THE CHINA FUND, INC. RECORDS THIRD QUARTER 2023/2024 RESULTS

BOSTON, Sept. 9, 2024 /PRNewswire/ — The China Fund, Inc. CHN today announced its financial results for its third fiscal quarter ended July 31, 2024.

For the nine months ended July 31, 2024, the Fund recorded net investment income of $1,408,498 or $0.14 per share, versus net investment income of $556,690 or $0.06 per share, for the nine months ended July 31, 2023. Net realized and unrealized loss on investments and foreign currency transactions for the nine months ended July 31, 2024 was $4,133,400 or $0.42 per share, compared to net realized and unrealized gain on investments and foreign currency transactions of $35,358,192 or $3.52 per share, for the nine months ended July 31, 2023.

The Fund’s total net assets on July 31, 2024 were $114,646,675 and its net asset value per share was $11.61 based on 9,871,307 shares outstanding. A distribution of $0.0185 per share from net investment income was declared in December 2023 and paid in January 2024.

The table below provides the Fund’s total net assets, net asset value, and shares outstanding for various time periods.

|

July 31, 2024 |

October 31, 2023 |

July 31, 2023 |

|

|

Total Net Assets |

$114,646,675 |

$119,149,099 |

$145,190,141 |

|

Net Asset Value Per Share |

$11.61 |

$11.88 |

$14.44 |

|

Shares Outstanding |

9,871,307 |

10,029,955 |

10,051,449 |

The Fund is a closed-end management investment company with the objective of seeking long-term capital appreciation by investing primarily in equity securities of (i) companies for which the principal securities trading market is in the People’s Republic of China (“China“), or (ii) companies for which the principal securities trading market is outside of China, or constituting direct equity investments in companies organized outside of China, that in each case derive at least 50% of their revenues from goods and services sold or produced, or have at least 50% of their assets, in China. While the Fund is permitted to invest in direct equity investments of companies organized in China, it presently holds no such investments. Shares of the Fund are listed on the New York Stock Exchange under the ticker symbol “CHN”. The Fund’s investment manager is Matthews International Capital Management, LLC.

Past performance is not indicative of future results. You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest.

For further information regarding the Fund and the Fund’s holdings, please call (888)-CHN-CALL or visit the Fund’s website at www.chinafundinc.com.

![]() View original content:https://www.prnewswire.com/news-releases/the-china-fund-inc-records-third-quarter-20232024-results-302242468.html

View original content:https://www.prnewswire.com/news-releases/the-china-fund-inc-records-third-quarter-20232024-results-302242468.html

SOURCE The China Fund, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

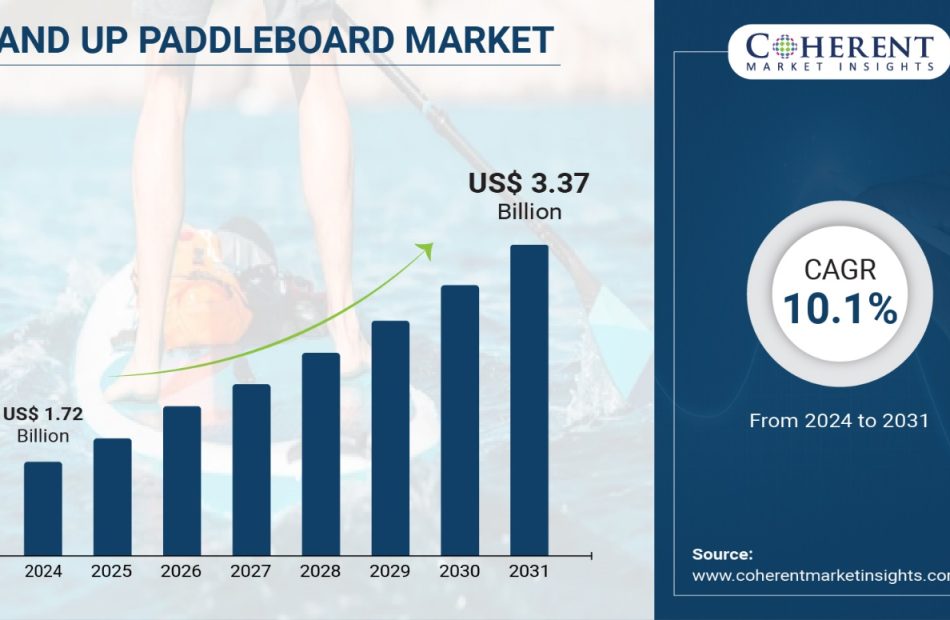

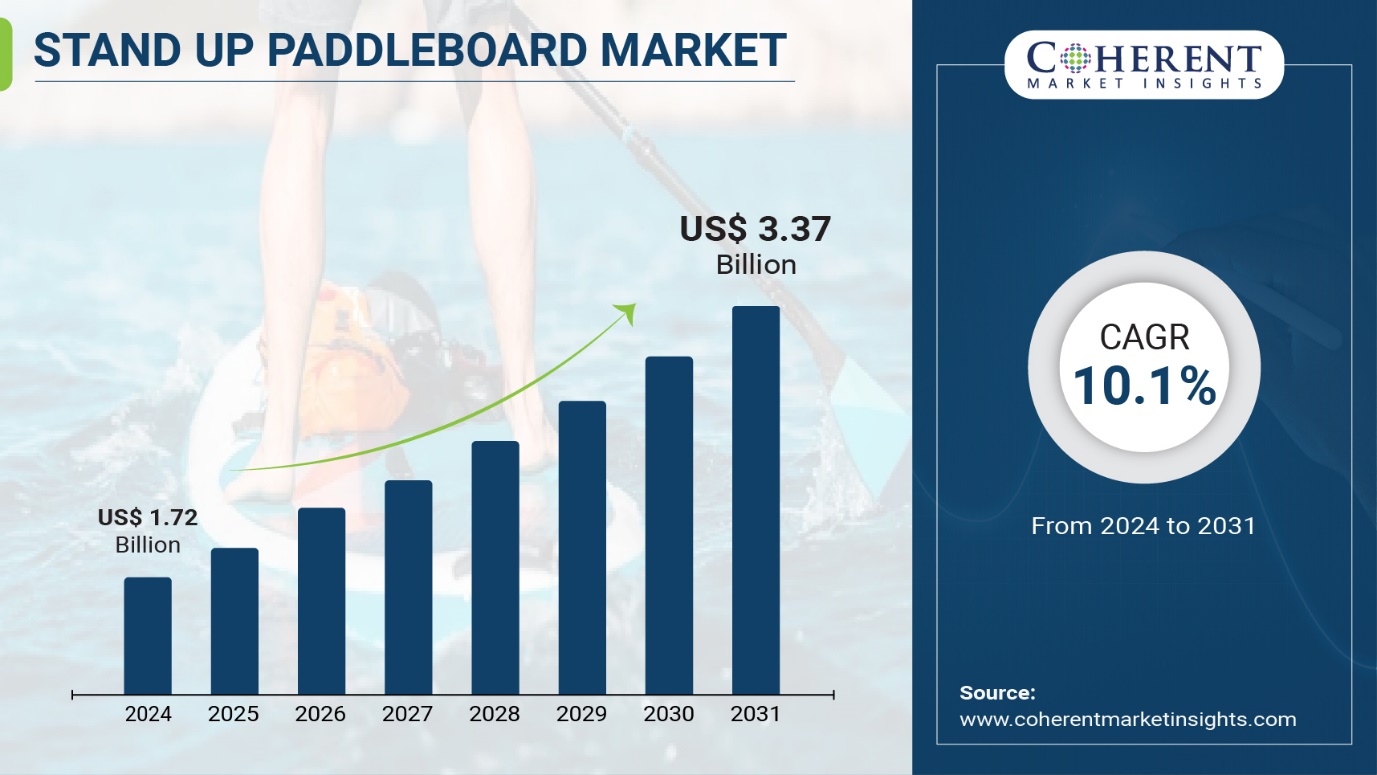

Stand Up Paddleboard Market to Hit $3.37 billion by 2028, at a CAGR of 10.1%, says Coherent Market Insights

Burlingame, Sept. 09, 2024 (GLOBE NEWSWIRE) — The global stand up paddleboard market, valued at 1.72 billion dollars in 2024, is on a trajectory of rapid expansion, with projections indicating it will soar to 3.37 billion dollars by 2031, at a Compound Annual Growth Rate (CAGR) of 10.1% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Stand up paddling provides full-body workout and is an effective low-impact exercise. It builds core strength and balance while helping reduce stress. Further, growing consumer preference for eco-friendly boards made from sustainable materials such as bamboo will also support the market expansion during the forecast period.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/6712

Market Dynamics:

The growing popularity of stand up paddleboarding among people of different age groups is fueling the market growth. Stand up paddleboarding is an engaging water sport that provides full body workout and allows people to enjoy scenic views, which is attracting young population as well as middle aged people. Furthermore, increasing tourism activities near beaches, lakes and rivers is boosting the adoption of stand up paddleboards for recreation purposes. Additionally, manufacturers are introducing innovative stand up paddleboards designed for convenience, stability and portability, which is positively impacting the market expansion.

Stand Up Paddleboard Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2023 | $1.72 billion |

| Estimated Value by 2031 | $3.37 billion |

| Growth Rate | Poised to grow at a CAGR of 10.1% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type, By Size, By Application, By Sales Channel: |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Need for Adventure and Fun Outdoor Activities • Growing Health Consciousness |

| Restraints & Challenges | • Weather Dependent Activity • Lack of Skilled and Experienced Professionals |

Market Trends:

Electric paddleboards are gaining traction in the market, thanks to advantages such as easy maneuverability and efficient battery life. Leading brands are launching electric stand up paddleboards equipped with rechargeable lithium-ion batteries to offer the fun of paddling with less effort. For instance, Starboard introduced an electric hydrofoil paddleboard called the E-Foil that uses an electric motor and hydrofoil designed for high-performance gliding experience. Furthermore, inflatable stand up paddleboards are witnessing strong demand owing to qualities like lightweight, durability and portability. Inflatable paddleboards can be easily deflated, packed and carried, making them an ideal option for travel and storage. Their growing popularity is projected to create new market opportunities over the forecast period.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/6712

The solid SUP boards segment held a market share of over 60% in 2023. Solid SUP boards are more durable and stable as compared to inflatable boards. They perform well in both calm and rough waters. Moreover, solid boards provide more control and stability to paddlers. Their rigid construction makes learning the sport easier.

The inflatable SUP boards segment is expected to witness double digit growth during the forecast period. Inflatable boards are lighter and more portable as compared to solid boards. They can be deflated and easily carried or stored. Their flexible nature makes them durable and less prone to damage. Inflatable boards are a cost-effective option for recreational users and travelers looking for a board they can pack in their car.

Key Market Takeaways:

The global stand up paddleboard market is anticipated to witness a CAGR of 10.1% during the forecast period 2024-2031, owing to the growing popularity of water sports among millennials and increasing health awareness. On the basis of type, the solid SUP board segment is expected to hold a dominant position, owing to its durability and stability. By size, the less than 9 feet segment accounts for the largest share as these boards are suitable for flatwater paddling and easy to handle.

On the basis of application, the surfing segment holds the highest market share due to the rising number of surfers globally. In terms of sales channels, the online segment dominates due to the convenient shopping experience. Regionally, North America is expected to hold a dominant position over the forecast period, due to higher consumer disposable income and growing participation in outdoor sports.

Key players operating in the stand up paddleboard market include C4 Waterman, Boardworks Surf and Sup., Cascadia Board Co., Goodhill Co., Ltd., Hobie Cat Co., Imagine Nation Sports LLC, LAIRSTANDUP, Mistral Red Dot Division B.V., Naish International, Neil Pryde Ltd., RAVE Sports, Red Paddle Co. Ltd., Starboard, SUP ATX LLC., SurfTech LLC., and Tahe Outdoors France. These companies are focusing on new product launches and mergers & acquisitions to gain a competitive edge in the market.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/6712

Detailed Segmentation:

By Type:

- Solid SUP Board

- Inflatable SUP Boards

By Size:

- Less than 9 Feet

- 9 to 12 Feet

- Greater than 12 Feet

By Application:

- Surfing

- Recreational/Touring

- Racing

- Fitness

- Others

By Sales Channel

By Region:

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Semiconductors Domain:

Depot Repair Service Market: The Global Depot Repair Service Market size was valued at US$ 29 billion in 2023 and is expected to reach US$ 45.4 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030.

Flat Flex Cable Market: The global flat flex cable market size was valued at US$ 1.47 Million in 2023 and is expected to reach US$ 3.20 Million by 2030, grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030.

Server PCB Market: The Global Server PCB Market size is expected to grow from US$ 45.22 Bn in 2023 to US$ 75.23 Bn by 2030, at a CAGR of 7.5% during the forecast period. The growth of the server PCB market is driven by the increasing demand for servers in data centers, cloud computing, and artificial intelligence (AI).

Arduino Compatible Market: The Arduino compatible Market size was valued at US$ 638.1 Million in 2023 and is expected to reach US$ 1,232.8 Million by 2030, growing at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030.

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rate Cuts Are Coming: 1 No-Brainer Cathie Wood Fintech Stock to Buy Hand Over Fist Right Now for Just $7

Two weeks ago, Wall Street and retail investors alike held their breath as Federal Reserve Chairman Jerome Powell took the stage at the Economic Symposium in Jackson Hole, Wyoming. While the investment community listened to Powell’s every word, the following remark seems to have resonated well: “The time has come for policy to adjust.”

I’m going to go out on a limb here and posit that the Fed is (finally!) going to begin reducing interest rates. Such a change to monetary policy would be welcomed by many types of businesses.

In particular, I see fintech platform SoFi (NASDAQ: SOFI) as an obvious beneficiary of lower interest rates. An integral part of Cathie Wood’s Ark Invest Management portfolio, SoFi stock has been decimated this year. After cratering 26% so far in 2024, SoFi shares currently trade for just $7.

Let’s dig into what’s going on with SoFi’s business and assess how the company is so exposed to interest rates. With changes to monetary policy looking likely, now could be a time to buy the dip in SoFi stock hand over fist.

Taking a look at SoFi’s entire business

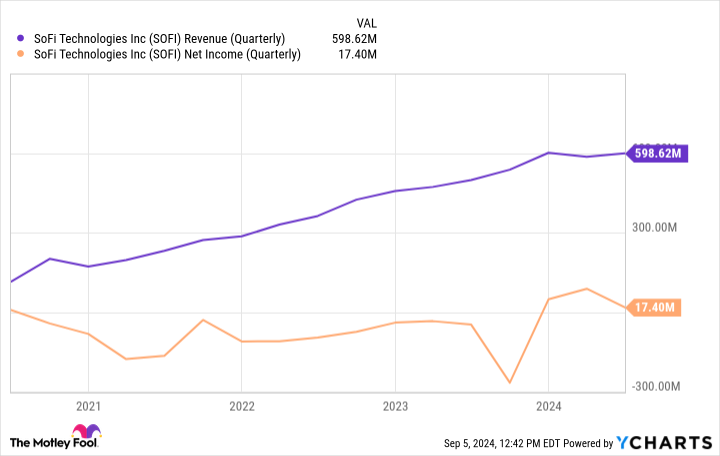

SoFi breaks its business down into three primary segments: lending, technology, and financial services. As the chart below indicates, SoFi has done an impressive job growing its revenue over the last few years. More importantly, the company has also demonstrated that it’s moved on from operating losses and is on a path to generate consistently positive net income. Pretty good stuff, right? Well, maybe not.

Despite SoFi’s overall relative strength, there is one blemish with the company’s operation. Lending services is by far SoFi’s biggest source of growth. The problem is that the lending segment has shown noticeable deceleration throughout 2024. For the six months ended June 30, SoFi’s lending business generated a total of $664 million in net revenue — only a 3% increase year over year.

I can see how slowing growth in a company’s main source of revenue wouldn’t bode well for investor confidence. I’d caution investors from hitting the panic button, though. There are still a couple of important ideas to explore before writing off SoFi’s prospects.

How would lower rates impact SoFi?

Rising interest rates don’t just make the cost of capital more expensive; they can also have a true ripple effect on the economy at large. Businesses and consumers may not be able to access loans at higher rates or will simply choose not to get a loan even if their credit meets a bank’s underwriting protocols. Considering SoFi’s largest business is lending services, it’s not too surprising to see this segment come to a screeching halt during a period of elevated interest rates.

However, given the recent remarks from Chairman Powell, I think it’s likely that the Fed is going to start lowering rates soon — and I’m not alone in this prediction. Investment banks including Goldman Sachs, Bank of America, JP Morgan, Wells Fargo, Morgan Stanley, and Citigroup are all forecasting a rate cut in September.

Lowering rates could serve as a bellwether for lending businesses. As a result, I see a Fed rate cut as a major catalyst for SoFi and one that can help supercharge the company’s performance. Specifically, I see refinancing in student loans and mortgages as well as home equity loans as three use cases that could see some rejuvenated activity for SoFi.

Now, although lower rates should theoretically inspire an uptick in lending activity, it’s important to assess the magnitude by which this dynamic impacts SoFi’s business. During the second-quarter earnings call, SoFi CEO Anthony Noto explained that when the economy eventually enters a lower interest rate environment, SoFi will still “maintain a high rate relative to our competition.” He went on to say that

as rates go down, the value of our loans generally go up, all else equal, and so we can maintain a superior APY. That doesn’t mean we may not change it. It just means it will be superior to drive our differentiated value proposition and leverage our competitive advantage.

What Noto is saying is that even when rates come down, SoFi can maintain higher coupons relative to the competition due to the company’s diversified platform, which offers users a multitude of financial-services products — with lending being just one of them. In his eyes, SoFi should witness an uptick in volume in its lending business while also maintaining strong unit economics despite reduced interest rates.

Why now looks like the time to load up on SoFi

One thing that I find interesting about SoFi’s current trading activity is that the stock has gone down during a period when the company has transitioned from consistently burning cash to enjoying a profitable enterprise. Moreover, SoFi has managed to turn consistent profits while its largest source of growth (lending) has basically remained flat. A big reason for this is that the company’s strategy to cross-sell other products and services throughout its ecosystem is paying off in spades.

At the end of June, SoFi boasted 8.8 million members on its platform — up 41% year over year. Among this user base, 12.8 million products are being utilized. This means that each SoFi member is using 1.5 services on average. This dynamic makes it easier to keep costs related to customer acquisition reasonable, while simultaneously achieving higher unit economics across the entire customer base. Still, I don’t think investors are fully appreciating this dynamic, and they have gone so far as to punish SoFi in the form of heavy stock sell-offs.

Considering rate cuts should inspire newfound activity for lending businesses at large, I would think SoFi is in a pretty solid position to witness even more accelerated growth across the top and bottom lines. In other words, I actually think SoFi’s current profitability profile is quite a bit below what it could be once the lending business returns to normal growth levels. I think the business is largely misunderstood, and investors are discounting the tailwind that rate cuts represent for future growth. For all of these reasons, I think investing in SoFi right now is a no-brainer.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in SoFi Technologies. The Motley Fool has positions in and recommends Bank of America, Goldman Sachs Group, and JPMorgan Chase. The Motley Fool has a disclosure policy.

Rate Cuts Are Coming: 1 No-Brainer Cathie Wood Fintech Stock to Buy Hand Over Fist Right Now for Just $7 was originally published by The Motley Fool

3 Stocks That Cut You a Check Each Month

Dividends are great, especially if you need income to help cover your current living expenses. But the way dividends are paid isn’t always convenient. Most dividend stocks only dish out payments once per quarter. You most likely pay your bills on a monthly basis. It would be nice if this money was coming in at the same rate it was going out.

While it’s relatively uncommon, there are some stocks that pay their dividends on a monthly rather than a quarterly schedule. Here’s a closer look at three of the better ones you may want to consider adding to your portfolio.

Realty Income

If you’re looking for a stock that pays a recurring monthly dividend, it makes sense to own a stake in a company that charges its customers on a recurring monthly basis.

Enter Realty Income (NYSE: O). It’s a real estate investment trust (REIT). That just means it owns rental real estate.

There are all sorts of REITs, specializing in everything from malls to apartment buildings to hotels to office space. Realty Income’s focus is retailing. It owns 15,450 different retail properties, 98.8% of which are currently rented out to more than 1,500 different consumer-facing companies. Its top tenants right now include Dollar General, Walgreens, and Dollar Tree, but Walmart, 7-Eleven, and FedEx are also key renters.

On the surface, it’s a concerning specialty for would-be shareholders. The retailing industry is supposedly fighting for its life, defending itself from the advent of online shopping.

However, some key players in this market will always stick around in brick-and-mortar form, with many of them being Realty Income’s tenants.

That’s what the numbers suggest, anyway. Not only is almost all of this REIT’s portfolio currently leased despite economic turbulence, it’s managed to pay a dividend every month since it was founded in 1969. Indeed, it’s not only been able to raise its full-year dividend payouts every year for the past 30 years, but it’s upped its monthly payment every three months for the past 107 quarters. Not bad.

Newcomers will be stepping into Realty Income while its forward-looking yield is just a little over 5%.

Stag Industrial

Like Realty Income, Stag Industrial (NYSE: STAG) is a REIT. Its forward-looking yield of 3.7% is also in the same ballpark as Realty Income’s, even if it’s measurably lower. It is different from Realty Income in one key way. Whereas Realty Income’s focus is on retail properties, Stag Industrial — just as the name suggests — largely owns industrial rental real estate.

The term “industrial” could be a little misleading here. The company doesn’t own a bunch of factories or production facilities. The bulk of its business and its tenants are consumer-oriented. Amazon is its biggest tenant, for instance, mostly renting warehouse space. The Coca-Cola Company is another major renter, along with FedEx. Most of its tenants use space rented from Stag Industrial for logistics, storage, delivery, and warehousing purposes.

Whatever the case, it works. As of this year’s midpoint, more than 97% of its 114.1 million square feet for rent was rented — at strong prices, too. This REIT is generating plenty of income to cover its ever-growing dividend payments. Although sometimes at a painfully slow pace, Stag’s raised its dividend payment every year since 2011. This year should be no exception.

There’s another great reason to consider stepping into a stake in Stag Industrial… a reason that’s rarely touted. That is, while REITs are well-suited for paying dividends, Stag also aims to drive meaningful price appreciation of its shares. Much of this growth will come from sales of previously purchased properties that have been developed, improved, or grown in value, or that no longer fit within its portfolio.

The strategy doesn’t always work. It works more than it doesn’t, though. Stag shares are up nearly 100% for the past decade, thanks to consistent (albeit volatile) long-term progress.

AGNC Investment

Finally, add AGNC Investment (NASDAQ: AGNC) to your list of tickers that pay a monthly dividend.

Yep, it’s another REIT, although still distinctly different than Stag or Realty Income. AGNC Investment is a mortgage REIT, meaning it buys bundles of mortgage loans — which essentially trade like bonds — facilitated by government agencies like the Federal National Mortgage Association (Fannie Mae). The quirk? It borrows money to make these purchases, paying shareholders most of the difference between what it’s got coming in every month and what’s going out.

It sounds odd at first… paying interest on borrowed money to earn interest on, well, borrowed money. Surprisingly enough, though, the model usually works. That’s because the interest costs on the short-term funds borrowed to buy bundles of long-term loans are typically lower than the interest earned on the bundled loans themselves. These are also highly leveraged purchases, so even the relatively small difference between AGNC’s borrowing costs and its return on ownership of the mortgages it owns are effectively magnified.

Usually, but not always.

As of the middle of 2022, long-term interest rates fell below short-term interest rates. You likely heard this rare phenomenon referred to as an inverted yield curve. It often happens in anticipation of economic or market weakness, marked by investors leaving stocks and plowing into anything seemingly safer.

Mortgage REITs like AGNC Investment can typically shrug it off if the yield curve doesn’t remain inverted for too long. This curve remained inverted for a couple of years, wreaking havoc on AGNC’s business model in the meantime. That’s the chief reason this stock’s been such a poor performer since then.

The yield curve is no longer inverted, and if the impending rate cuts work as expected, the yield curve will remain uninverted as demand for mortgage loans is rekindled. That’s exactly what AGNC and its shareholders want to see.

AGNC Investment’s projected dividend yield stands at an incredible 14% right now, but don’t get too excited. That could easily change as the economic backdrop evolves. That’s why this REIT shouldn’t be your first or only monthly dividend stock.

If you’ve got room for a little uncertainty and inconsistency among your dividend-paying holdings, this above-average yield may well be worth the risk.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

James Brumley has positions in Coca-Cola. The Motley Fool has positions in and recommends FedEx, Realty Income, Stag Industrial, and Walmart. The Motley Fool has a disclosure policy.

3 Stocks That Cut You a Check Each Month was originally published by The Motley Fool

FIVE FRAUD ALERT: Five Below, Inc. has been Sued for Securities Fraud – Contact BFA Law by September 30 if You Suffered Losses on Your Investment (Nasdaq:FIVE)

NEW YORK, Sept. 09, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Five Below, Inc. FIVE and certain of the Company’s senior executives.

If you invested in Five Below, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/five-below-inc.

Investors have until September 30, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Five Below securities. The case is pending in the U.S. District Court for the Eastern District of Pennsylvania and is captioned Himes v. Five Below, Inc., No. 2:24-cv-3638.

What is the Lawsuit About?

The complaint alleges that Five Below operates specialty discount stores, and prices most of its products at $5 or less. The complaint further alleges that during the relevant period, the company misrepresented its accelerating store traffic, merchandising opportunities and store expansions that underpinned its long-term growth. In truth, Five Below had allegedly experienced macroeconomic pressures that dented its store traffic and interfered with the successful execution of the company’s business.

On June 5, 2024, Five Below is alleged to have revealed that macroeconomic pressures caused lower income customers to reduce their spending, leading to disappointing financial results for the company’s first quarter of 2024. Still, Five Below assured investors that “chasing trends has always been a strength of ours, and we will continue to quickly identify and capitalize on trends.” Despite the assurance, the news caused the price of Five Below stock to decline about 10%, from $132.79 per share on June 5, 2024 to $118.72 per share on June 6, 2024.

After the market closed on July 16, 2024, Five Below announced that CEO Joel Anderson resigned as President and CEO, and as a member of the Board of Directors, effective immediately. At the same time, the company reported that the quarter-to-date results for its second quarter of fiscal 2024 showed that comparable sales decreased 5% over the prior year. As a result, Five Below also announced that sales for the full quarter would be in the range of $820 million – $860 million and that comparable sales would decline approximately 6%-7%. This news caused a significant 25% decline in the price of Five Below stock, from $102.07 per share on July 16, 2024 to $76.50 per share on July 17, 2024.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/five-below-inc.

What Can You Do?

If you invested in Five Below, you have rights and are encouraged to submit your information to speak with an attorney.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The Firm will seek court approval for any potential fees and expenses. Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/five-below-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/five-below-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

WATERFRONT RESTAURANT BLUE ANCHOR BAR + KITCHEN NOW OPEN IN NEWPORT

Elevated Seafood Restaurant Joins Diverse Culinary Scene

in Thriving Jersey City Neighborhood

NEWPORT, N.J., Sept. 9, 2024 /PRNewswire/ — LeFrak Commercial, Newport Associates Development Company and the owners of Downtown Brooklyn’s beloved Japanese restaurant Teppan Territory today announced the opening of Blue Anchor Bar + Kitchen, the newest culinary offering to debut in Jersey City’s waterfront neighborhood, Newport. The new seafood restaurant located on River Drive inside residential building The Beach offers an elevated dining option that enhances the neighborhood’s vibrant food scene.

“We’re thrilled to be part of the beautiful Newport neighborhood, an energetic community that offers a flourishing, innovative culinary scene created by the best of local and national chefs and restauranteurs,” said Chris Kong, partner and co-owner of Blue Anchor Bar + Kitchen. “Blue Anchor offers a new kind of dining experience and we’re eager for the local community to dive into our menu and enjoy the flavors we are so passionate about.”

Encompassing over 2,200 square feet, Blue Anchor Bar + Kitchen brings a full-service restaurant and bar, complete with patio seating overlooking the Hudson River and New York skyline, to Newport. The elevated menu features fresh, locally sourced seafood, including lobster rolls, a raw bar and other seasonal offerings, complemented by a curated selection of wines and craft cocktails. Blue Anchor will also be serving a brunch menu on the weekends. Blue Anchor is located at 166 River Drive on the ground floor of The Beach, a waterfront residential tower overlooking Newport Green.

Blue Anchor is a joint venture between restauranteurs Chris Kong, Admen Kong, Alan Lau, Johnny Leung and Kelvin Yiu, partners at Teppan Territory, an authentic Japanese teppanyaki-style restaurant in Downtown Brooklyn. Leung is also a partner in Newport’s celebrated Komegashi Too sushi restaurant.

“Over the past few years, Newport has solidified itself as a go-to food scene for local residents, office workers and even New Yorkers,” said Ray Kawas, director of commercial leasing for LeFrak. “We’re excited to welcome Blue Anchor Bar + Kitchen to the neighborhood and share this new waterfront dining experience with the Newport community.”

Newport has established a new hotspot for food lovers with a growing number of successful restaurants opening in recent years, including the renowned Ruth’s Chris Steak House, famed waterfront dining venue Batello, sushi restaurant Komegashi Too, upscale American eatery Fire & Oak, Mexican restaurant Los Cuernos, Chinese restaurant Dun Huang, Greek restaurant Efi’s Gyro and more.

Spanning 600 acres along the Hudson River, Newport is a vibrant live-work-play community with 16 residential buildings and eight state-of-the-art office towers that provide eight million square feet of office space for major employers. In addition to stunning water and skyline views and easy access to Manhattan, Newport is sought after for its diverse lifestyle amenities, including the sports and wellness offerings at Newport Swim & Fitness, shopping at Newport Centre Mall and The Newport River Market, recreation at Newport Green and year-round community programming, such as summer pickleball courts and annual holiday events.

For additional information on Newport, please visit https://www.newportnj.com/. For more information on Blue Anchor Bar + Kitchen, please visit www.blueanchorjc.com or follow on Instagram at @blueanchorjc.

About LeFrak

LeFrak is a preeminent, family-owned property company committed to community development and long-term ownership. LeFrak affiliates own and manage an extensive portfolio of real property concentrated in the New York/New Jersey metropolitan area, as well as South Florida, Los Angeles and throughout the West Coast. Through its affiliated companies, LeFrak has developed and built the majority of its real estate portfolio and is one of the world’s leading property firms. The firm is acclaimed around the globe for the quality of its projects and its properties, its financial strength and conservatism, its entrepreneurial business model and its commitment to long term ownership. Although primarily focused on the residential and office sectors, LeFrak affiliates also invest in numerous hospitality, retail assets, securities, private businesses and energy. www.lefrak.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/waterfront-restaurant-blue-anchor-bar–kitchen-now-open-in-newport-302242146.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/waterfront-restaurant-blue-anchor-bar–kitchen-now-open-in-newport-302242146.html

SOURCE Newport Associates Development Company

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oracle Stock Climbs On Strong Q1 Results, Partnerships With Google Cloud, AWS

Oracle Corporation ORCL reported its first-quarter financial results after Monday’s closing bell. Here’s a look at the details from the report.

The Details: Oracle reported quarterly earnings of $1.39 per share, which beat the analyst consensus estimate of $1.32 by 5.3%. Quarterly revenue came in at $13.307 billion, beating the consensus estimate of $13.231 billion and representing a 6.86% increase over the same period last year.

- Cloud Infrastructure (IaaS) revenue was $2.2 billion, up 45%.

- Cloud Application (SaaS) revenue was $3.5 billion, up 10%.

- Fusion Cloud ERP (SaaS) revenue of $900 million grew 16% in the quarter.

- NetSuite Cloud ERP (SaaS) revenue was $900 million billion, up 20%.

- Total Remaining Performance Obligations rose 53% to $99 billion in the first quarter.

Read Next: What’s Going On With GameStop Stock Ahead Of Earnings?

“As Cloud Services became Oracle’s largest business, both our operating income and earnings per share growth accelerated,” said Oracle CEO Safra Catz.

“Non-GAAP operating income was up 14% in constant currency to $5.7 billion, and non-GAAP EPS was up 18% in constant currency to $1.39 in Q1. RPO was up 53% from last year to a record $99 billion,” Catz noted.

“That strong contract backlog will increase revenue growth throughout FY25. But the biggest news of all was signing a MultiCloud agreement with AWS — including our latest technology Exadata hardware and Version 23ai of our database software — embedded into AWS cloud datacenters. AWS customers will get easy and convenient access to the Oracle database when we go live in December later this year,” Catz added.

The company will host a conference call at 5 p.m. ET on Monday to discuss the results.

Oracle and Amazon.com, Inc.’s AMZN AWS announced the launch of Oracle Database@AWS, a new offering that allows customers to access Oracle Autonomous Database on dedicated infrastructure and Oracle Exadata Database Service within AWS. The companies said Oracle Database@AWS will provide customers with a unified experience between Oracle Cloud Infrastructure (OCI) and AWS.

Oracle and Alphabet, Inc.’s GOOGL GOOG Google Cloud also announced the general availability of Oracle Database@Google Cloud in four Google Cloud regions across the U.S. and Europe. Customers will now be able to run Oracle Exadata Database Service, Oracle Autonomous Database, and Oracle Database Zero Data Loss Autonomous Recovery Service on Oracle Cloud Infrastructure (OCI) in Google Cloud datacenters across U.S. East (Ashburn, Va.), U.S. West (Salt Lake City, Utah), U.K. South (London), and Germany Central (Frankfurt), expanding to more regions in the coming months across North America, Europe, the Middle East, Africa, Asia Pacific and Latin America.

ORCL Price Action: According to Benzinga Pro, Oracle shares are up 9.25% in after-hours trading at $152.83 at the time of publication Monday.

Read Also:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

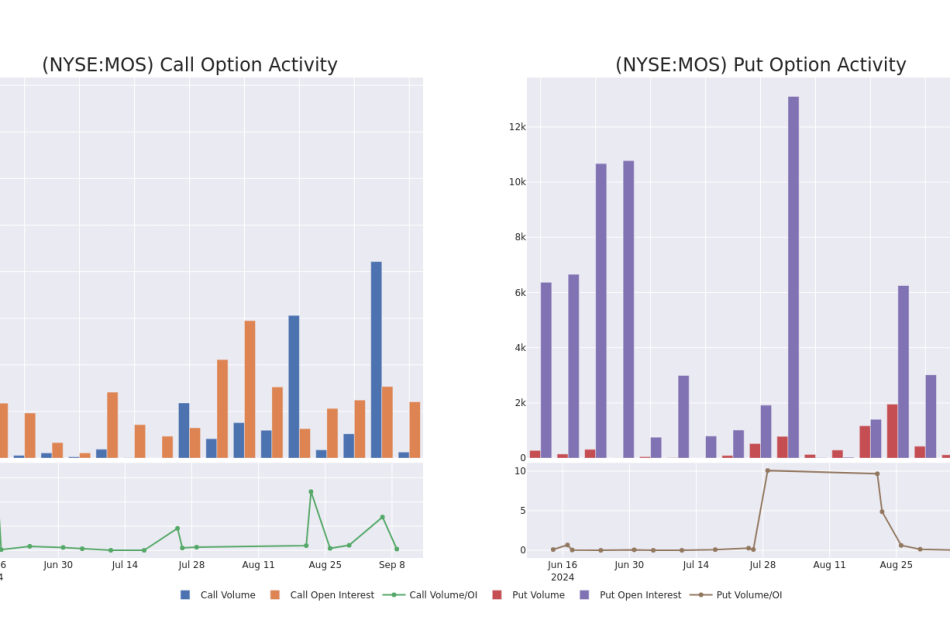

Unpacking the Latest Options Trading Trends in Mosaic

Investors with a lot of money to spend have taken a bearish stance on Mosaic MOS.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with MOS, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Mosaic.

This isn’t normal.

The overall sentiment of these big-money traders is split between 22% bullish and 55%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $519,614, and 2 are calls, for a total amount of $74,270.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $32.5 for Mosaic over the recent three months.

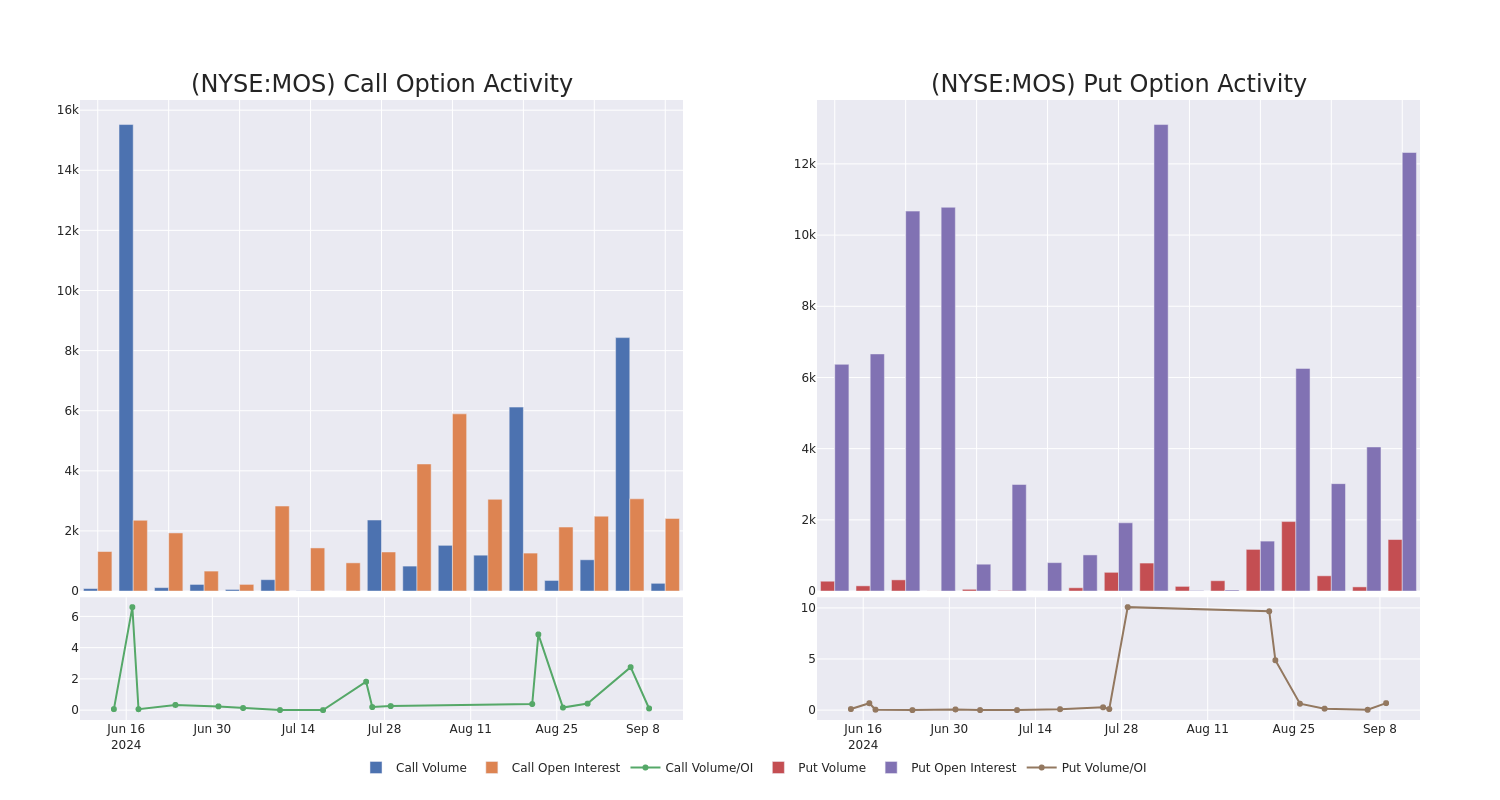

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Mosaic’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Mosaic’s whale activity within a strike price range from $20.0 to $32.5 in the last 30 days.

Mosaic 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MOS | PUT | SWEEP | BEARISH | 01/17/25 | $3.25 | $3.15 | $3.25 | $27.25 | $203.4K | 4.2K | 0 |

| MOS | PUT | SWEEP | BEARISH | 06/20/25 | $2.8 | $2.8 | $2.8 | $25.00 | $113.9K | 2.3K | 407 |

| MOS | PUT | TRADE | BULLISH | 03/21/25 | $7.6 | $7.45 | $7.5 | $32.50 | $63.7K | 371 | 89 |

| MOS | CALL | TRADE | BEARISH | 12/20/24 | $2.32 | $2.3 | $2.3 | $25.00 | $45.7K | 2.4K | 207 |

| MOS | PUT | SWEEP | BEARISH | 01/17/25 | $3.35 | $3.2 | $3.35 | $27.25 | $38.8K | 4.2K | 626 |

About Mosaic

Formed in 2004 by the combination of IMC Global and Cargill’s fertilizer business, Mosaic is one of the largest phosphate and potash producers in the world. The company’s assets include phosphate rock mines in Florida, Brazil, and Peru and potash mines in Saskatchewan, New Mexico, and Brazil. Mosaic also runs a large fertilizer distribution operation in Brazil through its Mosiac Fertilizantes business, which the company acquired from Vale in 2018.

Present Market Standing of Mosaic

- With a trading volume of 4,258,531, the price of MOS is down by -2.03%, reaching $25.06.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 57 days from now.

Expert Opinions on Mosaic

In the last month, 2 experts released ratings on this stock with an average target price of $31.0.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Mosaic, targeting a price of $32.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $30.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Mosaic options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bank Of America Warns Energy Could Be 'Cheap For A Reason,' Highlights Utilities As Defensive Play

Bank of America has reshuffled its sector outlooks, raising Utilities to “overweight” while downgrading Energy to “market-weight.”

The changes come as elevated volatility and policy uncertainty drive a recalibration of investment strategies. According to Savita Subramanian, Bank of America’s head of U.S. equity strategy, the shifting economic and political landscape has altered the risk-reward profiles of these key sectors.

Utilities: Defensive Hedge With Growth Potential

Subramanian argues that Utilities, as tracked by the Utilities Select Sector SPDR Fund XLU, long regarded as a defensive sector, have become increasingly attractive in the current rate environment.

As economic uncertainty persists, utilities offer stable fundamentals and a built-in defensive hedge against inflation.

One of the core factors behind the Bank of America’s upgrade is their higher dividend yield, which has become more appealing given the revised outlook for interest rates.

Bank of America economists now predict terminal interest rates will reach 3.25% by 2025, lower than previous expectations, and this environment is favorable for income-generating assets like utilities.

Further boosting the outlook for utilities is their exposure to artificial intelligence (AI) technologies. As companies in the sector begin to integrate AI for efficiency and operational improvements, there could be longer-term growth opportunities that hadn’t been factored in before, the analyst says.

Utilities are now benefiting from AI in ways that enhance productivity, making them not just a defensive play but also an indirect AI beneficiary, she adds.

Energy: From Value To Value Trap?

In contrast, Bank of America’s downgrade of the Energy sector, as tracked by the Energy Select Sector SPDR Fund XLE, comes amid concerns over political risk and weakening fundamentals.

Although energy companies have improved in terms of quality and discipline compared to prior cycles, the sector faces rising uncertainty that could undermine its stability.

Subramanian warns that the supply discipline that has supported oil prices could start to unravel if the political environment changes. This coincides with Bank of America’s commodity strategists lowering their oil price forecasts, casting doubt on the sector’s growth prospects.

“Energy stocks might look cheap, but they could be ‘cheap for a reason,’” she notes.

One of the most worrying signals is the sector’s earnings revisions: Energy now holds the “most negative earnings revision ratio of all sectors,” indicating that analysts are increasingly pessimistic about future earnings growth.

Moreover, Energy’s strong performance in recent years could turn into a liability if the political winds shift. Regulatory pressures, including potential changes in drilling policies and climate regulations, are key risks that could weigh heavily on the sector’s outlook.

Avoiding The Tech Dip: Underweight Information Technology

Bank of America remains cautious on the beaten-down Information Technology sector, maintaining its “underweight” rating, despite arguments that the recent selloff has created a buying opportunity.

Subramanian highlights that Tech stocks still trade at record valuations, particularly in terms of enterprise value to sales (EV/Sales), making the sector vulnerable to further downside.

“Technology is cyclical, not secular,” Subramanian asserts, meaning that its performance is closely tied to broader economic trends, not immune to them as some investors might hope.

Another concern is the upcoming changes in Standard & Poor’s index cap rules, which are likely to impact the largest Tech names. These changes could introduce concentration risk, leading to passive selling that could pressure some of the sector’s mega-cap stocks.

Read now:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.