ROSEN, TOP RANKED GLOBAL COUNSEL, Encourages Starbucks Corporation Investors to Secure Counsel Before Important Deadline in Securities Class Action – SBUX

NEW YORK, Sept. 01, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, announces the filing of a class action lawsuit on behalf of purchasers of securities of Starbucks Corporation SBUX between November 2, 2023 and April 30, 2024, both dates inclusive (the “Class Period”). A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 28, 2024.

SO WHAT: If you purchased Starbucks securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Starbucks class action, go to https://rosenlegal.com/submit-form/?case_id=28350 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 28, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants provided investors with material information concerning Starbucks’ fiscal year revenue for 2023 and expected guidance for the fiscal year 2024. Defendants’ statements included, among other things, confidence in Starbucks’ Reinvention and diversification of its global portfolio, which relies largely on both Rewards customers and more occasional consumers. Defendants provided these overwhelmingly positive statements to investors while, at the same time, disseminating materially false and misleading statements and/or concealing material adverse facts related to Starbucks’ Reinvention strategy, comprising: a roadmap and clear plan for success outside of the US, including opening new stores; positive same-store sales; and strong local innovation in foreign economies. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Starbucks class action, go to https://rosenlegal.com/submit-form/?case_id=28350 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Richmond American Announces Debut of New Yuba County Masterplan

Seasons at Riverton North & South are now selling in Plumas Lake!

PLUMAS LAKE, Calif., Aug. 30, 2024 /PRNewswire/ — Richmond American Homes of California, a subsidiary of M.D.C. Holdings, Inc. MDC, is pleased to announce that Seasons at Riverton (RichmondAmerican.com/SeasonsAtRiverton) is now open for sales in Plumas Lake. Featuring two exciting communities, this exceptional new masterplan offers ranch and two-story floor plans from the builder’s sought-after Seasons™ Collection, designed to maximize space and make homeownership more attainable for a variety of buyers.

About Seasons at Riverton North & South:

- New ranch and two-story homes from the $500s

- Seven inspired Seasons™ Collection floor plans

- Up to 6 bedrooms & approx. 3,040 sq. ft.

- 3-car & RV garages available

- Close proximity to highways & notable schools

- Short drive to popular shops & restaurants

- Near Beale Air Force Base & Toyota Amphitheatre

- Designer-curated fixtures & finishes

Seasons at Riverton is located at 1699 Bond Way (Leighton Grove and River Oaks Boulevard) in Plumas Lake. Call 530.491.7104 or visit RichmondAmerican.com for more information or to schedule an appointment.

About M.D.C. Holdings, Inc.

M.D.C. Holdings, Inc. was founded in 1972. MDC’s homebuilding subsidiaries, which operate under the name Richmond American Homes, have helped more than 240,000 homebuyers achieve the American Dream since 1977. One of the largest homebuilders in the nation, MDC is committed to quality and value that is reflected in each home its subsidiaries build. The Richmond American companies have operations in Alabama, Arizona, California, Colorado, Florida, Idaho, Maryland, Nevada, New Mexico, Oregon, Pennsylvania, Tennessee, Texas, Utah, Virginia and Washington. Mortgage lending, insurance and title services are offered by the following MDC subsidiaries, respectively: HomeAmerican Mortgage Corporation, American Home Insurance Agency, Inc. and American Home Title and Escrow Company. M.D.C. Holdings, Inc. stock is traded on the New York Stock Exchange under the symbol “MDC.” For more information, visit MDCHoldings.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/richmond-american-announces-debut-of-new-yuba-county-masterplan-302235325.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/richmond-american-announces-debut-of-new-yuba-county-masterplan-302235325.html

SOURCE M.D.C. Holdings, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Visa Stock a Buy?

One of the best ways to make solid investment decisions is to pay attention to Warren Buffett’s portfolio. Many of his largest holdings have outperformed the market for years or even decades at a time.

One of his long-term positions, Visa (NYSE: V), caught my eye after a recent correction. Buffett has held onto this stock since 2011. There are two exciting reasons why you should consider Visa for your portfolio right now.

This is the type of stock that every investor wants to own

In one of his more famous quotes, Buffett tried to explain a lesson he’s learned over and over: Trust great businesses, not management teams. “When a management with a reputation for brilliance tackles a business with a reputation for bad economics,” Buffett once advised, “it is the reputation of the business that remains intact.”

The lesson here is simple: Buy high-quality businesses that even a half-competent management team could run. In this regard, Visa is the perfect example. A few months ago, I speculated that Visa could become the next trillion-dollar stock. It wasn’t the savvy management team that I loved, but the business fundamentals that even a poor management team would find difficult to screw up. Visa’s main advantage, I argued, was the long-term tailwind of network effects.

What are network effects? This business school term essentially describes a product or service that gets more valuable the more that people use it. Social media is a prime example. Even the best social media platform won’t get anywhere without hitting a critical mass of users. In this way, a social media network’s greatest advantage is its user base, not its technology. People want to join networks that others are a part of, which means that the larger platforms generally tend to grow even bigger over time.

Payment networks like Visa operate in much the same way. No one wants to use a credit or debit card that merchants won’t accept. And merchants don’t want to accept forms of payment that consumers don’t use. The natural result is industry consolidation. According to data compiled by Statista, Visa has a massive 61% market share for general-purpose payment cards in the U.S. Mastercard comes in second with a market share of 25%, while just two companies round off the rest of the industry. This isn’t a new dynamic, either. Mastercard and Visa have enjoyed industry-duopoly positions for more than a decade, with Visa commanding a heavy lead the entire time.

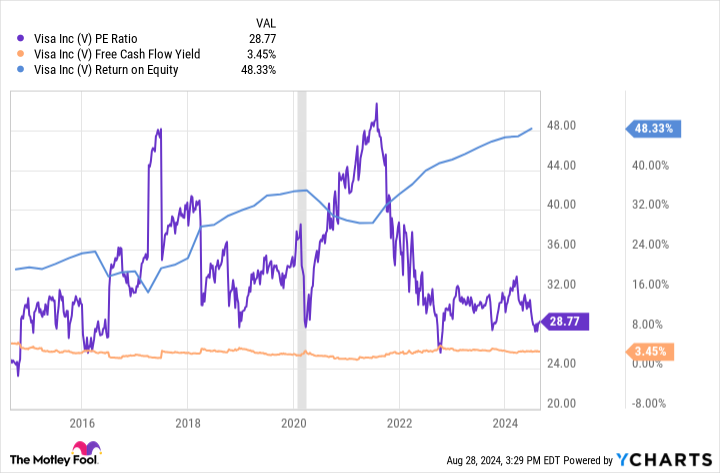

Great stocks rarely get this cheap

Massive-industry consolidation combined with an asset-light business model has resulted in huge and steady profits for Visa. Its returns on equity are incredibly impressive considering the company employs a conservative amount of leverage. Free-cash-flow generation has nearly always been positive. And after a small correction, shares now trade at nearly their cheapest levels in years on a price-to-earnings basis.

Right now, the S&P 500 as a whole trades at a price-to-earnings ratio of 29.2. That means Visa stock trades at a discount to the market average despite operating an incredibly reliable and profitable business model that benefits from network effects that should endure for decades to come. According to recent filings, it doesn’t appear as if Warren Buffett has been selling any of his Visa position. It’s hard to imagine him doing so at these prices.

Is Visa stock a buy right now? The answer appears to be a strong “yes.” At these levels, the company is a great match for value and growth investors alike.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Mastercard and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

Is Visa Stock a Buy? was originally published by The Motley Fool

Billionaires Are Buying These 2 Cryptocurrencies Hand Over Fist

With cryptocurrency emerging as a stand-alone asset class, a growing number of billionaires are now hunting for potential investment opportunities. Some of them are buying cryptocurrencies for their enormous upside potential, while others are buying them for their ability to diversify a portfolio or hedge their overall market position.

Based on public statements and official 13F filings with the Securities and Exchange Commission (SEC), it’s possible to put together a snapshot look at what top billionaires are buying. Unsurprisingly, Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) are at the top of their shopping lists.

1. Bitcoin

Hedge fund billionaires Stanley Druckenmiller and Paul Tudor Jones are two high-profile names making the case for why Bitcoin should become a part of a diversified portfolio. As Druckenmiller has pointed out, Bitcoin has many of the same properties as gold, making it interesting as a potential long-term store of value. And Paul Tudor Jones has made the case that Bitcoin can be one way to hedge against geopolitical and macroeconomic risk.

Billionaire hedge fund managers have emerged as some of the biggest buyers of the new spot Bitcoin exchange-traded funds (ETFs). Based on biweekly market data from CoinShares, it’s possible to see at a glance which hedge funds are the biggest buyers.

Some of them — such as Jane Street and Susquehanna International Group — may be familiar names to regular readers of The Wall Street Journal. Others, such as Boston-based Bracebridge Capital — which is run by the wealthiest female hedge fund manager in the U.S. — may be less familiar. But what they all have in common is that they’re loading up on Bitcoin.

And don’t forget about billionaire Larry Fink of BlackRock Inc. (NYSE: BLK), which manages over $10 trillion in assets. Back in June 2023, BlackRock was the first to file a spot Bitcoin ETF application with the SEC. That ETF — the iShares Bitcoin Trust (NASDAQ: IBIT) — is now the most popular spot Bitcoin ETF. Fink is also a regular guest on CNBC, explaining why average investors should be investing in Bitcoin.

Much of the billionaire demand for Bitcoin is being driven by its upside potential. The growing consensus is that Bitcoin now has a path to $150,000 by the end of 2025. And from there, the sky’s the limit. Cathie Wood of Ark Invest, for example, has suggested that Bitcoin could be worth as much as $3.8 million per coin by 2030.

2. Ethereum

While Bitcoin has garnered the most attention from billionaires, don’t sleep on Ethereum. Arguably, Ethereum gives you much more diversification than Bitcoin since it’s much more involved in every facet of the blockchain world. Ethereum is a smart contract blockchain network. It’s a building block for everything from games and non-fungible tokens (NFTs) to metaverse worlds.

But what billionaires like best about Ethereum is its potential to disrupt the traditional world of Wall Street. That’s due to the enormous strides being made in decentralized finance (DeFi), which can be thought of as the blockchain version of traditional finance. For example, traditional finance has centralized exchanges such as Coinbase Global (NASDAQ: COIN), while DeFi has decentralized exchanges such as Uniswap (CRYPTO: UNI).

Some of the best numbers about the disruptive potential of Ethereum come from Cathie Wood of Ark Invest. In this year’s “Big Ideas 2024” report, she outlined exactly how much value is flowing from traditional finance to decentralized finance, especially smart contract blockchain networks such as Ethereum. Wood suggests that DeFi could grow at a 32% annualized rate over the next few years, making it a $5.2 trillion market opportunity by 2030.

If you’re looking for a billionaire evangelist for Ethereum, look no further than Mark Cuban. Based on his experience as a tech entrepreneur and angel investor, he’s well-positioned to discuss the benefits of Ethereum. Cuban has been beating the drum for Ethereum ever since 2021, when he praised its versatility and technological sophistication.

Do billionaires buy altcoins?

Based on the above, you might conclude that billionaires are only buying Bitcoin and Ethereum. That’s not necessarily the case. If you parse the latest data from CoinShares, a handful of other cryptocurrencies appear to be attracting the attention of large institutional investors. These include Solana (CRYPTO: SOL), Litecoin (CRYPTO: LTC), XRP (CRYPTO: XRP), and Cardano (CRYPTO: ADA).

However, the amount of money that is flowing into these altcoins seems trivial in comparison. For example, over $8 billion has flowed into Bitcoin since the start of the year, and nearly $1 billion into Ethereum. In comparison, $34 million has flowed into Litecoin, $31 million into Solana, $22 million into XRP, and $12 million into Cardano.

This strategy of loading up on Bitcoin and Ethereum, while making relatively tiny crypto investments elsewhere, is probably one that makes sense for the average investor. You’ll get the best of both worlds: enormous upside potential combined with some additional diversification for your portfolio.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Dominic Basulto has positions in Bitcoin, Cardano, Ethereum, and Solana. The Motley Fool has positions in and recommends Bitcoin, Cardano, Coinbase Global, Ethereum, Solana, Uniswap Protocol Token, and XRP. The Motley Fool has a disclosure policy.

Billionaires Are Buying These 2 Cryptocurrencies Hand Over Fist was originally published by The Motley Fool

The Big Problem Palantir Technologies Hopes to Solve for Its Customers

Data analytics company Palantir Technologies (NYSE: PLTR) has experienced an increase in its growth rate as its customers look to use artificial intelligence (AI) to enhance their day-to-day operations. Palantir has held bootcamps to showcase its new AI platform, AIP, to demonstrate to customers how it can help their businesses. And it looks to be paying off with an improved growth rate.

While many companies may offer to provide AI solutions, it can often be difficult to implement them. That’s where Palantir can provide some excellent value to its customers, and it could unlock a tremendous growth opportunity for the business.

Getting from prototype to production isn’t easy for many companies

Designing new processes and testing out new AI products can seem easy, but actually implementing changes and putting them into production is a different ballgame, and that’s where Palantir sees many companies struggling.

On its latest earnings call, Palantir’s Chief Technology Officer Shyam Sankar said, “It is so easy to create an AI prototype, the equivalent effort of making a PowerPoint slide, but it’s actually very, very hard to get that in production, probably 10 to 100 times harder than traditional software transitioning to production. And therein lies our entire opportunity in the market.”

And not getting projects into production may be a potential source of frustration for companies as they try to justify costly AI initiatives. Research company Gartner estimates that 30% or more of generative AI projects may end up abandoned by the end of next year as businesses struggle to validate the payoff from their investments. This can result in managers feeling the pressure to move projects into production sooner rather than later, which can potentially lead to an increase in demand for Palantir’s services, including its AIP.

Palantir’s sales have been rising, and profits have been accelerating even faster

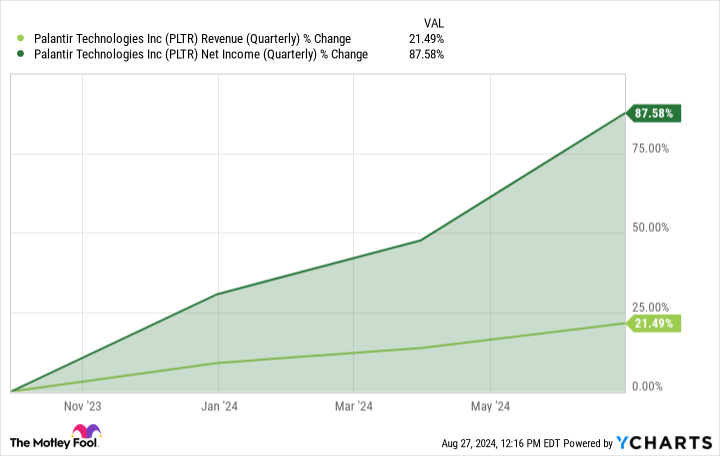

Palantir’s business has been moving in a positive trajectory in recent quarters as not only has it become consistently profitable, but its top and bottom lines have also been increasing. And a particularly positive sign is that profits have been rising at a faster rate than revenue.

In its latest quarterly results, which ended on June 30, Palantir’s revenue grew by 27% to $678 million, which is faster than the 13% growth it achieved a year earlier.

However, even amid all this revenue and even profit growth, Palantir’s stock still doesn’t look cheap. With Palantir at more than 180 times its trailing earnings and nearly 90 times next year’s estimated future profits (based on analyst expectations), investors are still paying a hefty premium for the business. Even based on revenue, Palantir looks egregiously overvalued, trading at close to 30 times its sales.

Palantir’s stock has potential, but it also comes with risks

Palantir has more than doubled in value this year as it has become a popular buy with AI investors. But there are challenges and headwinds looming, including a possible recession and a decline in AI-related spending.

While the business does appear to be moving in the right direction, it’s Palantir’s pricey valuation that would prevent me from buying shares of the company today. Without a more significant acceleration in its profits or more of a reduction in its stock price, there simply looks to be too much optimism and future growth already priced into its valuation to make it a good buy, and for this to be an investment with a high probability of generating a strong future return.

Investors may want to wait to see if the company can indeed build off its recent results and continue to accelerate its growth rate, because if it can’t, the stock could be due for a correction. As of now, it may be a bit too risky to buy the stock given its high price tag.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

The Big Problem Palantir Technologies Hopes to Solve for Its Customers was originally published by The Motley Fool

FIVE STOCK NEWS: A Securities Fraud Class Action has been Filed Against Five Below, Inc. — Contact BFA Law before September Deadline if You Suffered Losses (Nasdaq:FIVE)

NEW YORK, Sept. 01, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Five Below, Inc. FIVE and certain of the Company’s senior executives.

If you invested in Five Below, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/five-below-inc.

Investors have until September 30, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Five Below securities. The case is pending in the U.S. District Court for the Eastern District of Pennsylvania and is captioned Himes v. Five Below, Inc., No. 2:24-cv-3638.

What is the Lawsuit About?

The complaint alleges that Five Below operates specialty discount stores, and prices most of its products at $5 or less. The complaint further alleges that during the relevant period, the company misrepresented its accelerating store traffic, merchandising opportunities and store expansions that underpinned its long-term growth. In truth, Five Below had allegedly experienced macroeconomic pressures that dented its store traffic and interfered with the successful execution of the company’s business.

On June 5, 2024, Five Below is alleged to have revealed that macroeconomic pressures caused lower income customers to reduce their spending, leading to disappointing financial results for the company’s first quarter of 2024. Still, Five Below assured investors that “chasing trends has always been a strength of ours, and we will continue to quickly identify and capitalize on trends.” Despite the assurance, the news caused the price of Five Below stock to decline about 10%, from $132.79 per share on June 5, 2024 to $118.72 per share on June 6, 2024.

After the market closed on July 16, 2024, Five Below announced that CEO Joel Anderson resigned as President and CEO, and as a member of the Board of Directors, effective immediately. At the same time, the company reported that the quarter-to-date results for its second quarter of fiscal 2024 showed that comparable sales decreased 5% over the prior year. As a result, Five Below also announced that sales for the full quarter would be in the range of $820 million – $860 million and that comparable sales would decline approximately 6%-7%. This news caused a significant 25% decline in the price of Five Below stock, from $102.07 per share on July 16, 2024 to $76.50 per share on July 17, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/five-below-inc.

What Can You Do?

If you invested in Five Below, you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/five-below-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/five-below-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Acre NY Realty Successfully Held LIC Young Professional Networking Event at Athena LIC

NEW YORK, Aug. 30, 2024 /PRNewswire/ — Acre NY Realty is proud to announce the successful hosting of the LIC Young Professional Networking Event on August 22nd, 2024, at Athena LIC. The event drew nearly 200 attendees, offering a dynamic platform for young professionals working in New York City. It featured special guest speakers from various industries who shared their career experiences and entrepreneurial journeys with the attendees.

The primary goal of the event was to offer young professionals in New York a platform to gain clarity on their career paths and professional goals. This event has had a significant impact on the LIC community, fostering connections and collaboration among the city’s emerging talent. The Founder of Acre NY, Cathy Huang, said, “We believe that this event was an excellent opportunity for professionals to gain industry insights, connect with like-minded individuals, and build meaningful connections.”

Acre extends its sincere appreciation to the guests who took time out of their busy schedules to attend the event and engage in thoughtful discussions about their respective fields. Acre also extends sincere appreciation to the sponsors who made this event possible, including MG Law Group, CTC, Pro HR, Fer, Teazzi, SANSAM RAMEN, and Fantuan Delivery.

The venue for this event, Athena LIC, is located at 27-20 42nd Rd in Long Island City. This 9-story building features 51 meticulously designed units, each reflecting a commitment to modern living standards. Each unit in Athena LIC is a masterpiece that merges comfort with aesthetics. The living room features floor-to-ceiling windows and expansive ceiling heights ranging from 10’0″ to 11’1″, which allow natural light to cascade into the home, creating an atmosphere of openness and tranquility. The kitchen features elegant dark walnut cabinets and Taj Mahal quartzite countertops, equipped with advanced Bosch appliances and Wi-Fi connectivity for culinary excellence and modern convenience. The bathroom blends serene luxury with Calacatta porcelain and walnut vanities, enhanced by antique brass accents. The addition of heated floors and custom LED lighting creates a tranquil ambiance for a soothing experience. Moreover, smart living features like Latch smart apartment entry and Wi-Fi-enabled smart home appliances offer residents effortless control and seamless integration of daily home functions at their fingertips. Besides, smart living features like Latch smart apartment entry and Wi-Fi enabled smart home appliances offer residents effortless control and seamless integration of daily home functions at their fingertips.

In addition, the building offers ample communal spaces. Outdoor spaces like the rooftop terrace are beautifully designed to provide a perfect balance of activity and tranquility.

The storage room and pet spa provide unmatched safety and ease for residences. The fitness center, party room, children’s playroom and, E-game lounge offer a variety of choices for residents to socialize, and relax.

Pricing for current availability at Athena LIC starts at $700,000. Acre NY Realty is the exclusive marketing and sales agent. For more information or to schedule a sales appointment, please visit www.theathenalic.com

About Acre NY Realty

Acre NY Realty is one of the most influential real estate brokerages in New York. Acre prides itself on providing the highest quality and comprehensive real estate services to its clients. Acre provides extensive market research and analysis, pre-development & post-construction advice, investment strategies, and leasing and sales services. Acre’s success has led to over $300M+ in annual sales revenue. For more information, please visit https://www.acreny.us.

Media Contact:

Tony Tsai

212-653-8880

382565@email4pr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/acre-ny-realty-successfully-held-lic-young-professional-networking-event-at-athena-lic-302234597.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/acre-ny-realty-successfully-held-lic-young-professional-networking-event-at-athena-lic-302234597.html

SOURCE Acre NY Realty

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Have $100,000? Here Are 3 Ways to Grow That Money Into $1 Million for Retirement Savings

Despite America being one of the world’s best economies, the typical person living in the United States falls woefully short of saving for a comfortable retirement. According to studies, the median retirement savings across all U.S. families is $87,000. So, if you’re at or around $100,000 today, I have two crucial nuggets of good news for you.

First, you’re doing better than you might give yourself credit for, so give yourself some love. Second, the next $100,000 will feel much easier, thanks to the power of compounding.

Yes, retiring with $1 million or more in savings is attainable. However, the work to get there may depend on your life circumstances once you hit that first $100,000 milestone.

Here are three scenarios to outline what you can expect moving forward. Remember, you’re never out of the game, no matter where you start.

Scenario No. 1: You’re ahead of the game

The typical family doesn’t have $100,000 saved, so hitting this goal anytime before age 35 puts you well ahead of the game. Perhaps you are a high earner or lived frugally during your 20s and early 30s. Regardless of your circumstances, you can ease off the gas over the coming decades. Suppose you have this $100,000 invested in a diversified portfolio that generates an annualized return of 8%.

Assuming you’re 35, you would retire at 65 with almost $1.1 million without adding another penny. You could achieve FIRE (financial independence, retire early). For example, if you contributed $500 per month starting at 35, you would cross $1 million in savings by age 58. Bump that to $1,000, and you’ll hit $1 million by age 55. The bottom line is that you would have options, which is what financial independence is all about.

Scenario No. 2: You got a late start

Most families get a late start, based on the data on what people retire with. That’s OK. Life happens: People buy homes, start families, and have student loans. No, the math isn’t as friendly if you’re starting later, but there is still tons of time to build a comfortable retirement. For this scenario, imagine a family starting late but saving $100,000 by age 45.

You don’t benefit from compounding as much as those starting earlier. Without additional contributions, you would retire with $492,000 at age 65. How much do you need to add? Contributing $1,000 monthly will get you to $1 million by retirement.

That sounds like a lot; however, many people enter their prime earning years in their mid-40s. It could be time to revisit your budget if you struggle to contribute the necessary amounts. For example, the average new car payment is $726. Downgrading to a used vehicle isn’t ideal but could free up hundreds of dollars toward that monthly contribution goal. Eventually, one must sacrifice some luxuries to build a comfortable retirement. It doesn’t sound fun now, but I promise you won’t be thinking about that new car you once had decades later.

Scenario No. 3: You’re playing catch-up

Naturally, those who wait the longest to save for retirement have the most challenging road ahead. However, there is still time, even if you’re way behind. The worst thing you can do is give up because you think it’s too late.

Suppose you hit $100,000 at age 55 and want to retire with $1 million. You’ll have to save aggressively, but it is still possible. Contributing $4,300 monthly could likely get your retirement savings to $1 million by the age of 65, assuming an 8% interest rate.

No matter their budget, many people may not have that money available. So, you may have to extend your career to give compounding some extra time to help you. Retiring at 70 instead of 65 means an additional five years to save. In this scenario, one only needs to contribute $2,000 monthly to retire a millionaire. In other words, that additional five years cuts your monthly contribution goal to less than half! Compounding makes a tremendous difference, even with just five extra years.

This is the take-home point

You’ve read it throughout this article, but it is important enough to say it once more: You have time to build a better retirement, no matter where you are in life. The math might change based on your situation, but anyone can plan and work toward a better retirement than they would have otherwise.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” ›

The Motley Fool has a disclosure policy.

Have $100,000? Here Are 3 Ways to Grow That Money Into $1 Million for Retirement Savings was originally published by The Motley Fool

Savings interest rates today, September 1, 2024 (best accounts offering 5.50% APY)

Today’s savings account interest rates are some of the highest we’ve seen in more than a decade due to several rate hikes by the Federal Reserve. Even so, savings interest rates vary widely by bank, so it’s important to be sure you’re getting the best rate possible when shopping around for a savings account. The following is a breakdown of savings interest rates today and where to find the best offers.

Overview of savings interest rates today

The national average savings account rate stands at 0.46%, according to the FDIC. This might not seem like much, but consider that just two years ago, it was just 0.07%, reflecting a sharp rise in a short period of time.

This is largely due to monetary policy decisions by the Fed, which began raising it’s benchmark rate in March 2022 to combat skyrocketing inflation. Since then, the Fed increased rates 11 times, though it paused further rate hikes in 2024. Experts believe the Fed will eventually begin to lower its target rate in September, which means deposit account rates, including savings interest rates, will likely begin to fall.

Although the national average savings interest rate is fairly low compared to other types of accounts (such as CDs) and investments, the best savings rates on the market today are much higher. In fact, some of the top accounts are currently offering upwards of 5% APY.

Poppy Bank, for instance, is currently offering the highest savings account rate today at 5.50% APY for its Premier Online savings account. The minimum opening deposit is $1,000 and this rate is guaranteed for three months.

Betterment also offers an account with 5.50% APY. However, this is a cash management account for brokerage customers and not a traditional savings account. There is no minimum opening deposit required.

Since these rates may not be around much longer, consider opening a high-yield savings account now to take advantage of today’s high rates.

Here is a look at some of the best savings rates available today from our verified partners:

Related: 10 best high-yield savings accounts today>>

How much interest can I earn with a savings account?

The amount of interest you can earn from a savings account depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (savings account interest typically compounds daily).

Say you put $1,000 in a savings account at the average interest rate of 0.45% with daily compounding. At the end of one year, your balance would grow to $1,004.52 — your initial $1,000 deposit, plus just $4.52 in interest.

Now let’s say you choose a high-yield savings account that offers 5% APY instead. In this case, your balance would grow to $1,051.27 over the same period, which includes $51.27 in interest.

The more you deposit in a savings account, the more you stand to earn. If we took our same example of a high-yield savings account at 5% APY, but deposit $10,000, your total balance after one year would be $10,512.67, meaning you’d earn $512.67 in interest.

Read more: What is a good savings account rate?

CD rates today, August 31, 2024 (best account provides 4.70% APY)

Today’s certificate of deposit (CD) interest rates are some of the highest we’ve seen in more than a decade thanks to several rate hikes by the Federal Reserve. Still, CD rates vary widely across financial institutions, so it’s important to ensure you’re getting the best rate possible when shopping around for a CD. The following is a breakdown of CD rates today and where to find the best offers.

Overview of CD rates today

Historically, longer-term CDs offered higher interest rates than shorter-term CDs. Generally, this is because banks would pay better rates to encourage savers to keep their money on deposit longer. However, in today’s economic climate, the opposite is true.

See our picks for the best CD accounts available today>>

As of August 31, 2024, CD rates remain competitive across the board. However, the highest CD rates can be found for shorter terms of around one year or less.

Today, the highest CD rate available is offered by Marcus by Goldman Sachs on its 1-year CD. Account holders can earn 4.70% APY with a minimum deposit of $500.

It’s also possible to find CDs with longer terms of two years or more that offer competitive rates, though they are closer to about 4% to 4.5% APY.

Here is a look at some of the best CD rates available today from our verified partners:

How much interest can I earn with a CD?

The amount of interest you can earn from a CD depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (CD interest typically compounds daily or monthly).

Say you invest $1,000 in a one-year CD with 1.81% APY, and interest compounds monthly. At the end of that year, your balance would grow to $1,018.25 – your initial $1,000 deposit, plus $18.25 in interest.

Now let’s say you choose a one-year CD that offers 5% APY instead. In this case, your balance would grow to $1,051.16 over the same period, which includes $51.16 in interest.

The more you deposit in a CD, the more you stand to earn. If we took our same example of a one-year CD at 5% APY, but deposit $10,000, your total balance when the CD matures would be $10,511.62, meaning you’d earn $511.62 in interest.

Read more: What is a good CD rate?

Types of CDs

When choosing a CD, the interest rate is usually top of mind. However, the rate isn’t the only factor you should consider. There are several types of CDs that offer different benefits, though you may need to accept a slightly lower interest rate in exchange for more flexibility. Here’s a look at some of the common types of CDs you can consider beyond traditional CDs:

-

Bump-up CD: This type of CD allows you to request a higher interest rate if your bank’s rates go up during the account’s term. However, you’re usually allowed to “bump up” your rate just once.

-

No-penalty CD: Also known as a liquid CD, type of CD gives you the option to withdraw your funds before maturity without paying a penalty.

-

Jumbo CD: These CDs require a higher minimum deposit (usually $100,000 or more), and often offer higher interest rate in return. In today’s CD rate environment, however, the difference between traditional and jumbo CD rates may not be much.

-

Brokered CD: As the name suggests, these CDs are purchased through a brokerage rather than directly from a bank. Brokered CDs can sometimes offer higher rates or more flexible terms, but they also carry more risk and might not be FDIC-insured.