ACADIA ALERT: Bragar Eagel & Squire, P.C. is Investigating Acadia Healthcare Company, Inc. on Behalf of Acadia Stockholders and Encourages Investors to Contact the Firm

NEW YORK, Sept. 06, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized stockholder rights law firm, is investigating potential claims against Acadia Healthcare Company, Inc. (“Acadia” or the “Company”) ACHC on behalf of Acadia stockholders. Our investigation concerns whether Acadia has violated the federal securities laws and/or engaged in other unlawful business practices.

Click here to participate in the action.

On Sunday, September 1, 2024, The New York Times published an article entitled “How a Leading Chain of Psychiatric Hospitals Traps Patients.” This article stated that “Acadia Healthcare is one of America’s largest chains of psychiatric hospitals. Since the pandemic exacerbated a national mental health crisis, the company’s revenue has soared. [. . .] But a New York Times investigation found that some of that success was built on a disturbing practice: Acadia has lured patients into its facilities and held them against their will, even when detaining them was not medically necessary. In at least 12 of the 19 states where Acadia operates psychiatric hospitals, dozens of patients, employees and police officers have alerted the authorities that the company was detaining people in ways that violated the law, according to records reviewed by The Times. In some cases, judges have intervenes to force Acadia to release patients.”

On this news, the price of Acadia Healthcare stock fell by 4.5% on September 3, 2024.

If you purchased or otherwise acquired Acadia shares and suffered a loss, are a long-term stockholder, have information, would like to learn more about these claims, or have any questions concerning this announcement or your rights or interests with respect to these matters, please contact Brandon Walker or Marion Passmore by email at investigations@bespc.com, by telephone at (212) 355-4648, or by filling out this contact form. There is no cost or obligation to you.

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York and California. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Scanifly Integrates with SubcontractorHub to Streamline Residential Solar Sales, Project Management and PV Design

DENVER, Sept. 6, 2024 /PRNewswire/ — Scanifly, the industry leader in PV design and field operations software, has integrated with SubcontractorHub, an end-to-end platform that reduces installation costs, shortens project timelines, and produces robust solar and energy storage proposals. This integration incorporates Scanifly’s remote and drone-based design capabilities as one of SubcontractorHub’s design tool options, seamlessly complementing SubcontractorHub’s sales, financing, and project management solutions. Together, this integration delivers a streamlined workflow for sales dealers, EPCs, and installers.

Scanifly specializes in powering solar’s operational stages including design, site survey, engineering, commissioning, and maintenance. This new partnership offers contractors a true one-stop-shop experience, combining “front-end” and “back-end” solutions.

“Our efforts with SubcontractorHub mirror our recent collaboration with Energy Toolbase, which provides a similar experience for commercial developers. We’re excited to continue offering contractors front-end optionality by expanding our partnerships with various proposal tools,” commented Scanifly CEO, Jason Steinberg.

The SubcontractorHub + Scanifly integration synchronizes project data at critical stages across the solar project lifecycle. Sales representatives can now initiate Scanifly remote designs directly from their SubcontractorHub accounts, with completed designs automatically populating project records and timelines in their proposals. Following a site visit, surveyors and operations personnel can upload field data and checklists directly from Scanifly Mobile into a dedicated repository within SubcontractorHub for M2 and M3 submissions. Scanifly’s drone-based 3D designs, on-demand engineering documents, and real-time shade reports take the project to completion and accelerate post-sale milestone payments.

Scanifly’s centralized PV design platform delivers impressive results for contractors, cutting survey and design time by up to 90% compared to manual methods of roof climbs, tape measures, and CAD drafting. Scanifly’s unmatched design accuracy translates to fewer change orders, reduced roof time, and zero revisions on install day.

To learn more about the Scanifly and SubcontractorHub partnership, join our upcoming webinar in late September for an in-depth overview and walkthrough. Ready to initiate the bridge between the two platforms? Schedule a demo to get started today!

Contact:

Brad Knudsen

(952)-221-9268

Info@Scanifly.com

About Scanifly

Scanifly is the solar industry’s premier design and field operations software for residential and commercial contractors. Its leading end-to-end solution centralizes all design, site survey, engineering, installation, and maintenance processes on one platform. Contractors who use Scanifly’s mobile, web, and drone-based technology suite eliminate change orders and revisions, improve operational efficiency, and reduce site survey time by 90%. To learn more, hear what contractors have to say about Scanifly.

About SubcontractorHub

SubcontractorHub is the industry leader in sales velocity and project management solutions for the construction industry. Our cutting-edge platform equips contractors and business owners in roofing, solar, energy storage, and HVAC sectors with tools for AI-driven design, customized proposals, and efficient project management.

We streamline processes with built-in customer portals, project tracking, and comprehensive dashboards, enabling firms to scale asset-light and boost efficiency. Our white-label lead generation and ambassador program further drive referral transactions, helping clients expand their reach and accelerate growth. Learn more about this partnership in our customer story.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/scanifly-integrates-with-subcontractorhub-to-streamline-residential-solar-sales-project-management-and-pv-design-302240716.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/scanifly-integrates-with-subcontractorhub-to-streamline-residential-solar-sales-project-management-and-pv-design-302240716.html

SOURCE Scanifly

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Suffers Largest Weekly Drop Since March 2023 Banking Crisis, Chipmakers Notch Worst Week In Over Four Years

The S&P 500 index endured its sharpest weekly decline in over a year and a half — a drop that hasn’t been seen since the banking crisis in March 2023.

A cooler labor market report prompted investors to reduce their risk exposure after three consecutive weeks of gains.

On Friday, Wall Street experienced a strong “risk-off” session, with the S&P 500, tracked by the SPDR S&P 500 ETF Trust SPY, closing 1.7% lower. This extended the weekly loss to 4.1%.

Tech stocks were hit even harder. The Invesco QQQ Trust, Series 1 QQQ, which follows the performance of major tech stocks, plunged 2.6% on Friday. This resulted in a 5.8% weekly loss, the steepest since October 2022.

Semiconductors bore the brunt of the selling. The iShares Semiconductor ETF SOXX, a barometer for the semiconductor industry, sank 4.3% on Friday alone. Over the week, the sector was down 11.8%, its worst weekly performance since March 2020.

Cooling Employment Numbers Amplify Risk-Off Mood

Friday’s selloff was driven in large part by the latest labor market data. The U.S. economy added just 142,000 nonfarm payrolls in August, missing the forecast of 160,000 and significantly below the one-year average of 202,000 new jobs per month.

The unemployment rate ticked down slightly from 4.3% to 4.2%, in line with expectations, while wage growth provided a mild upside surprise.

“We acknowledge that today’s employment report was weaker than we expected, but we don’t see a recession,” said veteran Wall Street investor Ed Yardeni.

Yardeni highlighted that while employers are not laying off workers en masse, their demand for new hires has slowed down, even as the supply of labor has increased.

“The moderation in the labor market has been characterized by low layoffs and slowing hiring,” added Bank of America economist Shruti Mishra.

In response to the softer jobs data, Bank of America altered its forecast for Federal Reserve rate cuts. Previously, the bank had expected 25 basis point cuts per quarter beginning in September. Now, the firm foresees the Fed trimming rates by 25 basis points at each meeting for the next five sessions, bringing the policy rate down to 4% by March 2025.

Friday’s Major Drags On The S&P 500

Here’s a breakdown of the five largest contributors to Friday’s decline in the S&P 500:

| Name | Weight (%) | Return (%) | Contribution (bps) |

|---|---|---|---|

| NVIDIA Corporation | 5.69 | -4.04 | -24 |

| Broadcom Inc. AVGO | 1.44 | -10.35 | -16 |

| Amazon.com, Inc. AMZN | 3.51 | -3.64 | -13 |

| Tesla, Inc. TSLA | 1.38 | -8.44 | -13 |

| Microsoft Corporation MSFT | 6.55 | -1.63 | -11 |

Friday’s Worst-Performing Semiconductor Stocks

The semiconductor sector faced particular challenges, with major names among the worst performers:

| Name | Return (%) |

|---|---|

| Broadcom Inc. | -10.35 |

| Wolfspeed, Inc. WOLF | -6.53 |

| ASML Holding N.V. ASML | -5.37 |

| Rambus Inc. RMBS | -5.28 |

| Marvell Technology, Inc. MRVL | -5.25 |

Now Read:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga's 'Stock Whisper' Index: 5 Stocks Investors Secretly Monitor But Don't Talk About Yet

Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week of Sept. 6:

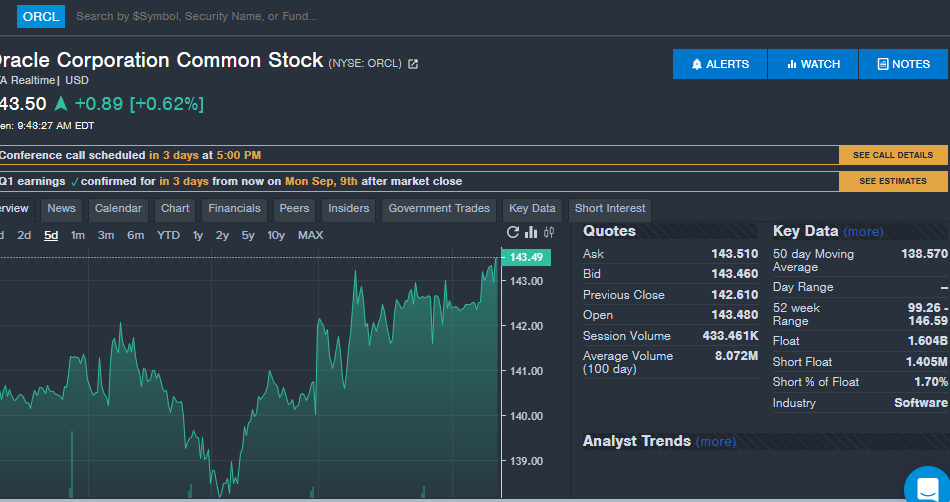

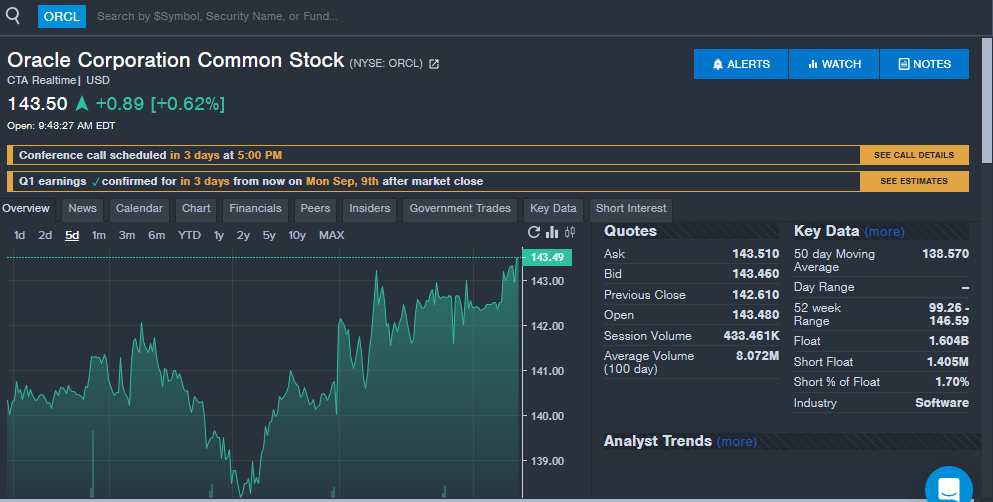

Oracle Corporation ORCL: The technology giant is seeing strong interest from Benzinga readers ahead of Monday’s first-quarter financial results.

The company is expected to report earnings per share of $1.33, up from $1.19 in last year’s first quarter, according to data from Benzinga Pro. The company has beaten earnings per share estimates from analysts in seven straight quarters and eight of the past 10 quarters overall.

Analysts estimate the company will report first-quarter revenue of $13.24 billion, up from $12.94 billion in last year’s first quarter. The company has missed revenue estimates from analysts in four straight quarters and six of the past 10 quarters overall.

Oracle highlighted AI demand in the fourth quarter with more than 30 AI sales contracts valued at over $12.5 billion signed, including a large contract with OpenAI. Oracle also announced a partnership with Google Cloud at the time.

Oracle shares are up 2.3% over the last five days, as seen on the Benzinga Pro chart below. Oracle stock is up 38% year-to-date in 2024.

Novavax Inc NVAX: Shares of the vaccine company were up over 4% in the past five days with news that the FDA granted Emergency Use Authorization of the company’s updated COVID-19 vaccine. The updated vaccine is included in the recommendations from the U.S. Centers for Disease Control and Prevention (CDC).

The vaccine is the only protein-based option available in the U.S. for people aged 12 and older for the prevention of COVID-19. The company could also be drawing interest from investors ahead of two company presentations next week. Novavax will present at H.C. Wainwright and Baird investor conferences on Monday, Sept. 9 and Tuesday, Sept. 10, respectively.

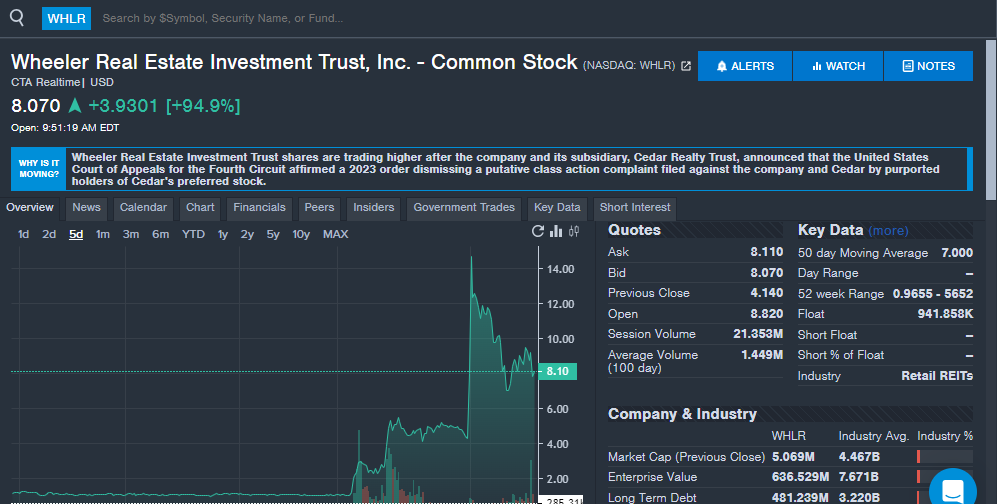

Wheeler Real Estate Investment Trust WHLR: Shares of the real estate investment trust surged over 500% on the week after the company announced a circuit court affirmed the dismissal of a class action lawsuit involving holders of Cedar Realty preferred stock. Wheeler acquired Cedar in August 2022 and the lawsuit alleged a breach of contract related to Cedar’s former board of directors.

“With this matter behind us, both companies remain well-positioned to execute on their strategic plans,” Cedar and Wheeler CEO Andrew Franklin said.

The company owns 77 grocery-anchored shopping centers in the Northeast, Mid-Atlantic and Southeast covering 14 states. With the lawsuit behind the company, investors could see a positive long-term outlook.

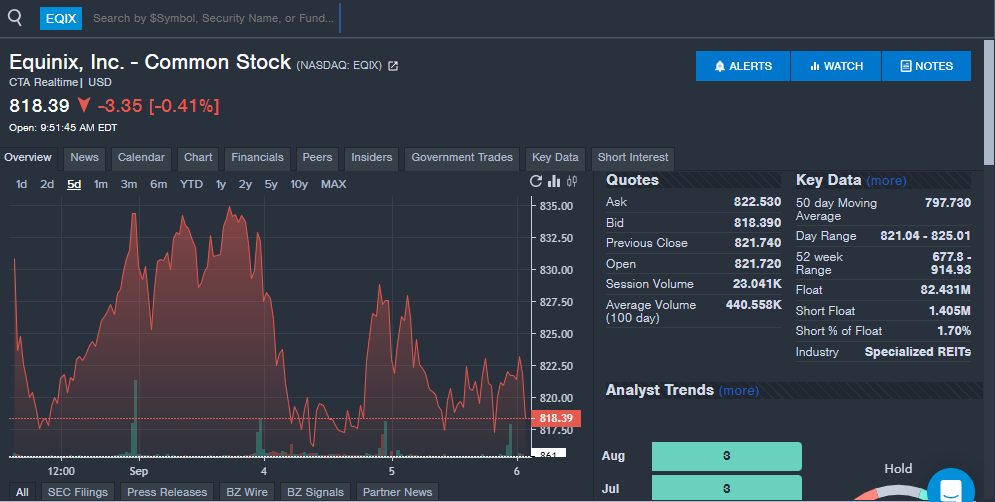

Equinix Inc EQIX: The data center company saw strong interest from investors on the week with shares up minimally. The company announced it issued $750 million in green bonds across two completed offerings. The green bonds are being used to help with sustainability initiatives for the company.

“Green bonds serve as a valuable means to secure funding and support significant initiatives that enhance the sustainability of our operations,” Equinix SVP Corporate Finance and Sustainability Katrina Rymill said. “Over the last five years, our green bonds have funded 172 green building projects across 105 sites, 33 energy efficient projects and two Power Purchase Agreement projects.”

The new green bonds could help the company continue to invest in new efforts to help support the company’s 86 consecutive quarters of top-line revenue growth, which the company said is the longest streak of any S&P 500 company.

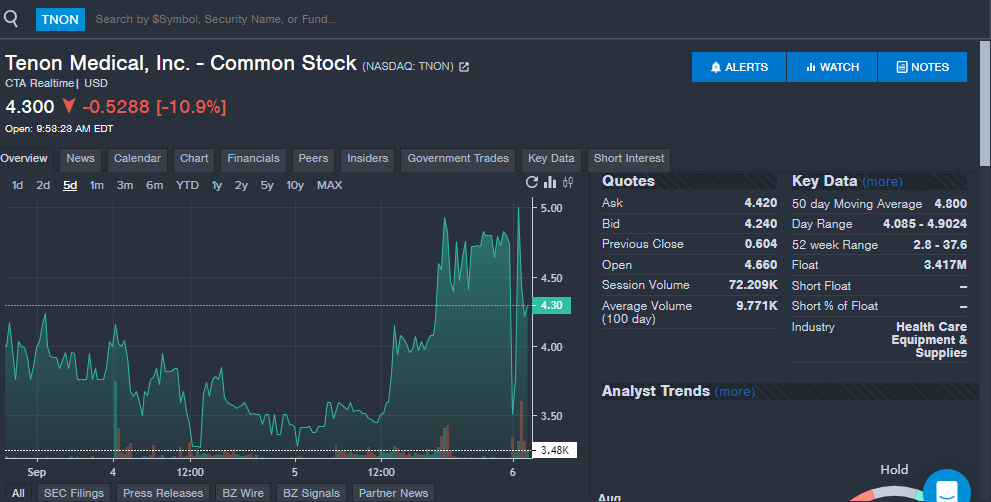

Tenon Medical Inc TNON: Investor interest in the medical device company grew during the week thanks to two items. The company announced a 1:8 reverse stock split on Sept. 4 that took effect on Sept. 6. Reverse stock splits often draw attention from retail investors as they reduce the float and shares outstanding of a company.

Tenon also announced a peer-reviewed publication of its Catamaran SI Joint Fusion System. The peer review showed evidence of fusion at the 12-month mark post-procedure, the company said.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Red Robin And 3 Other Stocks Under $5 Executives Are Buying

The Dow Jones index closed lower by more than 200 points on Thursday. When insiders purchase or sell shares, it indicates their confidence or concern around the company’s prospects. Investors and traders interested in penny stocks can consider this a factor in their overall investment or trading decision.

Below is a look at a few recent notable insider transactions for penny stocks. For more, check out Benzinga’s insider transactions platform.

Cyanotech

- The Trade: Cyanotech Corporation (OTC:: CYAN) Director Michael A / Davis bought a total of 47,037 shares at an average price of $0.82. To acquire these shares, it cost around $8,200.

- What’s Happening: On Aug. 7, Cyanotech announced financial results for the first quarter of fiscal year 2025, ended June 30, 2024.

- What Cyanotech Does: Cyanotech Corp is engaged in the production of natural products derived from microalgae for the nutritional supplements market.

Emeren Group

- The Trade: Emeren Group Ltd SOL 10% owner Shah Capital Management acquired a total of 70,194 shares at an average price of $1.84. To acquire these shares, it cost around $129,322.

- What’s Happening: On Sept. 3, Emeren named Dr. Ramki Srinivasan to its Board of Directors.

- What Emeren Group Does: Emeren Group Ltd is a solar project developer and operator, a solar downstream player.

Red Robin Gourmet Burgers

- The Trade: Red Robin Gourmet Burgers, Inc. RRGB CFO Joshua Todd Wilson acquired a total of 5,000 shares at an average price of $3.60. The insider spent around $18,000 to buy those shares.

- What’s Happening: On Aug. 22, Red Robin reported downbeat earnings for its second quarter and lowered its FY24 revenue guidance.

- What Red Robin Does: Red Robin Gourmet Burgers Inc is a restaurant operator.

Nanophase Technologies

- The Trade: Nanophase Technologies Corporation NANX Director R Janet Whitmore acquired a total of 9,263 shares at an average price of $1.50. The insider spent around $13,889 to buy those shares.

- What’s Happening: On Aug. 6, Nanophase Technologies posted an increase in second-quarter sales.

- What Nanophase Technologies Does: Nanophase Technologies Corp is engaged in the production of engineered nanomaterial solutions and larger, sub-micron, materials such as personal care sunscreens, architectural coatings, industrial coating applications, and abrasion-resistant additives, plastics additives, medical diagnostics, energy.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NICHI and federal government announce Southern Ontario recipients of funding to advance critical Indigenous housing projects in urban, rural and northern areas and address urgent and unmet needs

TORONTO, TERRITORIES OF THE MISSISSAUGAS OF NEW CREDIT AND THE ANCESTRAL HOME OF THE HURON-WENDAT, Sept. 6, 2024 /CNW/ – Today, the Honourable Gary Anandasangaree, Minister of Crown-Indigenous Relations, The Honourable Marci Ien, Minister for Women and Gender Equality and Youth of Canada, and Pam Damoff, Member of Parliament for Oakville North — Burlington and Parliamentary Secretary to the Minister of Foreign Affairs (Consular Affairs), on behalf of the Honourable Patty Hajdu, Minister of Indigenous Services and Minister responsible for FedNor, and National Indigenous Collaborative Housing Incorporated (NICHI) Chief Executive Officer John Gordon, announced the recipients of NICHI’s expression of need process to address the critical need for safe and affordable urban, rural and northern Indigenous housing projects in Southern Ontario.

Today’s announcement includes almost $24 million in funding for 4 organizations in Southern Ontario totalling up to 99 housing units and crucial staffing measures led by:

– Thunder Woman Healing Lodge Society, Toronto

– Ontario Federation of Indigenous Friendship Centres, Toronto

– Na-Me-Res,(Native Men’s Residence), Toronto

– Brantford Native Housing, Brantford

Through the national process, $273.9 million out of a total funding amount of $281.5 million is being distributed to 72 projects across the country aimed at building approximately 3725 units. This funding was provided to Indigenous Services Canada through Budget 2022 and was distributed by NICHI, applying its “For Indigenous, By Indigenous” approach. NICHI brings together Indigenous-led housing, homelessness, and housing-related service delivery organizations to provide lasting solutions that address diverse housing inadequacies including homelessness for Indigenous Peoples living in urban, rural and northern areas.

Over 171,000 Indigenous Peoples in urban, rural and northern areas off reserve are in core housing need according to the 2021 Census. Indigenous Peoples continue to experience core housing needs at a significantly higher rate than non-Indigenous people – with the gap between them being exacerbated by the housing and homelessness crisis and by inadequacies in distinctions-based funding. Through a For Indigenous, By Indigenous approach to Indigenous housing that recognizes Indigenous organizations are best placed to understand the needs of their communities, Indigenous Services Canada is striving to close this gap by 2030.

Access to safe and affordable housing is critical to improving health and social outcomes, and to ensure a better future for Indigenous communities. This funding initiative is part of the Government of Canada’s commitment to address the social determinants of health and advance self-determination in alignment with the United Nations Declaration on the Rights of Indigenous People Articles 21 and 23.

Quotes

“Southern Ontario is home to many Indigenous communities, and today’s investments represent a significant step forward in addressing their housing needs. Through NICHI’s For Indigenous, By Indigenous (FIBI) approach, we’re supporting the Indigenous housing service providers on the ground, who know their communities best and can respond directly to local needs and priorities. This ensures that community-driven solutions are always at the forefront.

NICHI’s role is to empower these service providers by helping them get the resources they need to create housing solutions that reflect the realities of their communities. These investments are not just about building housing; they’re about supporting Indigenous-led organizations and ensuring that communities themselves are leading the way.”

John Gordon

Chief Executive Officer, National Indigenous Collaborative Housing Incorporated

“Housing insecurity continues to be an issue for Indigenous People in Southern Ontario and across the country, with the housing gap in urban, rural and northern communities being harder to address because of overlapping jurisdictions. Today’s announcement shows that funding housing solutions led by and for Indigenous Peoples is the way forward for ensuring a better future for Indigenous People living in urban, rural and northern areas. “

The Honourable Gary Anandasangaree

Minister of Crown-Indigenous Relations

“Indigenous Peoples and organizations know the housing needs of their communities better than anyone. That is why we are funding community-oriented Indigenous housing projects like affordable apartments, transitional housing, and housing units for women across Southern Ontario – because everyone deserves a safe and comfortable place to call home.”

The Honourable Marci Ien

Minister for Women and Gender Equality and Youth of Canada

“These organizations are supporting some of the most underserved people in our communities. Thunder Woman Healing Lodge, for example, is providing a unique service as the only Indigenous healing lodge in Ontario fulfilling an unmet need for Indigenous women in our community. By working with organizations like these, we can partner with those who know what solutions work best for the Indigenous Peoples they serve.”

Pam Damoff

Member of Parliament for Oakville North—Burlington and Parliamentary Secretary to the Minister of Foreign Affairs (Consular Affairs)

Quick facts

- On June 8, 2023, the Government of Canada announced that the National Indigenous Collaborative Housing Inc. (NICHI) would deliver $281.5 million in immediate funding over two years to address the urgent, unmet needs of Indigenous Peoples living in urban, rural and northern areas.

- NICHI held its expression of need process from late November 2023 to January 12, 2024, and funding was allocated to 72 non-profit, Indigenous-led housing organizations by an objective, unbiased Project Selection Advisory Council who prioritized urgent and unmet housing need in Indigenous communities across the country. $6.6 million of the total funding amount remains to be allocated.

- The National Indigenous Collaborative Housing Inc. (NICHI) is an Indigenous-led national housing organization working to ensure that all Indigenous people across Canada have access to supports and services that provide safe, affordable, secure and dignified housing.

- Support for projects will include funding for acquisitions of new properties and buildings, construction of new facilities, repairs and renovations, housing-related training, growing organizational capacity and administration costs.

Associated links

National Indigenous Collaborative Housing Incorporated (NICHI)

Housing for Indigenous Peoples

Funding for urgent, unmet Indigenous housing projects in urban, rural and northern areas to be distributed through the National Indigenous Collaborative Housing Incorporated

NICHI announces recipients of funding to advance critical Indigenous housing projects in urban, rural and northern areas and address urgent and unmet needs

Stay connected

Join the conversation about Indigenous Peoples in Canada:

X: @GCIndigenous

Facebook: @GCIndigenous

Instagram: @gcindigenous

Facebook: @GCIndigenousHealth

You can subscribe to receive our news releases and speeches via RSS feeds. For more information or to subscribe, visit www.isc.gc.ca/RSS.

SOURCE Indigenous Services Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/06/c5182.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/06/c5182.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Intel Stock Is Falling and Hit a New 10-Year Low Today

Intel (NASDAQ: INTC) stock is sinking again in Friday’s trading. The chip company’s share price was down 2.1% as of 3:10 p.m. ET, according to data from S&P Global Market Intelligence.

Following disappointing August jobs numbers released the U.S. Labor Department today, the stock market is seeing an uptick in bearish sentiment — and Intel is part of the pullback. Recent reports about the company’s fabrication business and the possibility that it’s eyeing selling off other parts of its business are also weighing on the chipmaker’s valuation.

Are investors giving up on the Fed’s “soft landing?”

Today’s jobs report showed that the U.S. economy added 142,000 jobs in August. This performance missed the average Wall Street estimate of 160,000 new job additions, but the shortfall is actually even more significant than it appears on a surface level. Reacting to declines in U.S. manufacturing and other bearish indicators, analysts and economists had already begun guiding jobs estimates for last month downward.

The disappointing jobs numbers added to fears that the economy is on track for a recession. The Federal Reserve will likely cut interest rates at its meeting starting on Sept. 17, but investors are feeling increasingly uneasy about the overall macroeconomic backdrop. While the Fed has been trying to engineer a “soft landing” that sees inflation tamed and recession avoided, investors are now worried that economic contraction is on the horizon. A weakening macro outlook is weighing on stocks today, but that’s not the only bad news for Intel shareholders.

Uncertainty surrounds Intel’s outlook

With its Q2 report earlier this month, Intel sent signals that the company was in disarray. Quarterly margins and guidance came in significantly worse than expected, and the company announced that it was pursuing major cost-cutting and restructuring initiatives that would involve laying off 15% of its workforce and other big moves.

According to a report published by Bloomberg after the market closed yesterday, Intel is looking into selling part of its stake in Mobileye — its machine-vision-technology unit. The chipmaker is reportedly interested in selling as much of 88% of its equity position in Mobileye.

Reuters then reported this morning that Qualcomm was looking at buying part of Intel’s chip design business. Qualcomm is reportedly particularly interested in Intel’s client PC segment, but all of the design units are supposedly being looked at for potential acquisitions.

Meanwhile, other reports have suggested that Intel was looking into spinning off its chip fabrication business — and shareholders have had to contend with bad news on the fab front. According to a report from Tom’s Hardware, Intel will no longer be using its 20A process node for its consumer Arrow Lake processors. Instead, the company is expected to use a node from Taiwan Semiconductor Manufacturing. This news came on the heels of a report that Broadcom had evaluated using Intel’s 18A node but opted not to go through with it following unsatisfactory test results.

With today’s pullback, Intel stock went as low as $18.64 per share — its lowest price in the last 10 years. While shares could be tempting at current levels, there’s little visibility as to what path forward the company will take. Recent reports suggest the company itself may be unsure of what its strengths are in the highly competitive chip market.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Qualcomm and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Why Intel Stock Is Falling and Hit a New 10-Year Low Today was originally published by The Motley Fool

Friday's Jobs Report Is 'The Moment We've All Been Waiting For,' Economist Says

Friday’s lower unemployment figure is a strong indication that the Federal Reserve may cut rates by 0.25% instead of 0.50% when it meets in less than two weeks, economists say.

“This is the moment we’ve all been waiting for and, based on the data, it looks like the Fed won’t need to panic and start with a ‘jumbo’ rate cut,” said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

“Most likely the Fed will cut rates by 0.25% on 9/18 and then will have to watch the data from there, with our base case being two more rate cuts of 0.25% each in November and December,” he added.

Before the release of the August jobs report, traders priced in a 43% probability of a 50-basis-point interest rate cut by the Federal Reserve later this month.

Key Takeaways

- The U.S. economy added 142,000 nonfarm payrolls in August, marking a significant increase from July’s downwardly revised 89,000.

- The 142,000 increase in nonfarm payrolls fell short of the 160,000 consensus estimate tracked by TradingEconomics.

- The unemployment rate fell from 4.3% in July to 4.2% in August, meeting expectations

- Average hourly earnings rose 0.7% month-over-month, up from a downwardly revised decline of 0.1% in July and beating estimates of 0.3%.

- Year-over-year, average hourly earnings rose 3.8%, up from 3.6% in July and beating forecasts of 3.7%.

Fed Funds Futures Adjusts To Jobs Report

Zaccarelli said unemployment dropping from 4.3% to 4.2% “could be the big news of the day,” but it is less important than “the data beneath the surface.”

“That’s because it is an easy headline to run with and we are in a narrative-driven market,” he said.

“While the bears have plenty to work with — in terms of a softening labor market and a slowing economy — the facts still show an economy that is expanding and not one that is imminently headed into recession, and for that reason we believe that once the election is behind us, we will see this bull market resume climbing to new all-time highs before the next bear market begins.”

The Fed Funds Futures market adjusted quickly to the jobs report and indicates that the Fed will cut rates by 50 basis points at its Sept. 18 meeting, said Quincy Krosby, chief global strategist for LPL Financial.

“Hovering over the Fed’s decision, however, is a concern that prices are inching higher within manufacturing and services,” she said.

“Still, as the maximum employment mandate for the Fed has increasingly become its primary focus, the market now expects a deeper cut and it’s worrisome for market participants.

“Today’s comments from two Fed officials will be key to understanding whether the Fed sees today’s print as a labor market normalizing to pre-Covid conditions or a worrisome indication about the softening of the broader economy.”

But Charlie Ripley, senior investment strategist for Allianz Investment Management, said it is “unclear” at this point as to how much the Fed will lower rates on Sept. 18.

“Investors remain divided on how quickly the Fed should lower rates and the mixed employment data today did not augment the argument for either side, which is why the odds of a 50 basis point cut at the September meeting looks like a coin toss for now,” he said.

Read Now:

Image: Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Supercharged Growth Stock That Could Join Apple, Microsoft, and Nvidia in the $2 Trillion Club by 2029

The rapid and accelerating adoption of artificial intelligence (AI) has been gathering momentum since early last year. The clearest evidence of these secular tailwinds can be found in the list of the world’s largest companies when measured by market cap. Indeed, 7 of the world’s 10 most valuable companies are arguably pioneers in the realm of AI.

Topping the charts are three of the world’s leading purveyors of technology. Apple takes the top spot at $3.4 trillion, and Microsoft and Nvidia aren’t far behind with market values of $3 trillion and $2.6 trillion, respectively.

With a market cap of roughly $832 billion (as of this writing), Taiwan Semiconductor Manufacturing (NYSE: TSM), often referred to as TSMC, might seem like a dark horse to join this exclusive fraternity, but the writing is on the wall. New use cases for generative AI are being discovered at a breakneck pace, making the semiconductors capable of these advanced calculations indispensable. As the largest foundry in the world, TSMC seems a shoo-in to join the ranks of this prestigious club.

Want chips with that?

TSMC has been quietly building its legacy for decades but has suddenly burst into the limelight. The company bills itself as the “world’s largest and best semiconductor foundry,” making it a critical player in the paradigm shift to AI.

Because AI can only be performed using the most cutting-edge semiconductors, TSMC is the leader in the field. Its customer list reads like a veritable “who’s who” of AI, including Nvidia, Arm Holdings, Advanced Micro Devices, Broadcom, Apple, and many more.

Furthermore, the shift to AI has realigned TSMC’s business over the past couple of years. While processors used in smartphones were once its largest platform, high-performance computing (HPC) — which includes AI — now accounts for more than half of TSMC’s revenue, representing 52% of sales.

Business is booming. Revenue grew 14% to $20.8 billion in the second quarter, while earnings per share (EPS) of $1.48 jumped 30%. Management is expecting the company’s good fortune to continue.

TSMC’s forecast is calling for second-quarter revenue of $22.8 billion at the midpoint of its guidance, or growth of about 32%. That forecast could end up being conservative. In July, the company reported revenue growth of 45% year over year, far ahead of management’s outlook.

The path to $1 trillion

TSMC occupies a unique place in the AI ecosystem. Since its processors are prized by the biggest players in the space, it occupies the pole position in the rapid adoption of generative AI — which has made headlines since early last year. Additionally, TSMC’s accelerating revenue growth provides the clearest proof the company is up to the task. It also suggests TSMC could easily ascend to the ranks of trillionaires.

According to Wall Street, TSMC is poised to generate revenue of $87.38 billion in 2024, giving it a forward price-to-sales ratio (P/S) of roughly 9.5. Assuming its P/S remains constant, TSM would have to grow its revenue to roughly $210 billion annually to support a $2 trillion market cap.

The company is forecasting growth to increase to “slightly above mid-20%” for 2024, and Wall Street is already seemingly on board, forecasting revenue growth of 27% and 26% in 2024 and 2025, respectively. If the company can clear those relatively low benchmarks, it will likely achieve a $2 trillion market cap by early 2029. However, given the accelerating adoption of AI, it could cross that threshold even sooner.

Another catalyst for TSMC is the potential represented by AI-powered smartphones, which could provide the catalyst for an accelerated upgrade cycle. As the leading provider of smartphone processors, TSMC would be an obvious beneficiary.

Estimates regarding the ongoing adoption of AI suggest that TSMC’s future is bright. Generative AI is expected to add between $2.6 trillion and $4.4 trillion to the global economy annually over the next 10 years, according to global management consulting firm McKinsey & Company. Even that could end up being conservative as estimates continue to climb as new applications for AI are uncovered.

Finally, at 28 times earnings, TSMC’s valuation is attractive, offering investors a compelling way to invest in the paradigm shift represented by AI.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $650,810!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Danny Vena has positions in Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Supercharged Growth Stock That Could Join Apple, Microsoft, and Nvidia in the $2 Trillion Club by 2029 was originally published by The Motley Fool

Nobel Laureate Joseph Stiglitz Slams Federal Reserve For 'Going Too Far, Too Fast' With Rate Cuts

Nobel Prize-winning economist, Joseph Stiglitz, has called on the Federal Reserve to implement a major interest rate cut. Stiglitz accuses the Fed of worsening inflation by tightening monetary policy too quickly and excessively.

What Happened: Stiglitz is advocating for a half-point interest rate cut at the Fed’s next meeting. This comes ahead of the release of U.S. jobs data, which is being closely monitored by investors to gauge the potential size of the expected rate cut this month, CNBC reported on Friday.

Stiglitz, a 2001 Nobel Prize laureate for his market analysis, joins other influential figures, such as JPMorgan’s chief U.S. economist, in calling for a significant rate cut this month.

While speaking at the annual Ambrosetti Forum in Italy, Stiglitz criticized the Fed for its aggressive monetary tightening. He argued that the central bank’s actions have put the economy at risk and likely exacerbated inflation, especially in the housing sector.

“I’ve been criticizing the Fed for going too far, too fast,” Stiglitz said.

See Also: Could August Jobs Numbers Keep Recession Fears At Bay? ‘This Time Is Different,’ Analyst Says

Stiglitz contends that the Fed’s current strategy for dealing with inflation is flawed. He believes a rate cut would help tackle inflation and job issues. However, not everyone concurs with Stiglitz’s call for a major reduction. George Lagarias, chief economist at Forvis Mazars, warns that a large rate cut could convey a sense of urgency and potentially trigger an economic panic.

Why It Matters: The debate around the Fed’s rate cut has been heating up. Earlier this month, JPMorgan cautioned that anticipated rate cuts may not significantly boost the stock market. Meanwhile, an August payroll report indicated that a 0.5% rate cut by the Federal Reserve wouldn’t be surprising after private payrolls fell short.

However, some experts have suggested that the Federal Reserve may pause rate cuts in response to potential supply side shocks.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.