Before the Fed lowers interest rates, make these 4 money moves to prepare your finances

The Federal Reserve is expected to lower interest rates soon — and the central bank’s move could bring opportunities for borrowers, savers and spenders alike.

Fed Chair Jerome Powell said last week that “the time has come” for rate cuts — leading investors and analysts to speculate that the first cut could come as early as next month, when the Fed next meets, and that more cuts will come over the following 12 months.

Most Read from MarketWatch

The current federal-funds rate is in the range of 5.25% to 5.5%. The Fed made 11 rate hikes starting in March 2022 to combat soaring inflation, but those increases have made it harder for households already grappling with rising prices: Borrowing is more expensive, and interest rates for mortgages, credit cards and car loans have all gone up. Those same high rates have benefited savers, however, who can take advantage of high-yield savings accounts and certificates of deposit promising rates of return beyond 5%.

Rate cuts are likely to ease headaches for some households as borrowing becomes less expensive, but people who have cash parked in high-interest accounts might not earn as much as they do now. “It’s all about optimizing,” said Bankrate senior economic analyst Mark Hamrick.

How can you optimize your own financial situation? Here are three guiding principles and one easy fix to get the most out of your cash.

One quick move: Put next year’s spending money into a CD

A certificate of deposit, or CD, allows you to earn interest at a fixed rate while locking up your money for a set period. While rates for high-yield savings accounts will fall immediately following rate cuts, a CD can buy you additional time to earn interest on your cash at today’s higher rates.

Shorter-term CDs with terms ranging from 30 days to a year typically have lower rates of return than longer-term CDs that lock up money for periods of up to five years. At the moment, CDs with terms of around a year offer rates of around 5% or slightly higher, which are comparable to or higher than the rates for longer-term CDs. That’s because many banks are hesitant to make long-term predictions about the economy.

For savers planning to make a significant purchase within the next year or so, it’s smart to invest that cash in a CD with a term matching the goal’s time horizon, said Jaime Eckels, a wealth-management partner and financial planner at Plante Moran Financial Advisors.

But this approach only works well when the person knows exactly how and when they are going to spend the money, she added. Over a longer term, the money may not earn as much in a CD as it would in the stock market: The S&P 500’s SPX annualized rate of return was 12.03% over the past 10 years, according to Dow Jones Market Data. But the market can be unpredictable in the short run.

“If you are going to need money for a house and you’ve got a $100,000 down payment, you wouldn’t put it in the market and hope for the best,” Eckels said.

People need to shop around to find the best rates for CDs and high-yield savings accounts, but opting for either one is better than not saving at all, Hamrick noted. When asked about their biggest financial regret, Americans were more likely to cite not saving enough for retirement or emergency expenses than they were to say taking on too much credit-card or student-loan debt, according to a new Bankrate survey.

If you’re trying to save money: Prioritize liquidity

If you don’t have a clear spending goal at the moment, a high-yield savings account gives you access to your money when you need it, financial planners say. In contrast, withdrawing funds from a CD before the end of the set term often results in penalties, and those fees are higher for longer-term CDs.

Prioritizing liquidity is essential when preparing for emergencies, Hamrick noted, in order to avoid turning to more expensive forms of debt such as credit cards or personal loans. “[T]hat causes some dominoes to fall,” he said.

If you have credit-card debt: Prioritize negotiating a lower rate and consider a balance transfer

Even after the Fed starts cutting rates, credit-card interest rates will not go down significantly, according to financial experts.

The average credit-card rate in the U.S. is currently 24.92%, according to LendingTree, while the maximum annual percentage rate, or APR, for the average new-card offer is 28.34%.

Consumers with credit-card debt should keep paying down their debt per their original plan, and take proactive steps such as calling the credit-card company to negotiate a lower interest rate, said Bobbi Rebell, a financial planner and CEO of Financial Wellness Strategies, a finance-consulting company for employee financial wellness.

Another approach would be transferring the credit-card balance to a card that has an introductory 0% rate, Eckels noted.

If you’re waiting to make a big purchase: Don’t time the market

If you’re planning to buy a big-ticket item, like an expensive computer or a kitchen appliance, it makes sense to not put it on a credit card right now. But if you’re looking to buy a house, waiting won’t do much good, according to financial planners.

Interest rates aren’t the only factor affecting the cost of buying a house. Home prices are also subject to demand from buyers, and although mortgage rates tend to move in sync with the federal-funds rate, they have come down in the past month.

“You can’t time the [housing] market. Nobody knows how to do it,” Eckels said. When rates come down, there might be more demand and more buyers, which can then push up home prices, she noted.

At the same time, people sometimes forget that they can refinance a mortgage, she added. They won’t necessarily be stuck with the same rate forever, whether they have a fixed-rate or an adjustable-rate mortgage.

The bottom line: Don’t let the thought of rate cuts take over your financial decision-making, Rebell said.

“You should always be aware of what’s going on in the macroeconomy, but don’t be so absorbed that you can’t move forward with this life decision that makes sense to you at that time,” she said.

Most Read from MarketWatch

Why Is HondaJet Aircraft Operator Volato Stock Surging Premarket Thursday?

Volato Group, Inc. SOAR shares are jumping premarket Thursday after the company disclosed an agreement with flyExclusive, Inc. FLYX to transition the management of its fleet operations to flyExclusive.

As per the Aircraft Management Services Agreement (AMS), flyExclusive will assume full responsibility for operating Volato’s fleet, encompassing both revenue and expenses.

This move is expected to yield significant cost savings for Volato and allow the company to concentrate on its growth areas, including aircraft sales and proprietary software.

This transition will enable Volato to lower its cost base by shifting operational duties to flyExclusive, which expects the fleet to be profitable under its management.

Volato will continue acquiring new HondaJets and Gulfstream G280s, which will join flyExclusive’s managed fleet, letting Volato benefit from aircraft sales while avoiding operational costs. It will also earn revenue from its Vaunt program.

FlyExclusive will add some of its empty-leg flights to Vaunt, potentially increasing the inventory by up to 500%.

Additionally, Volato and flyExclusive are considering a merger to strengthen their position in private aviation.

Matt Liotta, CEO of Volato, said, “By shifting fleet operations to flyExclusive, we reduce our operational costs while continuing to focus on delivering value through our aircraft sales and expanding our software solutions, such as the Vaunt empty leg program.”

Price Action: SOAR shares are up 16.5% at $0.4871 premarket at the last check Thursday.

Photo via Shutterstock

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Don’t miss the opportunity to dominate in a volatile market at the Benzinga SmallCAP Conference on Oct. 9-10 at the Chicago Marriott Downtown Magnificent Mile. Get exclusive access to CEO presentations, 1:1 meetings with investors, and valuable insights from top financial experts. Whether you’re a trader, entrepreneur, or investor, this event offers unparalleled opportunities to grow your portfolio and network with industry leaders. Secure your spot and get your tickets today!

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MEDIA ADVISORY- FEDERAL GOVERNMENT TO MAKE HOUSING ANNOUNCEMENT IN LONDON

LONDON, ON, Sept. 4, 2024 /CNW/ – Media are invited to join Peter Fragiskatos, Parliamentary Secretary to the Minister of Housing, Infrastructure and Communities and Member of Parliament for London North Centre on behalf of the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities, alongside Arielle Kayabaga, Member of Parliament for London West and Josh Morgan, Mayor for the City of London for a housing announcement.

|

Date: |

September 5, 2024 |

|

Time: |

2:30 pm ET |

|

Location: |

City Hall 12th floor, 300 Dufferin Avenue |

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/04/c0390.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/04/c0390.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Digest: ADSK, CIEN, ED, SWX

Summary

Sectors are Rotating: Our Monthly Survey of the Economy, Interest Rates, and Stocks The stock market experienced a mid- to late-July selloff and a very rocky start to August. Yet the S&P 500 ended up rising for both months, extending its latest winning streak to four months. The stock-selling spasms that erupted in both months were triggered by concerns that the Fed had waited too long to cut rates and, due to the lags in rate changes impacting the economy, the U.S. was headed for recession. The markets then calmed, following reassuring commentary from Fed officials and solid earnings and GDP data. The market is now in September, which since 1980 has been the worst market month with an average 1.1% decline. Election-year Septembers can be particularly volatile, though on balance they are better than all Septembers since 1980. The Economy, Interest Rates, and Earnings The broadest measure of the U.S. economy, Gross Domestic Product, appeared to show a healthy and even accelerating economy as of mid-year. The preliminary (second of three) report of second-quarter GDP exceeded the advance report and was meaningfully above first-quarter levels, and in particular indicated a recovery in consumer spending. A review of the second quarter does appear to indicate a normally growing economy as of mid-year. The preliminary report of second-quarter GDP showed growth of 3.0%, more than double the 1.4% growth rate reported for 1Q24. Ahead of the advance report release, the consensus call was for low 2% growth in the first quarter. The increase in second-quarter 2024 GDP primarily reflected increases in personal consumption expenditures, private inventory investment, non-residential fixed investment, and total government spending. These gains were partly offset by a decline in residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased and exceeded exports. Personal consumption expenditures for 2Q24 increased 2.9%, up from 1.5% for 1Q24 and 2.2% for all of 2023. Spending on goods increased 4.9% in 2Q24, after falling 2.3% in 1Q24. Durable goods spending rebounded by a sharp 4.7% in 2Q24, after declining 4.5% in the prior quarter. Durable goods spending was up 4.2 % for all of 2023. Non-durable goods spending also bounced back, rising 2.0% for 2Q24 after declining 1.1% for 1Q24. The decline in annual inflation growth has mainly been concentrated in goods, while services inflation remains stubbornly elevated. Consumers may now be willing to buy goods at stable or even lower prices. Consumer spending on services grew 2.9% in 2Q24 and was the one component of PCE that declined from the first quarter. Consumer spending on services grew 3.3% in 1Q24. Some of the growth in consumer services spending is being driven by rent equivalent and insurance, two costs consumers cannot control and many cannot avoid. The very weak trend in 1Q24 consumer spending appeared to provide further evidence of the consumer under siege from multiple years of inflation. The bounce-back in second-quarter consumer spending could suggest that consumers have adapted to higher prices, or it could turn out to be a head-fake. We expect PCE within the GDP accounts to continue to send conflicting signals, with overall goods spending more volatile than services. Non-residential fixed investment, the proxy for corporate capital spending, rose at a 4.6% annual rate in 2Q24, after rising 4.4% in 1Q24. This category was also healthy in 2023, rising 4.5%. Spending on equipment increased in low-double-digit percentages, while spending on intellectual property was up in low-single digits. Some of the growth in capital spending in 2023 and in the 2024 first half has been the result of corporations facing higher costs for everything. PCE and non-residential fixed investment represent about four-fifths of gross domestic product in any quarter. In 2Q24, consumer spending added 1.95 percentage point to GDP, while non-residential fixed investment added 0.6 percentage point. Residential fixed investment, which surprised with 16% growth in 1Q24, dropped back into negative territory, declining 2.0% in 2Q24. The export-import balance heavily favored imports in 2Q24, as it did in 1Q24. Exports grew 1.6% in 2Q24, while imports were up 7.0%. Given the higher dollar value of imports, the net exports-imports balance subtracted about three-quarters of a percentage point (77 basis points) from overall 2Q24 GDP growth. We expect this category to remain volatile quarter over quarter. Another volatile character has been the change in private inventories. This category added 78 basis points (bps) to GDP in 2Q24, after subtracting 42 bps from 1Q24 GDP growth. Disruptions in the distribution channel began with the trade and tariff wars of 2017-2020 and worsened with the supply-chain crisis in 2021-2022 and the supply-chain glut in 2023. We look for private inventories to maintain the excessive volatility in this series that has prevailed since the pandemic. Overall government spending was up 3.1% and added just under one-half percentage point to GDP growth. Federal spending increased 3.3% in 2Q24 after declining in 1Q24, while state and local government spending grew 2.3%. The price index for gross domestic purchases increased 2.4% in 2Q24, compared with an increase of 3.1% in 1Q24. The PCE price index advanced 2.5%, down from 3.4% in 1Q24. The core PCE index also came down from 1Q24. Higher GDP with lower price increases in 2Q24 marked a real improvement from 1Q24. Much of investors’ concerns can be found outside the GDP accounts. U.S. economic indicators generally suggest deceleration, although growth continues at a subdued level. The consumer economy continues to send mixed signals, with jobs and wages still growing – but at a meaningfully slower pace. The U.S. economy shocked with 114,000 new jobs in July, well below the consensus of 175,000. July was also well below the 12-month average of 215,000. The unemployment rate rose to 4.3% for July 2024 from 4.1% for June, and was up sharply from 3.5% a year earlier in July 2023. Average hourly earnings increased eight cents month-to-month for July and were 3.6% higher year-over-year. July annual wage growth represented a return to sub-4% growth; annual wage has mainly exceeded 4% since June 2021. Annual wage growth continues to run above inflation, but the premium has narrowed. In August, the Bureau of Labor Statistics within the Department of Labor reported revised data showing 818,000 fewer nonfarm payroll jobs than initially reported were created for the trailing one-year period. From April 2023 through March 2024, the economy added about 2.1 million new jobs – 30% fewer than the initially reported 2.9 million. Most industries reported downward revisions, with notably lower levels in information services, professional & business services, and mining & logging. Transportation & warehousing was the only category to be revised higher, indicative of our increasing reliance on e-commerce. The consumer seems slightly more optimistic or perhaps reconciled to higher prices. After three straight tepid months in April through June, retail sales for July surged by 1.0% from June levels. On a year-over-year basis, retail sales were up 2.7% in July, compared with 2.3% annual growth reported for June 2024. Annual growth was particularly strong for electronics & appliances, motor vehicle parts & gasoline, and health and personal care items. Purchasing managers across the industrial economy remain cautious. ISM’s manufacturing PMI came in at 46.8% for July 2024, down from 48.5% in June. The manufacturing PMI remained in contraction territory – below 50 – for the fourth straight month and for the twentieth time in the past 21 months. ISM’s services PMI slipped into contraction territory in June, falling to 48.8%. ISM’s service PMI rebounded to 51.4% in July, however, and has been in positive territory in six of the seven months reported for 2024 to date. The services economy is significantly larger than the manufacturing economy, and continued strength in this category is vital to ongoing economic growth. Industrial production showed surprising weakness in July, declining 0.6% month over month after rising a revised 0.3% in June. July capacity utilization dipped to 77.8%, putting it nearly two percentage points below the long-run average. Straddling the commercial and consumer economies is housing. Consistent with the negative residential fixed investment data from 2Q24 GDP, the housing economy continues to struggle. Based on SAAR (seasonally adjusted annual rate), both new and existing home sales are running at about 60% of peak pandemic levels. At the same time, pent-up Millennial demand for housing continues to intensify. Aging Baby Boomers have been locked into too-large homes by low mortgage rate. The plunge in interest rates accompanying the summer stock selloff could have a silver lining if it unlocks the housing market. Following surprising second-quarter strength, Director of Economic Research Chris Graja, CFA, raised the Argus forecast for 2024 GDP growth to 1.9%, from a prior 1.7%. Chris expects quarterly GDP to growth in the sub-2% range in the third and fourth quarters. We expect GDP growth in the 2% range in 2025, with the economy strengthening into the second half as lower rates stimulate consumer and business activity. Given the overhang of high prices and interest rates, and with the consumer weary from years of inflation, our GDP growth forecasts for 2024 and 2025 are likely to remain volatile. We also continue to believe the U.S. economy can avoid recession in 2024 and 2025, as it did in 2023 and 2022. The U.S. central bank started its rate-hiking campaign in March 2022 well behind the inflation curve. Sixteen months and more than five percentage points later, the Fed halted in July 2023. At its mid-July 2024 FOMC meeting, the Fed voted to hold the fed funds rate steady at the 5.25%-5.50% tendency, as it had done for eight straight meetings since July 2023. The market mood has certainly changed, however. Weariness with inflation has given way to worries about recession. At the beginning of the central-banking rate-hiking campaign, investors feared that the Fed was ‘behind the curve’ in its fight against inflation. With inflation down to within a point of the Fed’s 2% target, that now seems like the last war. Investors once again fear that the Fed is ‘behind the curve,’ this time in its need to cut rates before the U.S. tips into recession. In July, the FOMC statement pushed back against recession fears, noting that economic activity ‘continues to expand at a solid pace.’ Although employment growth has moderated, the statement continued, unemployment has moved up but remains low. Language in the June FOMC report noted ‘modest further progress toward the Committee’s 2% inflation objective.’ In July, the Fed echoed its ‘further progress’ commentary. In August, Fed Chair Jay Powell used the forum of this year’s Jackson Hole Economic Symposium to allay recession fears. In his calm and reassuring speech, the Fed Chair stated that the ‘time has come’ to cut interest rates in response to cooler inflation and slowing economic growth. Inflation has ‘declined significantly,’ he added, and the labor market ‘is no longer overheated.’ Perhaps most notably, Fed Chair Powell acknowledged that ‘the balance of risks to our two mandates has changed.’ Inflation is receding, and the mandate to return inflation to 2% has nearly been met. At the same time, the economy has softened from recent peaks, and the mandate to maintain maximum sustainable employment is now at risk. Reversals in Fed policy, and particularly the move from raising rates to cutting rates, inevitably come at a fraught time for the economy. In those periods, the economy is seen as vulnerable to too little stimulus, while inflation is at risk of returning from too much stimulus. Mr. Powell’s calm tone in addressing the dual mandate, in our view, was a necessary lubricant in the shift from restrictive to accommodative monetary policy. The Fed’s preferred inflation gauge, the core PCE price index, rose 0.2% in July and was up 2.6% year over year. The monthly number matched the June and May levels. The annual change declined from the June reading, which had been the lowest annual rate of change in the core PCE price index since March 2021. The core PCE data confirmed inflation inputs from the July CPI report issued in August. The all-items CPI rose 0.2% month over month in July, after declining 0.1% in June. On an annual basis, the July all-items CPI was up 2.9%, down from June’s 3.0% annual rate of change. Core CPI was up 0.2%, and the annual change in core CPI was 3.22%, also down one tick from June. Goods inflation has come off markedly, while inflation in services is still stubbornly high. The index for shelter rose 0.4% month-over-month in July and accounted for nearly 90% of the increase in all-items CPI. The 10-year Treasury yield was 3.91% as of the end of August, level with 3.89% at the end of July and down from the 4.7% level as recently as the end of April. The two-year Treasury yield was 3.91% as of the end of August, down from 4.16% as of end of July and the peak level of 4.96% as of end of April. On 8/27/24, the two-year and 10-year Treasury yields were both 3.83%. This marked the first time the two-year yield was not above the 10-year yield since April 2022. These two yields also ended August at the same level. Argus expects long yields to move relatively higher from current levels and short-term yields to move relatively lower. But we are not ready to call for a decisive end to twos-10s inversion. Given recession fears and potential volatility in inflation data, two-year and 10-year yields may remain in close proximity as late as the first quarter of 2025. We also see the potential for twos-10s inversion to end during 2024. Argus Fixed Income Strategist Kevin Heal is now modeling three quarter-point rate cuts in 2024: one each at the September, November, and December FOMC meetings. Note that the November FOMC meeting occurs post-election. Each cut is expected to be 25 basis points, bringing the Fed’s central tendency to the 4.50%-4.75% level by year-end. We regard the rate-cut outlook as dynamic, to say the least. As shown in the CME FedWatch tool, the probability of a 25 bps cut at the September FOMC meeting is about 66%; the probability of a 50 bps cut at the September meeting is now about 34%. As of the November meeting, the CME FedWatch tool indicated a 42% probability of cumulative 50 bps reduction in fed funds and 47% probability of cumulative 75 bps reduction. And by the December meeting, the CME FedWatch tool indicated a 44% probability of cumulative 75 bps reduction in fed funds and 27% probability of cumulative 100 bps reduction. Despite the increasing likelihood of multiple rate cuts in the final four months of 2024, the Fed is expected to proceed cautiously next year, according to Kevin Heal, with a measured pace of additional rate cuts in 2025. First-quarter 2024 earnings outpaced expectations, but were below the double-digit growth that prevailed in the pandemic and immediate post-pandemic era. Second-quarter 2024 earnings from continuing operations are up in high-single-digit to low-double-digit percentages, according to our vendor survey. Along with GDP growth, second-quarter earnings represent a bulwark against growing recession concerns. With over 75% of S&P 500 component companies having reported results, second-quarter 2024 earnings from continuing operations were up 11.5% compared with 2Q23 EPS, according to FactSet, and up 12.9% according to Refinitiv. According to Bloomberg, 2Q24 earnings w up 12.5% on a share-weighted basis and 16.5% on a market-cap-weighted basis. This premium of market-cap-weighted to share-weighted EPS growth is reflective of the earnings outperformance of large-capitalization companies compared with small- and mid-caps. An unusually high percentage of companies (25%-plus) have reported negative earnings for 2Q24. The average EPS decline for the negative-earnings group, which is heavily weighted in Energy, Materials, and Real Estate, is 16%. For the 75% of companies reporting positive EPS, average earnings growth is a robust 22%. A key reason investors are optimistic about second-half 2024 earnings growth is that the negative drag from Energy, Materials, and Real Estate is expected to diminish in 3Q24 and potentially reverse in 4Q24. About 78% of companies have reported positive EPS surprises in 2Q24, compared with 14% of companies reporting negative surprises. These percentages are above the 10-year average of 74%. For these companies, the median beat against consensus estimates is 5% (FactSet has it at 4.5%). For the first time in several quarters, the median beat against expectations is below the 10-year average of 6.8%. At the sector level, the strongest earnings growth is coming from Financial, Information Technology, and Utilities – all up in mid-teen percentages year over year. Other sectors reporting positive EPS growth include Communication Services, Healthcare, Consumer Discretionary, Consumer Staples, and Industrials, in descending order. As noted, Energy, Materials, and Real Estate are all down; Materials is off in high single digits, while Energy and Real Estate earnings are down 20%-21% from a year earlier. Second-quarter earnings were coming in about in line with Argus expectations. For 2Q24, Argus continues to model high-single-digit continuing-operations EPS growth for S&P 500 component companies. We see a higher likelihood that our forecast misses on the upside than on the downside. In other words, once all the component companies are tallied, we are more likely to see low-double-digit EPS growth for 2Q24 than we are to see mid-single-digit EPS growth. According to Argus President John Eade, our stock-bond barometer is near equilibrium. Given declining inflation growth and interest rates along with our forecast for high-single-digit EPS growth for 2024 and 2025, coupled with the July-August selloff, stocks appear favorable at current levels. A key risk to valuations would be earnings growth failing to meet the market’s targets and/or inflation or interest rates ticking higher. Either of those factors would result in elevated valuations, but represent just modest risks at present. Domestic and Global Markets Growth stocks sectors began to pull away from the broad market in May and extended that leadership in June. Both July and August had strong sell-offs but rallied to post wins for the month. Beneath the surface, both months extended the severe rotation away from growth leaders and toward stocks seen as safer havens. For the firs

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

1 Stock-Split Artificial Intelligence (AI) Stock to Buy Before It Soars 285%, According to Certain Wall Street Experts

Last week, Nvidia (NASDAQ: NVDA) reported solid financial results for the second quarter, but the stock has now tumbled 20% from its high. The drawdown was fueled by concerns about the sustainability of the artificial intelligence (AI) boom and the delayed launch of Blackwell, Nvidia’s next generation of data center chips.

That represents a dramatic change in market sentiment for the semiconductor company. Only three months ago, Nvidia announced a 10-for-1 stock split alongside phenomenal first-quarter financial results, and that news caused shares to surge 20% during the following week.

But Nvidia is still on pace to be a $10 trillion company by 2030, according to Beth Kendig, lead technology analyst at the I/O Fund. She remains upbeat about Blackwell and expects an upward revision in the consensus earnings estimate for the next fiscal year. “Early next year will be fireworks again for Nvidia, and we will be on track for that $10 trillion,” she told Yahoo Finance.

Former hedge fund manager and current Mad Money host Jim Cramer came to the same conclusion several years earlier. In 2021, he told CNBC’s Halftime Report that Nvidia could eventually be a $10 trillion company, and his conviction has not wavered. “I stand by my view that you should own Nvidia stock and not trade it,” Cramer recently told viewers.

Nvidia is currently worth $2.6 trillion, so the $10 trillion target set by Kendig and Cramer implies 285% upside for shareholders. Here’s what investors should know.

Nvidia has a durable competitive advantage in AI chips

Nvidia is best known for its graphics processing units (GPUs), chips that complete complex calculations orders of magnitude faster than central processing units (CPUs). The company accounted for 98% of data center GPU shipments last year, and its GPUs accounted for over 80% of AI processors, according to analysts. Nvidia is also the market leader in AI networking equipment, according to Morningstar.

However, Nvidia is truly formidable because it pairs cutting-edge hardware with proprietary CUDA software. The CUDA platform includes over 400 software libraries (building blocks) that streamline GPU application development across a broad range of disciplines. Nvidia launched CUDA in 2006, and the ecosystem is still expanding. For instance, the company added new libraries for data processing, generative AI, and physics simulations in August.

Morgan Stanley analysts wrote in a recent note, “We have seen many threats to Nvidia come and go since 2018 — something like a dozen start-ups, several efforts from merchant competitors such as Intel and AMD, and several custom designs. Most of these have come up short. Competing with Nvidia, a company that spends over $10 billion per year in R&D, is a difficult feat.”

Blackwell GPUs could be the most important product in Nvidia’s history

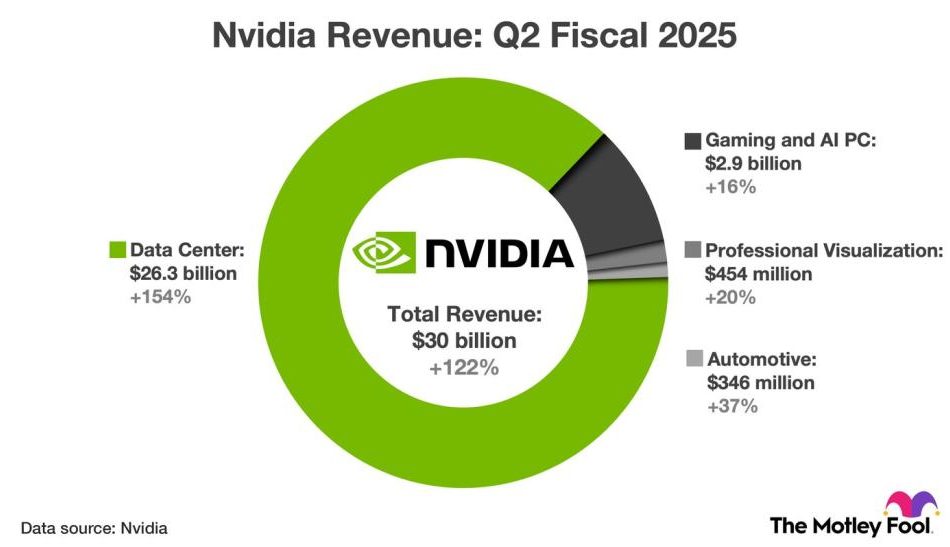

Last week, Nvidia reported excellent financial results for the second quarter of fiscal 2025 (ended July 2024). Revenue increased 122% to $30 billion as demand for AI hardware and software drove strong sales growth in the data center segment. Meanwhile, non-GAAP (generally accepted accounting principles) net income surged 152% to $0.68 per diluted share.

The chart below provides segment-specific revenue figures for the second quarter.

Shown above is second-quarter revenue growth across Nvidia’s four primary business segments. OEM & Other revenue has been excluded because it accounted for less than 1% of total revenue.

In August, The Information published a report alleging that Blackwell GPU shipments would be delayed due to design flaws discovered unusually late in production. Nvidia CFO Colette Kress provided context on the recent earnings call: “We executed a change to the Blackwell GPU mass to improve production yields. Blackwell production ramp is scheduled to begin in the fourth quarter.”

That means Blackwell will hit the market about three months later than originally quoted by management. But CEO Jensen Huang still believes the platform will be a game changer for the industry. In fact, he recently told analysts, “The Blackwell architecture platform will likely be the most successful product in our history.”

Nvidia stock trades at a reasonable valuation

Wall Street analysts expect Nvidia’s adjusted earnings to increase at 49% annually through fiscal 2026 (ends January 2026). That consensus estimate makes its current valuation of 48 times adjusted earnings look reasonable.

As for the $10 trillion target Beth Kendig and Jim Cramer set, I think Nvidia could hit the milestone by 2030. For instance, if we assume the price-to-earnings ratio falls to 25 by the end of the decade, Nvidia would achieve a $10 trillion valuation if earnings increased at 36% annually.

That is well within the realm of possibility. In fact, spending across AI hardware, software, and services is expected to increase by 36% annually through 2030, according to Grand View Research. However, investors should not take that outcome for granted. A lot could go wrong in the next six and a half years.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

1 Stock-Split Artificial Intelligence (AI) Stock to Buy Before It Soars 285%, According to Certain Wall Street Experts was originally published by The Motley Fool

Kroger CEO pins price increases on rising costs at trial

By Deborah Bloom and Jody Godoy

PORTLAND, Oregon (Reuters) – Kroger CEO Rodney McMullen attributed rising grocery prices to increasing costs for retailers as he defended the grocery chain’s proposed $25 billion merger with rival Albertsons at a trial on Wednesday.

In testimony a trial in Portland, Oregon, McMullen cited rising supplier costs, fuel prices and credit card swipe fees when asked by the company’s lawyer why prices have risen.

The U.S. Federal Trade Commission and several states sued in federal court to block the merger, and are seeking to show the deal would lead to higher prices and reduce the bargaining leverage of unionized store workers by ending the fierce rivalry between Kroger and Albertsons.

Soaring food prices, which have become a hot button political issue in the U.S. presidential race, have risen 25% between 2019 and 2023, faster than other consumer goods and services, U.S. Department of Agriculture statistics showed.

“Absolutely not,” McMullen replied when asked if Kroger would raise its prices after the merger. “We believe over time, value will be increasingly important and you can’t price your items above the market.”

Kroger has argued it needs the increase in scale from the merger to compete with Walmart, the largest U.S. retailer, while Albertsons has said if the deal falls through, it may have to consider layoffs and store closures.

(Reporting by Deborah Bloom in Portland; Writing by Jody Godoy in New York; Editing by Richard Chang)

Why ChargePoint Stock Is Crashing Today

ChargePoint Holdings (NYSE: CHPT) stock slumped this morning, plunging 23.1% at its lowest point in trading through 11:20 a.m. ET Thursday. ChargePoint operates the largest electric vehicle (EV) charging network in the U.S., but demand has failed to keep up with the company’s expectations. The evidence lies in ChargePoint’s latest quarterly numbers, released yesterday.

Although ChargePoint’s net loss shrank in the second quarter, the company’s guidance has left investors in the lurch.

ChargePoint’s revenue continues to fall

Here are some key numbers from ChargePoint’s second-quarter earnings report:

-

Revenue: Down 28% year over year to $108.5 million

-

Gross margin: 24% versus 1% in the year-ago quarter

-

Net loss: Improved to $68.9 million from $125.3 million in the year-ago period

The improvement in ChargePoint’s gross margin and losses looks impressive. Still, management primarily credited it to year-over-year comparisons, having booked inventory impairment charges in Q2 last year that hit its bottom line.

More importantly, ChargePoint’s top line is showing no signs of a recovery yet, with revenue from its primary business of networked charging systems slumping 44% year over year in the second quarter. Although its subscription revenue rose 21%, it wasn’t enough to offset weak demand for ChargePoint’s charging systems.

Is there any hope left for ChargePoint stock?

There’s no point in mincing words when it comes to ChargePoint. The truth is that ChargePoint is facing plenty of challenges. On the one hand, demand for EVs has softened globally, and on the other, competition in EV charging is heating up.

ChargePoint knows these are tough times and it must save money to slow down its cash burn, which is why it has also announced plans to lay off 15% of its global workforce. With the company also projecting revenue of only $85 million to $95 million for the third quarter — meaning an 18% drop year over year — ChargePoint stock will need a really solid catalyst to rebound.

Should you invest $1,000 in ChargePoint right now?

Before you buy stock in ChargePoint, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ChargePoint wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $650,810!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why ChargePoint Stock Is Crashing Today was originally published by The Motley Fool

Stocks could see a 10% correction by early October on a trifecta of bearish factors, strategist says

-

Renaissance Macro’s Jeff DeGraaf predicts a 10% stock market drop amid three bearish factors.

-

Tech stocks may underperform after rate cuts, impacting market stability, according to DeGraaf.

-

“There’s still a little longer fuse on this correction that’s likely to take place before we’re done,” DeGraaf said.

A trifecta of bearish factors could send stocks lower by about 10% within the next few weeks, according to Renaissance Macro Research founder and technical strategist Jeff DeGraaf.

In an interview with CNBC on Wednesday, DeGraaf said the Nasdaq 100 could trade to 17,000, a key technical level he is monitoring which represents 10% downside from current levels.

For the S&P 500, DeGraaf is closely watching the early August low of 5,120 for a potential retest of support. That level represents about 7% downside from current levels.

DeGraaf is concerned that sentiment remains in bullish territory, which isn’t typically seen when the market is at or near a bottom.

“When we look at where the sentiment is in terms of small speculators on the NDX futures, they’re still very very net long. In other words, they’ve been using this weakness as a buying opportunity. And that’s not usually the right behavior to create some kind of low,” DeGraaf said.

The S&P 500 is about 3% below its record high, while the Nasdaq 100 is down about 8%.

The bullish sentiment among traders is also contrasted by the fact that September has historically been a bad month for stocks.

Finally, DeGraaf said that technology stocks, which have been leading the market higher since the bull market started in October 2022, typically underperform in the three months following the Federal Reserve’s first interest rate cut.

“When we look particularly at technology, it does not fare well after the first rate cut. It’s very pro-cyclical, cyclicals tend to underperform for at least three months after the first Fed rate cut,” DeGraaf said.

“So even though it feels like the calvary is on the way and good things are likely to happen, the data probably continues to be weaker and I think that’s one of the things that’s kind of piling up on us here.”

As to how the decline plays out, DeGraaf said there could be further weakness toward the end of September, spilling over into early October.

Such a decline would create a two-month window of stocks seeing little movement, which can “become pretty disheartening for people,” DeGraaf said.

Another potential decline could come in the form of a quick flush of positioning among trend followers and “sheer panic” among investors, similar to what happened in early August amid the yen carry trade blowup.

Until one of those two things happens, DeGraaf sees short-term stock market risks skewed to the downside.

“Neither one of those have we seen yet and that’s why we think there’s still a little longer fuse on this correction that’s likely to take place before we’re done,” DeGraaf said.

Read the original article on Business Insider

Compass CEO & Founder Robert Reffkin to Speak at Zelman Housing Summit

NEW YORK, Sept. 4, 2024 /PRNewswire/ — Compass, Inc. COMP (“Compass” or “the Company”), the largest residential real estate company in the United States by sales volume1, announces that its CEO & Founder Robert Reffkin will speak at the Zelman Housing Summit on Thursday, September 12, 2024, at the InterContinental Hotel in Boston.

Reffkin’s interview will be broadcast via a public webcast at https://walkerdunlop.zoom.us/webinar/register/WN_UiJjrHB7QX-xVIRNX0heaw#/registration and will be available for replay under the “Events & Presentations” section on the Compass Investor Relations website: https://investors.compass.com.

About Compass

Compass is the largest residential real estate brokerage in the United States by sales volume. Founded in 2012 and based in New York City, Compass provides an end-to-end platform that empowers its residential real estate agents to deliver exceptional service to seller and buyer clients. The platform includes an integrated suite of cloud-based software for customer relationship management, marketing, client service, brokerage services and other critical functionality, all custom-built for the real estate industry. Compass agents utilize the platform to grow their business, save time and manage their business more effectively. For more information on how Compass empowers real estate agents, one of the largest groups of small business owners in the country, please visit www.compass.com.

1 RealTrends, Online, “Top Real Estate Brokerages By Volume in 2024”, https://www.realtrends.com/500-by-volume/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/compass-ceo–founder-robert-reffkin-to-speak-at-zelman-housing-summit-302238565.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/compass-ceo–founder-robert-reffkin-to-speak-at-zelman-housing-summit-302238565.html

SOURCE COMPASS

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.