Steel Connect Recent Insider Activity

Disclosed in the latest SEC filing, a significant insider purchase on September 5, involves STEEL PARTNERS HOLDINGS LP, Board Member at Steel Connect STCN.

What Happened: In a significant move reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, LP purchased 439,673 shares of Steel Connect, demonstrating confidence in the company’s growth potential. The total value of the transaction stands at $5,276,076.

The latest market snapshot at Thursday morning reveals Steel Connect shares up by 8.27%, trading at $11.0.

Get to Know Steel Connect Better

Steel Connect Inc is a diversified holding company. The company’s operating segment include Direct Marketing and Supply Chain. It generates maximum revenue from the Direct Marketing segment. Geographically, it derives a majority of revenue from the United States and also has a presence in China; Netherlands, and others. The company serves clients in various industries including consumer electronics, communications, computing, software, storage, and retail industries.

Breaking Down Steel Connect’s Financial Performance

Revenue Challenges: Steel Connect’s revenue growth over 3 months faced difficulties. As of 30 April, 2024, the company experienced a decline of approximately -4.96%. This indicates a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Interpreting Earnings Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 29.68%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 2.73, Steel Connect showcases strong earnings per share.

Debt Management: Steel Connect’s debt-to-equity ratio is below the industry average at 0.24, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: Steel Connect’s P/E ratio of 3.26 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The P/S ratio of 1.71 is lower than the industry average, implying a discounted valuation for Steel Connect’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 2.4, Steel Connect’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Steel Connect’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

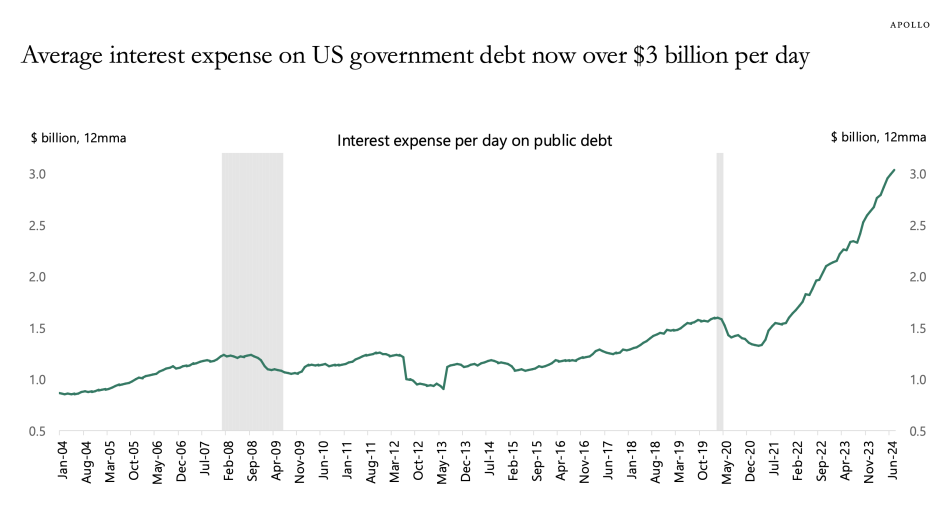

U.S. debt is so massive, interest costs alone are now $3 billion a day

With U.S. debt now at $35.3 trillion, the cost of paying the interest on all that borrowing has soared recently and now averages out to $3 billion a day, according to Apollo chief economist Torsten Sløk.

And that includes Saturdays and Sundays, he pointed out in a note on Tuesday.

The daily interest expense has doubled since 2020 and is up from $2 trillion about two years ago. That’s when the Federal Reserve began its campaign of aggressive rate hikes to rein in inflation.

In the process, that made servicing U.S. debt more costly as Treasury bonds paid out higher yields. But with the Fed now poised to start cutting rates later this month, the reverse can happen.

“If the Fed cuts interest rates by 1%-point and the entire yield curve declines by 1%-point, then daily interest expenses will decline from $3 billion per day to $2.5 billion per day,” Sløk estimated.

Meanwhile, the federal government closes out its fiscal year at the end of this month, and the year-to-date cost of paying interest on U.S. debt was already at $1 trillion months ago.

But even if Fed rate cuts lighten the burden on interest payments, the next president is expected to worsen budget deficits, adding to the pile of total debt and offsetting some of the benefit of lower rates.

In fact, a recent analysis from the Penn Wharton Budget Model found that the deficit will expand under either Donald Trump or Kamala Harris.

But there’s a big difference between the two.

Under Trump’s tax and spending proposals, primary deficits would increase by $5.8 trillion over the next 10 years on a conventional basis and by $4.1 trillion on a dynamic basis that includes the economic effects of the fiscal policy.

Under a Harris administration, primary deficits would increase by $1.2 trillion over the next 10 years on a conventional basis and by $2 trillion on a dynamic basis.

Still, JPMorgan analysts called the outlook unsustainable, regardless of who wins the presidential election, while acknowledging the prospect of bigger deficits with Trump.

“Irrespective of the election outcome, the trend since the pandemic has been profligate fiscal policy that is absorbing substantial amounts of capital and is incentivizing additional private investment,” the bank said. “At the same time, the en masse retirement of baby boomers is shifting a substantial share of the population from a high-savings period in life to a low-savings period, depressing the supply of capital.”

This story was originally featured on Fortune.com

Dow Jones Futures: Stock Market Has Worst Week In Over A Year; Apple iPhone 16 On Deck

Dow Jones futures will open Sunday evening, along with S&P 500 futures and Nasdaq futures. Apple (AAPL) will unveil the iPhone 16, headlining key AI events along with earnings from Oracle (ORCL) and Adobe (ADBE). All three tech giants are close to buy points.

↑

X

Stocks Slammed As Selloff Intensifies; Palantir, CubeSmart, ResMed In Focus

The stock market rally suffered its worst weekly losses in more than year, sending highly bearish signals. The S&P 500 went from the cusp of record highs to clearly below its 50-day line. The Nasdaq plunged below the low of its Aug. 13 follow-through day.

Investors are worried the economy is sputtering and that the Federal Reserve may be behind the curve. Meanwhile, the sell-off in artificial intelligence stocks, led by Nvidia (NVDA), intensified.

A number of stocks holding up or showing strength crumbled in the past week, while others are just hanging on.

Tesla (TSLA), which bucked the trend with a strong Thursday, gave it all back Friday and then some.

Investors should be scaling back exposure and largely steering clear of AI and tech names.

Nvidia stock is on IBD Leaderboard, though the position is hedged.

Palantir, Dell Will Finally Join S&P 500. The Stocks Are Jumping.

Dow Jones Futures Today

Dow Jones futures open at 6 p.m. ET on Sunday, along with S&P 500 futures and Nasdaq 100 futures.

Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Stock Market Rally

The stock market rally suffered sharp losses in a holiday-shortened week.

The Dow Jones Industrial Average slumped 2.9% in last week’s stock market trading and the S&P 500 index tumbled 4.25%, their worst weekly losses since March 2023. The Nasdaq composite plunged 5.8%, its worst week since January 2022. The small-cap Russell 2000 shed 5.7%.

The S&P 500, which entered a power trend on Aug. 30 and seemed poised for record highs entering this past week, fell decisively below its 50-day line. The Russell 2000 also broke below that key level.

The Dow Jones fell from record highs to just above its 50-day.

The Nasdaq is leading the sell-off, plunging below its 50-day line on Tuesday and starting to near its 200-day line. On Friday, the tech-heavy index knifed below the low of its Aug. 13 follow-through day.

The Invesco S&P 500 Equal Weight ETF (RSP) fell 3.1%, dropping below its 21-day line and testing its 10-week.

U.S. crude oil futures plunged 8% to $67.67 a barrel last week, the lowest price since June 2023. Gasoline futures dived 9.4% to a three-year low.

The 10-year Treasury yield plunged 20 basis points to 3.71%. The yield hit 3.65% Friday morning, undercutting its low from the Aug. 5 global sell-off. The two-year yield dived 27.5 points to 3.65%, as the yield curve finally stopped being inverted.

Despite a slew of weak economic reports, capped by Friday’s jobs report, the odds of a half-point Fed rate cut on Sept. 18 are about 30% after briefly topping 50% early Friday. Fed Gov. Christopher Waller, a more hawkish member, backed a September rate cut but signaled he’d favor a smaller move for now. Expectations of a quarter-point rate cut heighten concerns that the Fed is behind the curve.

Investors do see 100-125 basis points of cuts before year-end.

This coming week’s CPI and PPI inflation reports could give policymakers leeway to take bolder action this month.

Time The Market With IBD’s ETF Market Strategy

ETFs

Among growth ETFs, the iShares Expanded Tech-Software After Worst Week In Over A Year, Here’s What To DoSector ETF (IGV) slumped 4%, with Adobe and Oracle big members.

The VanEck Vectors Semiconductor ETF (SMH) dived 11.7%. Nvidia stock, the dominant SMH holding, plummeted 13.9% to 102.83 for the week after tumbling 7.7% in the prior week. The 100 level is a key area for NVDA and by extension the chip and AI sectors.

SPDR S&P Metals & Mining ETF (XME) plunged 9.8% last week. SPDR S&P Homebuilders ETF (XHB) skidded 4.4%. The Energy Select SPDR ETF (XLE) shed 5.8% and the Health Care Select Sector SPDR Fund (XLV) gave up 2.1%.

The Industrial Select Sector SPDR Fund (XLI) retreated 4.2%. The Financial Select SPDR ETF (XLF) sank 3.2%.

Reflecting more-speculative story stocks, ARK Innovation ETF (ARKK) sold off 7.2% last week and ARK Genomics ETF (ARKG) gave up 8.15%. Tesla is a major component across Ark Invest’s ETFs. Nvidia stock is also a key holding.

Apple To Unveil iPhone 16

Apple will show off its iPhone 16 smartphone at a Monday product launch event at 10 a.m. PT. This will be the first iPhone with AI tech, which the Dow tech giant has branded Apple Intelligence. There’s hope that the AI-enhanced handset will trigger a huge wave of new iPhone upgrades.

Apple also should show off its latest Apple Watch smartwatches and new AirPods wireless earbuds.

Apple stock fell 3.6% last week to 220.82, back below its 50-day line. AAPL stock has forged a V-shaped cup-with-handle base with a 232.92 buy point. It’s a base-on-base formation to a prior cup base.

The Apple iPhone event, and the AAPL stock reaction, will be key for iPhone chipmakers as well as AI plays generally.

What’s On Tap: Apple To Unveil iPhone 16; Adobe, Oracle Earnings Due

Oracle, Adobe Earnings

Oracle earnings are due Monday night. The database software giant likely will discuss AI wins on the earnings call or at a conference later in the week.

ORCL stock just edged up 0.4% to 141.81, but held above its key moving averages. Oracle is working on a 146.59 consolidation buy point.

Adobe earnings are Thursday night, with the software maker’s generative AI offerings in focus.

ADBE stock tried to clear a 580.55 cup-with-handle base on Tuesday, but reversed lower. Shares fell 1.9% for the week to 563.41, but held above their 21-day line.

The Oracle and Adobe earnings will offer hints about software makers’ ability to generate revenue from costly AI investments.

Tesla Stock Round-Trips

Tesla stock rallied on Wednesday and especially Thursday, buoyed by robust China sales and the EV giant’s FSD rollout plans. On Thursday, shares popped above their 50-day line and cleared a 238.22 short-term high. That offered an aggressive entry for TSLA stock, but the weak market added to the risks.

On Friday, Tesla plunged 8.45%, back below the 50-day line. Shares lost 1.6% to 210.73 for the week.

Tesla stock has a 271 cup-base buy point, according to MarketSurge.

DoorDash Leads 5 Stocks Near Buy Points Amid Market Sell-Off

What To Do Now

The stock market rally is looking weak. While some sectors are holding up better than others, most are still heading down.

Investors should have slim or modest exposure. They should largely be out of tech aside from big long-term winners if they have conviction in those names.

Don’t get excited by a strong open or even one strong session. After so much selling, the market may be “due” for a bounce, but it doesn’t have to happen right away and it doesn’t have to last.

Look for stocks holding key levels and showing relative strength. Those will mostly be in defensive and defensive growth sectors, along with a few traditional growth names.

The number of leading stocks that are still relatively healthy is a positive sign. However, just because stocks have been resilient so far doesn’t mean they’ll continue to do so. Tesla’s quick round-trip is an obvious example. ServiceNow (NOW), Meta Platforms (META), DoorDash (DASH) and Netflix (NFLX) also started to break key levels on Friday.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MIGHT ALSO LIKE:

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

When It’s Time To Sell Your Favorite Stock

Tesla Vs. BYD: EV Giants Vie For Crown, But Which Is The Better Buy?

Trump Or Harris Election Sweep? Prepare For Huge Impact On Taxes, Stocks

Dividend Investor Earning $70,000 a Year Shares His Portfolio: Top 7 Stocks

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Can you live entirely off dividends? This is perhaps the most common question asked on Reddit dividend discussion boards, where hundreds of people share their income investing experience and seek advice. About nine months ago, someone asked /dividends, a community on Reddit with over 570,000 members, whether it’s possible to live off your dividend investments. While there were many interesting responses, one caught our attention.

A Redditor responded that he’s 59 and invested about $250,000 in dividend stocks after the COVID-19 pandemic-led crash. He said that the market rebound buoyed his portfolio and he invested about $200,000 more. He claimed that he rakes in about $70,000 per year in dividend income. Most of the stocks in his initial portfolio were from the oil and gas industry, but he later diversified into other sectors. The Redditor was generous enough to mention the specific stocks in his portfolio. Let’s take a look at these companies.

Don’t Miss Out:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Private credit outperformed both high-yield bonds and equities in the last 3 market downturns (2008, COVID and 2022). Should you be adding private credit to your portfolio?

These stocks are based on an income report publicly shared by an investor on Reddit. This is not investment advice or a recommendation.

Sunoco LP

Sunoco LP (NYSE:SUN) is a Texas-based MLP energy company with a dividend yield of about 6.8%. Last month, the company reported strong second-quarter results that beat estimates for both earnings and revenue. In May, Sunoco completed its $7.3 billion acquisition of NuStar. In June, Citi increased its rating on SUN shares to Buy from Neutral with a $65 price target.

Exxon Mobil

With over 40 years of consecutive dividend increases and a 3.4% dividend yield, Exxon Mobil Corp (NYSE:XOM) is one of the top dividend stocks in the Redditor portfolio, earning $70,000 a year in dividend income. Exxon Mobil continues investing in fossil fuel opportunities, believing that over 50% of the global energy demand will be fulfilled by oil and gas even by 2050. However, the company is investing in carbon capture and clean energy. Exxon expects to produce 40 million tons of LNG annually by 2030, more than double its current production.

Crossamerica Partners LP

Crossamerica Partners LP (NYSE:CAPL) distributes motor fuels with a dividend yield of about 10%. The company reported second-quarter results in August, in which GAAP EPS beat Wall Street estimates. However, revenue fell 1.7% year over year and missed the Street’s forecasts by $140 million.

Trending Now:

Crestwood Equity Partners (now part of Energy Transfer)

Crestwood Equity Partners was an energy infrastructure company that was acquired by Energy Transfer for about $7.1 billion last year. The Redditor said he bought this stock in 2020, and it was later merged into Energy Transfer (ET).

Altria Group

With a 7.5% yield and more than 50 years of consecutive dividend growth, Altria Group Inc. (NYSE:MO) is one of Redditors’ top favorite income plays. Despite concerns about the future of its smokeable products amid a decline in smoking worldwide, Altria continues to be a reliable dividend stock. In August, it upped its dividend by 4.1%. The company’s latest quarterly results show its smoke-free and oral tobacco products have started to offset declines from smokeable products.

Pfizer

Pfizer Inc. (NYSE:PFE) has a dividend yield of over 5% and has increased its payouts for 15 straight years. With a strong pipeline and strengths in the pharmaceutical market, Pfizer is a reliable dividend stock for any portfolio. Pfizer spends about $2.5 billion to $3 billion on research and development every quarter and has over 110 candidates in its pipeline.

The Redditor claiming to earn about $70,000 per year in dividends said he added Pfizer quite later in his investment journey for added diversification.

Johnson & Johnson

Johnson & Johnson (NYSE:JNJ) is one of the top dividend stocks, with over six decades of consistent payout growth. Despite headwinds related to lawsuits, the sheer scale and diversity of its revenue stream make Johnson & Johnson an attractive income play. In July, Johnson & Johnson posted strong quarterly results, beating estimates on both revenue and EPS. MedTech and Oncology businesses posted decent YoY revenue growth.

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a minimum investment of $5,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Dividend Investor Earning $70,000 a Year Shares His Portfolio: Top 7 Stocks originally appeared on Benzinga.com

This Overlooked Utility Outshines NextEra. Is It Time to Buy?

There’s no question that NextEra Energy (NYSE: NEE) is a well-run company. But that fact is so well known that investors have bid the shares up to levels that, likely, fully reflect the information. If you are trying to find a good mix of dividend income and dividend growth, you may want to consider buying WEC Energy (NYSE: WEC) instead of NextEra. Here’s why.

NextEra Energy’s value is fully priced in

NextEra Energy is a solid dividend growth utility, with a strong regulated utility core (largely Florida Power & Light) and a fast-growing renewable power operation. That combination has allowed the utility to increase dividends annually for three decades. But the real treat for investors is that the rate of dividend growth has been an attractive 10% a year over the past decade.

Ten percent dividend growth for a utility, an industry known for being slow and boring, is incredible. Half that level would be considered a good number. Notably, management is calling for dividend growth of 10% a year through at least 2026, too, so this trend isn’t expected to end. That figure is backed by an earnings growth projection of 6% to 8%. If you are a hard-core dividend growth investor it would be understandable if you wanted to buy NextEra Energy.

The problem is valuation. NextEra Energy’s success and positive outlook are well known. That generally leaves the shares priced at a premium to the utility sector. For example, NextEra’s dividend yield is currently around 2.6%. The average utility’s, using Utilities Select Sector SPDR ETF as a proxy, is roughly 3%. That may not seem like a huge difference on an absolute basis, particularly when you consider the S&P 500 index’s yield is a scant 1.2%, but it means collecting roughly 13% less income each year.

WEC Energy gives you more income

By comparison, WEC Energy is offering a 3.6% dividend yield today. That works out to 20% more than the average utility and 33% more than what you’d collect if you owned NextEra Energy. That sounds pretty attractive if you are trying to maximize the income your portfolio generates.

But what about dividend growth? WEC Energy hiked its dividend roughly 7% in January. It has increased its dividend annually for two decades. The average increase over the past decade has been around 7%. That’s a bit slower than NextEra Energy, but the starting yield is so much higher that investors looking for a better mix of yield and dividend growth might find it more appealing.

That said, WEC Energy is not as large or diverse as NextEra. WEC provided natural gas and electricity to 4.7 million customers in parts of Wisconsin, Illinois, Michigan, and Minnesota. It is a far more boring utility, but it still has big plans. Its five-year capital spending goal is $23.7 billion and is expected to push earnings higher by 6.5% to 7% a year through 2028. If history is any guide, the dividend will grow roughly in line with earnings.

Once again, that’s nearly as good as NextEra, but with a notably higher starting yield. And that’s the big story here. NextEra is a great utility, but one that is usually fully priced. WEC Energy is a very good utility that appears to be trading at a more attractive level. Notably, the dividend yield, even after a recent stock rally, is still near the high end of WEC Energy’s 10-year yield range.

WEC Energy is worth a closer look

Nobody would fault you for buying an industry leader like NextEra Energy. However, that doesn’t mean it is the best option for all investors. If you are willing to accept a little less dividend growth potential for a utility with a still strong earnings growth profile and a much higher yield, you should put WEC Energy on your short list today. And if you already own NextEra Energy, consider augmenting that position with a new one in WEC Energy.

Should you invest $1,000 in WEC Energy Group right now?

Before you buy stock in WEC Energy Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and WEC Energy Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Reuben Gregg Brewer has positions in WEC Energy Group. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.

This Overlooked Utility Outshines NextEra. Is It Time to Buy? was originally published by The Motley Fool

Why Trump Media Stock Sank to a New All-Time Low This Week

Trump Media & Technology (NASDAQ: DJT) stock fell again this week. The company’s share price closed out the stretch down 12.3% from the previous Friday’s closing price, according to data from S&P Global Market Intelligence. The S&P 500 index closed out the week down 4.3%, and the Nasdaq Composite index ended the period down 5.8%.

Trump Media stock lost ground as rising fears that the U.S. economy could slip into a recession prompted sell-offs for the broader market. In addition to macroeconomic factors, the company’s share price likely moved lower due to competition from other social media platforms and the lock-up expiration on insider stock sales set to take place later this month.

Investors worry economic conditions could turn bearish

Bearish sentiment surrounding the U.S. economy increased this week. Tracking released on Tuesday showed that the country’s manufacturing sector had declined again in August, and Friday’s jobs report from the Labor Department arrived with weaker-than-expected results. The average Wall Street target had called for 160,000 jobs to be added last month, but only 142,000 jobs were added in the period. Job growth numbers for June and July were also revised downwards.

The Labor Department’s data further raised concerns that the economy could be headed for recession in the not-too-distant future. Investors had hoped the Federal Reserve’s anticipated rate cut this month would create bullish macro conditions for stocks, but these concerns could dash those hopes.

Trump Media stock hits a new record low

Former President Donald Trump is Trump Media’s majority shareholder, and Truth Social is currently the centerpiece of the company. The social media platform shares similarities with X, formerly known as Twitter. Trump was previously banned from Twitter, but his status was reversed after Tesla CEO Elon Musk purchased the platform.

Despite X being a competitor to Truth Social, Trump has returned to posting on the rival platform to aid his presidential campaign. While the former president is still posting far more messages on Truth Social than on X, being active on both platforms takes away some of Truth Social’s value proposition.

In addition to those concerns, investors also appear worried that a large amount of stock will soon be sold on the open market. The lock-up period preventing insider selling is set to expire on Sept. 25, although it could happen five days earlier due to previously announced stipulations. The company’s valuation could plummet if Trump or other large insider owners wind up selling a large amount of shares, and this risk pushed Trump Media stock to a new record low this week.

Should you invest $1,000 in Trump Media & Technology Group right now?

Before you buy stock in Trump Media & Technology Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Trump Media & Technology Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Trump Media Stock Sank to a New All-Time Low This Week was originally published by The Motley Fool

4 REIT Stocks That Are Screaming Buys in September

Real estate investment trusts (REITs) buy a lot of properties, lease them out, and split the rental income with their investors. U.S. REITs are also required to pay out at least 90% of their taxable income as dividends to maintain a favorable tax rate.

That simple business model usually makes REITs a sound investment for most income investors, but rising interest rates weighed down the sector for two reasons. First, higher rates made it more expensive to purchase new properties. Second, REITs lost their luster as income plays as the yields of risk-free CDs and T-bills soared above 5%.

But with interest rates set to decline in the near future, shrewd investors should pivot back toward REITs before the yield-starved bulls rush back. I believe these four resilient REITs are worth buying right now: Realty Income (NYSE: O), Vici Properties (NYSE: VICI), STAG Industrial (NYSE: STAG), and Digital Realty Trust (NYSE: DLR).

1. Realty Income

Realty Income is one of the world’s largest REITs. It owns 15,450 properties in the U.S., U.K., and Europe, and it leases them out to over 1,500 tenants across 90 industries. Its top tenants include recession-resistant retailers like Walmart, 7-Eleven, Walgreens, and Dollar Tree.

Some of its top tenants struggled with store closures in recent years, but it still maintained a high occupancy rate of more than 96% over the past three decades. It pays its dividends on a monthly basis, and it’s raised its payout 126 times since its IPO in 1994. It currently pays an attractive forward yield of 5%, and its stock looks like a bargain at 16 times last year’s adjusted funds from operations (AFFO) per share.

2. Vici Properties

Vici is a REIT that mainly owns casino and entertainment properties in the U.S. and Canada. Its top tenants, which it tightly locks into multidecade contracts, include Caesar’s Entertainment, MGM Resorts, Penn Entertainment, and Century Casinos. It’s also maintained an impressive occupancy rate of 100% ever since its IPO in 2018.

Vici reduced its dividend during the peak of the pandemic in 2020 and 2021, but it’s raised its payout over the past two years. It pays a high forward yield of 4.9% on a quarterly basis, and its stock still looks cheap at 16 times its trailing AFFO.

3. STAG Industrial

STAG Industrial is an REIT that owns 573 industrial properties across 41 states. Its top tenants include Amazon, FedEx, and XPO, and it ended 2023 with a high occupancy rate of 98.2%. Many of its properties are used as e-commerce fulfillment centers, and that foundation could make it a less macro-sensitive play than brick-and-mortar retail or commercial REITs.

STAG pays monthly dividends, and it’s consistently increased its payout every year since its IPO in 2011. It currently pays a forward dividend yield of 3.7% and trades at just 18 times last year’s core FFO per share.

4. Digital Realty Trust

Digital Realty Trust is an REIT that leases data centers to over half of the Fortune 500 companies. Its top customers include tech giants like IBM, Oracle, and Meta Platforms. It operates more than 300 data centers in 50 metro areas across the world, and the secular expansion of the cloud and artificial intelligence (AI) markets should continue to drive its long-term growth.

Digital Realty’s year-end occupancy rate slipped from 84.7% in 2022 to 81.7% in 2023 as high rates and other macro headwinds throttled the expansion of the cloud market. It trades at 23 times last year’s core FFO per share, which makes it a bit pricer than the other REITs on this list, and it pays a lower forward dividend yield of 3.3% on a quarterly basis. It also didn’t raise its dividend last year as its growth cooled off.

But despite those challenges, Digital Realty could still represent a good way to simultaneously profit from the REIT sector’s recovery and the expansion of the data center market.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Leo Sun has positions in Amazon, Meta Platforms, Realty Income, and Vici Properties. The Motley Fool has positions in and recommends Amazon, Digital Realty Trust, FedEx, Meta Platforms, Oracle, Realty Income, Stag Industrial, and Walmart. The Motley Fool recommends International Business Machines, Vici Properties, and XPO. The Motley Fool has a disclosure policy.

4 REIT Stocks That Are Screaming Buys in September was originally published by The Motley Fool

What Does This High-Yield Stock Look Like After Its Dividend Cut?

When you let someone down, you have to build back trust. That’s the position that W.P. Carey (NYSE: WPC) finds itself in today after announcing that it was cutting its dividend by roughly 20% at the end of 2023. A lot of investors simply won’t touch a dividend cutter, but it is worth giving this large net lease real estate investment trust (REIT) a second chance. Here’s why.

The cut that rocked W.P. Carey

W.P. Carey was on the cusp of achieving an important dividend milestone. Just a few months before it could claim a 25-year streak of annual dividend increases, the REIT, instead, chose to cut its dividend. For some, that move destroyed years of trust built up quarter by quarter, which is understandable.

However, the reason for the cut is important to understand. W.P. Carey looked at its portfolio and decided that it needed to get out of the office sector. That was something it had been doing gradually for years, but the upheaval in the office market following the coronavirus pandemic changed the math. Management felt ripping the bandage off would be better than having to materially write down the value of office assets for years into the future.

The company intended to spin off a large chunk of its office business and sell whatever it didn’t spin off. Prior to this new direction, office assets represented around 16% of the REIT’s rent roll. So the dividend cut basically represented the income lost and perhaps a little extra leeway to deal with the costs of the restructuring effort and general portfolio changes.

Just one quarter after the dividend cut, meanwhile, W.P. Carey got right back to increasing the dividend again. It has now increased the dividend for two quarters in a row, effectively getting back to the quarterly increase cadence that existed prior to the cut. The dividend increases were small, but that was the norm before the cut, too. The more important piece here is that the cut looks more like a reset than a change that was made from a position of weakness.

The portfolio remains strong at W.P. Carey

That was, actually, the whole point of the office spinoff. W.P. Carey had exposure to an asset class that was likely to face years of headwinds and it wanted to shift gears, which it believed would allow the positive attributes throughout the rest of the portfolio to shine. But what are those positives?

For starters, W.P. Carey is a net lease REIT. This means that it owns single-tenant properties for which the tenants are responsible for most property-level operating costs. Although any single property is high-risk, across a large portfolio this is a fairly low-risk business model. W.P. Carey owns nearly 1,300 properties, which is sizable. In fact, it is the second largest net lease REIT by market cap, after industry giant Realty Income (NYSE: O).

There are other similarities between these two REITs. For example, they both have operations in Europe, providing an additional lever for future growth. The net lease model is still fairly new in Europe, so this is a material avenue for long-term growth. Notably, W.P. Carey has more than two decades of experience in the European market and was there well ahead of Realty Income.

In addition, W.P. Carey and Realty Income both have diverse portfolios, but W.P. Carey’s portfolio is actually more diverse. Realty Income’s focus is on retail assets, which make up around 73% of rents. W.P. Carey’s portfolio breakdown is 35% industrial, 29% warehouse, and 21% retail, with the rest in a rather sizable “other” category. The industrial sector has been fairly attractive of late, with leases rolling over to much higher rates throughout the industry. As you might expect, W.P. Carey has had very strong lease renewal trends.

Meanwhile, W.P. Carey is sitting on a material amount of cash today. The exit from office real estate was a big piece of that, though there were some other recent asset sales that helped. But with a record level of liquidity, the REIT isn’t on the back foot. It is operating from a position of strength as it looks to regain investor trust. The healthy liquidity position suggests that it will, eventually, be able to get investors back on board with acquisition-driven growth.

The real reason to like W.P. Carey right now

So, despite making a major strategic change that necessitated a dividend cut, W.P. Carey remains a well-run and well-positioned REIT. It seems highly likely to, eventually, regain investor trust and might even be afforded a higher price tag once it does (now that office assets are no longer an overhang). W.P. Carey’s dividend yield is nearly 5.8% today, which is higher than that of Realty Income (5.1%) and the average REIT (3.9%). In other words, if you are a long-term dividend investor willing to take on an unloved stock that probably deserves more love than it gets, W.P. Carey looks like an attractive choice today.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Reuben Gregg Brewer has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

What Does This High-Yield Stock Look Like After Its Dividend Cut? was originally published by The Motley Fool

GAIMIN GLADIATORS ANNOUNCE NEW PARTNERSHIP WITH STEELSERIES

TORONTO, Sept. 7, 2024 /CNW/ – Gaimin Gladiators, a leading esports organization renowned for its dominance across multiple gaming titles, is proud to announce a groundbreaking partnership with SteelSeries, the worldwide leader in premium gaming and esports peripherals. This collaboration marks a significant milestone for the Gaimin Gladiators, bringing together two powerhouses committed to delivering top-tier gaming experiences to competitors and fans alike.

SteelSeries, known for its innovative and high-performance gaming gear, has long been a cornerstone of the gaming community, setting industry standards with its award-winning products and celebrating its 20th anniversary as the world’s original esports brand in 2021. Additionally, Pros have won more prize money with SteelSeries than with any other brand and the company continues to invest deeper in the esports and gaming ecosystems it helped to create.

“You’ve got to feel confident while playing and to win championships,” said Melchior “Seleri” Hillenkamp, Professional Dota 2 Player and Team Captain for Gaimin Gladiators. “I am really comfortable and confident with my SteelSeries Aerox 3 Mouse, and it has helped me in all our major victories, at Esports World Cup and leading up to The International.”

The partnership will see Gaimin Gladiators’ players equipped with the latest in SteelSeries technology, enhancing their performance in competitive arenas across the globe. Moreover, this collaboration extends beyond just hardware, as both organizations are aligned in their mission to elevate the overall gaming experience for fans, making it more immersive, enjoyable, and accessible.

“We are incredibly excited to start working with SteelSeries,” said Joseph Turner, Co-Founder of Gaimin Gladiators. “Knowing that they are industry leaders in creating not just equipment, but premier experiences for their fans, this partnership wholly matches the ethos of Gaimin Gladiators, and the wider Gaimin Group, bringing premium competitive gaming to the masses.”

Through this partnership, Gaimin Gladiators and SteelSeries aim to push the boundaries of what is possible in esports, creating unparalleled opportunities for gamers and fostering a community that thrives on excellence. Fans can look forward to exclusive content, co-branded events, and merchandise that encapsulates the spirit of this dynamic collaboration.

“We are thrilled to be partnering with Gaimin Gladiators, a team that embodies the spirit of competitive excellence,” said Tony Trubridge, Global Esports Director at SteelSeries. “By equipping the Gladiators with our industry-leading, esports gaming gear, we’re both supporting their journey to victory and also continuing to support and grow the esports industry.”

Gaimin Gladiators and SteelSeries are both dedicated to empowering gamers at all levels, and this partnership will serve as a catalyst for new and exciting developments in the esports world. Together, they are set to redefine the future of competitive gaming.

To learn more about SteelSeries, visit steelseries.com, check out the steelseries.com/blog, and join the conversation on Twitter at @SteelSeries, Instagram at @SteelSeries, and TikTok at @SteelSeries.

About Gaimin Gladiators: Gaimin Gladiators is a premier esports organization with a global presence, fielding teams in some of the most competitive titles in the industry. Known for their strategic gameplay, exceptional talent, and a commitment to fostering the esports community, Gaimin Gladiators continue to be at the forefront of the gaming world.

About SteelSeries: SteelSeries is the original esports brand that fuses gaming & culture, leading the way in defining a “gaming lifestyle.” The worldwide brand creates industry-defining esports and gaming peripherals with a focus on premium quality, innovation, and functionality. Founded in 2001, SteelSeries improves performance through first-to-market innovations and technologies that enable gamers to play harder, train longer, and rise to the challenge. SteelSeries is the pioneering supporter of esports and competitive gaming tournaments, connecting gamers and fostering a sense of community and purpose. SteelSeries’ family of professional and gaming enthusiasts are the driving force behind the company and help influence, design, and craft every single accessory and the brand’s software ecosystem (SteelSeries GG, Moments video clip service, and the Sonar Audio Software Suite). The SteelSeries family of brands includes KontrolFreek, the industry leader in high-performance controller accessories, and Nahimic, the leader in 3D sound solutions for gaming. In 2022 SteelSeries joined the GN family, a global leader in innovative and intelligent audio and video communications solutions sold in approximately 100 countries around the world.

SOURCE Gaimin

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/07/c9791.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/07/c9791.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biden Administration Says Unemployment Is Low — But Do Americans See It That Way?

In August, the Biden administration reported a drop in the unemployment rate to 4.2%, indicating that the labor market remains resilient despite weaker-than-expected employment growth.

This has tempered expectations for a major Federal Reserve rate cut this month.

However, rising public skepticism toward government data complicates the picture.

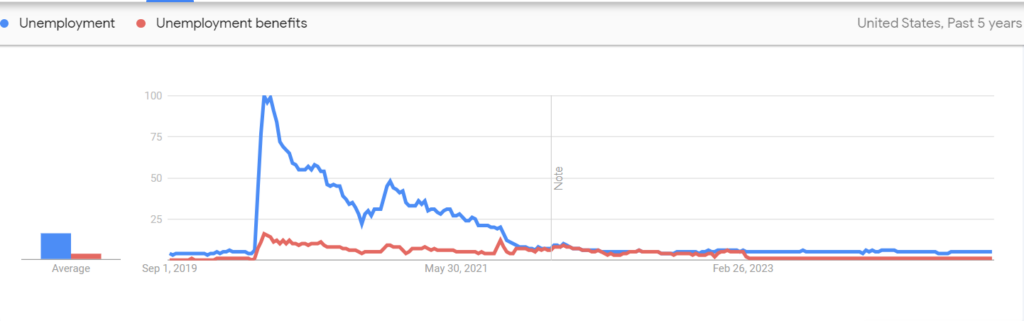

Recent data from Google Trends shows that searches for terms like “unemployment” and “unemployment benefits” have plummeted to multi-year lows, indicating that the public isn’t as worried as the fluctuating economic indicators might suggest.

This decline in search interest reflects a broader skepticism towards official economic data, with many Americans questioning the accuracy and reliability of the numbers they are being given.

The chart above, derived from Google Trends, reveals a striking decline in searches for terms like “unemployment” and “unemployment benefits” since 2019, suggesting that public concern may be cooling off even as economic uncertainties simmer beneath the surface.

This is in stark contrast to the substantial increases seen during the COVID-19 pandemic and the Great Recession of 2008-2009.

This skepticism isn’t new.

Business magnate Jack Welch, former CEO of General Electric, famously dismissed Obama-era economic data as biased “Chicago guys” propaganda.

Welch’s critical stance has influenced how many view economic statistics, contributing to a broader distrust of official figures.

The public’s low search interest in unemployment-related terms suggests that the anxiety over a potential recession may be overstated. While it’s always wise to be cautious, the data indicates that the labor market isn’t as dire as some narratives might suggest.

This disconnect raises an important question: Are markets reacting to genuine economic signals, or are they caught in a cycle of “sell the news” due to entrenched skepticism?

To navigate this economic landscape effectively, it’s essential to look beyond traditional data sources and consider alternative indicators. The stability in unemployment figures hints that the economic situation might not be as bleak as some fear, and that a recession isn’t necessarily imminent due to some hidden shadow jobs market.

Despite the pervasive skepticism towards government agencies, it’s crucial to recognize that these indicators may hold more truth than the prevailing narratives suggest.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.