Last Call For SNDL's Liquor President: Stock On The Rocks Amid Leadership Changes

SNDL Inc. SNDL announced on Tuesday that Taranvir “Tank” Vander, president of its Liquor Division, is stepping down after two decades of leadership in the liquor industry. Vander, who began his career as a liquor store manager in the early 2000s, is retiring to pursue new opportunities.

In 2013, Vander founded Ace Liquor Corporation, expanding it to 15 stores. In 2019, he joined forces with Alcanna Inc., helping it become one of Canada’s largest liquor retailers. Zachary George, CEO of SNDL, thanked Vander for his contributions. “We want to thank Tank for his exceptional leadership and wish him continued success in his future endeavors.”

Navroop Sandhawalia, VP of finance for Liquor Retail at SNDL, will take over as interim president of the liquor division while the company searches for a permanent replacement.

Get Benzinga’s exclusive analysis and top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

SNDL Stock Performance Compared To Other Canadian Cannabis Companies

After the market closed on Tuesday, September 10, 2024, SNDL experienced a slight dip in its stock price, closing at $2.10, down 0.47%. Trading volume for SNDL reached 1,697,281 shares, reflecting continued investor activity as the company transitions leadership in its Liquor Division.

In comparison, other notable Canadian cannabis stocks also saw mixed results:

- Aurora Cannabis ACB closed at $5.55, down 1.56%, with 568,615 shares traded. Despite a lower percentage drop than SNDL, Aurora’s stock showed greater volatility with a day high of $5.90 and a low of $5.55.

- OrganiGram Holdings OGI fared slightly better, closing at $1.83, up 1.1%. The stock saw a trading volume of 297,194 shares, indicating moderate investor interest.

- Tilray Brands TLRY closed at $1.69, down 0.59%, with a significant trading volume of 18,592,650 shares, reflecting heightened activity compared to other stocks.

- High Tide HITI showed positive momentum, increasing by 3.3% to close at $2.13, with 447,671 shares traded, positioning it among the stronger performers in the sector today.

- Canopy Growth CGC closed at $4.84, down 1.03%, with a volume of 2,777,417 shares. Despite the decline, Canopy saw considerable trading activity, suggesting continued investor engagement.

Overall, SNDL’s performance was relatively stable compared to its peers, with many Canadian cannabis stocks experiencing minor fluctuations throughout the trading day. The trading volumes across the sector reflected ongoing interest but no significant market shifts following the day’s developments.

Read Next: Cannabis Flower? No, Thanks: Canadians Shift To Pre-Rolls & Vapes As Market Eyes C$5.47B

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pennybacker Expands Capital Formation Team with Appointment of Carey Doyle, Managing Director

AUSTIN, Texas, Sept. 9, 2024 /PRNewswire/ — Pennybacker Capital Management, LLC (Pennybacker), a leading real assets investment manager, has appointed Carey Doyle as Managing Director, Capital Formation, effective Sept. 3. In this new role, Doyle will spearhead capital formation efforts across the east region of the United States and Canada and will be based in the firm’s New York office.

Before joining Pennybacker, Doyle served as a Director at Lazard, leading capital formation efforts in the central U.S. region across multiple real asset strategies. She brings over 15 years of experience to Pennybacker, specializing in U.S. private equity real estate and real assets capital formation.

Doyle previously held various senior roles at Park Madison Partners, Macquarie (formerly GLL Real Estate Partners), and Cushman & Wakefield.

“We are dedicated to expanding and enhancing our capital formation team,” said Andrew Knox, Head of Capital Formation at Austin, Texas-based Pennybacker. “Carey brings a wealth of knowledge in real assets and has extensive experience working with limited partners.”

Tim Berry, Chief Executive Officer, Founder, and Co-Chief Investment Officer, added: “We have known Carey for many years and are thrilled to welcome her to the Pennybacker team. Her addition strengthens our commitment to advancing the firm and complements several recent strategic hires within our capital formation team.”

About Pennybacker

Pennybacker Capital Management, LLC (Pennybacker) is a real assets investment manager based in Austin, Texas with offices in Charlotte, North Carolina, Dallas, Denver, and New York. With approximately $4 billion in assets under management, the firm pursues real estate and infrastructure strategies through closed-end and open-ended vehicles across the capital structure. For more information, visit https://www.pennybackercap.com

Media Contact:

Newton Park PR, LLC

Margaret Kirch Cohen/Richard Chimberg

margaret@newtonparkpr.com

(+1) 847 507 2229

rich@newtonparkpr.com

(+1) 617 312 4281

![]() View original content:https://www.prnewswire.com/news-releases/pennybacker-expands-capital-formation-team-with-appointment-of-carey-doyle-managing-director-302242276.html

View original content:https://www.prnewswire.com/news-releases/pennybacker-expands-capital-formation-team-with-appointment-of-carey-doyle-managing-director-302242276.html

SOURCE Pennybacker Capital Management, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

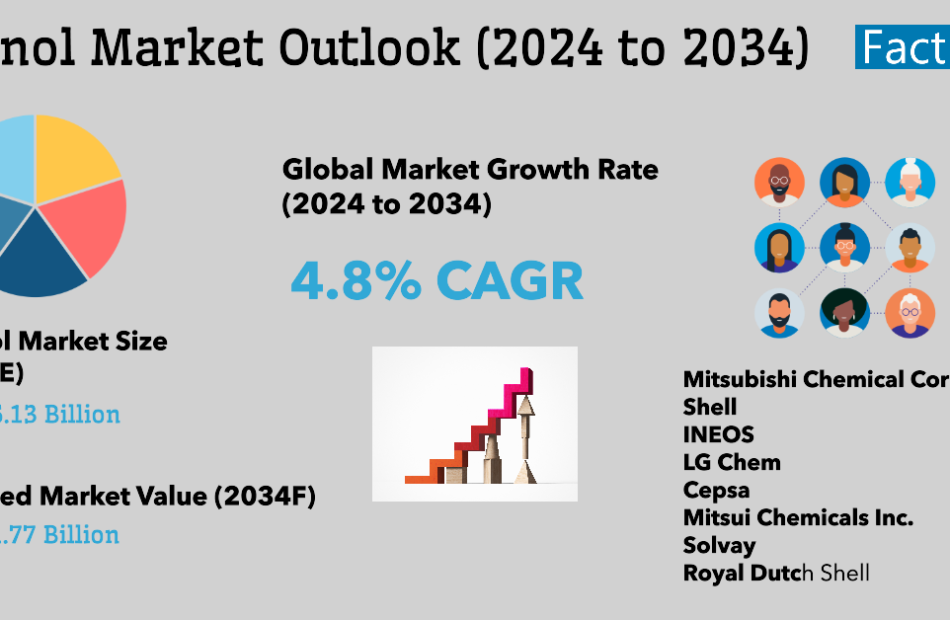

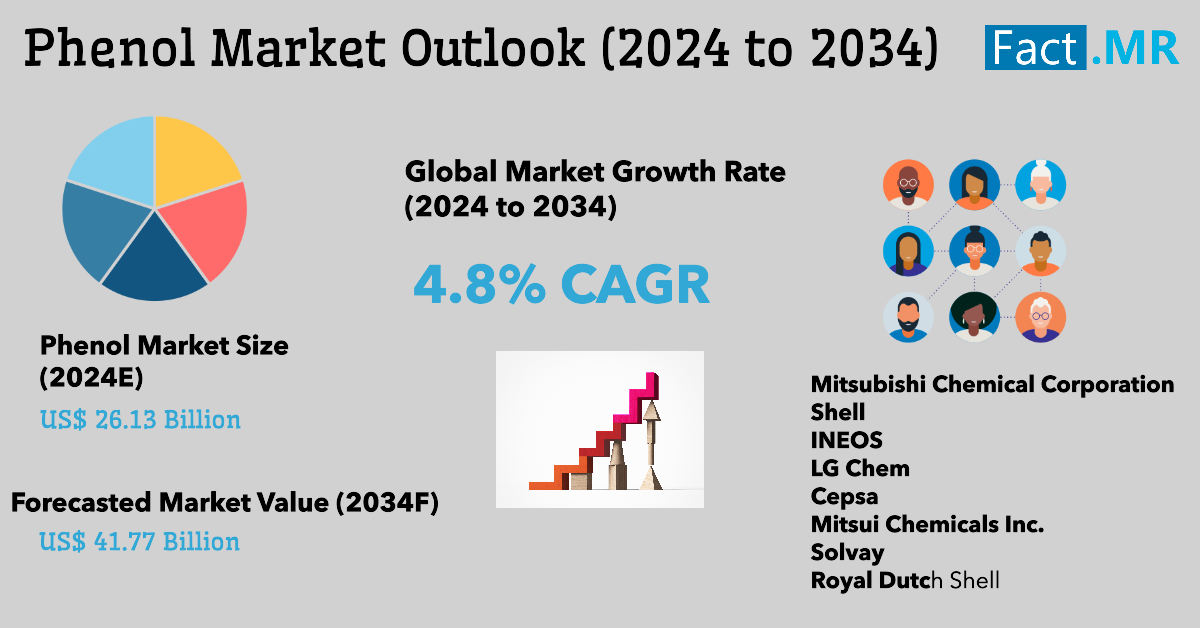

Phenol Market is Set to Surge at 4.8% CAGR, Reach US$ 41.77 Billion by 2034 | Fact.MR Report

Rockville, MD, Sept. 10, 2024 (GLOBE NEWSWIRE) — Strong demand for phenol in the pharmaceutical sector, where it is used to produce medications such as disinfectants, slimicides, and antiseptics, is complementing market growth. The global Phenol Market has been calculated at a value of US$ 26.13 billion in 2024 and is forecasted to advance at a CAGR of 4.8% from 2024 to 2034.

Substantial investments by industry giants in research and analysis are contributing to the growth of the phenol market. These investments are aimed at uncovering breakthroughs and further market acceleration over the coming years.

Phenol helps relieve irritation and aids in skin cleansing. Moreover, phenol is also used as an oral analgesic in products such as Chloraseptic to treat conditions such as pharyngitis. Phenol is widely used in a surgical procedure called phenolization to treat ingrown toenails.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9993

Key Takeaways from Market Study:

- The global phenol market is projected to expand at a CAGR of 4.8% through 2034.

- Global sales of phenol are estimated at US$ 26.13 billion in 2024.

- The market is forecasted to reach US$ 41.77 billion by 2034-end.

- The North American market is forecasted to expand at a CAGR of 4.9% through 2034.

- The PPO/orhtooxylenol production segment is estimated to account for a 31% market share in 2024.

- East Asia is projected to account for 38.4% share of the global market by 2034.

“Phenol market growth is being fueled by its crucial role in chemical and pharmaceutical production, extensive use in medicine and phenolic resin production, and significance in the electrical sector,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Phenol Market:

Key players in the phenol market such as Mitsubishi Chemical Corporation, Shell, and INEOS are keeping a strong eye on their quality checks considering the toxicity of their products.

Competitive Landscape:

Leading manufacturers of phenol such as Shell, INEOS, and Mitsubishi Chemical Corporation are closely monitoring their quality inspections. These important market players are searching for new opportunities to grow and are now looking for ways to improve the quality of their products even further to strengthen their position.

Country-specific Analysis:

The automotive sector makes extensive use of phenolic resins and its derivatives, such polycarbonate, because of their exceptional durability and heat resistance. Heating iron and steel is a step in the car manufacturing process that may necessitate the use of phenol to improve component durability.

Because of their mechanical robustness, phenolic resins find employment in a wide range of applications, including filters, separators, varnishes, and laminates. The automotive industry in the United States is strong, with leading companies constantly striving to improve the efficacy and efficiency of their offerings.

Phenol Industry News:

- Mitsubishi Corporation and South Pole partnered in May 2021 to produce and market carbon credits produced by carbon removal technologies.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=9993

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the phenol market for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on manufacturing process (cumene phenol manufacturing process, Dow phenol manufacturing process, Raschig-Hooker phenol manufacturing process) and end use (bisphenol-A production, phenol formaldehyde resin production, nylon-KA oil production, PPO/orthooxylenol production, alkyl phenol production), across six major regions of the world (North America, Latin America, Europe, East Asia, South Asia & Oceania, and MEA).

Key Segments of Phenol Market Research:

By Manufacturing Process :

- Cumene Phenol Manufacturing Process

- Dow Phenol Manufacturing Process

- Raschig-Hooker Phenol Manufacturing Process

By End User :

- Bisphenol-A Production

- Phenol-Formaldehyde Resin Production

- Nylon-KA Oil Production

- Alkyl Phenol Production

- Phenol for PPO/Orthooxylenol Production

Check out More Related Studies Published by Fact.MR:

9 Decanoic Acid Methyl Ester Market: Size is valued at US$ 246.0 million in 2024 and has been forecast to expand at a noteworthy CAGR of 6.7% to end up at US$ 470.6 million by 2034.

Home Care Chemical Market: Share is projected to reach a value of US$ 23.75 billion in 2024, according to a newly published study by Fact.MR. Worldwide sales of home care chemicals have been forecasted to climb at a CAGR of 4.9% and reach US$ 38.32 billion by 2034.

White Spirit Market: Size is estimated at US$ 7.56 billion in 2024 and has been forecasted to increase at a CAGR of 4.2% to climb to US$ 11.4 billion by the end of 2034.

Advanced Phase Change Material Market: Size is projected to advance at a CAGR of 14.8% and climb to a value of US$ 15.04 billion by 2034.

Glycerin Market: Size is projected to reach US$ 24.64 billion in 2024, as stated in a newly published Fact.MR report. The global glycerin market has been forecasted to expand at 6.9% CAGR and climb to a value of US$ 48.03 billion by the end of the assessment period (2024 to 2034).

Pulp and Paper Processing Chemical Market: Size is estimated at a value of US$ 28.16 billion in 2024 and is forecasted to ascend to US$ 57.49 billion by the end of 2034. Worldwide sales of pulp and paper processing chemicals are evaluated to rise at 7.4% CAGR from 2024 to 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If You Bought 1 Share of Broadcom at Its IPO, Here's How Many Shares You Would Own Now

You don’t have to study stock charts daily to know that artificial intelligence (AI) stocks have been all the rage for the past couple of years. The market’s voracious appetite for semiconductor stocks, in particular, has resulted in shares of leading manufacturers like Broadcom (NASDAQ: AVGO) soaring in value.

But exactly how much have early investors in Broadcom benefited from the growing enthusiasm for AI stock? A lot. Those who clicked the buy button on Broadcom stock when it debuted on the public markets in August 2009 have seen their investments soar in value. An investment of $1,000 at the time of the company’s IPO would now be worth about $85,000. Investors have also seen their number of shares increase in quantity thanks to its stock split.

After only one stock split, investors have considerably more shares in their portfolios

While there are some semiconductor stalwarts that have completed several stock splits over the years — I’m looking at you, Nvidia — Broadcom has split its stock on only one occasion. And it happened recently. In July, Broadcom executed a 10-for-1 stock split. The math, consequently, is extraordinarily simple. If you purchased a single share of Broadcom stock when it held its IPO, you now have 10 shares sitting in your brokerage account.

With shares priced at about $140, it’s likely that management doesn’t see another stock split even remotely visible on the horizon.

Is now the time to load up on Broadcom stock?

Whether today represents a good opportunity to bulk up on Broadcom stock is a source of considerable debate. The company reported solid third-quarter 2024 financial results, including year-over-year increases of 47% and 42% for revenue and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), respectively, and it issued auspicious guidance. However, the stock is trading at a rich valuation, changing hands at about 114 times trailing earnings and 28 times operating cash flow.

For investors hesitant to buy Broadcom stock due to its valuation, an artificial intelligence ETF that counts the stock among its holdings may be a better option.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

If You Bought 1 Share of Broadcom at Its IPO, Here’s How Many Shares You Would Own Now was originally published by The Motley Fool

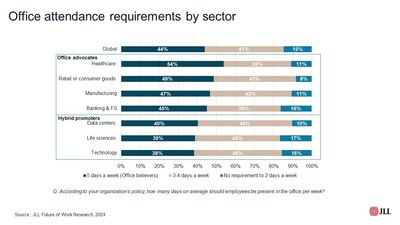

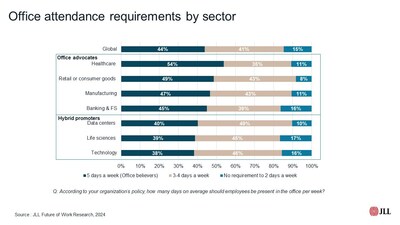

Business leaders look to increase real estate investment but expect smarter use of portfolio

JLL’s Future of Work Survey uncovers new opportunities for corporate real estate as two-thirds of business leaders expect their CRE budget to increase between now and 2030

CHICAGO, Sept. 9, 2024 /PRNewswire/ — Despite the challenging commercial real estate landscape and mixed economic environment, global business leaders are bullish on the future, with two-thirds (65%) expecting their CRE budgets to increase between now and 2030, as revealed in JLL’s JLL Future of Work survey. The biennial, global survey explores the evolving world of work by assessing the key priorities, challenges and strategies that are top of mind for more than 2,300 business and CRE decision makers.

This year’s findings are unveiled through a series of articles exploring key areas of focus for corporate real estate teams: Managing the implications of shifting work patterns; Partnering with the C-suite to support CRE investment; Identifying CRE activities for ‘AI copiloting’; Moving from ambition to action on sustainability commitments; and Defining the future-fit CRE function. The first two articles, launched today, dive into the effects of shifting work patterns on workplace expectations, and what the changing world of work means for the way the CRE function operates as more than 64% of leaders expect to increase and rebalance their headcount by 2030, in an attempt to recruit the right skills for the future.

“Since our 2022 survey, the CRE landscape has become increasingly complex and dynamic, evolving toward better office use. We see that in these results, and in our conversations with clients,” said Neil Murray, Global CEO, Work Dynamics, JLL. “Looking ahead, business and CRE leaders working to drive talent and efficiency throughout their organization must consider the unique needs of their organization, and leverage tools such as tech, AI, and upskilling, as well as strategic partnerships across the value chain to enable the CRE function to reach its full potential as a powerful agent of transformation.”

Competing visions on the most efficient workstyles create renewed CRE challenges

Business leaders are mainly focused on three corporate goals over the next five years: growing revenue through expansion and M&A (57%), attracting and retaining talent (53%) and achieving organizational efficiency (54%). However, the juxtaposition that lies between driving revenue growth through top talent and increasing efficiency requires leaders to delicately balance priorities and assess the role of offices as places that enable employees to deliver their best work.

Strong momentum toward office-based work since 2022 has brought forth expectations among respondents to increase use of office space (62%), where more than half of leaders plan to grow their total footprint over the next five years. Today, 44% of organizations are considered “office advocates,” who would like to see staff in the office five days a week – as compared to 2022, when just 34% of employees were working in the office full time. Hybrid work is here to stay, but the office is central to work again. Today, 85% of organizations have a policy of at least three days of office attendance per week, and 43% expect the number of in-office days to increase by 2030.

Globally, hybrid work is more likely to take place at large organizations in EMEA, where hybrid workstyles are considered a key part of the employee value proposition, and largely in sectors including e-commerce, energy & renewables, technology and life sciences. Office advocates alternatively tend to be small-to-medium sized companies in APAC or the Americas, across sectors such as healthcare, retail and manufacturing. Beyond those big trends, the reality is often more complex, with different workstyles coexisting within many organizations.

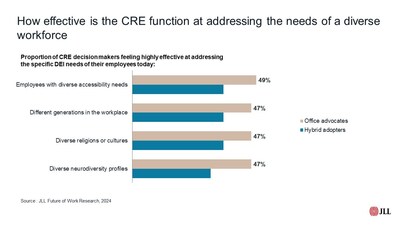

Today’s office advocates also make a concerted effort to address diverse workplace needs – they are more focused on making accessible workplaces (49% vs. 36% of hybrid adopters), tailored to meet the needs of different generations, cultures, and neurodiversity specificities, and may even pay a premium to occupy buildings with leading health and wellbeing credentials. With office attendance may also come new opportunities for compensation and career advancement– more than a third (39%) of respondents could envision introducing different pay and benefits to employees who attend the office regularly.

“The future of work looks different across companies and regions, reflecting the unique nature of organizations and employee needs. It keeps shifting and requires building evolutionary office programs and spaces, able to adapt to continuous changes in the workstyles,” said Cynthia Kantor, CEO, Project & Development Services, JLL. “Globally, as CRE budgets and footprints receive new investment, the corporate real estate function must effectively partner with the C-suite to demonstrate the desired value.”

The corporate real estate function can serve as a powerful agent of transformation, particularly with the use of technology, AI and the support of strategic partners

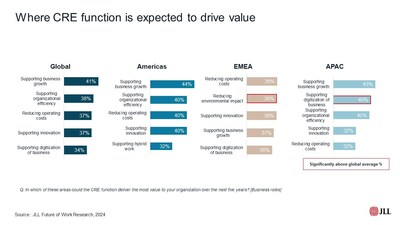

The value the corporate real estate function can deliver will vary depending on the needs of the organization and regional priorities. Globally, business leaders believe CRE can add the most value by supporting business growth (41%), enabling organizational efficiency (38%) and reducing operating costs (37%). Environmental, social and governance (ESG) factors are also an area in which the CRE function is expected to add value, especially in EMEA. Organizations in the Americas are more likely to expect CRE to support business growth, innovation and efficiency, while companies in Asia Pacific are more focused on digitization.

These varying expectations around value require agility throughout CRE functions, in a context where 41% of CRE decision makers report challenges with thinking and investing for the long term due to the pace of organizational change. The same percentage believe CRE is perceived as a cost center, rather than a value driver. Identifying the right metrics and ways to demonstrate value, in addition to strengthening relationships with the C-suite, will ensure CRE is more integrated into the wider business and positioned to quickly adapt to changing priorities – 46% of CRE leaders say influencing and leadership will be critical skills in the future.

Technology is also emerging with greater impacts for CRE, as more decision-makers expect to report to business transformation or technology by 2030. CRE leaders believe that 70% of their activities will be at least partially supported through the use of AI by 2030, and a quarter of the CRE function could be initially completed through automation – freeing up time for more strategic work. Nearly two-thirds (62%) of decision makers see technology and AI adoption as critical for enhancing the value that CRE delivers in the future. A ‘future fit’ CRE team should focus on high value-add tasks internally, while automation and AI take on routine and repetitive tasks and outsourcing partners are brought in for specialist tasks and individual projects.

About JLL

For over 200 years, JLL JLL, a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 110,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Contact: Allison Heraty

Phone: +1 312 228 3128

Email: Allison.Heraty@jll.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/business-leaders-look-to-increase-real-estate-investment-but-expect-smarter-use-of-portfolio-302242353.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/business-leaders-look-to-increase-real-estate-investment-but-expect-smarter-use-of-portfolio-302242353.html

SOURCE JLL

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Fed backpedals—and unveils a scaled-back proposal for bank capital requirements

The Federal Reserve unveiled plans that would massively scale back a proposal to raise capital requirements for banks after politicians and the banking industry pushed back on the initial plan, warning it could restrict lending and hurt the economy.

The new proposal would increase capital levels for big banks like JPMorgan Chase (JPM) and Bank of America (BAC) by 9% in aggregate, down by half from the original plan from more than a year ago, which set the capital increase to around 19% for those institutions.

Banks with assets between $100 billion and $250 billion, which were initially subject to the stricter standards of the largest banks, would also no longer be subject to the increases — other than the requirement to recognize unrealized gains and losses of their securities portfolios in regulatory capital. This a major reversal following the string of regional bank failures last year that was touched off by Silicon Valley Bank.

“Capital has costs too,” Fed Vice Chair for Supervision Michael Barr said Tuesday at an event in Washington hosted by the Brookings Institution. “As compared to debt, capital is a more expensive source of funding to the bank. Thus, higher capital requirements can raise the cost of funding to a bank, and the bank can pass higher costs on to households, businesses, and clients engaged in a range of financial activities.”

Read more: How do banks make money?

Barr defended the change to largely exclude banks with assets between $100 billion and $250 billion from the capital requirements of the largest banks — but for the unrealized losses on securities in capital requirements. He said he felt that addressed the heart of the issue seen with Silicon Valley Bank, a bank that failed because of poor interest rate risk management.

He also emphasized that the backpedaling for the capital requirements for the smaller subset of banks stemmed from their feeling that extra capital wouldn’t impact their safety.

“Do we really need them to go through all of the process of creating new systems to comply with this new capital rule when there’s no capital impact on how safe they are,” Barr said. “That didn’t seem like a trade-off worth making.”

The new version of this plan, known as Basel III endgame, comes after months of anticipation after Fed Chair Jerome Powell said as far back as March that the central bank sought “broad material changes” to the initial proposal and was looking to secure a consensus from the Federal Reserve board.

When it was first released more than a year ago, the capital plan was met with immediate disagreement and division among Fed officials, who questioned whether the plan could actually do more harm than good in its initial form.

Fed governor Michelle Bowman argued that the plan needed “substantive changes” and that an increase in capital requirements at the scale proposed by regulators could significantly harm the economy. Fed governor Chris Waller also argued the plan needed a major overhaul.

Barr said the changes reflect the feedback the Fed received from the public, improve the tiering of the proposal, and better reflect risks. Barr said the Fed worked “hand in glove” with the FDIC and the Office of the Comptroller for the Currency for “many, many months” on the new proposed rules. He also said he spent a lot of time working with his Fed colleagues on the board in developing this proposal.

“I do expect it will have broad support,” when asked whether the Fed board supports the re-proposal.

In his speech, he stressed that the new plans are far from final and that the Fed, along with the Office of the Comptroller for the Currency and FDIC, “have not made final decisions on any aspect of the re-proposals, including those that are not explicitly addressed in the re-proposal.”

“This is an interim step,” he said.

The Fed is putting the new proposal out for comment. The comment period will last 60 days. After that, whenever the Fed finalizes the rule, banks will have a year before implementation begins, and then there will be a phase-in period for all the provisions.

The comment period, which was initially set for Nov. 30 of last year after being proposed in July 2023, was extended to January 2024 following letters submitted by banks to the Fed listing the many problems they had with the rules along with an aggressive lobbying effort.

Among the top concerns was that the Fed’s proposed capital requirements would make costs of several banking activities, from residential mortgage and small business lending to trading, more expensive with such a dynamic potentially embedding higher costs into economic activity.

JPMorgan CEO Jamie Dimon even argued the capital plan could cause inflation to rise by way of increasing capital requirements for hedging, which will trickle down to consumers in the form of higher prices for everything from a can of soda to meat products.

Read more: What is inflation, and how does it affect you?

The proposed changes unveiled Thursday are part of an effort by bank regulators to follow through on the US version of an international accord known as Basel III, which was developed by the Basel Committee on Banking Supervision.

The goal of the Basel committee, which was convened by the Bank for International Settlements in Basel, Switzerland, was to set global regulatory capital standards so that banks would have enough in reserves to cover unforeseen losses and survive crises.

Bank regulators across the US, UK, and Europe began rolling out the last version of this accord following the 2007 to 2009 global financial crisis. It was agreed to in 2017, but in the US, the proposal was delayed by the COVID-19 pandemic.

Europe and the UK have each moved forward with adopting capital cushion increases in the single digits and are now in the implementation phases.

Bar also said that the Fed is looking at the agency’s large bank stress tests, another measuring stick for how regulators set bank capital cushions in the event of severe market shocks.

“We are attentive to the interactions across all components of our capital framework as well as the combined burden and benefits, and we take these issues seriously,” Barr added.

Though the revised plans may not be final yet, they will play a significant role in overall bank earnings and how much lenders can give back capital to shareholders.

“That’s going to be an important factor as we think about how much more we want to do and when in the way of [stock] buybacks,” Citigroup CFO Mark Mason said Monday at a conference in New York.

If the full proposal comes out in September, “expect banks to comment on how much their excess capital will increase vs. current rule during October earnings calls,” Morgan Stanley analyst Betsy Graseck said in a Tuesday note.

This post was updated to reflect breaking news developments.

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas in finance.

Jennifer Schonberger is a veteran financial journalist covering markets, the economy, and investing. At Yahoo Finance she covers the Federal Reserve, cryptocurrencies, and the intersection of business and politics. Follow her on X @Jenniferisms.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Jim Cramer Says AES Is 'Very Inexpensive', Recommends Buying This Industrial Stock

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said recommended buying Vertiv Holdings Co VRT, saying it has “come down enough.”

On July 24, Vertiv said second-quarter net sales rose 13% Y/Y to $1.953 billion, beating the consensus of $1.939 billion. Organic orders (excluding foreign exchange) rose 57% Y/Y in the quarter. The book-to-bill ratio stood at 1.4x in the quarter.

AES AES is “good,” Cramer said. “It’s very inexpensive, let’s go for it.”

On Aug. 1, AES reported mixed financial results for the second quarter. AES reported quarterly earnings of 38 cents per share which beat the analyst consensus estimate of 37 cents per share. The company reported quarterly sales of $2.94 billion which missed the analyst consensus estimate of $3.19 billion.

When asked about NextEra Energy NEE, “I don’t get this. I’ve got to find out what’s the truth, and then we’ll come back with a more considerate opinion.”

On Sept. 3, Wells Fargo analyst Neil Kalton maintained NextEra Energy with an Overweight and raised the price target from $95 to $102.

“That stock really does have me very concerned,” Cramer said when asked about Hertz Global Holdings, Inc. HTZ.

On Aug. 1, Hertz reported second-quarter revenue of $2.4 billion, missing the consensus estimate of $2.46 billion, according to estimates from Benzinga Pro. The company reported an adjusted earnings loss of $1.44 per share, missing analyst estimates for a loss of 90 cents per share.

Price Action:

- AES shares gained 0.1% to settle at $16.20 on Monday.

- NextEra Energy shares rose 1.5% to close at $81.19 during Monday’s session.

- Vertiv shares gained 3.8% to close at $74.48 during Monday’s session.

- Hertz gained 4.1% to settle at $2.82 during the session.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bispecific Antibody Drug Conjugates Mechanism of Action In Cancer Therapy

Delhi, Sept. 10, 2024 (GLOBE NEWSWIRE) — Global Bispecific Antibody Drug Conjugates Clinical Trials Patents Commercial Opportunity Insight Report Highlights:

- Report Answers Question On Why There Exist Need For Bispecific Antibody Drug Conjugates

- Insight On More Than 60 Bispecific Antibody Drug Conjugates In Clinical Trials

- Bispecific Antibody Drug Conjugates Clinical Trials Insight By Company, Country, Indication & Phase

- Bispecific Antibody Drug Conjugates In Combination Therapy By Indication & Clinical Phase

- Key Companies Involved In Development Of Bispecific Antibody Drug Conjugates

Download Report: https://www.kuickresearch.com/ccformF.php?t=1725598917

The mechanism of bispecific antibody drug conjugates in cancer treatment represents a sophisticated and highly targeted approach to combatting malignancies. These antibodies are designed with two distinct binding sites, allowing them to simultaneously engage with two different antigens. This dual-targeting mechanism provides a level of precision that significantly enhances their effectiveness in cancer therapy. By specifically binding to both cancer cells and immune cells or other relevant cellular components, bispecific antibody drug conjugates can trigger direct tumor cell killing while minimizing damage to healthy tissues.

At the core of their mechanism, bispecific antibodies are designed to bind to tumor-associated antigens (TAAs) on cancer cells, which serve as a marker for malignant tissue. These antigens are often proteins overexpressed on the surface of cancer cells, making them an ideal target for therapies. The other binding site of the bispecific antibody is typically directed toward immune cells, such as T cells or natural killer (NK) cells, which are then recruited to the tumor site. This dual-binding capacity creates a bridge between the cancer cells and immune cells, facilitating immune-mediated killing of the cancerous cells.

One of the most common bispecific antibody formats used in cancer treatment involves T-cell engagers (BiTEs), which bind to both a T cell receptor (CD3) and a tumor antigen, such as CD19 or HER2. Upon binding, the bispecific antibody brings the T cells into close proximity with the tumor cells, activating the T cells to release cytotoxic molecules, such as perforin and granzymes, that lead to the destruction of the tumor cell. This immune-mediated killing mechanism is highly effective, as it leverages the body’s natural defense mechanisms to target and destroy cancer cells without relying on external cytotoxic agents.

Another key mechanism by which bispecific antibody drug conjugates operate is through the delivery of cytotoxic payloads directly to the tumor site. In these cases, the bispecific antibody is conjugated to a small molecule drug or toxin that is released upon binding to the cancer cell. The antibody’s dual-targeting capability ensures that the cytotoxic agent is delivered specifically to the tumor, reducing the risk of systemic toxicity. Once the bispecific antibody binds to the tumor-associated antigen, the cytotoxic payload is internalized by the cancer cell, leading to its destruction from within. This targeted delivery system is particularly beneficial in solid tumors, where traditional chemotherapy often results in widespread damage to healthy tissues.

The mechanism of bispecific antibody drug conjugates is also evolving to target multiple antigens simultaneously. Tumor heterogeneity, where different cells within the same tumor express different antigens, is a major challenge in cancer treatment. By designing bispecific antibodies that can recognize multiple tumor antigens, researchers hope to improve the coverage of the tumor and reduce the likelihood of resistance. This multi-targeting approach is expected to be particularly useful in cancers that are prone to rapid genetic mutations or that exhibit significant diversity in antigen expression.

In addition to engaging the immune system, bispecific antibody drug conjugates can also disrupt key signaling pathways that are essential for tumor survival. By binding to receptors or ligands that promote cancer cell growth and proliferation, bispecific antibodies can inhibit these pathways and trigger tumor cell death. This mechanism is particularly effective in cancers that rely on specific growth factors or signalling molecules to sustain their rapid proliferation.

Overall, the mechanism of bispecific antibody drug conjugates in cancer treatment represents a significant advancement in targeted therapy. By simultaneously targeting cancer cells and engaging the immune system, these drugs offer a highly effective and precise method of killing tumor cells. As research in this area continues to advance, bispecific antibody drug conjugates are expected to play an increasingly important role in the treatment of various cancers, offering new hope to patients with previously untreatable malignancies.

Neeraj Chawla Research Head Kuick Research neeraj@kuickresearch.com https://www.kuickresearch.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rubrik Reports Q2 Results, Joins Ionis Pharmaceuticals, Hewlett Packard Enterprise And Other Big Stocks Moving Lower In Tuesday's Pre-Market Session

U.S. stock futures were slightly lower this morning, with the Dow futures falling around 0.1% on Tuesday.

Shares of Rubrik, Inc. RBRK fell sharply in today’s pre-market trading after reporting second-quarter results.

Rubrik reported quarterly losses of 40 cents per share which beat the analyst consensus estimate of losses of 49 cents. Quarterly sales came in at $204.951 million, which beat the analyst consensus estimate of $196.209 million by 4.46%.

Rubrik shares dipped 8.1% to $29.45 in pre-market trading.

Here are some big stocks recording losses in today’s pre-market trading session.

- Ionis Pharmaceuticals Inc IONS declined 7% to $ 44.98 in pre-market trading. Ionis priced its $500.3 million public offering of 11.5 million common shares at $43.50/share.

- Applied Digital Corporation APLD shares dipped 6.2% to $6.17 in pre-market trading after jumping 45% on Monday.

- VNET Group Inc – ADR VNET shares fell 5.4% to $2.63 in pre-market trading.

- Hewlett Packard Enterprise Company HPE shares fell 5.2% to $16.69 in pre-market trading. The company announced it has commenced a public offering of $1.35 billion (27 million shares) of Series C mandatory convertible preferred stock.

- Extreme Networks, Inc. EXTR shares fell 4.6% to $13.00 in pre-market trading.

- PureTech Health plc PRTC shares fell 3.5% to $19.99 in pre-market trading after gaining 6% on Monday.

- Dropbox Inc DBX shares slipped 2.7% to $22.51 in pre-market trading.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed to cut rates by 25 basis points on Sept. 18, twice more in 2024: Reuters poll

By Indradip Ghosh

BENGALURU (Reuters) – The Federal Reserve will lower interest rates by 25 basis points at each of the U.S. central bank’s three remaining policy meetings in 2024, according to a majority of economists in a Reuters poll that found only nine of 101 expected a half-percentage-point cut next week.

With inflation approaching the Fed’s 2% target and some signs of an economic slowdown, policymakers have made it clear “the time has come” to start reducing the federal funds rate, which has been held in the 5.25%-5.50% range since July 2023.

After the release on Friday of a mixed jobs report for August, interest rate futures contracts briefly priced in more than a 50% chance of a half-percentage-point cut next week, but the chances have narrowed to about one in four. Rate markets are still pricing in more than 100 basis points of cuts this year.

Remarks from New York Fed President John Williams and Fed Governor Christopher Waller late last week also did not signal any support among policymakers for an outsized rate cut this month.

A strong majority of economists in the Sept. 6-10 poll, 92 of 101, expect a 25-basis-point cut when the U.S. central bank’s Federal Open Market Committee (FOMC) concludes its two-day meeting next week.

“The employment report was soft but not disastrous. On Friday, both Williams and Waller failed to offer explicit guidance on the pressing question of 25 basis points vs. 50 on Sept. 18, but both offered a relatively benign assessment of the economy, which points strongly, in my view, to a 25-basis-point cut,” said Stephen Stanley, chief U.S. economist at Santander.

Among primary dealers surveyed, Santander has provided the most consistent end-year rate forecast throughout 2024, predicting 50 basis points of cuts in total in each Reuters poll up until July, when it switched to 75 basis points.

Fifty-four of 71 economists polled said a 50-basis-point cut at any of the Fed’s remaining meetings this year was unlikely, including five who said it was very unlikely. The other 13 said such a move was very likely, with four saying very likely.

“If the Fed were to cut by 50 bp in September, we think markets would take that as an admission it is behind the curve and needs to move to an accommodative stance, not just get back to neutral,” said Aditya Bhave, senior U.S. economist at Bank of America.

A majority of economists polled by Reuters since May have been calling for two Fed rate cuts this year, but the number increased to three last month.

Some economists have argued the reductions in borrowing costs will be aimed not at responding to an ailing economy, but instead to reduce the amount of policy restriction as inflation falls toward the Fed’s target.

ECONOMIC EXPANSION

The median probability of a recession in the latest poll was just 30%, a figure little changed all year, despite recent concerns in financial markets about a possible economic contraction.

After its meeting next week, the Fed will deliver two more 25-basis-point rate cuts this year – in November and December – according to 65 of 95 economists. That was up from 55 of 101 last month.

Among 19 primary dealers polled, 11 expected the Fed to deliver a total of 75 basis points of rate cuts this year.

The U.S. economy, which grew at an annualized pace of 3.0% in the second quarter, is expected to expand at or faster than what Fed officials currently see as the non-inflationary growth rate of 1.8% over the coming years, according to median forecasts in the poll.

The unemployment rate was forecast to remain at around the current 4.2% through the end of 2026. Personal consumption expenditures (PCE) price index inflation – the Fed’s preferred gauge – was expected to hit the 2% target in the first quarter of 2025.

(Other stories from the Reuters global economic poll)

(Reporting by Indradip Ghosh; Polling by Purujit Arun; Editing by Ross Finley and Paul Simao)