Algoma Steel Group to Participate in the Jefferies 2024 Industrials Conference

SAULT STE. MARIE, Ontario, Sept. 03, 2024 (GLOBE NEWSWIRE) — Algoma Steel Group Inc. ASTLASTL (“Algoma” or “the Company”), a leading Canadian producer of hot and cold rolled steel sheet and plate products, today announced that the Company will be participating in the Jefferies 2024 Industrials Conference on Wednesday, September 4 and Thursday, September 5, 2024. Prior to Algoma’s attendance at this conference, the Company will post a copy of the presentation it will use in the Investors section of its website on ir.algoma.com.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains “forward-looking information” under applicable Canadian securities legislation and “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”), including statements regarding, Algoma’s transition to electric arc furnace (EAF) steelmaking, Algoma’s future as a leading producer of green steel, Algoma’s modernization of its plate mill facilities, transformation journey, ability to deliver greater and long-term value, ability to offer North America a secure steel supply and a sustainable future, and investment in its people, and processes. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “design,” “pipeline,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions. Many factors could cause actual future events to differ materially from the forward-looking statements in this document. Readers should also consider the other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Information” in Algoma’s Annual Information Form, filed by Algoma with applicable Canadian securities regulatory authorities (available under the company’s SEDAR+ profile at www.sedarplus.com) and with the SEC, as part of Algoma’s Annual Report on Form 40-F (available at www.sec.gov), as well as in Algoma’s current reports with the Canadian securities regulatory authorities and SEC. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Algoma assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

About Algoma Steel Group Inc.

Based in Sault Ste. Marie, Ontario, Canada, Algoma is a fully integrated producer of hot and cold rolled steel products including sheet and plate. Driven by a purpose to build better lives and a greener future, Algoma is positioned to deliver responsive, customer-driven product solutions to applications in the automotive, construction, energy, defense, and manufacturing sectors. Algoma is a key supplier of steel products to customers in North America and is the only producer of discrete plate products in Canada. Its state-of-the-art Direct Strip Production Complex (“DSPC”) is one of the lowest-cost producers of hot rolled sheet steel (HRC) in North America.

Algoma is on a transformation journey, modernizing its plate mill and adopting electric arc technology that builds on the strong principles of recycling and environmental stewardship to significantly lower carbon emissions. Today Algoma is investing in its people and processes, working safely, as a team to become one of North America’s leading producers of green steel.

As a founding industry in their community, Algoma is drawing on the best of its rich steelmaking tradition to deliver greater value, offering North America the comfort of a secure steel supply and a sustainable future as your partner in steel.

For more information, please contact:

Michael Moraca

Vice President – Corporate Development and Treasurer

Algoma Steel Group Inc.

Phone: 705.945-3300

E-mail: IR@algoma.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AMH to Participate in BofA Securities 2024 Global Real Estate Conference

LAS VEGAS, Sept. 3, 2024 /PRNewswire/ — AMH AMH, a leading large-scale integrated owner, operator, and developer of single-family rental homes, today announced that members of the Company’s management team will participate in a roundtable discussion at the BofA Securities 2024 Global Real Estate Conference on Wednesday, September 11, 2024 at 10:20 a.m. Eastern Time.

A live audio webcast of the presentation will be available on the Company’s website at www.amh.com under the “Investor Relations” tab. A replay of the webcast will be available through September 25, 2024.

About AMH

AMH AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We’re an internally managed Maryland real estate investment trust (REIT) focused on acquiring, developing, renovating, leasing and managing homes as rental properties. Our goal is to simplify the experience of leasing a home and deliver peace of mind to households across the country.

In recent years, we’ve been named one of Fortune’s 2023 Best Workplaces in Real Estate™, a 2024 Great Place to Work®, a 2024 Most Loved Workplace®, a 2024 Top U.S. Homebuilder by Builder100, and one of America’s Most Responsible Companies 2024 and Most Trustworthy Companies in America 2024 by Newsweek and Statista Inc. As of June 30, 2024, we owned nearly 60,000 single-family properties in the Southeast, Midwest, Southwest and Mountain West regions of the United States. Additional information about AMH is available on our website at www.amh.com.

AMH refers to one or more of American Homes 4 Rent, American Homes 4 Rent, L.P. and their subsidiaries and joint ventures. In certain states, we operate under AMH Living or American Homes 4 Rent. Please see www.amh.com/dba to learn more.

AMH Contacts

Media Relations

Phone: (855) 774-4663

Email: media@amh.com

Nicholas Fromm

Investor Relations

Phone: (855) 794-2447

Email: investors@amh.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/amh-to-participate-in-bofa-securities-2024-global-real-estate-conference-302237155.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/amh-to-participate-in-bofa-securities-2024-global-real-estate-conference-302237155.html

SOURCE AMH

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This 4.6% Yielding Finance Stock Raised Its Dividend Through the Past 4 Recessions

Recessions can be scary and have real-world consequences on jobs and the stock market. However, they are a part of life as a long-term investor. Recessions can threaten weak companies that lack the fundamental strength to survive economic downturns.

How do you know a business can survive tough times? Dividends are a great litmus test. Look for companies that can share their earnings with investors and continue increasing that payout through recessions. The U.S. economy has fallen into recession four times since 1990.

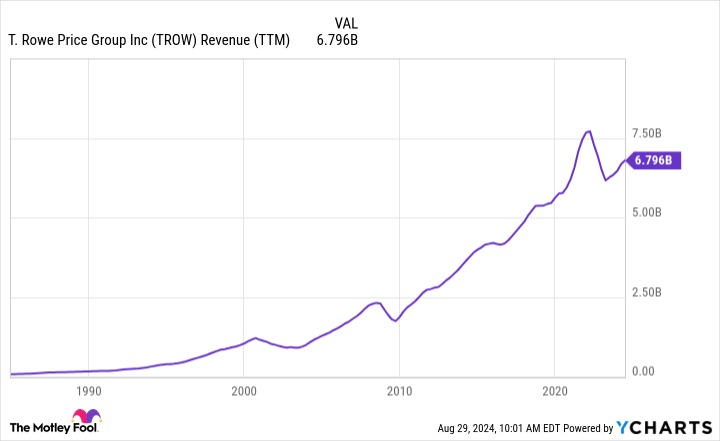

Investment management company T. Rowe Price (NASDAQ: TROW) has raised its dividend in all four recessions as well as annually for the last 38 years. Here is the secret behind T. Rowe Price’s longevity and why it could be an excellent buy for any long-term investor today.

A business built on the markets

The financial markets are the core avenue to building wealth in the modern world, but most people don’t have the time, desire, or education to manage all their investments independently. Investment management companies like T. Rowe Price sell various financial products, such as mutual funds, offer advisory services to clients, and operate retirement plans for employers. T. Rowe Price primarily generates revenue by charging fees on the collective $1.6 trillion in assets it manages.

T. Rowe Price’s assets under management (AUM) grow when clients invest more money in its products and services or when the assets themselves appreciate. The U.S. stock market continues to increase over the long term, and that builds growth into T. Rowe Price’s business. However, it also makes the company susceptible to market crashes because asset prices decline, and scared clients might pull their funds out of the markets.

You can see the occasional decline during recessions (2001, 2008, 2020), but the long-term trend points up:

Iron-clad financials support generous shareholder returns

T. Rowe Price gushes cash profits; the company has few expenses besides its employees, which means management can be very generous to shareholders. The company has gone beyond annual dividend raises and paid special dividends twice over the past decade. These are one-time dividends and usually far larger amounts than the typical payout. During that time, T. Rowe Price repurchased 15% of its total shares, which helped boost the stock’s price by increasing earnings per share.

Most importantly, management can do this without sacrificing the company’s financial health. Today, T. Rowe Price has $2.7 billion in cash and zero debt. When the next recession comes, management can supplement any dip in its profits with the cash it already has.

Why T. Rowe Price is a buy today

One risk T. Rowe Price faces is that investors have increasingly moved to passive investment funds over the past decade. T. Rowe Price specializes in actively managed funds that charge higher fees than a passive fund that might follow a market index and charge investors less. This year, total assets in passive investments surpassed active for the first time, which could stunt T. Rowe Price’s long-term growth.

That said, the stock seems priced appropriately for that risk. Shares trade at a forward P/E ratio of 12 today, below its decade average of 15. Analysts believe T. Rowe Price will still grow earnings by almost 7% annually over the long term. Again, the stock’s valuation is pretty reasonable for that expected growth. Even if the stock’s valuation remains the same, investors could still see total annualized returns of around 11% because the dividend yield is 4.6% today.

T. Rowe Price could fall short of growth, and investors are getting a high-yield dividend stock that will likely continue raising its payout. That’s a solid worst-case scenario. On the other hand, the stock could outperform the market if the business delivers as expected. This heads-you-win, tails-you-still-win investment scenario makes the stock a buy today.

Should you invest $1,000 in T. Rowe Price Group right now?

Before you buy stock in T. Rowe Price Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and T. Rowe Price Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends T. Rowe Price Group. The Motley Fool has a disclosure policy.

This 4.6% Yielding Finance Stock Raised Its Dividend Through the Past 4 Recessions was originally published by The Motley Fool

Here's Why GE Aerospace Stock Slumped Today

GE Aerospace‘s (NYSE: GE) shares declined by more than 5% as of 11 a.m. ET today. It’s not often you can blame a stock price decline on an analyst downgrade of another company, but in this case, it’s applicable. Wells Fargo‘s downgrade of GE’s principal partner, Boeing, sent a shock wave through both companies’ share prices.

Should GE Aerospace prospects also be downgraded?

A Wells Fargo analyst downgraded Boeing stock to underweight, arguing that Boeing’s cash-flow difficulties will run into the next investment cycle for the airplane manufacturer. That’s an issue for GE because it’s the leading engine provider to Boeing. Its joint venture, CFM International, provides the sole engine on the Boeing 737 MAX, and GE provides the sole engine the Boeing 777X and one of two engine options on the 787.

Any push-out of the development of a new Boeing model will negatively impact GE, not least as the company develops engines in anticipation of Boeing’s development. GE typically makes money from multiyear servicing of airplane engines after they are sold into new airplanes.

What it means to GE Aerospace investors

While this is merely an analyst opinion, it is based on solid arguments. Boeing looks highly unlikely to meet its medium-term cash-flow target, and new airplane development will take years and cost significant amounts of money.

Still, it’s worth noting that Boeing isn’t abandoning airplane manufacturing anytime soon. Moreover, while a potential equity raise (to help fund new airplane development) isn’t great news for Boeing shareholders, it’s something GE investors should be agnostic over.

After all, an airplane produced with the financial backing of an equity raise will likely be similar to one made without it, and GE Aerospace will benefit all the same.

Should you invest $1,000 in GE Aerospace right now?

Before you buy stock in GE Aerospace, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and GE Aerospace wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Here’s Why GE Aerospace Stock Slumped Today was originally published by The Motley Fool

Mar-a-Lago Profits Quadruple Since Donald Trump's Presidency, Could Money-Making Property Keep Him From Selling DJT Stake?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Mar-a-Lago Profits Quadruple Since Donald Trump’s Presidency, Could Money-Making Property Keep Him From Selling DJT Stake?

Former President Donald Trump will be free to sell his stake in Trump Media & Technology Group Corp (NASDAQ:DJT) soon, but he might not have to thanks to the success of his Mar-a-Lago club.

What Happened: Trump’s Mar-a-Lago club and residence has made headlines for years and was one of the many talking points during a civil fraud case against the former president.

Trump purchased the 1100 S. Ocean Boulevard property in Palm Beach, Florida for a reported $7 million to $8 million back in 1985.

Check It Out:

Mar-a-Lago was valued at $18 million to $27 million by an assessor and valued at $24.15 million by Zillow. An expert who spoke on behalf of Trump’s team during the civil trial said the property could be sold for $1 billion to the likes of Bill Gates or Elon Musk as it is a one-of-a-kind property.

While the $1 billion price tag is high, a new report sheds light on how much money Trump’s famous property is making.

A Forbes report said profits at Mar-a-Lago have quadrupled since Trump left the White House in 2021. Among the ways the club makes money are rising membership dues, political fundraisers and other hosted events like weddings.

In 2023, the club took in around $40 million, which is double what the club made in 2019 before the COVID-19 pandemic put a damper on events. The figure is also triple what Mar-a-Lago made in 2014 before Trump started his political career.

The report says Mar-a-Lago brought in $90 million in the four years Trump was serving as the president of the United States. The three years after Trump left the White House have brought in $105 million in business.

Along the growing revenue, the annual costs to run Mar-a-Lago have mostly stayed in the $12 million to $16 million range. The profit margin went from 9% in 2011 to 60% in 2023 according to the report, with $22 million in 2023 profit.

“It is actually the best year we’ve ever had at Mar-a-Lago,” a manager told Forbes.

The club currently caps members at 500, who pay annual dues estimated at $15,000. Initiation fees are $700,000 and could rise to $1 million soon, with Forbes said the club has started a waiting list with all 500 spots filled.

Read More:

-

Don’t miss out: earn 8-15% expected returns by investing in fractional real estate. Get started with only $10.

-

With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

Why It’s Important: Trump’s political rise and past history as a president has helped boost the notoriety of the club and also the demand for memberships and to host events at the Florida property.

With Trump owning 100% of the club, the rising profits could help the former president with his mounting legal costs and 2024 election campaign. This could be potential good news for shareholders of Trump Media & Technology Group.

Trump owns 114,750,000 shares of the media company he co-founded, representing 64.9% of the company. By the end of September, Trump will be able to sell his stake in the company and maintain control, as Benzinga previously reported.

The decision of whether or not he will sell a portion or his entire stake comes as the social media stock, which owns the Truth Social network Trump frequently posts on, has hit new lows since completing a SPAC merger in March 2024.

The sale of the shares could lead to a further decline in the share price of Trump Media & Technology Group shares, while also freeing up additional capital for Trump to use in his election battle against Kamala Harris.

Trump’s stake is worth around $2.2 billion based on a price of $19.51 at the time of writing.

Trump Media & Technology Group shares opened for trading at $70.90 on March 26 when its long-awaited SPAC merger with Digital World Acquisition was completed.

While the company had a market capitalization of $8 billion and Trump’s net worth soared to $6.4 billion, the stock quickly fell after the public debut and has fallen in recent weeks after Trump was found guilty of 34 counts of falsifying business records.

Trump faces a $355 million fine from a previous ruling in a New York court, and has spent hundreds of millions on legal fees related to several court cases.

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a minimum investment of $5,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Mar-a-Lago Profits Quadruple Since Donald Trump’s Presidency, Could Money-Making Property Keep Him From Selling DJT Stake? originally appeared on Benzinga.com

Guardian Capital Group Limited completes its acquisition of Galibier Capital Management Ltd.

TORONTO, Sept. 03, 2024 (GLOBE NEWSWIRE) — Guardian Capital Group Limited (Guardian) GCG GCG.A))) announced today that it has completed its acquisition of Galibier Capital Management Ltd. (Galibier), a Toronto, Canada-based investment management firm. Guardian completed the transaction on the terms announced on June 20, 2024. The addition of Galibier increases Guardian’s assets under management by approximately C$1 billion and adds a team of high-quality, experienced investment professionals focused on fundamental equity research and valuation.

“We are truly pleased that Galibier founder, Joe Sirdevan, and his team are joining Guardian and look forward to jointly building on the opportunities ahead. There is a good cultural alignment between the firms, and we welcome incorporating Galibier’s distinctive investment approach into our existing lineup of strategies,” said George Mavroudis, Guardian’s President and Chief Executive Officer.

“Having access to Guardian’s deep resources will provide us with added support as we grow and continue to implement Galibier’s rigorous investment philosophy and process for our clients,” said Joe Sirdevan, Galibier’s Chief Executive Officer. “All of us at Galibier are excited to join the Guardian group.”

Galibier will retain its brand, and the current management and investment team will remain in place, continuing to invest on behalf of institutions, foundations and individuals through segregated accounts and pooled funds.

For further information, please contact:

Angela Shim

416-947-8009

About Guardian Capital Group Limited

Guardian Capital Group Limited (Guardian) is a global investment management company servicing institutional, retail and private clients through its subsidiaries. As at June 30, 2024, Guardian had C$58.6 billion of total client assets while managing a proprietary investment portfolio with a fair market value of C$1.1 billion. On July 2, 2024, Guardian completed its acquisition of Sterling Capital Management, LLC, a Charlotte, North Carolina-based investment management firm, adding approximately C$104.0 billion (US$76.0 billion) in client assets. Founded in 1962, Guardian’s reputation for steady growth, long-term relationships and its core values of authenticity, integrity, stability and trustworthiness have been key to its success over six decades. Its Common and Class A shares are listed on the Toronto Stock Exchange as GCG and GCG.A, respectively. To learn more about Guardian, visit www.guardiancapital.com.

This press release contains forward-looking statements with respect to Guardian Capital Group Limited and its products and services, including its business operations and strategy and financial performance and condition. Although management believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from expectations include, among other things, general economic and market factors, including interest rates, business competition, changes in government regulations or tax laws, and other factors discussed in materials filed with applicable securities regulatory authorities from time to time.

Any forward-looking statements included in this press release are provided as of the date of this press release and should not be relied upon as representing Guardian’s views as of any date subsequent to the date of this press release. Guardian undertakes no obligation, except as required by applicable law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under licence.

About Galibier Capital Management Ltd.

Galibier Capital Management Ltd., founded in 2012, is an investment process-driven investment management firm based in Toronto, Ontario. Galibier provides investment advisory services through separately managed accounts and pooled funds, in accordance with its philosophy of Growth. At a Reasoned Price™. Its client base includes corporations, pensions, charitable foundations and endowments. To learn about Galibier, visit galibiercapital.com.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Winstead Opens in Nashville

5 Leading Nashville Attorneys join the Firm

DALLAS and NASHVILLE, Tenn., Sept. 3, 2024 /PRNewswire/ — Winstead announces the establishment of a Nashville office with the addition of 4 Nashville-based shareholders: construction lawyers Christopher Dunn and Keith Randall, land use attorney Emily Lamb, and commercial litigator Jeremy Oliver. Joining them is associate Will Stout.

“Nashville is one of the country’s hottest and most dynamic markets. We have worked with many of the region’s most sophisticated owners and developers on large regional real estate development projects. The timing is right to add a new office with Chris, Keith, Emily and Jeremy. We have tremendous momentum; this is just the beginning of our strategic growth in Nashville,” said Jeff Matthews, Chairman & CEO of Winstead.

“Winstead is an outstanding firm with a tremendous reputation as a leader in the real estate sector. Their expertise and experience will add huge value for our clients, and the firm’s culture is a perfect fit for us. We are excited to join this entrepreneurial firm and continue to grow our business,” said Chris Dunn.

“The real estate and healthcare industries have contributed to the significant growth in the Greater Nashville business community throughout the last decade. Adding these outstanding lawyers and opening an office in Nashville just makes good business sense and allows us to meet a growing client demand,” said Bob Burton, Co-Chair of Winstead’s Business & Transaction Department.

Chris Dunn will become Co-Chair of Winstead’s Real Estate Industry Group, and Jeremy Oliver will be the Nashville Office Managing Shareholder.

About Winstead

Winstead is a leading Texas-based law firm with national practices serving clients across the country. We focus on exceeding our clients’ expectations by providing innovative solutions to their business and legal opportunities and challenges. We work as a trusted counsel to public and private companies, governments, individuals, universities, and public institutions.

Our business, transactions, and litigation practices serve key industries, including real estate, financial services, investment management and private funds, higher education and P3, airlines, healthcare and life sciences, sports business, and wealth management.

![]() View original content:https://www.prnewswire.com/news-releases/winstead-opens-in-nashville-302237192.html

View original content:https://www.prnewswire.com/news-releases/winstead-opens-in-nashville-302237192.html

SOURCE Winstead PC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Magnificent Stock-Split Stocks to Buy Hand Over Fist in September, and 2 That Are Priced for Perfection and Worth Avoiding

Move over, artificial intelligence (AI)! Wall Street has a new hot trend, and its name is stock-split euphoria.

A stock split allows publicly traded companies the ability to adjust their share price and outstanding share count by the same magnitude. However, these changes are purely superficial and don’t impact a company’s market cap or its operating performance.

Since 2024 began, 13 outstanding companies have announced and/or completed a stock split, including (all are forward-stock splits, unless otherwise noted):

-

Walmart (NYSE: WMT): 3-for-1 stock split

-

Nvidia (NASDAQ: NVDA): 10-for-1

-

Amphenol (NYSE: APH): 2-for-1

-

Chipotle Mexican Grill (NYSE: CMG): 50-for-1

-

Mitsui (OTC: MITSY)(OTC: MITSF): 2-for-1

-

Williams-Sonoma (NYSE: WSM): 2-for-1

-

Broadcom (NASDAQ: AVGO): 10-for-1

-

MicroStrategy (NASDAQ: MSTR): 10-for-1

-

Sirius XM Holdings (NASDAQ: SIRI): 1-for-10 reverse split

-

Cintas (NASDAQ: CTAS): 4-for-1

-

Super Micro Computer (NASDAQ: SMCI): 10-for-1

-

Lam Research (NASDAQ: LRCX): 10-for-1

-

Sony Group (NYSE: SONY): 5-for-1

Among these top-notch stock-split stocks are two magnificent, inexpensive companies that are begging to be bought in September, as well as two highfliers that are priced for perfection and worth avoiding.

Stock-split stock No. 1 that can be bought hand over fist in September: Sirius XM Holdings

The first phenomenal stock-split stock you can scoop up with confidence in September is the only company of the 13 listed above that’s set to conduct a reverse-stock split: satellite-radio operator Sirius XM Holdings.

Whereas most companies completing reverse splits are doing so from a position of operating weakness, this isn’t the case with Sirius XM. Its roughly 3.85 billion outstanding shares have held its stock in the mid-single-digits for a decade, which might be a deterrent for some institutional investors who deem its low share price too risky. This reverse split will take place following the merger of Sirius XM with Liberty Media’s Sirius XM tracking stock, Liberty Sirius XM Group in a little over week, and likely make shares more attractive to big-money investors.

What investors get with Sirius XM is easily identifiable competitive advantages. For example, it’s the only licensed satellite-radio operator in the country, which affords it substantial subscription pricing power.

Sirius XM also generates its revenue differently than terrestrial and online radio providers. Instead of relying almost exclusively on advertising, as traditional radio companies do, Sirius XM has generated 77% of its net sales from subscriptions through the first-half of 2024. People are much less likely to cancel their service during periods of economic turbulence than businesses are to pare back to marketing budgets at the first sign(s) of trouble. In other words, Sirius XM is better positioned to navigate uncertain economic climates.

A forward price-to-earnings (P/E) ratio of less than 10, coupled with a dividend yield of 3.4%, makes Sirius XM stock quite the bargain for opportunistic long-term investors.

Stock-split stock No. 2 to purchase with confidence in September: Sony Group

The other magnificent stock-split stock that’s begging to be bought in September is none other than Japan-based electronics goliath Sony Group. Sony’s American Depositary Receipts (ADRs) are set to undergo a 5-for-1 split on Oct. 8.

Even though we’re coming up on four years since Sony introduced the PlayStation 5, and it’s perfectly normal to see gaming console sales taper off late in the cycle, Sony has found a couple of ways to boost one of its top revenue channels.

For instance, it’s increasing the price of PlayStation 5 by about 19% in Japan to counter challenging economic conditions. It’s also seeing strong subscription sales growth from PlayStation Plus, which allows subscribers to play games with their friends and store gaming data in the cloud.

Though it’s best-known for gaming, Sony Group is a diverse company. It’s one of the primary suppliers of image sensors used in smartphones. With telecom companies upgrading their wireless networks to support faster download speeds, consumers and businesses have been steadily trading in their old devices for new ones that are 5G-capable. The 5G revolution is providing a healthy boost to Sony’s Imaging and Sensing Solutions segment.

A forward P/E of 16 is a fair (if not inexpensive) price to pay for a wonderful company that’ll likely be introducing a new gaming console in about two years’ time.

The first stock-split stock to avoid in September: Nvidia

However, not every stock-split stock is worth buying. Even though Nvidia has been the hottest megacap stock on the planet since the start of 2023, and its H100 graphics processing unit (GPU) is the preferred choice in AI-accelerated data centers, there are too many potential red flags to ignore.

A point I’ve been trying to drive home for months is that there hasn’t been a next-big-thing innovation, technology, or trend that’s escaped an early stage bubble-bursting event in 30 years. This is a nice way of saying that investors always overestimate how quickly new innovations/technologies are adopted by consumers and businesses.

The simple fact that most businesses lack a defined game plan for their AI data center investments strongly suggests that we’re witnessing the next in a long line of bubbles with AI. If and when the AI bubble bursts, I’d expect Nvidia’s stock to be clobbered.

Competitive pressures can also no longer be ignored. Advanced Micro Devices is ramping up production of its MI300X AI-GPU, which is substantially cheaper than the H100, and doesn’t face the same supply chain constraints as Nvidia’s chips.

Beyond external competition, Nvidia may lose out on valuable data center space from its top customers. The four members of the “Magnificent Seven” that account for around 40% of Nvidia’s net sales are developing AI chips of their own. Even with Nvidia’s H100 and Blackwell chips almost certainly hanging onto their computing advantage, we’re witnessing a concerted effort by America’s most-influential businesses to reduce their reliance on Nvidia’s hardware.

Nvidia’s sequentially declining adjusted gross margin suggests we’ve witnessed the peak of the latest hot trend on Wall Street.

The second stock-split stock to shy away from in September: MicroStrategy

The other stock-split stock of the 13 that’s worth avoiding in September is AI-inspired enterprise analytics software company MicroStrategy.

Although MicroStrategy is, technically, a software company, almost the entirety of its $27.2 billion market cap (as of this writing on Aug. 27) is derived from the Bitcoin (CRYPTO: BTC) it holds. As of July 31, MicroStrategy held 226,500 Bitcoins, which is more than 1% of the entire supply that’ll ever be mined. It also makes MicroStrategy the top corporate holder of the world’s largest cryptocurrency.

There are lot of ways to wager on Bitcoin if you’re a crypto optimist. However, buying MicroStrategy stock is, arguably, the worst possible way to do it. With Bitcoin trading at $59,338 per token, as of this writing, MicroStrategy’s Bitcoin portfolio is worth $13.44 billion. Yet, its market cap of $27.2 billion (placing a fair value estimate on the software segment of around $1 billion), implies a value of roughly $115,650 per token. Investors are paying a 95% premium for its Bitcoin assets, which makes no sense.

Another reason to shy away from MicroStrategy has to do with how the company is financing its Bitcoin purchases. With minimal positive operating cash flow generated from its software segment, CEO Michael Saylor has overseen a number of convertible-debt offerings to fund its acquisition of Bitcoin. If Bitcoin were to enter a steep bear market, as it’s done a couple of times over the last decade, MicroStrategy could struggle to meet its debt obligations.

Lastly, I’m not convinced that Bitcoin is in any way superior in the crypto arena. Its scarcity is based on lines of computer code that could, in theory, be altered with community consensus. Most importantly, Bitcoin’s payment network isn’t anywhere close to the fastest or the cheapest. It’s a first-mover network that’s been outdone by third-generation blockchain networks. MicroStrategy tethering its future to Bitcoin looks like a mistake I’d suggest avoiding.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Sean Williams has positions in Sirius XM. The Motley Fool has positions in and recommends Advanced Micro Devices, Bitcoin, Chipotle Mexican Grill, Lam Research, Nvidia, Walmart, and Williams-Sonoma. The Motley Fool recommends Broadcom and Cintas and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

2 Magnificent Stock-Split Stocks to Buy Hand Over Fist in September, and 2 That Are Priced for Perfection and Worth Avoiding was originally published by The Motley Fool

AI server maker Super Micro denies short-seller Hindenburg's claims

(Reuters) – Super Micro Computer on Tuesday denied claims made by short-seller Hindenburg Research in its report last week and said it contained “false or inaccurate statements” about the AI server maker.

In its first comments on the allegations, Super Micro said the report contained “misleading presentations of information that we have previously shared publicly”.

The company said it would address those statements “in due course” without elaborating. Its shares rose more than 2% in early trading.

Hindenburg did not immediately respond to a Reuters request for comment on Super Micro’s statement.

Hindenburg last week disclosed a short position in Super Micro and alleged “accounting manipulation” at the company, citing evidence of undisclosed related-party transactions and failure to abide by export controls, among other issues.

A day after the short-seller report, Super Micro delayed the filing of its annual report, citing a need to assess “its internal controls over financial reporting”, which sent its shares tumbling about 19%.

Hindenburg, which has tussled with billionaire investor Carl Icahn and India’s Gautam Adani, said it had conducted a three-month investigation that included interviews with former senior Super Micro employees and litigation records.

Super Micro on Tuesday also reiterated that it does not expect any material changes in its fourth-quarter or fiscal year financial results as a result of the delay in the filing of its annual report.

“Neither of these events affects our products or our ability and capacity to deliver (IT solutions) … Our production capabilities are unaffected and continue operating at pace to meet customer demand,” CEO Charles Liang said in a statement.

(Reporting by Deborah Sophia in Bengaluru; Editing by Shilpi Majumdar)

Weed Smuggler Among Few Freed Under Germany's New Cannabis Law

Germany’s cannabis legalization law applies retroactively. This means that people who were arrested for possessing up to 25 grams of weed and are still in jail should be released. The law took effect on April 1st, but how many prisoners have been freed since then?

Only a few have been released, according to data requested and obtained by IPPEN.MEDIA. According to the data received for 13 out of 16 federal states, Bavaria has released the most people, with 33 prisoners freed, writes Frankfurter Rundschau according to the translation. The second state with the most freed individuals is Baden-Württemberg, which has released 19 people.

However, the highest number of releases is likely in North Rhine-Westphalia (NRW), a state in western Germany. With more than 18 million inhabitants, NRW is the most populous state in the country. Moreover, it is said that the state’s regulators have reviewed the most files, but the ministry couldn’t provide the requested data.

Cannabis legalization opponents often argue that legalization leads to a large number of criminals being back on the streets. The number of released prisoners under the new cannabis law in Germany testifies against this claim. This is because a significant number of people imprisoned for substance offenses have multiple convictions. They were not put in prison just because they were “caught with a joint,” according to one ministry.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Complexity And Controversy

One particularly interesting case made headlines recently and opponents are using it as an argument against the reform. The case is before the Mannheim Regional Court and involves a 36-year-old man who smuggled 450 kilograms (992.08 lbs) of cannabis into Germany, estimated to be worth 1.9 million euros ($2.1 million), reports the German outlet. The controversy arises from the new law, which doesn’t consider cannabis-related crimes as serious crimes and therefore the prosecutors can’t use encrypted chats from the provider Encrochat as evidence. The man was released, prompting Baden-Württemberg’s Minister of Justice, Marion Gentges (CDU), to say, “Drug dealers are beneficiaries of this law.”

‘Enormous Workload’ For The Judiciary

Back in March, justice ministers from various states joined together to push for postponing its enactment from April 1 to October arguing that the judicial system will be burdened with thousands of cases of people seeking retroactive amnesty or expungement.

“In Lower Saxony alone, we anticipate over 16,000 files due to the proposed amnesty, which will need to be manually reviewed by our already overburdened staff – nationally, this figure is significantly higher,” Lower Saxony’s Justice Minister Kathrin Wahlmann said at the time, according to CannaBizEu.

Since the postponement failed, the judiciary has been flooded with files that need to be reviewed. It is estimated that a minimum of 200,000 files need to be manually reviewed. Some amnesty cases fall fully, some partially, under the intended amnesty, and this needs to be clarified, which requires time.

“The additional workload caused by the Cannabis Law is enormous for the judiciary,” said Bavaria’s CSU Justice Minister Georg Eisenreich. In Bavaria alone, prosecutors need to manually review about 41,500 paper files.

On the bright side, as time passes, there will be fewer cannabis prisoners under the new law, which will reduce the judiciary’s workload.

Continue reading on Frankfurter Rundschau.

Read Next:

Photo: Courtesy of Couperfield via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.