10th Annual Glow Ride for Cystic Fibrosis: Claire's Place Foundation Shines Brighter Than Ever

Los Angeles, CA, Sept. 05, 2024 (GLOBE NEWSWIRE) — Claire’s Place Foundation, a non-profit organization providing support to children and families affected by cystic fibrosis (CF), is excited to announce its milestone 10th Annual Glow Ride for CF, set to light up Hermosa Beach on September 21, 2024.

Celebrated as a finalist for “Fundraiser of the Year” by the Los Angeles Business Journal, the 2024 Glow Ride for CF will once again transform the iconic Hermosa Beach Pier into a radiant celebration of community and hope. Participants of all ages are invited to deck out their bikes in brilliant glowing decor, lace up their skates or hop on their skateboards, creating an unforgettable evening of vibrant energy. The event will feature electrifying beats from three DJs, a silent disco and dazzling moments under the gigantic rainbow arch, perfect for capturing those Instagram-worthy memories. By joining the Glow Ride, you’ll not only experience the joy of a luminous beachside party, but also play a vital role in supporting families battling CF.

“Our Glow Ride for CF has grown into a beloved tradition—a night where joy and purpose converge,” said Claire’s Place Foundation Executive Director Melissa Yeager. “As we celebrate the 10th anniversary of this incredible event, I’m filled with pride and emotion, reflecting on how my daughter Claire’s vision has blossomed into something truly special. Her unwavering passion for helping others is her legacy, and it continues to inspire us through every Glow Ride and every grant we provide. This year’s Glow Ride will be extra special with unique attractions to mark this momentous occasion.”

Claire’s Place Foundation has been a steadfast source of hope and assistance for CF families. The Glow Ride for CF directly supports the Claire’s Place Foundation Extended Hospital Stay Grant Program, which covers essential living expenses for CF patients and their families during prolonged hospitalizations.

“This year, the CF community faces unprecedented financial challenges,” said Melissa. “The funds we raise at the Glow Ride are crucial in helping families keep a roof over their heads and their lights on during extended hospital stays due to this life-threatening illness. We need your support more than ever! Please join us on September 21st, light up the night with us, and help make a difference in the lives of those who need it most.”

EVENT REGISTRATION DETAILS

The 10th annual Glow Ride for CF on Saturday, September 21, 2024, promises an evening of excitement, unity and compassion. Each ticket includes a limited edition glow-in-the-dark t-shirt, a glow wristband and glow goodies to decorate your wheels for the 3.4-mile ride. Can’t make it to Hermosa Beach? Sign up as a virtual participant. Communities worldwide can unite and fundraise in their neighborhoods. Register here for all options. The CF community needs your glowing support!

EVENT SPONSORS

The 2024 Annual Glow Ride welcomes Vertex Pharmaceuticals, NorthStar Moving Company, Hermosa Cyclery, Athens Services, Withum, Western Truck Insurance Company, Southbay Lexus, UCLA Health and Manhattan Dermatology, as event sponsors.

About Claire’s Place Foundation, Inc.

Claire’s Place Foundation, Inc. is a 501(c)(3) non-profit organization providing support to children and families affected by cystic fibrosis (CF). Claire’s Place Foundation is named in honor of Claire Wineland who lived with CF her entire life and died at the age of 21. Claire was an activist, author, TEDx Speaker, social media star and received numerous awards. Claire’s foundation was a way for her to assure that others living with CF enjoyed the same hope, strength and joy that she enjoyed. Recipient of Los Angeles Business Journal’s “Small Nonprofit of the Year” and “Fundraiser of the Year Finalist” for its annual Glow Ride, the foundation provides grants to families affected by CF, offering both emotional and financial support. Today, Claire’s Place Foundation continues to carry on Claire’s legacy. For more information and make a donation, please visit www.clairesplacefoundation.org.

Carrie N Callahan Claire's Place Foundation 6174134589 carrie@nashcallahan.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TDFO Hospitality Welcomes Shiah Goldberg to Executive Leadership Team

MELBOURNE, Fla., Sept. 4, 2024 /PRNewswire/ — TDFO Hospitality, operating as Blend and Barrel, a Community Champion Company and subsidiary of TDFO Holdings, is thrilled to announce the addition of Shiah Goldberg to its Executive Leadership team. Mr. Goldberg joins TDFO Hospitality as a new partner and will assume the role of Director of Operations.

In his new role, Mr. Goldberg will oversee the rebranding of the flagship retail location, Executive Cigar Shop and Lounge, situated on the picturesque Lake Monroe in Sanford, FL, to the new Blend and Barrel brand. Additionally, he will spearhead brand and product development in coordination with Blend’s second location in Cocoa Beach, FL, known as “The Office,” managed by partner Micah Rose. “The Office” recently celebrated a successful grand opening on August 17th, and the executive team is enthusiastic about its new beachside location.

Mr. Goldberg’s extensive background in hospitality encompasses every position within the service industry. His journey began with a passion for service, hospitality, and the culinary arts, leading him to culinary school post-university. “An early mentor of mine ingrained in me the importance of proficiency and respect for each role within the industry. It was this philosophy that helped to shape my parallel paths through the luxury hospitality and premium cigar arenas,” Shiah explains. His evolution has taken him through various roles in both front and back-of-house to General Manager. At an early age, he became an operating partner in his first upscale cigar retail operation, where he also served as General Manager and Business Development Lead for a sister speakeasy-themed lounge. This experience solidified his lifelong connection to the cigar industry.

Leveraging his comprehensive hospitality experience, Mr. Goldberg transitioned to roles such as Sales Director and VP of Sales for two emerging cigar manufacturers, significantly growing their core accounts and customer development. In September 2016, he joined Prime Cigar in Boca Raton, FL, as a manager, evolving to General Manager of the Brickell location in downtown Miami. This Casa De Montecristo co-branded entity became one of the most sought-after cigar lounges in the country during this period and the flagship for Prime Cigar’s brand evolution into Empire Social.

Amid the COVID-19 pandemic, Davidoff of Geneva recruited Mr. Goldberg for the US Brand Ambassador position. During his tenure, he led Brand Activation, Training, and Education initiatives both internally and within their Appointed Merchant Network, while also managing internal and external communications. Reflecting on his time with Davidoff, Mr. Goldberg states, “My tenure at Davidoff was as educational towards the marketplace and business of premium cigars as my previous 12 years combined.” He adds, “It feels like my entire working life has been leading me to this point. From the desire to anticipate and exceed customer expectations, to the operations of acclaimed companies such as Hillstone and Davidoff of Geneva, as well as the experiential emphasis from Empire Social, I am thrilled and honored to be able to bring this to TDFO Hospitality and Blend and Barrel. From the very first time we met, Tom Darnell and I aligned personally and professionally. Our appreciation for the finer things and the entities who excel at delivering exceptional products and experiences had us talking, brainstorming, and building excitement from the starting line. With each step closer to this partnership, our excitement and passion for the present and what we will bring in the future reinforced our collective drive. I look forward to working with the incredible team already in place and propelling us to the pinnacle of this beloved industry. Customer experience is the single most important aspect, and we will always keep this focused in the crosshairs.”

Contact:

Thomas Darnell

1321-508-0992

tdarnell@govcompanion.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/tdfo-hospitality-welcomes-shiah-goldberg-to-executive-leadership-team-302238601.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/tdfo-hospitality-welcomes-shiah-goldberg-to-executive-leadership-team-302238601.html

SOURCE Community Solutions Partner, CSP dba/ Community Champions

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Electric Vehicle (EV) Stocks That Could Make You a Millionaire

There’s no denying electric vehicles (EVs) aren’t quite as common as the world initially expected them to be by this point in time. Although they exist and have a place within the automobile industry, the International Energy Administration reports that a little less than 1-in-5 vehicles sold in 2023 are powered by an electrically driven motor (including plug-in hybrids). In the meantime, consumer interest in EVs is waning here and abroad, with many people citing a combination of range concerns and sheer cost as their chief purchase roadblocks. Far too many electric vehicle stocks have performed far too poorly as a result.

While it has fallen short of early expectations, the EV industry is still growing. Bloomberg Intelligence predicts last year’s worldwide EV sales of around 14 million will swell sales of 30 million in 2027, en route to 73 million EV sales in 2040. With trends working in their favor, several unprofitable EV manufacturers could grow their way out of the red and into the black, pushing their underperforming stocks much higher as a result. It’s this projected growth that has investors excited about the potential for millionaire-making returns.

Here’s a closer look at three potential millionaire-making EV stocks that risk-tolerant investors might want to consider.

1. Nikola

The discussion around EVs tends to focus on passenger vehicles, and for good reason — the world buys more than 70 million such automobiles every year. EVs’ underlying technology, however, isn’t limited to passenger-first automobiles. In many ways, are well suited to the hauling and logistics market. That’s mostly class-8 tractor-trailers (or “big rigs”) which are on the road for several hours per day for several days a week. Averaging just 6 mpg of diesel fuel, one truck can burn through tens of thousands of gallons of fuel every single year.

Enter Nikola (NASDAQ: NKLA). It makes battery-powered class-8 tractors — as well as hydrogen-powered versions of these haulers — that are proving efficient, and marketable. They’re on par with diesel in terms of total pulling power, trip distance, and operating costs, but markedly cleaner to operate, meaning they’re already meeting ever-rising emission standards. That’s why the company sold another 72 of its hydrogen fuel cell trucks last quarter, bringing total unit sales to 147 after just three quarters’ worth of availability. Buyers include outfits like Walmart. For perspective, roughly a quarter-of-a-million of these heavy haulers are sold every year in the United States alone, and the U.S. is only a fraction of the global market.

Oh, Nikola also monetizes the tech by supplying the hydrogen needed to power its rigs. This network of fueling stations is expanding as well, as usage of its trucks grows.

The company isn’t yet profitable, which is perhaps the key reason its stock has dished out more frustration than gains since soaring in 2020 during the COVID-19 pandemic. With revenue growth this year and next year expected to exceed 200%, the losses are shrinking fast.

Analysts expect this trend to matter. Their current consensus price target over the next 12 months of $16.80 is more than 150% above the stock’s present price. Keep in mind though that Nikola is dealing with some serious capital (or lack thereof) problems of late. That means there’s above-average risk to consider here as well for investors.

2. Rivian Automotive

To be sure, ordinary passenger vehicles present a tremendous EV opportunity as well.

Tesla (NASDAQ: TSLA) mainstreamed the idea and, for years, was the only major player in the EV space. But good business ideas eventually draw newcomers. Founded as EV sports car maker Mainstream Motors back in 2009, the company became Rivian Automotive (NASDAQ: RIVN) a couple of years later and officially entered the EV market at scale in 2021 with all-electric pickup trucks, sports utility vehicles, and thousands of battery-powered delivery vans made for e-commerce giant Amazon.

Rivian’s product focus is savvy. Conventional sedans are marketable, but consumers love their trucks and SUVs. The National Automobile Dealers Association estimates about 80% of last year’s vehicle sales in the United States were light trucks — a category that includes SUVs and pickups. These bigger vehicles also sell surprisingly well in Europe, and increasingly, even in China. For now, Rivian only manufactures and markets its vehicles in North America, but it intends to enter Europe in the foreseeable future. China and other parts of Asia have been on the radar for some time as well.

Like Nikola, Rivian isn’t profitable. It probably won’t be profitable in the near future either.

It is making progress to that end though, and is positioned to capitalize on the EV industry’s long-term growth.

3. Toyota

Last but not least, add Toyota Motor (NYSE: TM) to your list of electric vehicle stocks that could help you eventually become a millionaire.

If it seems like Toyota hasn’t shown much focus on EVs in the past, you’re not imagining things. It hasn’t. While it does make battery-powered and hybrid vehicles, it’s not invested a ton of time and money in them. It’s instead remained largely focused on traditional combustion-powered vehicles while allowing other carmakers to go to the trouble and expense of blazing the EV trail.

Now that’s finally changing. With EV technology (mostly) optimized and charging infrastructure now falling into place, the company’s turning up the heat. Last year’s sales of Toyota EVs jumped 35%. That’s huge progress even if these vehicles still only account for about one-third of Toyota’s total unit sales.

However, there’s a twist here. Recognizing that car owners are increasingly worried a vehicle solely powered by charged batteries just doesn’t or won’t meet their needs, Toyota is doubling down on hybrid vehicles that also run on conventional gasoline once their battery’s charge has been depleted.

The plan seems to be working too. At a time when sales growth of conventional battery-powered EVs is slowing, Toyota saw accelerating growth from hybrid vehicles that already make up the vast majority of its EV production (up 24% last quarter). As it turns out, at least some drivers are comfortable with the idea of a vehicle that’s capable of burning gas when necessary.

This stock’s potential upside as an EV investment, though, isn’t rooted in Toyota’s capacity to pivot. It lies in the fact that Toyota is already a known and trusted name here and abroad. America’s best-selling cars in 2023 (and in prior years too) include its Camry, Rav4, Tacoma, and Corolla. While some consumers might be hesitant to purchase an EV from a newer company like Rivian or even Tesla, they’re more likely to be comfortable buying one from a manufacturer that’s seemingly been around forever.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Tesla, and Walmart. The Motley Fool has a disclosure policy.

3 Electric Vehicle (EV) Stocks That Could Make You a Millionaire was originally published by The Motley Fool

One Stop Systems to Participate at the Lake Street Best Ideas Growth Conference on September 12

ESCONDIDO, Calif., Sept. 05, 2024 (GLOBE NEWSWIRE) — One Stop Systems, Inc. (“OSS” or the “Company”) OSS, a leader in rugged Enterprise Class compute for artificial intelligence (AI), machine learning (ML) and sensor processing at the Edge, today announced that Mike Knowles, President and CEO, and John Morrison, CFO will participate in the Lake Street Capital Markets’ Best Ideas Growth “Big8” Conference on September 12, 2024, at The Yale Club in New York City.

Management is scheduled to host one-on-one meetings with investors during the conference. Investors interested in arranging one-on-one meetings should contact their Lake Street conference representative.

About One Stop Systems

One Stop Systems, Inc. OSS is a leader in AI enabled solutions for the demanding ‘edge’. OSS designs and manufactures Enterprise Class compute and storage products that enable rugged AI, sensor fusion and autonomous capabilities without compromise. These hardware and software platforms bring the latest data center performance to harsh and challenging applications, whether they are on land, sea or in the air.

OSS products include ruggedized servers, compute accelerators, flash storage arrays, and storage acceleration software. These specialized compact products are used across multiple industries and applications, including autonomous trucking and farming, as well as aircraft, drones, ships and vehicles within the defense industry.

OSS solutions address the entire AI workflow, from high-speed data acquisition to deep learning, training and large-scale inference, and have delivered many industry firsts for industrial OEM and government customers.

As the fastest growing segment of the multi-billion-dollar edge computing market, AI enabled solutions require-and OSS delivers-the highest level of performance in the most challenging environments without compromise.

OSS products are available directly or through global distributors. For more information, go to www.onestopsystems.com. You can also follow OSS on X, YouTube, and LinkedIn.

Forward-Looking Statements

One Stop Systems cautions you that statements in this press release that are not a description of historical facts are forward-looking statements. These statements are based on the company’s current beliefs and expectations. The inclusion of forward-looking statements should not be regarded as a representation by One Stop Systems or its partners that any of our plans or expectations will be achieved, including but not limited to, management’s expectation for new market opportunities, the Company’s penetration of the Defense and Commercial sectors, future changes to our business objectives, and other future financial projections. Actual results may differ from those set forth in this press release due to the risk and uncertainties inherent in our business, including risks described in our prior press releases and in our filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in our latest Annual Report on Form 10-K and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the company undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

About the Lake Street “Big8” Conference

Lake Street Capital Markets is a research-powered investment bank focused on growth companies. The Best Ideas Growth Conference is Lake Street’s annual invitation-only event, featuring dynamic, small-cap companies interacting with top institutional investors. The format has been designed to give attendees direct access to senior management via one-on-one & group meeting formats. Learn more about Lake Street at www.lakestreetcapitalmarkets.com.

Media Contacts:

Robert Kalebaugh

One Stop Systems, Inc.

Tel (858) 518-6154

Email contact

Investor Relations:

Andrew Berger

Managing Director

SM Berger & Company, Inc.

Tel (216) 464-6400

Email contact

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Celsius Stock Suddenly Plunged Today

It started out as a calm morning for shares of Celsius Holdings (NASDAQ: CELH). But around noon, management made an appearance at Barclays‘ 17th Annual Global Consumer Staples Conference. During the chat, management said something that sparked fear in investors: In the current quarter, sales to PepsiCo (NASDAQ: PEP) are down $100 million to $120 million compared to last year.

Investors took action, and that’s why Celsius stock was down a painful 12% as of 3:15 p.m. ET.

How does Celsius generate revenue?

Pepsi became the primary distribution partner for Celsius in August 2022. For Celsius, it now recognizes revenue when it delivers inventory to Pepsi. From there, Pepsi distributes it to retail channels where it’s purchased by consumers. And for this reason, there’s a different between when Celsius generates revenue and when its products actually sell in stores.

In 2023, Celsius’ revenue was up an impressive 102% year over year and well ahead of expectations from analysts. But it’s now clear that this outperformance was because Pepsi ordered too much product. It’s a misstep that Pepsi is now correcting by ordering less from Celsius while it sells inventory it has on hand.

For the current third quarter of 2024, Celsius management estimates that Pepsi will order between $100 million and $120 million less than it ordered in the third quarter of 2023. To be sure, this will be a huge drag on Q3 results and it’s why the stock plunged today.

What should investors do now?

There are cases where the financials don’t clearly reflect the health of the business, and I believe this is one of those cases. During its chat today, Celsius management pointed out that Q3 sales for its products are up 10% so far. This won’t be reflected in its revenue, because it generates revenue when it supplies inventory to Pepsi. But sales to consumers are growing nevertheless.

Moreover, Celsius management believes it’s gained another whole point of market share in the energy drink space. And market share is huge for a beverage stock.

I’ll stop short of calling the bottom for Celsius stock. But I believe the explanation of what’s happening with the business is reasonable. And I consequently believe that investors are overreacting to today’s news.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Jon Quast has positions in Celsius. The Motley Fool has positions in and recommends Celsius. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.

Why Celsius Stock Suddenly Plunged Today was originally published by The Motley Fool

Where Will Palantir Technologies Stock Be in 1 Year?

Palantir Technologies (NYSE: PLTR) stock shot up 110% in the past year, as investors bought shares of this software platform provider hand over fist, thanks to the rapidly growing demand for its artificial intelligence (AI) offerings. And yet, because it has already rallied so far, Wall Street doesn’t anticipate more gains in the coming year.

Palantir stock carries a median 12-month price target of $28 (per 24 analysts covering it). That implies an 11% drop from its current price. A third of those analysts recommend selling Palantir, with 38% rating it as a buy and the rest as a hold.

Does this divided analyst sentiment mean it’s time for investors to book profits in Palantir? Or can this high-flying AI stock sustain the rally and deliver more gains in the coming year? Let’s check if Palantir has what it takes to defy Wall Street’s expectations.

Palantir’s growth profile continues to improve

Palantir’s expensive valuation looks like a key reason why analysts are doubtful it can deliver more upside over the next 12 months. The stock’s price-to-sales ratio of 29 is admittedly expensive. It nearly quadruples the U.S. technology sector index’s average sales multiple of 7.7. Palantir’s trailing price-to-earnings ratio is also very expensive at 178. Its forward earnings multiple of 86 points toward a nice bump in its earnings over the next year, but it is still on the expensive side.

One way to justify buying Palantir stock despite its rich valuation is the acceleration in the company’s growth. In the second quarter, the company’s revenue increased 27% from the same period last year to $678 million. That was better than the 21% year-over-year growth Palantir reported in the first quarter of the year. The company’s top-line growth in the first half of the year indicates that it is well on track to exceed the 17% full-year revenue jump it delivered in 2023 to $2.2 billion.

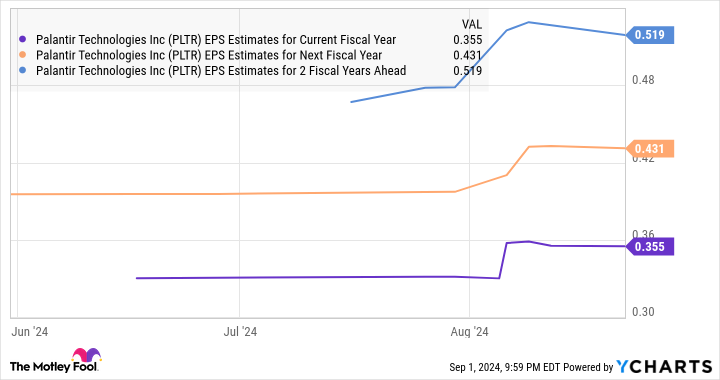

The company expects to finish 2024 with almost $2.75 billion in revenue. That would be a 25% increase over last year. Analysts forecast its earnings will increase by 44% in 2024 to $0.36 per share. But it is worth noting that analysts have been raising their expectations of late.

Stronger-than-expected growth could send Palantir stock higher

Another thing worth noting in the chart is that despite a bump in Palantir’s revenue estimates for the next couple of years, analysts expect it to grow at a slower pace in 2025 and 2026. However, that may not be the case, as the recent acceleration in the company’s growth seems sustainable in the coming year.

In simpler words, Palantir’s top-line growth could be much stronger than what analysts expect in 2025. That’s because its Artificial Intelligence Platform (AIP) is leading to robust growth in its revenue pipeline. The company’s remaining performance obligations (RPO) increased 41% year over year in Q2 to $1.37 billion.

Palantir’s RPO reflects the value of contracts that the company entered into with customers, which means that it is an indicator of its future revenue growth. However, Palantir points out that its RPO mainly consists of commercial contracts. The remaining deal value (RDV) is the metric to look at to get an idea of the potential top-line growth that Palantir could deliver. RDV is the total remaining value of all the company’s contracts at the end of a quarter. This metric was worth $4.3 billion in Q2, jumping 26% from the same quarter last year. It remains to be seen how quickly Palantir can translate those contracts into actual revenue, but it is worth noting that its RDV is significantly higher than its trailing-12-month revenue of $2.5 billion.

So there is a strong possibility of Palantir’s growth being better than expected in the next year, especially considering that it could continue to attract new customers toward its AI software offerings in light of the huge end-market opportunity available in this market. Market research firm IDC forecasts the market for AI software platforms that Palantir offers could clock a compound annual growth rate of 41% through 2028, generating $153 billion in annual revenue at the end of the forecast period.

Palantir is in a solid position to make the most of this opportunity. According to research firm Forrester, Palantir has been ranked as the No. 1 provider of AI software platforms. This is also evident from the fact that the company’s deal count has been increasing rapidly. For instance, it struck 123 deals with U.S. commercial customers in Q2, which was a 98% jump from the year-ago period.

More importantly, Palantir’s deal sizes are getting bigger, with the company closing 96 deals worth $1 million or more in the previous quarter, up from 66 such deals in the same period last year. What’s more, the number of $10 million-plus deals increased by 50% year over year to 27. So, as the adoption of Palantir’s AI platforms increases, its growth rate should also pick up.

Moreover, Palantir’s price/earnings-to-growth ratio (PEG ratio) is well below 1.

The PEG ratio is a forward-looking valuation metric calculated by dividing a company’s trailing P/E by its projected earnings growth. A reading of less than 1 means that a stock is undervalued in light of its potential growth. So, growth investors can still consider buying Palantir stock, as there is a good chance that its stronger-than-expected performance in the coming year could be rewarded with more gains on the market.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Where Will Palantir Technologies Stock Be in 1 Year? was originally published by The Motley Fool

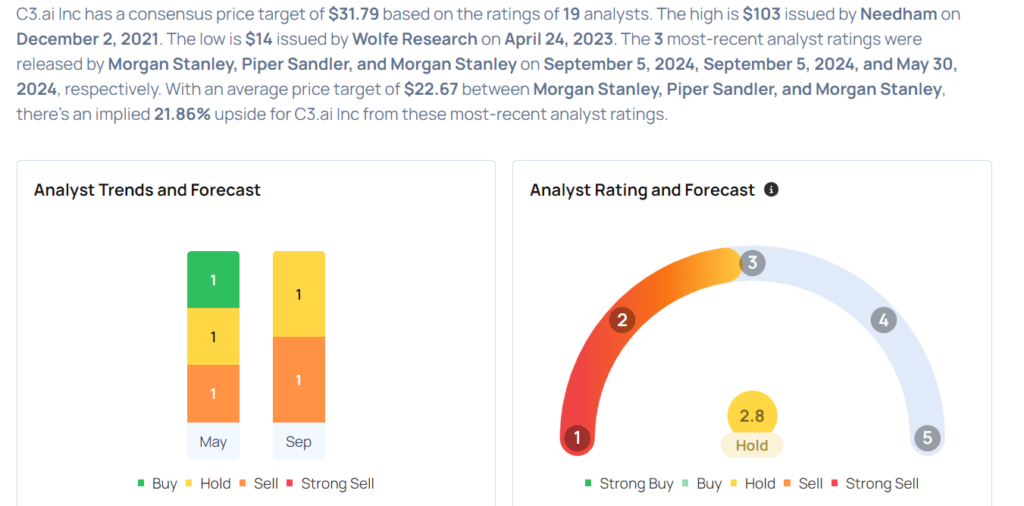

C3.ai Analysts Cut Their Forecasts After Q1 Earnings Results

C3.ai Inc AI posted upbeat earnings and sales results for its first quarter on Wednesday.

C3.ai reported first-quarter revenue of $87.2 million, up 21% year-over-year. The revenue figure beat a Street consensus estimate of $86.9 million, according to data from Benzinga Pro.

Subscription revenue was $73.5 million in the first quarter, up 20%. Subscription revenue made up 84% of the company’s total revenue in the first quarter.

The company reported a loss of 5 cents per share in the first quarter, beating a Street consensus estimate of a loss of 13 cents per share.

“We had a solid start to the fiscal year, with rising demand for Enterprise AI driving our sixth consecutive quarter of accelerating revenue growth,” C3.ai CEO Thomas Siebel said.

The company is guiding for second-quarter revenue in a range of $88.6 million to $93.6 million. Full fiscal-year revenue is guided to be in a range of $370 million to $395 million.

C3.ai shares fell 1.9% to close at $23.01 on Wednesday.

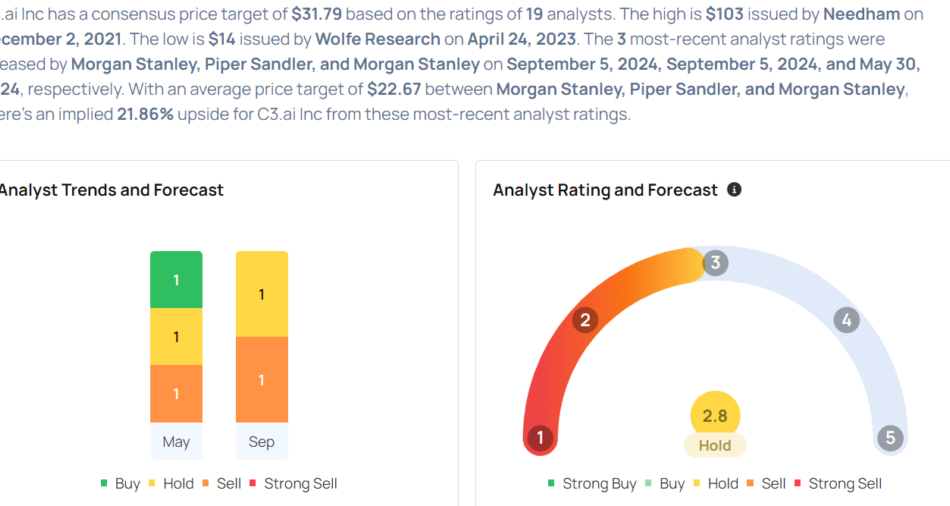

These analysts made changes to their price targets on C3.ai following earnings announcement.

Considering buying AI stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

History Says September May Be The Perfect Time to Pounce On This Ultra-High-Yield Dividend Stock

After experiencing sharp declines in 2022, the capital markets have showcased unparalleled resiliency over the last 20 months or so. Since January 2023, the S&P 500 and Nasdaq Composite have boasted total returns of 48% and 66% respectively (as of the time of this article). While it may be tempting to let the good times roll, savvy investors know that now may be a good time to take some gains off the table and seek more reliable opportunities.

Why is that? Well, September is generally a poor month in the stock market — one that’s hallmarked by hefty selling activity. There are many factors that influence selling stocks toward the end of the year including tax planning or potential changes in monetary policy from the Federal Reserve. However, 2024 carries another variable: the upcoming presidential election. The common theme among these items is that widespread unpredictability pertaining to a number of important topics can result in abnormal levels of selling in the market.

For these reasons, investors might want to consider opting for more predictable opportunities over volatile growth stocks. A good example of this would be to allocate a portion of your portfolio to consistent dividend stocks. Below, I’ll share one ultra-high-yield dividend stock that I think should be on your radar and explain why September could be the perfect time to scoop up shares for this particular player.

I’ll concede right off the bat that the telecom industry is not nearly as exciting as other opportunities in the technology realm. Telecommunications businesses offer a commoditized set of products and services, ultimately forcing major players to compete for customers with price. This dynamic can take a toll on growth, which often leaves investors uninspired.

However, I see things differently with Verizon (NYSE: VZ) — and history suggests that September could be the perfect time to buy, especially for those seeking some passive income.

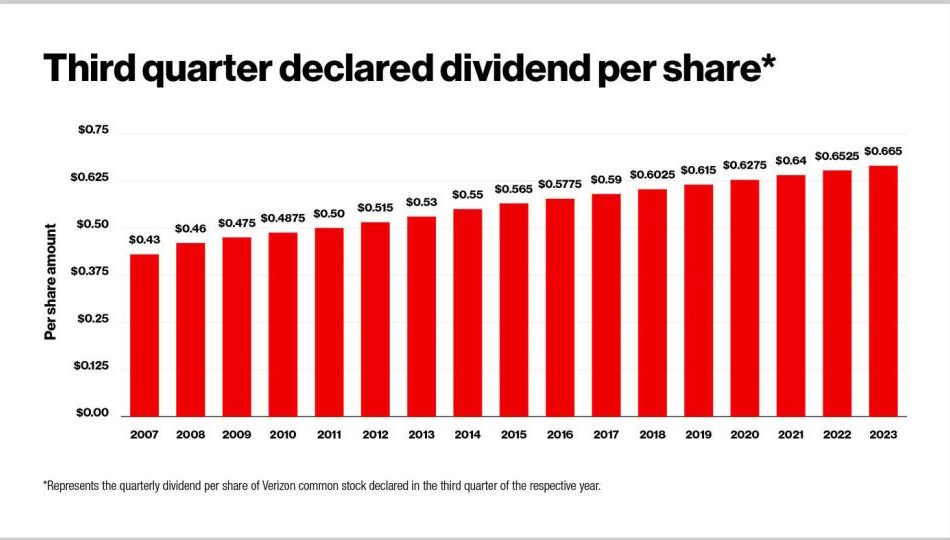

The chart below illustrates that Verizon has raised its dividend for 17 consecutive years. But so what? Many other companies raise their dividends each year.

While that’s true, Verizon tends to announce raises to its quarterly dividend in September.

Why Verizon might raise its dividend again

It’s interesting to identify a pattern regarding the timing of Verizon’s dividend raises. However, smart investors know that historical performance does not guarantee future outcomes. A close assessment of Verizon stock’s recent trading activity combined with a thorough analysis of its financial position will help us determine whether an upcoming dividend raise seems likely or not.

The table below breaks down Verizon’s revenue and free cash flow growth over the last few years. Clearly, there have been some inconsistencies in Verizon’s growth.

|

Growth Metric (Year-over-Year) |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|

|

Revenue |

(3%) |

4% |

(2.4%) |

(2%) |

|

Free Cash Flow |

32.4% |

(18.3%) |

(27%) |

33.1% |

Data Source: Verizon Investor Relations

While the trends above might make you skittish, it’s important to zoom out and look at the bigger picture. The company has consistently generated heaps of cash flow, and even during years when its growth decelerated, it still managed to sustain its dividend and raise it.

Through the first six months of 2024, Verizon has generated a total of $65.8 billion in total revenue. Considering this only represents about a 0.5% increase year over year, you might think the rest of Verizon’s financial profile is equally uninspiring. Yet despite this mundane level of acceleration across the top line, Verizon has done a respectable job growing its profitability. For the six months ended June 30, Verizon generated $8.5 billion in free cash flow — an increase of 6.9% year over year.

In my eyes, Verizon’s dividend looks safe right now.

Should you buy Verizon stock right now?

Right now, Verizon stock boasts an ultra-high dividend yield of 6.2%. By comparison, the SPDR S&P 500 ETF Trust has a dividend yield of just 1.2%. Moreover, Verizon’s forward price to earnings (P/E) multiple of 9.4 lags considerably from the S&P 500’s forward P/E of 22.4. While an upcoming dividend hike is speculation on my end, recent upticks in Verizon shares could suggest that I’m not the only one anticipating the company will continue rewarding shareholders and announce a dividend raise soon.

Historical trends suggest that prolonged hefty market sell-offs could be imminent, so I encourage investors to look for more insulated opportunities. Given Verizon’s consistent ability to generate cash flow, combined with its historical tendency to announce dividend raises in September and its noticeable valuation discount to the broader market, I think now is a great time to pounce and scoop up shares.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

History Says September May Be The Perfect Time to Pounce On This Ultra-High-Yield Dividend Stock was originally published by The Motley Fool

Better AI Stock: Nvidia vs. Super Micro Computer

Nvidia (NASDAQ: NVDA) and Super Micro Computer (NASDAQ: SMCI) have been two of the market’s hottest artificial intelligence (AI) stocks. Nvidia is the world’s largest producer of high-end data center GPUs for processing machine learning and AI tasks. Super Micro Computer, more commonly known as Supermicro, is a rapidly growing supplier of dedicated AI servers. Most of those systems are powered by Nvidia’s GPUs.

Over the past two years, Nvidia’s stock surged more than 640% as Supermicro’s stock rallied nearly 550%. Both stocks soared as the rapid expansion of the generative AI market drove more companies to upgrade their data centers with new AI chips and servers. But should investors chase either of these high-flying AI stocks right now?

Nvidia is still firing on all cylinders

Nvidia once generated most of its revenue from gaming GPUs for PCs. But the rapid expansion of the AI market turned its data center unit, which accounted for 87% of its top line in its latest quarter, into its largest and fastest-growing business.

That’s why Nvidia’s revenue surged 126% in fiscal 2024, which ended in January 2024, and 171% year over year in the first half of fiscal 2025. Analysts expect its revenue and adjusted earnings per share (EPS) to grow 123% and 137%, respectively, for the full year.

Those growth rates are incredible, but Nvidia still faces some unpredictable challenges. It controlled 98% of the data center GPU market last year, according to TechInsights, but it faces stiff competition from AMD‘s cheaper GPUs. Nvidia has also been struggling to ramp up its production of its latest Blackwell GPUs, and several of its top AI customers — including Microsoft, OpenAI, and Alphabet‘s Google — have been developing their own first-party AI accelerator chips.

Nvidia’s red-hot data center chip sales are also gradually cooling off. Its 16% sequential sales growth in the second quarter of fiscal 2025 actually marked a deceleration from its 23% growth in the first quarter and 27% growth in the fourth quarter of fiscal 2024. Its yield issues with Blackwell also reduced its gross margin sequentially in the second quarter.

Analysts expect Nvidia’s revenue and adjusted EPS to both grow 41% in fiscal 2026. Its stock doesn’t look that pricey at 44 times forward earnings, but it might shed its premium valuation if companies start to scrutinize and rein in their AI spending.

Supermicro faces some major challenges

Supermicro is an underdog in the server market, but it carved out a niche by producing high-performance liquid-cooled servers. That made it an ideal partner for Nvidia, which provided it with a steady supply of GPUs for its high-end AI servers.

Supermicro’s revenue rose 37% in fiscal 2023, which ended last June, and surged 110% in fiscal 2024. Its soaring sales of AI servers, which now account for over half of its top line, offset its slower sales of traditional servers. Bank of America expects the company to expand its share of the AI server market from 10% to 17% over the next three years.

But in the fourth quarter of fiscal 2024, Supermicro’s gross margin shrank sequentially and year over year as it grappled with supply chain issues, ramped up its spending on new liquid-cooling technologies, and faced more pricing pressure from Dell Technologies and Hewlett-Packard Enterprise in the AI server market.

On Aug. 27, prolific short seller Hindenburg Research accused Supermicro of stuffing its sales channels with partial orders of defective products and inflating its revenues. It also said Supermicro hadn’t resolved all of the accounting issues that previously caused its stock to be delisted from the Nasdaq in 2018. A day later, Supermicro postponed its 10-K filing for fiscal 2024 and said it needed “additional time” to assess its “internal controls over financial reporting.”

Analysts still expect Supermicro’s revenue and earnings to grow 90% and 58%, respectively, in fiscal 2025 as it ramps up its shipments of AI servers. For fiscal 2026, they expect its revenue and earnings to rise 19% and 30%, respectively. Those growth rates seem impressive for a stock that trades at just 13 times forward earnings, but its recent problems could drive away the bulls and compress its valuations for the foreseeable future.

The better buy: Nvidia

Nvidia remains the linchpin of the booming AI market, and its market dominance still gives it plenty of pricing power. We can’t say the same about Supermicro, which is a lot smaller than Dell and HPE. Supermicro’s delayed 10-K filing could also contain some nasty surprises that provide more fuel for Hindenburg’s bearish thesis against the company. I once thought Supermicro had a shot at outperforming Nvidia this year, but its shrinking gross margin, Hindenburg’s allegations, and its postponed 10-K filing raise too many red flags. That’s why I’d stick with Nvidia instead of Supermicro as my top AI play.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Bank of America, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Better AI Stock: Nvidia vs. Super Micro Computer was originally published by The Motley Fool

Insiders Pour Million-Plus Dollars Into These 2 Stocks — Here’s Why You Should Take Notice

After bouncing back from the early August dip, the stock market opened September with another round of losses. In volatile times, investors need a clear signal, something to suggest a particular stock is ready to climb.

Insider buying is one of the clearest signs available. The insiders are corporate officers, company officials responsible to both Boards of Directors and stockholders of all stripes for ensuring profits and returns – and their positions give them access to the inner workings of their companies. The key point to remember: insiders may sell shares in their own companies for any number of reasons, but they only buy when they believe the stock is on track to gain. And when the insiders start spending millions on their shares, investors should take notice.

To keep things fair, financial regulatory authorities require that insiders publish their trades – and we can use the Insiders’ Hot Stocks tool, from TipRanks, to follow the trends of the insiders’ trades. The data aggregated by the tool points out the stocks that the insiders like, and we can follow those shares, dipping into the details to find out just what makes them so compelling.

Bill.com Holdings (BILL)

The first stock on our radar, Bill.com, is a cloud software provider focused on the small- and medium-sized business niche, where it offers customers solutions for the accounting and paperwork requirements of the business world. With Bill.com’s platform, small business managers can automate, digitize, and simplify the back-office financial issues and processes that come up, whether they occur every day or once a year. The company’s platform lets its users find greater efficiency in their billing, payment processing, and invoicing activities.

Small and medium businesses are always looking for efficient solutions to smooth out their paperwork, and Bill.com, which lets them put all of this into one place, has leveraged that fact into a successful business model of its own. The company has created a one-stop-shop for its customers, small entrepreneurs looking to save costs on some of their world’s most time-consuming requirements. Some of the platform’s features include allowing the creation and payment of bills for accounts receivable and payable, and management of expenses and budgets.

In the last reported quarter, covering fiscal 4Q24 (June quarter), Bill.com had a top line of $343.7 million for the quarter, gaining over 16% year-over-year and beating the forecast by almost $15.7 million. The company’s bottom line, 57 cents per share by non-GAAP measures, was 10 cents per share better than had been anticipated. And, looking forward, the company’s fiscal Q1 revenue guidance, in the range of $346 million to $351 million, was well ahead of the $336.95 million consensus.

The guide wasn’t an all-out success, however, as for FY25, revenue is expected in the range between $1.41 to $1.45 billion, at the midpoint below consensus at $1.44 billion, while non-GAAP EPS is expected to come in between $1.36 to $1.61, some distance below the Street’s $2.21 estimate.

Meanwhile, shares have been drifting lower this year, and evidently those in the know have been thinking the time is right for loading up. When we turn to the insider trades on BILL, we find several recent informative buys of more than $1 million each. John Rettig, CFO, picked up 21,124 shares for $1.04 million; Brian Jacobs, of the company Board, bought 25,000 shares for $1.338 million; and Rene Lacerte, CEO and Board member, spent an impressive $2.095 million on 42,248 shares of BILL. Currently, Jacobs and Rettig’s holdings are worth $12.25 million and $7.7 million, respectively; Lacerte’s holding is valued at almost $146 million.

This stock is covered by analyst Joseph Vafi, from Canaccord Genuity. Vafi is rated among the upper 3% of his peers by TipRanks, and he sees Bill.com as a good option under current conditions. He writes, “Against a macro backdrop that remains tough, Bill’s fintech value proposition for SMB’s continues to resonate. At a high level, we note that even though Bill’s SMB target market is more economically sensitive than large enterprises, most of the company’s KPIs and financial metrics are still sector wide standouts. We attribute this continued relative outperformance to what remains a still relative greenfield in SMB FPA/payments combined, strong channel partnerships and what is a great service set of service offerings.”

Vafi goes on to put a Buy rating on the shares, while his $100 price target suggests a one-year gain of 87.5%. (To watch Vafi’s track record, click here)

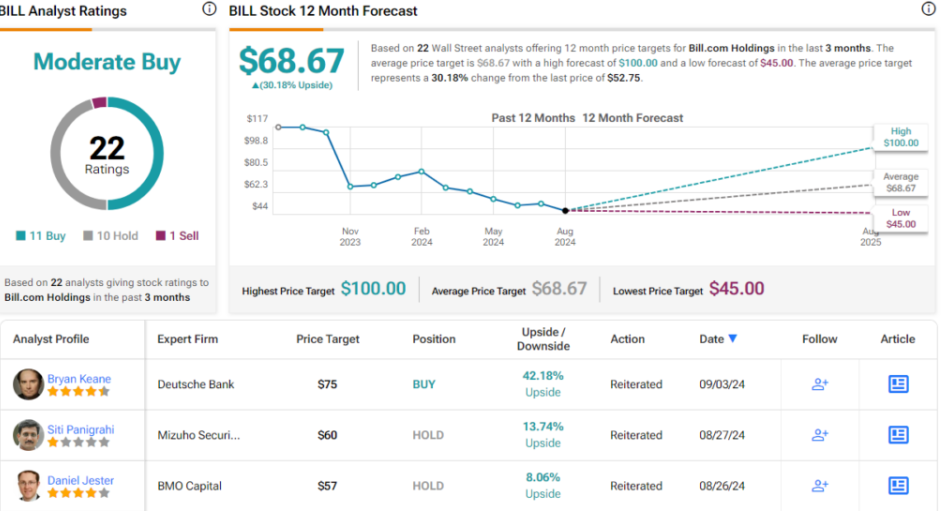

Overall, BILL shares get a Moderate Buy consensus rating from the Street, based on 22 recent recommendations that include 11 Buys, 10 Holds, and 1 Sell. The stock is priced at $52.75 and its average target price implies a gain of 30% on the one-year horizon. (See BILL stock forecast)

Butterfly Network (BFLY)

One of the greatest advances of medical technology was the development of medical imaging. Starting with the discovery of X-rays in 1895, and the application of that discovery to diagnostically important images of a patient’s hand one year later, medical imaging has grown to become a vital specialty in the health care profession, with a powerful impact on improved patient outcomes. Butterfly Network has taken upon itself the goal of ‘democratizing medical imaging,’ by making it accessible to everyone, no matter where in the world they are. The company has developed a groundbreaking technology, dubbed Ultrasound-on-Chip, that can integrate into hospital and clinic networks and transform the delivery of care – by allowing a single-probe, whole-body, ultrasound imaging solution at the point-of-care.

In short, this is portable ultrasound imaging tech at the next level, using handheld scanner technology and miniaturized components. Butterfly’s portable systems cost less than older ultrasound systems, are more accessible, and are easier to use. Ultrasound is a long-known niche within the medical imaging field, and large numbers of providers are experienced in interpreting the images, making it a good choice for a technology company that aims to expand the base of medical imaging users.

In 2Q24, revenues reached a record $21.5 million, a figure that was up more than 16% year-over-year and $1.9 million better than had been forecast. At the bottom-line, the 7-cent per share net loss came in 3 cents per share better than the estimates.

There is only one recent ‘informative buy’ insider purchase on BFLY shares, and it’s something of a doozy. Larry Robbins, of the Board of Directors, bought 1,676,869 shares of the stock – and paid just over $1.675 million for the shares. Robbins now holds company stock worth $15.85 million.

Joshua Jennings, in his coverage of Butterfly for TD Cowen, is impressed by the company’s product line, especially its new iQ3, which was launched earlier this year. Jennings sees the product as just one of several potential growth engines for Butterfly, and writes of the company, “Although the 3Q guide implies a slight deceleration from 2Q, we think the setup for BFLY in the back half of 2024 is intriguing as the company will have multiple growth channels (especially iQ3) which will continue to ramp through the remainder of the year and could provide upside to current guidance. Following its launch in February, BFLY’s iQ3 device is already seeing significant commercial demand from customers… We’re encouraged by the iQ3 commercial progress and will look for more updates on the launch in the quarters ahead.”

For Jennings, all of this adds up to a Buy rating for this stock. His price target, currently set at $3 per share, implies an impressive 12-month upside of 152%. (To watch Jennings’ track record, click here)

While there are only 2 recent reviews of this stock on file, they are both positive – giving the stock a Moderate Buy consensus rating. The shares are trading for $1.19, and the average target, at $3.38, is even more bullish than Jennings allows, suggesting a strong upside of 184% for the coming year. (See BFLY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.