Analyst Says 'Don't Buy The Tech Dip' Amid Election Policy Uncertainty, Advises Focusing On These Sectors For 'Quality, Stability, And Income'

Bank of America has issued a cautionary note to investors, advising them to steer clear of increasing their exposure to the tech sector due to ongoing market volatility and election-related policy uncertainty.

What Happened: Bank of America has issued a warning to investors, advising them to avoid increasing their exposure to the tech sector. The firm cited ongoing market volatility and election-related policy uncertainty as key factors, reported Business Insider on Monday.

“Don’t buy the tech dip,” analysts said. “We remain underweight Information Technology despite arguments that it has gotten so beaten up.”

On Monday, analysts from Bank of America recommended that investors focus on defensive stocks, which tend to perform better during periods of market instability. They emphasized the importance of “quality, stability, and income” in protecting investments in volatile markets.

The bank’s proprietary “regime indicator” has entered downturn territory, signaling further volatility through the end of 2027. Despite the potential for price swings to make mega-cap tech stocks appear cheaper, the bank remains underweight on Information Technology.

Analysts pointed to the sector’s enterprise-value-to-sales ratio, which remains at record highs, as an indication of overvaluation. Additionally, upcoming changes to the S&P 500 index-cap rules could lead to passive selling pressure on tech funds.

Bank of America also highlighted the attractiveness of utilities and real estate dividends, especially as the Federal Reserve’s interest-rate cuts drive investors to seek yield opportunities. The firm noted that real estate dividends are likely more sustainable now, with a significant proportion of high-quality market cap.

Top U.S. tech giants, renowned for their advancements in technology and AI, have been instrumental in driving stock market growth. This includes the “Magnificent Seven” — Microsoft Corp. MSFT, Apple Inc. AAPL, NVIDIA Corp. NVDA, Meta Platforms Inc. META, Tesla Inc. TSLA, Amazon.com Inc. AMZN, and Google‘s parent company Alphabet Inc. GOOG GOOGL.

Why It Matters: The advisory from Bank of America comes at a time when market sentiment is already cautious. In April, the bank had a bullish outlook, predicting a potential 19% surge in the S&P 500 by August 2025.

However, recent market conditions have shifted. Last week, equity strategist Tom Lee warned of a possible 7%-10% market pullback in September, urging caution but also advising investors to be ready to “buy that dip.”

Adding to the complexity, JPMorgan has suggested that anticipated Federal Reserve rate cuts may not significantly boost the stock market, indicating a more reactive approach from the Fed.

Meanwhile, tech stocks have faced additional pressure. Despite Gene Munster of Deepwater Asset Management maintaining a bullish stance on AI’s transformative potential.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

mRNA Vaccine Market Size to Achieve USD 9.6 Billion Revenue by 2034, Real-World Efficacy and Infrastructure Investments Boost Market Dynamics – Exclusive Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Sept. 09, 2024 (GLOBE NEWSWIRE) — The global mRNA vaccine market (mRNA 백신 시장) is estimated to decline at a CAGR of -4.3% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for mRNA vaccine is estimated to reach US$ 9.6 billion by the end of 2034.

Streamlined approval processes and regulatory reforms aimed at accelerating vaccine development and deployment contribute to market growth. Innovations in logistics, cold chain management, and manufacturing processes optimize vaccine distribution, ensuring timely access and reducing wastage.

Increasing public trust and acceptance of mRNA vaccines, driven by real-world efficacy data and education campaigns, influence market dynamics and demand. Investments in healthcare infrastructure, including vaccination centers, storage facilities, and digital vaccination passports, bolster vaccine delivery capabilities and market penetration.

Ongoing research into the long-term efficacy and durability of mRNA vaccines, including booster doses and vaccine modifications, shapes future market trends and demand patterns.

Unlock Growth Potential in Your Industry! Download PDF Brochure from Here! https://www.transparencymarketresearch.com/mrna-vaccine-market.html

Key Findings of the Market Report

- COVID-19 leads the mRNA vaccine market due to urgent global demand for effective vaccination against the pandemic.

- Private hospitals & clinics lead the mRNA vaccine market due to their role in vaccine administration and distribution to the public.

- North America leads the mRNA vaccine market, driven by robust research infrastructure, extensive clinical trials, and rapid vaccination campaigns.

mRNA Vaccine Market Growth Drivers & Trends

- Heightened global focus on pandemic preparedness and rapid vaccine development drives demand for mRNA vaccines, offering a flexible and scalable platform for response.

- Continued innovation in mRNA technology enhances vaccine efficacy, safety, and manufacturing efficiency, fostering market growth.

- Beyond infectious diseases, mRNA vaccines show promise in cancer immunotherapy and other therapeutic areas, expanding market opportunities.

- Government-led immunization campaigns and initiatives to address vaccine inequities fuel demand for mRNA vaccines, particularly in developing regions.

- Collaborations between biotech firms, pharmaceutical companies, and government agencies drive research, development, and distribution of mRNA vaccines, shaping market dynamics.

Global mRNA Vaccine Market: Regional Profile

- In North America, stringent regulatory frameworks and robust vaccination campaigns drive market growth. Key players like Pfizer-BioNTech and Moderna spearhead mRNA vaccine development, leveraging advanced research facilities and extensive clinical trials. Government support and public-private partnerships accelerate vaccine deployment, ensuring widespread immunization coverage.

- Europe boasts a well-established healthcare system and a strong emphasis on preventive medicine. Leading pharmaceutical companies like AstraZeneca and CureVac contribute to the region’s mRNA vaccine market, catering to diverse healthcare needs across EU member states. The European Medicines Agency’s (EMA) approval process facilitates market access for innovative vaccine candidates.

- In the Asia Pacific, rapid population growth, urbanization, and infectious disease outbreaks fuel demand for mRNA vaccines. Countries like China and India invest in domestic vaccine manufacturing capabilities, fostering regional vaccine production hubs. Collaborations with international biotech firms and technology transfer agreements drive market expansion, addressing the region’s evolving healthcare challenges.

mRNA Vaccine Market: Competitive Landscape

The mRNA vaccine market showcases substantial competition driven by the urgent global demand for effective vaccination against infectious diseases.

Pfizer-BioNTech and Moderna dominate, pioneering mRNA technology with their COVID-19 vaccines. Emerging players like CureVac and Translate Bio aim to carve their niche with novel mRNA vaccine candidates.

Established pharmaceutical giants such as Novavax and Johnson & Johnson enter the fray, diversifying the market landscape. Collaborations between biotech firms and government agencies fuel innovation, while manufacturing scalability and distribution efficiency become critical factors in gaining competitive advantage.

This dynamic landscape underscores the pivotal role of mRNA vaccines in shaping the future of global immunization strategies. Some prominent players are as follows:

- Pfizer Inc.

- Moderna Inc.

- Novartis AG

- Sanofi

- Arcturus

- Gennova Biopharmaceuticals Ltd

- Aimei Vaccine Co. Ltd

Product Portfolio

- Moderna Inc. pioneers mRNA technology to develop transformative medicines and vaccines. Their innovative mRNA platform accelerates drug discovery and enables rapid response to global health challenges. With a commitment to revolutionizing healthcare, Moderna leads the way in delivering next-generation therapeutics.

- Novartis AG is a global healthcare company dedicated to reimagining medicine through innovative therapies and technologies. From pharmaceuticals to advanced therapies and generics, Novartis addresses unmet medical needs and improves patient outcomes worldwide with a focus on precision medicine and breakthrough research.

- Sanofi is a leading global pharmaceutical company committed to advancing healthcare for all. With a diverse portfolio spanning vaccines, specialty care, and consumer healthcare, Sanofi delivers innovative solutions to prevent and treat diseases, improve access to healthcare, and enhance quality of life for millions of people globally.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=85998<ype=S

mRNA Vaccine Market: Key Segments

By Application

By End User

- Government Entities

- Private Hospitals & Clinics

- Others (Pharmacies etc.)

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

More Trending Reports by Transparency Market Research –

- Influenza Vaccine Market – The global influenza vaccine market (인플루엔자 백신 시장) is projected to advance at a CAGR of 7.2% from 2023 to 2034.

- Meningococcal Vaccines Market – The global meningococcal vaccines market (수막구균 백신 시장) is projected to expand at a CAGR of 9.4% during the forecast period from 2022 to 2031.

- Europe Fecal Immunochemical Test (FIT) Market – The global Europe fecal immunochemical test (fit) market is projected to grow at a CAGR of 7.1% from 2024 to 2034 and reach more than US$ 2.9 Billion by the end of 2034.

- U.S. Dermal Fillers Market – The U.S. dermal fillers market is projected to grow at a CAGR of 8.4% from 2024 to 2034 and reach more than US$ 3.4 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Senator Elizabeth Warren Joins The Call For REIT Crackdowns: What's Behind The Controversy?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Sen. Elizabeth Warren (D-Mass.) is the latest member of Congress to call for the Internal Revenue Service (IRS) to pay more attention to taxation around real estate investment trusts (REITs). Officials are closely examining how some in the health care and hospitality sectors behave regarding owning properties.

REITs don’t pay corporate income tax if they meet certain requirements. Instead, they pass most of their income directly to shareholders, avoiding the “double taxation” other corporations face. To maintain this tax-exempt status, a REIT must follow certain rules, including distributing at least 90% of its taxable income to shareholders as dividends. A REIT must also have 75% of its assets in real estate, cash, or government securities and derive at least 75% of its gross income from real estate-related activities, such as rent, mortgage interest, or property sales.

Concerns over REIT taxation began this summer with a July letter from Senator Ron Wyden (D-OR) to the IRS. The IRS responded in August with a letter clarifying and restating REIT rules. It pointed out that one exception to rules about related party rents exists for qualified lodging facilities. REITs are allowed to own qualified lodging facilities or qualified health care properties, but they cannot directly operate them. Instead, REITs use a taxable REIT subsidiary (TRS).

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

The REIT Investment Diversification and Empowerment Act of 2007 created the TRS structure. It allowed health care and hospitality businesses to be structured as REITs. Before that, many REITs were restricted from operating health care and senior housing facilities because they had to generate most of their income from passive sources, such as rent, rather than active business operations.

The IRS letter clarified that the TRS must contract an eligible independent contractor to operate and manage the qualified lodging facility. It cannot directly or indirectly operate or manage a lodging facility or it risks losing its special tax status. The IRS stated that it is aware that some REITs have been having the TRS lease the qualified lodging facility from the REIT and indirectly operate it, warning that REITs using this approach could lose their tax status for five years.

Read Now:

Senator Warren responded to that letter with her own letter to the IRS. She stated that while REITs are intended to be passive income opportunities for smaller-scale investors, some may violate the rules. She specifically called out Medical Properties Trust (NYSE:MPW) as raising questions about whether it has met IRS requirements.

In the letter, she said: “As the IRS continues to identify massive corporations and businesses that may be violating tax law, I urge you to increase enforcement scrutiny of REITs, especially large health and hospitality REITs that may be illegally claiming significant tax breaks while meddling in the operations of their tenants.”

Bisnow contacted the National Association of Real Estate Investment Trusts (Nareit), which said in a statement that there are no signs that REITs have violated any tax laws. The IRS has named no specific REITs concerning any potential violations.

Better Yields Than Some REITs?

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through publicly-traded REITs.

Arrived Homes, the Jeff Bezos-backed investment platform has launched its Private Credit Fund, which provides access to a pool of short-term loans backed by residential real estate with a target 7% to 9% net annual yield paid to investors monthly. It paid 8.1% in July. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

This article Senator Elizabeth Warren Joins The Call For REIT Crackdowns: What’s Behind The Controversy? originally appeared on Benzinga.com

Wall Street Analysts Think AeroVironment Could Surge 25.46%: Read This Before Placing a Bet

AeroVironment AVAV closed the last trading session at $179.47, gaining 2% over the past four weeks, but there could be plenty of upside left in the stock if short-term price targets set by Wall Street analysts are any guide. The mean price target of $225.17 indicates a 25.5% upside potential.

The average comprises six short-term price targets ranging from a low of $210 to a high of $245, with a standard deviation of $12.50. While the lowest estimate indicates an increase of 17% from the current price level, the most optimistic estimate points to a 36.5% upside. More than the range, one should note the standard deviation here, as it helps understand the variability of the estimates. The smaller the standard deviation, the greater the agreement among analysts.

While the consensus price target is a much-coveted metric for investors, solely banking on this metric to make an investment decision may not be wise at all. That’s because the ability and unbiasedness of analysts in setting price targets have long been questionable.

But, for AVAV, an impressive average price target is not the only indicator of a potential upside. Strong agreement among analysts about the company’s ability to report better earnings than they predicted earlier strengthens this view. While a positive trend in earnings estimate revisions doesn’t gauge how much a stock could gain, it has proven to be powerful in predicting an upside.

Here’s What You May Not Know About Analysts’ Price Targets

According to researchers at several universities across the globe, a price target is one of many pieces of information about a stock that misleads investors far more often than it guides. In fact, empirical research shows that price targets set by several analysts, irrespective of the extent of agreement, rarely indicate where the price of a stock could actually be heading.

While Wall Street analysts have deep knowledge of a company’s fundamentals and the sensitivity of its business to economic and industry issues, many of them tend to set overly optimistic price targets. Are you wondering why?

They usually do that to drum up interest in shares of companies that their firms either have existing business relationships with or are looking to be associated with. In other words, business incentives of firms covering a stock often result in inflated price targets set by analysts.

However, a tight clustering of price targets, which is represented by a low standard deviation, indicates that analysts have a high degree of agreement about the direction and magnitude of a stock’s price movement. While that doesn’t necessarily mean the stock will hit the average price target, it could be a good starting point for further research aimed at identifying the potential fundamental driving forces.

That said, while investors should not entirely ignore price targets, making an investment decision solely based on them could lead to disappointing ROI. So, price targets should always be treated with a high degree of skepticism.

Here’s Why There Could be Plenty of Upside Left in AVAV

Analysts’ growing optimism over the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason to expect an upside in the stock. That’s because empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

The Zacks Consensus Estimate for the current year has increased 1% over the past month, as one estimate has gone higher compared to no negative revision.

Moreover, AVAV currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on four factors related to earnings estimates. Given an impressive externally-audited track record, this is a more conclusive indication of the stock’s potential upside in the near term.

Therefore, while the consensus price target may not be a reliable indicator of how much AVAV could gain, the direction of price movement it implies does appear to be a good guide.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Costco Perks You Aren't Taking Advantage of — but You Should

The cost of an annual Costco membership recently increased from $60 to $65 for a basic Gold Star membership, and from $120 to $130 for an Executive membership. Now that you’re paying more, it’s especially important to make sure you’re getting great value out of your membership — no matter which one you have.

With that in mind, here are a few Costco benefits you may not be taking advantage of. And if that’s the case, you’re missing out big time.

1. Inexpensive gas that outperforms other fuel

There’s a reason Costco members love filling their tanks at the store’s fuel stations. And it’s not just the convenience of being able to get gas in conjunction with buying groceries.

Not only is Costco’s gasoline known to be competitively priced, but it’s also TOP TIER certified. This means you’re likely to get better performance out of Costco gas than gas that doesn’t have that same designation.

Now, one downside of filling up your car at Costco is that you won’t be eligible for the 2% cash back that comes with an Executive membership. While most Costco purchases qualify for Executive member cash back, gas is an exception. But if you pay for your fuel using a credit card with bonus gas rewards, you can potentially earn more than 2% back each time you fill up.

2. Discounted gift cards

Costco is known for its bulk groceries and paper towels more so than its selection of gift cards. But if you’re not buying gift cards at Costco, you may be overpaying for them elsewhere.

Costco discounts its gift cards below their face value, which means you’re guaranteed to save money on whichever ones you decide to buy. As one example, right now, Costco is selling $100 worth of IHOP gift cards for $69.99. If you were to buy those gift cards from IHOP directly, you’d probably pay $100 unless you managed to snag some limited-time promotion.

3. An extremely flexible return policy

If you’ve ever kept a Costco purchase you ended up not wanting because you were afraid to take it back months after the fact, you cost yourself money for nothing. Don’t sweat it, though — just pledge to take advantage of the flexible returns Costco is known for in the future.

In a nutshell, Costco will let you bring back almost any product at any time for a full refund. There are some exceptions you should know about, though.

Electronics and appliances must be returned within 90 days if you want your money back. And certain items, like cigarettes, alcohol, and gift cards can’t be returned at all.

You should also know that you can return partially eaten food to Costco if there’s an issue with its taste, or if it spoils ahead of its printed sell-by date. But you need to be reasonable when returning opened food products.

The general rule is that if you’re bringing food back due to a quality issue, you have to return 50% of it or more. You can’t buy a giant carton of strawberries, eat most of them, and then bring back three tiny berries for a refund while claiming their taste was off.

The $65 or $130 you pay for a Costco membership gives you access to a world of benefits. It pays to familiarize yourself with the perks of joining Costco so you can get the maximum value.

Top credit card to use at Costco (and everywhere else!)

We love versatile credit cards that offer huge rewards everywhere, including Costco! This card is a standout among America’s favorite credit cards because it offers perhaps the easiest $200 cash bonus you could ever earn and an unlimited 2% cash rewards on purchases, even when you shop at Costco.

Add on the competitive 0% interest period and it’s no wonder we awarded this card Best No Annual Fee Credit Card.

Click here to read our full review for free and apply before the $200 welcome bonus offer ends!

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.Maurie Backman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

3 Costco Perks You Aren’t Taking Advantage of — but You Should was originally published by The Motley Fool

Qualcomm considering acquiring parts of Intel’s chip business

Qualcomm has reportedly considered the acquisition of certain segments of Intel’s chip design business to enhance its product offerings, reports Reuters, citing sources.

The mobile chipmaker has shown interest in Intel’s client PC design unit, among other divisions.

However, Qualcomm has not made any formal approach to Intel regarding a potential acquisition, according to an Intel spokesperson.

Intel, which recently faced financial challenges, including a second-quarter loss, staff reductions, and a pause on dividend payments, is said to be committed to its PC business.

The spokesperson emphasised that Intel remains “strongly dedicated to our PC business.”

The company is also planning to present a strategy to its board of directors that may include divesting non-core business units to streamline costs.

This includes potentially selling the programmable chip unit Altera.

Qualcomm, with a market value of $184bn and known for its smartphone chips, has been contemplating the acquisition for several months, although plans have not been finalised and may change.

The interest from Qualcomm comes at a time when Intel’s PC client business revenue has declined by 8% to $29.3bn last year, reflecting the broader weakness in the PC market.

Intel’s client group, once famed for its “Intel Inside” campaign, produces laptop and desktop chips that are widely used globally.

Intel executives believe that the advent of artificial intelligence in PCs will lead to increased consumer demand and sales.

In a recent setback for Intel, its contract manufacturing business failed tests with Broadcom, indicating that Intel’s advanced manufacturing process, known as 18A, is not ready for high-volume production.

The tests involved sending silicon wafers through the 18A process, with Broadcom receiving the wafers last month.

After evaluation, it was determined that the process requires further development.

A representative for Broadcom said the company is “evaluating the product and service offerings of Intel Foundry and have not concluded that evaluation.”

“Qualcomm considering acquiring parts of Intel’s chip business ” was originally created and published by Verdict, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

What happened when Spain ‘punished’ its millionaires

Martin Varsavsky is one of more than 12,000 multimillionaires living in Spain who were blindsided by a “solidarity” tax at the end of 2022.

Pedro Sánchez’s Socialist government introduced a temporary levy of 1.7pc on citizens whose net wealth exceeds €3m (£2.6m) rising to 3.5pc for those worth €10m or more.

The Argentine-born Varsavsky, who has founded five billion-dollar companies spanning telecoms to renewable energy, was hit by a significant tax bill.

“I felt cheated,” he says.

The 64-year-old, who now runs a network of fertility clinics in North America, says he’s thought about leaving Madrid ever since.

“I went to visit Portugal, Italy and also Florida, where I used to live,” Varsavsky says.

“What’s especially egregious in my case is that now I make all my money in the US. So Spain is making all this money out of me. So I have all the incentives in the world to move away, and I will.”

Some have already gone. The “impuesto de solidaridad a las grandes fortunas” raised just €632m in 2022, representing 0.1pc of all taxpayers in Spain.

Despite the relatively low yield, Labour’s union paymasters are already calling for the UK Government to follow suit. The Tax Justice Network claims as much as £24bn a year could be raised from the UK if it copied Spain’s model.

Sharon Graham, the leader of Unite, has urged Rachel Reeves, the Chancellor, to announce a 1pc tax on Britain’s richest 1pc. “It’s time for a wealth tax on the super-rich and a tax on excess profits. We don’t need more excuses about fiscal responsibility or talk of wealth creation,” Graham said last month.

The G20 is also exploring plans for a global minimum tax on the world’s 3,000 billionaires.

The drive is being led by Gabriel Zucman, the tax guru behind US senator Elizabeth Warren’s proposal of a 2pc levy on the world’s richest. He claims it could unlock $250bn (£189bn) a year.

However, the issue remains highly contentious, and revenues have usually disappointed.

Esther Villa, a lawyer at Osborne Clarke in Barcelona, says the levy had a chilling effect on Spain’s entrepreneurs.

“The initial response from many of my clients was a feeling of being punished for being successful.” But she also notes that initial revenues were disappointing.

“When the solidarity tax was adopted, the government made a big deal of what they expected to collect, but what was collected in 2023 is less than half what was anticipated,” adds Villa.

Still, Villa says one reason revenues flowed in in the first year was people had very little time to plan before being hit with their first bill.

But she says this is unlikely to be repeated.

“Feedback from clients suggests they are aware of the things they have to do in terms of how to structure their assets to make sure that the impact is as efficient as possible.”

Together with Spain’s existing wealth tax, the country raised €1.9bn from various levies in 2022.

While the figure is not to be sneered at, it’s also the equivalent of making all of Spain’s 1.2m dollar millionaires pay just over €1,500 each.

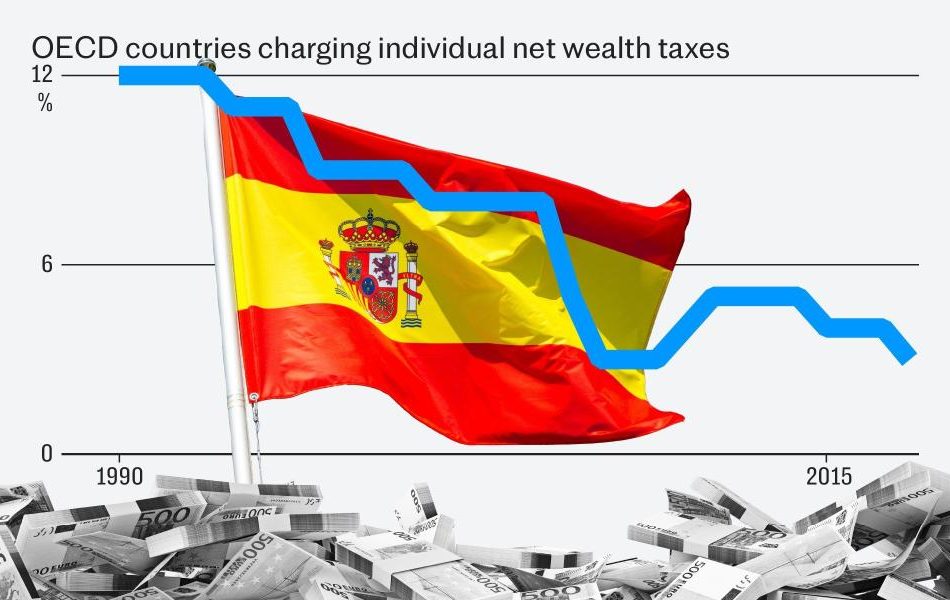

Meanwhile, the number of countries imposing a wealth tax has dwindled. Just over three decades ago in 1990, 12 countries had one. Today, only Norway, Spain, and Switzerland remain and the yields in these countries are low while the deterrents are high.

Emmanuel Macron ditched France’s wealth tax just over five years ago following an exodus of billionaires to destinations including the UK.

According to the OECD, countries have ditched them because they cost too much to administer, distort investment decisions and punish people who are asset-rich but cash-poor. The people it’s designed to target can also leave if they want to.

In short, wealth taxes don’t really raise much cash.

The closest the UK came to introducing an explicit wealth tax one was in the mid-1970s inflation strike that led to mass strike action.

Denis Healey, then-Labour chancellor, wrote in his memoirs: “We had committed ourselves to a wealth tax; but in five years I found it impossible to draft one which would yield enough revenue to be worth the administrative cost and political hassle.”

Chris Sanger, the global head of tax policy at EY, says the costs of administering a wealth tax should not be underestimated.

“The problem is the mechanism for calculating wealth. Because every year you’ve got to calculate the value of an asset that doesn’t always have a ready price,” says Sanger.

“It’s easy if it’s stocks and shares that are quoted, but if you’ve got a house that you’ve owned, how much has that increased in value? If it’s a painting sitting on the wall, has that gone up in value?

“Of course, people sometimes do this once upon death or for inheritance tax purposes where you actually have to go and get a valuation. But doing that once is very different from doing that every year for a wealth tax.”

Sanger says this can make getting wealth taxes in an arduous business, while the basic premise of a wealth tax sends out a signal that countries aren’t open for business.

“There are theoretical benefits for going for a wealth tax,” he adds. “The challenge with one is as the rate gets higher, it becomes more and more of a deterrent for people to actually have wealth. It’s also a tax that needs to be collected.”

Villa, at Osborne Clarke, admits that Spain’s tax grab has so far not led to billionaires leaving Spain in their droves.

“There has been no exodus. Lots of people took it in their stride the fact that it was supposed to be temporary. Having said that, I think there’s a high likelihood that it will be upheld for 2024, and subsequent years.”

For all his complaints, Varsavsky is also still living in Madrid.

“It’s a family thing,” he says. “My children are still at school here, and they have their friends and everything here. It’s difficult because of course taxes are not the only thing. I have seven children: two live in London, one lives in New York and then the other four in Madrid.”

However, he is leaving his options open. “There’s an issue of age. It’s not the same thing to tax a person who’s 30, who has many more years to make money, than to tax a person who is 70 and needs to have savings,” adds Varsavsky.

“If you start taking 3.5pc of their money year after year, then you end up having much less money at a time in your life when you can’t even go out and make more. So it’s pretty unattractive for anyone who has done moderately well in life to stay in Spain.”

Varsavsky says he’s banking on a change of administration, with Sanchez currently leading a precarious minority government.

“My hope here is that this will be short-lived, as the title of the tax is called, and they will go back to the way things used to be,” he adds.

“If not, eventually I will move out. Because it gets to a point where, in my sixties, it makes no sense to be in a place where my savings are taken away.

“It’s a pity, because Spain is a wonderful country to live in, but not if you are being forced to be impoverished year after year.”

SpaceX Bastrop Facility Touches 1M Starlink Hardware Production Milestone

SpaceX‘s factory in Bastrop, Texas has built a million Starlink standard hardware kits, the company announced on X on Monday.

What Happened: “Just 10 months after opening our factory in Bastrop, Texas, the Starlink team there has built 1 million Starlink Standard kits!,” the company wrote on the social media platform X while adding that the team is ramping production to meet surging demand.

Starlink is the satellite internet segment of Elon Musk‘s SpaceX. The company aims to provide low-latency internet to subscribers worldwide with a network of satellites in low-Earth orbit.

The standard hardware refers to the hardware ideal for residential use and everyday internet applications like streaming and video calls. It is currently priced at $299 in the U.S.

Why It Matters: SpaceX said in May that Starlink is connecting over 3 million people with high-speed internet. The facility is available over across 100 countries, territories, and other markets.

According to data from astronomer Jonathan McDowell, SpaceX has launched over 7000 Starlink satellites into space, of which 6337 are working, to provide the service.

Starlink achieved breakeven cash flow in November 2023, rekindling hopes for an IPO of the segment. In late 2020, Musk said that SpaceX would probably IPO Starlink when its revenue growth is ‘smooth and predictable.’

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DIYer Builds Tiny Home For $17K That Brings In $50K A Year In 'Almost Completely Passive' Income

Tiny homes have become increasingly popular in recent years as many look for ways to cut costs and reduce the size of their carbon footprints. One young DIYer figured out a way to turn his tiny house into a giant moneymaker.

What To Know: According to a CNBC report, 34-year-old Ivan Ellis Nanney bought a parcel of land just outside of Boise, Idaho, for $17,000, and spent another $17,000 building a tiny home on it. The property now generates close to $50,000 in revenue a year.

He originally listed it on Airbnb Inc ABNB in 2019 with intentions to live in it for half of the year, but the overwhelming demand led him to move out for good and start listing the miniature home year-round.

“It became very popular. It just didn’t make sense for me to stay there at all. [The income] has become almost completely passive,” Nanney told CNBC.

The tiny home has been such a success for the Idaho native that he is working on two more rental homes. Here’s how he managed to build the first.

Check This Out: How This Millennial Generates $40K Per Month Working 30 Minutes A Day: ‘It’s About The Experience’

Piece By Piece: The lot, which he purchased back in 2015, came with an abandoned house. He spent close to three and a half years tearing down the old structure and then building the new one using secondhand building materials.

Nanney was also able to hook up water lines and wire the home for electricity himself, which is quite the cost saver.

Now he generates a majority of his income from the home and only works about two hours each week setting up bookings. He pays someone to clean the place for about $150 a week and he returns to the location at least a couple of times each year to perform routine maintenance.

Most of the rest of his time is spent traveling, although he also makes some extra money helping other nearby Airbnb hosts with upkeep for their properties.

And then there are the two additional properties he’s working on. One is a nearby house that he bought in 2021 with a down payment of less than $8,000. The other is in the mountains of Idaho, but he’s splitting that one with four members of his family.

“You can increase your income and reduce your debt while maximizing assets you already own. I don’t like having things sit around when someone could be benefiting from it,” Nanney told CNBC.

Read Next:

This story is part of a new series of features on the subject of success, Benzinga Inspire. Some elements of this story were previously reported by Benzinga and it has been updated.

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Implied Volatility Surging for Axos Financial Stock Options

Investors in Axos Financial, Inc. AX need to pay close attention to the stock based on moves in the options market lately. That is because the Oct 18, 2024 $37.50 Call had some of the highest implied volatility of all equity options today.

What is Implied Volatility?

Implied volatility shows how much movement the market is expecting in the future. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big move in one direction or the other. It could also mean there is an event coming up soon that may cause a big rally or a huge sell-off. However, implied volatility is only one piece of the puzzle when putting together an options trading strategy.

What do the Analysts Think?

Clearly, options traders are pricing in a big move for Axos Financial shares, but what is the fundamental picture for the company? Currently, Axos Financial is a Zacks Rank #3 (Hold) in the Financial – Miscellaneous Services industry that ranks in the Top 29% of our Zacks Industry Rank. Over the last 60 days, no analysts have increased their earnings estimates for the current quarter, while three analysts have revised their estimates downward. The net effect has taken our Zacks Consensus Estimate for the current quarter from $1.86 per share to $1.84 in that period.

Given the way analysts feel about Axos Financial right now, this huge implied volatility could mean there’s a trade developing. Oftentimes, options traders look for options with high levels of implied volatility to sell premium. This is a strategy many seasoned traders use because it captures decay. At expiration, the hope for these traders is that the underlying stock does not move as much as originally expected.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.