This Tech Stock Has Gone Parabolic, and You Should Consider Buying It Before It Soars Even Higher

Fortinet (NASDAQ: FTNT) released its second-quarter 2024 results on Aug. 6, and the stock has witnessed a massive surge of 35% since then thanks to impressive growth in its revenue and earnings that were enough to help it beat Wall Street’s expectations.

The cybersecurity specialist also raised its full-year revenue guidance. This further explains why the stock has made a parabolic move, a phenomenon that refers to the rapid increase in the share price of a company within a short time, just like the right side of a parabolic curve.

The good news for investors is that Fortinet stock could continue to head higher thanks to the company’s focus on tapping fast-growing niches of the cybersecurity market, which should allow it to profit from a massive addressable market in the long run.

Fortinet’s growth is likely to improve

Fortinet delivered Q2 revenue of $1.43 billion, an increase of 11% from the same quarter last year. Its non-GAAP net income grew at a much faster pace of 50% from the year-ago quarter, to $0.57 per share, thanks to a reduced share count due to buybacks, lower indirect costs, and the growing demand for its higher-margin security subscription offerings.

Fortinet’s non-GAAP operating margin jumped from 26.9% to 35.1% as the proportion of service-based revenue increased on a year-over-year basis. More specifically, Fortinet’s service revenue increased nearly 20% year over year to $982 million, accounting for 69% of its top line. That was an improvement from the same quarter last year when service revenue accounted for 63% of its top line.

There is still a lot of room for growth in Fortinet’s service revenue, which also means that the company’s margin profile could continue to improve. The good part is that the improvement in Fortinet’s deferred revenue indicates that its revenue from sales of security subscriptions could continue improving.

The company’s deferred revenue increased 15% year over year to $5.9 billion in the second quarter, outpacing the growth in its top line. This metric refers to the money that’s collected in advance by a company for services that will be rendered in the future. Once Fortinet delivers those services, it will be able to recognize the deferred revenue on the income statement as actual revenue.

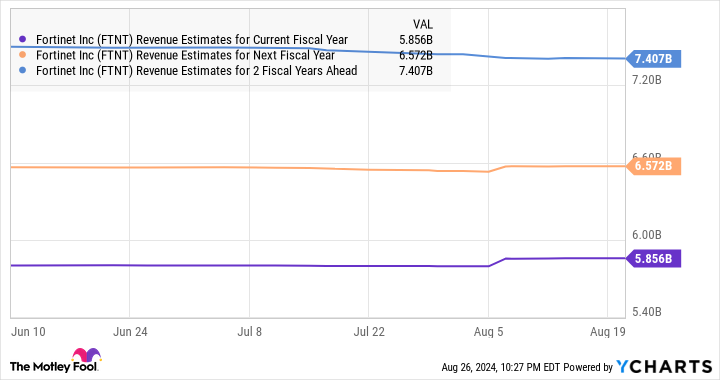

Given that the company expects its addressable market to jump to a whopping $228 billion in 2028, there is a lot of room for Fortinet to grow, considering that it is expecting its 2024 revenue to land at $5.85 billion. That would be a 10% jump from last year, but as the following chart indicates, Fortinet’s growth is expected to pick up going forward.

Is the stock worth buying right now?

Fortinet is now trading at 44 times trailing earnings following its red-hot rally. That is a bit lower than the U.S. technology sector’s average price-to-earnings ratio of almost 46. Fortinet’s forward earnings multiple of 39 points toward an improvement in its bottom line, and the good part is that analysts are now expecting a stronger bottom-line performance from the company.

The forecast for the next five years is also bright, with Fortinet expected to clock an annual earnings growth rate of 15%. So, let’s do some math.

Assuming it can indeed notch such solid growth on the back of the huge addressable opportunity it is sitting on, its earnings could jump to $4.10 per share after five years (using fiscal 2024’s projected earnings of $2.04 per share as the base).

The Nasdaq-100 index has an average forward price-to-earnings ratio of 29 (using the index as a proxy for tech stocks). Assuming Fortinet trades at a similar multiple after five years (which would be a significant discount to its current earnings multiple), its stock price could jump to $119 (based on the projected earnings of $4.10 per share calculated above).

These calculations point toward a 58% jump from current levels, which is why investors might want to consider buying this cybersecurity stock despite the terrific gains that it has clocked of late.

Should you invest $1,000 in Fortinet right now?

Before you buy stock in Fortinet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fortinet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Fortinet. The Motley Fool has a disclosure policy.

This Tech Stock Has Gone Parabolic, and You Should Consider Buying It Before It Soars Even Higher was originally published by The Motley Fool

Leave a Reply