Nike Unusual Options Activity For September 06

Whales with a lot of money to spend have taken a noticeably bullish stance on Nike.

Looking at options history for Nike NKE we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 57% of the investors opened trades with bullish expectations and 28% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $335,365 and 8, calls, for a total amount of $581,526.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $97.5 for Nike, spanning the last three months.

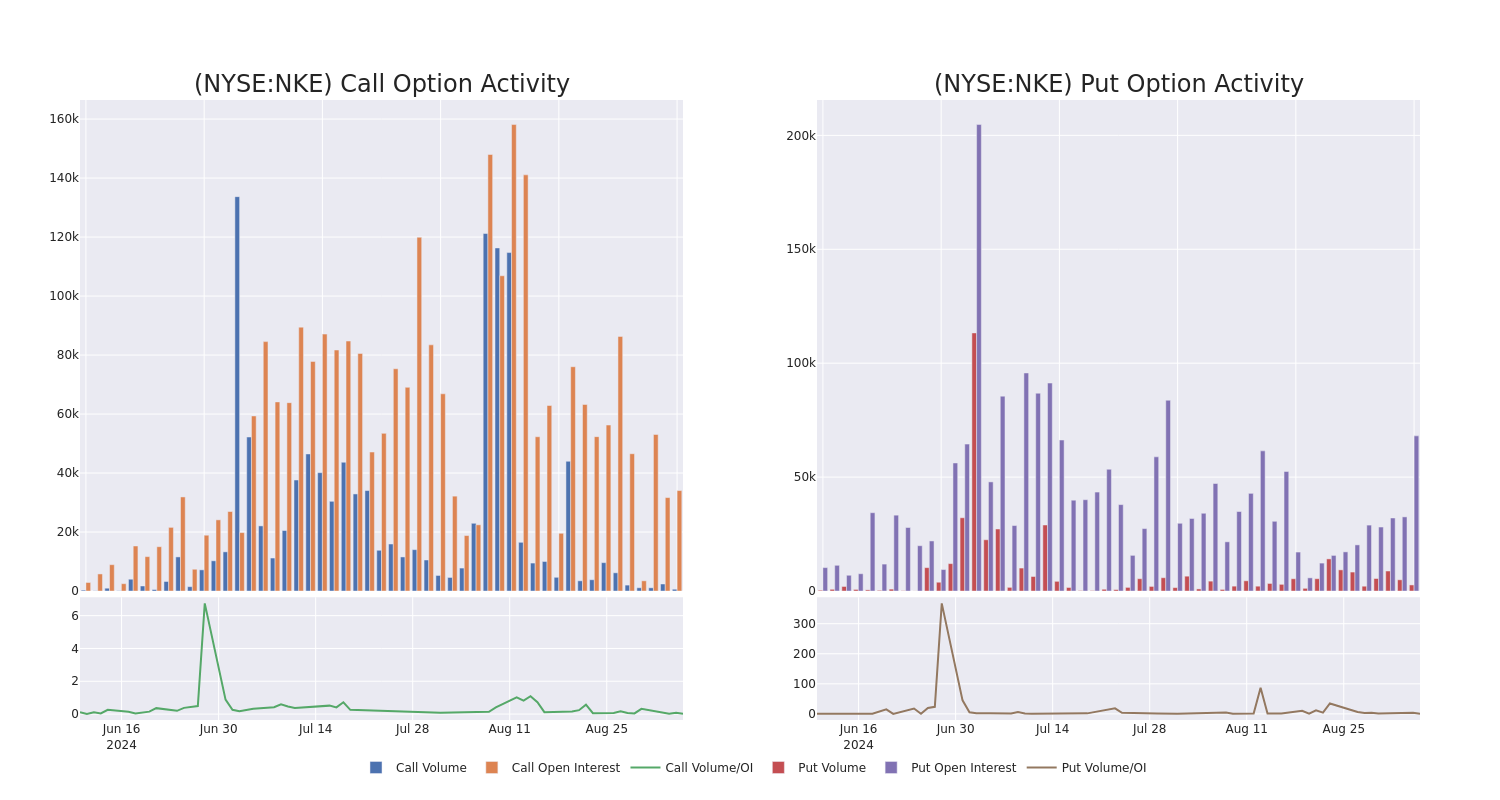

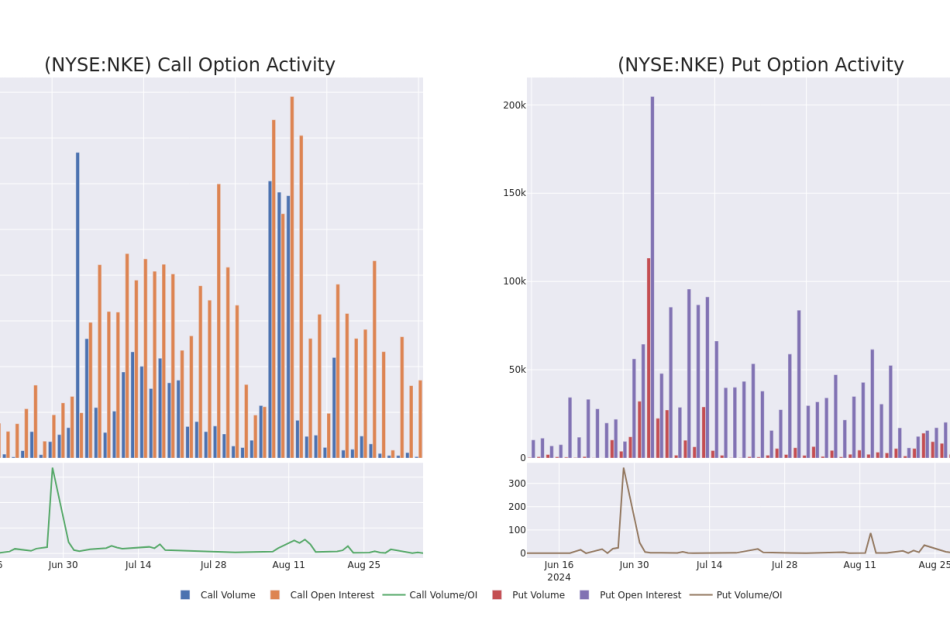

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Nike’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Nike’s significant trades, within a strike price range of $50.0 to $97.5, over the past month.

Nike Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | CALL | SWEEP | BEARISH | 03/21/25 | $8.05 | $7.95 | $7.95 | $82.50 | $185.2K | 496 | 246 |

| NKE | CALL | SWEEP | BULLISH | 09/06/24 | $3.7 | $3.65 | $3.7 | $78.00 | $185.0K | 530 | 502 |

| NKE | PUT | SWEEP | BULLISH | 12/20/24 | $12.7 | $12.55 | $12.55 | $92.50 | $183.2K | 1.3K | 149 |

| NKE | CALL | TRADE | BULLISH | 10/18/24 | $2.69 | $2.64 | $2.69 | $85.00 | $52.1K | 8.3K | 449 |

| NKE | PUT | SWEEP | BEARISH | 11/15/24 | $2.27 | $2.2 | $2.27 | $75.00 | $34.0K | 4.8K | 156 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Nike’s Current Market Status

- Trading volume stands at 8,502,745, with NKE’s price down by -0.25%, positioned at $80.63.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 25 days.

What The Experts Say On Nike

3 market experts have recently issued ratings for this stock, with a consensus target price of $84.0.

- In a positive move, an analyst from Williams Trading has upgraded their rating to Buy and adjusted the price target to $93.

- An analyst from Stifel has decided to maintain their Hold rating on Nike, which currently sits at a price target of $79.

- An analyst from Piper Sandler has revised its rating downward to Neutral, adjusting the price target to $80.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Nike with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply