3 Reasons Nike Stock Can Be a Great Long-Term Buy

Nike (NYSE: NKE) is a top apparel company, and its iconic brand is known around the world. Even though its products are often more expensive than others, the company has managed to grow its business significantly for years. Today, its market capitalization is around $130 billion.

But lately, investors have grown worried about the company’s growth prospects. Business has been slowing down, and inflation isn’t helping. While the short-term headwinds can send it lower this year (it’s already down 22%), this is why I think the stock can still be a winner in the long run.

It has strong brand recognition among teens

Even if you’re not a customer of Nike’s and think its products are too expensive, the data suggests that there’s still a lot of interest from younger people. The company’s brand ranks high among teens, according to a report this year from Piper Sandler.

The report found that Nike’s brand was far and away the favorite among teens polled in a recent semi-annual survey, for both clothing and footwear. What’s particularly noteworthy is that the gap between first and second is considerable. In footwear, Nike was the most popular brand with 59% of teens, with the next closest brands having a mindshare of just 7%. In clothing, it was a bit closer, with Nike’s percentage coming in at 34% versus 6% for the second most popular brand.

While the company’s growth rate may be showing signs of weakness, the brand remains strong, which suggests that it could just be the poor economic conditions weighing down the business as opposed to problems with Nike’s overall brand.

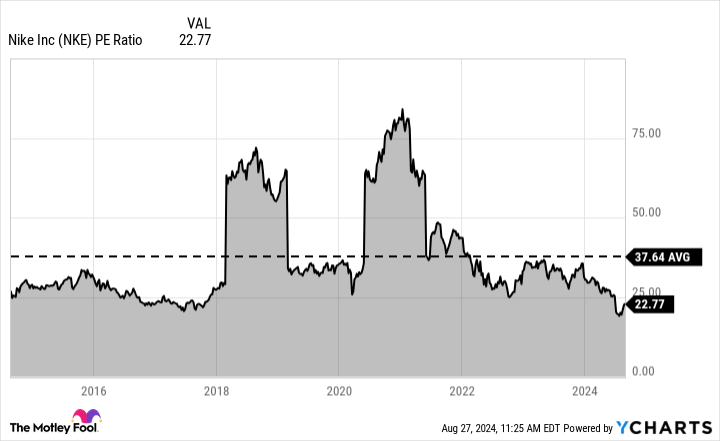

Its low earnings multiple can set up investors for gains down the road

Another reason to consider buying the stock is that it looks really cheap right now. At just 22 times its trailing earnings, Nike is trading at a much lower multiple than it has in the past, and it’s well below its 10-year average.

The counterpoint, of course, is that growth investors aren’t going to want to pay a premium for a business that’s struggling to grow. In its most recent earnings report, covering results until the end of May, Nike’s quarterly revenue totaled $12.6 billion — down 2% year over year. That’s not the type of stock investors are going to be wanting to pay 30 times earnings for right now.

But at its current multiple, the stock could be cheap enough that it makes sense to invest, anyway. The average stock on the S&P 500 trades at nearly 25 times its trailing earnings. And while Nike’s growth rate may be negative today, that doesn’t mean it will stay that way. As economic conditions improve and as the company launches new products, the growth rate could pick up.

Nike’s profit margin is solid

What’s promising is that even amid the current adversity in the market, Nike’s profit margins remain strong at nearly 12% of revenue.

This is important for two reasons. The first is that a high profit margin can give the company room to offer discounts and cut prices to stimulate some growth, while ensuring it stays profitable in doing so. Second, a double-digit profit margin means that once its growth rate does start to pick up, a lot of that incremental revenue will result in stronger earnings numbers, which, in turn, will potentially bring down Nike’s earnings multiples and make the apparel stock a better buy in the process.

If you’re patient, this can be an excellent stock to buy and hold

In the past, Nike’s stock didn’t look like a good buy to me due to its elevated valuation. But now, at a much more tenable price, the stock can make for a potentially solid investment for those who are willing to be patient and hang on for the long term.

There may not be a quick turnaround for Nike’s business, and a lot will inevitably depend on the strength of the economy, but I’m confident it can get back to growing its sales. When that happens, its earnings numbers will improve, and it could look like a bargain buy.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool has a disclosure policy.

3 Reasons Nike Stock Can Be a Great Long-Term Buy was originally published by The Motley Fool

Leave a Reply