Biden Administration Says Unemployment Is Low — But Do Americans See It That Way?

In August, the Biden administration reported a drop in the unemployment rate to 4.2%, indicating that the labor market remains resilient despite weaker-than-expected employment growth.

This has tempered expectations for a major Federal Reserve rate cut this month.

However, rising public skepticism toward government data complicates the picture.

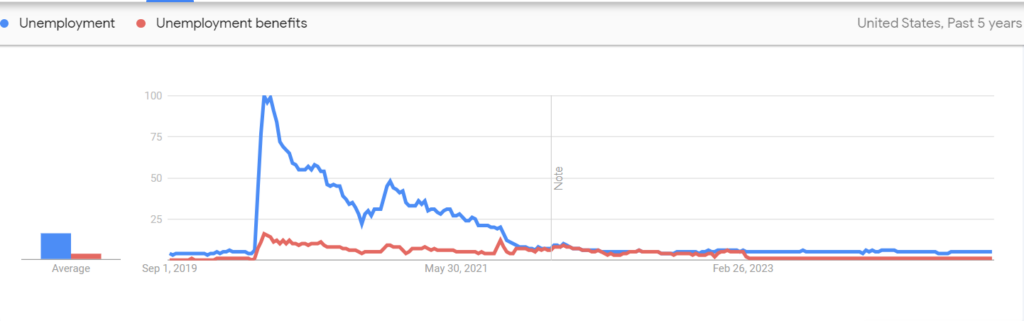

Recent data from Google Trends shows that searches for terms like “unemployment” and “unemployment benefits” have plummeted to multi-year lows, indicating that the public isn’t as worried as the fluctuating economic indicators might suggest.

This decline in search interest reflects a broader skepticism towards official economic data, with many Americans questioning the accuracy and reliability of the numbers they are being given.

The chart above, derived from Google Trends, reveals a striking decline in searches for terms like “unemployment” and “unemployment benefits” since 2019, suggesting that public concern may be cooling off even as economic uncertainties simmer beneath the surface.

This is in stark contrast to the substantial increases seen during the COVID-19 pandemic and the Great Recession of 2008-2009.

This skepticism isn’t new.

Business magnate Jack Welch, former CEO of General Electric, famously dismissed Obama-era economic data as biased “Chicago guys” propaganda.

Welch’s critical stance has influenced how many view economic statistics, contributing to a broader distrust of official figures.

The public’s low search interest in unemployment-related terms suggests that the anxiety over a potential recession may be overstated. While it’s always wise to be cautious, the data indicates that the labor market isn’t as dire as some narratives might suggest.

This disconnect raises an important question: Are markets reacting to genuine economic signals, or are they caught in a cycle of “sell the news” due to entrenched skepticism?

To navigate this economic landscape effectively, it’s essential to look beyond traditional data sources and consider alternative indicators. The stability in unemployment figures hints that the economic situation might not be as bleak as some fear, and that a recession isn’t necessarily imminent due to some hidden shadow jobs market.

Despite the pervasive skepticism towards government agencies, it’s crucial to recognize that these indicators may hold more truth than the prevailing narratives suggest.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply