Volkswagen's Battery Plant In Germany To Operate At Reduced Capacity Amid Financial Strains

Volkswagen AG’s VWAGY PowerCo battery subsidiary has decided to operate its Salzgitter plant in Germany at half its planned capacity. This decision comes in the wake of financial pressures and a dip in the demand for electric vehicles.

What Happened: The company’s technology chief, Thomas Schmall, announced during a staff meeting that only one of the two planned production lines at the plant will be constructed. The plant, which has space for two lines, will now have a reduced capacity of 20 gigawatt hours, Reuters reported on Friday.

Employees voiced their fears about the second line being permanently abandoned as part of a larger cost-saving strategy at Volkswagen. This news follows the company’s startling revelation earlier this week about potential plant shutdowns and job cuts, stating it has a narrow window of 1-2 years to “turn things around.”

Despite the cutbacks, a PowerCo spokesperson assured that the company will commence production at the Salzgitter plant in 2025 as planned.

“The further expansion of production capacities will be driven forward flexibly and in line with demand,” the spokesperson clarified.

Why It Matters: This decision by Volkswagen comes on the heels of Tesla CEO Elon Musk questioning Volkswagen’s proposed $5 billion investment in Rivian Automotive. Musk had expressed skepticism about where the German automaker would source the funds for this investment, especially considering reports of potential factory closures in Germany.

Price Action: Volkswagen closed at $11.20 on Thursday in the OTC and was trading 2.50% lower in the after-hours, according to Benzinga Pro.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Campbell Set to Deliver Elevated Living in Charlotte's South End

Refined Apartments Redefining Luxury Living Now Pre-leasing

CHARLOTTE, N.C., Sept. 5, 2024 /PRNewswire/ — The Campbell, a 12-story, 117-unit boutique multifamily community in the heart of Charlotte’s South End and adjacent to the charming Dilworth neighborhood, is pleased to announce that it is now pre-leasing units with move-ins starting this month. Abacus Capital developed the project in partnership with JE Dunn Capital Partners and L&B Realty Advisors. Upon delivery, The Campbell will be professionally managed by Greystar.

“We’re very excited to begin pre-leasing at The Campbell,” Mason Ellerbe, a Partner at Abacus Capital said. “The boutique scale, unimpeded city views, designer finishes and unique and highly walkable location on the Dilworth side of South End will set this project apart from the multifamily stock that has historically been built in the submarket.”

The Campbell’s residences will be differentiated from the rest of the South End rental submarket by the generous size of its units, averaging nearly 1,200 SF, roughly 50% larger than the “typical” South End apartment.

With one-, two- and three-bedroom floorplans that range from 746 SF to 1,718 SF The Campbell is designed to cater to the city’s most discerning renters. Designer finishes include chef’s kitchens equipped with gas stoves, floor-to-ceiling windows, custom walk-in closets and smart technology throughout. Built-in wine fridges and expansive balcony terraces will be a standard feature in the majority of The Campbell’s residences. The parking garage will occupy floors one through four with apartments across floors five through twelve. Bordered by the Dilworth neighborhood and surrounding low-rise buildings, every apartment will have a sweeping view above the city’s famous tree canopy.

A sky terrace on the twelfth floor with city skyline views is the highlight of the community amenities. Others include a state-of-the-art fitness center, resident lounge with golf simulator and catering kitchen, private co-working spaces with a reservable conference room, dedicated parking garage with gated access, dog spa and bike room as well as onsite retail.

The Campbell will boast a Walk Score of 96. The community provides convenient access to local retail and transportation options, with Publix located 0.1 miles away and the East-West Lynx Light Rail station 0.25 miles away.

Wes McAdams, managing partner at Abacus Capital, said, “We intentionally positioned the project to appeal to a more discerning renter cohort than the average South End apartment building. With the best retail and restaurants in South End at Atherton Mill and the Design District out The Campbell’s front door, and the historic Dilworth neighborhood’s tree-lined streets out its back door, future residents should be able to enjoy all the benefits of elevated city living,” he said.

The Campbell was developed on the historical site of Campbell’s Greenhouses, a beloved plant nursery that supplied residents of the city with beautiful orchids for decades before selling in late 2022 to make way for Abacus’ high-rise apartment project by the same name. Residents can expect to see subtle nods to the site’s botanical history in The Campbell’s custom art and curated interior design throughout the project.

Abacus indicated that it should have several exciting retail announcements to make in the weeks ahead as it prepares for the first residents to take occupancy at The Campbell.

For more information, or to schedule a tour, please visit thecampbellclt.com.

About Abacus Capital

Launched in 2018, Abacus Capital is a multi-strategy product type agnostic real estate investor that seeks out special situations or other tactical opportunities in which to deploy its capital, institutional experience, relationships and hands-on, solution-oriented approach to creating and/or unlocking value and driving investment outperformance on behalf of its partners and clients. The principals of Abacus Capital have over 40 years of real estate investing experience and have acquired or developed over 17.0M square feet of commercial real estate with a total capitalization in excess of $4.0B. Please visit www.abacuscapitalusa.com for more information.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/the-campbell-set-to-deliver-elevated-living-in-charlottes-south-end-302239646.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-campbell-set-to-deliver-elevated-living-in-charlottes-south-end-302239646.html

SOURCE Greystar

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump just called for a U.S. sovereign wealth fund. What would that look like?

The U.S. may be home to some of the world’s biggest investors, but unlike other countries such as Saudi Arabia and Singapore, the federal government doesn’t have an investment arm of its own.

That might change if Donald Trump is elected to a second term as president. Speaking at the Economic Club of New York on Thursday, Trump called for the creation of a sovereign wealth fund—a term that describes state-owned organizations that operate like hedge funds or private equity firms, pursuing different financial strategies such as buying up stock in public companies or backing startups and other private companies.

In his remarks, Trump kept the proposal vague, saying the fund would invest in “great national endeavors for the benefit of all of the American people” and arguing that other countries have sovereign wealth funds, but “we have nothing.” He added that the government could call its investing firm something other than a “sovereign wealth fund,” which, he said, may not be “appropriate.”

A history of sovereign wealth

While Trump may be looking to other countries as inspiration for his idea, the creation of sovereign wealth funds has typically coincided with budget surpluses, often as a result of oil booms. One of the first examples was Kuwait, which created an investment authority in 1953, followed by Norway’s Norges Bank Investment Management in 1967, and the Abu Dhabi Investment Authority in 1976; all three managed surplus oil revenue.

Even the U.S. has its own homegrown fund born out of oil money, with Alaska establishing one in 1976 that has yielded an annual payout to every state citizen since 1980. In 2023, every Alaskan—including children—received $1,312.

In recent years, sovereign wealth funds—especially from Asia and the Middle East—have become major players in the tech industry. Temasek, a Singaporean investment company that counts the country’s government as the sole equity shareholder, has backed top public companies such as Microsoft and Nvidia, as well as private companies—including, disastrously, FTX. Temasek also backs other funds, including the OpenAI investor Alpha Intelligence Capital, which is closing a $250 million second fund.

Another prominent example is Saudi Arabia’s Public Investment Fund, which owns a venture arm called Sanabil. Top U.S. funds including Andreessen Horowitz, Coatue, and KKR have drawn scrutiny for receiving Saudi capital from Sanabil, especially after the assassination of journalist Jamal Khashoggi by agents of the Saudi government.

‘America First’

Without additional context from Trump, it’s unclear how the U.S. sovereign wealth fund he proposed would operate, especially without a clear source of funding—or direction for capital investments.

Matt Bruenig, a progressive lawyer and founder of the think tank People’s Policy Project, has previously proposed a “social wealth fund for America,” about which he posted again on X after Trump’s remarks. Under Bruenig’s plan, the fund would tackle wealth inequality by issuing every American a share of ownership and accumulating assets such as stocks, bonds, and real estate. Citizens would not be permitted to sell their shares, but would earn a universal basic dividend, similar to the Alaskan model.

The sovereign wealth fund was not the only proposal from Trump in his speech on Thursday. He also announced that he would establish a “government efficiency commission” headed by Elon Musk that would be tasked with completing an audit of the government.

“I look forward to serving America if the opportunity arises,” Musk posted on X.

This story was originally featured on Fortune.com

Investor Notice: Robbins LLP Informs Stockholders of the Class Action Lawsuit Filed Against ZoomInfo Technologies, Inc.

SAN DIEGO, Sept. 05, 2024 (GLOBE NEWSWIRE) — Robbins LLP informs investors that a shareholder filed a class action on behalf of all purchasers of ZoomInfo Technologies, Inc. ZI Class A common stock between November 10, 2020 and August 5, 2024. ZoomInfo is a software and data company that provides customer analytics and intelligence to sales and marketing teams.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that ZoomInfo Technologies, Inc. (ZI) Misled Investors Regarding Demand for its Product

According to the complaint, during the class period, defendants failed to disclose to investors: (a) that ZoomInfo’s financial and operational results during the Class Period had been temporarily inflated by the ephemeral effects of the COVID-19 pandemic, which had pulled-forward demand for the Company’s database of digital contact information; (b) that material portions of ZoomInfo’s existing customer base were attempting to either substantially reduce their use of the Company’s product or abandon it altogether; (c) that ZoomInfo had used manipulative and coercive auto-renew policies and threats of litigation to force customers into remaining with the Company for an additional contractual term even though they did not want to; (d) that ZoomInfo’s coercive customer retention tactics had materially damaged the Company’s customer relationships, client franchise, and competitive advantages, and created a hidden demand cliff for costumer contract renewals in future periods; (e) that ZoomInfo’s reported accounts receivable were materially comprised of debts owed by high-risk small business customers that had a high likelihood of non-payment and had been induced to transact with the Company through a credit program the Company implemented in 2022; (f) that ZoomInfo’s allowance for credit losses was materially inadequate and understated the risk of non-payments by the Company’s customers; and (g) that as a result of (a)–(f), above, ZoomInfo’s reported revenues, operating income, and customer and retention metrics were materially overstated.

As a result, the price of ZoomInfo Class A common stock declined from a class period high of over $79 per share to just $8 per share by the end of the class period, a 90% decline. Further, Defendants, sold billions of dollars’ worth of ZoomInfo stock at artificially inflated prices before the truth was revealed.

What Now: You may be eligible to participate in the class action against ZoomInfo Technologies, Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by November 4, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against ZoomInfo Technologies, Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/1cfa0f39-b1c3-45c9-81de-ad0d12d01698

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Real Estate Stocks to Grab Now on Slowing Mortgage Rates

Real estate has been having a decent 2024. The S&P 500 Real Estate Select Sector SPDR XLRE has advanced 11.1% year to date as of Sept. 4. The sector declined till the end of June. However, optimism about the Fed introducing rate cuts in the economy and falling mortgage rates seem to have triggered a turnaround.

Buoyed by signals from the Fed, the benchmark 30-year average mortgage rate fell to 6.5% late last week, its lowest level since May 2023. The 30-year fixed-rate mortgage fell further on Aug. 30 to 6.37%. The National Association of Realtors (“NAR”) expects the 30-year fixed mortgage rate to average 6.9% in its recent quarterly forecast published in June. This is an upward revision from its previous forecast of 6.7%. NAR has also revised its forecast upward for the fourth quarter to 6.5-6.7%. It expects that the second half of 2024 will witness moderately lower mortgage rates, higher home sales and price stability.

Elevated mortgage rates have reduced affordability and hence, dampened home sales. It has also put pressure on existing homeowners with adjustable-rate mortgages who have seen their monthly payments go through the roof. Overall confidence in the housing market remains fairly subdued, according to the NAHB/Wells Fargo Housing Market Index (HMI). The index changed only slightly in July, falling to 42 from 43 in June.

However, with rate cuts almost certainly starting from September, coupled with the fact that mortgage rates are coming down, there might be better times ahead for home buyers. Even in case of an unlikely recession, a higher inventory of homes would bring prices further down, luring first-time buyers. One must, thus, start considering parking part of their investments in promising stocks in the sector.

Our Picks

We have narrowed our search to three real estate or related stocks that have good potential. These stocks have seen positive earnings estimate revisions in the past 60 days. Our picks carry either a Zacks Rank #1 (Strong Buy) or 2 (Buy).

Two Harbors Investment Corp. TWO is a real estate investment trust that invests in mortgage servicing rights, residential mortgage-backed securities and other financial assets.

TWO has an expected earnings growth rate of 757.1% for the current year. The Zacks Consensus Estimate for its current-year earnings has surged 178% over the past 60 days. TWO currently sports a Zacks Rank #1.

Tanger Inc. SKT is a real estate investment trust primarily investing in shopping centers.

SKT has an expected earnings growth rate of 6.6% for the current year. The Zacks Consensus Estimate for its current-year earnings has improved 1.5% over the past 60 days. SKT currently holds a Zacks Rank #2.

Dynex Capital, Inc. DX is a mortgage real estate investment trust.

DX has an expected earnings growth rate of 205.3% for the current year. The Zacks Consensus Estimate for its current-year earnings has improved 33.3% over the past 60 days. DX currently holds a Zacks Rank #2.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia's 15% stock slide has created a compelling buying opportunity, BofA says

-

Nvidia stock has tumbled since it reported earnings last week.

-

Bank of America says the slide opens up an attractive buying opportunity.

-

The chip maker’s stock is trading near its lowest valuation in five years, the bank said.

Nvidia bulls may feel paralyzed by the sudden onslaught of headwinds blowing against the company, but to Bank of America, the move down in the stock price in the last week offers an attractive buying opportunity.

On Tuesday, shares of the semiconductor kingpin tanked, wrenching down its market value by $279 billion for the largest one-day decline in US corporate history.

The pullback came after the firm’s recent earnings report failed to meet the market’s most bullish expectations, adding to fears that the artificial intelligence rally may be losing steam.

The stock briefly continued its retreat on Wednesday, following a report that the firm received a subpoena from the Department of Justice. In all, the stock has fallen by as much as 15% since Nvidia released its second-quarter earnings in late August.

To Bank of America, the post-earnings skid marks a buying opportunity.

In a note released Thursday, the bank said that Nvidia is now hovering around its cheapest valuation in the past five years.

“While market forces could enhance near-term stock volatility, we continue to find NVDA valuation compelling at 27x CY25/FY26E consensus PE (or only ~20x PE at high-end of $5+ CY25 eps estimate),” analyst Vivek Arya wrote.

Compared to this, Nvidia price-to-earnings have ranged between the mid-20s to mid-60s over the past half-decade.

Investors who buy the stock now could be facing 54% upside, according to BofA’s price target of $165 per share.

This looks achievable, as Nvidia will remain a key beneficiary of AI investing and won’t always be pressured down by headwinds, the bank said. For instance, weak supply-side fundamentals should subside in the near term, the analysts noted.

While investors are disappointed by delays in the firm’s next-gen Blackwell chip, shipments should be confirmed over the next several weeks, BofA estimates.

In any case, the bank doesn’t anticipate demand for prior-gen Hopper chips to disappear, given how strong AI demand is.

Concerning regulatory headwinds, Nvidia has since denied receiving a subpoena from the DOJ.

Bloomberg — which first reported on the subpoena — later reported that the DOJ sent a civil investigative demand, citing a source close to the matter.

Though BofA assumes no impact from these developments, it noted that government cases are not uncommon against large US tech companies.

Finally, skepticism about AI’s potential remains a non-issue, the bank said, at least until 2026. Those concerned that the AI spending wave has yet to show results must simply be patient, the analysts wrote.

“The tech industry will give itself at least another 1-2 years of intense buildout of NVDA Blackwell chip with its 4x lift in AI training and 25x+ lift in inference. Efforts thus far with the first wave of large language models (LLM), using NVDA Hopper was just the teaser,” BofA wrote, anticipating that real AI capabilities will be unlocked by upcoming LLMs.

Read the original article on Business Insider

Glancy Prongay & Murray LLP Reminds Investors of Looming Deadline in the Class Action Lawsuit Against Indivior PLC (INDV)

LOS ANGELES, Sept. 05, 2024 (GLOBE NEWSWIRE) — Glancy Prongay & Murray LLP (“GPM”) reminds investors of the upcoming October 1, 2024 deadline to file a lead plaintiff motion in the class action filed on behalf of investors who purchased or otherwise acquired Indivior PLC (“Indivior” or the “Company”) INDV securities between February 22, 2024 and July 8, 2024, inclusive (the “Class Period”).

If you suffered a loss on your Indivior investments or would like to inquire about potentially pursuing claims to recover your loss under the federal securities laws, you can submit your contact information at www.glancylaw.com/cases/Indivior-PLC-1/. You can also contact Charles H. Linehan, of GPM at 310-201-9150, Toll-Free at 888-773-9224, or via email at shareholders@glancylaw.com to learn more about your rights.

On July 9, 2024, Indivior disclosed that it would be immediately ceasing all sales and marketing activities related to its schizophrenia treatment, PERSERIS due to the highly competitive market “and impending changes that are expected to intensify payor management in the treatment category in which PERSERIS participates.” Additionally, the Company significantly reduced its 2024 net revenue guidance.

On this news, Indivior’s stock price fell $5.15, or 33.6%, to close at $10.19 per share on July 9, 2024, thereby injuring investors.

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants: (1) grossly overstated their ability to forecast the negative impact of certain legislation on the financial prospects of Indivior products, which forecasting ability was far less capable and effective than Defendants had led investors and analysts to believe; (2) overstated the financial prospects of SUBLOCADE, PERSERIS and OPVEE, and thus overstated the Company’s anticipated revenue and other financial metrics; (3) knew or recklessly disregarded that because of the negative impact of certain legislation on the financial prospects of Indivior’s products, Indivior was unlikely to meet its own previously issued and repeatedly reaffirmed FY 2024 net revenue guidance, including its FY 2024 net revenue guidance for SUBLOCADE, PERSERIS and OPVEE; (4) knew or recklessly disregarded that Indivior was at a significant risk of, and/or was likely to, cease all sales and marketing activities related to PERSERIS; and (5) as a result, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis at all relevant times.

Follow us for updates on LinkedIn, Twitter, or Facebook.

If you purchased or otherwise acquired Indivior securities during the Class Period, you may move the Court no later than October 1, 2024 to request appointment as lead plaintiff in this putative class action lawsuit. To be a member of the class action you need not take any action at this time; you may retain counsel of your choice or take no action and remain an absent member of the class action. If you wish to learn more about this class action, or if you have any questions concerning this announcement or your rights or interests with respect to the pending class action lawsuit, please contact Charles Linehan, Esquire, of GPM, 1925 Century Park East, Suite 2100, Los Angeles, California 90067 at 310-201-9150, Toll-Free at 888-773-9224, by email to shareholders@glancylaw.com, or visit our website at www.glancylaw.com. If you inquire by email please include your mailing address, telephone number and number of shares purchased.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Contacts

Glancy Prongay & Murray LLP, Los Angeles

Charles Linehan, 310-201-9150 or 888-773-9224

shareholders@glancylaw.com

www.glancylaw.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These Ultra-High Dividend Stocks Are Soaring: Is It Too Late to Buy Shares?

The Federal Reserve has officially signaled that interest rate hikes have peaked and that interest rate cuts will begin this year. Since the start of 2022, the Federal Reserve in the United States has increased the interest rate it charges banks, which leads to increasing interest rates paid to customers for banks and savings products.

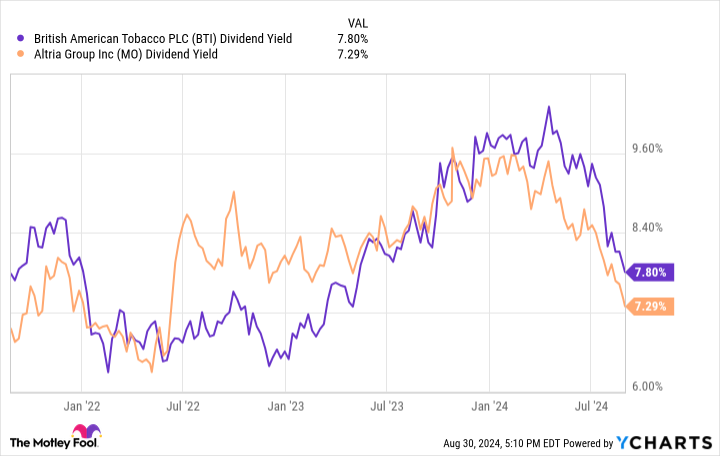

Higher interest rates make slow-growth dividend stocks less attractive, all else equal. The logic goes that if you can get the yield in a savings account, why take the risk with a dividend stock that may fall in value? This is why ultra-high-yielding tobacco stocks British American Tobacco (NYSE: BTI) and Altria Group (NYSE: MO) went nowhere for a few years. This summer, everything changed. Both stocks have soared in the past three months, crushing the returns of the broad market S&P 500 over this time.

Is it too late to buy these two high-yielding tobacco stocks? Or is the party just getting started with interest rates set to decline shortly?

Altria Group: 7.3% dividend yield in a tough customer environment

Altria Group owns the leading premium cigarette brand in the United States: Marlboro. Along with Marlboro, it owns the NJOY nicotine vaping brand, Middleton Cigars, On! nicotine pouches, and a large stake in Anheuser Busch. It currently has a 7.29% dividend yield, down from over 9% earlier this year.

Investors have concerns about declining volumes for Marlboro in the United States. To put it simply, people are smoking less and less in the country. So far this year, Marlboro shipment volumes have declined by more than 10% with no signs of slowing down. They have declined for many years. And yet, Altria’s operating income is up 51.8% in the last 10 years. Why? Because of the pricing power it is able to pass on for cigarette packs. This is a dynamic that can continue for many years.

On top of this, there are a lot of other segments that can drive earnings growth for Altria Group. Cigars are not seeing nearly as quick of a volume decline and also have pricing power. Vaping and nicotine pouches are growth markets and should replace volumes from Marlboro in the coming years. Add it all together, and I think that the concerns about Marlboro’s volume declines are overblown.

Let’s not forget the company’s repurchase program, either. Shares outstanding are down by 13.7% in the last 10 years, which makes it easier for Altria to grow its dividend per share. Free cash flow per share — the fuel for dividend payments — is up 125% in the last 10 years. As long as the company can keep raising prices and transition some consumers to new products while decreasing its share count, I think free cash flow per share can continue to grow.

British American Tobacco: Higher yield and higher upside?

The other ultra-high dividend payer is British American Tobacco. It has some similarities and differences to Altria Group and an even higher dividend yield of 7.8%.

British American Tobacco is similar to Altria in that it has exposure to the fast-declining U.S. market. It owns brands such as Dunhill and Lucky Strike. As discussed above, the company will need to raise prices and improve its profit margin in order to keep profits up in the United States.

Unlike Altria Group, British American Tobacco has exposure to international markets. In general, these markets are seeing slower volume declines compared to the United States, which is a benefit for the company. However, it still has foreign currency risk, which can impact U.S. investors. If the U.S. dollar rises in value relative to other currencies, that can be an earnings headwind to British American Tobacco. The international segment is a mixed bag, but I think it can drive profit growth for many years as long as the U.S. dollar isn’t too strong.

British American Tobacco is doing much better than Altria in new tobacco-free nicotine products. It has strong brands like Vuse (vaping) and Velo (nicotine pouches) that are becoming a much larger part of its business. In fiscal 2023, these smokeless products were 16.5% of revenue and finally flipped from losing money to positive profitability. There is no sign that these divisions are slowing down, either. This can drive cash-flow growth and therefore maintain or grow the British American Tobacco dividend.

Is it too late to buy these dividend payers?

Depending on your tax profile (which can be important for dividend stocks), dividend stocks are great to own if they have a higher yield than a savings account or U.S. Treasury bond. This is especially true if Treasury rates are about to fall. Altria and British American Tobacco both have dividend yields above 7%, which is much higher than what you can get in a savings account.

The only question is: Are the dividend yields safe? I think they clearly are. Both companies are seeing declining volumes in the United States but can counteract these effects with price increases and more profit contributions from new divisions. This is why it shouldn’t be surprising that Altria just raised its quarterly dividend payout by 4% to $1.02.

In fact, I think that both stocks have a good chance to grow their dividend-per-share payouts at a consistent rate over the next five to 10 years. If that happens, income-focused investors will be happy to have bought shares at today’s prices.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

These Ultra-High Dividend Stocks Are Soaring: Is It Too Late to Buy Shares? was originally published by The Motley Fool

Prediction: This Biotech Stock Will Outperform Nvidia in the Second Half of the Year

Nvidia (NASDAQ: NVDA) is a tough one to beat when it comes to share-price performance. The technology giant has seen its shares soar 2,500% over the past five years, and this year, it’s heading for a 118% increase.

There’s a good reason for this incredible run. Nvidia dominates one of today’s biggest growth areas — the artificial intelligence (AI) chip market — holding an 80% share. As a result, Nvidia’s earnings have been climbing in the triple digits to new records, quarter after quarter.

Though Nvidia makes a great buy, this stock isn’t the only potential winner for your portfolio in the second half of 2024. My prediction is that a biotech stock operating in a particularly dynamic field will outperform the tech giant during this period. (It already beat Nvidia’s performance in the first half.)

This biotech has fallen behind over the past six months, but major advancements in its pipeline may give the stock the boost it needs to jump ahead, once again. Read on to find out more.

The billion-dollar obesity drug market

Which biotech company are we talking about? Viking Therapeutics (NASDAQ: VKTX), a player that’s making significant progress in the obesity drug market, which Goldman Sachs Research predicts may reach $100 billion by the end of the decade. Viking is developing candidates known as dual GIP/GLP-1 receptor agonists, much like the already commercialized drugs of Eli Lilly and Novo Nordisk.

These types of drugs work by acting on hormones involved in the digestion process, controlling blood sugar levels and appetite. They’ve been immensely popular, leading to shortages in the market and pushing Lilly and Novo Nordisk to expand their production capabilities.

Viking’s candidates have produced promising data in clinical trials. For example, the phase 2 trial of injectable candidate VK2735 met its primary endpoint and all secondary endpoints, with patients achieving as much as a 15% reduction in body weight after 13 weeks. And in the phase 1 trial of the tablet version of the candidate, patients showed as much as 5.3% reduction in weight in just 28 days. The announcement of these results earlier in the year wowed investors, prompting the stock to take off.

In the second half of 2024, Viking is planning an end-of-phase 2 meeting with the U.S. Food and Drug Administration for VK2735. Following that, it aims to launch a phase 3 trial. The company also expects to start a phase 2 trial for the oral version later this year. This progression may offer the stock fuel to rocket higher in the coming months.

A potential takeover target?

Investors also have speculated that a bigger biotech or pharma company may consider Viking as a takeover target to get in on the booming weight loss drug market. Further speculation or concrete developments here also could keep Viking stock flying high in the later months of the year.

Meanwhile, Nvidia could advance, as well, especially considering the company’s upcoming launch of its new architecture Blackwell, its most powerful chip ever. But Viking’s share performance following pipeline developments has proven to be better than that of Nvidia following good news. When Viking reported positive VK2735 data earlier this year, the stock surged more than 120% in one trading session. Nvidia, after announcing the launch of a stock split — news investors generally welcome — climbed about 9% in one session.

Any positive news from Viking could result in outsized gains. With programs advancing in the coming months, more news could be on the horizon.

Long-term investing

Of course, this is just short-term performance. Before buying a stock, it’s important to consider its long-term potential because holding on to solid companies for at least five years is the way to truly boost your portfolio.

I expect Eli Lilly to dominate the weight loss drug market, thanks to its position today and candidates in the pipeline. However, considering the great demand in this market, Viking could carve out share down the road — or potentially join forces with another company.

Viking comes with some risk since it’s an up-and-coming player and not an established one like Eli Lilly. But it also carries significant growth potential if pipeline programs continue to advance successfully. That’s why this stock — which I predict will beat Nvidia in the second half — also may score a long-term win for investors.

Should you invest $1,000 in Viking Therapeutics right now?

Before you buy stock in Viking Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Viking Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and Nvidia. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Prediction: This Biotech Stock Will Outperform Nvidia in the Second Half of the Year was originally published by The Motley Fool

SPIR Lawsuit Reminder: Robbins LLP Encourages Spire Global, Inc. Stockholders to Seek Counsel for the Class Action Lawsuit

SAN DIEGO, Sept. 05, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action on behalf of all persons and entities that purchased or otherwise acquired Spire Global, Inc. SPIR securities between March 6, 2024 and August 14, 2024. Spire Global is a provider of satellite data, analytics, and services.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that Spire Global, Inc. (SPIR) Misled Investors Regarding Revenue Recognition Related to its Space Services Contracts

According to the complaint, during the class period, defendants failed to disclose to investors: (1) that there were embedded leases of identifiable assets and pre-space mission activities for certain Space Services contracts; (2) that Spire Global lacked effective internal controls regarding revenue recognition for these contracts; and (3) that, as a result, the Company overstated revenue for certain Space Services contracts.

Plaintiff alleges that on August 14, 2024, after the market closed, the Company announced it would be unable to timely file its second quarter 2024 financial report as the Company was “reviewing its accounting practices and procedures with respect to revenue recognition” regarding certain Space Services contracts and “related internal control matters.” The Company disclosed the “type of Contracts that the Company has identified for re-evaluation resulted in recognized revenue of $10 to $15 million on an annual basis” and “additional financial measures such as gross profit could also be impacted.” On this news, the Company’s share price fell $3.41 or 33.56%, to close at $6.75 per share on August 15, 2024.

What Now: You may be eligible to participate in the class action against Spire Global, Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by October 21, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against Spire Global, Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/759b39ef-c66f-419f-acd4-94c5a679c07c

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.