its dividend yield over the past 12 months is 7.6%. This level rivals high-yield junk bonds (7.9% yield) and is much higher than other income-focused investments like real estate investment trusts (4.4%) and the 10-year U.S. Treasury Bond (4.4%).

The ETF generates such a generous income stream with a two-pronged strategy: investing in a defensive portfolio of high-quality stocks selected based on its proprietary rankings, and writing out-of-the-money call options on the S&P 500 index. You can read more about options trading here, but simply put, the ETF is hedging on its stock holdings with a bet that the S&P 500 won’t close above a given price on a certain date. This strategy produces options premium income that the fund distributes to investors each month.

Add them together and the fund provides investors with passive income and upside potential with less volatility. Those features make it a great fit for my portfolio.

iShares 0-3 Month Treasury Bond ETF

iShares 0-3 Month Treasury Bond ETF (NYSEMKT: SGOV) invests in short-term U.S. Treasury bills (T-bills) with remaining maturities of three months or less. Short-term T-bills carry minimal risk (treasuries are often called “risk-free” investments). Meanwhile, they offer a generous income yield (currently around 5.2%).

This ETF is a great place to park idle cash. Many brokerage accounts don’t pay high yields on cash (at least, mine doesn’t). Because of that, investors who like to have a meaningful cash position (like me) are losing out in the current higher-interest-rate environment.

I’ve found that investing most of my idle cash into iShares 0-3 Month Treasury Bond ETF is a great way to generate some incremental passive income. The fund makes cash distributions each month, which I can reinvest in this ETF or another income-generating investment. It’s also highly liquid, which means you can sell shares when you need the cash for another investment.

SPDR Portfolio High Yield Bond ETF

SPDR Portfolio High Yield Bond ETF (NYSEMKT: SPHY) provides exposure to the large and lucrative junk bond market. U.S. high-yield debt is a more than $1 trillion market. These bonds offer higher yields than investment-grade bonds to compensate investors for their higher risk of default. This ETF’s distribution yield has averaged 7.7% over the past year).

While high-yield bonds are riskier, this ETF helps mute some of that through diversification. It currently holds over 1,925 bonds from issuers across a broad array of sectors (bonds issued by consumer cyclical companies are the largest at 20.5%). Diversification across issuers and sectors helps reduce default risk.

SPDR Portfolio High Yield Bond ETF makes monthly distribution payments. While those payments will ebb and flow with interest rates and the economic cycle, this ETF can generate more income than one focused on investment-grade corporate bonds like iShares iBoxx $Investment Grade Corporate Bond ETF. It’s a good ETF for those seeking to earn a little more income on a small slice of their fixed-income portfolio.

Padding my passive income

I believe passive income will be my ticket to financial freedom. That’s why I invest some of my active earnings each month into vehicles that generate passive income, like higher-yielding ETFs. This strategy enables me to grow my passive income each month, putting me a little closer to my goal of becoming financially independent.

Should you invest $1,000 in iShares Trust – iShares 0-3 Month Treasury Bond ETF right now?

Before you buy stock in iShares Trust – iShares 0-3 Month Treasury Bond ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust – iShares 0-3 Month Treasury Bond ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has positions in JPMorgan Equity Premium Income ETF, SPDR Series Trust-SPDR Portfolio High Yield Bond ETF, and iShares Trust-iShares 0-3 Month Treasury Bond ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

3 High-Yielding ETFs I Can’t Wait to Buy for Passive Income This September was originally published by The Motley Fool

Factory Showcase Homes Announces Expanded Offerings of Customizable Tiny Homes and Land & Home Packages

Mansfield, TX August 30, 2024 –(PR.com)– Factory Showcase Homes (FSH), a leader in affordable housing solutions, has announced the availability of over 20 customizable Park Model Tiny Home RVs and 13 distinct smaller Singlewide manufactured homes. These offerings come with a range of options, upgrades, and color choices, allowing customers to find or create a home that meets their specific needs and preferences.

Expanding Access to Affordable, Customized Housing

Factory Showcase Homes continues to innovate in the housing market with its extensive range of customizable Park Model Tiny Home RVs, which start at $59,900. Each model offers various customization options, enabling homeowners to personalize every aspect of their living space. In addition to the tiny homes, FSH also offers 13 different Singlewide manufactured homes, designed with features such as textured walls, full-size appliances, spacious front decks, custom windows, and cabinetry, all aimed at enhancing comfort and aesthetics.

Interactive Showroom Experience in Mansfield, TX

To assist customers in visualizing their ideal living spaces, Factory Showcase Homes has a showroom located in Mansfield, TX. The showroom features a dedicated decor room, allowing potential homeowners to explore and select finishes and features for their new homes. This interactive experience supports a personalized approach to home selection, ensuring that customers can create a living space that aligns with their unique style.

Comprehensive Home Integration Services

Factory Showcase Homes is committed to providing a seamless home-buying experience. The company offers comprehensive services that include partnerships with lenders and RV parks to facilitate smooth transitions for new homeowners. For those looking to place a new home on their property, FSH provides expert guidance throughout the entire process, from selection to installation.

Additionally, FSH offers land and home packages in Tarrant County, Wise County, and Parker County. These packages include new Doublewides on ready-to-move-in land, with properties approved by FHA, VA, and USDA. Prices for these packages range from $200,000 to $275,000, providing accessible and affordable quality living options.

New Development: The Reserve on McKinney in Denton, TX

Factory Showcase Homes is also excited to announce its latest development, The Reserve on McKinney, a premier 500-space manufactured home community in Denton, TX. This community features homes from Cottage Homes with amenities such as wide streets, three-car driveways, storage sheds, brick skirting, landscaping, and attached porches.

Residents at The Reserve on McKinney will have access to a variety of amenities, including a fitness center, community center, swimming pool, playground, and courts for basketball and pickleball. Cottage Homes offers move-in-ready Singlewide and Doublewide homes, priced between $117,000 and $200,000. Customization options are available to accommodate specific needs, ensuring a perfect home for every resident.

About Factory Showcase Homes

Factory Showcase Homes is dedicated to offering innovative, high-quality, and affordable housing solutions. With a focus on customization and customer satisfaction, FSH aims to transform the home-buying experience by providing a variety of homes that cater to diverse lifestyles and preferences. For more information, visit the showroom in Mansfield, TX, or explore offerings online.

Contact Information:

Factory Showcase Homes

606 S 2nd Ave, Mansfield, TX 76063

Main Phone: 682-400-8590

Lessley’s Phone: 214-207-3023

Terry Riggle (Land Home Department): 580-467-1270

Email: lessley@fstexas.com, derral@fstexas.com

The Reserve on McKinney

Joell Kemp, Sales Manager

6105 E McKinney St, Lot 10, Denton, TX 76208

Phone: 940-736-3734

Business Hours:

Monday – Saturday: 9:00 am – 6:00 pm

Sunday: Closed

For more information, please visit Factory Showcase Homes (https://www.factoryshowcasehomes.com/).

Contact Information:

Factory Showcase Homes

Lessley Feeler Vining

682-400-8590

Contact via Email

www.factoryshowcasehomes.com/

Read the full story here: https://www.pr.com/press-release/919182

Press Release Distributed by PR.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Better Real Estate Stock to Buy: Opendoor vs. Redfin

Opendoor Technologies (NASDAQ: OPEN) and Redfin (NASDAQ: RDFN) are cut from the same cloth in many ways. Both are real estate tech stocks aiming to disrupt the massive real estate industry. They have a lot of exposure to the housing market, which has sunk both stocks in the post-pandemic slump.

As the chart below shows, Opendoor and Redfin are both down sharply from their previous peaks.

Both stocks are down roughly 90% from their pandemic-era peaks, but as investors look forward to interest rate cuts, expected to begin in September, Redfin and Opendoor are suddenly popping.

As of Aug. 27, Redfin was up 75% from where it closed on Aug. 7, while Opendoor is up 49% in the same timeframe.

Those rallies make sense. Investors now widely expect the Federal Reserve to cut benchmark interest rates in September, especially after Jerome Powell’s comments last week. Lower mortgage rates should help revive the struggling housing market, boosting Opendoor and Redfin.

But if you’re trying to choose between these two stocks, which is the better one to buy today? Let’s take a look to see who comes out on top.

Opendoor vs. Redfin: business model

Though Opendoor and Redfin position themselves as tech-forward real estate disruptors, they operate with different business models. Opendoor is essentially a home flipper. The company seeks to purchase homes and resell them for a higher value after making modest repairs or improvements that, in addition to a 5% service fee, it typically charges the seller.

Opendoor aims to disrupt the housing market by presenting a form of home-selling that it believes is easier and more efficient than the traditional route. By selling to Opendoor, a seller can avoid finding an agent, preparing the home for showings, hosting visits, waiting for offers, and negotiating over repairs, as well as the risk that the seller will back out.

Redfin, on the other hand, functions as an online real estate brokerage. The company charges most home sellers a commission of 1%-1.5%, compared to traditional brokerages’ 2.5%-3% standard rate. However, that could change after the National Association of Realtors (NAR) settlement.

In addition to the traditional brokerage business, the company offers rentals, mortgages, and title services in an effort to be a one-stop shop for prospective homebuyers. Redfin previously had a home-flipping business similar to Opendoor, called Redfin Now, but it shuttered it in 2022 as it was losing money and found it too hard to predict prices accurately.

Opendoor vs. Redfin: financials

Both Redfin and Opendoor have been historically unprofitable, especially amid the challenges in the housing market. Redfin was briefly profitable on an operating income basis during the pandemic, while Opendoor has never been operating-income profitable since it went public, though it came close in 2022 before mortgage rates started to rise.

In its most recent quarter, Opendoor reported a gross profit of $129 million on $1.51 billion in revenue and an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $5 million. Opendoor’s numbers had improved substantially from the quarter a year ago as the company cleared its overpriced inventory.

Redfin’s revenue rose 7% to $295.2 million in the second quarter, and its gross profit was up 9% to $109.6 million. It also reported flat adjusted EBITDA, up from a loss of $6.9 million in the second quarter.

Opendoor vs. Redfin: valuation

Valuing the two companies is difficult because they aren’t profitable. Revenue is also a poor metric to use with Opendoor because its revenue is essentially pass-through income from the sales of the homes it purchases. It can easily generate unprofitable revenue.

Perhaps the best way to compare the two companies on valuation is by using gross profit. The two companies have similar valuations, with Opendoor trading at 4.1 times gross profit while Redfin is valued at 3.9. The difference is negligible.

Opendoor vs. Redfin: Which is the better buy?

As you can see from the comparisons, the two stocks have a lot in common, including similar valuations, financial challenges, and disruptive-yet-unproven business models in the real estate industry.

Of the two companies, Redfin seems to have a slight edge right now. The brokerage model is profitable in a healthy real estate environment, and Redfin could benefit from the NAR settlement, which could encourage more agents frustrated with what could be lower commissions from traditional brokerages to work with Redfin.

Redfin also seems better positioned to capitalize on lower rates as that seems likely to bring homebuyers back into the market and drive a rebound in housing inventory for sale. Opendoor is more reliant on home prices rising, but that may be more difficult since they are already at all-time highs.

Between the two, Redfin looks like the better way to play the real estate recovery, but investors looking for a range of options wouldn’t be remiss to buy shares of Opendoor. Both stocks have a lot of upside potential as the housing market comes back to life.

Should you invest $1,000 in Redfin right now?

Before you buy stock in Redfin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Redfin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Jeremy Bowman has positions in Redfin. The Motley Fool has positions in and recommends Opendoor Technologies and Redfin. The Motley Fool recommends the following options: short November 2024 $13 calls on Redfin. The Motley Fool has a disclosure policy.

Better Real Estate Stock to Buy: Opendoor vs. Redfin was originally published by The Motley Fool

Salesforce CEO Marc Benioff says Microsoft Copilot has disappointed many customers

Marc Benioff said Microsoft’s Copilot AI hasn’t lived up to the hype.

The Salesforce CEO said on the company’s second-quarter earnings call that its own AI is nothing like Copilot, which he said was unimpressive.

“So many customers are so disappointed in what they bought from Microsoft Copilot because they’re not getting the accuracy and the response that they want,” Benioff said. “Microsoft has disappointed so many customers with AI.”

Microsoft Copilot integrates OpenAI’s ChatGPT tech into the company’s existing suite of business software like Word, Excel, and PowerPoint that comes with Microsoft 365. Launched last year, Copilot is meant to help companies boost productivity by responding to employee prompts and helping them with daily tasks like scheduling meetings, writing up product announcements, and creating presentations.

In response to Benioff’s comments, Jared Spataro, Microsoft’s corporate vice president for AI at work, said in a statement to Fortune that the company was “hearing something quite different,” from its customers.

“When I talk to CIOs directly and if you look at recent third-party data, organizations are betting on Microsoft for their AI transformation,” he said.

The company’s Copilot customers also shot up 60% last quarter and daily users have more than doubled, Spataro added.

Benioff’s comments come as he prepares to show off Salesforce’s new AI platform, dubbed Agentforce, at the company’s annual Dreamforce meeting next month. The platform will be targeted at sales and customer service at first and will launch publicly in October.

Meanwhile, Agentforce is already being used by some of Salesforce’s biggest customers including payroll and HR software company ADP, restaurant reservation platform OpenTable, and the Wyndham hotel chain, Benioff told CNBC. He added that its Agentforce AI agents were resolving more than 90% of ADP’s customer service inquiries.

On the earnings call, Benioff predicted Agentforce AI agents are going to be a breakthrough for its customers.

“With our new Agentforce platform, we’re going to make a quantum leap for AI,” he said.

This story was originally featured on Fortune.com