C3.ai Dives After Earnings; Is AI Stock A Buy Now?

Artificial intelligence may well be the next big technological revolution after the internet. But investors looking to participate in this growth story have their work cut out trying to identify whether C3.ai (AI) is a potential leader. That begs the question, is C3.ai stock a buy now?

↑

X

How To Buy Stocks: 4 Factors For Finding Quality Trade Ideas

C3.ai reported its first-quarter results after Wednesday’s market close. Sales grew 21% to $87.2 million, above analyst estimates for $86.9 million, and well ahead of the company’s own prediction for $82.5 million at the midpoint. C3.ai reported a loss of 5 cents per share, ahead of views for a 13-cent loss. Still, shares plunged more than 15% in after hours trading.

Shares of C3.ai soared after the company posted its fiscal fourth-quarter results in May and rebounded from the 50-day line. But the stock has given up those gains now.

Shares rose 0.5% on Sept. 3, but are in a downtrend and below the 50-day and 200 day moving averages.

Weakening Relative Strength For C3.ai Stock

C3.ai stock has a Relative Strength Rating of 13, a sharp drop from 97 a year ago. Investor’s Business Daily recommends focusing on stocks with an RS Rating of 80 or above. Its chart is also bearish as the 200-day moving average is above the 50-day line.

The stock has been underperforming the S&P 500 as well.

In January, the S&P 500 rose 1.6% while C3.ai fell 14%. In February, the stock catapulted 50% on fiscal third-quarter results and bullish guidance, while the S&P 500 gained 5%. But most of its gains evaporated in March as the stock fell 27% vs. the S&P 500’s gain of 3%.

It underperformed the index again in April, although fourth-quarter results helped the stock outperform the benchmark index in May as it gained 31% vs. the index’s 4.8% rise. In June and July, the stock fell 2% and 7.6% while the S&P 500 gained 3.5% and 1.1%. In August the index gained 2.3% with C3.ai stock falling 12.8%.

The stock is also prone to drastic swings. On Nov. 20, 2023, C3.ai stock jumped more than 5% but reversed lower to close with a 4.3% loss when Sam Altman was ousted as chief executive from another artificial intelligence specialist, OpenAI. Altman quickly returned to OpenAI, but the news apparently triggered speculative trading as the market continues to search for leaders in the space.

Shift In Pricing Model

However, industry trends have worked in its favor as well. C3.ai stock skyrocketed Feb. 1, when users successfully tapped OpenAI’s ChatGPT artificial intelligence app to generate answers, texts, emails and even write books.

The ChatGPT app reached 100 million monthly active users in two months, beating popular apps like TikTok and Instagram. OpenAI’s partnership with Microsoft‘s (MSFT) ChatGPT uses natural language to help users write emails, write code and find answers to daily questions.

There are other considerations. In December 2022, C3.ai changed its pricing model from subscription to consumption-based pricing.

The move brought the company in line with industry standards for software-as-a-service providers. The practice is common across Amazon.com‘s (AMZN) Amazon Web Services, Alphabet‘s (GOOGL) Google Cloud and Microsoft’s Azure, as well as smaller players.

Consumption pricing works like a utility bill. That is, the higher the consumption, the pricier the service. Since AI customers will benefit from having access to an AI enterprise platform with unlimited use and developer licenses, the switch to consumption pricing could drive revenue growth, but not immediately.

C3.ai CEO Thomas Siebel has indicated the consumption-pricing model will also lower barriers to entry because companies do not have to be tied to long contracts.

Artificial Intelligence News And AI Stocks To Watch

Is C3.ai Stock A Buy Now?

Redwood City, Calif.-based C3.ai makes software applications equipped with artificial intelligence that can be configured for different purposes.

The software can make networks more reliable by detecting fraud, balancing inventory and demand, solving supply-chain issues and increasing energy efficiency. It can also help defend against money laundering.

The enterprise software stock popped on its first day of trading on Dec. 9, 2020. Shares leapt from an IPO price of 42 to finish at 92.49 that day.

C3.ai stock has some work to do to improve its Composite Rating, which stands at 26 out of 99. The EPS Rating lags even more, at 14. Shares are also below the 50-day moving average with no base in sight yet. The stock is not a buy now.

To find the best stocks, check out IBD Stock Lists and IBD Data Tables.

Please follow VRamakrishnan on Twitter/X for more news on AI stock.

YOU MAY ALSO LIKE:

MarketSurge: Research, Charts, Data And Coaching All In One Place

Best AI Stocks to Buy And Watch Now

View Breakout Stocks & Technical Analysis

Get Free IBD Newsletters: Market Prep | Tech Report | How To Invest

MEI Class Action Notice: Robbins LLP Reminds Stockholders of the Methode Electronics, Inc. Class Action

SAN DIEGO, Sept. 04, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action on behalf of all persons and entities that purchased or otherwise acquired Methode Electronics, Inc. MEI common stock between June 23, 2022 and March 6, 2024. Methode designs, engineers, and produces mechatronic products for Original Equipment Manufacturers (“OEMs”).

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that Methode Electronics, Inc. (MEI) Misled Investors Regarding its Business Prospects

According to the complaint, defendants’ failure to disclose adverse facts regarding problems at the Company’s Monterrey facility and efforts to transition away from the GM center console program caused Methode stock to trade at artificially inflated prices during the class period.

Specifically, plaintiff alleges: (a) that the Company had lost highly skilled and experienced employees during the COVID-19 pandemic necessary to successfully complete the Company’s transition from its historic low mix, high volume production model to a high mix, low production model at its Monterrey facility; (b) that the Company’s attempts to replace its GM center console production with more diversified, specialized products for a wider array of vehicle manufacturers and OEMS, in particular in the EV space, had been plagued by production planning deficiencies, inventory shortages, vendor and supplier problems, and, ultimately, botched execution of the Company’s strategic plans; (c) that the Company’s manufacturing systems at its critical Monterrey facility suffered from a variety of logistical defects, such as improper system coding, shipping errors, erroneous delivery times, deficient quality control systems, and failures to timely and efficiently procure necessary raw materials; (d) that the Company had fallen substantially behind on the launch of new EV programs out of its Monterrey facility, preventing the Company from timely receiving revenue from new EV program awards; and (e) that, as a result of (a)-(d) above, the Company was not on track to achieve the 2023 diluted EPS guidance or the 3-year 6% organic sales CAGR represented to investors and such estimates lacked a reasonable factual basis.

Following a series of corrective disclosures, the price of Methode stock dropped precipitously from a class period high of over $50 per share to less than $10 per share by mid-June 2024 – a decline of more than 80%, causing investors to suffer hundreds of millions of dollars in financial losses.

What Now: You may be eligible to participate in the class action against Methode Electronics, Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by October 25, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against Methode Electronics, Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/27b9596d-8964-43da-a117-6ba8daeddb75

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

STATEMENT FROM THE STRONACH GROUP REGARDING STRONACH v. STRONACH CIVIL LITIGATION

TORONTO, Sept. 4, 2024 /PRNewswire/ — The Stronach Group is pleased to announce that the litigation between Andrew Stronach and Selena Stronach and Belinda Stronach, Frank Walker, Nicole Walker, Alon Ossip, the Estate of Elfriede Stronach and Stronach Consulting Corporation has been settled by the parties.

Belinda Stronach will continue as the Chairman, CEO and President of The Stronach Group, leading the company’s world-class Thoroughbred racing, gaming, content, media, entertainment, real estate and related assets. This includes all businesses under The Stronach Group’s consumer-facing brand, 1/ST.

Belinda Stronach said: “I am very pleased that the litigation with my brother and niece has been resolved. We look forward to moving ahead with exciting plans for our business and moving forward as a family.”

The terms of settlement are confidential, and the parties will not be providing any additional comments.

Press Contact:

Tiffani Steer, VP, Communications – tiffani.steer@stronachgroup.com

About The Stronach Group and 1/ST

The Stronach Group is a world-class technology, entertainment and real estate development company with Thoroughbred racing and pari-mutuel wagering at the core. The Stronach Group’s 1/ST business (pronounced “First”) is North America’s preeminent Thoroughbred racing and pari-mutuel wagering company and includes the 1/ST RACING & GAMING, 1/ST CONTENT, 1/ST TECHNOLOGY and 1/ST EXPERIENCE businesses, while advocating for and driving the 1/ST HORSE CARE mission. 1/ST represents The Stronach Group’s continued movement toward redefining Thoroughbred racing and the ecosystem that drives it. 1/ST RACING & GAMING drives the best-in-class racing operations and gaming offerings at the company’s premier racetracks and training centers including: Santa Anita Park and San Luis Rey Downs (California); Gulfstream Park – home of the Pegasus World Cup and Palm Meadows Thoroughbred Training Center (Florida); the Maryland Jockey Club at Laurel Park, The Preakness Stakes, Rosecroft Raceway and Bowie Training Center (Maryland). 1/ST CONTENT is the operating group for 1/ST’s media and content companies including: Monarch Content Management, Elite, TSG Global Wagering Solutions (GWS) and XBTV. 1/ST TECHNOLOGY is racing’s largest racing and gaming technology company offering world-class products via its AmTote, Xpressbet, 1/ST BET, XB SELECT, XB NET, PariMAX and Betmix brands. 1/ST EXPERIENCE blends the worlds of sports, entertainment and hospitality through innovative content development, elevated national and local venue management and hospitality, strategic partnerships, sponsorships, and procurement development. As the advocate for critical industry reforms and by making meaningful investments into aftercare programs for retired horses and jockeys, 1/ST HORSE CARE represents The Stronach Group’s commitment to achieving the highest level of horse and rider care and safety standards in Thoroughbred racing on and off the track. The Stronach Group’s TSG Properties is responsible for the development of the company’s live, play and work communities surrounding its racing venues including: The Village at Gulfstream Park (Florida) and Paddock Pointe (Maryland). For more information, visit www.1st.com or follow @1ST_racing on Twitter or @1stracing on Instagram and Facebook.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/statement-from-the-stronach-group-regarding-stronach-v-stronach-civil-litigation-302238633.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/statement-from-the-stronach-group-regarding-stronach-v-stronach-civil-litigation-302238633.html

SOURCE The Stronach Group

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

All It Takes Is $800 Invested in Each of These 3 High-Yield Dividend Stocks to Generate Over $100 in Passive Income Per Year

The Federal Reserve could begin cutting interest rates as early as this month — which could be great news for dividend stocks.

Higher rates have made certificates of deposit and high-yield savings accounts more attractive to income investors over the past two years or so. But as rates of return begin going down again, there will be more incentive to hold dividend stocks. And that’s not counting the ways lower rates could benefit the kinds of companies that often pay dividends. For capital-intensive businesses that tend to carry a high amount of debt on their balance sheets, lower interest rates can reduce the cost of capital and make debt financing less expensive.

Lower rates should be excellent news for investors in pipeline and energy infrastructure giant Kinder Morgan (NYSE: KMI) and utilities Dominion Energy (NYSE: D) and Southern Company (NYSE: SO). Investing $800 into each stock should produce over $100 a year in passive income. Here’s why all three companies are rock-solid dividend stocks to buy now.

Kinder Morgan has made the necessary moves to regain investors’ trust

Kinder Morgan slashed its dividend by 75% in December 2015 to preserve cash and address its overly leveraged balance sheet. Nearly nine years later, Kinder Morgan has turned its business around by managing spending and paying down debt.

The blueprint for a successful midstream oil and gas company like Kinder Morgan is to build useful infrastructure projects that can earn steady cash flows for decades. Kinder Morgan’s pipelines act as toll booths for exploration and production companies, while its terminals provide storage, distribution, blending, and logistical needs for petroleum products, chemicals, and renewable fuels.

Kinder Morgan has made several reasonably sized acquisitions in recent years for legacy assets and to boost its exposure to liquefied natural gas and low-carbon fuels. Kinder Morgan also believes natural gas will play a role in powering the growth of energy-intensive data centers, though the extent of that opportunity remains to be seen.

With a dividend that’s steadily risen over the past few years and yields 5.3% at recent prices, Kinder Morgan can power your portfolio with passive income.

Meet the new Dominion Energy

Dominion Energy might be beating the S&P 500 this year, but zoom out and the stock has been a terrible performer over the medium term, losing 28% of its value over the last five years.

Blame the bulk of that underperformance on a business model that used to be more complex. Dominion used to own oil and natural gas production assets, pipelines, and utilities. But it has sold off a large portion of those assets over the last five years to Berkshire Hathaway Energy and Enbridge. Today, Dominion is more focused on its regulated electric utility assets.

Dominion is concentrated in Virginia, West Virginia, North Carolina, and South Carolina. These states are ripe for offshore wind opportunities, between coastal access to shallow waters along the continental shelf and the government’s desire to bring down emissions. Dominion’s Coastal Virginia Offshore Wind (CVOW) project is costly but expected to be decently efficient. Subsidies, such as those provided by the Inflation Reduction Act, will help make the project more affordable. And Stonepeak acquired a 50% interest in CVOW in February, which will help reduce Dominion’s commitment. With less capital at stake, Dominion is better positioned from a risk management perspective.

For years, Dominion has been a messy company to invest in, and dividend investors suffered. Dominion cut its quarterly payout from $0.94 per share to $0.63 in late 2020 to reset expectations and get the dividend back to a manageable point. It has since raised that payout back to $0.6675 per share for an impressive yield of 4.8% at recent prices.

With the worst likely in the rear view, Dominion looks like a good dividend stock to buy now.

The perfect role player in a passive income portfolio

With a market cap around $95 billion, Southern Company is one of the most valuable U.S.-based utilities — and for good reason. Primarily focused on the Southeastern U.S., the utility’s foundation is centered on traditional electric operating companies. But it also has a natural gas distribution and utility segment and a power generation arm that includes wind, solar, and natural gas generation facilities. Southern Company’s business model helps it generate predictable cash flows from long-term contracts and power purchase agreements.

The company has raised its dividend for over 20 consecutive years, with the dividend roughly doubling during that period. It’s not the fastest growth rate, but Southern Company wants to ensure it keeps its payout ratio in check. For that reason, we can expect the dividend to grow at roughly the same pace as earnings so Southern Company can maintain a payout ratio between 50% and 75%. That way, the dividend expense doesn’t become too much of a burden.

With a 20.6 price-to-earnings ratio and a yield of 3.3% at recent prices, Southern Company is a reliable dividend stock for income investors to consider now.

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Enbridge, and Kinder Morgan. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

All It Takes Is $800 Invested in Each of These 3 High-Yield Dividend Stocks to Generate Over $100 in Passive Income Per Year was originally published by The Motley Fool

That ‘Chase Bank glitch’ could lead to negative balances, locked accounts — and jail time

Forget Monopoly: A bank error in your favor almost never works out.

Some people who tried to take advantage of the viral “Chase Bank glitch” could face serious consequences, experts say, including frozen bank accounts, negative balances in the thousands of dollars — and even jail time.

Most Read from MarketWatch

The glitch, which has been highlighted in several viral TikTok videos, had some people believing that they could get “free” cash from Chase JPM ATMs. According to these posts, at least some Chase cash machines allowed customers to deposit a check that they wrote to themselves for an amount larger than the balance in their bank account. This gave them immediate access to some or all of the money listed on the check.

Banks can sometimes take several days to verify checks prior to making funds available in customers’ accounts. But in the case of the “Chase Bank glitch,” some or all of the money listed on the deposited check was available immediately, allowing people to withdraw the funds before the checks were identified as fraudulent. Posts online showed that some of these fraudulent transactions were for as much as $40,000.

As one would expect, the bank took action after social-media posts surfaced of this “glitch” occurring. Chase said the issue has “been addressed” and urged people not to try it anymore.

“Regardless of what you see online, depositing a fraudulent check and withdrawing the funds from your account is fraud, plain and simple,” a Chase spokesperson said.

Legal and account experts agree. “The intent to do this is nothing short of fraud,” Dr. James Mohs, accounting professor at the University of New Haven, told MarketWatch. “Depending on the severity of the fraud, penalties can be levied on a state or federal level or both, and can run from fines to incarceration. Facts and circumstances would dictate the severity of the penalties.”

And some people who did this could face severe penalties, depending on which state they’re in and how much money the check was written for. Here’s an example of how these check-fraud punishments could be handed down in New Jersey, for example, according to criminal law attorney Kevin Conway.

|

Check amount |

Offense |

Jail time (up to) |

Fine amount |

|

Under $200 |

Disorderly persons |

6 months |

Up to $1,000 |

|

$200-$1,000 |

Fourth-degree |

18 months |

Up to $10,000 |

|

$1,000-$75,000 |

Third-degree |

5 years |

$15,000 |

|

Over $75,000 |

Second-degree |

10 years |

$150,000 |

These charges listed above are only for check fraud, and depending on the case, other charges could be added to a person’s actions.

“If they cash the money, take the money, don’t give the money back, then it becomes criminal,” Conway said. “If they are bragging about it, that they know it’s a mistake, [then] it’s grand larceny. It doesn’t take much to become a felony.”

To be clear, not every bank error is a criminal offense. “I’ve had cases where the bank puts money into someone’s account by mistake,” said Conway. “That’s OK that in and of itself isn’t a crime.”

But you do have to give that money back. “If you spend it and don’t give it back, or take it to the next level like people are doing here, where they realize it’s a problem with the system, [then] it becomes a bigger problem, because your actions are intentional,” Conway added.

See: Before the Fed lowers interest rates, make these 4 money moves to prepare your finances

So how could people really think they could get away with such a move — especially after sharing it on social media?

“When it comes to intentional fraud, people’s motivations are always confusing and defy logic and are hard to justify. Fraud is fraud, whether the amounts are small or not,” Mohs said.

Will people actually go to jail over the Chase Bank glitch? It depends.

If a person didn’t return the money, they could face harsh penalties, as it’s up to the financial institution whether it wants to make a criminal referral.

JPMorgan Chase declined to comment on possible criminal referrals.

“First-degree and second-degree is an automatic state prison sentence, the ranges are high. Third- and fourth-degree, you can get local time or probation with local time. It’s not good,” Conway said.

But the charges could change, too.

“If you negotiate it down to a lesser sentence, you can plead to a second degree and get sentences to a third [degree], then potentially you wouldn’t have jail. It’s all subject to negotiation,” Conway said.

But jail time isn’t the only punishment that people who exploited this glitch could face. Many users who uploaded videos of themselves performing this “free money” hack later posted shots of their bank accounts having massive negative balances, sometimes in the tens of thousands of dollars, once Chase deducted the stolen cash from the accounts. Other people who tried taking advantage of the glitch reported holds being placed on their bank accounts.

“This Chase glitch s***, don’t do this s*** man,” one person who claimed to try the glitch said in a follow-up video. His account showed a negative balance of $10,997.58.

Most Read from MarketWatch

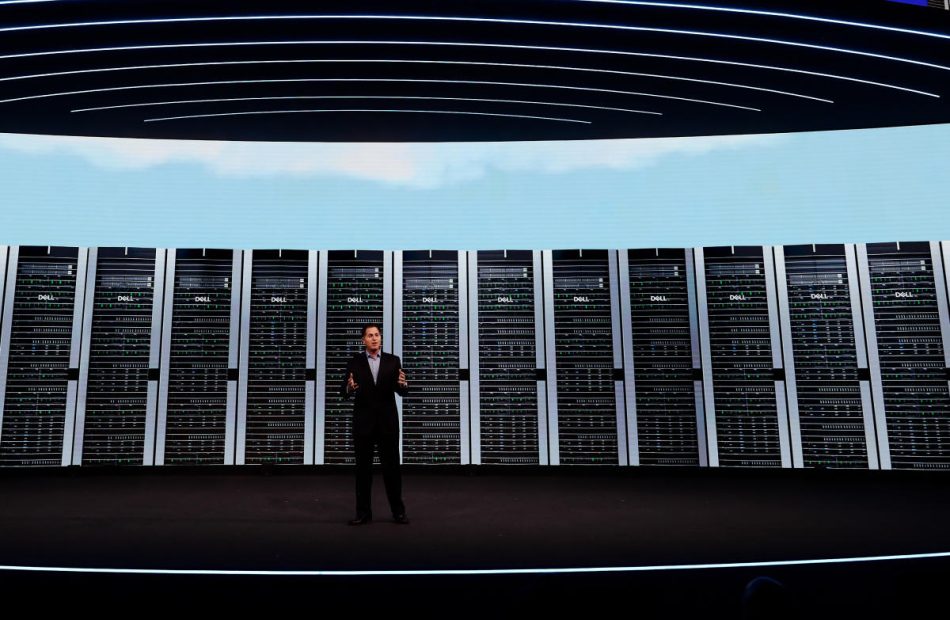

Michael Dell on AI: Talk of a slowdown is way overblown

Dell Technologies (DELL) founder and CEO Michael Dell thinks talk of an AI spending letdown is way overblown.

“There always are bumps in the road as you launch a rocket and create new capabilities. You have new product cycles. You have new introductions of things. And some customers want the existing one faster. Some want to wait for the new one. We have all the above,” Dell told Yahoo Finance at the Citi TMT conference in New York City on Wednesday.

“But the macro picture here is very, very clear, and that is that there’s enormous demand. It’s growing. It’s expanding out from the hyperscalers to the service providers to enterprise to commercial to sovereign AI to embedded AI to the edge to retail to manufacturing to your PC to here, there, and everywhere,” he added.

Dell’s second quarter underscored why the tech titan’s stock has gained an impressive 45% year to date, in part as it’s seen as a key player in the build-out of America’s AI infrastructure.

The company said it secured $3.1 billion of AI server sales in the quarter, almost double the $1.7 billion netted in the preceding quarter.

Sales in the company’s Infrastructure Solutions Group (ISG) surged 38% to $11.65 billion. AI sales are captured in the ISG segment.

Dell’s Client Solutions Group — which includes sales of PCs and laptops — saw sales drop 4% to $12.41 billion. Consumer sales declined 22% to $1.86 billion, while the commercial business was flat at $10.6 billion.

“What organizations are seeing is this is a historic opportunity to make their businesses way more productive and efficient, while at the same time, kind of reimagining them given all this capability,” Dell, who first started the company in 1984, said.

By and large, the Street remains bullish on Dell’s stock due to its AI exposure and because it looks too cheap to ignore.

“Combining the revenue opportunity [for AI] over the medium-term — which increases visibility into double-digit revenue growth for the core business, and the continued focus on operating expenses, we see a robust earnings growth trajectory [for Dell] which is not fully appreciated in the 13x P/E multiple the shares are trading at currently,” said JPMorgan analyst Samik Chatterjee in a client note.

Chatterjee reiterated an Overweight rating on Dell shares, the equivalent of a Buy.

Three times each week, I field insight-filled conversations with the biggest names in business and markets on Yahoo Finance’s Opening Bid podcast. Find more episodes on our video hub. Watch on your preferred streaming service. Or listen and subscribe on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

In the Opening Bid episode below, DataStax CEO Chet Kapoor shares what it was like to work alongside Apple (AAPL) co-founder Steve Jobs and his outlook for AI.

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on X @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email brian.sozzi@yahoofinance.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

Here's How Much $100 Invested In Ross Stores 15 Years Ago Would Be Worth Today

Ross Stores ROST has outperformed the market over the past 15 years by 1.52% on an annualized basis producing an average annual return of 13.22%. Currently, Ross Stores has a market capitalization of $50.62 billion.

Buying $100 In ROST: If an investor had bought $100 of ROST stock 15 years ago, it would be worth $638.85 today based on a price of $151.76 for ROST at the time of writing.

Ross Stores’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Toll Brothers Announces New Luxury Home Community Coming Soon to Murfreesboro, Tennessee

MURFREESBORO, Tenn., Sept. 04, 2024 (GLOBE NEWSWIRE) — Toll Brothers, Inc. TOL, the nation’s leading builder of luxury homes, today announced its newest community, Meadowlark, is coming soon to Murfreesboro, Tennessee. Nestled near Clari Park and within walking distance to premium shopping and dining at The Avenue, Meadowlark by Toll Brothers will feature both single-family homes and townhomes, each thoughtfully crafted with elegant architecture and versatile spaces for modern living.

The homes in Meadowlark will range in size from 1,869 to 2,268+ square feet of luxury living space, with 3 to 4 bedrooms, 2 to 3 bathrooms, and two-car garages. Toll Brothers homebuyers can choose from a variety of floor plans and exterior designs and can personalize the interior of their new home with a selection of curated designer-appointed features and finishes. The Sapling Collection at Meadowlark features new townhomes from the upper $400,000s, while the Radnor Collection offers new single-family homes priced from the upper $500,000s.

“We are excited to bring our new home designs to Murfreesboro,” said Jordan Hartigan, Division President of Toll Brothers in Tennessee. “With its prime location near shopping, dining, and entertainment options, Meadowlark by Toll Brothers offers homeowners the best of both worlds—a tranquil, relaxed setting and easy access to all the amenities of city life.”

Residents will enjoy low maintenance living with lawn care and trash removal included. Toll Brothers homeowners can stroll along the community walking trails, meet other residents at the neighborhood pavilion, and enjoy a variety of shopping, dining, and entertainment options all within walking distance of the community.

The community is conveniently located near major commuter routes and is part of the top-rated Rutherford County School District. Recreation abounds near Meadowlark, with numerous parks, country clubs, and golf courses nearby, including Walter Hill Recreation Area, Barfield Crescent Park, Stones River Country Club, and Old Fort Golf Course. World-class shopping, dining, and entertainment are located just steps away at The Avenue and Clari Park.

For more information on Meadowlark by Toll Brothers, call (855) 949-8655 or visit TollBrothers.com/TN.

About Toll Brothers

Toll Brothers, Inc., a Fortune 500 Company, is the nation’s leading builder of luxury homes. The Company was founded 57 years ago in 1967 and became a public company in 1986. Its common stock is listed on the New York Stock Exchange under the symbol “TOL.” The Company serves first-time, move-up, empty-nester, active-adult, and second-home buyers, as well as urban and suburban renters. Toll Brothers builds in over 60 markets in 24 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, and Washington, as well as in the District of Columbia. The Company operates its own architectural, engineering, mortgage, title, land development, smart home technology, and landscape subsidiaries. The Company also develops master-planned and golf course communities as well as operates its own lumber distribution, house component assembly, and manufacturing operations.

In 2024, Toll Brothers marked 10 years in a row being named to the Fortune World’s Most Admired Companies™ list and the Company’s Chairman and CEO Douglas C. Yearley, Jr. was named one of 25 Top CEOs by Barron’s magazine. Toll Brothers has also been named Builder of the Year by Builder magazine and is the first two-time recipient of Builder of the Year from Professional Builder magazine. For more information visit TollBrothers.com.

From Fortune, ©2024 Fortune Media IP Limited. All rights reserved. Used under license.

Contact: Andrea Meck | Toll Brothers, Director, Public Relations & Social Media | 215-938-8169 | ameck@tollbrothers.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a4147539-67f5-48df-aa7b-d27ec80b8601

https://www.globenewswire.com/NewsRoom/AttachmentNg/c321aa41-006b-48f8-90a2-9d93f3126ae1

https://www.globenewswire.com/NewsRoom/AttachmentNg/fe9b3909-b747-40d4-9a02-61e3b83b48dd

Sent by Toll Brothers via Regional Globe Newswire (TOLL-REG)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Zscaler Earnings Beat. Guidance Disappoints Amid Big Changes In Sales Organization.

Zscaler (ZS) stock tumbled after the cybersecurity firm reported fiscal fourth-quarter earnings, revenue and billings that beat estimates but fiscal 2025 guidance underwhelmed investors amid big changes in its sales organization.

↑

X

AI Stocks Are Running. Is The Dot-Com Bubble A Blueprint Or A Cautionary Tale For Investors?

“Zscaler delivered a good finish to the fiscal year with a beat across the board while fiscal 2025 guidance was a bit mixed,” said RBC Capital analyst Matthew Hedberg in a report.

At Jefferies, analyst Joseph Gallo said in a report: “Fiscal Q4 billings growth of 27% versus consensus 24% was overshadowed by first half 2025 guide of 13% year-over-year…Guidance justifiably amplifies competitive and total addressable market penetration questions.”

Reported after the market close on Tuesday, Zscaler earnings rose 37% to 88 cents a share from a year earlier on an adjusted basis. Revenue climbed 30% to $592.9 million, the San Jose, Calif.-based firm said.

Zscaler stock analysts expected earnings of 70 cents per share on sales of $567.5 million.

Also, fiscal Q4 billings rose 27% to $910.8 million, compared with estimates for $892.5 million.

Zscaler Stock: Guidance Underwhelms

For the current quarter, Zscaler said it expects revenue of $605 million at the midpoint of guidance, versus estimates of $603 million.

For fiscal 2025, which starts with the current October-ending quarter, Zscaler forecast EPS of $2.84, well below estimates of $3.33. Zscaler predicted revenue of $2.61 billion, slightly below estimates of $2.62 billion.

“According to management, fical 2025 is a year of sales transition,” said BMO Capital Markets analyst Keith Bachman in a report. “Nevertheless, we are encouraged by Zscaler’s expanding platform, increasing contributions from newer products, and growing cohorts of large customers.”

On the stock market today, Zscaler stock fell 17.7% to near 159 in afternoon trading.

Zscaler Stock: Sales Shake-Up

Zscaler has brought in a new chief revenue officer, chief marketing officer and other top sales staff as its go-to-market strategy undergoes big changes. Analysts have lowered consensus estimates amid the sales organization overhaul.

Heading into the Zscaler earnings release, the cybersecurity stock had retreated 10% in 2024. Also, ZS stock had a Relative Strength Rating of 69 out of a best-possible 99, according to IBD Stock Checkup.

Zscaler provides cloud-based cybersecurity services via 150 data centers worldwide. Zscaler’s web security gateways inspect customers’ data traffic for malware.

Further, the Zscaler Private Access cloud service replaces virtual private networks to support remote work.

Zscaler competes with Palo Alto Networks (PANW) and Microsoft (MSFT) as well as well-funded startup Wiz.

Meanwhile, Zscaler stock belongs to the IBD Computer-Software Security group, which ranks No. 150 out of 197 groups tracked.

Follow Reinhardt Krause on Twitter @reinhardtk_tech for updates on artificial intelligence, cybersecurity and cloud computing.

YOU MAY ALSO LIKE:

Want To Trade Options? Try Out These Strategies

Monitor IBD’s “Breaking Out Today” List For Companies Hitting New Buy Points

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Analyst Report: Lennar Corp.

Summary

Lennar Corp. based in Miami, is one of the two largest builders of homes based on 73,087 closings, across approximately 23 states, in FY23. Rival D.R. Horton actually delivered 82,917. Lennar’s $34.2 billion in revenue ranks close to Horton’s $35.5 billion helped by an average sales price that is about $60,000 higher. The company’s East region is its biggest, accounting for 31% of deliveries. Lennar builds step-up (68% of closings), entry level (28%) and retirement (4%) homes, with an average selling price of $446,000. The company also provides mortgage financing. Lennar’s Multifamily business develops and manages apartment complexe

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level