Limbach Upgraded to Strong Buy: Here's What You Should Know

Limbach LMB could be a solid choice for investors given its recent upgrade to a Zacks Rank #1 (Strong Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The sole determinant of the Zacks rating is a company’s changing earnings picture. The Zacks Consensus Estimate — the consensus of EPS estimates from the sell-side analysts covering the stock — for the current and following years is tracked by the system.

The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time.

Therefore, the Zacks rating upgrade for Limbach basically reflects positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for Limbach imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for Limbach

This company is expected to earn $2.43 per share for the fiscal year ending December 2024, which represents a year-over-year change of 38.1%.

Analysts have been steadily raising their estimates for Limbach. Over the past three months, the Zacks Consensus Estimate for the company has increased 8%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of Limbach to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft, Bank of America And 2 Other Stocks Executives Are Selling

The Nasdaq 100 closed slightly higher during Thursday’s session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company’s prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

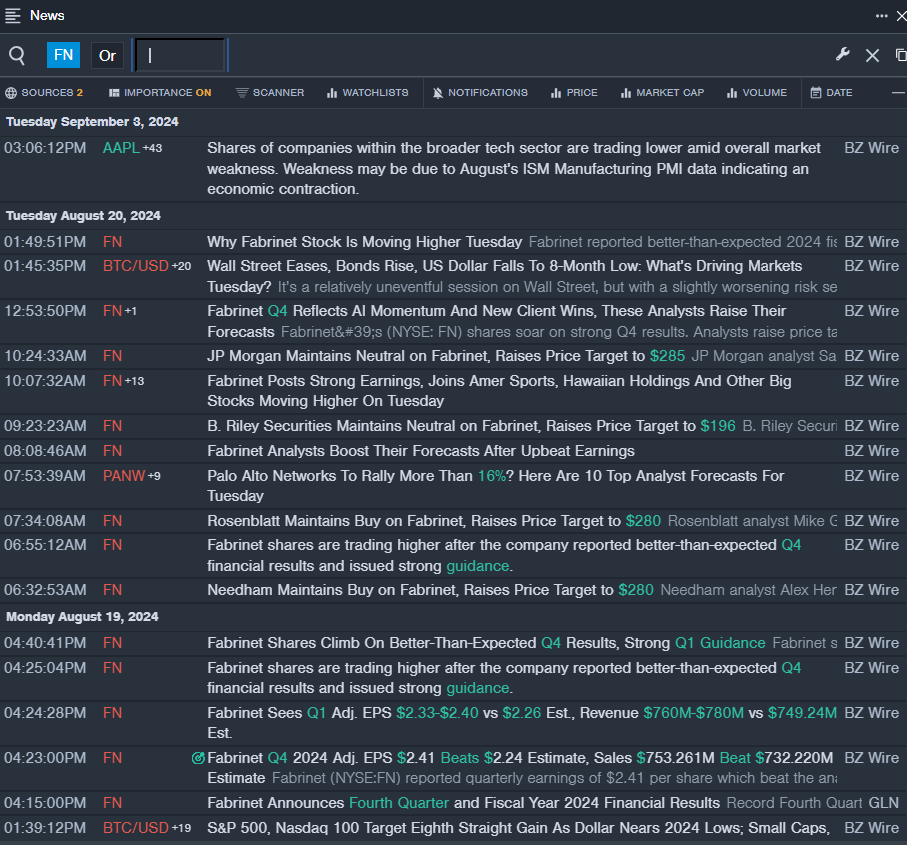

Fabrinet

- The Trade: Fabrinet FN EVP, Sales & Marketing Edward T. Archer sold a total of 8,690 shares at an average price of $220.26. The insider received around $1.9 million from selling those shares.

- What’s Happening: On Aug. 19, Fabrinet reported better-than-expected fourth-quarter financial results and issued strong guidance.

- What Fabrinet Does: Fabrinet provides advanced optical packaging and precision optical, electro-mechanical, and electronic manufacturing services to original equipment manufacturers of complex products, such as optical communication components, modules and sub-systems, industrial lasers, automotive components, medical devices, and sensors.

- Benzinga Pro’s real-time newsfeed alerted to latest FN news.

Bank of America

- The Trade: Bank of America Corporation BAC 10% owner Warren E Buffett sold a total of 18,746,304 shares at an average price of $40.54. The insider received around $760.04 million from selling those shares.

- What’s Happening: The company is reportedly providing a major boost to climate technology, which has struggled to gain momentum through a landmark tax credit deal. The bank will invest $205 million in exchange for tax credits from an ethanol producer, Harvestone Low Carbon Partners, that captures carbon at a plant in North Dakota, reported WSJ.

- What Bank of America Does: Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets.

- Benzinga Pro’s charting tool helped identify the trend in BAC stock.

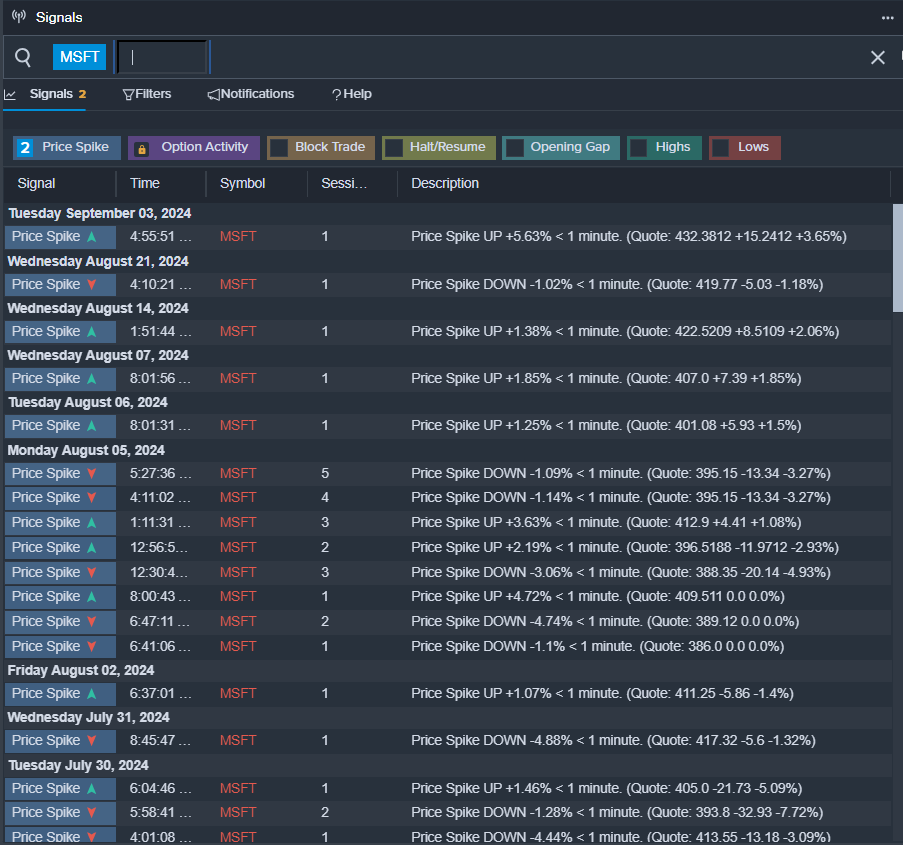

Microsoft

- The Trade: Microsoft Corporation MSFT CEO Satya Nadella sold a total of 78,353 shares at an average price of $408.63. The insider received around $32.02 million from selling those shares.

- What’s Happening: Microsoft Corp recently launched a new line of Windows PCs with AI capabilities.

- What Microsoft Does: Microsoft develops and licenses consumer and enterprise software.

- Benzinga Pro’s signals feature notified of a potential breakout in MSFT shares.

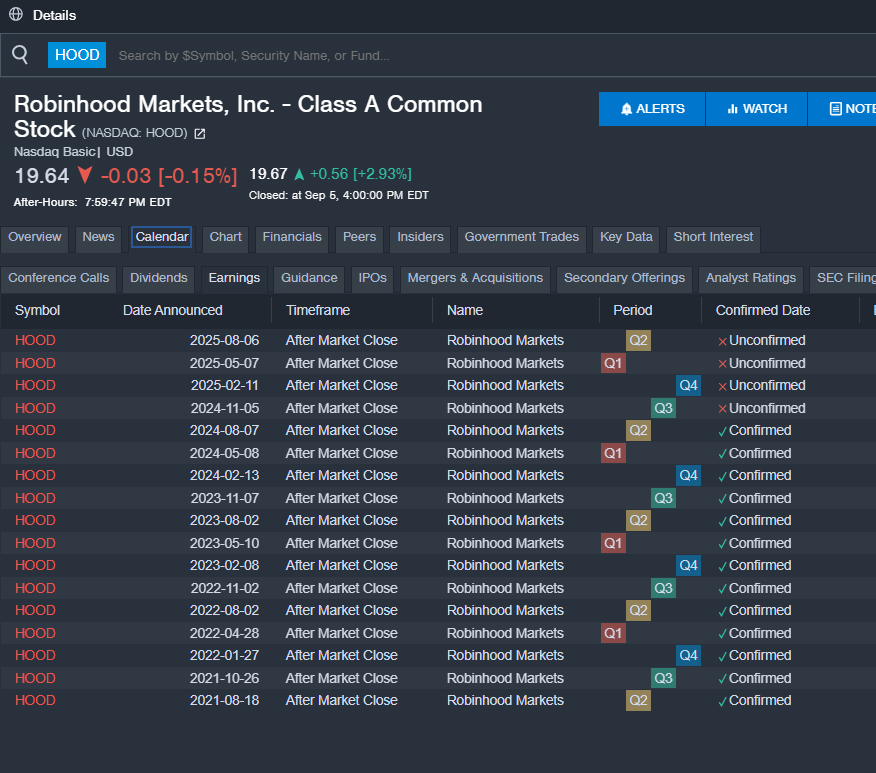

Robinhood

- The Trade: Robinhood Markets, Inc. HOOD Chief Legal Officer Daniel Martin Gallagher Jr sold a total of 12,500 shares at an average price of $19.33. The insider received around $241,566 from selling those shares.

- What’s Happening: Robinhood Markets agreed to a $3.9 million settlement with California’s Department of Justice over its past ban on Bitcoin BTC/USD cryptocurrency withdrawals.

- What Robinhood Does: Robinhood Markets Inc is creating a modern financial services platform.

- Benzinga Pro’s earnings calendar was used to track upcoming HOOD’s earnings reports.

Check This Out:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

WALL FINANCIAL CORPORATION ANNOUNCES Q2 2025 FISCAL RESULTS

VANCOUVER, BC, Sept. 6, 2024 /CNW/ – Wall Financial Corporation (the “Company”) released its operating results and financial statements for the six months ended July 31, 2024. The Company recorded net earnings and comprehensive income attributable to shareholders of the Company for the six months ended July 31, 2024 of $14,775,288 or $0.45 per share compared to $11,908,823 or $0.37 per share in the prior period.

Revenue and income from the rental apartment operations increased due to acquisitions of investment properties in the prior year, a decrease in vacancy rates, and increased rents on tenant turnover. Revenues and earnings from the Company’s hotels increased due to higher average daily rates. Revenues and earnings from the Company’s development operations increased due to the closing of condominium units in the current period.

|

Three months ended July 31 |

Six months ended July 31 |

||||

|

Statements of Earnings |

2024 |

2023 |

2024 |

2023 |

|

|

Total revenue and other income |

$ 72,654,945 |

$ 45,018,996 |

$ 108,836,768 |

$ 77,516,286 |

|

|

Net earnings attributable to shareholders of the Company |

11,417,472 |

9,178,082 |

14,775,288 |

11,908,823 |

|

|

Earnings per share (diluted and non-diluted) |

0.35 |

0.29 |

0.45 |

0.37 |

|

|

Statements of Financial Position |

July 31, 2024 |

January 31, 2024 |

|||

|

Total assets |

$ 921,844,116 |

$ 896,277,758 |

|||

|

Total non-current liabilities |

340,552,452 |

344,969,288 |

|||

|

Dividends paid |

– |

97,360,095 |

|||

|

Dividends paid per share |

– |

3.00 |

|||

The above unaudited financial information, including comparative information, is expressed in Canadian dollars and has been prepared in accordance with International Financial Reporting Standards, using the same accounting policies and methods of application as described in notes 2 and 3 of the Company’s audited consolidated financial statements for the years ended January 31, 2024 and 2023.

Wall Financial Corporation is a B.C. based real estate company active in the development and management of residential and commercial rental units, development and construction of residential housing for resale, and the development and management of hotel properties. For further information, contact Bruno Wall, President, WALL FINANCIAL CORPORATION WFC, 1010 Burrard Street, Vancouver, British Columbia V6Z 2R9, 604.893.7131.

SOURCE Wall Financial Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/06/c5624.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/06/c5624.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock drops and flirts with key technical levels as investors flee tech

-

Investors continued to sell Nvidia stock, sending the chipmaker 4% lower on Friday.

-

Shares are on track to end the week 14% lower amid news of an antitrust probe.

-

The stock is flirting with $100 a share, a key technical threshold watched by analysts.

Nvidia stock extended its post-earnings decline on Friday, with shares of the chip maker flirting with a key technical level amid a wider tech sell-off in the session.

Nvidia shares slid over 4.5% on Friday, trading around $102.15 a share. That puts the stock close to a key psychological threshold of $100 a share and its 200-day moving average just below $90.

Traders are eyeing those levels for signs that the chip titan’s blistering rally may be fading, analysts told Business Insider this week. Wall Street, though, generally remains bullish on the outlook for the stock, of which analysts have projected an average price target of $153 a share, according to Nasdaq data.

Investors have been cautious on Nvidia stock since the company posted second-quarter financials that beat earnings estimates but not quite enough to meet the loftiest expectations.

The stock staged a small recovery earlier this week, but continued its steep sell–off after a report from Bloomberg that said the Department of Justice was probing the company over antitrust concerns.

“While every case is different, we also highlight the plethora of govt. cases ongoing against other large US tech companies over the last several years. Until we have more details, we assume no specific material impact on NVDA’s fundamental opportunity,” Bank of America strategists said in a note, reiterating their “buy” rating on the stock.

Nvidia has lost around $500 million in market value from levels in early June, with the firm being valued at $2.53 trillion on Friday. The stock is on track to end the week 14% lower, though shares are still up 111% from levels at the start of the year.

The slide on Friday came amid a larger decline in tech, with the Nasdaq Composite down 2.5% at 2:00 p.m. ET. Investors were fleeing high-flying growth names after the August jobs report was weaker than expected, sparking new fears about an economic slowdown.

Read the original article on Business Insider

Are You Looking for a Top Momentum Pick? Why Phibro Animal Health is a Great Choice

Momentum investing revolves around the idea of following a stock’s recent trend in either direction. In the ‘long’ context, investors will be essentially be “buying high, but hoping to sell even higher.” With this methodology, taking advantage of trends in a stock’s price is key; once a stock establishes a course, it is more than likely to continue moving that way. The goal is that once a stock heads down a fixed path, it will lead to timely and profitable trades.

Even though momentum is a popular stock characteristic, it can be tough to define. Debate surrounding which are the best and worst metrics to focus on is lengthy, but the Zacks Momentum Style Score, part of the Zacks Style Scores, helps address this issue for us.

Below, we take a look at Phibro Animal Health PAHC, which currently has a Momentum Style Score of B. We also discuss some of the main drivers of the Momentum Style Score, like price change and earnings estimate revisions.

It’s also important to note that Style Scores work as a complement to the Zacks Rank, our stock rating system that has an impressive track record of outperformance. Phibro Animal Health currently has a Zacks Rank of #2 (Buy). Our research shows that stocks rated Zacks Rank #1 (Strong Buy) and #2 (Buy) and Style Scores of A or B outperform the market over the following one-month period.

Set to Beat the Market?

Let’s discuss some of the components of the Momentum Style Score for PAHC that show why this maker of animal health products and nutritional supplements shows promise as a solid momentum pick.

A good momentum benchmark for a stock is to look at its short-term price activity, as this can reflect both current interest and if buyers or sellers currently have the upper hand. It is also useful to compare a security to its industry, as this can help investors pinpoint the top companies in a particular area.

For PAHC, shares are up 0.29% over the past week while the Zacks Medical – Products industry is flat over the same time period. Shares are looking quite well from a longer time frame too, as the monthly price change of 11.23% compares favorably with the industry’s 1.3% performance as well.

While any stock can see a spike in price, it takes a real winner to consistently outperform the market. Over the past quarter, shares of Phibro Animal Health have risen 9.22%, and are up 55.61% in the last year. On the other hand, the S&P 500 has only moved 3.12% and 23.92%, respectively.

Investors should also pay attention to PAHC’s average 20-day trading volume. Volume is a useful item in many ways, and the 20-day average establishes a good price-to-volume baseline; a rising stock with above average volume is generally a bullish sign, whereas a declining stock on above average volume is typically bearish. PAHC is currently averaging 181,236 shares for the last 20 days.

Earnings Outlook

The Zacks Momentum Style Score also takes into account trends in estimate revisions, in addition to price changes. Please note that estimate revision trends remain at the core of Zacks Rank as well. A nice path here can help show promise, and we have recently been seeing that with PAHC.

Over the past two months, 2 earnings estimates moved higher compared to none lower for the full year. These revisions helped boost PAHC’s consensus estimate, increasing from $1.42 to $1.46 in the past 60 days. Looking at the next fiscal year, 1 estimate has moved upwards while there have been no downward revisions in the same time period.

Bottom Line

Given these factors, it shouldn’t be surprising that PAHC is a #2 (Buy) stock and boasts a Momentum Score of B. If you’re looking for a fresh pick that’s set to soar in the near-term, make sure to keep Phibro Animal Health on your short list.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

HYZON ANNOUNCES 1-FOR-50 REVERSE STOCK SPLIT

Move Aims to Ensure Continued Listing on Nasdaq

BOLINGBROOK, Ill., Sept. 6, 2024 /PRNewswire/ — Hyzon HYZN (“Hyzon” or the “Company”), a U.S.-based high-performance hydrogen fuel cell system manufacturer and technology developer focused on providing zero-emission power to decarbonize the most demanding industries, today announced that its Board of Directors and stockholders approved a 1-for-50 reverse stock split of the Company’s Class A common stock, par value $0.0001 per share, which will be effective at 12:01 a.m., Eastern Time, on September 11, 2024 (the “Reverse Stock Split”). Hyzon’s Class A common stock will continue to be traded on The Nasdaq Capital Market on a split-adjusted basis beginning on September 11, 2024, under the Company’s existing trading symbol “HYZN.”

The Reverse Stock Split is intended to increase the bid price of the Company’s Class A common stock so that Hyzon can regain compliance with the minimum bid price requirement of $1.00 per share for continued listing on The Nasdaq Capital Market. The new CUSIP number following the Reverse Stock Split will be 44951Y201. The Company filed a Certificate of Amendment with the Secretary of State of the State of Delaware on September 6, 2024 to effect the Reverse Stock Split.

The Reverse Stock Split will affect all stockholders uniformly and will not alter any stockholder’s percentage ownership interest in the Company, except to the extent that the Reverse Stock Split results in that stockholder owning a fractional share as described in more detail below.

The Reverse Stock Split will reduce the number of shares of Class A common stock issued and outstanding from approximately 272.5 million to approximately 5.5 million. The total number of authorized shares of Class A common stock will also be reduced proportionally from 1,000,000,000 to 20,000,000. No fractional shares will be issued in connection with the Reverse Stock Split. In lieu, thereof, each stockholder who would be entitled to receive a fractional share will be entitled to receive a cash payment equal to the product of the closing price on the day immediately prior to effectiveness of the Reverse Stock Split and the amount of the fractional share.

The Reverse Stock Split will also result in proportional adjustments being made to all outstanding options, warrants, restricted stock units, performance stock units, or similar securities entitling their holders to receive or purchase shares of our Class A common stock.

The company’s publicly-traded warrants will continue to be traded under the symbol “HYZNW” and the CUSIP identifier for the warrants will remain unchanged.

Continental Stock Transfer and Trust Company (“Continental”), the Company’s transfer agent, will act as the exchange agent for the Reverse Stock Split. Continental will provide instructions to any stockholders with physical stock certificates regarding the process for exchanging their certificates for split-adjusted shares into “book-entry form.” Shares held by stockholders in “street name” will have their accounts automatically credited by their brokerage form, bank or other nominee, as will any stockholders who held their shares in book-entry form at Continental.

About Hyzon

Hyzon is a global supplier of high-performance hydrogen fuel cell technology focused on providing zero-emission power to decarbonize demanding industries. With agile, high-power technology designed for heavy-duty applications, Hyzon is at the center of a new industrial revolution fueled by hydrogen, the most abundant natural element, and a clean energy source. Hyzon is focusing on deploying its fuel cell technology in heavy-duty commercial vehicles in Class 8 and refuse collection vehicles across North America, as well as new markets such as stationary power applications. To learn more about how Hyzon partners across the hydrogen value chain to accelerate the clean energy transition, visit www.hyzonfuelcell.com.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, express or implied forward-looking statements regarding the Company’s expectations, hopes, beliefs, intentions, or strategies for the future. You are cautioned that such statements are not guarantees of future performance and that the Company’s actual results may differ materially from those set forth in the forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause the Company’s actual expectations to differ materially from these forward-looking statements include the Company’s ability improve its capital structure; Hyzon’s liquidity needs to operate its business and execute its strategy, and related use of cash; its ability to raise capital through equity issuances, asset sales or the incurrence of debt; the possibility that Hyzon may need to seek bankruptcy protection; Hyzon’s ability to fully execute actions and steps that would be probable of mitigating the existence of substantial doubt regarding its ability to continue as a going concern; our ability to enter into any desired strategic alternative on a timely basis, on acceptable terms; our ability to maintain the listing of our Common Stock on the Nasdaq Capital Market; retail and credit market conditions; higher cost of capital and borrowing costs; impairments; changes in general economic conditions; and the other factors under the heading “Risk Factors” set forth in the Company’s Annual Report on Form 10-K, as supplemented by the Company’s quarterly reports on Form 10-Q and current reports on Form 8-K. Such filings are available on our website or at www.sec.gov. You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hyzon-announces-1-for-50-reverse-stock-split-302240928.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hyzon-announces-1-for-50-reverse-stock-split-302240928.html

SOURCE Hyzon

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Don't Rely on These Analyst Price Targets: More Downgrades Could Be Coming for These 3 Struggling Stocks

Looking at analyst price targets, you might find some undervalued stocks. However, you’ll often find a stock that looks like it has a lot of upside, but only because its price has fallen sharply and analysts haven’t put through their updated price targets (i.e., downgrades) for it yet.

Three stocks that look like they might be great buys today based on their consensus analyst price targets include PDD Holdings (NASDAQ: PDD), Intel (NASDAQ: INTC), and MicroStrategy (NASDAQ: MSTR). But here’s why you might want to hold off on buying these stocks right now and why analysts could downgrade their price targets for them in the near future.

PDD Holdings

If analyst projections prove accurate, you could be sitting on a potential 80% return if you buy shares of PDD Holdings today. The Chinese-based company owns Pinduoduo and Temu, one of the hottest e-commerce sites in the world.

While the company’s recent earnings numbers were strong, they failed to meet Wall Street’s expectations, leading to a sell-off. Pinduoduo’s growth rate was impressive for the quarter ending in June, with sales up 86% year over year, but it still failed to meet the high expectations analysts have for the stock. An earnings miss is just part of the reason you may want to temper your expectations for the stock.

Downgrades could be coming if the U.S. government decides to close a tariff loophole that many Chinese online retail sites have been taking advantage of, using it to offer dirt cheap products to consumers. That could make items more expensive on those sites and hurt the growth prospects of PDD Holdings.

Given Temu’s popularity, PDD could still make for a good investment in the long run, but investors shouldn’t assume the stock is going to skyrocket in the near future.

Intel

Analyst downgrades were pouring in for Intel after the tech company reported disappointing earnings numbers in August. Based on the consensus, though, the implied upside for the stock is still more than 50% right now. But with the company in the midst of restructuring and working to try to grow its business while also making its foundry operations profitable, investors who buy the stock today will need to take a leap of faith in the company’s management as this is a highly risky investment to own right now.

Shares of Intel are down around 60% this year, and if not for such a deep sell-off, the implied upside based on price targets wouldn’t look nearly as high as it does. There’s not much optimism around Intel these days. Even though it’s trading at multiyear lows, doubts about its ability to be profitable and compete in the chip market make it probable that there will be more downgrades to come for the stock. Given its volatility, investors may be better off taking a wait-and-see approach with the stock.

MicroStrategy

The one stock on this list that may be the most likely to hit its lofty price targets is MicroStrategy. But that’s not because the software company has incredible products or growth prospects. Its performance links back to how well Bitcoin does. If the cryptocurrency rises, MicroStrategy’s stock could go along for the ride. MicroStrategy is the largest corporate holder of Bitcoin and now refers to itself as “the world’s first Bitcoin development company.”

However, MicroStrategy’s exposure to Bitcoin also makes it an incredibly risky investment, and gains and losses on its crypto assets can have a significant impact on MicroStrategy’s earnings numbers. In the most recent period, which ended on June 30, the company incurred digital asset impairment losses of $180.1 million — more than the $111.4 million in revenue it generated during the quarter.

Bitcoin has been struggling in recent months, and it may not be the safe haven many investors assumed it might be. Amid more challenging economic conditions, it could struggle and downgrades could be inevitable for crypto stocks like MicroStrategy, which are increasingly dependent on Bitcoin’s valuation.

Right now, analysts expect MicroStrategy stock to rise by an average of around 60% over the next 12 months. But investors shouldn’t be surprised to see downgrades coming for the stock, especially if there’s a recession next year.

Should you invest $1,000 in PDD Holdings right now?

Before you buy stock in PDD Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PDD Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Don’t Rely on These Analyst Price Targets: More Downgrades Could Be Coming for These 3 Struggling Stocks was originally published by The Motley Fool

Job Creation Falls Short Of Expectations In August, Unemployment Rate Ticks Lower, Wage Growth Soars

Signs of a cooling U.S. labor market eased in the government’s Friday August jobs report, tempering recession fears that had intensified in July and earlier this week.

In August, the U.S. economy added 142,000 nonfarm payrolls, signaling a sharp improvement from July’s downwardly revised 89,000.

The 142,000 increase in nonfarm payrolls fell short of the 160,000 consensus estimate tracked by TradingEconomics, highlighted weaker-than-expected job acceleration during the month.

Before the release of the August jobs report, traders priced in a 43% probability of a 50-basis-point interest rate cut by the Federal Reserve later this month.

August Employment Situation: Key Highlights

- The unemployment rate softened from 4.3% to 4.2%, matching expectations of a slight decline.

- Wage growth showed some upward pressure. Average hourly earnings rose 0.7% month-over-month, up from a downwardly revised contraction of 0.1% in July and surpassing estimates of 0.3%.

- On a year-over-year basis, average hourly earnings rose 3.8%, compared to 3.6% in July and above expectations of 3.7%.

| August 2024 | Consensus | July 2024 | |

|---|---|---|---|

| Nonfarm payrolls | 142,000 | 160,000 | 89,000 (downwardly revised from 114,000) |

| Unemployment rate | 4.2% | 4.2% | 4.3% |

| Average hourly earnings (m/m) | 0.7% | 0.3% | -0.1% (downwardly revised from 0.2%) |

| Average hourly earnings (y/y) | 3.8% | 3.7% | 3.6% |

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Transaction: Regan Robert Shannon Sells $67K Worth Of Permian Resources Shares

A substantial insider sell was reported on September 5, by Regan Robert Shannon, EVP at Permian Resources PR, based on the recent SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Shannon sold 4,822 shares of Permian Resources. The total transaction amounted to $67,178.

At Friday morning, Permian Resources shares are down by 0.0%, trading at $13.48.

Delving into Permian Resources’s Background

Permian Resources Corp is an independent oil and natural gas company focused on generating outsized returns to stakeholders through the responsible acquisition, optimization and development of oil and liquids-rich natural gas assets. The Company’s assets and operations are primarily concentrated in the core of the Permian Basin, and its properties consist of large, contiguous acreage blocks located in West Texas and New Mexico.

Key Indicators: Permian Resources’s Financial Health

Positive Revenue Trend: Examining Permian Resources’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 99.89% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 49.45%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Permian Resources’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.38.

Debt Management: Permian Resources’s debt-to-equity ratio is below the industry average at 0.48, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 10.14 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.64, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 4.54, Permian Resources’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Transaction Codes To Focus On

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Permian Resources’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Top High-Yield Utility Stocks to Buy in September

The utility sector tends to be sensitive to interest rates because utilities generally make heavy use of leverage. With Wall Street expecting rates to fall, utility stocks have started to rise. That has lowered the dividend yield for some of these utility stocks.

But don’t pass on the sector if you are looking for yield. There are still some attractive dividend options. The list includes Brookfield Renewable (NYSE: BEP)(NYSE: BEPC), Black Hills (NYSE: BKH), and WEC Energy (NYSE: WEC).

Here’s a quick primer on why these three high-yield utility stocks might make great buys in September.

1. Brookfield Renewable offers two ways to play

Brookfield Renewable hails from Canada and is backed by the investment powerhouse Brookfield Asset Management (NYSE: BAM). Essentially, it is a way for Brookfield Asset Management to raise additional capital for investment in the clean energy sector. However, Brookfield Renewable also allows smaller investors to invest alongside one of the largest and most experienced infrastructure investors in the world. Brookfield Renewable’s portfolio spans across the globe (North America, South America, Europe, and Asia) and across all of the major clean energy technologies (hydropower, solar, wind, and storage).

What’s interesting here is that Brookfield Renewable has two classes of stock. There’s the partnership unit with a distribution yield of 5.8% (BEP) and the corporate share class with a dividend yield of roughly 5% (BEPC). They represent the same entity; the difference in yield is based on demand for the corporate share class, which more investors are comfortable buying (some large investors, like pension funds, can’t buy partnerships). The dividend backing that yield has been increased annually at roughly 6% a year since 2001.

A big yield, a generous distribution growth rate, and a long runway for growth as clean energy becomes more and more important to the global energy pie. What’s not to like?

2. Black Hills is small but mighty

Black Hills is more of a traditional utility, offering regulated natural gas and electric services to 1.3 million customers in eight states. The stock yields roughly 4.4%, which is toward the high end of the stock’s yield range over the past decade. From this perspective, it looks like the utility is on sale. However, the average utility yields around 3%, using the Utilities Select Sector SPDR ETF (NYSEMKT: XLU) as an industry proxy, so Black Hills also looks cheap relative to its peers.

The really interesting thing here, however, is that this relatively small regulated utility (its market cap is a modest $4 billion or so) happens to have one of the best dividend records in the utility sector. Black Hills has increased its dividend annually for more than five decades, making it a highly elite Dividend King. Dividend growth of around 5% a year over the past decade or so isn’t too bad, either. And all of this from what is, basically, a very boring company. If you are looking for a utility that you can put on autopilot, Black Hills is one you need to look at today.

3. WEC Energy: Dividend growth and income

Last up is WEC Energy, which has the lowest yield of the three at roughly 3.6%. Don’t dismiss it out of hand, that’s still well more than the average utility. And the dividend has grown at a generous 7% a year over the past decade. The most recent increase, in January, was 7%. The company expects earnings to grow between 6.5% and 7% a year through at least 2028. The dividend is likely to grow at roughly the same pace as earnings.

That’s a great combination of yield and dividend growth for investors who are looking at low-yield dividend-growth-focused utility stocks like NextEra Energy (which has a below-average yield of 2.5%). WEC Energy is a simple and boring regulated electric and natural gas utility (NextEra mixes a regulated utility with a clean energy business), operating in parts of Wisconsin, Illinois, Michigan, and Minnesota with 4.7 million customers. The yield may be a bit low for some dividend investors, but if you are interested in killing two birds with one stone, this dividend growth machine (it’s increased its dividend annually for 20 years) should be on your radar.

If you look hard enough, you’ll find it

There’s no question that the utility sector has started to recover in price, but that doesn’t mean the opportunity to find good dividend stocks is over. You just need to be more selective. Brookfield Renewable, Black Hills, and WEC Energy are all examples of the strong high-yield dividend stocks you can find if you take the time to dig in.

Should you invest $1,000 in WEC Energy Group right now?

Before you buy stock in WEC Energy Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and WEC Energy Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Reuben Gregg Brewer has positions in WEC Energy Group. The Motley Fool has positions in and recommends Brookfield Asset Management, Brookfield Renewable, and NextEra Energy. The Motley Fool recommends Bausch Health Companies and Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

3 Top High-Yield Utility Stocks to Buy in September was originally published by The Motley Fool