How Much Does Cannabis Black Market Dealer 'Frank' Make Per Month?

We recently came across an intriguing article that reported on the earnings of a black-market weed dealer the article referred to only as Frank. Using the numbers provided in the article, we decided to calculate just how much Frank could realistically make from selling cannabis on the black market.

The Scenario

According to the Herb.co article, Frank buys a quarter-pound (QP) of cannabis for about $1,000, which seems quite expensive, but we’ll roll with it.

In Frank’s region, weed is typically sold at the following prices:

- $50 for an eighth (3.5 grams)

- $100 for a quarter (7 grams)

- $350 for an ounce (28 grams)

If Frank sells his product by the ounce, he’ll make $400 in profit per QP, netting $100 per ounce. However, if he breaks the quarter-pound into smaller eighths, he’ll make a more lucrative $600 in profit per QP, gaining $150 per ounce.

An impressive 40% return on investment (ROI) for the first scenario, an astonishing 60% for the second.

How We Calculated Frank’s Earnings

To estimate Frank’s potential monthly income, we first assumed that he sells one QP of cannabis per week. With this assumption, we calculated his total monthly profits based on both selling strategies: selling by the ounce and by the eighth.

Scenario 1: Selling by the Ounce

- Cost of a quarter-pound: $1,000

- Selling price of an ounce: $350

- Profit per ounce: $100

- Total profit per QP: 4 ounces × $100 = $400 per QP

- Monthly profit: $400 per QP × 4 weeks = $1,600 per month

Scenario 2: Selling by the Eighth

- Cost of a quarter-pound: $1,000

- Selling price of an eighth: $50

- Profit per ounce: $150 (if sold in eighths)

- Total profit per QP: 4 ounces × $150 = $600 per QP

- Monthly profit: $600 per QP × 4 weeks = $2,400 per month

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Impact Of Frequent Customers

But that’s not the whole story. Frank reports having around 10-12 regular customers, with about 4-5 described as “good, frequent” customers who visit him every day or every other day. These frequent buyers account for a significant portion of his income. He says that $200 is the most he’s made from a single transaction.

Using these details, we estimated Frank’s additional monthly income from these frequent customers:

- Frequent customers: An average of 4.5 customers

- Transactions per month per customer: 15 (assuming every other day)

- Income per transaction: $200

- Monthly income from frequent customers: 4.5 customers × 15 transactions × $200 = $13,500 per month

Read Also: State By State: Price Of Weed Across The U.S. In August 2024

Total Monthly Income

When we combine Frank’s profit from selling his cannabis with the income from his frequent customers, his total monthly income looks like this:

- Selling by the ounce: $1,600 (monthly profit) + $13,500 (income from frequent customers) = $15,100 per month

- Selling by the eighth: $2,400 (monthly profit) + $13,500 (income from frequent customers) = $15,900 per month

This is assuming frank has no other associated costs, which are most likely to exist in illegal markets when operating at certain scales.

While these numbers may seem staggering, it’s important to remember that Frank operates outside of the legal market. Typically illegal markets charge higher prices because of the implied risks.

In the regulated cannabis industry, businesses face operational costs, including taxes, compliance fees and overhead expenses such as storefronts, employee wages and security measures. These costs significantly reduce the profit margins of legal cannabis companies.

Comparing To Legal Cannabis Businesses

But legal dispensaries play a crucial role in ensuring the safety and health of consumers. By adhering to strict regulations, legal businesses offer products that are tested for quality, potency, and harmful contaminants. While taxes and compliance costs—such as licensing, packaging, and marketing—may seem high, they ensure that cannabis is sold responsibly, in environments that prioritize consumer safety. The costs of ensuring safety and accountability are well worth it when weighed against the risks of unregulated products.

Frank’s ability to pull in between $15,100 and $15,900 per month is a testament to the profitability of the black market, despite growing legalization efforts.

The black market thrives on its ability to bypass the regulatory and tax burdens that weigh down legal sellers.

While the profits may be enticing, operating in the black market comes with its own set of risks, especially the potential legal penalties if caught.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's How the S&P 500 Performed in August. (Hint: The Experts Weren't Predicting It When the Market Dipped.)

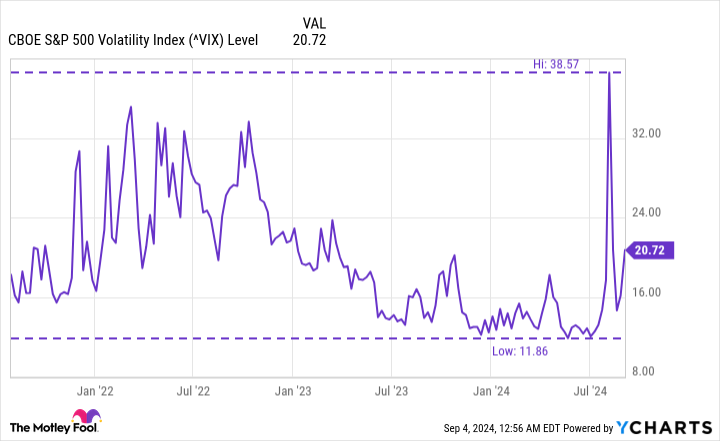

Rarely is there a dull month in the stock market, and August proved to be another example. During the first few trading days of the month, the S&P 500 (SNPINDEX: ^GSPC) declined by over 6% alongside a sell-off of major tech stocks, sending the CBOE Volatility Index to its highest levels in years.

The CBOE VIX — known as the “fear index” — measures market volatility and rises during unstable times. There’s no universal CBOE VIX scale, but any number above 30 generally indicates significant fear and uncertainty.

All the commotion around the S&P 500 in early August caused some Wall Street experts to sound the alarm and raise their recession predictions. Admittedly, it’s better to be prepared for a recession that doesn’t happen versus unprepared for one that does, but looking back, these fears were likely overblown and misguided based on just a few days.

Despite the rough start, the S&P 500 recovered the rest of the month and finished August up 2.3%. Those aren’t necessarily eye-popping returns, but it beat its performance in January, April, and July of this year.

The only stock market certainty is uncertainty

The S&P 500’s August roller coaster is a reminder that nobody truly knows how the market will move. You can have all the resources in the world and make educated guesses, but at the end of the day, there’s no definitive way to say how it will perform.

The quicker people learn that lesson, the better their chances of avoiding one of the biggest mistakes in investing: trying to time the market.

It’s easy to want to sell shares when you anticipate the market dropping or load up on shares when you anticipate it rising, but that’s a slippery slope. Even if you’re right once or a few times, timing the market correctly over the long haul is as far-fetched as hitting a bull’s-eye blindfolded.

It’s a habit that you don’t want to form because it typically does more harm than good.

The focus should be on consistency through thick and thin

Volatility is as much a part of the stock market as the stocks themselves. It’s been like that since the beginning of investing, and there’s no reason to believe it won’t be like that for the rest of time. The best thing the average investor can do is focus on consistency; that usually yields the best long-term results.

A great way I’ve found to remain consistent is to use dollar-cost averaging. When you do so, you decide on a set amount to invest, put yourself on an investing schedule, and stick to the schedule regardless of how the market is performing.

For example, let’s assume you have $400 you want to invest monthly into an S&P 500 exchange-traded fund (ETF) like the Vanguard S&P 500 ETF (NYSEMKT: VOO). You could decide you want to divide the $400 into four $100 weekly investments every Monday, two $200 investments every other Friday, or one lump sum at the beginning of each month.

The frequency and schedule you decide on aren’t too important; it’s all about what works for you. What’s most important is that you stick to your schedule no matter what. Having a set schedule reduces the temptation to make sporadic moves based on short-term market movements (or at least that’s the goal).

So, should you invest in the S&P 500?

Few investments are great at any time, like an S&P 500 ETF. It’s a one-stop shop that can be the cornerstone of virtually any investor’s portfolio. The S&P 500, like any other stock or index, has its ups and downs, but it’s hard to go against its historical results.

That doesn’t guarantee it will continue, but decades of solid performance are encouraging.

There are a handful of S&P 500 ETFs, but my personal go-to fund is the Vanguard S&P 500 ETF. Since all S&P 500 ETFs mirror the same index, there isn’t much tangible difference besides cost. With a 0.03% expense ratio, the Vanguard S&P 500 ETF is one of the cheapest ETFs on the market and a third of the cost of the popular SPDR S&P 500 ETF at 0.0945%.

Ignore the noise in the stock market and trust the power of long-term investments in the S&P 500.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Stefon Walters has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Here’s How the S&P 500 Performed in August. (Hint: The Experts Weren’t Predicting It When the Market Dipped.) was originally published by The Motley Fool

3 Magnificent S&P 500 Dividend Stocks Down 22%, 35%, and 45% to Buy and Hold Forever

If you insist on buying your dividend stocks at a discount, you’re largely out of luck right now. Although the S&P 500 has been uncomfortably volatile since July, it’s still up more than 30% since November’s low, and still within sight of record highs. There just aren’t a lot of bargains to choose from.

There are a few worthy prospects, however, if you’re willing to do enough digging.

Here’s a rundown of three beaten-down S&P 500 dividend stocks you may want to consider scooping up before a bunch of other investors decide to do the same.

1. United Parcel Service

There’s no getting around the fact that the wind-down of the COVID-19 pandemic has proven challenging for United Parcel Service (NYSE: UPS). The stock soared in the wake of a wave of online shopping, but the return of in-person shopping since 2022 has affected investor sentiment. Economic lethargy and new (and more expensive) labor contracts also get some of the credit for its recent weakness. All told, UPS shares are now down 45% from their early 2022 peak.

It’s arguable, however, the sellers overshot their target on fears that trouble would linger for longer than initially expected, and cut deeper into its business.

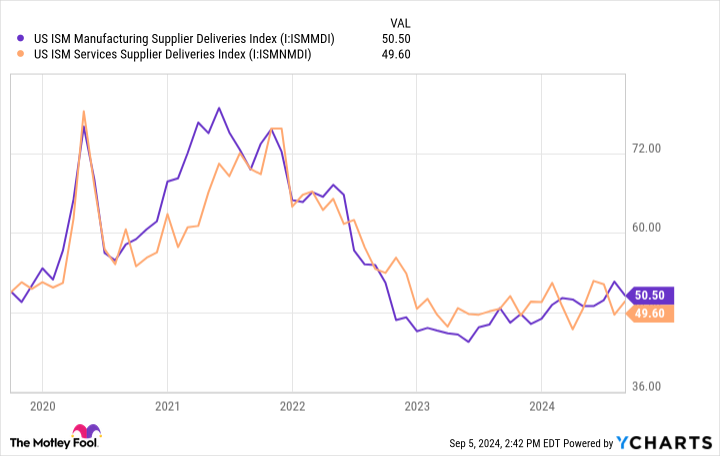

See, deliveries — at least within this company’s important U.S. market — are actually on the rise. The Institute of Supply Management’s measures of total deliveries from manufacturers as well as service providers continue to inch higher from their 2023 lull.

Consumers are doing their part, too. E-commerce giant Amazon‘s North American business saw a 9% uptick in its total business last quarter, while its international operation experienced nearly 7% growth.

In a similar but separate vein, the American Association of Railroads reports that total rail traffic in North America is in line with levels seen last year as well as the year before, while intermodal rail traffic is higher than it’s been in the past three years. This has implications for UPS simply because the goods shipped inside intermodal containers are also the kinds of goods most likely to end up in the back of a UPS delivery van. For that matter, while this year’s set to be a bit of a bust, analysts are calling for United Parcel Service’s revenue to grow nearly 5% next year, driving even greater earnings growth.

There are higher-growth and higher-yielding stocks out there to be sure. There aren’t many sporting the same forward-looking dividend yield of 5% that UPS stock currently does though, particularly at its relatively low level of risk versus its strong growth prospects.

2. Devon Energy

Devon Energy‘s (NYSE: DVN) forward-looking yield of 4.7% is just as juicy as United Parcel Services’ is, but there’s a catch. That is, this stock’s payout isn’t consistent. It ebbs and flows in step with the company’s ever-changing earnings. If you need reliable, predictable income to pay your recurring bills, this isn’t the ideal name to start with.

If you’re able to digest erratic dividend income in exchange for above-average income potential, though, this ticker’s 22% pullback from its April peak is an entry opportunity.

Devon Energy is in the oil and gas business. Its focus is onshore projects within the center of the United States, with five core sites running from south Texas all the way up to North Dakota. Last quarter it cranked out an average of 335,000 barrels of crude oil and 1.1 billion cubic feet of natural gas every day, more or less matching its recent production.

The energy business is a tricky one, of course. The market price for oil and gas is constantly changing, but the cost of drilling and extracting it doesn’t change nearly as much. That’s why the sector’s profits seem to soar when oil prices are elevated, but earnings slump when crude prices are even just modestly pressured. Devon is no exception to this dynamic.

Devon is something of an exception to most of its oil and gas-producing peers, however, in the sense that it dishes out the bulk of its earnings in the form of dividend payments. In this light, it’s very much a direct play on the price of oil itself. That’s not a bad bet to make either, given that OPEC, ExxonMobil, and Standard & Poor’s all predict we’ll be using at least as much of the stuff in 20 years as we’re using today.

3. Franklin Resources

Finally, add investment management outfit Franklin Resources (NYSE: BEN) to your list of S&P 500 dividend stocks to buy and hold forever. Its 35% sell-off since late last year has dragged shares to nearly a four-year low and pumped its projected dividend yield up to more than 6%.

The pullback makes some degree of superficial sense. Investors appear to be increasingly interested in exchange-traded funds (ETFs), or even individual stocks. Traditional mutual funds like the ones its investment company Franklin Templeton mostly manages appear to be falling out of favor. (Franklin does manage some ETFs as well, but that’s not the bulk of its business.)

This assumption ignores a couple of important realities regarding Franklin Resources though.

The first of these realities is that despite growing interest in ETFs and must-have individual stocks like Nvidia or Amazon, people aren’t actually losing interest in conventional funds. Data from the Investment Company Institute indicates that United States fund companies were managing $28.6 trillion worth of assets as of the end of 2022, down slightly from 2021’s record thanks to the bear market at the time, and en route to last year’s ending figure of $33.6 trillion. Most of this money is invested in ordinary mutual funds rather than exchange-traded funds. Frankin’s total assets under management (AUM) currently stands at $1.66 trillion, topping its late-2021 peak of nearly $1.6 trillion.

The other misunderstanding is how the fund-management business works. While certainly these companies thrive on bull markets that generate investor interest, mutual funds still charge their management fees based on the amount of assets invested even when their funds are performing poorly. That’s how Franklin was able to hold up so well in 2022 despite the market’s relatively lousy performance then. The key is simply attracting and then retaining investors’ money.

And analysts don’t expect this company to have any trouble doing that. They’re collectively calling for revenue growth of 7% this year followed by another 6% growth next year, rekindling earnings growth.

These earnings of course support dividend payments that have grown every single year for the past 44 years. You’d be hard-pressed to find a better track record than that.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, and S&P Global. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

3 Magnificent S&P 500 Dividend Stocks Down 22%, 35%, and 45% to Buy and Hold Forever was originally published by The Motley Fool

Intel, Moderna And Dollar General Were Among Top 10 Large Cap Losers In August: Are The Others In Your Portfolio?

These ten large-cap stocks were the worst performers in August. Are they in your portfolio?

- Super Micro Computer, Inc. (NASDAQ:SMCI) stock lost 34.89% in August. The company delayed filing its 10-K.

- Dollar General Corporation (NYSE:DG) stock decreased 30.95%. The company posted worse-than-expected second-quarter earnings, and many analysts cut the price target on the stock.

- Snap Inc. (NYSE:SNAP) stock dived 27.09%. The company posted a revenue miss for the second quarter, and analysts slashed the price target.

- Temu parent PDD Holdings …

40.5% of Warren Buffett's $312 Billion Berkshire Hathaway Portfolio Is in These 2 Dividend Stocks

Under the leadership of CEO Warren Buffett, Berkshire Hathaway has paid a dividend to its investors just once (a $0.10 per share payout back in 1967). Instead, the company chooses to use its capital to invest in its wholly owned businesses and other companies, make new acquisitions, buy Treasury bonds, and buy back its own shares.

With Berkshire’s stock up more than 3,976,400% since Buffett purchased a controlling stake in the company in 1965, it’s hard to argue with the Oracle of Omaha’s capital-allocation strategy. The stock’s gains across the stretch would have turned a $1,000 investment into more than $42.5 million today.

Even though Berkshire doesn’t pay a dividend itself, Buffett is a big fan of companies that return cash to shareholders through direct payouts. In fact, each of the company’s 10 largest stock holdings pays a dividend — and its portfolio is heavily weighted toward just a handful of dividend-paying stocks. Read on for a look at the two dividend stocks that account for 40.5% of Berkshire Hathaway’s $312 billion stock portfolio.

A lot more than the dividend

Jennifer Saibil: Apple (NASDAQ: AAPL) was recently inducted into Buffett’s hallowed trio of stocks he said he’d never sell. As it turns out, he meant that he’d never sell the full position because he sold some Apple stock immediately after he said it.

But that doesn’t mean it’s fallen out of Buffett’s favor. It still accounts for roughly 28.3% of the entire Berkshire Hathaway portfolio.

Like the other Buffett forever holdings, Apple is a dividend stock. It doesn’t have a high yield — just 0.45% at the current price, or well below the S&P 500 average of 1.3%. That’s close to its lowest-ever yield, which is partially because Apple stock has been outstanding this year, gaining almost 15% year to date.

The dividend demonstrates several things that are important to Buffett, regardless of the yield. It’s a tangible sign of Apple’s commitment to creating shareholder value and means management is prioritizing its cash position, which is paramount to operating a viable and growing business. Apple has a low payout ratio of only 14.9% because it’s still in a robust growth mode and uses most of its earnings for innovation and operations.

Apple has the global brand name and moat that Buffett loves, and being able to support that is a key element of sustaining its lead and edge. Apple fans are known to stick with the company’s platform, trading up for new models when they’re released. They’re loyal to the Apple ecosystem, which is differentiated through its innovation, operating system, ease of use, and general excellence. Buffett said that Apple is an even better business than his other forever stocks, Coca-Cola and American Express (NYSE: AXP).

It’s not surprising that Apple is beating the market this year or is back in the top spot as the most valuable company on the stock market. It’s exciting investors with its advancement in artificial intelligence, and the newest iteration of the iPhone is expected to be released this month. Even though it’s already minted plenty of millionaires, there’s a lot more to expect from Apple stock.

American Express is now Buffett’s second-biggest bet

Keith Noonan: Following some significant portfolio reshuffling in the second quarter, American Express overtook Bank of America to become Berkshire’s second-largest overall stock holding. The Oracle of Omaha’s company owns more than 151.6 million shares of AmEx stock, and the position accounts for 12.2% of its total stock holdings.

The credit card-focused banking company has been serving up strong financial results, and its share price has risen roughly 58% over the last year. These big gains have also pushed down the company’s dividend yield. That’s not a problem for Berkshire because the company acquired the bulk of its AmEx shares at much lower prices, but is the stock still worthwhile for other income-seeking investors at today’s prices?

While the company’s current yield of roughly 1% may not look like much, there’s a good chance that shares purchased today will boast a much bigger yield down the line. American Express has increased its dividend payout by roughly 63% over the last three years and hasn’t been letting up on the gas pedal when it comes to payout growth.

With the payout increase it announced back in March, American Express hiked its dividend by 17%. Strong financial performance has paved the way for big payout growth, and there are good reasons to expect that profit expansion will continue to facilitate rapid dividend growth.

American Express’s revenue increased 8% year over year in the second quarter, and non-GAAP (adjusted) earnings per share rose 21%, compared to the prior-year period. The company added 3.3 million new card accounts in the quarter and recorded its 24th consecutive quarter of double-digit annual growth for card fees. For the full-year period, the company expects that it will grow sales between 9% and 11%, and its midpoint guidance calls for earnings growth of roughly 21%.

The American Express brand and its financial products have continued to gain favor. And thanks to its focus on attracting a high-credit-quality customer base, the company also has the benefit of credit default rates that are best in class. While the stock’s yield comes in below the S&P 500 index’s average, it still looks like a worthwhile investment.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Jennifer Saibil has positions in American Express and Apple. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

40.5% of Warren Buffett’s $312 Billion Berkshire Hathaway Portfolio Is in These 2 Dividend Stocks was originally published by The Motley Fool

2 Tech Stocks to Buy Hand Over Fist in September

Artificial intelligence (AI) has quickly become the most important narrative in the tech industry as companies recognize the massive opportunity it creates, from enterprise productivity to cybersecurity.

Already, a handful of companies have emerged as AI tech leaders, including semiconductor company Broadcom (NASDAQ: AVGO) and cybersecurity leader CrowdStrike (NASDAQ: CRWD). Here’s why these tech stocks could be worth buying right now.

1. Broadcom

Broadcom has emerged as a leading AI company thanks to the company’s semiconductors and AI software. Investors who’ve followed the company for a while have likely noticed a shift toward AI chips lately — and it’s paying off in big ways.

Broadcom makes custom AI chips used by Alphabet and other tech companies that have become a popular option for companies ramping up their infrastructure needs to compete in the AI market. At the same time, Broadcom’s acquisition of VMWare has also boosted the company’s AI-related infrastructure software sales, which spiked 200% year over year to $5.8 billion in the third quarter (which ended Aug. 4).

Broadcom’s total sales rose 47% in the most recent quarter to $13.1 billion, and non-GAAP net income of $6.1 billion was up about 33% year over year.

The company’s recent growth and its emergence as a top AI tech stock have pushed up demand for its shares, which now trade at a forward price-to-earnings ratio of 27. While that’s not cheap, it’s still relatively inexpensive compared to tech rival Nvidia, which has a forward P/E of 42.

Investors may be wondering if there’s room for Broadcom’s AI chip sales to keep growing; management certainly thinks there is, because they estimate revenue from AI will be $12 billion for fiscal 2024. With demand for AI chips just ramping up, picking up shares of the company could be a great long-term move.

2. CrowdStrike

CrowdStrike is a leader in cybersecurity, earning a top position because its Falcon platform offers companies comprehensive security solutions that are difficult to match.

One reason CrowdStrike has been able to fend off rivals is that it has imbued its security platform with artificial intelligence. Falcon has had AI capabilities for years, and the platform continues to get smarter as it is trained on over 2 trillion security events daily.

The company’s commitment to create a leading cybersecurity platform has resulted in robust growth. Revenue in the second quarter (which ended July 31) rose 32% year over year to $963.9 million, and non-GAAP net income increased nearly 46% to $226.8 million. Growth in the quarter helped push CrowdStrike’s free cash flow up 44% from the year-ago quarter to $272 million.

Customers continue to expand their use of CrowdStrike’s platform, with 65% of customers in the second quarter adopting five or more security modules on Falcon and 45% having six or more.

If there’s one drawback to CrowdStrike, it’s that the company’s shares trade at a premium. The stock’s forward P/E ratio is 75, which is far above the cybersecurity industry average of about 22. But with CrowdStrike’s leading position in security and its Falcon platform continually improving through AI, I think picking up some of the company’s shares after their 16% dip over the past three months could be a smart decision.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Chris Neiger has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, CrowdStrike, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

2 Tech Stocks to Buy Hand Over Fist in September was originally published by The Motley Fool

Apple iPhone 16 Leaks: Get Ready For Unmatched Camera Capabilities And Much More

The expected release of Apple Inc. AAPL’s iPhone 16 at its Monday “Glowtime” event has been accompanied by last-minute leaks, hinting at enhanced camera features and a touch-sensitive capture button.

What Happened: A recent report suggests that the iPhone 16 Pro is set to offer 4K video recording at up to 120fps, a significant upgrade from the current iPhone 15 Pro range’s capture speed.

This enhancement will enable users to achieve up to 4x slow-motion effects at the camera’s highest resolution.

The report by Forbes also indicates that Apple has been experimenting with 8K video recording on the iPhone 16 Pro. However, this feature may be held back for the iPhone 17 Pro range, as the next iteration is expected to sport a higher-resolution zoom lens.

Details have also surfaced about the iPhone’s new touch-sensitive capture button. This innovative feature, capable of performing different actions based on how it is pressed or slid, is anticipated to transform the way users take photos with their iPhones.

Also Read: Apple’s Tabletop Robot: The Future Of Home Technology Or A Potential Misstep?

Apple is set to officially announce the iPhone 16 models and other products at its “Glowtime” event, scheduled for Monday at 10 a.m. PT.

Why It Matters: The leaked features of the iPhone 16 Pro suggest that Apple continues to prioritize camera capabilities, a key selling point for its devices.

The introduction of a touch-sensitive capture button could redefine the user experience, offering a more intuitive and versatile way to capture moments.

The potential inclusion of 8K video recording in future models also signifies Apple’s commitment to staying at the forefront of technological advancements.

These enhancements could help Apple maintain its competitive edge in the fiercely contested smartphone market.

Read Next

Apple Eyes Meta For Potentially Game-Changing AI Partnership

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Another Artificial Intelligence (AI) Stock Just Hiked Its Dividend, This Time by a Whopping 17%

‘Tis the season. The weather gets cooler, kids go back to school, and many technology companies raise their dividends for the year ahead.

While artificial intelligence (AI) technology stocks aren’t necessarily known for high dividend payouts, they are known for growth. So if you can find a winning AI name that also pays a dividend, a small payout today could look much, much bigger in five, 10, or 20 or more years.

Two weeks ago, one semiconductor manufacturing company raised its dividend by 15%. But not to be outdone, one of its peers bested it last Tuesday — by raising its quarterly payout by 17%.

And yet, there are reasons I’m more bullish on the first company, if I had to pick between them.

KLA Corporation delivers an early Christmas

KLA Corporation (NASDAQ: KLAC), which makes semiconductor capital (semicap) equipment, announced Tuesday that it would raise its quarterly payout to shareholders by 17%, from $1.45 per share to $1.70, good for an annual dividend of $6.80. That’s an impressive increase, especially since it marks KLA’s 15th consecutive year of annual dividend increases.

The new heightened dividend only yields about 0.9% at the current stock price. But that shouldn’t necessarily stop dividend investors from looking at KLA. If a company has the ability to outpace inflation with dividend raises for years, it can make for a great long-term holding and wind up paying you a lot in retirement.

KLA’s outsized payout increase is a sign of optimism about AI growth, which should be celebrated. But two of its peers also just raised their dividends, and appear to have greater capacity to raise theirs even more in the years ahead.

How KLA is different from Lam and Applied Materials

KLA Corporation is a leader in process control and metrology equipment, which is used to inspect chips and wafers for defects at many points along the semiconductor manufacturing process. These machines are in high demand as chip designs get ever smaller and more complex, especially in the age of AI. Like many large semiconductor equipment names, KLA dominates its respective niche, with well over 50% market share for certain processes.

KLA’s dominant position, and the stability of process control and diagnostics relative to other equipment segments, get its stock a more favorable valuation in terms of a higher multiple. The companies that dominate the etch and deposition market, Lam Research (NASDAQ: LRCX) and Applied Materials (NASDAQ: AMAT), tend to trade at lower multiples, even though all three companies have similar long-term growth prospects, profitability, and cyclicality. Lam just raised its dividend by 15% two weeks ago. Applied Materials seems set for a big increase when it raises its dividend (as is typical) in March; six months ago, Applied raised its dividend by 23%.

Which semicap dividends seem primed for the most growth?

To be sure, KLA has proven itself to be a great dividend grower, and should continue to be. But despite its outsized raise today, it may be a little more constrained in how much it can grow its payout, compared to Lam Research or Applied Materials.

This is due to a variety of factors, including overall valuation, current payout ratio (the portion of earnings paid out as dividends), and leverage on the balance sheet:

|

Company |

Dividend Yield (Forward) |

P/E Ratio (Forward) |

Payout Ratio (Forward) |

Operating Margin |

Net Debt |

|---|---|---|---|---|---|

|

KLA Corporation (NASDAQ: KLAC) |

0.9% |

25.6 |

22.8% |

38% |

$2.13 billion |

|

Lam Research (NASDAQ: LRCX) |

1.2% |

21.1 |

25.6% |

29.2% |

($0.89 billion) |

|

Applied Materials (NASDAQ: AMAT) |

0.9% |

18.7 |

20.7% |

28.6% |

($2.85 billion) |

Data source: Yahoo! Finance. Forward payout ratio = forward dividend divided by current-year earnings estimates.

Now, all three of these look like great companies to own for dividend growth investors, with high margins and relatively low payout ratios.

But KLA does trade at a higher valuation, although it has more than $2 billion in net debt, while both Lam Research and Applied Materials have hefty net cash positions (more cash than debt). It also has a high trailing price-to-earnings (P/E) ratio at 36, much higher than its two peers, and a higher current payout ratio than Lam. So the forward estimates above already assume a lot of growth for KLA’s earnings.

Clearly, KLA’s dominance of its niche, evidenced by its higher operating margin, is tantalizing for investors. But by the same token, KLA is given credit for that with its higher valuation.

Meanwhile, its earnings power has shown itself to be similar, in terms of growth and cyclicality, to that of the other two companies:

Finally, while KLA has a dominant position now, it’s beginning to see some strong competition in the metrology market from both Applied Materials and newcomer Onto Innovation. So while it has higher margins and seems safer at the moment, there probably isn’t as much room for market-share or margin increases. Investors are simply assuming that both will continue to rise.

KLA is still a great stock, it’s just not preferable to the other two

KLA’s big dividend increase is another indicator of the bright long-term future of semicap equipment stocks, especially in the age of AI. No doubt it would be a great stock to own for the long term, and should continue growing its payout above the rate of inflation.

However, given their lower valuations, better balance sheets, and similar growth prospects, Lam or Applied would be my current preferences for future dividend growth.

Should you invest $1,000 in KLA right now?

Before you buy stock in KLA, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and KLA wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Billy Duberstein and/or his clients have positions in Applied Materials, KLA, Lam Research, and Onto Innovation. The Motley Fool has positions in and recommends Applied Materials and Lam Research. The Motley Fool has a disclosure policy.

Another Artificial Intelligence (AI) Stock Just Hiked Its Dividend, This Time by a Whopping 17% was originally published by The Motley Fool

Traders Keep Half an Eye on CPI With Jobs Fear the New Inflation

(Bloomberg) — For two years since the Federal Reserve started its aggressive fight against inflation, equity traders have been glued to their screens on days when the consumer price index was reported.

Most Read from Bloomberg

But things should be different on Wednesday when the latest CPI print hits. Why? Because with inflation heading down toward the Fed’s target and the central bank getting ready to cut interest rates, the reading is less crucial for the stock market. Instead, it’s all about a weakening employment landscape and whether the central bank can avoid a hard landing.

“The pivotal question for stock investors is whether the Fed waited too long to cut rates because recession risks are higher now than just two months ago,” said Eric Diton, president and managing director of the Wealth Alliance. “All of the sudden, inflation is no longer the big issue.”

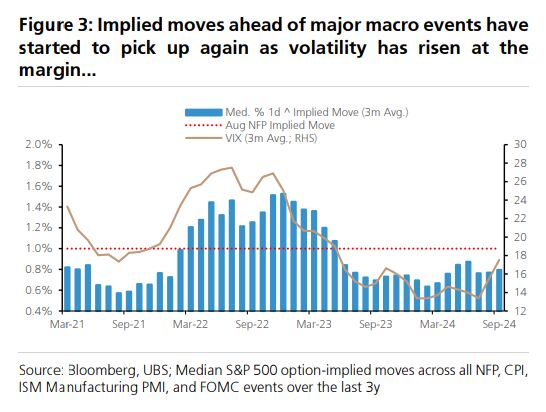

The S&P 500 Index is coming off its worst week since Silicon Valley Bank collapsed in March 2023 as Big Tech shares sank, led by Nvidia Corp.’s 14% plunge. Volatility also made a comeback, with the Cboe Volatility Index, or VIX, rising from 15 on Aug. 30 to a high of almost 24 on Sept. 6.

Options traders are betting on more of that, but less than what the market has come to expect on CPI day. As of Friday morning they’d priced in move of 0.85% in either direction for the S&P 500 on Wednesday. If realized, that would be among the smallest CPI-day moves this year, data compiled by Piper Sandler show.

On the flip-side, traders had priced an implied move of 1.1% for the S&P 500 heading into Friday’s soft jobs report. That’s among the highest this year on an absolute level and 83% above the average implied daily move in 2024, according to data compiled by Susquehanna International Group. And the broad equities benchmark still managed to outdo the forecast, falling 1.7%.

“Stocks have had a heck of a run this year,” Diton said. “So why not take some profits?”

Attitude Adjustment

Basically, the market’s thinking has been transformed now that rate cuts are considered a given but the strength of the economy seems less secure.

Fed Chair Jerome Powell all but proclaimed victory in the fight against inflation during his comments at the central bank’s symposium at Jackson Hole, Wyoming, on Aug. 23. Since then, more policymakers like New York Fed President John Williams, Chicago Fed President Austan Goolsbee and Fed Governor Christopher Waller have all indicated that cuts are needed — it’s the size that’s up for debate.

Now the Fed is turning to the other side of its dual mandate, maintaining maximum employment. Friday’s jobs report showed nonfarm payrolls rose by 142,000 last month, putting the three-month average at the lowest level since mid-2020, according to the Bureau of Labor Statistics.

Looking ahead to the Fed’s Sept. 18 rate decision, swaps contracts are fully pricing in at least a quarter-point reduction. Meanwhile, implied moves ahead of major macro events tied to employment are picking up steam, with equity volatility metrics like skew remaining elevated as traders hedge for further downside risks for stocks, according to data compiled by UBS Group AG.

“Skew is signaling that there’s extra value in having downside protection for hedges,” said Rocky Fishman, founder of derivatives analytical firm Asym 500. “If things do end up disappointing from a macro perspective, the potential ride down for stocks may be more volatile this time around than previously thought.”

Investors have good reason to be more leery of employment figures than inflation data at this point. The S&P 500 posted its worst jobs day since 2022 last month, falling 1.8% on Aug. 2, a Friday, and another 3% on Aug. 5 off a weak labor report. Then, two weeks later, inflation figures came in broadly in line with estimates, and the S&P 500 rose just 0.4%, the smallest move for any CPI day since January.

Elevated Risk

Traders are expecting higher volatility in the S&P 500 now, since out-of-the-money put options are in more demand relative to out-of-the-money calls, UBS data shows. Commodity trading advisers, or CTAs, which surf the momentum of asset prices through long and short bets in the futures market, see little room to add to their positions from here, according to UBS.

The VIX, which measures implied volatility of the benchmark U.S. equity futures via out-of-the-money options, is trading the low 20s, a level that doesn’t necessarily scream outright danger in an of itself. But it’s 52% above its average reading this year, and the volatility curve implies elevated risk for months to come.

With Fed officials in a quiet period ahead of their next policy decision, there won’t be any commentary before Sept. 18. However, the central bank’s latest Beige Book, which compiles information from business contacts in each of its 12 districts, revealed business contacts are more concerned about slowing growth than inflation. Still, there were no mentions of a “recession” and just 10 “inflation” references — a low for 2024, according to DataTrek Research.

While consensus expectations are for the US economy to remain sturdy, the Atlanta Fed’s GDPNow model shows some slowing, with a projection that third-quarter real GDP growth will climb to 2.1% annual rate, down from roughly 3% weeks ago.

It’s just one more signal that the Fed needs to cut rates before it’s too late to prevent a recession. If they don’t, investors who bid up stocks on expectations that policymakers will soon reduce borrowing costs may be forced to reckon with the old cliche, “Be careful what you wish for.”

This is particularly true if fear builds in the stock market that central bankers are failing to adequately fight an economic slowdown that will eventually hit corporate earnings, according to the Wealth Alliance’s Diton.

“Now everyone is watching every single data point on the economy and jobs,” he said. “If it continues to come in weak, there will continue to be more selling.”

–With assistance from Elena Popina.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

1 Growth Stock Down 68% to Buy Right Now

There’s no denying that Dollar General (NYSE: DG) shareholders were sucker-punched last week. In response to the discount retailer’s second-quarter earnings miss and lowered revenue guidance for the remainder of the year, shares fell 32% on Aug. 29, the stock’s worst day ever.

Most investors are now more than a little leery of owning a stake in the discount store chain. But if you believe it’s darkest before dawn, with the stock now down 68% from its 2022 peak and trading at a seven-year low, this might actually be a prime time to buy shares in this savvily positioned company.

“Financially strapped”

Dollar General dished out some serious disappointment with its second-quarter numbers. Although overall sales grew 4.2% year over year to $10.21 billion, growth in same-store sales (comps) was an anemic 0.5%. Operating profits actually fell 20%, dragging per-share profits down from $2.13 a year earlier to $1.70 this time around. Analysts were looking for earnings of $1.79 per share on a top line of $10.37 billion.

Fanning the bearish flames was lowered sales guidance for all of 2024. The retailer had been modeling revenue growth of between 6% and 6.7%, fueled by more cost-conscious consumer spending. Now it’s only looking for revenue growth between 4.7% and 5.3%, with comps growth dialed back to an expected range of only 1% to 1.6%.

Perhaps the brunt of the post-earnings plunge, however, was driven by the fact that these numbers contrasted so starkly with those from similar Walmart. It produced top-line growth of 4.8%, fueled by same-store sales growth of 4.2% within the U.S. The retailer also raised its full-year revenue and earnings guidance.

What gives? The key is the difference between the two companies’ typical customer. As CEO Todd Vasos commented during the second-quarter earnings conference call, the “lower-end consumer continues to be very much financially strapped, especially as it relates to her ability to feed her families and support her families.”

With Dollar General’s core value-minded customers unable to continue spending as they have in the past, the retailer is largely on the defensive until things get better. That could take a while, though, and matters could remain miserable for the company in the meantime. Given this, it’s not surprising investors panicked.

Just remember one important idea about how the economy and the stock market work.

Dollar General’s worst-case scenario is its current reality

Dollar General doesn’t really go head-to-head with bigger players like Walmart or Target. If anything, it mostly avoids competing directly with either chain. Whereas Target and Walmart stores are typically found in heavily populated areas, 80% of Dollar General’s stores are in often-underserved small towns with populations of less than 20,000.

It also caters to the households with lower incomes more likely to be seen in such locales, according to data from market researcher Numerator. Products with customized product sizing allow for lower prices, for example. Much of its inventory is also private-label stuff, giving the retailer even more control over how it meets the needs of its most frequent shoppers.

And the strategy usually works great. The discount retailer saw incredible revenue and footprint growth between the end of 2008’s subprime mortgage crisis and the beginning of the pandemic.

The circumstances since 2021, however, have been extraordinary. Namely, inflation has been rampant. The U.S. Consumer Price Index is now 21% higher than four years ago, and that number arguably understates the actual effective increase in the cost of living. Income growth just hasn’t kept up. That’s why for the better part of the past three years Walmart has been touting that most of its gains in market share have come from households earning in excess of $100,000 per year — this crowd’s looking to stretch their dollars too. McDonald’s recently reported disappointing quarterly results largely as well because, according to CEO Chris Kempczinski, customers “continue to feel the pinch of the economy and a higher cost of living.” And that echoes recent observations from executives with PepsiCo and other consumer-facing companies.

It’s a problematic dynamic for Dollar General simply because its core customers — lower-income rural households hit hardest by inflation — aren’t changing how they’re shopping or what they’re buying. These consumers are simply spending less. Underscoring this idea is similar results from direct competitor Dollar Tree. Its Dollar Tree brand saw modest same-store sales growth of 1.3% last quarter, while its Family Dollar banner actually suffered a same-store sales decline of 0.1%.

In light of all of this, it’s not surprising that investors are worried about the retailer’s foreseeable future. But there’s something the market seems to be forgetting here.

The risk is worth the reward for strong-stomached investors

That is, the economy is reliably cyclical, but ultimately growing. The past couple of years have been the extreme exception to this norm, creating the affordability crunch that’s crimping consumer spending now.

There’s never been any doubt about Dollar General’s business strategy, however. The economy that usually works in Dollar General’s favor will do so again sooner or later, and likely sooner than later.

And waiting for clear evidence of that rebound to dive into Dollar General stock could be a strategic mistake. Stocks have a funny way of trading predictively, reflecting probable results anywhere from a few months to a couple of years into the future.

So while it’s struggling right now, Dollar General is likely to be faring better soon. Its stock should start pricing in such a turnaround even sooner. Indeed, now down 68% and trading at a seven-year low, the worst-case scenario may already be priced into the stock, and then some.

Taking a swing right now isn’t for the faint of heart. The likely volatility could prove unsettling even if its net effect is bullish. Keep it in perspective if you’re inclined to dive in.

If your gut is telling you to dive in, though, don’t be afraid. As Warren Buffett likes to say, be fearful when others are greedy and greedy when others are fearful. And the market is clearly quite fearful of Dollar General right now.

Should you invest $1,000 in Dollar General right now?

Before you buy stock in Dollar General, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dollar General wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Target and Walmart. The Motley Fool has a disclosure policy.

1 Growth Stock Down 68% to Buy Right Now was originally published by The Motley Fool