UNDER ARMOUR ANNOUNCES UPDATE TO ITS RESTRUCTURING PLAN AND FISCAL 2025 OUTLOOK

BALTIMORE, Sept. 9, 2024 /PRNewswire/ — Under Armour, Inc. UAA UA))) today announced an update to its Fiscal 2025 restructuring plan, including additional initiatives to optimize the company’s strategic supply chain capabilities and overall business performance.

Previously, the company expected to incur pre-tax restructuring and related charges of approximately $70 million to $90 million in connection with its Fiscal 2025 restructuring plan. Following further evaluation, the company has identified approximately $70 million of charges, largely related to the decision to exit one of its primary distribution facilities located in Rialto, California, by March 2026. Accordingly, it now expects approximately $140 million to $160 million of pre-tax restructuring and related charges to be incurred in Fiscal 2025 and Fiscal 2026, including:

- Up to $75 million in cash-related charges, consisting of approximately $30 million in employee severance and benefits costs and $45 million related to various transformational initiatives and

- Up to $85 million in non-cash charges, including approximately $7 million in employee severance and benefits costs and $78 million in facility, software, and other asset-related charges and impairments.

Through the three months ended June 30, 2024, the company had incurred approximately $34 million of restructuring and related charges ($19 million in cash and $15 million in non-cash). The company anticipates incurring approximately two-thirds of the charges under the revised total plan by the end of fiscal year 2025.

“We continue to proactively identify opportunities to optimize our business to help create a better and stronger Under Armour,” said Under Armour Chief Financial Officer David Bergman. “As we work to reconstitute our brand and increase our financial productivity over the long term – optimizing our supply-chain network will make us a more efficient, uncomplicated, and agile company.”

Updated Fiscal 2025 Outlook

Based on the expansion of the Fiscal 2025 restructuring plan range and the impacts related to fiscal 2025, the company updated the following expectations for its fiscal 2025 outlook:

- Operating loss is expected to be $220 to $240 million versus the previous expectation of $194 to $214 million. Excluding the mid-point of anticipated restructuring charges and the litigation reserve expense, adjusted operating income is expected to be $140 to $160 million.

- Diluted loss per share is expected to be $0.58 to $ 0.61 versus the previous expectation of $0.53 to $0.56, and adjusted diluted earnings per share are expected to be $0.19 to $0.22.

Non-GAAP Financial Information

This press release refers to “adjusted” forward-looking estimates of the company’s results for its 2025 fiscal year ending March 31, 2025. References to adjusted financial measures exclude the company’s litigation reserve expense, any gain or loss in connection with the sale of the MyFitnessPal platform, and the impact of the company’s fiscal year 2025 restructuring plan and related charges and related tax effects. Management believes these adjustments are not core to the company’s operations. The reconciliation of non-GAAP amounts to the most directly comparable financial measure calculated according to GAAP is presented in supplemental financial information furnished with this release. All per-share amounts are reported on a diluted basis. These supplemental non-GAAP financial measures should not be considered in isolation. They should be contemplated in addition to, and not as an alternative to, the company’s reported results prepared per GAAP. Additionally, the company’s non-GAAP financial information may not be comparable to similarly titled measures reported by other companies.

About Under Armour, Inc.

Under Armour, Inc., headquartered in Baltimore, Maryland, is a leading inventor, marketer, and distributor of branded athletic performance apparel, footwear, and accessories. Designed to empower human performance, Under Armour’s innovative products and experiences are engineered to make athletes better. For further information, please visit http://about.underarmour.com.

Forward-Looking Statements

Some of the statements contained in this press release constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, such as statements regarding our restructuring efforts, including the scope of these restructuring efforts and the amount of potential charges and costs, the timing of these measures. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “could,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “outlook,” “potential” or the negative of these terms or other comparable terminology. The forward-looking statements in this press release reflect our current views about future events. They are subject to risks, uncertainties, assumptions, and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, activity levels, performance, or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by these forward-looking statements, including, but not limited to: changes in general economic or market conditions, including increasing inflation, that could affect overall consumer spending or our industry; increased competition causing us to lose market share or reduce the prices of our products or to increase our marketing efforts significantly; fluctuations in the costs of raw materials and commodities we use in our products and our supply chain (including labor); our ability to successfully execute our long-term strategies; our ability to effectively drive operational efficiency in our business; changes to the financial health of our customers; our ability to effectively develop and launch new, innovative and updated products; our ability to accurately forecast consumer shopping and engagement preferences and consumer demand for our products and manage our inventory in response to changing demands; our ability to successfully execute any potential restructuring plans and realize their expected benefits; loss of key customers, suppliers or manufacturers; our ability to further expand our business globally and to drive brand awareness and consumer acceptance of our products in other countries; our ability to manage the increasingly complex operations of our global business; the impact of global events beyond our control, including military conflicts; the impact of global or regional public health emergencies on our industry and our business, financial condition and results of operations, including impacts on the global supply chain; our ability to successfully manage or realize expected results from significant transactions and investments; our ability to effectively market and maintain a positive brand image; our ability to attract key talent and retain the services of our senior management and other key employees; our ability to effectively meet regulatory requirements and stakeholder expectations with respect to sustainability and social matters; the availability, integration and effective operation of information systems and other technology, as well as any potential interruption of such systems or technology; any disruptions, delays or deficiencies in the design, implementation or application of our global operating and financial reporting information technology system; our ability to access capital and financing required to manage our business on terms acceptable to us; our ability to accurately anticipate and respond to seasonal or quarterly fluctuations in our operating results; risks related to foreign currency exchange rate fluctuations; our ability to comply with existing trade and other regulations, and the potential impact of new trade, tariff and tax regulations on our profitability; risks related to data security or privacy breaches; and our potential exposure to and the financial impact of litigation and other proceedings. The forward-looking statements here reflect our views and assumptions only as of the date of this press release. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect unanticipated events.

|

Under Armour, Inc. |

||||

|

The tables below present the reconciliation of the Company’s fiscal 2025 outlook presented in accordance with GAAP to certain adjusted non-GAAP financial measures discussed in this press release. See “Non-GAAP Financial Information” above for further information regarding the Company’s use of non-GAAP financial measures. |

||||

|

ADJUSTED OPERATING INCOME RECONCILIATION |

||||

|

(in millions) |

Year Ending March 31, 2025 |

|||

|

Low end of estimate |

High end of estimate |

|||

|

GAAP loss from operations |

$ (240) |

$ (220) |

||

|

Add: Impact of litigation reserve |

274 |

274 |

||

|

Add: Impact of charges under 2025 restructuring plan (1) |

106 |

106 |

||

|

Adjusted income from operations |

$ 140 |

$ 160 |

||

|

ADJUSTED DILUTED (LOSS) EARNINGS PER SHARE RECONCILIATION |

||||

|

Year Ending March 31, 2025 |

||||

|

Low end of estimate |

High end of estimate |

|||

|

GAAP diluted net loss per share |

$ (0.61) |

$ (0.58) |

||

|

Add: Impact of litigation reserve |

0.63 |

0.63 |

||

|

Add: Impact of charges under 2025 restructuring plan (1) |

0.24 |

0.24 |

||

|

Add: Impact of provision for income taxes |

(0.7) |

(0.7) |

||

|

Adjusted diluted net income per share |

$ 0.19 |

$ 0.22 |

||

|

(1) The estimated fiscal 2025 impact of the restructuring plan presented above assumes the mid-point of the Company’s estimated range of fiscal 2025 restructuring and related charges under the total plan of $140-160 million. |

||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/under-armour-announces-update-to-its-restructuring-plan-and-fiscal-2025-outlook-302242385.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/under-armour-announces-update-to-its-restructuring-plan-and-fiscal-2025-outlook-302242385.html

SOURCE Under Armour, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biden And Trump Debate Had 0 Mention Of Bitcoin, What Are The Odds Kamala Harris And Ex-President Will End Up Discussing Crypto?

Bettors on the decentralized prediction platform Polymarket expected few mentions of cryptocurrencies and Bitcoin BTC/USD in the hotly anticipated presidential debate between Donald Trump and Kamala Harris.

What happened: The odds of Republican hopeful Trump uttering the words stood at 14% as of this writing, significantly down from 23% seen on Sunday.

Wagers worth more than $129,000 were placed on the probability of the occurrence, higher than some of the other burning topics like abortion and border security.

The odds of Harris mentioning cryptocurrency and Bitcoin was at 10%, a decline from 14% seen during the weekend.

Trump continued to lead Harris in presidency betting odds, with bettors expecting a 52% chance of the Republican winning the race for the White House.

Polymarket, built atop Ethereum’s ETH/USD Layer-2 chain, Polygon MATIC/USD, has emerged as one of the world’s top prediction markets for U.S. elections in the last few months. The novel initiative allows users to bet on major global events using cryptocurrencies.

Why It Matters: The upcoming debate will be the second of this election cycle and the first between Trump and Harris, who replaced incumbent Joe Biden following his withdrawal from the race after the first presidential debate.

Notably, the last debate between Biden and Trump saw no mentions of cryptocurrency or Bitcoin.

The outcome of the election was expected to have serious implications for Bitcoin’s price, according to a Bernstein report.

A Trump victory could propel Bitcoin to new heights, potentially reaching $80,000 to $90,000 by the end of Q4, the report said, citing the former president’s vocal support for the asset class.

On the contrary, a Harris presidency could witness the leading cryptocurrency dropping to the $30,000 to $40,000 range. The analysis identified the absence of cryptocurrency mentions in the Vice President’s speeches and policy pronouncements as a contributing cause to the uncertainty.

While Harris has not shown her stance on cryptocurrencies, her campaign team has tried to engage with top industry names like Coinbase and also earned the support of Ripple co-founder Chris Larsen.

Photo Courtesy: Shutterstock.com

Check This Out:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Norfolk Southern says investigating CEO over alleged misconduct

(Reuters) – Norfolk Southern said late on Sunday it has opened an investigation into allegations of potential misconduct by Chief Executive Alan Shaw.

The company said that its audit committee is working with a law firm “to conduct an independent investigation of the allegations.”

CNBC had first reported, citing people familiar with the matter, that Shaw engaged in an inappropriate workplace relationship.

Shaw did not immediately respond to a request for comment on the investigation.

In May, activist investor Ancora won three board seats at the railroad operator but failed to oust the railway’s chief executive.

Ancora had proposed investors push Alan Shaw off the board and elect Jim Barber, a former chief operating officer at UPS, so that he could eventually replace Shaw as CEO. They also proposed Jamie Boychuk to become the chief operating officer.

Shaw was appointed as the CEO in May 2022, replacing Jim Squires.

The hedge fund argued new blood was needed to improve financial and operational metrics and said it would continue to hold the company accountable for any future railway accidents or underperformance.

The Atlanta, Georgia-based company reported operating revenue of $3 billion in the second quarter, up 2% from last year, narrowly missing analysts’ estimates of $3.04 billion.

(This story has been corrected to say that Shaw was appointed CEO in May 2022, not that he joined Norfolk Southern in May 2022, in paragraph 7)

(Reporting by Urvi Dugar and Rishabh Jaiswal; Editing by Diane Craft and Christopher Cushing)

Intel faces 'uphill battle' as its stock hovers near record lows: Goldman Sachs analyst

The road ahead for struggling Intel (INTC) is uncertain at best as its stock hovers near record lows.

Intel faces an “uphill battle” to turn itself around and compete with the likes of Nvidia (NVDA), AMD (AMD), and Taiwan Semiconductor (TSM), Goldman Sachs analyst Toshiya Hari told Yahoo Finance at the Goldman Sachs Communacopia & Technology Conference on Monday.

Hari rates shares of Intel as Sell. He thinks the company will need some time to get its technology —notably AI chips — on par with its better-performing rivals, if they can do it at all.

Goldman’s bearish take on Intel — while having Nvidia on its closely watched conviction buy list — comes at a precarious time for the company.

Intel widely missed second quarter analyst estimates on sales, gross profit margin, and earnings as it encountered more challenging market conditions and higher-than-expected costs to ramp AI chip production.

The company took the drastic action of suspending its dividend, which will go into effect in the fourth quarter. Intel has paid a dividend for 125 straight quarters previously, including $3.1 billion in 2023.

Intel said it would slash 15% of its workforce to get costs under wraps.

“This is the biggest restructuring of Intel I’d say since the memory microprocessor decision four decades ago,” Intel CEO Pat Gelsinger told Yahoo Finance following the results in early August.

Gelsinger says he’s in it for the long haul despite being disappointed in the quarter and outlook.

“This is what I signed up for [when I came in as CEO],” Gelsinger added.

Gelsinger is reportedly exploring an IPO of Intel’s chipmaking business Altera and a possible sale of its foundry business to shore up investor confidence.

Intel’s stock is down by about 50% in the past year. By comparison, shares of Nvidia and AMD are up 132% and 30%, respectively.

“From a company fundamental perspective, the company is facing tough macro headwinds and a highly competitive compute environment exacerbated by lingering questions on its ability to execute on its technology/product/diversification road maps,” JPMorgan analyst Harlan Sur said in a recent client note.

Sur — who rates Intel’s stock at Underweight (Sell equivalent) — added, “Given the market has time to gain confidence in Intel’s ability to execute in its core compute and diversification initiatives, we believe INTC will be an underperformer relative to the group over the next 12-18 months.”

Three times each week, I field insight-filled conversations with the biggest names in business and markets on Yahoo Finance’s Opening Bid podcast. Find more episodes on our video hub. Watch on your preferred streaming service. Or listen and subscribe on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

In the Opening Bid episode below, EMJ Capital founder and veteran tech investor Eric Jackson makes the case for a doubling in Nvidia’s stock price.

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on X @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email brian.sozzi@yahoofinance.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

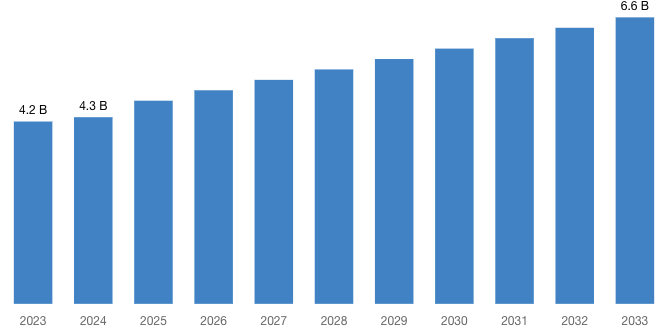

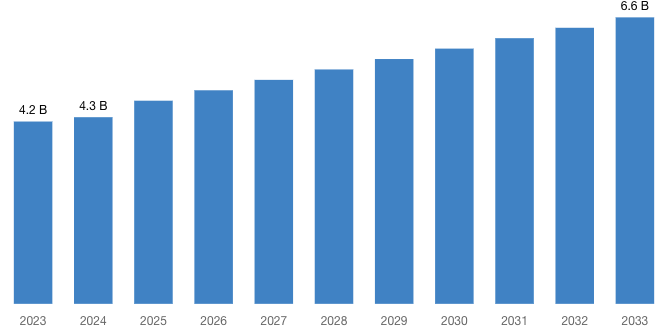

[Latest] Global Grader Blades Market Size/Share Worth USD 6.6 Billion by 2033 at a 5.1% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

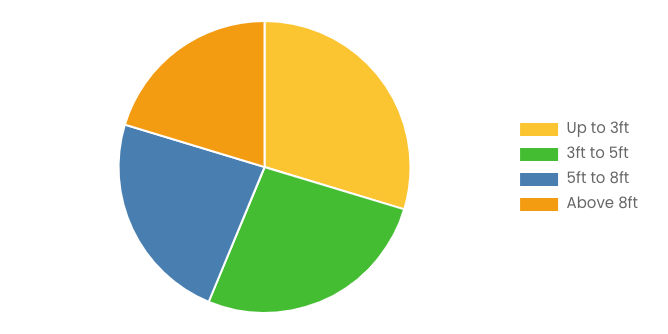

Austin, TX, USA, Sept. 10, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Grader Blades Market Size, Trends and Insights By Type (Flat Edges, Serrated Edges, Curved Edges, Scarifier Edges, Corrugated Edges), By Blade Length (Up to 3ft, 3ft to 5ft, 5ft to 8ft, Above 8ft), By Material (Steel, Carbide, Heat Treated, Others), By Application (Construction, Mining, Snow Removal, Road Maintenance and Development, Agriculture, Others), By Distribution channel (Direct Sales, Indirect Sales), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Grader Blades Market size & share was valued at approximately USD 4.2 Billion in 2023 and is expected to reach USD 4.3 Billion in 2024 and is expected to reach a value of around USD 6.6 Billion by 2033, at a compound annual growth rate (CAGR) of about 5.1% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Grader Blades Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=51802

Grader Blades Market: Overview

A grader blade is a machine, either self-powered or towed by a tractor, that levels earth, rubble, etc., as in road construction.

The growth of the grader blades market is being driven by an increase in building activities and the development of infrastructure in major nations such as the United States, Canada, India, China, Mexico, and Brazil. Recent market trends include technological innovations like adjustable grader blades for a range of grading applications and for effective performance.

Grader blades are becoming more popular in several end-use industries, which raises their price. Leading producers are creating cutting-edge grader blades to support a variety of jobs in the fields of construction, agriculture, mining, snow removal, and road maintenance.

Prominent businesses have also upped their R&D expenditures to create and produce a variety of grader blades, including all-season grader blades that are weather-resistant. This presents profitable prospects for expanding the market.

Request a Customized Copy of the Grader Blades Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=51802

By type, the flat edges segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Flat edges are variable and it’s used for different grading applications, including levelling, spreading, and smoothing surfaces. Their adaptability makes them suitable for a wide range of projects, from road construction to landscaping.

By blade length, the 3-5 ft segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The drive for grader blades with blade lengths ranging from 3 feet to 5 feet is fueled by the diverse needs of the construction and road maintenance industries.

By material, the steel grade segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Steel is a material that is frequently utilized in grader blades because of its great variation.

By application, the construction segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Government initiatives for the development of regional roads and the construction industry’s increasing global expansion.

Asia Pacific is anticipated to dominate the worldwide landscape throughout the forecast period, followed by Asia Pacific., road construction, land development, and infrastructure projects are among the applications that drive the need for grader blades, North America has a thriving construction industry.

One of the main factors driving the growth of the grader blades market is the existence of well-established original equipment manufacturers (OEMs) and a strong following.

Caterpillar Inc., also known as CAT, is an American construction, mining and other engineering equipment manufacturer. The company is the world’s largest manufacturer of construction equipment.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 4.3 Billion |

| Projected Market Size in 2033 | USD 6.6 Billion |

| Market Size in 2023 | USD 4.2 Billion |

| CAGR Growth Rate | 5.1% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Blade Length, Material, Application, Distribution channel and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Grader Blades report is available upon request; please contact us for more information.)

Request a Customized Copy of the Grader Blades Market Report @ https://www.custommarketinsights.com/report/grader-blades-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Grader Blades report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Grader Blades Market Report @ https://www.custommarketinsights.com/report/grader-blades-market/

CMI has comprehensively analyzed the Global Grader Blades market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict in depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Blister Packaging industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Grader Blades market and what is its expected growth rate?

- What are the primary driving factors that push the Grader Blades market forward?

- What are the Grader Blades Industry’s top companies?

- What are the different categories that the Grader Blades Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Grader Blades market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Grader Blades Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/grader-blades-market/

Grader Blades Market: Regional Analysis

By region, Grader Blades Market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. The Asia Pacific dominated the Grader Blades Market in 2023 with a market share of 41.3% and is expected to keep its dominance during the forecast period 2024-2033.

The grader blades industry in the Asia Pacific region is thriving due to rapid infrastructure development, particularly in countries like China and India. Increasing road construction, urbanization projects, and agricultural mechanization are driving the demand for grader blades, leading to growth and innovation within the industry.

Request a Customized Copy of the Grader Blades Market Report @ https://www.custommarketinsights.com/report/grader-blades-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Grader Blades Market Size, Trends and Insights By Type (Flat Edges, Serrated Edges, Curved Edges, Scarifier Edges, Corrugated Edges), By Blade Length (Up to 3ft, 3ft to 5ft, 5ft to 8ft, Above 8ft), By Material (Steel, Carbide, Heat Treated, Others), By Application (Construction, Mining, Snow Removal, Road Maintenance and Development, Agriculture, Others), By Distribution channel (Direct Sales, Indirect Sales), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/grader-blades-market/

List of the prominent players in the Grader Blades Market:

- Caterpillar Inc.

- Komatsu Ltd.

- Deere & Company

- Volvo Construction Equipment

- CNH Industrial N.V.

- Liebherr Group

- JCB Ltd.

- Hitachi Construction Machinery Co. Ltd.

- Doosan Infracore Co. Ltd.

- Hyundai Construction Equipment Co. Ltd.

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- LiuGong Machinery Corp.

- Shantui Construction Machinery Co. Ltd.

- Sany Group Co. Ltd.

- Terex Corporation

- Wirtgen Group

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

- Atlas Copco AB

- Bobcat Company

- CASE Construction Equipment

- Others

Click Here to Access a Free Sample Report of the Global Grader Blades Market @ https://www.custommarketinsights.com/report/grader-blades-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Charging Oxygen Gas Systems Market: Charging Oxygen Gas Systems Market Size, Trends and Insights By Product Type (Oxygen Concentrators, Gas Cylinders, Liquid Oxygen Systems, Oxygen Generators), By End User (Medical Facilities, Industrial Sector, Aviation and Aerospace, Scuba Diving and Sports, Research and Laboratories, Others), By Application (Welding and Metalwork, Aviation and Aerospace, Oxygen Therapy, Scuba Diving, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Sanitary Pumps and Valves Market: Sanitary Pumps and Valves Market Size, Trends and Insights By Type (Centrifugal, Positive Displacement, Other), By Pump Power Source (Air, Electric), By End-User (Processed Foods, Dairy, Non-Alcoholic Beverages, Alcoholic Beverages, Pharmaceuticals, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Liquid Ring Vacuum Pump Market: Liquid Ring Vacuum Pump Market Size, Trends and Insights By Material (Stainless Steel, Cast Iron, Others), By End User (Automotive, Aerospace, Oil & gas, Pharmaceuticals, Chemical, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Storage Tank Market: Storage Tank Market Size, Trends and Insights By Material (Stainless Steel, Fiberglass, Concrete, Plastic), By Application (Storage of Portable Water, Rain Water Harvesting, Water Storage for Firefighting, Others), By End-use (Oil & Gas Industry, Water and Waste water Treatment, Pharmaceutical Industry, Chemical Industry, Food and Beverage Industry, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Refuse Compactor Market: Refuse Compactor Market Size, Trends and Insights By Product Type (Portable, Stationary), By Waste Type (Dry Waste, Wet Waste), By Application (Residential, Agricultural, Municipal, Commercial, Industrial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Pedestrian Bridge Market: Pedestrian Bridge Market Size, Trends and Insights By Type (Truss bridges, Beam bridges, Suspension bridges, Cable-stayed pedestrian bridges, Arch bridges), By Construction Type (New construction, Reconstruction & repair), By Material (Concrete, Steel, Composite, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Mortar Mixing Equipment Market: Mortar Mixing Equipment Market Size, Trends and Insights By Type (Diesel Mixer, Non-Tilting Mixer, Tilting Mixer, Twin Shaft Mixer, Drum Rotating Mixer), By Application (Residential, Commercial, Industrial), By Product Type (Volume 2 Tons, Volume 3 Tons, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Hydraulic Breaker Market: Hydraulic Breaker Market Size, Trends and Insights By Type (Premium, Non-Premium), By Application (Breaking Oversized Material, Trenching, Demolition, Others), By End-use Industry (Construction, Mining, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Grader Blades Market is segmented as follows:

By Type

- Flat Edges

- Serrated Edges

- Curved Edges

- Scarifier Edges

- Corrugated Edges

By Blade Length

- Up to 3ft

- 3ft to 5ft

- 5ft to 8ft

- Above 8ft

By Material

- Steel

- Carbide

- Heat Treated

- Others

By Application

- Construction

- Mining

- Snow Removal

- Road Maintenance and Development

- Agriculture

- Others

By Distribution channel

- Direct Sales

- Indirect Sales

Click Here to Get a Free Sample Report of the Global Grader Blades Market @ https://www.custommarketinsights.com/report/grader-blades-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Grader Blades Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Grader Blades Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Grader Blades Market? What Was the Capacity, Production Value, Cost and PROFIT of the Grader Blades Market?

- What Is the Current Market Status of the Grader Blades Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Grader Blades Market by Considering Applications and Types?

- What Are Projections of the Global Grader Blades Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Grader Blades Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Grader Blades Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Grader Blades Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Grader Blades Industry?

Click Here to Access a Free Sample Report of the Global Grader Blades Market @ https://www.custommarketinsights.com/report/grader-blades-market/

Reasons to Purchase Grader Blades Market Report

- Grader Blades Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Grader Blades Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Grader Blades Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Grader Blades Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Grader Blades market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Grader Blades Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/grader-blades-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Grader Blades market analysis.

- The competitive environment of current and potential participants in the Grader Blades market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Grader Blades market should find this report useful. The research will be useful to all market participants in the Grader Blades industry.

- Managers in the Grader Blades sector are interested in publishing up-to-date and projected data about the worldwide Grader Blades market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Grader Blades products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Grader Blades Market Report @ https://www.custommarketinsights.com/report/grader-blades-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Blog: https://www.moizwordpress.com

Buy this Premium Grader Blades Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/grader-blades-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Calavo Growers Stock Climbs After Q3 Results, Dividend Increase: Details

Calavo Growers, Inc. CVGW shares are climbing after the company reported its third-quarter financial results after Monday’s closing bell. Here’s a look at the details from the report.

The Details: Calavo Growers reported quarterly earnings of 57 cents per share, which beat the analyst consensus estimate of 43 cents by 32.56%. The company reported quarterly sales of $179.6 million which beat the analyst consensus estimate of $178.54 million.

Grown segment sales increased 13.3%, while Prepared segment sales decreased 2.4% and the average selling price of avocados in the Grown segment increased by 25% compared to the prior year.

Read Next: What’s Going On With GameStop Stock Ahead Of Earnings?

“Our third quarter results reflect continued momentum in our flagship avocado business,” said Lee Cole, president and CEO of Calavo Growers, Inc.

“Despite temporary industry supply disruptions from Mexico during the quarter, we generated strong financial results due to our operational flexibility and our resilient team. Although our guacamole business experienced headwinds from higher fruit input costs compared to the third quarter last year, our volume increased 7% due to our focus on growing the business. I am also pleased to share that we will be launching some exciting, innovative guacamole products during the fourth quarter.”

The company increased its cash dividend by 10 cents per share to 20 cents per share to be paid on Oct. 30, 2024, to shareholders of record on Oct. 2, 2024

CVGW Price Action: According to Benzinga Pro, Calavo Growers shares are up 8.29% after-hours at $25.99 at the time of publication Monday.

Read Also:

Photo: Courtesy of Calavo Growers, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is the Options Market Predicting a Spike in CoStar Stock?

Investors in CoStar Group, Inc. CSGP need to pay close attention to the stock based on moves in the options market lately. That is because the Jan 17, 2025 $35.00 Call had some of the highest implied volatility of all equity options today.

What is Implied Volatility?

Implied volatility shows how much movement the market is expecting in the future. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big move in one direction or the other. It could also mean there is an event coming up soon that may cause a big rally or a huge sell-off. However, implied volatility is only one piece of the puzzle when putting together an options trading strategy.

What do the Analysts Think?

Clearly, options traders are pricing in a big move for CoStar shares, but what is the fundamental picture for the company? Currently, CoStar is a Zacks Rank #3 (Hold) in the Computers – IT Services industry that ranks in the Top 25% of our Zacks Industry Rank. Over the last 60 days, no analysts have increased their earnings estimates for the current quarter, while three have dropped their estimates. The net effect has taken our Zacks Consensus Estimate for the current quarter from earnings of 18 cents per share to 16 cents in that period.

Given the way analysts feel about CoStar right now, this huge implied volatility could mean there’s a trade developing. Oftentimes, options traders look for options with high levels of implied volatility to sell premium. This is a strategy many seasoned traders use because it captures decay. At expiration, the hope for these traders is that the underlying stock does not move as much as originally expected.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Companion Diagnostic Tests in Oncology Market Size is Set to Achieve USD 17.0 Billion by 2034, with 9.5% CAGR: Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 09, 2024 (GLOBE NEWSWIRE) — The global companion diagnostic tests in oncology market (الاختبارات التشخيصية المصاحبة في سوق الأورام) is estimated to flourish at a CAGR of 9.5% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for companion diagnostic tests in oncology is estimated to reach US$ 17.0 billion by the end of 2034.

Liquid biopsy technologies are gaining traction, offering non-invasive methods to detect tumor-specific biomarkers. This approach holds promise for early cancer detection and monitoring treatment response. The incorporation of AI and machine learning algorithms enhances the interpretation of genomic data from companion diagnostic tests, improving diagnostic accuracy and personalized treatment recommendations.

Increased patient engagement and advocacy efforts are influencing market dynamics. Patients are demanding access to comprehensive genomic profiling and involvement in treatment decisions, driving demand for companion diagnostic tests. The digital transformation of healthcare systems facilitates the integration of companion diagnostic tests into electronic health records (EHRs) and clinical decision support systems, streamlining testing processes and improving accessibility.

The COVID-19 pandemic has underscored the importance of diagnostic testing and accelerated the adoption of telemedicine and remote monitoring solutions, potentially influencing the uptake of companion diagnostic tests in oncology.

Download Sample Copy of the Report: https://www.transparencymarketresearch.com/companion-diagnostic-tests-market.html

Companion Diagnostic Tests in Oncology Market: Competitive Landscape

In the dynamic realm of oncology, companion diagnostic tests play a pivotal role in guiding personalized treatment decisions. The market is fiercely competitive, with key players like Roche Diagnostics, Agilent Technologies, and Foundation Medicine dominating. Roche’s extensive CDx portfolio, including the FDA-approved Ventana assays, underscores its leadership. Agilent Technologies’ precision oncology solutions and Foundation Medicine’s comprehensive genomic profiling services pose formidable competition.

Emerging players like Guardant Health and Thermo Fisher Scientific intensify the landscape with innovative liquid biopsy and NGS technologies. This competitive environment fosters innovation, driving advancements in precision medicine and ultimately improving outcomes for cancer patients globally. Some prominent players are as follows:

- Abbott

- Hoffmann-LA Roche AG

- Genomic Health Inc.

- QIAGEN

- Agilent Technologies Inc.

- AGENDIA N.V.

- bioMérieux SA

- Illumina Inc.

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

- BioGenex

Product Portfolio

- Agendia N.V. pioneers precision oncology solutions, delivering genomic insights to optimize cancer treatment decisions. Their innovative tests, like MammaPrint® and BluePrint®, empower physicians and patients worldwide. With a commitment to personalized medicine, Agendia continues to redefine cancer care through cutting-edge molecular diagnostics.

- bioMérieux SA is a global leader in in vitro diagnostics, offering innovative solutions for infectious diseases, microbiology, and molecular diagnostics. Their advanced diagnostic technologies, including VITEK® and FilmArray®, enable healthcare professionals to make accurate and timely decisions, improving patient outcomes and public health worldwide.

- Illumina Inc. revolutionizes genomic analysis with its state-of-the-art sequencing and array technologies. As a pioneer in genomics, Illumina empowers researchers, clinicians, and consumers to unlock the potential of the genome. With a commitment to innovation and precision, Illumina drives advancements in healthcare, agriculture, and beyond.

Key Findings of the Market Report

- Next-generation Sequencing (NGS) emerges as the leading detection technique segment in the companion diagnostic tests in oncology market.

- EGFR biomarker segment leads the companion diagnostic tests in oncology market, driving targeted therapy selection for various cancers.

- Breast cancer holds the lead in the companion diagnostic tests in oncology market due to extensive research and targeted therapy developments.

Companion Diagnostic Tests in Oncology Market Growth Drivers & Trends

- Increasing integration of companion diagnostics in personalized cancer therapies drives market growth, enhancing treatment efficacy and patient outcomes.

- Growing number of targeted therapies in development necessitates companion diagnostic tests, fueling market expansion.

- Favorable regulatory landscape, with agencies endorsing CDx for targeted therapy selection, accelerates market growth and adoption.

- Innovations in genomics, liquid biopsy, and next-generation sequencing drive the evolution of companion diagnostic technologies, enhancing their accuracy and utility.

- Partnerships between diagnostic companies, pharmaceutical firms, and research institutions foster innovation and market penetration, shaping the future of oncology diagnostics.

Global Companion Diagnostic Tests in Oncology Market: Regional Profile

- North America leads the charge, boasting a robust healthcare infrastructure, favorable reimbursement policies, and a high prevalence of cancer. The region is a hotbed of innovation, with key players like Roche Diagnostics and Foundation Medicine driving advancements in CDx technology.

- Europe follows closely, with stringent regulatory frameworks and a growing emphasis on personalized medicine. The European Medicines Agency’s (EMA) endorsement of CDx further propels market growth. Strategic collaborations between pharmaceutical companies and diagnostic firms bolster market expansion.

- In the Asia Pacific, rapid economic growth, increasing healthcare expenditure, and a rising burden of cancer fuel market demand. Challenges such as regulatory complexities and limited access to advanced diagnostics hinder growth potential. Despite this, initiatives to enhance healthcare infrastructure and awareness campaigns are driving market penetration.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=4684<ype=S

Companion Diagnostic Tests in Oncology Market: Key Segments

By Detection Technique

- Protein Detection

- Immunohistochemistry

- DNA Detection

- Polymerase Chain Reaction (PCR)

- Next-generation Sequencing (NGS)

- In Situ Hybridization

- Others

By Biomarker

- EGFR

- KRAS

- HER2

- BRAF V600E

- Others

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Liver Cancer

- Melanoma

- Others

By End User

- Hospitals

- Specialty Clinics

- Diagnostic Labs

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Explore More Trending Report by Transparency Market Research:

- Wearable Heart Monitoring Devices Market – The global wearable heart monitoring devices market size (سوق أجهزة مراقبة القلب القابلة للارتداء) to hit us$ 5.8 billion, globally, by 2031, Expanding at a CAGR of 12.5% Says, Transparency Market Research

- Lactate Meter Market – The global lactate meter market size (سوق مقياس اللاكتات) was worth USD 141.3 Mn in 2022 and is expected to reach USD 299.5 Mn by 2031 with a CAGR of 8.5%.

- Metabolomics Market – The global metabolomics market (سوق الأيض) is projected to advance at a CAGR of 12.3% from 2024 to 2034 and reach more than US$ 9.5 Billion by the end of 2034.

- In-vitro Colorectal Cancer Screening Tests Market – The global In-vitro colorectal cancer screening tests market (نطاق سوق اختبارات فحص سرطان القولون والمستقيم في المختبر) is projected to grow at a CAGR of 7.1% from 2024 to 2034 and reach more than US$ 2.5 Billon by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Hewlett Packard Stock After-Hours?

Hewlett Packard Enterprise Company HPE shares are trading lower after Monday’s closing bell. The company announced it has commenced a public offering of $1.35 billion (27 million shares) of Series C mandatory convertible preferred stock.

The Details: Hewlett Packard also expects to grant the underwriters a 30-day option to purchase up to an additional $150 million (3 million shares) of preferred stock to cover over-allotments, if any.

Hewlett Packard said it intends to use the net proceeds from the offering to fund all or a portion of the consideration for the previously announced pending acquisition of Juniper Networks, Inc., to pay related fees and expenses, and, if any proceeds remain, for other general corporate purposes.

Read Next: Dell Technologies To Be Included In S&P 500: What’s Going On With The Stock?

The company said each share of preferred stock will have a liquidation preference of $50 per share, and each share will automatically convert into a number of shares of common stock on or around Sept. 1, 2027, based on the applicable conversion rate.

Hewlett Packard intends to apply to list the preferred stock on the New York Stock Exchange under the symbol “HPEPrC.”

HPE Price Action: According to Benzinga Pro, Hewlett Packard shares are down 6.08% after-hours at $16.53 at the time of publication Monday.

Read Also:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.