Is It Time to Buy August's Worst-Performing Nasdaq Stocks?

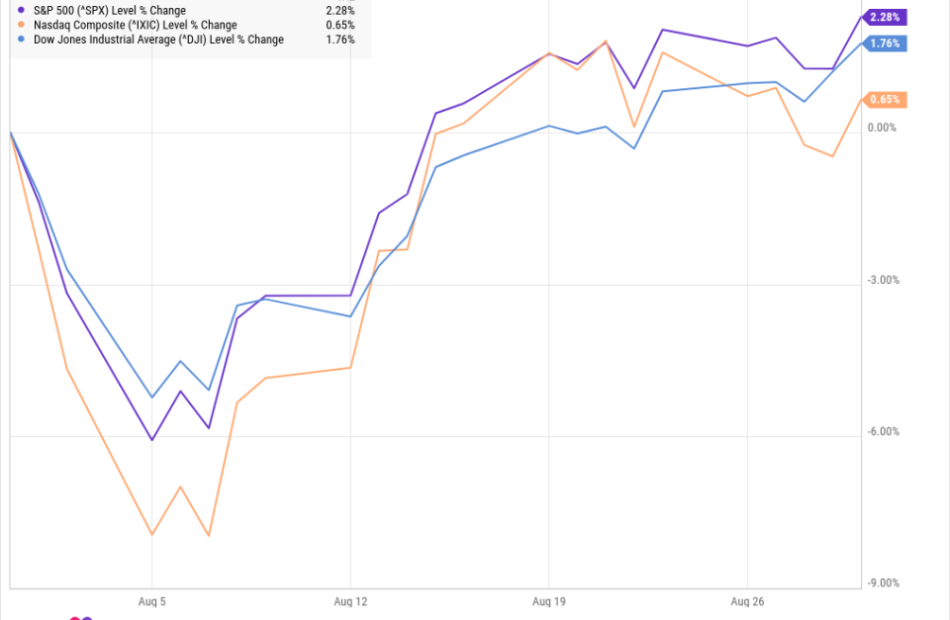

August had one of the worst beginnings of a month for the stock market in recent memory.

Shares plunged on a combination of disappointing economic data and a surprise rate hike in Japan that ended the “carry trade” through which professional investors had borrowed money in yen and bought U.S. stocks.

However, stocks recovered over the rest of the month and actually finished in positive territory as those earlier concerns faded.

As you might guess, it was an active month for individual stocks as well, including those on the Nasdaq-100. Let’s take a look at the three worst performers in August from the elite group of tech stocks to see if any are worth buying.

1. Super Micro Computer (down 37.4%)

The worst performer on the Nasdaq-100 was actually one of the best performers over the past year, Super Micro Computer (NASDAQ: SMCI), aka Supermicro.

The AI server stock got hit by a double whammy last month. First, the stock fell at the beginning of the month as the company reported blowout revenue growth in its fiscal fourth quarter, but its gross margin fell sharply, cramping profit growth. That seemed to convince investors that the company’s growth wasn’t sustainable, or that price competition was heating up, weighing on Supermicro’s bottom line.

Though management said that margins would expand over the coming year, that wasn’t enough to assuage investors’ fears.

Later in the month, the stock plunged further. It was hit first by a short-seller report making various allegations about its business. Then, the following day, Supermicro said it would delay its 10-K filing as it needed more time to “complete its assessment of the design and operating effectiveness of its internal controls over financial reporting.”

Those two things didn’t seem to be related. But the timing of the 10-K delay certainly didn’t calm investors’ nerves.

At this point, Supermicro seems likely to remain in the doghouse until it files its 10-K. When it does, investors may get their answer to Hindenburg’s claims.

For now, the stock looks risky but also cheap. Taking a small position in Supermicro could pay off if it can navigate the current situation.

2. Moderna (down 35.1%)

Shares of Moderna (NASDAQ: MRNA), the mRNA vaccine maker, plunged on its earnings report to start August and never recovered.

The biotech company cut its guidance following its second-quarter earnings report, saying it now expects full-year product sales of $3 billion to $3.5 billion, down from previous guidance of around $4 billion. The update was caused by very low sales in the EU, possible revenue deferrals from some international sales, and increasing competition in the U.S. market for respiratory vaccines.

The sell-off on guidance isn’t surprising, as Moderna has gone from earning a windfall for its COVID vaccine to now being a high-risk stock posting significant losses. Moderna is now on track to report an operating loss of about $4 billion this year.

Despite the wide losses and guidance cut, Moderna’s technology still holds promise. In fact, HSBC just upgraded its rating to hold due to the potential for its developmental personalized cancer vaccine, which is now in late-stage clinical trials.

A breakthrough for Moderna could lead to another surge in the stock. While that doesn’t seem imminent, taking a small speculative position at this point could pay off down the road.

3. Intel (down 28%)

Finally, Intel (NASDAQ: INTC) is the third Nasdaq-100 stock to fall flat on its face in August.

Intel’s problems came after it reported second-quarter results. Not only did the company deliver a weak quarter and offer disappointing guidance, but it also said it was eliminating its dividend and restructuring the business, including by laying off at least 15% of its workforce.

Those moves show how desperate things have gotten for Intel. Critics have assailed the company for a lack of innovation for years, and it’s now falling behind Nvidia and AMD in AI, a high-stakes technology in the semiconductor industry.

CEO Pat Gelsinger has bet on a turnaround in the foundry business, but that segment is losing billions of dollars each quarter.

Towards the end of the month, the stock got a minor reprieve on reports that it was considering strategic options, including potentially spinning off the foundry business, which was enough for the stock to jump 9% on the last day of August.

Intel may look cheap, but the stock is best avoided at this point, as the business is clearly in disarray, and any turnaround is going to take years to materialize.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

HSBC Holdings is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has positions in Moderna. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends HSBC Holdings, Intel, and Moderna and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Is It Time to Buy August’s Worst-Performing Nasdaq Stocks? was originally published by The Motley Fool

Leave a Reply