Are Options Traders Betting on a Big Move in TopBuild Stock?

Investors in TopBuild Corp. BLD need to pay close attention to the stock based on moves in the options market lately. That is because the Oct 18, 2024 $195 Call had some of the highest implied volatility of all equity options today.

What is Implied Volatility?

Implied volatility shows how much movement the market is expecting in the future. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big move in one direction or the other. It could also mean there is an event coming up soon that may cause a big rally or a huge sell-off. However, implied volatility is only one piece of the puzzle when putting together an options trading strategy.

What do the Analysts Think?

Clearly, options traders are pricing in a big move for TopBuild shares, but what is the fundamental picture for the company? Currently, TopBuild is a Zacks Rank #3 (Hold) in the Building Products – Miscellaneous industry that ranks in the Top 28% of our Zacks Industry Rank. Over the last 30 days, no analysts have increased their earnings estimates for the current quarter, while two analysts have revised their estimates downward. The net effect has taken our Zacks Consensus Estimate for the current quarter from $5.87 per share to $5.74 in that period.

Given the way analysts feel about TopBuild right now, this huge implied volatility could mean there’s a trade developing. Oftentimes, options traders look for options with high levels of implied volatility to sell premium. This is a strategy many seasoned traders use because it captures decay. At expiration, the hope for these traders is that the underlying stock does not move as much as originally expected.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Long-Dated Treasury ETFs Hit Yearly Highs Ahead Of August CPI Data: More 'Good News On Inflation' Expected

Exchange-traded funds (ETFs) investing in long-term U.S. Treasury bonds surged to their highest levels of the year as investors gear up for another benign inflation report due Wednesday.

The popular iShares 20+ Year Treasury Bond ETF TLT ended Monday’s session at $99.99 per share, its highest closing price since December 2023.

The U.S. Bureau of Labor Statistics is scheduled to release the Consumer Price Index (CPI) for August on Wednesday at 8:30 a.m. ET. Economists are predicting a 0.2% month-over-month increase in both headline and core inflation, the latter of which excludes food and energy prices.

The Cleveland Fed’s Inflation Nowcasting model projects similar results, with headline CPI at 2.56% year-over-year and core CPI at 3.21%.

Ed Yardeni, a well-known Wall Street veteran, said, “August’s CPI should continue to show progress in moderating inflation,” adding that the expected print would mark the lowest headline inflation since February 2021.

In a similar tone, Bank of America analysts predict that headline inflation will decline by 0.3 percentage points to 2.6% year-over-year, while core inflation is expected to hold at 3.2%.

“The August CPI report should continue the string of good news on inflation,” the bank said in a recent note.

Key Data and Expectations Summary

| Metric | August MoM (exp.) | August YoY (exp.) | July YoY |

|---|---|---|---|

| Headline CPI | +0.2% | 2.6% | 2.9% |

| Core CPI (ex-food and energy) | +0.2% | 3.2% | 3.2% |

Federal Reserve Rate Cut Speculation

Market participants are currently pricing in a 71% probability of a 25-basis-point rate cut at the Federal Reserve’s September meeting, and a 29% chance of a larger 50-basis-point cut.

Recent comments from Fed Governor Christopher Waller and New York Fed President John Williams indicate that a 25bp rate cut remains the baseline expectation, but larger cuts could be on the table if economic data, particularly from the labor market, worsens.

Waller, speaking at the University of Notre Dame, noted that the Fed could act “quickly and forcefully” if needed, and signaled openness to “front-loading cuts.”

Williams emphasized that the U.S. is “moving in the right direction” on inflation but warned, “we are not there yet on achieving 2% inflation.”

Williams also highlighted that the labor market remains strong, with the unemployment rate still “relatively low by historical standards.”

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Analysts Believe HealthEquity Could Rally 36.59%: Here's is How to Trade

HealthEquity HQY closed the last trading session at $76.24, gaining 7.1% over the past four weeks, but there could be plenty of upside left in the stock if short-term price targets set by Wall Street analysts are any guide. The mean price target of $104.14 indicates a 36.6% upside potential.

The average comprises 14 short-term price targets ranging from a low of $92 to a high of $115, with a standard deviation of $6.14. While the lowest estimate indicates an increase of 20.7% from the current price level, the most optimistic estimate points to a 50.8% upside. More than the range, one should note the standard deviation here, as it helps understand the variability of the estimates. The smaller the standard deviation, the greater the agreement among analysts.

While the consensus price target is a much-coveted metric for investors, solely banking on this metric to make an investment decision may not be wise at all. That’s because the ability and unbiasedness of analysts in setting price targets have long been questionable.

However, an impressive consensus price target is not the only factor that indicates a potential upside in HQY. This view is strengthened by the agreement among analysts that the company will report better earnings than what they estimated earlier. Though a positive trend in earnings estimate revisions doesn’t give any idea as to how much the stock could surge, it has proven effective in predicting an upside.

Here’s What You Should Know About Analysts’ Price Targets

According to researchers at several universities across the globe, a price target is one of many pieces of information about a stock that misleads investors far more often than it guides. In fact, empirical research shows that price targets set by several analysts, irrespective of the extent of agreement, rarely indicate where the price of a stock could actually be heading.

While Wall Street analysts have deep knowledge of a company’s fundamentals and the sensitivity of its business to economic and industry issues, many of them tend to set overly optimistic price targets. Are you wondering why?

They usually do that to drum up interest in shares of companies that their firms either have existing business relationships with or are looking to be associated with. In other words, business incentives of firms covering a stock often result in inflated price targets set by analysts.

However, a tight clustering of price targets, which is represented by a low standard deviation, indicates that analysts have a high degree of agreement about the direction and magnitude of a stock’s price movement. While that doesn’t necessarily mean the stock will hit the average price target, it could be a good starting point for further research aimed at identifying the potential fundamental driving forces.

That said, while investors should not entirely ignore price targets, making an investment decision solely based on them could lead to disappointing ROI. So, price targets should always be treated with a high degree of skepticism.

Why HQY Could Witness a Solid Upside

There has been increasing optimism among analysts lately about the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher. And that could be a legitimate reason to expect an upside in the stock. After all, empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

The Zacks Consensus Estimate for the current year has increased 4.1% over the past month, as three estimates have gone higher compared to no negative revision.

Moreover, HQY currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on four factors related to earnings estimates. Given an impressive externally-audited track record, this is a more conclusive indication of the stock’s potential upside in the near term.

Therefore, while the consensus price target may not be a reliable indicator of how much HQY could gain, the direction of price movement it implies does appear to be a good guide.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Job Slowdown? Headhunters Are On A Roll, Revenue For Executive Searches Is Up

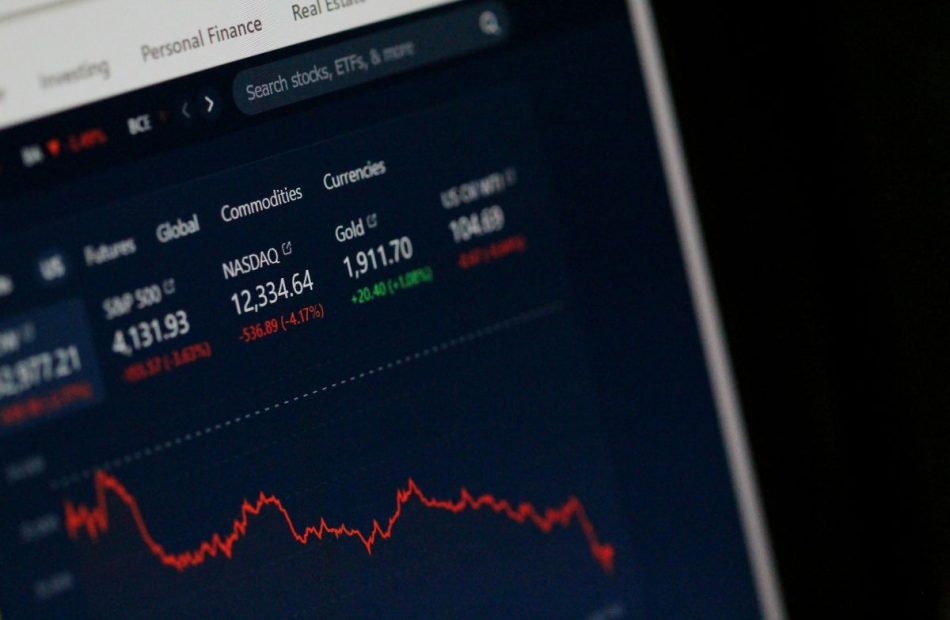

Last week’s jobs report sent the stock market into one of the worst weeks for Wall Street since the start of the year.

While hiring appears to be weakening, the trend is going in the opposite direction for executive-level positions.

That’s according to data shared by headhunting firm Korn Ferry KFY in its latest earnings call.

The talent acquisition service reported a 6% increase in revenue from its executive search arm in North America, as compared to the same period last year. The segment also accounted for 31% of its revenue during the latest quarter, as per earnings documents.

The trend is replicated globally, where the uptick was 3% when taking all territories into account. Korn Ferry is located in 53 countries across North America, Europe, Asia/Pacific and Latin America.

“The level of work that we’re doing these days in executive search is probably the highest that I’ve seen,” said Korn Ferry CEO Gary Burnison.

A lot of those searches are due to job succession, he added. As an unprecedented number of Americans retire, companies are in dire need of successors for high-level positions.

Read Also: The ‘Great Wait’ Economy: Jobs Data Paints Unique Picture, Analyst Says

Peak 65

This year, the U.S. experienced a trend that observers call “peak 65.” That means that the number of workers reaching the retirement age of 65 is at the highest it’s ever been.

The Alliance for Lifetime Income reports that an average of 11,000 Americans are entering retirement age each day this year. Through 2027, there will be an average of 4.1 million new retirees a year.

This demographic event is driving one of the largest executive renewal trends in U.S. history. And it goes against overall data on unemployment. The Labor Department showed consistent increases since March, with a 0.1% decrease between July and August.

“Over the next two to three years, the United States is probably going to lose 4 million, 5 million workers a year from the last of the baby boom retirements,” said Burnison.

Korn Ferry benefits. The firm beat analyst estimates on Thursday for the latest quarter, reporting $682.761 million in sales which beat the consensus of $663.937 million by 2.84%, as per data from Benzinga Pro.

Jobs Data: The U.S. economy added 142,000 nonfarm payrolls in August, an improvement from July, but below economist expectations of 160,000.

And a recent revision by the Labor Department found that the jobs market added 818,000 fewer jobs than originally reported in the year leading up to March 2024.

The silver lining is that the recent jobs data has pushed a majority of traders to price in a 25% rate cut in the upcoming FOMC meeting in what one analyst referred to as “the moment we’ve all been waiting for”.

Over the weekend, Treasury Secretary Janet Yellen reassured the public of the economy’s resilience, despite recent job reports.

“We’re seeing less frenzy in terms of hiring and job openings, but we’re not seeing meaningful layoffs,” said Yellen at a politics and policy event on Saturday.

Now Read:

Shutterstock image.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stocks React To Trump's Marijuana Comments: See Which Ones Posted Solid Gains

Former President Donald Trump announced on Sunday night that, if re-elected, he would reschedule cannabis and support banking reforms for the marijuana industry. He also confirmed his support for Florida’s Amendment 3, which would legalize recreational cannabis in the state. Trump’s comments sparked a reaction in the cannabis stock market on Monday.

Get Benzinga’s exclusive analysis and top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Stocks Reaction

- Trulieve Cannabis TCNNF: The price at market close was $10.99 with a change of +$1.28 (+13.18%). Trading volume reached 707,392, with a market cap of $2.06 billion.

- Green Thumb Industries GTBIF: The price at market close was $10.66 with a change of +$1.02 (+10.58%). Trading volume hit 473,092, with a market cap of $2.52 billion.

- Curaleaf Holdings CURLF: The price at market close was $3.10 with a change of +$0.26 (+9.15%). Trading volume reached 639,920, and the market cap stood at $2.09 billion.

- Canopy Growth CGC: The price at market close was $4.86 with a change of +$0.38 (+8.54%). Trading volume was 6,041,892, with a market cap of $412 million.

- Sundial Growers SNDL: The price at market close was $2.14 with a change of +$0.16 (+8.08%). Trading volume hit 1,946,306, and the market cap was $530 million.

- Aurora Cannabis ACB: The price at market close was $5.80 with a change of +$0.39 (+7.25%). Trading volume was 1,136,294, with a market cap of $317 million.

- Cronos Group CRON: The price at market close was $2.21 with a change of +$0.07 (+3.27%). Trading volume reached 1,448,055, with a market cap of $847 million.

- HEXO Corp HEXO: The price at market close was $1.35 with a change of +$0.05 (+3.85%). Trading volume was 1,215,840, with a market cap of $401 million.

- AdvisorShares Pure US Cannabis ETF MSOS: The price at market close was $7.16 with a change of +$0.75 (+11.70%). Trading volume hit 13,998,304.

- Innovative Industrial Properties IIPR: The price at market close was $122.69 with a change of +$2.02 (+1.67%). Trading volume was 90,181, with a market cap of $3.42 billion.

- GrowGeneration GRWG: The price at market close was $1.92 with a change of +$0.05 (+2.96%). Trading volume hit 454,306, and the market cap was $110 million.

- Corbus Pharmaceuticals CRBP: The price at market close was $52.48 with a change of +$2.43 (+4.87%). Trading volume was 153,424, with a market cap of $630 million.

- AdvisorShares Pure Cannabis ETF YOLO: The price at market close was $3.35 with a change of +$0.21 (+6.69%). Trading volume reached 37,519.

- Scotts Miracle-Gro SMG: The price at market close was $67.62 with a change of -$0.20 (-0.29%). Trading volume reached 323,540, with a market cap of $3.85 billion.

- Village Farms International VFF: The price at market close was $1.01 with a change of +$0.01 (+1.02%). Trading volume hit 459,136, and the market cap was $113 million.

- Trees CANN: The price at market close was $0.042 with a change of -$0.012 (-22.22%). Trading volume was 118,407.

- Medical Marijuana MJNA: The price at market close was $0.001 with no change. Trading volume hit 9,393,761, with a market cap of $5.68 million.

- OrganiGram Holdings OGI: The price at market close was $1.83 with a change of +$0.08 (+4.29%). Trading volume was 348,054, with a market cap of $186 million.

- High Tide HITI: The price at market close was $2.12 with a change of +$0.16 (+8.16%). Trading volume hit 648,008, with a market cap of $162 million.

- Planet 13 Holdings PLNHF: The price at market close was $0.96 with no significant change. Trading volume was 275,004.

- Cresco Labs CRLBF: The price at market close was $1.74 with a change of +$0.13 (+7.74%). Trading volume hit 438,517, with a market cap of $565 million.

Highs And Lows In 2024

The cannabis market has experienced several significant stock movements in recent months. On April 30, 2024, stocks soared after the DEA announced plans to reschedule cannabis to Schedule III, with Canopy Growth jumping by 78.8% and Aurora Cannabis rising 46%.

However, two weeks ago, following the DEA’s decision to delay its final ruling, the sector saw a sharp decline, with Curaleaf falling 15.68% and Green Thumb Industries dropping 10.15%. In contrast, Monday’s gains following Trump’s support for Amendment 3 were more modest, with a mean growth of 4.31%, suggesting a recovery but not on the same scale as the April surge.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

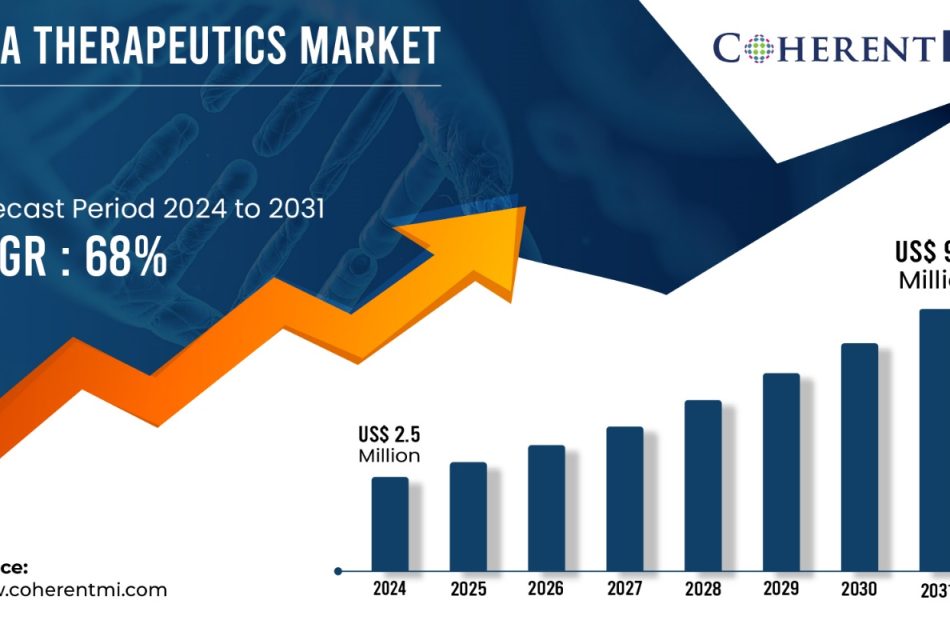

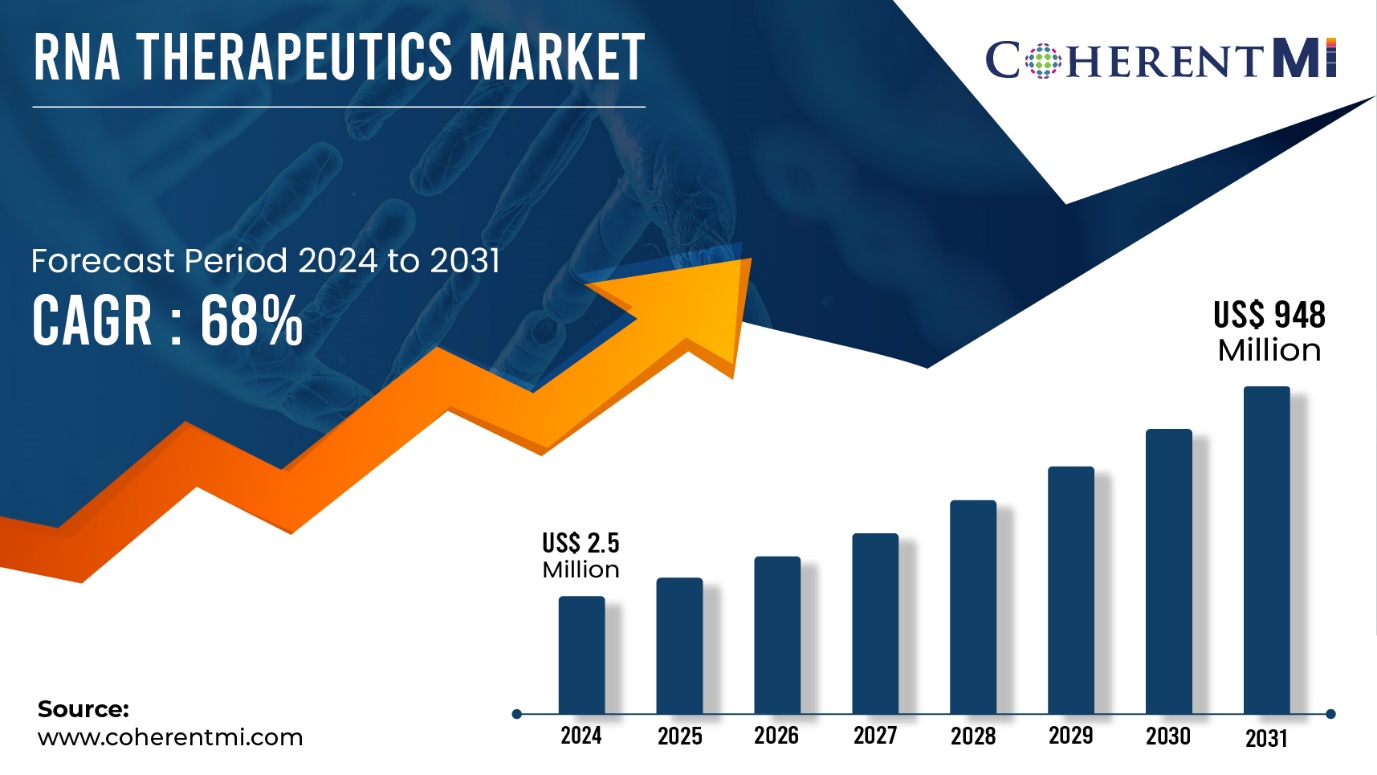

RNA Therapeutics Market Size is expected to reach US$ 948 Million by 2031, Report by CoherentMI

Burlingame, Sept. 09, 2024 (GLOBE NEWSWIRE) — CoherentMI published a report, titled, RNA Therapeutics Market is estimated to value at US$ 2.5 Million in the year 2024 and is anticipated to reach US$ 948 Million by 2031, at a CAGR of 68% during forecast period 2024-2031. RNA therapeutics utilizes RNA interference and antisense technologies for modulating gene expression using RNA molecules. RNA therapeutics provides treatments for hereditary disorders, cancer, and infectious diseases. RNAi therapeutics is considered as one of the most promising areas of modern drug discovery. This is due to its ability to treat previously undruggable disease targets through selective silencing of gene expressions. Pharmaceutical companies are actively investing in RNAi therapeutics research to develop novel treatments for various chronic diseases like cancer, cardiovascular disease, neurodegenerative disorders etc.

Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2024: | US$ 2.5 Million |

| Estimated Value by 2031: | US$ 948 Million |

| Growth Rate: | Poised to grow at a CAGR of 68% |

| Historical Data: | 2019–2023 |

| Forecast Period: | 2024–2031 |

| Forecast Units: | Value (USD Million/Billion) |

| Report Coverage: | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered: | By Type of Modality, By Type of Molecule |

| Geographies Covered: | Global |

| Growth Drivers: | • Increasing Prevalence of Chronic Diseases Demanding Advanced Therapies |

| • Growing Investments in RNA-based Research and Development | |

| Restraints & Challenges: | • High Cost and Complexity of RNA-based Therapeutics |

Market Dynamics:

The growing demand for precision medicine and increasing R&D investment are the major factors fueling the growth of the RNA therapeutics market. Precision medicine is an emerging approach for disease treatment and prevention that takes into account individual variability in genes, environment, and lifestyle for each person. It allows doctors and researchers to predict more accurately which treatment and prevention strategies for a particular disease will work in which groups of people. Thus, RNA therapeutics that offers highly targeted and personalized treatment is gaining more attention in the precision medicine domain. Furthermore, increasing funding from both private and public organizations has resulted in high investment in R&D by key market players, which is supporting the market growth.

Key Market Takeaways:

- The RNA therapeutics market size was valued at USD 2.5 billion in 2024 and is anticipated to witness a CAGR of 68% during the forecast period 2024-2031. This significant growth can be attributed to increasing success of mRNA vaccines and therapies in clinical trials.

- By type of modality, RNA Therapeutics segment dominated the market in 2024 due to higher adoption of personalized mRNA cancer vaccines and gene therapies. Within this segment, replicating RNA (repRNA) sub-segment is expected to grow at a higher pace owing to capabilities of self-amplification.

- Based on region, North America held the major share of RNA therapeutics market in 2024 due to strong presence of key pharma companies and favorable regulatory environment for novel drug development.

- The key players operating in the global RNA therapeutics market include Alphavax, Arcturus Therapeutics, Atyr Pharma and Gritstone Bio among others. Strategic collaborations between big pharma and biotech firms are helping further clinical development of different RNA molecules.

Market Trends:

RNA interference (RNAi) therapeutics holds promising potential to revolutionize the treatment of diseases. RNAi is an innate cellular mechanism involved in regulating gene expression. By exploiting this natural pathway with synthetic small interfering RNA (siRNA), it is possible to target and degrade specific messenger RNA (mRNA) molecules and thereby reduce the production of disease-associated proteins.

Several biopharmaceutical companies are engaged in developing RNAi therapeutics and have candidates in different stages of clinical trials for various diseases such as cancer, hepatitis, neurodegenerative diseases, and genetic disorders. For instance, Alnylam Pharmaceuticals commercialized the first-ever RNAi therapeutic called Onpattro in 2018, used for the treatment of polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults.

Nucleoside-modified mRNA has gained attention as a safer and more sustainable approach for gene therapy compared to DNA or viral vectors. The non-integrating nature of mRNA makes it less likely to cause genomic alterations. Some companies such as Moderna, BioNTech, and CureVac are leveraging the potential of mRNA for delivering genetic instructions to produce therapeutic proteins inside patient cells.

Recent Developments:

- In February 2023, Tevard Biosciences partnered with Vertex Pharmaceuticals to develop tRNA-based therapies for Duchenne Muscular Dystrophy.

- In January 2024, Circular Genomics raised $8.3 million in series A funding for the world’s first circRNA-based clinical assay to improve depression treatment.

Get a detailed analysis on regions, market segments, and companies: https://www.coherentmi.com/industry-reports/rna-therapeutics-market

RNA Therapeutics Market Opportunities:

RNA Cell and Gene Therapy: RNA cell and gene therapy is one of the major market opportunities in the RNA therapeutics industry. RNA cell and gene therapy utilizes RNA-based molecules like mRNA and engRNA to target and modify specific cells and genes for treating various diseases. It offers more flexibility and safety compared to conventional gene therapy as RNA doesn’t integrate into the host genome. Many biotech companies are developing innovative RNA cell and gene therapies for cancers, monogenic disorders, infectious diseases etc. For instance, Moderna is conducting clinical trials for personalized cancer mRNA vaccine and engRNA therapy for Fabry disease.

RNA Vaccines: RNA vaccines against infectious diseases and cancers have emerged as another big opportunity area. RNA vaccines help produce the immunogenic protein inside the body to elicit a strong immune response without the risk of infection. They can be designed and manufactured faster than conventional vaccines. Many players are developing self-amplifying mRNA vaccines for COVID-19, influenza, Zika virus etc. Biotech firms like CureVac, Translate Bio are also exploring RNA vaccines for various cancers. The success of COVID mRNA vaccines has further boosted interest and funding in this sector.

RNA Therapeutics Market Segmentation:

- By Type of Modality

- RNA Therapeutics

- RNA Vaccines

- By Type of Molecule

- Replicating RNA (repRNA)

- Self amplifying RNA (saRNA)

- Self activating RNA (sacRNA)

- Self activating mRNA (samRNA)

- Transfer RNA (tRNA)

Purchase Latest Edition of this Research Report @ https://www.coherentmi.com/industry-reports/rna-therapeutics-market/buynow

The research provides answers to the following key questions:

- What is the estimated growth rate of the market for the forecast period 2024-2031?

- What will be the market size during the estimated period?

- What are the key driving forces responsible for shaping the fate of the RNA Therapeutics market during the forecast period?

- Who are the major market vendors and what are the winning strategies that have helped them occupy a strong foothold in the RNA Therapeutics market?

- What are the prominent market trends influencing the development of the RNA Therapeutics market across different regions?

- What are the major threats and challenges likely to act as a barrier in the growth of the RNA Therapeutics market?

- What are the major opportunities the market leaders can rely on to gain success and profitability?

Key insights provided by the report that could help you take critical strategic decisions?

- Regional report analysis highlighting the consumption of products/services in a region also shows the factors that influence the market in each region.

- Reports provide opportunities and threats faced by suppliers in the RNA Therapeutics industry around the world.

- The report shows regions and sectors with the fastest growth potential.

- A competitive environment that includes market rankings of major companies, along with new product launches, partnerships, business expansions, and acquisitions.

- The report provides an extensive corporate profile consisting of company overviews, company insights, product benchmarks, and SWOT analysis for key market participants.

- This report provides the industry’s current and future market outlook on the recent development, growth opportunities, drivers, challenges, and two regional constraints emerging in advanced regions.

Browse More Trending Reports:

Short-Acting Insulin Market: The short-acting insulin market is estimated to be valued at USD 9.5 Bn in 2024 and is expected to reach USD 13.2 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2031.

Knee Osteoarthritis Market: The knee osteoarthritis market is estimated to be valued at USD 11.7 Bn in 2024 and is expected to reach USD 30.01 Bn by 2031, growing at a compound annual growth rate (CAGR) of 12.5% from 2024 to 2031.

Clinical Trial Services Market: The clinical trial services market is estimated to be valued at USD 1.09 billion in 2024 and is expected to reach USD 2.75 billion by 2031, growing at a compound annual growth rate (CAGR) of 14.1% from 2024 to 2031.

Blastomycosis Treatment Market: The blastomycosis treatment market is estimated to be valued at USD 202 Mn in 2024 and is expected to reach USD 321.6 Mn by 2031, growing at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2031.

Author of this marketing PR:

Priya Pandey is a dynamic and passionate PR writer with over three years of expertise in content writing and proofreading. Holding a bachelor’s degree in biotechnology, Priya has a knack for making the content engaging. Her diverse portfolio includes writing contents and documents across different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. Priya’s meticulous attention to detail and commitment to excellence make her an invaluable asset in the world of content creation and refinement.

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

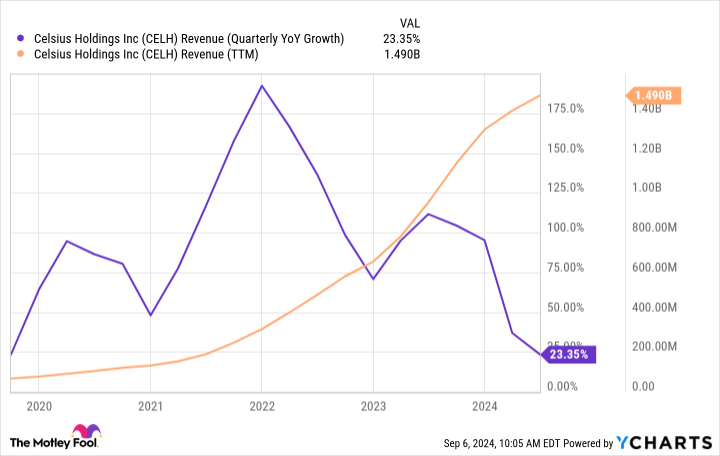

1 Growth Stock Down 66% to Buy Right Now

Celsius Holdings’ (NASDAQ: CELH) energy drink has become wildly popular over the past several years. The company’s rampant sales growth caught PepsiCo‘s attention, leading to an investment and distribution partnership and sizzling investment returns for shareholders. However, Celsius has lost some of its luster throughout this year. The stock has now fallen a whopping 66% from its high.

No stock goes up forever. The question is whether investors should buy the dip or if Celsius’ time in the sun is over.

A sharp decline can completely change a stock’s outlook. Here is why Celsius fell and why investors should consider buying the stock now.

Resetting expectations

Celsius’ energy drink products enjoyed viral popularity beginning during the COVID-19 pandemic. The brand appeals to young and health-conscious consumers with its “Live Fit” marketing angle. Revenue growth accelerated to more than 50% year over year in the pandemic’s early days, then spiked once PepsiCo jumped into the picture in 2022.

PepsiCo has become Celsius’ primary distribution partner, opening up access to more points of sale and helping Celsius launch in new markets. Year-over-year sales growth peaked at more than 175%. But with high growth comes high expectations. Celsius’ price-to-sales (P/S) ratio jumped to 17, more than double that of its chief competitor, Monster Beverage.

As you can see above, growth rates have slowed dramatically. Not only is triple-digit growth a tough follow-up act, but PepsiCo’s initial surge to fill inventories pulled some growth forward. In its Q2 earnings call, management noted that PepsiCo’s inventory movements created a headwind of $20 million to $30 million during the quarter. Celsius is a much larger company today with $1.5 billion in annual sales; it’s unlikely that revenue will grow by triple digits again.

In other words, the market has reset its expectations (valuation) for Celsius to a new reality of slower growth.

Looking forward

Celsius isn’t done growing just because the business isn’t growing at 100% anymore. The company’s $402 million in Q2 sales was still a 23% increase over the prior year. If you add in the $20 million to $30 million headwind due to PepsiCo’s inventory, growth would have been at least 5 percentage points higher. There are two take-home points for investors here.

First, Celsius is still gaining market share from its competition. The company’s North American sales grew 23% year over year in Q2. The energy drink market isn’t growing that fast; according to Mordor Intelligence, the energy drink market in North America will grow at a low-single-digit rate through 2030. Mathematically, Celsius’ growth is coming from somewhere. Monster Beverage is a top competitor and only grew North American sales by 3% year over year in Q2. Celsius is likely outperforming other brands.

Second, Celsius’ international growth story is very early. Success isn’t a given, but PepsiCo’s distribution support will significantly help. International sales grew 30% year over year in Q2 but represented just 5% of total sales, so it doesn’t move the needle. This year, Celsius launched in six new countries; the international growth story could become more important over time.

There is no reason Celsius can’t maintain double-digit sales growth for a while yet.

Assessing the stock’s long-term potential

Investors could be poised for strong investment returns if that’s the case.

Despite growing sales much faster than Monster, the stock is cheaper than Monster:

Celsius is profitable under generally accepted accounting principles (GAAP) with similar profit margins to Monster, so it’s hard to argue that Celsius’ revenue isn’t as “high-quality” as Monster’s and would thus deserve a lower valuation. Instead, Celsius’ stock seems oversold and mispriced relative to its peers. The stock doesn’t need a higher P/S ratio if sales keep growing at a double-digit pace; the growth alone would drive the share price higher over time.

Investors shouldn’t let the adverse price action write the narrative about Celsius stock. The company is doing well, and the stock’s valuation more than compensates for slower long-term growth. The stock wasn’t a great buy at its highs, but it’s a compelling investment idea today.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius and Monster Beverage. The Motley Fool has a disclosure policy.

1 Growth Stock Down 66% to Buy Right Now was originally published by The Motley Fool

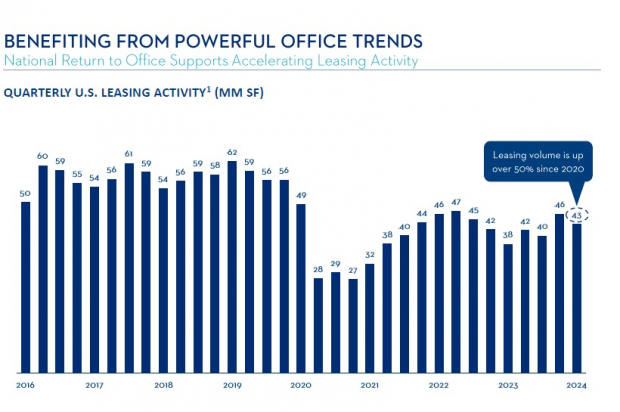

Cousins Properties Leases Full Building at The Domain in Austin

Cousin Properties CUZ recently announced that it has entered into a lease arrangement with a Fortune 100 technology company for around 320,000 square feet of all of its Domain 12 property in Austin, TX.

The said customer is new to Cousins’ portfolio and will take up the ongoing lease from Meta Platforms, effective from Jan. 1, 2026, extending its maturity from 2031 to 2040.

Cousins’ Domain portfolio, spanning around 2.5 million square feet, is at present more than 99% leased, reflecting the solid demand for space. Delivered in 2020, Domain 12 exists near The Domain’s main dining and entertainment district.

This Cousins lifestyle office property’s offerings of amenities such as cafes, outdoor terraces, a fitness center and bike storage, with direct access to several hiking and bike trails, lead to a wholesome experience for its clients.

As per Colin Connolly, the president and chief executive officer of Cousins Properties, “We are excited that our teams found a creative solution to welcome another global technology innovator to a trophy property in The Domain.” He also asserted, “The Domain provides a highly amenitized experience that leading companies recognize as a critical tool to drive employee recruitment, retention, and culture.”

Cousins Properties Sees a Recovery in Demand

Cousins Properties is seeing a recovery in demand for its high-quality, well-placed office properties, as highlighted by a rebound in new leasing volume. For the six months ended June 2024, the company executed 77 leases for a total of 794,240 square feet of office space with a weighted average lease term of 7.8 years. This included 404,011 square feet of new leases, 268,210 square feet of renewal leases and 122,019 square feet of expansion leases.

Image Source: Cousins Properties

Going forward, Cousins Properties’ high-quality office portfolio, impressive tenant roster, opportunistic investments and developments in best sub-markets and strong balance sheet are expected to drive its growth. However, a continuation of the hybrid work environment and high supply in the office real estate market is expected to adversely impact its pricing power.

Over the past three months, shares of this Zacks Rank #2 (Buy) company have risen 24.3% compared with the industry’s upside of 16.7%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader REIT sector are Paramount Group PGRE and Lamar Advertising LAMR, each carrying a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Paramount Group’s 2024 FFO per share has been raised marginally northward over the past three months to 78 cents.

The Zacks consensus estimate for Lamar Advertising’s current-year FFO per share has been revised marginally upward over the past month to $8.09.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 ‘Strong Buy’ Stocks With at Least 10% Dividend Yield

The markets have kicked off September with a reprise of the swoon we saw in early August, making it clear that investors are not quite as sanguine as the politicians would like in this election year.

Bad news from the jobs reports is fueling fears that a recession could be on the way; the July numbers included a downward revision of more than 800,000 for the past year, and the August numbers missed expectations, coming in barely at maintenance level.

The commodity markets are also down in recent weeks, with oil losing all of the gains it saw earlier in the year. The drop in oil prices could signal potential economic trouble ahead, as it reflects weakened global demand and industrial slowdown – key indicators that a recession may be looming.

Watching the situation from JPMorgan Asset Management, portfolio manager Priya Misra says, “I think no market is really pricing in a reasonable chance of a recession, but the totality of data suggests that risks of a recession are growing. While there is so much hand-wringing about a 25bp or 50bp cut from the Fed in September, all markets will move if a recession is upon us. It will take a while for rate cuts to filter through into the economy.”

A smart investor will always have a plan for the worst case – and this scenario will naturally draw attention to dividend stocks. These shares generate an income stream no matter how the market rises or falls.

With this in mind, we’ve opened up the TipRanks database, and found div stocks with ‘Strong Buy’ ratings from the analysts that are yielding at least 10%, a solid return at any time. Here are the details on two of them.

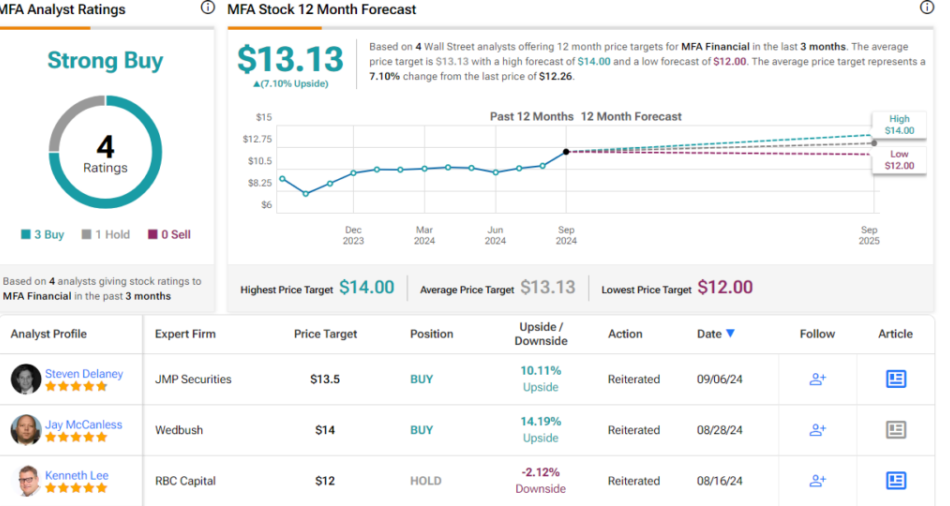

MFA Financial (MFA)

The first stock we’ll look at is MFA Financial, a company in the specialty finance realm acting as a real estate investment trust (REIT). These companies operate in the world of real property and mortgage financing, investing in property purchases directly or in financing loans on real properties. MFA Financial invests mainly in residential real estate assets, primarily residential mortgage loans and residential mortgage-backed securities. The company is internally managed and publicly traded.

As of the end of Q2 this year, June 30, the company had a total residential whole loan balance of $9.2 billion and a total securities portfolio worth $863.3 million. During Q2, the company made $688.2 million in loan acquisitions and added $175.5 million in agency mortgage-backed securities to its holdings.

During the same period, MFA generated $53.49 million in net interest income, a figure that was up 20% year-over-year and beat the forecast by $330,000. The company’s non-GAAP earnings per share, at 44 cents, was up 10% from the prior year quarter and was 6 cents per share better than had been anticipated.

For dividend investors, the key point here is that MFA’s earnings fully covered the 35-cent common stock dividend. The dividend was declared on June 11, and paid out on July 31; at its current rate, the payment annualizes to $1.40 per common share and gives a forward yield of 11.4%. We should note that MFA has paid out $4.7 billion in cumulative dividends since going public in 1998.

For 5-star analyst Jay McCanless, of Wedbush, this stock is emerging from a transformative period and is primed for near-term gains. The analyst, who is rated in the top 1% of his peers by TipRanks, is especially impressed by the dividend here, and writes of the shares, “MFA performed near the middle of pack in our mREIT screen, as the company was not immune from the pressures impacting the overall group over the last few years. However, we believe that MFA has since been able to successfully rebuild itself on several fronts, and we believe that this positive transformation is being seen in more recent financial results, as the company has covered its dividend on an EAD basis for the last couple of years and thus far into 2024. We also view MFA’s current valuation as relatively attractive, given its ~11.5% dividend yield on what we view to be a fairly stable ongoing dividend.”

Overall, McCanless rates the stock as Outperform (Buy) with a $14 price target that suggests a 14%-plus upside for the coming year. With the dividend, that adds up to a total potential return of more than 25%. (To watch McCanless’ track record, click here)

While there are only 4 recent analyst reviews of this stock on file, they include 3 Buys to just 1 Hold, for a Strong Buy consensus rating. The stock has a trading price of $12.26 and an average price target of $13.13, implying a one-year upside of 7%. (See MFA stock forecast)

Golub Capital BDC (GBDC)

Next up on our list is a business development corporation, or BDC. Golub Capital provides the needed combinations of capital, credit, and financial services that keep the small- to mid-sized enterprise sector – the traditional driver of the American economy – afloat. These companies that make up Golub’s potential customer base are not always able to access financial services through the major banks, and firms like Golub pick up the slack.

That’s not to say that Golub operates at a small scale. Earlier this year, the company completed an approved merger with a sister firm, GBDC 3, under which the two companies combined their business and portfolio activities under the Golub Capital’s name and stock ticker. The merger was completed in June of this year, and the combined entity has approximately $8.8 billion in total assets, at fair value, and investments in 367 portfolio companies.

Golub’s portfolio is focused heavily on senior loans. 86% of the company’s investments are in first lien traditional senior loans, and 7% are in first lien one-stop instruments. The remaining 7% of the portfolio is in equity investments. Of Golub’s loan portfolio, 99% is in floating rate loans.

The most crucial aspect of Golub’s business is generating total returns for its investors. The company builds the foundation for this by cultivating a portfolio of high-quality clients, with repeat business. Golub is an experienced credit asset manager and understands the importance of not just building a portfolio at scale, but of maintaining the quality of the investments.

In the second quarter of this year, the quarter in which Golub completed its GBDC 3 acquisition, the company reported a total investment income of $171.27 million while the adj. investment income per share came in at 48 cents.

The company’s earnings more than covered the regular dividend payment, which was declared on August 5 for payment this coming September 27. The dividend, at 39 cents per common share, annualizes to $1.56 and yields ~10.6% going forward.

This stock caught the eye of Paul Johnson, from KBW, who is impressed by the overall quality of the company. He writes of Golub, “We believe Golub Capital is one of the highest quality BDCs in the sector, and the management team has deep experience in the middle market. We expect the portfolio at GBDC will be of higher quality than many BDC peers due to their focus on more senior debt assets. GBDC’s cost structure is one of the best in the sector with low fees, lower operating expenses, and significant shareholder protections.”

Quantifying his stance, Johnson puts an Outperform (Buy) rating on GBDC, with a price target of $16.50 implying an upside of 12% in the next 12 months. Add in the forward dividend yield, the return could be more than 22.5%. (To watch Johnson’s track record, click here)

This is another stock with 4 recent analyst reviews and a 3 to 1 split favoring Buy over Hold for a Strong Buy consensus rating. The shares are priced at $14.76 and their $16.50 average price target matches the KBW view. (See GBDC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Mobile Virtual Network Operators Market to reach $146.31 billion by 2031, says Coherent Market Insights

Burlingame, Sept. 09, 2024 (GLOBE NEWSWIRE) — The global mobile virtual network operators market, valued at $85.14 billion dollars in 2024, is on a trajectory of rapid expansion, with projections indicating it will soar to 146.31 billion dollars by 2031, at a Compound Annual Growth Rate (CAGR) of 8% during the forecast period, as highlighted in a new report published by Coherent Market Insights. The Mobile Virtual Network Operators are able to offer cost competitive data plans with reasonable pricing as they do not have standalone network infrastructure and ride on existing telco networks. They partner with mobile network operators and lease their network capacity at wholesale rates which allows MVNOs to price their offerings attractively. This has made MVNOs a popular choice for data centric consumers looking for value for money plans.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/7141

Market Dynamics:

The Mobile Virtual Network Operator Market is primarily driven by expanding telecom sector across the globe. Mobile Virtual Network Operators (MVNOs) provide mobile services to consumers and businesses by using infrastructure and spectrum access from traditional Mobile Network Operators (MNOs). Thus, expanding telecom infrastructure is creating opportunities for MVNOs to establish their business. Furthermore, growing adoption of connectivity services due to rising internet penetration is another major factor fueling growth of the market. For instance, according to Worldwide Internet Statistics, global internet users reached 5.3 billion in 2022 which accounts for approximately 67% of world population.

Mobile Virtual Network Operators Market Report Coverage:

| Report Coverage | Details |

| Market Revenue in 2023 | $85.14 billion |

| Estimated Value by 2031 | $146.31 billion |

| Growth Rate | Poised to grow at a CAGR of 8% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Service Type, By Operational Model, By End User: |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Emergence and spread of internet connectivity • Growing demand for converged services from businesses |

| Restraints & Challenges | • High dependence on host networks • Regulatory challenges in management of spectrum allocation |

Market Trends:

Enterprise/Business MVNO trend is growing in the market. MVNOs play a vital role in providing affordable, reliable connectivity solutions to businesses through flexible plans and services. They help companies reduce infrastructure and spectrum costs as compared to setting up their own network while meeting specific business communication needs. Growing need for managing mobility costs is prompting enterprises to shift from traditional telcos to MVNO business models. Additionally, IoT MVNOs have emerged to address the connectivity requirements of Internet of Things devices. They provide tailored connectivity plans designed specifically for IoT solutions. This helps drive revenue streams from M2M/IoT services.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7141

Market Opportunities:

Discount MVNOs hold the largest share of the overall MVNO market currently. They provide cellular services to users at significantly lower prices compared to traditional mobile network operators by stripping out unnecessary services and infrastructure costs. As data consumption and smartphone penetration continue to rise globally, especially in developing markets, there is a massive opportunity for discount MVNOs to acquire more customers interested in affordable cellular plans. Many people in price-sensitive regions will opt for the cost savings that discount MVNOs provide over the higher tariffs of MNOs.

With the proliferation of IoT devices and M2M connectivity requirements across various industry verticals, MVNOs can capitalize on providing dedicated cellular networks for IoT/M2M applications. Traditional MNOs may not focus much on customized IoT plans due to lower average revenue per user. MVNOs have an opportunity to partner with MNOs and offer scalable IoT connectivity solutions tailored to industries like utilities, manufacturing, transportation, etc. As IoT spending rises exponentially worldwide, MVNOs targeting the B2B segment have significant growth prospects.

Key Market Takeaways:

The global mobile virtual network operator market is anticipated to witness a CAGR of 8% during the forecast period 2024-2031, owing to rising smartphone adoption in emerging markets and increasing IoT connectivity requirements across industries.

On the basis of deployment, the cloud segment is expected to hold a dominant position, owing to advantages like scalability, flexibility, and lower upfront costs.

On the basis of operational mode, the reseller segment holds the largest share currently due to their independent business models.

On the basis of application, the discount segment dominates currently due to the high popularity of affordable cellular plans worldwide.

Regionally, Asia Pacific is expected to hold the dominant position over the forecast period owing to the untapped growth potential in developing APAC countries.

Key players operating in the mobile virtual network operator market include AT&T Inc., Lycamobile Group, Sprint Corporation, Verizon Wireless Inc., T-Mobile International AG, CITIC Telecom International Holding Limited, Telefónica S.A., TracFone Wireless Inc., Transatel, and America Movil. These players are focusing on strategic collaborations and mergers & acquisitions to expand their geographic footprint.

Recent Developments:

In September 2022, Cloudflare Inc. announced the Cloudflare Zero Trust SIM, the first solution to secure every data packet leaving mobile devices. Organizations will effectively integrate devices with Cloudflare’s Zero Trust platform and will be able to quickly and securely connect employee devices to Cloudflare’s global network. Along with this, they can also prevent their network and employees no matter where they work with the help of Zero Trust SIM.

In July 2022, ORANGE and MASMOVIL agreed to merge their operations in Spain. The formation of a joint company combines the forces of ORANGE and MASMOVIL into a single, stronger operator, allowing for investments in 5G and Fiber that would benefit customers throughout Spain.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7141

Detailed Segmentation:

By Service Type:

By Operational Model:

- Full MVNO

- Reseller MVNO

- Service Operator MVNO

By End User:

By Regional:

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Information and Communication Technology Domain:

Remote Radio Unit Market, by Type (2G, 3G, 4G, 5G, and others), By Application (Integrated Base Station and Distributed Base Station) and by Region- Size, Share, Outlook, and Opportunity Analysis, 2024-2031

5G Smartphone Market Report, By Operating System (IOS, Android and Windows), By Sales Channel (Online and Offline), and by Region – Size, Share, Outlook, and Opportunity Analysis, 2024 – 2031

Multiple Input Multiple Output (MIMO) Market, By Technology (LTE, 5G), By Type (Single Input Multiple Output (SIMO), Multiple Input Single Output (MISO), Multiple Input Multiple Output), By Application (Wi-Fi Hotspots, Smart Home Devices, Mobile Broadband Connections, Fixed Wireless Access, Smartphones, Others), By Antenna Type (Single User MIMO, Multi-User MIMO, Massive MIMO, Others), By End User (Telecom Operators, Automotive, Government, Healthcare, Others), By Region – Size, Share, Outlook, and Opportunity Analysis, 2024 – 2031

Mobile Application Market, By Store Type, By End-use, By Region – Size, Share, Outlook, and Opportunity Analysis, 2024 – 2031

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.