This Ultra High-Yield Dividend Stock Just Raised Its Payout. Should You Buy?

Among ultra-high-yield dividend stocks of long standing, you don’t get much more reliable than Altria Group (NYSE: MO). The company has consistently paid a generous dividend, and its stock is one of the market’s rare Dividend Kings, meaning its management has enacted dividend raises at least once annually for at least 50 years in a row.

Sure enough, like clockwork, Altria made its habitual once-per-year dividend raise this summer. Here’s a look at the particulars of the hike and whether it helps make the cigarette giant’s stock worth owning.

A king in its industry

In mid-August, Altria declared its latest dividend raise. It decided to lift the quarterly payout by 4% to $1.02 per share, which pumps the forward yield up to 7.7% on the most recent closing stock price. The first distribution of the raised amount will occur on Oct. 10 to investors of record as of Sept. 16. So, there’s still time for dedicated income stock fans to take advantage of the hike.

But should they? I’ve been convinced for some time now that Altria stock isn’t a long-term winner, no matter how sky-high the yield — and its dividend is up there for sure, paying several times the 1.3% average yield of S&P 500 index component stocks.

Altria’s big problem is the continued and serious decline of the traditional cigarette market. With increasing general health awareness and anti-smoking campaigns from influential entities, such as the federal government, much of the American public has eschewed ciggies. From 2001 to 2021, hardly an epic stretch of time, the number of cigarettes sold in the U.S. declined by more than half to just over 190 billion in the latter year, according to data compiled by Statista.

Understandably, Altria is attempting to pivot to what it calls “a smoke-free future.” This will be anchored by NJOY, the e-cigarette brand it acquired in June 2023 for a cool $2.75 billion in cash following the debacle that was its investment in troubled brand JUUL. The company was quick to point out in its latest quarterly earnings report that its shipment volumes for NJOY devices increased 80% quarter over quarter to 1.8 million units, and the brand’s market share rose by 1.3 percentage points to 5.5%.

That’s impressive up to a point, but then again, NJOY is a relatively new brand for Altria, and its mass rollout in this country began only recently. It feels, then, that those hefty shipment numbers derive from a relatively low base. And while vaping has been a growing trend, it might not be the savior of the cigarette industry. Again, according to Statista, the estimated compound annual growth rate (CAGR) for e-cigarette revenue from 2024 to 2029 is 5.8%.

That certainly isn’t a bad figure, but probably not enough of a rise to offset the apparently eternal decline in traditional cigarette sales. Altria’s second-quarter net revenue fell by nearly 5% year over year, largely because of this.

Of yield hunters and yield traps

Most investors who consider loading up on Altria or its publicly traded peers, like Philip Morris International and British American Tobacco (BAT), are well aware of the challenges the industry faces. Still, they’ve lately piled into all three companies, as the trio has notably outperformed the S&P 500 index year to date.

I think much of this popularity is due to yield; the three stocks all boast high figures, with Altria’s theoretical 7.7% being beaten only slightly by BAT’s 8%. Philip Morris is a laggard among the three but still delivers an appealing 4.3% on its payout.

Yield chasing is in fashion these days, particularly with Federal Reserve (Fed) Chair Jerome Powell’s near-direct pledge recently to cut the regulator’s key interest rate in the near future. Since this rate is a reference point for nearly any financial asset, investor payouts, like bond coupons, tend to drop when rates dip. So, it’s little wonder that some market players are eager to get their hands on stocks with reliably high payouts.

In my view, this has left the share prices of the tobacco merchants inflated. It only compounds the secular decline in what is still very much their core business. I don’t feel these price increases are sustainable, and the industry as a whole is set for a correction. Meanwhile, the ciggie merchants aren’t the only high-yield dividend stocks in town, far from it. We need only to glance at the real estate investment trust (REIT) industry, to name one example, to find sturdy companies with generous distributions.

It’s always tempting to jump into a company that has declared a dividend raise, particularly if it’s raising an already ultra-high-yield dividend. Yet, I think Altria qualifies as a yield trap these days. I wouldn’t be a buyer of the stock, particularly for the long term.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

This Ultra High-Yield Dividend Stock Just Raised Its Payout. Should You Buy? was originally published by The Motley Fool

Down 86%, Is It Time to Buy the Dip on This Growth Stock?

Roku (NASDAQ: ROKU) is another perfect example of a pandemic-era darling that has fallen from grace. Shares skyrocketed 530% from their March 2020 low to their all-time high in July 2021, driven by monster success fueled by consumers spending more time at home.

However, the shares now trade 86% below that peak price. So, is it time to buy the dip on this growth stock?

Riding the streaming wave

Part of the reason Roku’s stock has been under pressure in recent years is because of slowing growth. Revenue jumped more than 55% in both 2020 and 2021. As consumer behavior normalized, those gains weren’t as impressive.

But the situation is not as bad as the stock’s performance would suggest. Roku posted a 14% revenue gain in the latest quarter, with management forecasting an 11% rise in the third quarter. The business is still expanding at a healthy pace.

The company added 2 million active accounts in Q2, bringing the total to 83.6 million. Roku has top-market share among providers of smart-TV operating systems not only in the U.S. but also in Canada and Mexico. And engagement is through the roof, as a whopping 30.1 billion hours of content were streaming in the last three-month period. This means that each account on average spends four hours per day on Roku.

Roku prides itself on being an agnostic platform that plays ball with all the content companies out there. Consequently, the business is in a favorable position to gain from the ongoing cord-cutting trend. Another benefit is that it doesn’t have to shell out billions of dollars each year to license and produce content. As more consumers ditch their cable subscriptions, Roku will undoubtedly be a top choice to aggregate the numerous services out there into a single-user interface.

Investors might not like the cyclicality of the digital-ad industry. In softer economic periods, marketing executives pull back spending. This is exactly what happened in 2022 and 2023. Over the long term, though, it’s inevitable that ad dollars will flow to streaming services because that’s where the eyeballs are. This should play to Roku’s favor.

Risk and valuation

Roku might be the leading-streaming platform. However, the business isn’t without some notable risks that investors should know about.

For starters, the company isn’t generating positive-net income. Management boasts that the business has reported positive-adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in four straight quarters, with the expectation that this will continue going forward. But that figure not only excludes key expenses, but it can be manipulated to make things look good.

The fact that Roku isn’t yet profitable on a generally accepted accounting principles (GAAP) basis means that the business model hasn’t yet proven that it’s financially sustainable.

Roku has grown its revenue, user base, and engagement over the years on the backs of the streaming-secular trend. But by keeping a critical eye on the company’s industry positioning, there is one thing to keep in mind.

A valid argument can be made that Roku is at the mercy of the major content companies. For example, I’d suspect that Netflix or Alphabet‘s YouTube share none or very little ad inventory with Roku. And Roku needs these two businesses to cooperate more than the other way around. This tells me that the content publishers have the negotiating leverage.

Investors need to be aware of these risks. But given that the stock trades at a price-to-sales ratio of 2.6, which is substantially below its historical average of 9.5, the valuation is compelling enough to buy the dip on this growth stock.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Netflix, and Roku. The Motley Fool has a disclosure policy.

Down 86%, Is It Time to Buy the Dip on This Growth Stock? was originally published by The Motley Fool

Is This 1 Thing the Biggest Risk for Airbnb Stock?

Despite being around for less than two decades, Airbnb (NASDAQ: ABNB) has sure experienced monster success throughout its history. The alternative accommodations platform has truly upended the hospitality industry. And its scale is unmatched, with $21 billion in gross booking value just in the last quarter, as well as 5 million hosts on the site.

With the growth tech stock trading 46% below its all-time high, investors might want to buy the dip with Airbnb. Before doing so, it’s worth taking the time to understand what might be the company’s biggest risk.

Ongoing headaches

Airbnb has found tremendous success, but to be clear, it still operates in a competitive sector of the economy. There’s competition from global hotel chains, boutique properties, and other booking platforms.

However, I think its biggest headache has been the regulatory landscape. There are varying rules that Airbnb must follow on a local, state, and federal level. It can be challenging to navigate all of this. The advent of the internet and these platform business models is making it difficult for lawmakers to keep up. So, there has definitely been some uncertainty for Airbnb.

The business has a big bullseye on its back because of how it can have a profound impact on the markets that it operates in, which can cause local residents to push back. For example, a higher number of listed properties could result in the constant influx of travelers, making a neighborhood feel more like a tourist destination than a real community. There could also be safety concerns.

Potential impacts to the cost of living can’t be ignored, either. Buyers could be drawn to a market due to attractive demographics, leading to home values going up. Moreover, these properties become a financial asset as opposed to a place for the owner to actually live in. This could exacerbate the problem of housing affordability in the U.S.

For what it’s worth, there are already regulations in place in 80% of the company’s top 200 markets, which does reduce the uncertainty somewhat. However, that doesn’t mean Airbnb is out of the woods. About a year ago, New York City banned rentals of less than 30 days. Any other adverse legislative actions taken in key markets could negatively impact the business.

Founder and CEO Brian Chesky and his team don’t agree with the move. They say that hosts pay their taxes and bring in tourism and spending that can enhance an economy. And a valid argument can be made that if Airbnb were charged higher fees or fines were imposed, the experience for both hosts and guests could be diminished.

Of the more than 100,000 cities and towns Airbnb has active listings in, not a single one accounts for more than 2% of the company’s revenue. That geographic diversity helps to mitigate regulatory risk at least at the local level.

Should you buy Airbnb stock?

Investors looking to buy Airbnb stock need to understand that regulatory actions pose a threat to the company’s trajectory. I still believe the shares are a worthy investment candidate, though.

Airbnb’s growth is still healthy, even though it is slowing down. Sales increased 11% from under $2.5 billion in the second quarter last year to over $2.7 billion in Q2 this year.

Airbnb generates robust profitability. Free cash flow totaled $4.3 billion in the last 12 months, which represented 41% of overall business revenue.

And the company’s two-sided marketplace creates network effects. The larger the platform becomes, with more hosts and guests, the more valuable it becomes to everyone.

All of these positive attributes should mean the stock deserves a closer look.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Airbnb. The Motley Fool has a disclosure policy.

Is This 1 Thing the Biggest Risk for Airbnb Stock? was originally published by The Motley Fool

1 Top Space Stock You Need to Know About Before a Key Launch in September

Long-term investors shouldn’t make decisions about buying or selling a stock based on a single event. Data from a quarterly earnings report, for example, should be monitored, reviewed, and added to an investor’s mental database. But a quarterly report is just a single snapshot of the company’s business.

Yet in the case of AST SpaceMobile (NASDAQ: ASTS), there is one upcoming event to which investors looking for a growth opportunity should be paying especially close attention. The company is getting ready to launch its first set of commercial broadband satellites. Those five satellites represent the commercial start to what could become one of the largest global telecom companies over the coming years.

Untapped potential for space-based mobile connectivity

AST’s patented technology will supply cellular providers around the world with broadband internet access to connect those without internet service. The market for that could be huge. AST estimates that worldwide, as of the end of 2022, there were 5.5 billion cellular subscribers, and as many as 3.5 billion of them were not subscribed to cellular broadband. The opportunity this offers helps explain why the stock has exploded by about 600% over the last 12 months.

Importantly, AST SpaceMobile is building the first and only global, space-based cellular broadband network to operate directly with mobile devices. It aims to connect standard mobile phones directly to satellites, bypassing the need for ground infrastructure like cell towers. The satellite network could improve connectivity to the billions of existing mobile subscribers in addition to offering service to those who are currently unconnected.

AST SpaceMobile’s service also differentiates itself from SpaceX’s Starlink because it would connect directly to typical smartphones without any additional hardware. Existing mobile devices will be all that users need. Starlink requires users to have a satellite dish for connectivity. That dish must be purchased, then set up and pointed toward the satellites to access the internet.

Sept. 11 launch window

Somewhat ironically, while SpaceX’s Starlink service will compete with AST, a SpaceX Falcon 9 rocket is currently scheduled to launch AST’s first five BlueBird satellites during a launch window that begins Sept. 11.

That launch also highlights the complex relationships among companies and regulatory bodies in the evolving space sector. In May, AST announced a new commercial agreement with AT&T to provide its space-based broadband network directly to existing cellphones. AT&T Chief Operating Officer Jeff McElfresh explained the relationship this way:

Space-based direct-to-mobile technology is designed to provide customers connectivity by complementing and integrating with our existing mobile network. This agreement is the next step in our industry leadership to use emerging satellite technologies to provide services to consumers and in locations where connectivity was not previously feasible.

Mobile network operators like AT&T and Verizon Communications will be both competitors to and partners with AST SpaceMobile. Those network operators spend more than $300 billion in capital expenditures and nearly $70 billion for cell tower leases annually, according to a report by Scotiabank. That consumes an enormous amount of free cash flow, giving those companies a good reason to partner with AST for its planned global satellite constellation.

Early for valuation estimates

As is the case with other companies that are attempting to commercialize emerging technologies, it is difficult to properly value AST SpaceMobile at this early stage. Its market cap recently stood at about $7.5 billion. The network operator spending noted above dwarfs that value.

The opportunity to enhance mobile network operators’ coverage for typical smartphone users and for potential government contracts is vast. But there are plenty of hurdles to overcome. That includes getting through the initial BlueBird launch successfully.

Any issue with this launch might negatively impact AST’s share price in the short term. Regulatory issues will also need to be navigated, as governments need to ensure that different satellite operators’ networks can coexist without causing harmful interference to each other.

But AST SpaceMobile has enormous potential. Even with SpaceX’s Starlink well ahead in terms of the number of satellites it has in orbit, there are separate markets to be tapped by AST. Starlink largely targets broadband internet users in remote or rural areas. AST will focus on mobile connectivity for the billions of current and potential cellphone users.

That makes the stock a worthwhile speculative investment for aggressive investors. Given that its thesis has so many moving parts, the stock is a good candidate for a cautious buying strategy; I’d suggest those who want to should ease into their full position by buying in thirds. The most notable of those variables is the upcoming scheduled launch. For those interested in this space sector growth stock, that BlueBird launch will be well worth monitoring.

Should you invest $1,000 in AST SpaceMobile right now?

Before you buy stock in AST SpaceMobile, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AST SpaceMobile wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Howard Smith has positions in AT&T. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

1 Top Space Stock You Need to Know About Before a Key Launch in September was originally published by The Motley Fool

GOTS combatting greenwashing with #BehindTheSeams campaign that educates consumers about sustainable textiles

Stuttgart, Germany, Sept. 02, 2024 (GLOBE NEWSWIRE) — For the second year running, Global Standard is taking consumers #BehindTheSeams this September, highlighting the sustainable and social qualities of GOTS-certified products – from runway fashion to hygiene products and so much more in between. Building on the success of last year, #BehindTheSeams 2024 has expanded to take over the entire month with more education on the people and practices making sustainable textiles, plus giveaways planned each day.

Global Organic Textile Standard (GOTS) is recognised for its comprehensive approach to sustainability. From promoting human rights along the value chain to banning harmful chemicals in certified textiles, GOTS sets a benchmark for integrity and sustainability. This campaign gives certified companies the opportunity to emphasise how they are at the forefront of changing the textile industry, and how adherence to GOTS is better for the environment more socially conscious throughout their textile production value chain.

Throughout September, Global Standard is excited to introduce daily giveaways on Instagram, featuring partnerships with leading GOTS-certified brands such as Frugi, FC St. Pauli, LangerChen, Natracare, Organic Basics, Mandala, Dedicated and more. Additionally, two major giveaways will be hosted on behindtheseams.eco, where visitors can learn about sustainability by answering daily questions and earning entries. One lucky person based in Europe and their guest will win a sustainable trip for two to Paris. This includes train travel, a two-night stay at the eco-friendly Eden Lodge Paris and a private fitting for a custom GOTS-certified jacket by John Preston. The winner will also enjoy dinner at La Table de Colette, a Michelin-starred restaurant committed to eco-responsibility, including a menu highlighting the carbon footprint of each dish. A lucky winner based in North America will win a hand-built GOTS-certified organic “Serenade” mattress sponsored by Naturepedic.

#BehindTheSeams is also spotlighting “organic in-conversion” farming and urging brands to support farmers during the critical transition period from conventional to organic. In this campaign, GOTS has partnered with the Organic Cotton Accelerator, a multi-stakeholder organisation dedicated to supporting farmers throughout the cotton supply chain as they make the shift to and sustain organic practices. Together, GOTS and OCA want to send a message that brands can bolster the organic cotton supply by investing in and buying organic in-conversion cotton.

“Global Standard and GOTS-certified companies work hard in the background to ensure a more organic, sustainable and socially conscious textile industry, but the consumer doesn’t always see or know what that actually means when they pick up a GOTS item in a store,” said Holger Stripf, head of marketing at Global Standard. “This campaign is a fun, engaging way to educate the public on living eco-consciously and why choosing organic textiles is better for the health of humans and the planet.”

Learn more at behindtheseams.eco.

日本語のプレスリリースはこちらをご覧ください。(Press release in Japanese)

请在此阅读中文新闻稿。(Press release in Chinese)

###

About Global Organic Textile Standard

GOTS (Global Organic Textile Standard), managed by non-profit Global Standard, is the world’s leading standard for organic textile certification. It sets strict environmental and social criteria for the entire textile value chain, from the harvesting of raw materials to the finished product. GOTS certification ensures the integrity of finished organic textiles and provides comprehensive solutions for the industry and assurance to consumers worldwide. For more information, visit www.global-standard.org.

Katie Lee Global Standard gGmbH lee@global-standard.org

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Economy Roars In Q2, Dow Jones Smashes Records, Nvidia Fails To Amaze: This Week In The Market

August ended with a strong rebound in Wall Street’s major indices, reversing the early month market selloff as robust economic data dispelled recession fears.

The U.S. economy roared at an annualized growth rate of 3% in the second quarter, surpassing earlier estimates of 2.8% and more than doubling the pace recorded in the first quarter. This marked the eighth consecutive quarter of expansion, bolstered by a substantial upward revision in consumer spending.

A stronger-than-expected acceleration in personal spending and income in July underscored the health of household finances.

The Federal Reserve’s preferred inflation gauge plateaued after three straight months of decline, yet it fell short of the anticipated uptick, paving the way for a September interest rate cut.

The Dow Jones Industrial Average, as tracked SPDR Dow Jones Industrial Average ETF DIA, notched fresh all-time highs. The S&P 500 index, meanwhile, inched closer to its previous July peak.

The positive market momentum persisted despite Nvidia Corp‘s NVDA much-hyped quarterly earnings — the most anticipated event of the week— failing to impress investors with heightened expectations.

You might have missed…

Berkshire’s $1-Trillion Milestone

Warren Buffett celebrated his 94th birthday the same week his company Berkshire Hathaway Inc. BRK hit a $1 trillion market cap. The achievement underscores Buffett’s legendary investment acumen, solidifying his legacy as one of the most successful investors of all time.

EV Sales Slow

J.D. Power projects U.S. electric vehicle sales in 2024 to reach only 9% of the market, down from the previously estimated 12%. The firm attributes the slowdown to increased competition from gasoline-powered vehicles and delays in new EV models from major Detroit automakers like Ford Motor Co. F and General Motors GM.

Real Estate Inflows

Investors have poured $2.2 billion into five real estate ETFs, anticipating potential Federal Reserve rate cuts. This influx highlights growing investor confidence in the sector as lower rates are expected to boost housing demand and provide attractive returns in the evolving economic landscape.

Homebuyers Pressure Builders

Homebuyers are exerting pressure on builders, as mortgage rates are projected to decline. With falling rates in sight, buyers are negotiating harder. They expect better deals on new homes as the market adjusts to the anticipated shift in borrowing costs.

Now Read:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Buy Dutch Bros Stock While It's Below $40?

There are pockets of the market that can give investors growth opportunities that don’t have to be related to the tech sector or the artificial intelligence (AI) trend. Dutch Bros (NYSE: BROS) is proof of that.

But shares have been a disappointment in recent years. They have lost about 13% of their value since the initial public offering in September 2021. Some people might view this as a good opportunity to make a move.

Should you buy this mid-cap stock while it trades well below $40 per share? Here’s what investors need to know.

Dutch Bros is in growth mode

Dutch Bros is probably a top choice for investors seeking growth potential in the restaurant sector. The company reported a revenue jump of 30% in the second quarter (ended June 30). This was partly driven by same-store sales growth of 4.1%, which is healthy given the uncertainty across the economy.

Another big part of Dutch Bros’ strategy is to expand the physical footprint. After 30 new locations opened in the last three months, there are now 671 stores in the U.S. Executives have explicitly stated that the target is to get to 4,000 locations in the next 10 to 15 years.

When companies are fully focused on expansion, as is the case here, there are typically no profits being reported. Here’s where Dutch Bros bucks the trend. Net income soared roughly 130% from $9.7 million in Q2 2023 to $22.2 million in the latest quarter. Expenses are rising at a slower rate than the top line, a positive trend.

According to Wall Street consensus analyst estimates, the business is projected to increase sales and earnings per share at compound annual rates of 22.3% and 25.3%, respectively, between 2023 and 2026. This is a robust outlook.

Valuation and quality

As of this writing, shares trade 58% below their peak, which was established during the last rising market environment in late 2021. Investor sentiment has cooled down considerably since that record was reached. But the stock still looks extremely expensive at a price-to-earnings ratio of 127.

For some investors, though, this might not matter. The bulls believe that Dutch Bros can one day get to its target of 4,000 stores. To be clear, these are the only people who should buy the stock. That’s because the current valuation likely bakes in that this favorable outcome is more likely than not to occur. And if the business does hit that goal, revenue and earnings will surely be much higher than they are today.

I’m not as confident. In fact, I believe that Dutch Bros still has a lot to prove before it’s worthy of investment consideration.

One reason I feel this way is because I don’t think the business possesses an economic moat. Despite its recent struggles, Starbucks clearly dominates this industry. Over the decades, it has developed durable competitive strengths that stem from its powerful brand recognition, as well as cost advantages.

Dutch Bros doesn’t hold a candle to Starbucks’ long-running relevance. And with the latter having a store base that’s about 25 times the size of the former’s footprint just in the U.S., Dutch Bros has a lot of work to do before it can even be mentioned in the same breath as the market leader.

Investors always fall in love with a good growth story. But the reality is that strong growth doesn’t last forever. In Dutch Bros’ case, there’s downside should the gains slow down, something that wouldn’t surprise me if it happened. The retail coffee industry is one of the most competitive around, with no barriers to entry or switching costs.

Even at a price below $40 per share, investors should stay away from Dutch Bros.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

Should You Buy Dutch Bros Stock While It’s Below $40? was originally published by The Motley Fool

The Smartest Bank Stocks to Buy With $500 Right Now

Bank stocks are an appealing option for many investors because they tend to offer appealing dividends as well as solid long-term returns. I say “tend to offer” because not all bank stocks are created equal nor do all bank stocks perform well.

If you’re looking for the best bank stock ideas right now, the two picks featured below have real potential. And the second pick might just surprise you.

1. TD Bank: This stock has a proven history of profitability

When it comes to making money with bank stocks, Toronto-Dominion Bank (NYSE: TD) is a prime case study. Over the last 30 years, shares of TD Bank (as it is more commonly known) have posted an incredible total return (including dividends reinvested) of 3,140%. The S&P 500‘s total return was 1,340% over the same time period.

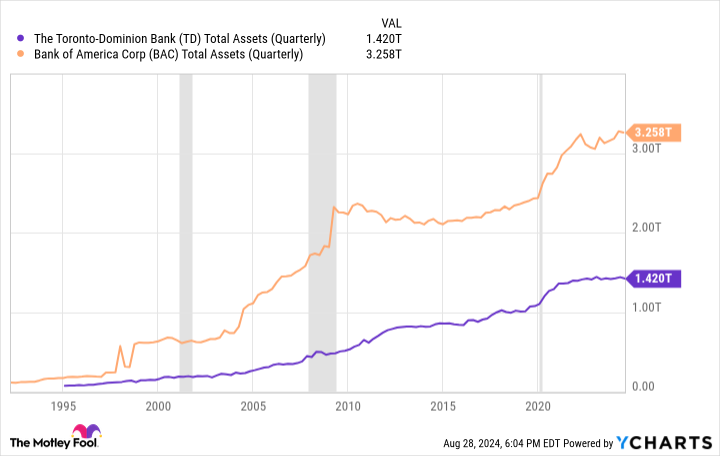

What made TD Bank’s rise so spectacular? It’s partially due to the unique operating conditions of Canada’s banking sector, where regulations encourage industry consolidation. For example, TD Bank is currently the second-largest bank in Canada, with $1.4 trillion in assets. The second-largest bank in the U.S. is Bank of America, which has assets of $3.3 billion despite the U.S. banking industry being many times larger than Canada’s. Outsized market share has allowed TD Bank to post profits and returns on equity that its U.S. counterparts can’t quite match. TD Bank’s average annual return on equity over the past five years, for instance, has been roughly 13.2%. Bank of America, for comparison, has averaged just 9.7%.

To be fair, TD Bank’s performance in more recent years hasn’t matched its historical average. Over the last three years, shares have delivered a total return of just 2% versus a total return for the S&P 500 of 30%. That underperformance is reflective of struggles in the banking sector as a whole. Bank of America shares, for instance, rose by just 0.8% over the same time period. It’s also related to some U.S. regulatory issues from 2023 involving the bank’s money-laundering controls that TD Bank is working to resolve. Until they are resolved, TD’s growth could be somewhat slowed.

Investors could use this underperformance to their advantage. TD Bank currently trades at just 1.4 times book value, a discount versus its three-year average of 1.6 times book value. The dividend yield, too, recently hit new highs and now tops 5%. If you’re looking for a bank stock with good value and a solid dividend that is well covered, TD Bank is for you.

2. Berkshire Hathaway: A secret way to bet on the best bank stocks

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) isn’t a bank stock, but it owns stakes in enough bank stocks to qualify for consideration. For decades, CEO Warren Buffett has made Berkshire a big investor in a variety of banks. Right now, Berkshire’s portfolio is betting tens of billions of dollars on well-known banks like Capital One, Citigroup, and Bank of America, as well as lesser-known banks like Ally Financial and Nu Holdings. In total, Berkshire’s portfolio has more than $40 billion invested directly in bank stocks, with another $43 billion bet on financial services companies like Mastercard, American Express, and Visa. Berkshire is more of a bank stock than many realize.

Of course, buying Berkshire shares also exposes you to a wide variety of other businesses, and your direct exposure to banks will be relatively small. But the upside is that you get to outsource your bank stock picks to one of the best investors of all time: Warren Buffett. Buffett has outlined his strategy for investing in bank stocks before.

“It’s a business that can be a very good business, when run right,” he told investors in 1996. “There’s no magic to it. You just have to stay away from doing something foolish.” With Buffett managing your bank stock portfolio, you’re much less likely to invest in a bank stock bust.

Despite the holding company recently topping $1 trillion in market cap for the first time, Berkshire Hathaway’s valuation is highly reasonable, especially considering the quality of the conglomerate. Shares trade just shy of 1.7 times book value, a figure that is likely overstated due to massive share buybacks, which grow shareholder value but tend to depress accounting book value.

It’s a strange pick as a bank stock, but Berkshire could be a great fit for those looking to add banking sector exposure while diversifying much of the risk.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Ally is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends Nu Holdings and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

The Smartest Bank Stocks to Buy With $500 Right Now was originally published by The Motley Fool

'Ethereum Killer' ADA Set To Get A Utility Boost As Cardano Upgrade 'Chang' Goes Live

Cardano’s ADA/USD ambitious “Chang hard fork” went live on Sunday, marking the Layer-1 blockchain’s shift toward decentralized governance.

What happened: Romain Pellerin, the CTO of IOG—the company behind the blockchain’s development—announced on X that the upgrade was successfully executed. He added that holders of the ADA token will have the “power to decide the fate of the protocol on-chain.”

Cardano founder Charles Hoskinson, who also co-founded Ethereum ETH/USD, called the upgrade a new chapter.

Indeed, with the hard fork, ADA holders will be able to elect representatives (known as Delegate Representatives or dReps) and vote on proposals for improvements and technical modifications to the blockchain.

The heart of this upgrade is CIP-1694, a Cardano Improvement Proposal that introduces various governance structures, including the Constitutional Committee, dReps, and Stake Pool Operators (SPOs).

For the uninitiated, a hard fork brings about a radical change in a blockchain’s programming, making it incompatible with older versions.

The Chang upgrade is part of the Voltaire Era, the final phase in Cardano’s current development roadmap to become a self-sustaining system.

Why It Matters: The upgrade added more utility for the native token ADA, which has been lackluster on price charts this year.

Currently the 11th-largest cryptocurrency, ADA has plummeted 44% year-to-date, compared to Bitcoin’s BTC/USD 30% gains and Ethereum’s ETH/USD 7.22% advances.

Price Action: The upgrade failed to rev up demand for the token, as it traded 3.57% lower than what it was 24 hours earlier, according to data from Benzinga Pro.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Jobs Data Will Help the Fed Gauge the Extent of Its Moderation

(Bloomberg) — Upcoming readouts on the US labor market, including the monthly payrolls report, will give Federal Reserve policymakers insight into the need for further interest-rate reductions after an all-but-certain cut in a little more than two weeks.

Most Read from Bloomberg

With inflation slowing — although still running faster than the Fed’s goal — Chair Jerome Powell has telegraphed a September rate cut and said that officials “do not seek or welcome” further cooling in the labor market. Weeks earlier, government figures showed lower-than-expected July job growth and the highest unemployment rate in nearly three years.

This coming Friday, the August jobs report is expected to show payrolls in the world’s largest economy increased by about 165,000, based on the median estimate in a Bloomberg survey of economists.

While above the modest 114,000 gain in July, average payrolls growth over the most recent three months would ease to a little more than 150,000 — the smallest since the start of 2021. The jobless rate probably edged down in August, to 4.2% from 4.3%.

Two days before Friday’s report, the government will issue figures on July job vacancies. The number of open positions, a measure of labor demand, is seen easing to a three-month low of 8.1 million — just above a more than three-year low.

The number of vacancies per unemployed worker, a ratio the Fed watches closely, currently stands at 1.2, similar to pre-pandemic levels and a sign labor demand is roughly in line with supply. At its peak in 2022, the ratio was 2 to 1.

Also included in the job openings report are data on lay-offs and discharges. Any large increase could add to Fed officials’ concerns about a weakening labor market.

Other labor-related reports in the upcoming holiday-shortened week include weekly jobless claims and ADP Research Institute’s August snapshot of private payrolls. In addition, the Fed will issue its Beige Book of regional economic conditions, while the Institute for Supply Management reports purchasing managers indexes for manufacturing and services.

What Bloomberg Economics Says:

“Non-farm payrolls will likely improve from July’s disappointing reading – but the 818k downward revision in the BLS’s early estimate for the March 2024 benchmark period probably leaves Fed officials less willing to take the initial prints at face value.”

— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full analysis, click here

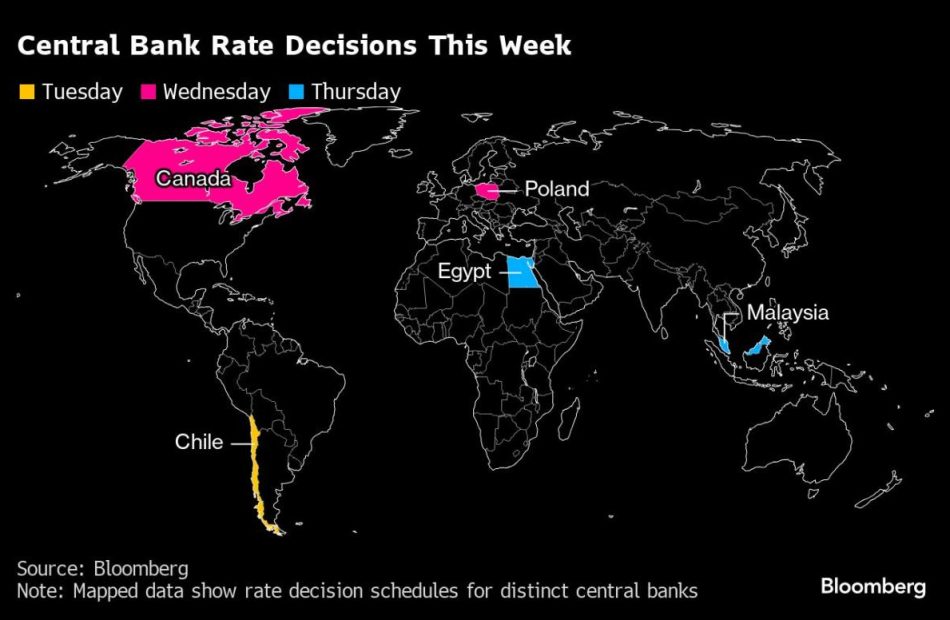

Elsewhere, the Bank of Canada is widely expected to deliver a third straight rate cut, as inflation that’s been within its target range all year allows officials to shift focus to weakness in the job market.

Purchasing manager indexes from around Asia, German industrial numbers and gross domestic product from Brazil are among other highlights.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

Asia begins the week with a wave of August manufacturing PMI data – including from Indonesia, South Korea, Malaysia, Thailand, Taiwan and the Philippines – following on from China’s official figures at the weekend.

China’s Caixin manufacturing PMI is also out on Monday, and is expected to show a return to expansion after a dip below 50 in July.

Japan on Monday gets a report on corporate performance in the second quarter. Capital investment may recover a tad after slipping in the three months through March, data that will feed into revised economic growth figures the following week.

In Australia, attention falls on current account figures that will also likely affect gross domestic product data. Those figures, due Wednesday, are expected to show that economic growth accelerated slightly from the prior quarter.

South Korea revises its second-quarter GDP the following day, and the region also gets a flurry of inflation updates. Trade data for August — published Sunday — showed that export growth returned to a double-digit clip, an outcome that bodes well for the economic outlook and reflects the resilience of global demand for technology products.

Vietnam’s consumer price gains may slow below 4% for the first time since March, while consumer-price data are also due from South Korea, Thailand, Taiwan, Indonesia and the Philippines. Trade statistics will be published in Australia, Vietnam and Pakistan.

Among central banks, Malaysia sets its overnight policy rate on Thursday and Reserve Bank of Australia Governor Michele Bullock delivers a speech the same day.

Europe, Middle East, Africa

Euro-zone policymakers have until the close of play on Wednesday to make comments before a blackout period kicks in ahead of their Sept. 12 decision.

With inflation now at a three-year low, a second rate cut for the newly-minted easing cycle looks increasingly likely. Central bank chiefs from Germany and France are among those scheduled for appearances.

The calendar for data is relatively light, with Germany likely to be a highlight. Factory orders on Wednesday and industrial production the following day will reveal the state of the country’s struggling manufacturers at the start of the third quarter.

Among regional reports on the agenda, a second reading of the euro-zone’s GDP measurement for the three months through June will be released.

The UK is likely to be similarly quiet, with final takes on August purchasing manager indexes for manufacturing and services scheduled for Monday and Wednesday respectively.

Consumer-price data in Switzerland may draw eyeballs in advance of the Swiss National Bank’s rate decision later this month. Inflation may stick at 1.3% for a third month, comfortably below the 2% ceiling for policymakers.

Turning east, in Poland — where data on Aug. 30 showed the fastest inflation so far this year — the central bank is widely expected to keep its key rate unchanged at 5.75% on Wednesday. Governor Adam Glapinski will speak at a news conference the following day.

Data from South Africa on Tuesday will likely show that the continent’s most industrialized economy skirted recession. Analysts expect the economy to have grown 0.5% in the second quarter after contracting 0.1% in the prior three months, helped by improved power supplies.

In Turkey, data is expected to show the inflation rate dropped by about 10 percentage points in August, to 52% from 62%. The central bank is hoping it declines to about 40% by year-end.

From Wednesday to Friday, African heads of and Chinese President Xi Jinping will gather in Beijing for the Forum on China–Africa Cooperation, where they’re expected to discuss new investment opportunities.

On Thursday, Egypt’s central bank is widely expected to hold its main rate at 27.5%. Some analysts, though, think it may opt to start the easing process now given the steady retreat in price pressures over the past year.

Latin America

Brazil on Tuesday will report second-quarter economic growth figures likely to reinforce that demand is shaking off the effects of tight monetary policy.

GDP is expected to have risen 0.9% quarter-on-quarter, more than during the first three months of the year, as a tight labor market and strong consumption propel activity.

The release will likely boost leftist President Luiz Inacio Lula da Silva, who’s raised public spending while pledging to improve living standards for ordinary citizens in Latin America’s largest economy. It could further pressure the central bank for interest rate increases as soon as in September.

The coming week will be crucial for economic data releases in Chile. On Tuesday, the nation’s central bank is likely to cut its key rate by a quarter-point, to 5.5%, after having paused the easing cycle at its prior meeting.

The next day, Chilean central bankers will publish their quarterly monetary policy report, with updated estimates on economic growth, inflation, and the future path for borrowing costs.

On Friday, the government will report August consumer price data, which is expected to show inflation accelerating further above the 3% target due to a series of electricity tariff hikes.

–With assistance from Matthew Malinowski, Piotr Skolimowski, Laura Dhillon Kane, Brian Fowler and Monique Vanek.

(Updates with South Korea trade in Asia section)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.