Decoding Chevron's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bullish stance on Chevron CVX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CVX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 28 uncommon options trades for Chevron.

This isn’t normal.

The overall sentiment of these big-money traders is split between 35% bullish and 28%, bearish.

Out of all of the special options we uncovered, 18 are puts, for a total amount of $1,626,319, and 10 are calls, for a total amount of $472,975.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $160.0 for Chevron during the past quarter.

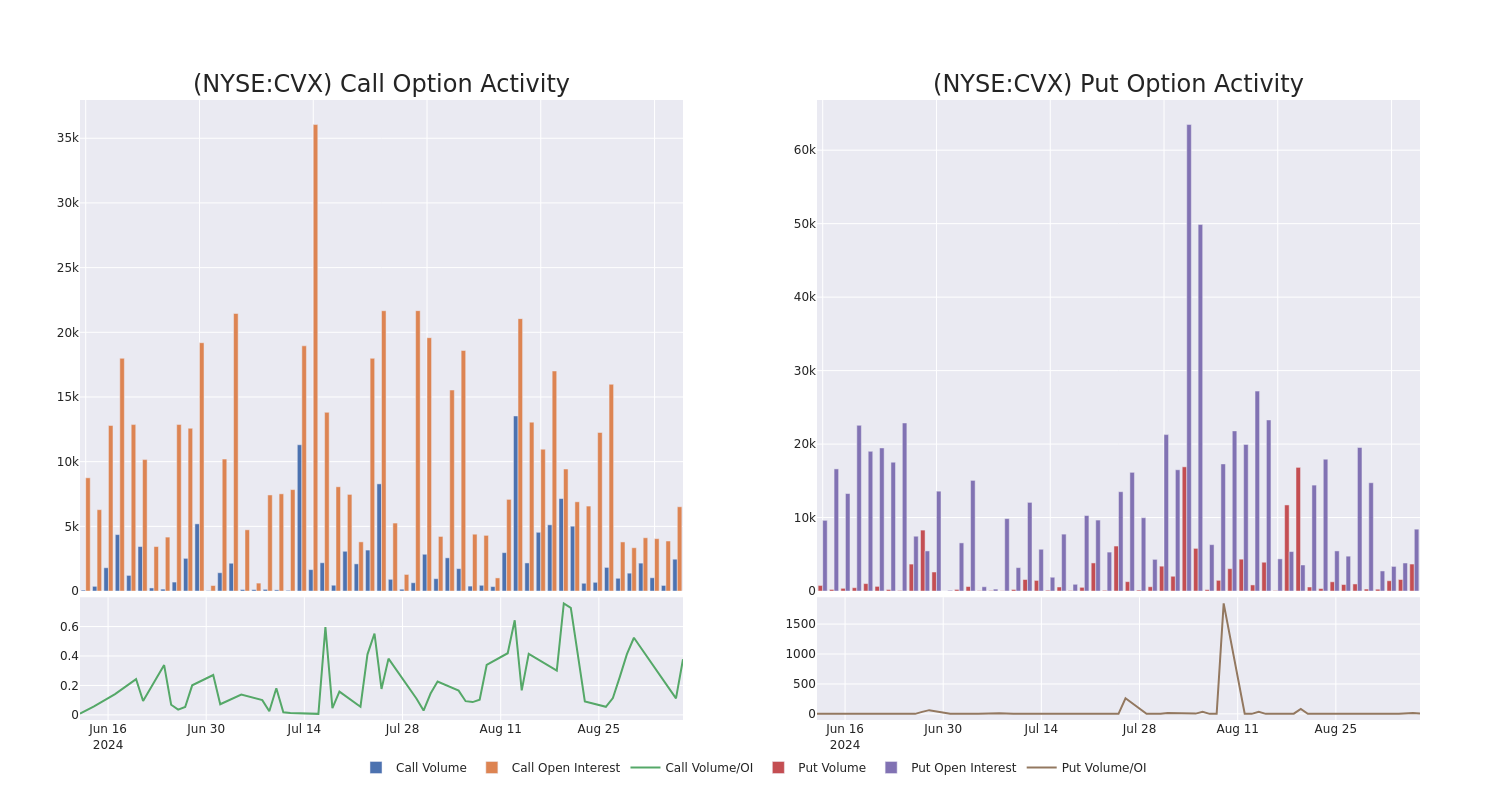

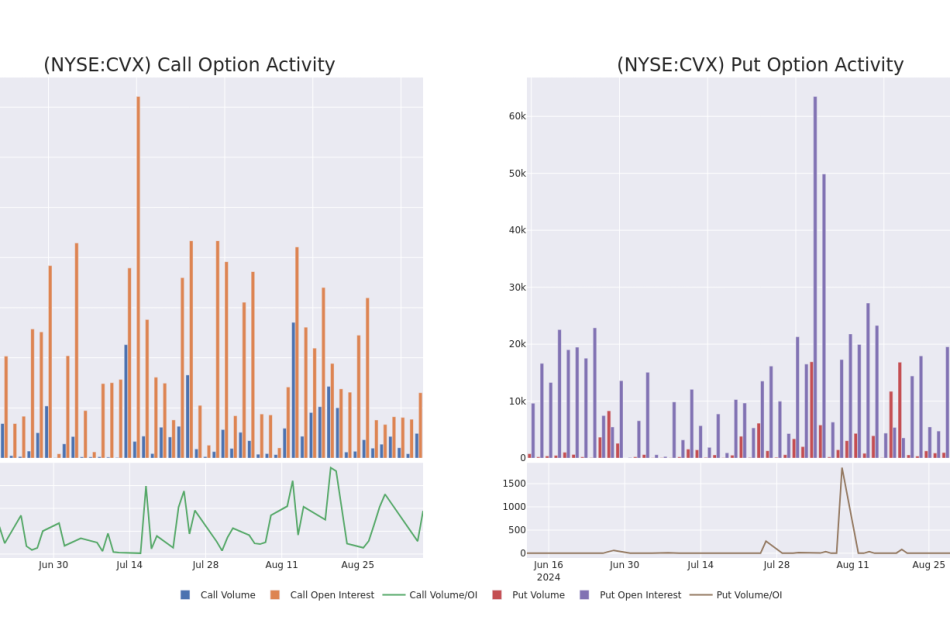

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Chevron’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Chevron’s whale trades within a strike price range from $120.0 to $160.0 in the last 30 days.

Chevron 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | PUT | SWEEP | BULLISH | 03/21/25 | $18.75 | $18.5 | $18.6 | $155.00 | $185.8K | 770 | 492 |

| CVX | PUT | SWEEP | BULLISH | 03/21/25 | $18.75 | $18.5 | $18.57 | $155.00 | $185.7K | 770 | 695 |

| CVX | PUT | SWEEP | BULLISH | 03/21/25 | $18.75 | $18.5 | $18.57 | $155.00 | $185.7K | 770 | 695 |

| CVX | PUT | SWEEP | BULLISH | 03/21/25 | $18.7 | $18.5 | $18.56 | $155.00 | $185.7K | 770 | 695 |

| CVX | PUT | SWEEP | BULLISH | 09/20/24 | $11.0 | $10.85 | $10.9 | $150.00 | $98.1K | 4.8K | 170 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

After a thorough review of the options trading surrounding Chevron, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Chevron’s Current Market Status

- With a volume of 7,804,635, the price of CVX is down -1.62% at $138.64.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 49 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chevron, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply