September Volatility Returns As Labor Cools, Bets On Large Fed Rate Cut Intensify, Semiconductors Plunge: This Week In The Markets

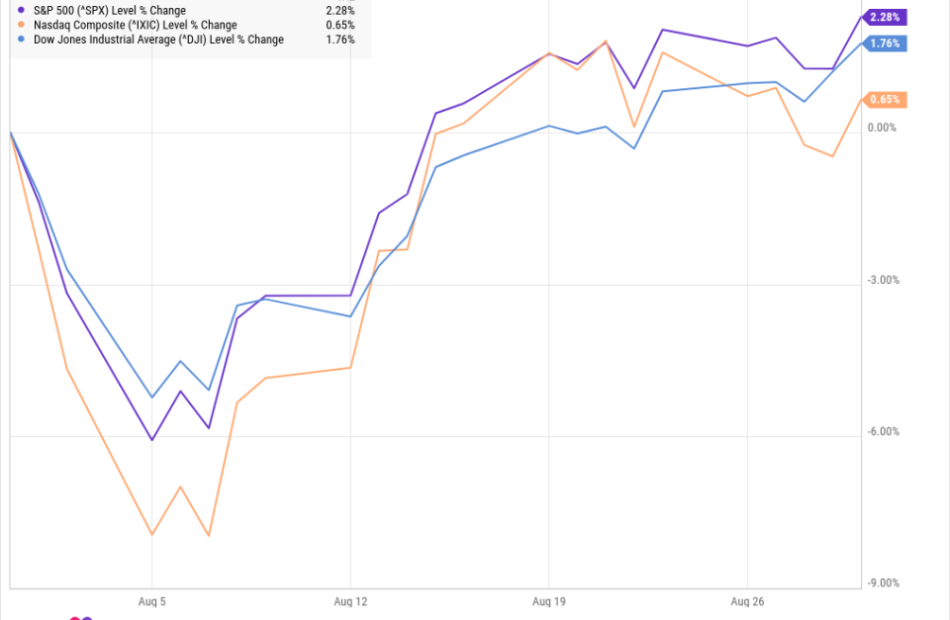

September’s notorious volatility has once again gripped the markets as cooling jobs data spurred Wall Street into its worst week of the year.

In August, the U.S. economy added 142,000 jobs — a rebound from July’s disappointing 89,000 figure but below expectations of 160,000 and significantly lower than the average pace of 202,000 over the past year.

While the unemployment rate edged down slightly from 4.3% to 4.2% as expected — and wage growth exceeded estimates — these figures did little to sway market sentiment. Labor data released during the week simply failed to meet expectations.

As a result, traders are now placing a higher probability on the Federal Reserve cutting interest rates by 50 basis points rather than 25 basis points in September.

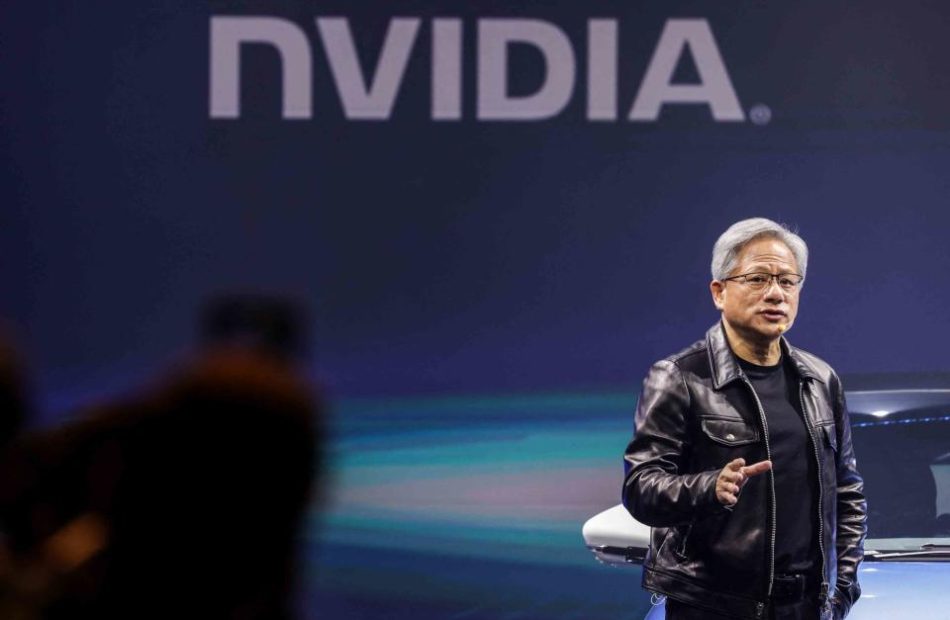

Semiconductors were hit by several headwinds, including reports of a potential antitrust investigation into Nvidia Corp. NVDA by the Department of Justice and disappointing guidance from major chipmaker Broadcom.

The Philadelphia Semiconductor Index, tracked by the iShares Semiconductor ETF SOXX, endured its worst week in over two years. Nvidia’s shares extended their biweekly losses to over 20%.

See Also: Harris Administration Bodes Well For Economy, Trump Tariffs Will Drive Up Inflation

Tax Reform Impact

Goldman Sachs warns of potential S&P 500 earnings volatility under tax plans proposed by Kamala Harris and Donald Trump. Corporate tax changes could lead to significant swings in company profits, with implications for market performance, particularly in sectors sensitive to tax policy shifts.

Ford In-Car Ads

Ford Motor Co. F’s new patent suggests displaying targeted ads inside vehicles based on location data. The technology could offer drivers advertisements relevant to their driving routes, potentially creating new revenue streams while raising questions about privacy and user experience in connected cars.

iPhone 16 Event

A Bank of America equity analyst suggests Apple Inc.‘s AAPL imminent iPhone 16 event may drive stock prices higher, countering the usual “sell the news” trend. Anticipated innovations and strong demand could positively impact investor sentiment, with shares potentially benefiting from the product launch excitement.

Fake Ozempic Alert

Counterfeit Ozempic batches are flooding the weight loss market, posing serious health risks. Authorities are raising alarms as demand for the drug surges, increasing the circulation of these dangerous, unauthorized products worldwide.

Now read:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Douglas R. Rippel Offloads $877K Worth Of FirstCash Hldgs Stock

Douglas R. Rippel, Board Member at FirstCash Hldgs FCFS, reported an insider sell on September 4, according to a new SEC filing.

What Happened: Rippel’s decision to sell 7,316 shares of FirstCash Hldgs was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $877,773.

Monitoring the market, FirstCash Hldgs‘s shares down by 0.82% at $118.5 during Thursday’s morning.

All You Need to Know About FirstCash Hldgs

FirstCash Holdings Inc operates pawn stores in the United States and Latin America. Its primary business involves making small loans secured by personal property. The the company has three reportable segments: U.S. pawn; Latin America pawn; and Retail POS payment solutions (AFF). It derives majority revenue from U.S. Pawn segment. These pawn loans give the borrower the option of either repaying the loans with interest or forfeiting the property without further penalty. Close to 30% of total company revenue comes from interest earned on the loans. Close to 70% of total revenue comes from reselling forfeited property in the company’s retail stores.

FirstCash Hldgs’s Financial Performance

Revenue Growth: FirstCash Hldgs displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 10.71%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 47.58%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): FirstCash Hldgs’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 1.09.

Debt Management: FirstCash Hldgs’s debt-to-equity ratio is below the industry average. With a ratio of 1.01, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: FirstCash Hldgs’s P/E ratio of 22.84 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.64, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 7.5, FirstCash Hldgs presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Essential Transaction Codes Unveiled

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of FirstCash Hldgs’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DISCO CORP Upgraded to Strong Buy: Here's What You Should Know

DISCO CORP DSCSY could be a solid choice for investors given its recent upgrade to a Zacks Rank #1 (Strong Buy). This rating change essentially reflects an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

A company’s changing earnings picture is at the core of the Zacks rating. The system tracks the Zacks Consensus Estimate — the consensus measure of EPS estimates from the sell-side analysts covering the stock — for the current and following years.

The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time.

Therefore, the Zacks rating upgrade for DISCO CORP basically reflects positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

For DISCO CORP, rising earnings estimates and the consequent rating upgrade fundamentally mean an improvement in the company’s underlying business. And investors’ appreciation of this improving business trend should push the stock higher.

Harnessing the Power of Earnings Estimate Revisions

Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for DISCO CORP

For the fiscal year ending March 2025, this company is expected to earn $0.79 per share, which is a change of 33.9% from the year-ago reported number.

Analysts have been steadily raising their estimates for DISCO CORP. Over the past three months, the Zacks Consensus Estimate for the company has increased 13.8%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of DISCO CORP to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Stocks notch worst weekly decline since March 2023 after August jobs report

-

US stocks fell sharply on Friday after a weak August jobs report raised recession fears.

-

The S&P 500 had its worst week since March 2023, dropping about 4%.

-

The Federal Reserve is expected to cut interest rates by 25 basis points at its September 18 meeting.

US stocks declined sharply on Friday after a weaker-than-expected August jobs report set off fresh fears about a recession.

The S&P 500 closed out its worst week since March 2023, dropping about 4% in the week, while the Nasdaq 100 dropped nearly 6%.

The US economy added 142,000 jobs in August, below the average economist estimate of 164,000. The unemployment rate fell to 4.2% from 4.3%.

While the jobs report wasn’t as jarring as the July reading, which saw the unemployment rate unexpectedly jump, it affirmed the cooldown of the labor market and the need for the Federal Reserve to cut interest rates at its September 18 policy meeting.

New York Fed President John Williams said in a speech on Friday that it’s time to cut rates.

“It is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate,” Williams said.

The market expects a 25-basis-point interest-rate cut from the Fed later this month, according to the CME FedWatch Tool. It was see-sawing between 25 and 50 basis points earlier in the day.

The August report decisively shows how the US job market has weakened in recent months, with the three-month moving average of monthly job gains dropping from just under 270,000 in March to just over 110,000 in August.

JPMorgan wrote following the report that the data pointed to the “waning vigor” of the labor market and should prompt a larger, 50-basis-point cut from the Fed at its upcoming meeting.

But the stock-market weakness in the past week is typical, according to Fundstrat’s Tom Lee, who believes that this decline is right on time based on weak September seasonality.

“Even if we are cautious about the next 8 weeks, to us, stocks are at the lower end of the range, and we see more upside than downside,” Lee told clients in a note on Friday.

Analysts at Ned Davis Research echoed the sentiment, saying that the September sell-off was ultimately a buying opportunity as the stock market approached its best three-month stretch of the year.

Here’s where US indexes stood at the 4 p.m. closing bell on Friday:

Here’s what else was happening on Friday:

In commodities, bonds, and crypto:

-

West Texas Intermediate crude oil decreased 1.55% to $68.08 a barrel. Brent crude, the international benchmark, fell 1.83% to $71.36 a barrel.

-

Gold was down 0.82% to $2,522.20 an ounce.

-

The 10-year Treasury yield was down 1 basis point to 3.719%.

-

Bitcoin dropped 4.48% to $53,651.

Read the original article on Business Insider

EXCLUSIVE: Fed's Course Change Is 1 Of 4 Market Catalysts Direxion Exec Says Investors Should Watch (CORRECTED)

Editor’s Note: The story has been updated to reflect the correct number of commodities.

As market volatility continues to captivate investors, understanding the macroeconomic forces at play is crucial. In an exclusive interview with Benzinga, Ed Egilinsky, managing director at Direxion, sheds light on the critical trends shaping the market and where investors can find promising opportunities.

Egilinsky shared that in the current market environment, there is an opportunity for traders to “take advantage of short-term shifts in market sentiment whether bullish or bearish.”

He highlighted several factors that can potentially create some opportunities. These include, “1) the Fed starting to reverse course from hawkish to dovish, 2) outcome of the U.S. election and effect on policy, 3) ongoing global geopolitical risk, and 4) fears of a recession.”

The market’s swift transition from risk-on to risk-off sentiment in August, with the VIX spiking into the 60s, underscores the volatility driven by these factors. Egilinsky highlighted potential catalysts in “Nvidia earnings, PCE deflator, CPI and FOMC meeting.” These could drive significant market movements in the near term.

For long-term investors, Egilinsky recommends looking beyond traditional stocks and bonds. “Historically, commodities have shown a low correlation to stocks and bonds and the ability to perform in difficult equity and bond environments, such as in 2022.” This makes them a viable option in challenging market conditions, he said.

The Direxion Auspice Broad Commodity Strategy ETF COM exemplifies this approach, he said. “Unlike other broad commodity strategies, it is not always static 100% long, and based on price trends it can get defensive by going to cash with an individual commodity when it shows a downward price trend,” Egilinsky explained.

“Currently, the COM ETF is long only three (crude oil, gold and silver) out of the possible 12 commodities” — i.e. commodities with strong performance histories.

Egilinsky added, “Commodity cycles tend to be long in duration and many believe the current Supercycle still has a significant runway.” This makes the Direxion Auspice Broad Commodity Strategy ETF a compelling choice for diversifying in the current environment.

Read Next:

Image: Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Nvidia and Chip Stocks Just Had Their Worst Week in More Than 2 Years

I-Hwa Cheng / AFP / Getty Images

Nvidia CEO Jensen Huang speaks at an event in Taipei last October.

Key Takeaways

-

Chip stocks had their worst week since January 2022, as AI investor favorite Nvidia lost about 14% during the holiday-shortened trading week.

-

Broadcom shares fell 10% after the company disappointed investors with its earnings report, and the stock lost nearly 16% of its value this week.

-

Chip stocks’ rough week comes as concerns about the health of the economy mount.

-

Investor concerns about AI spending have also weighed on sentiment.

Chip stocks slumped this week, with the PHLX Semiconductor Index (SOX) tumbling 10%, its biggest weekly decline since January 2022.

Market darling Nvidia (NVDA) shed 4.1% on Friday to finish the holiday-shortened trading week down almost 14%. That’s about as much as lost by Intel (INTC), which on Tuesday was hit with reports that it could lose its coveted place in the Dow Jones Industrial Average.

Broadcom (AVGO) tumbled 10% on Friday after posting disappointing quarterly results on Thursday afternoon. The stock lost nearly 16% of its value this week.

Worries About AI Spending Weigh on Sentiment

Chip stocks’ rough week comes as concerns about the health of the economy mount. The U.S. added fewer jobs than expected in August, according to Labor Department data published Friday, adding to the growing body of evidence that the U.S. economy is slowing. It was a similar report on August 2 that capped off semiconductors’ second-worst week of the year (-9.7%).

Economic concerns have coincided with a shift in investor sentiment around artificial intelligence (AI). Corporate spending on AI, once music to Wall Street’s ears, has come under scrutiny in recent months. Big tech’s ballooning capital expenditures have some investors worried about when—or if—the spending will pay off. That has dampened the mood of tech investors and weighed on shares of the semiconductor companies whose products are AI’s vital organs.

The industry’s second-quarter earnings—specifically their outlooks for the rest of the year—have also struggled to meet investors’ exceedingly high expectations. Nvidia again topped earnings expectations last week, but growth has slowed. And after a year of blowout reports, its good sales guidance was simply not good enough.

Read the original article on Investopedia.

ROBERT WEBB At National Health Investors Decides to Exercises Options Worth $1.59M

In a new SEC filing on September 5, it was revealed that WEBB, Board Member at National Health Investors NHI, executed a significant exercise of company stock options.

What Happened: The latest Form 4 filing on Thursday with the U.S. Securities and Exchange Commission uncovered WEBB, Board Member at National Health Investors, exercising stock options for 70,000 shares of NHI. The total transaction was valued at $1,585,550.

The Friday morning update indicates National Health Investors shares down by 0.0%, currently priced at $82.51. At this value, WEBB’s 70,000 shares are worth $1,585,550.

All You Need to Know About National Health Investors

National Health Investors Inc is a housing and medical facility REIT. The company operates through two reportable segments i.e. Real Estate Investments and Senior Housing Operating Portfolio. The Real Estate Investments segment consists of real estate investments and leases, mortgages, and other notes receivables in independent living facilities, assisted living facilities, entrance-fee communities, senior living campuses, skilled nursing facilities, and a hospital. The SHOP segment is comprised of two ventures that own the operations of independent living facilities. The company’s revenues are derived from rental income, mortgage and other notes receivable interest income, and resident fees and services.

Understanding the Numbers: National Health Investors’s Finances

Revenue Growth: National Health Investors’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 9.11%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Real Estate sector.

Exploring Profitability:

-

Gross Margin: Achieving a high gross margin of 96.7%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 0.81, National Health Investors showcases strong earnings per share.

Debt Management: With a below-average debt-to-equity ratio of 0.91, National Health Investors adopts a prudent financial strategy, indicating a balanced approach to debt management.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 28.06, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 10.99 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 18.63, National Health Investors presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of National Health Investors’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Missed Out On Nvidia's Run-Up? My Best AI Stock to Buy and Hold.

If you look up “artificial intelligence” (AI) in the dictionary, you might just see a picture of the Nvidia logo. I’m obviously kidding, but there’s no denying that this business has been the clear poster child of this revolutionary technological trend.

This AI infrastructure company has been a monster winner. Shares have catapulted 2,560% higher in the past five years, crushing the broader Nasdaq Composite Index by an incredibly wide margin. This means that a $10,000 investment in September 2019 would be worth a whopping $266,000 today.

You might be discouraged if you missed out on Nvidia’s run-up. But perhaps it’s time to take a closer look at what I believe to be the best AI stock right now.

Nvidia’s impressive run

Some investors might believe that Nvidia’s huge gains are warranted. The business sells the graphics processing units (GPUs) necessary to power many AI systems. And as companies of all sizes try to position their operations to integrate AI, Nvidia has been the best beneficiary.

According to research from Mizuho Securities, Nvidia has between a 70% to 95% share of the market for chips that power AI models. Unsurprisingly, growth has been unbelievable. Revenue increased 122% from $13.5 billion in the year-ago period to $30 billion in the fiscal 2025 second quarter (ended July 28).

Nvidia is also wildly profitable, posting a 75% gross margin and 62% operating margin in the latest fiscal quarter. It’s not a surprise that the market has become incredibly bullish and optimistic about Nvidia’s prospects. This is now a $2.7 trillion enterprise.

But as of this writing, shares trade at a price-to-earnings (P/E) ratio of 52. This makes it the second most expensive “Magnificent Seven” stock, which isn’t an attractive proposition for investors.

Alphabet’s enviable position

Nvidia gets all the attention when it comes to AI stocks, but investors should look at Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). I think it’s the best AI stock to buy and hold.

Back in 2001, the business was already utilizing machine learning and AI capabilities in its powerful search engine, helping users with their spelling. And even before OpenAI’s launch of ChatGPT in November 2022 kicked off the AI boom, this technology was being developed and integrated in various Alphabet products and services, like providing traffic data in Maps, making it easier to find Photos by searching what’s in them, and preventing spam in Gmail.

CEO Sundar Pichai positioned the business to be “AI first” back in 2016. Nowadays, AI is undoubtedly a part of Alphabet’s current DNA. To be clear, the company’s first AI steps weren’t the smoothest. But its Gemini AI model is working.

“All six of our products with more than 2 billion monthly users now use Gemini. This means that Google is the company that’s truly bringing AI to everyone,” Pichai said on the Q2 2024 earnings call.

Alphabet has unrivaled reach to continue introducing AI features to almost instant adoption. This allows for rapid feedback, which only helps to constantly improve the offerings and bolster Alphabet’s competitive positioning.

And the business has virtually unlimited financial resources. It generated $54 billion of annualized free cash flow in the second quarter. And Alphabet is currently sitting on a massive net cash balance of $87.5 billion, which gives it the firepower to keep investing heavily in AI.

While Nvidia’s valuation is steep, that isn’t really a concern in this case. Alphabet shares trade for a reasonable P/E ratio of 23. Investors shouldn’t overthink it. Alphabet has long been a dominant force in the internet age. And I see this continuing in the years ahead, particularly in a world where AI becomes more prevalent.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

Missed Out On Nvidia’s Run-Up? My Best AI Stock to Buy and Hold. was originally published by The Motley Fool

Is It Time to Buy August's Worst-Performing Nasdaq Stocks?

August had one of the worst beginnings of a month for the stock market in recent memory.

Shares plunged on a combination of disappointing economic data and a surprise rate hike in Japan that ended the “carry trade” through which professional investors had borrowed money in yen and bought U.S. stocks.

However, stocks recovered over the rest of the month and actually finished in positive territory as those earlier concerns faded.

As you might guess, it was an active month for individual stocks as well, including those on the Nasdaq-100. Let’s take a look at the three worst performers in August from the elite group of tech stocks to see if any are worth buying.

1. Super Micro Computer (down 37.4%)

The worst performer on the Nasdaq-100 was actually one of the best performers over the past year, Super Micro Computer (NASDAQ: SMCI), aka Supermicro.

The AI server stock got hit by a double whammy last month. First, the stock fell at the beginning of the month as the company reported blowout revenue growth in its fiscal fourth quarter, but its gross margin fell sharply, cramping profit growth. That seemed to convince investors that the company’s growth wasn’t sustainable, or that price competition was heating up, weighing on Supermicro’s bottom line.

Though management said that margins would expand over the coming year, that wasn’t enough to assuage investors’ fears.

Later in the month, the stock plunged further. It was hit first by a short-seller report making various allegations about its business. Then, the following day, Supermicro said it would delay its 10-K filing as it needed more time to “complete its assessment of the design and operating effectiveness of its internal controls over financial reporting.”

Those two things didn’t seem to be related. But the timing of the 10-K delay certainly didn’t calm investors’ nerves.

At this point, Supermicro seems likely to remain in the doghouse until it files its 10-K. When it does, investors may get their answer to Hindenburg’s claims.

For now, the stock looks risky but also cheap. Taking a small position in Supermicro could pay off if it can navigate the current situation.

2. Moderna (down 35.1%)

Shares of Moderna (NASDAQ: MRNA), the mRNA vaccine maker, plunged on its earnings report to start August and never recovered.

The biotech company cut its guidance following its second-quarter earnings report, saying it now expects full-year product sales of $3 billion to $3.5 billion, down from previous guidance of around $4 billion. The update was caused by very low sales in the EU, possible revenue deferrals from some international sales, and increasing competition in the U.S. market for respiratory vaccines.

The sell-off on guidance isn’t surprising, as Moderna has gone from earning a windfall for its COVID vaccine to now being a high-risk stock posting significant losses. Moderna is now on track to report an operating loss of about $4 billion this year.

Despite the wide losses and guidance cut, Moderna’s technology still holds promise. In fact, HSBC just upgraded its rating to hold due to the potential for its developmental personalized cancer vaccine, which is now in late-stage clinical trials.

A breakthrough for Moderna could lead to another surge in the stock. While that doesn’t seem imminent, taking a small speculative position at this point could pay off down the road.

3. Intel (down 28%)

Finally, Intel (NASDAQ: INTC) is the third Nasdaq-100 stock to fall flat on its face in August.

Intel’s problems came after it reported second-quarter results. Not only did the company deliver a weak quarter and offer disappointing guidance, but it also said it was eliminating its dividend and restructuring the business, including by laying off at least 15% of its workforce.

Those moves show how desperate things have gotten for Intel. Critics have assailed the company for a lack of innovation for years, and it’s now falling behind Nvidia and AMD in AI, a high-stakes technology in the semiconductor industry.

CEO Pat Gelsinger has bet on a turnaround in the foundry business, but that segment is losing billions of dollars each quarter.

Towards the end of the month, the stock got a minor reprieve on reports that it was considering strategic options, including potentially spinning off the foundry business, which was enough for the stock to jump 9% on the last day of August.

Intel may look cheap, but the stock is best avoided at this point, as the business is clearly in disarray, and any turnaround is going to take years to materialize.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

HSBC Holdings is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has positions in Moderna. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends HSBC Holdings, Intel, and Moderna and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Is It Time to Buy August’s Worst-Performing Nasdaq Stocks? was originally published by The Motley Fool

FIVE DEADLINE REMINDER: Five Below, Inc. Investors who Lost Money are Reminded to Contact BFA Law before Upcoming Securities Litigation Deadline (Nasdaq:FIVE)

NEW YORK, Sept. 07, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Five Below, Inc. FIVE and certain of the Company’s senior executives.

If you invested in Five Below, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/five-below-inc.

Investors have until September 30, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Five Below securities. The case is pending in the U.S. District Court for the Eastern District of Pennsylvania and is captioned Himes v. Five Below, Inc., No. 2:24-cv-3638.

What is the Lawsuit About?

The complaint alleges that Five Below operates specialty discount stores, and prices most of its products at $5 or less. The complaint further alleges that during the relevant period, the company misrepresented its accelerating store traffic, merchandising opportunities and store expansions that underpinned its long-term growth. In truth, Five Below had allegedly experienced macroeconomic pressures that dented its store traffic and interfered with the successful execution of the company’s business.

On June 5, 2024, Five Below is alleged to have revealed that macroeconomic pressures caused lower income customers to reduce their spending, leading to disappointing financial results for the company’s first quarter of 2024. Still, Five Below assured investors that “chasing trends has always been a strength of ours, and we will continue to quickly identify and capitalize on trends.” Despite the assurance, the news caused the price of Five Below stock to decline about 10%, from $132.79 per share on June 5, 2024 to $118.72 per share on June 6, 2024.

After the market closed on July 16, 2024, Five Below announced that CEO Joel Anderson resigned as President and CEO, and as a member of the Board of Directors, effective immediately. At the same time, the company reported that the quarter-to-date results for its second quarter of fiscal 2024 showed that comparable sales decreased 5% over the prior year. As a result, Five Below also announced that sales for the full quarter would be in the range of $820 million – $860 million and that comparable sales would decline approximately 6%-7%. This news caused a significant 25% decline in the price of Five Below stock, from $102.07 per share on July 16, 2024 to $76.50 per share on July 17, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/five-below-inc.

What Can You Do?

If you invested in Five Below, you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/five-below-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/five-below-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.