3 Magnificent S&P 500 Dividend Stocks Down 22%, 35%, and 45% to Buy and Hold Forever

If you insist on buying your dividend stocks at a discount, you’re largely out of luck right now. Although the S&P 500 has been uncomfortably volatile since July, it’s still up more than 30% since November’s low, and still within sight of record highs. There just aren’t a lot of bargains to choose from.

There are a few worthy prospects, however, if you’re willing to do enough digging.

Here’s a rundown of three beaten-down S&P 500 dividend stocks you may want to consider scooping up before a bunch of other investors decide to do the same.

1. United Parcel Service

There’s no getting around the fact that the wind-down of the COVID-19 pandemic has proven challenging for United Parcel Service (NYSE: UPS). The stock soared in the wake of a wave of online shopping, but the return of in-person shopping since 2022 has affected investor sentiment. Economic lethargy and new (and more expensive) labor contracts also get some of the credit for its recent weakness. All told, UPS shares are now down 45% from their early 2022 peak.

It’s arguable, however, the sellers overshot their target on fears that trouble would linger for longer than initially expected, and cut deeper into its business.

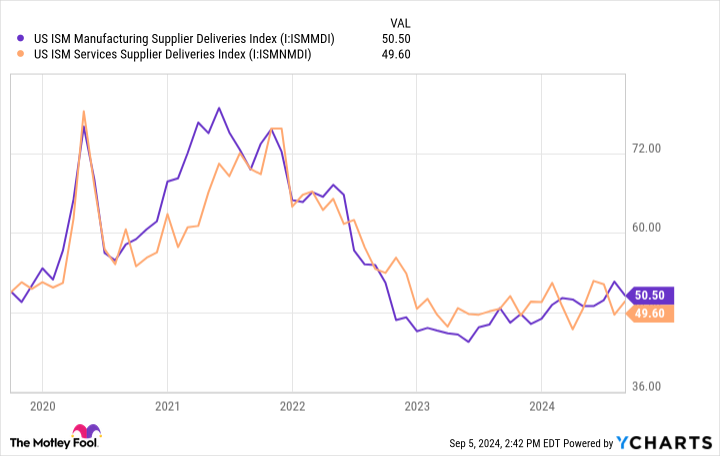

See, deliveries — at least within this company’s important U.S. market — are actually on the rise. The Institute of Supply Management’s measures of total deliveries from manufacturers as well as service providers continue to inch higher from their 2023 lull.

Consumers are doing their part, too. E-commerce giant Amazon‘s North American business saw a 9% uptick in its total business last quarter, while its international operation experienced nearly 7% growth.

In a similar but separate vein, the American Association of Railroads reports that total rail traffic in North America is in line with levels seen last year as well as the year before, while intermodal rail traffic is higher than it’s been in the past three years. This has implications for UPS simply because the goods shipped inside intermodal containers are also the kinds of goods most likely to end up in the back of a UPS delivery van. For that matter, while this year’s set to be a bit of a bust, analysts are calling for United Parcel Service’s revenue to grow nearly 5% next year, driving even greater earnings growth.

There are higher-growth and higher-yielding stocks out there to be sure. There aren’t many sporting the same forward-looking dividend yield of 5% that UPS stock currently does though, particularly at its relatively low level of risk versus its strong growth prospects.

2. Devon Energy

Devon Energy‘s (NYSE: DVN) forward-looking yield of 4.7% is just as juicy as United Parcel Services’ is, but there’s a catch. That is, this stock’s payout isn’t consistent. It ebbs and flows in step with the company’s ever-changing earnings. If you need reliable, predictable income to pay your recurring bills, this isn’t the ideal name to start with.

If you’re able to digest erratic dividend income in exchange for above-average income potential, though, this ticker’s 22% pullback from its April peak is an entry opportunity.

Devon Energy is in the oil and gas business. Its focus is onshore projects within the center of the United States, with five core sites running from south Texas all the way up to North Dakota. Last quarter it cranked out an average of 335,000 barrels of crude oil and 1.1 billion cubic feet of natural gas every day, more or less matching its recent production.

The energy business is a tricky one, of course. The market price for oil and gas is constantly changing, but the cost of drilling and extracting it doesn’t change nearly as much. That’s why the sector’s profits seem to soar when oil prices are elevated, but earnings slump when crude prices are even just modestly pressured. Devon is no exception to this dynamic.

Devon is something of an exception to most of its oil and gas-producing peers, however, in the sense that it dishes out the bulk of its earnings in the form of dividend payments. In this light, it’s very much a direct play on the price of oil itself. That’s not a bad bet to make either, given that OPEC, ExxonMobil, and Standard & Poor’s all predict we’ll be using at least as much of the stuff in 20 years as we’re using today.

3. Franklin Resources

Finally, add investment management outfit Franklin Resources (NYSE: BEN) to your list of S&P 500 dividend stocks to buy and hold forever. Its 35% sell-off since late last year has dragged shares to nearly a four-year low and pumped its projected dividend yield up to more than 6%.

The pullback makes some degree of superficial sense. Investors appear to be increasingly interested in exchange-traded funds (ETFs), or even individual stocks. Traditional mutual funds like the ones its investment company Franklin Templeton mostly manages appear to be falling out of favor. (Franklin does manage some ETFs as well, but that’s not the bulk of its business.)

This assumption ignores a couple of important realities regarding Franklin Resources though.

The first of these realities is that despite growing interest in ETFs and must-have individual stocks like Nvidia or Amazon, people aren’t actually losing interest in conventional funds. Data from the Investment Company Institute indicates that United States fund companies were managing $28.6 trillion worth of assets as of the end of 2022, down slightly from 2021’s record thanks to the bear market at the time, and en route to last year’s ending figure of $33.6 trillion. Most of this money is invested in ordinary mutual funds rather than exchange-traded funds. Frankin’s total assets under management (AUM) currently stands at $1.66 trillion, topping its late-2021 peak of nearly $1.6 trillion.

The other misunderstanding is how the fund-management business works. While certainly these companies thrive on bull markets that generate investor interest, mutual funds still charge their management fees based on the amount of assets invested even when their funds are performing poorly. That’s how Franklin was able to hold up so well in 2022 despite the market’s relatively lousy performance then. The key is simply attracting and then retaining investors’ money.

And analysts don’t expect this company to have any trouble doing that. They’re collectively calling for revenue growth of 7% this year followed by another 6% growth next year, rekindling earnings growth.

These earnings of course support dividend payments that have grown every single year for the past 44 years. You’d be hard-pressed to find a better track record than that.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, and S&P Global. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

3 Magnificent S&P 500 Dividend Stocks Down 22%, 35%, and 45% to Buy and Hold Forever was originally published by The Motley Fool

Leave a Reply