Where Will Palantir Technologies Stock Be in 1 Year?

Palantir Technologies (NYSE: PLTR) stock shot up 110% in the past year, as investors bought shares of this software platform provider hand over fist, thanks to the rapidly growing demand for its artificial intelligence (AI) offerings. And yet, because it has already rallied so far, Wall Street doesn’t anticipate more gains in the coming year.

Palantir stock carries a median 12-month price target of $28 (per 24 analysts covering it). That implies an 11% drop from its current price. A third of those analysts recommend selling Palantir, with 38% rating it as a buy and the rest as a hold.

Does this divided analyst sentiment mean it’s time for investors to book profits in Palantir? Or can this high-flying AI stock sustain the rally and deliver more gains in the coming year? Let’s check if Palantir has what it takes to defy Wall Street’s expectations.

Palantir’s growth profile continues to improve

Palantir’s expensive valuation looks like a key reason why analysts are doubtful it can deliver more upside over the next 12 months. The stock’s price-to-sales ratio of 29 is admittedly expensive. It nearly quadruples the U.S. technology sector index’s average sales multiple of 7.7. Palantir’s trailing price-to-earnings ratio is also very expensive at 178. Its forward earnings multiple of 86 points toward a nice bump in its earnings over the next year, but it is still on the expensive side.

One way to justify buying Palantir stock despite its rich valuation is the acceleration in the company’s growth. In the second quarter, the company’s revenue increased 27% from the same period last year to $678 million. That was better than the 21% year-over-year growth Palantir reported in the first quarter of the year. The company’s top-line growth in the first half of the year indicates that it is well on track to exceed the 17% full-year revenue jump it delivered in 2023 to $2.2 billion.

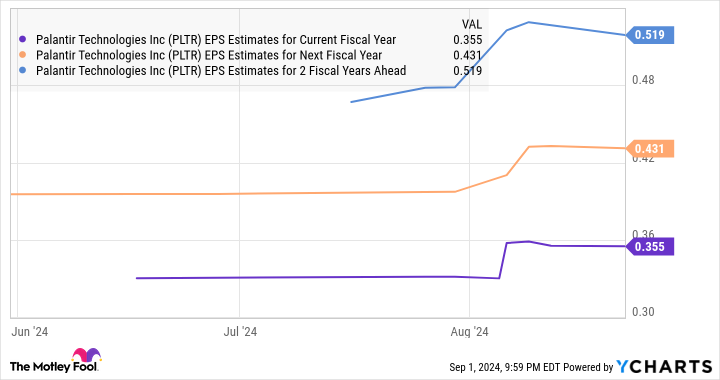

The company expects to finish 2024 with almost $2.75 billion in revenue. That would be a 25% increase over last year. Analysts forecast its earnings will increase by 44% in 2024 to $0.36 per share. But it is worth noting that analysts have been raising their expectations of late.

Stronger-than-expected growth could send Palantir stock higher

Another thing worth noting in the chart is that despite a bump in Palantir’s revenue estimates for the next couple of years, analysts expect it to grow at a slower pace in 2025 and 2026. However, that may not be the case, as the recent acceleration in the company’s growth seems sustainable in the coming year.

In simpler words, Palantir’s top-line growth could be much stronger than what analysts expect in 2025. That’s because its Artificial Intelligence Platform (AIP) is leading to robust growth in its revenue pipeline. The company’s remaining performance obligations (RPO) increased 41% year over year in Q2 to $1.37 billion.

Palantir’s RPO reflects the value of contracts that the company entered into with customers, which means that it is an indicator of its future revenue growth. However, Palantir points out that its RPO mainly consists of commercial contracts. The remaining deal value (RDV) is the metric to look at to get an idea of the potential top-line growth that Palantir could deliver. RDV is the total remaining value of all the company’s contracts at the end of a quarter. This metric was worth $4.3 billion in Q2, jumping 26% from the same quarter last year. It remains to be seen how quickly Palantir can translate those contracts into actual revenue, but it is worth noting that its RDV is significantly higher than its trailing-12-month revenue of $2.5 billion.

So there is a strong possibility of Palantir’s growth being better than expected in the next year, especially considering that it could continue to attract new customers toward its AI software offerings in light of the huge end-market opportunity available in this market. Market research firm IDC forecasts the market for AI software platforms that Palantir offers could clock a compound annual growth rate of 41% through 2028, generating $153 billion in annual revenue at the end of the forecast period.

Palantir is in a solid position to make the most of this opportunity. According to research firm Forrester, Palantir has been ranked as the No. 1 provider of AI software platforms. This is also evident from the fact that the company’s deal count has been increasing rapidly. For instance, it struck 123 deals with U.S. commercial customers in Q2, which was a 98% jump from the year-ago period.

More importantly, Palantir’s deal sizes are getting bigger, with the company closing 96 deals worth $1 million or more in the previous quarter, up from 66 such deals in the same period last year. What’s more, the number of $10 million-plus deals increased by 50% year over year to 27. So, as the adoption of Palantir’s AI platforms increases, its growth rate should also pick up.

Moreover, Palantir’s price/earnings-to-growth ratio (PEG ratio) is well below 1.

The PEG ratio is a forward-looking valuation metric calculated by dividing a company’s trailing P/E by its projected earnings growth. A reading of less than 1 means that a stock is undervalued in light of its potential growth. So, growth investors can still consider buying Palantir stock, as there is a good chance that its stronger-than-expected performance in the coming year could be rewarded with more gains on the market.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Where Will Palantir Technologies Stock Be in 1 Year? was originally published by The Motley Fool

Leave a Reply