‘The price is an insult. Not getting over it, ever’: The iPhone 16 starts at $799 — and it’s not exciting enough for an upgrade

It’s crazy — on the one hand, we want sustainability and to preserve the world for our kids, but on the other hand, we replace perfectly good products on a yearly basis.

iPhone Owner

Dear iPhone Owner,

Viva la revolución! Dónde está la revolución?

I’d like to celebrate the new iPhone 16, but like you, I’m wondering, ‘Where is the revolution?’ Whatever happened to it? The average iPhone owner holds on to their device for three-plus years, but I’m hanging on to my cracked, ugly iPhone 12 for as long as it lasts. After Apple officially launched the new iPhone at an event at the company’s headquarters in Cupertino, Calif., on Monday, I realized most people won’t keep their old iPhone is not to save the planet. They might, however, for other reasons.

Amid all the pontification about the latest features on the iPhone 16, most people have other things to worry about — notably the price. Prices start at $799 and go as high as $1,599 for the iPhone 16 Pro Max. That’s a month’s rent for the average American. As another reader wrote to the Moneyist: “Sorry, Apple. I am holding on to my original iPhone SE. I just can’t pay for something that will irritate me every time I see the screen … The price is an insult. Not getting over it, ever.” (Not everyone agrees.)

It’s hard to blame politicians for rising prices only to fork out $799 for yet another iPhone. Where is Apple’s next blockbuster product? Sure, the iPhone 16 will be powered by a new “A18 Bionic” chip, integrate artificial intelligence into its camera control, feature 85% recycled content in its enclosure and use an ultrawide camera for automatic focus that will be able to take better pictures in darker environments. The new chip will be 60% faster than my iPhone 12’s central processing unit.

It’s cool to hold on to something until it’s on its last legs. Just like it’s uncool to adopt a pet, only to return it.

Americans in 2024 don’t need a brand to tell them who they are. Inflation does that to a person. Remember those lines for the latest iPhone in the early years of the device? Did you feel envious that those lucky ducks would be the first to experience the joys of the latest model? Or did you, as I did, feel sorry for them and think — however uncharitably — “Don’t you have anything better going on in your life than standing in line for a smartphone?” That’s how I feel today.

Is it because I’m a cynical, jaded European who is devoid of the optimism and consumerism of the New World? Perhaps, but I’m not the only one who feels this way. Writing on MarketWatch, Cody Willard, the chief investment officer at 10,000 Days Capital Management and the publisher of TradingWithCody.com, says Apple AAPL must grow its ecosystem and show the same revolutionary culture that led to the Mac, the iPod, iTunes, iPhone and iPad.

As I wrote last month: From Tesla TSLA cars and Nike NKE sneakers to Stanley water cups, we live in an upgrade culture. I try not to follow trends. I wear dead men’s shoes, after all: Yes, I have bought leather uppers in a thrift store. (They were handmade and in exquisite condition.) But I was out with friends recently and somebody commented on my pathetic, broken iPhone 12. I braced for judgment, but then he showed his own battered iPhone with pride. His smile was one of solidarity.

Related: Was Apple’s iPhone 16 event a dud? There’s underrated good news for investors.

Weakening brand loyalty

Peer pressure is operating the other way. It’s cool to hold on to something until it’s on its last legs. Just as it’s uncool to adopt a pet during a pandemic — only to return it. Waiting to trade up is a sign of good character. If you couldn’t care less whether you have the latest and greatest iPhone, it shows that your values lie elsewhere. Just swap out the battery. Meanwhile, the advertising industry preys on our insecurities to sell us everything from anti-aging cream to the latest fashions.

McKinsey & Co.’s State of the Consumer: 2024 report found that what consumers want is changing. “Weakened brand loyalty, affordability over sustainability, and heightened interest in wellness products and services reflect the preferences and priorities of consumers across ages and geographies,” the report said. Apple CEO Tim Cook knows this: Walks in the park with your aging parents are helped by — and are even more fun because of — the iOS Health infomatics app.

Chief among the consumer trends was brand exploration. “When they couldn’t find exactly what they needed because of pandemic-era supply chain disruptions, roughly half of consumers switched products or brands,” McKinsey says. “That behavioral change has proved quite sticky: consumers continue to be open to exploring alternatives, and brand loyalty is fading across demographic groups.” (Apple loyalty, to be fair, is high compared to other brands.)

Amid the pontification about the new iPhone, most people have other things to worry about — notably the price.

But the trending tide is turning. In “advanced markets,” McKinsey says, over a third of consumers have tried different brands, and approximately 40% have switched retailers in search of deals. “Inflation and economic uncertainty are almost certainly inducing this behavior,” the researchers say. Those advanced markets include the U.S., France, Germany, Italy, Spain, the United Kingdom, Canada, South Korea, Japan, Australia and the Netherlands.

Apple is pitching its products to a new generation that is less likely to stand in line for the joy of holding the latest gadget. “This weakening of brand loyalty is not limited to a specific age group,” McKinsey adds. “In the past, older consumers remained consistently loyal to their preferred brands, but today, they’re just as likely to embrace new brands and retailers. In Europe and the United States, Gen Zers and millennials are only slightly more likely than older consumers to trade down to lower-priced brands and retailers.”

Tim Cook, naturally, holds a strong hand: Apple, along with your favorite toothpaste, bank and football team, is among the stickiest of brands in America. Once you’re locked into the technological ecosystem, the minty-fresh flavor that reminds you of your childhood, the sports fandom, the financial network and the memories of supporting your local team with your father, that’s a hard habit to break. You can add Netflix NFLX, Spotify SPOT and Tinder MTCH to that list.

It will take a revolutionary device for me to open my wallet.

The Moneyist regrets he cannot respond to letters individually.

More columns from Quentin Fottrell:

Check out The Moneyist’s private Facebook group, where members help answer life’s thorniest money issues. Post your questions, or weigh in on the latest Moneyist columns.

By emailing your questions to The Moneyist or posting your dilemmas on The Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Is It Time To Buy Or Sell ExxonMobil Stock As Ends Losing Streak?

ExxonMobil (XOM) rose nearly 3% Monday to break a five-day losing streak. Can XOM stock reclaim the throne of the energy industry?

↑

X

How To Trade Options: Choosing The Right Strategy For Best Results

The stock is in a cup-with-handle base and bumped up to its 50-day moving average after sinking below it in sympathy with lower crude oil prices in early September. The stock climbed Monday as oil prices rose on threats that tropical storm Francine is headed toward the southern U.S. crude oil prices climbed around 1.5% Monday.

Exxon Fights For Oil Fields In Guyana

The company continues its fight for an oil-rich field in Guyana owned by Hess (HES). Hess shareholders approved the acquisition of the company by Chevron (CVX) on May 28.

The $53 billion stock deal includes the 30% stake that Hess owns in the prime Guyana oil fields. Exxon and China National Offshore Oil Corporation, or CNOOC Group, claim they have a right to provide a counteroffer to Hess for the Guyana offshore oil operation project.

The potential counteroffer prompted Chevron to alert investors that it may not go through with the acquisition of Hess “within the time frame the company anticipates or at all.”

Crude Oil Prices Influence XOM Stock

Energy companies made up less than 4% of the S&P 500 as of July 2024. And Chevron continues to battle ExxonMobil for leadership of the energy industry, as do foreign oil giants such as Shell (SHEL) and BP (BP).

Crude oil prices are coming off a 15-month low reached on Friday. The average price of gasoline across the U.S. on Monday was $3.27 per gallon vs. $3.82 one year ago, according to AAA data. West Texas Intermediate (WTI) oil prices dipped 1.5% to $68.71 a barrel on Monday.

Natural gas prices soared after the Russia-Ukraine war erupted then plunged to a low in April. Prices rallied to a high in early June before reversing sharply.

Earnings Turnaround Looks To Be Over

Exxon reported higher-than-expected adjusted second-quarter earnings and higher sales than views on Aug. 2.

Adjusted EPS rose 10% from the prior year to $2.14 per share, after four straight quarters of declining earnings growth. Meanwhile sales increased 12% to $93.1 billion following five consecutive quarters of falling sales.

The oil giant had been one of one of America’s most profitable companies but Exxon lost its edge when its earnings and sales started dropping. It reported a total of six straight quarters of slowing or declining profits before the current turnaround.

FactSet estimates, however, show the improvement will be short-lived: Analysts expect third-quarter profit to drop 7% and 15% in Q4.

Sales are projected to increase 6% in the third quarter followed by 10% and 7% growth in the following two periods. Analysts lowered their 2024 EPS expectations to $8.50, or an 11% drop, with a rise to $9.11 in 2025, according to MarketSurge.

XOM stock’s Composite Rating weakened to a suboptimal 64 while its EPS Rating is 83 out of 99.

The stock holds an Accumulation/Distribution Rating of D-, indicating fairly heavy institutional selling over the last 13 weeks. The stock’s annualized dividend yield is around 3.3%.

XOM Stock Technical Analysis

ExxonMobil stock is in an early stage cup-with-handle base with a 120.50 buy point. The stock broke out of a saucer base with a 120.70 buy point on April 5, but the stock reversed lower within days of the breakout. That started the current base.

XOM stock tested the 120 level in August, a level where it has faced resistance going back to November 2022. Its weekly MarketSurge chart now shows several breakouts that have stalled or failed near that level.

Its relative strength line has been on a jagged downtrend since November — a drawback for the current base.

ExxonMobil Follows Oil Prices

As with other oil stocks, Exxon will rise and fall with crude oil prices. So even when Exxon looks good based on fundamentals, crude oil prices may suddenly plunge, taking XOM stock down, too. On the other hand, a rise in oil prices may help lift the stock.

Investors could choose to buy an energy exchange traded fund as a way to play sector moves while avoiding stock-specific risk. Energy Select Sector SPDR Fund (XLE) and the iShares U.S. Energy ETF (IYE) are two energy-related ETFs. But those ETFs are still exposed to crude oil price swings.

Exxon and Chevron are major weights in XLE.

Is XOM Stock A Buy?

The bottom line: XOM stock is in a base but it is not currently a buy or a sell. If the stock climbs back above its 50-day line, it would be a positive sign. Still, investors could put it on a watchlist and wait for the stock to break out.

Investors can check out IBD Stock Lists and other IBD content to find dozens of the best stocks while waiting for Exxon’s bottom line to improve and for the stock to reach a buy point.

Follow Kimberley Koenig for more stock market news on X, the platform formerly known as Twitter, @IBD_KKoenig.

YOU MAY ALSO LIKE:

Costco Stock, 3 Others Flash Classic Bullish Sign | Stocks To Watch

Insurance Company Revs Up For Next Move As Profit Growth Continues | Stocks To Watch

ServiceNow, Several Other IBD 50 Stocks Recover, Power Up Near Buy Points

Looking For Market Insights? Check Out Our Live Daily Segment | Stocks To Watch

Warren Buffett’s Berkshire Hathaway Joins $1 Trillion Club | Stocks To Watch

Steve Jobs Urged Bob Iger To Retire And Enjoy Life Before It's Too Late — Here's How That Advice Shaped Disney's CEO Journey

Steve Jobs, co-founder of Apple Inc. advised Bob Iger to retire from Walt Disney Co and enjoy life. This advice was given shortly before Jobs’s death in 2011.

What Happened: Jobs, who was worth an estimated $10.2 billion at the time of his death, emphasized the importance of enjoying life over accumulating wealth. This sentiment was echoed in a 1996 PBS documentary where Jobs stated, “It wasn’t that important,” referring to his wealth.

Nearly a decade later, Iger reflected on Jobs’s advice as he considered his own future at Disney. The New York Times reported that Iger thought about this advice during his departure from the CEO role in 2020 and his return in 2022.

In 2021, Iger told CNBC that he stepped down as CEO when he felt he was becoming dismissive of other views. Despite stepping down, Iger remained involved in Disney’s operations, which led to friction with his successor, Bob Chapek. This eventually resulted in Chapek’s dismissal and Iger’s return as CEO.

Currently, Iger is focused on finding his successor and is keen on retiring. He mentioned in a podcast with Kelly Ripa that he is “obsessed” with CEO succession, a priority established by the board upon his return.

Why It Matters: The advice from Jobs to Iger holds significant weight, given Jobs’s status as a visionary leader. Jobs’s management style, which combined creativity and business acumen, has been influential in various sectors.

His belief in the limited value of management consultants compared to business owners underscores his emphasis on hands-on leadership.

In addition, Iger’s journey at Disney has been marked by significant milestones and challenges. His return as CEO in 2022 was pivotal, especially considering the friction with his successor, Chapek.

Iger’s focus on succession planning is crucial for Disney’s future stability. During a second-quarter earnings call in May, Iger assured a “smooth transition” for the next CEO, although he remained tight-lipped about specific plans.

Moreover, Iger’s potential acquisition of a stake in the women’s soccer team Angel City highlights his continued influence and interest in diverse ventures. This move could set a record for the priciest women’s sports team, further cementing Iger’s legacy as a multifaceted leader.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MCAN Financial Group Announces Incoming Senior Vice President and Chief Financial Officer

TORONTO, Sept. 9, 2024 /CNW/ – MCAN Mortgage Corporation (d/b/a MCAN Financial Group) (“MCAN”) announced today that after a comprehensive search, Santokh Birk will assume the Senior Vice President and Chief Financial Officer role on October 1, 2024. He will support Don Coulter, President & CEO of MCAN and join the executive leadership team.

Santokh brings over 30 years of progressive leadership experience covering key areas in Finance, Risk Management and Corporate Strategy with extensive international experience. He joins MCAN from Home Trust Company, where he most recently was the Senior Vice President, Finance & Chief Accounting Officer. He was instrumental in leading a number of initiatives to improve the financial performance of the company, in addition to modernizing the finance function. Prior to this, Santokh held a number of senior roles with HSBC in Canada, the Middle East and the U.S. over a 28-year career.

Santokh graduated with a Bachelor of Administration (Honours) from Simon Fraser University and a Master of Business Administration (MBA) in Financial Services from Dalhousie University. He also holds a CPA, CA designation.

“We are excited to have Santokh join MCAN. He brings decades of financial experience and a collaborative, energetic leadership style. He will play a key role in the continued success of MCAN. We look forward to having him on our team.” says President & CEO, Don Coulter.

We would like to thank Peter Ryan, our Interim CFO for his excellent leadership over the past five months. Peter will be returning to his full time role as Vice President, Controller.

About MCAN

MCAN Mortgage Corporation d/b/a MCAN Financial Group is a public company listed on the Toronto Stock Exchange under the symbol MKP and is a reporting issuer in all provinces and territories in Canada. MCAN also qualifies as a Mortgage Investment Corporation (“MIC”) under the Income Tax Act (Canada). MCAN is the largest MIC in Canada and the only federally regulated MIC.

MCAN’s primary objective is to generate a reliable stream of income by investing in a diversified portfolio of Canadian mortgages, including residential mortgages, residential construction, non-residential construction and commercial loans, as well as other types of securities, loans, and real estate investments. MCAN employs leverage by issuing term deposits that are eligible for Canada Deposit Insurance Corporation deposit insurance. MCAN is Investing in Communities and Homes for Canadians.

A Caution About Forward-Looking Information and Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information can be identified by words such as: “expect”, “intend,” “plan,” “seek,” “believe,” “estimate,” “future,” “likely,” “may,” “should,” “will” and similar forward-looking language. Forward-looking information contained in this news release includes statements relating to Mr. Birk assuming the role of Senior Vice President and Chief Financial Officer on October 1, 2024. Forward-looking information entails various risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking information, including, but not limited to, risks as discussed under “Risk Factors” in the Company’s most recent annual information form available under the Company’s profile on SEDAR+ at www.sedarplus.ca. In addition, general risks relating to capital markets, economic conditions, regulatory changes, as well as the operations of MCAN’s business may also cause actual results to differ materially from those expressed or implied in such forward-looking information. Forward-looking information is not a guarantee of future performance, and management’s assumptions upon which such forward-looking information is based may prove to be incorrect. Investors are cautioned not to place undue reliance on any forward-looking information contained herein. The Company disclaims any obligation to update or revise any forward-looking information contained in this news release, whether as a result of new information, future events or otherwise, except to the extent required by law.

SOURCE MCAN Mortgage Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/09/c9729.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/09/c9729.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

System1 And 2 Other Stocks Under $2 Executives Are Buying

The Dow Jones index closed higher by more than 1% on Monday. When insiders purchase or sell shares, it indicates their confidence or concern around the company’s prospects. Investors and traders interested in penny stocks can consider this a factor in their overall investment or trading decision.

Below is a look at a few recent notable insider transactions for penny stocks. For more, check out Benzinga’s insider transactions platform.

Roadzen

- The Trade: Roadzen, Inc. RDZN Rohan Malhotra bought a total of 2,600 shares at an average price of $1.92. To acquire these shares, it cost around $4,999.

- What’s Happening: On Aug. 13, Roadzen reported a quarterly loss of 71 cents per share.

- What Roadzen Does: Roadzen Inc is an insurance technology company on a mission to transform global auto insurance powered by advanced AI.

System1

- The Trade: System1, Inc. SST 10% owner Cee Holdings Trust acquired a total of 18,055 shares at an average price of $1.22. To acquire these shares, it cost around $21,961.

- What’s Happening: On Aug. 8, System1 posted upbeat quarterly earnings.

- What System1 Does: System1 Inc develops technology and data science to operate a responsive acquisition marketing platform.

Nanophase Technologies

- The Trade: Nanophase Technologies Corporation NANX R Janet Whitmore Gaboury acquired a total of 4,488 shares at an average price of $1.51. The insider spent around $6,777 to buy those shares.

- What’s Happening: On Aug. 6, Nanophase Technologies posted an increase in second-quarter sales.

- What Nanophase Technologies Does: Nanophase Technologies Corp is engaged in the production of engineered nanomaterial solutions and larger, sub-micron, materials such as personal care sunscreens, architectural coatings, industrial coating applications, and abrasion-resistant additives, plastics additives, medical diagnostics, energy..

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

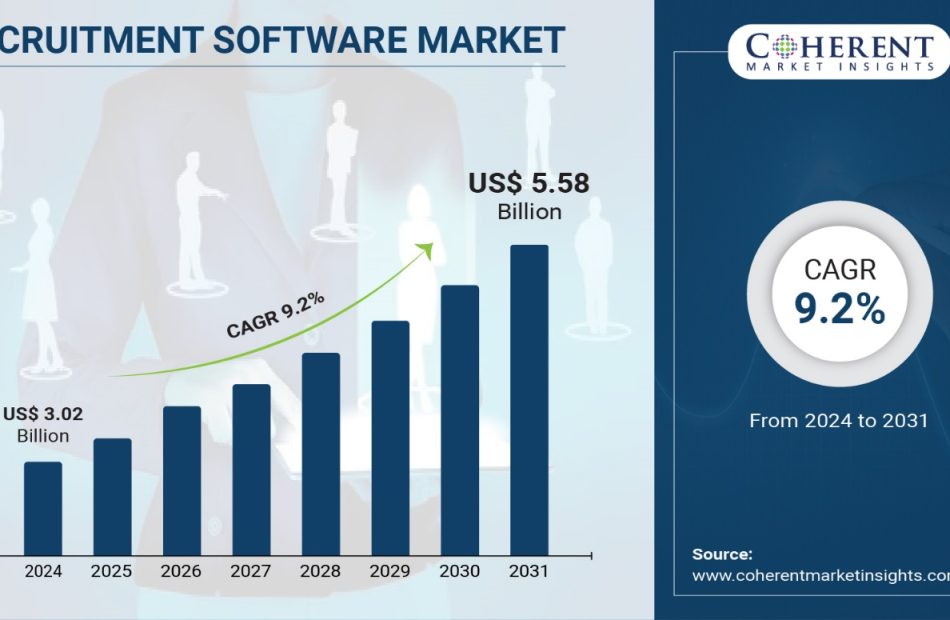

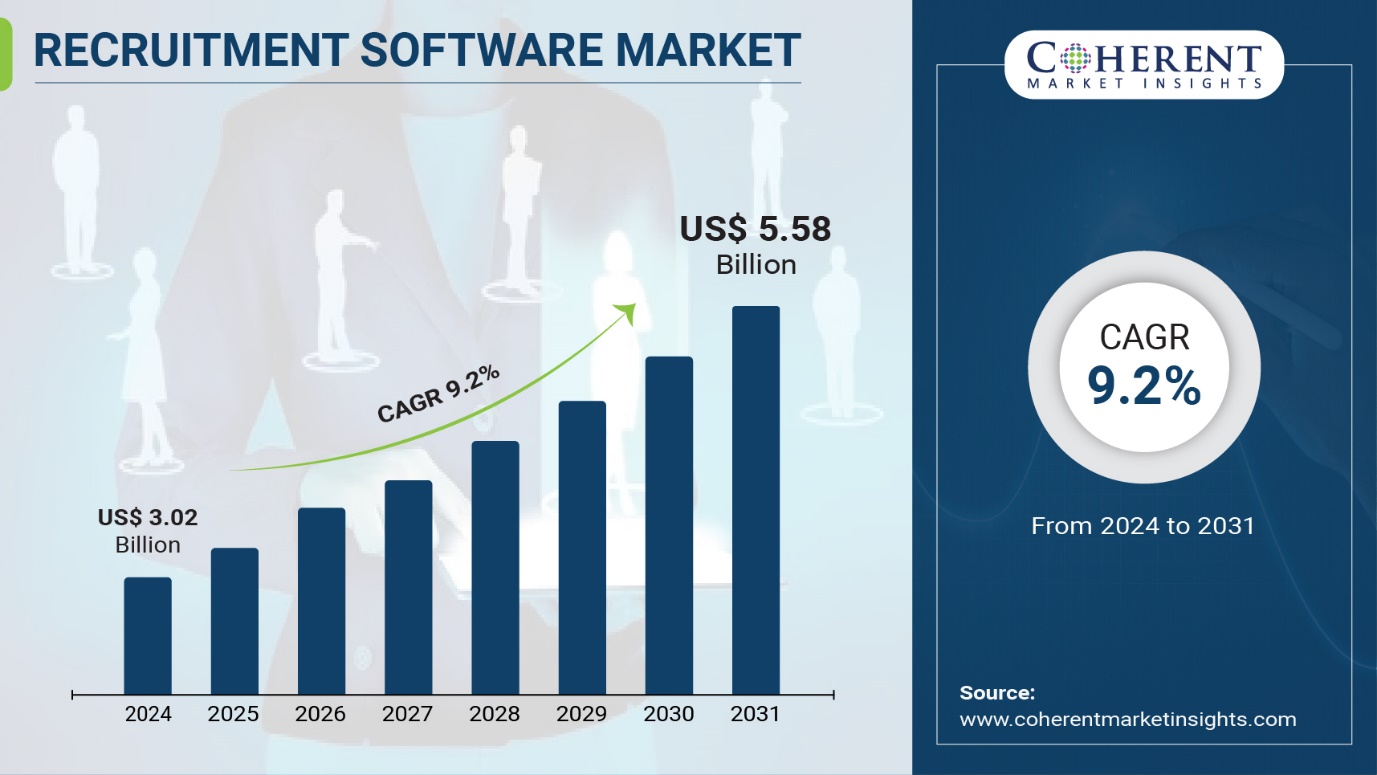

Recruitment Software Market Size to reach $5.58 billion, Globally, by 2031 at 9.2% CAGR, says Coherent Market Insights

Burlingame, Sept. 10, 2024 (GLOBE NEWSWIRE) — The global Recruitment Software Market Size to Grow from USD 3.02 Billion in 2024 to USD 5.58 Billion by 2031, at a Compound Annual Growth Rate (CAGR) of 9.2% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Growing focus of companies on streamlining and digitizing hiring processes is also driving the demand for recruitment software. Rising number of startups and expansion of established companies have further increased the recruitment volume, fueling sales of these software.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/7176

Market Dynamics:

The recruitment software market is driven by the rising adoption of cloud-based recruitment software solutions among enterprises. Cloud recruitment software offers benefits such as scalability, accessibility from any device with an internet connection, lower upfront costs, and automatic updates. They are also easy to deploy and manage. Furthermore, recruitment software helps businesses streamline and automate the recruiting process from sourcing candidates to onboarding. They efficiently manage applicant tracking, candidate relationship management, and other recruitment activities. This boosts hiring efficiency and quality while reducing costs.

Recruitment Software Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2023 | $3.02 billion |

| Estimated Value by 2031 | $5.38 billion |

| Growth Rate | Poised to grow at a CAGR of 9.2% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Component, By Organization Size, By Vertical: |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Increasing workforce mobility • Stricter compliance regulations |

| Restraints & Challenges | • High costs associated with customization and maintenance • Lack of skilled workforce for advanced recruitment tools |

Market Trends:

One of the key trends in the recruitment software market is the increasing integration of social media platforms. Most modern recruitment solutions allow posting job openings on popular professional networking sites like LinkedIn. They also facilitate screening candidate profiles and communicating with potential hires over social media. This enables recruiters to leverage the large professional networks and talent pools on social platforms to widen their search.

Integration of AI and machine learning capabilities is another prominent trend. Advanced recruitment tools use predictive algorithms and analytics to source resumes that are the best-fit, schedule interviews intelligently, and determine optimal candidate experience. They also assist recruiters through automated screening, matchmaking, and skills/personality assessments. This helps optimize hiring outcomes.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7176

Market Opportunities:

Over the past few years, with increasing digitalization and the demand for streamlining HR processes, applicant tracking has emerged as one of the key opportunities in the recruitment software market. Applicant tracking software automates many of the tasks associated with recruitment like posting job openings, tracking applicants, managing resumes and CVs, evaluating candidates, scheduling interviews as well as performing background checks. They provide a centralized platform for recruiters to manage the entire recruitment process from beginning to end. This has resulted in improved efficiency, reduced cost and time spent on recruitment. Going forward, advanced features around candidate matching, AI/ML powered candidate recommendations as well as mobile optimization are expected to further push the demand for applicant tracking solutions.

Rising need to hire the best talent and evaluate hard as well as soft skills of potential employees has boosted the adoption of candidate assessment tools. Candidate assessment software allows hiring managers to assess cognitive abilities, language proficiency, technical skills, personality traits, interests, work styles and other attributes of candidates through online tests and assessments. They offer data-driven insights to help recruiters identify the right fit for job roles. With remote and hybrid work models gaining traction globally, online proctoring and video interview capabilities embedded in assessment solutions are proving invaluable for screening candidates remotely. This presents a major market opportunity for vendors providing advanced candidate assessment tools.

Key Market Takeaways

Recruitment software market is anticipated to witness a CAGR of 9.2% during the forecast period 2024-2031, owing to growing emphasis on applicant experience and talent acquisition analytics.

On the basis of component, software segment is expected to hold a dominant position, owing to wide availability of applicant tracking and candidate assessment tools.

On the basis of vertical, manufacturing segment is expected to hold a dominant position over the forecast period, due to high demand from automotive and electronics industries.

On the basis of region, North America is expected to hold a dominant position over the forecast period, due to rapid technological adoption and presence of leading recruitment software providers in the region.

Key players operating in the recruitment software market include IBM, Oracle, Jobvite, ADP, Cornerstone OnDemand, SAP SuccessFactors, Ultimate Software, ClearCompany, BreezyHR, and Greenhouse Software. Leveraging latest technologies like ML and analytics is the core strategy among these players.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7176

Recent Developments:

In March 2022, UKG Inc. announced the completion of its acquisition of Ascentis Corporation, a leading provider of full-suite HR and workforce management solutions to strengthen the company’s market strength through the addition of tenured industry expertise, with the additional force of Ascentis.

In February 2020, iCIMS, Inc., the market leader for cloud-based talent acquisition software solutions, announced that it has joined Ceridian’s Dayforce Software Partner Program (DSPP). This partnership aims to offer a seamless integration between Ceridian’s human capital management platform and iCIMS’ best-in-class talent acquisition platform, to exchange data across the entire candidate and employee lifecycle.

Detailed Segmentation:

By Component

By Organization Size

By Vertical

- BFSI

- IT & Telecom

- Retail

- Manufacturing

- Media & Entertainment

- Healthcare

- Government

- Others

By Region

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Information and Communication Technology Domain:

The global trade management software market is estimated to be valued at US$ 2.53 Bn in 2024 and is expected to reach US$ 5.06 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 10.4% from 2024 to 2031.

Global category management software market is estimated to be valued at US$ 1.71 Bn in 2024 and is expected to reach US$ 3.52 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 10.9% from 2024 to 2031.

The Global Remote Desktop Software Market is estimated to be valued at US$ 3.98 Bn in 2024 and is expected to reach US$ 9.22 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 12.7% from 2024 to 2031.

Global club management software market is estimated to be valued at US$ 6.87 Bn in 2024 and is expected to reach US$ 18.09 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 14.8% from 2024 to 2031.

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Icon Energy Corp. Reports Financial Results for the Six-Month Period Ended June 30, 2024

ATHENS, Greece, Sept. 10, 2024 (GLOBE NEWSWIRE) — Icon Energy Corp. (“Icon” or the “Company“) ICON, an international shipping company that provides worldwide seaborne transportation services for dry bulk cargoes through the ownership, chartering and operation of oceangoing vessels, announces its financial results for the six-month period ended June 30, 2024 (the “Reporting Period“).

Financial Highlights for the Reporting Period

- Revenue, net of $2.7 million, an 18% increase compared to the six-month period ended June 30, 2023

- Net income of $1.0 million, a 43% increase compared to the six-month period ended June 30, 2023

- EBITDA(1) of $1.5 million, a 26% increase compared to the six-month period ended June 30, 2023

- Operating profit of $1.0 million, a 46% increase compared to the six-month period ended June 30, 2023

Ismini Panagiotidi, Chairwoman and Chief Executive Officer of Icon, commented:

“We are pleased to report that our financial results for the first half of 2024 have surpassed last year’s performance across all key metrics, providing tailwinds to our transition to a public company with the successful listing of our common shares on the Nasdaq in July 2024.

Since then, we have announced our first dividend and first vessel acquisition as a public company, consistent with both our dividend policy and growth strategy. In addition, we have secured employment for our soon-to-be acquired vessel and have entered into an innovative financing term sheet with upsize potential to fuel our further growth, all with top-tier counterparties.

We are thrilled by this positive momentum and are honored by the trust demonstrated by our charterers and financiers during Icon’s early stages, supporting our goal to create value for our shareholders.”

Financial Performance Summary

| (in thousands of U.S. dollars, except daily figures) |

| Six-month period ended June 30, 2024 (unaudited) |

| Six-month period ended June 30, 2023 (unaudited) |

| Income statement data | ||||

| Revenue, net | $ | 2,719 | $ | 2,309 |

| Operating profit | 962 | 657 | ||

| Net income | | 987 | 688 | |

| Non-GAAP financial measures (2) | | | ||

| EBITDA | $ | 1,477 | $ | 1,168 |

| Daily TCE | | 14,324 | | 12,325 |

| Daily OPEX | | 4,962 | | 5,066 |

During the six-month period ended June 30, 2024, revenue, net, amounted to $2.7 million, an increase of $0.4 million, or 18%, compared to the first six months of 2023. Icon’s sole vessel operated under similar index-linked charters and was 100% utilized during both periods. The increase in revenues, net, is attributable to the higher charter rates prevailing in the market during the first half of 2024 compared to the same period of 2023, resulting in a $0.3 million, or 46%, increase in operating profit and a $0.3 million, or 43%, increase in net income.

Fleet Employment and Operational Data

| Six-month period ended June 30, 2024 |

| Six-month period ended June 30, 2023 |

|

| Fleet operational data (3) | | ||

| Ownership Days | 182.0 | | 181.0 |

| Available Days | 182.0 | | 181.0 |

| Operating Days | 182.0 | | 180.9 |

| Vessel Utilization | 100.0% | | 100.0% |

| Average Number of Vessels | 1.0 | | 1.0 |

As of June 30, 2024, Icon owned one vessel, the M/V Alfa, which is employed by an international commodity trading conglomerate on a time charter expiring between October 2025 and February 2026, earning a floating daily hire rate linked to the Baltic Panamax Index. The minimum contracted revenue(4) expected as of June 30, 2024, to be generated by this contract between June 30, 2024, and its earliest expiration date is $6.7 million.

Key Developments Subsequent to the Reporting Period

Initial public offering. On July 15, 2024, Icon successfully completed the initial public offering of 1,250,000 of its common shares, at an offering price of $4.00 per share, for gross proceeds of approximately $5,000,000, before deducting underwriting discounts and offering expenses. Icon’s common shares began trading on the Nasdaq Capital Market on July 12, 2024, under the symbol “ICON.”

Dividend. On August 23, 2024, Icon declared a cash dividend of $0.08 per common share, payable on or around September 30, 2024, to all of its common shareholders of record as of September 15, 2024. Icon expects to pay quarterly cash dividends on its common shares during the one-year period following its initial public offering, in an aggregate amount of approximately $500,000 for the year (including the dividend declared on August 23, 2024).

Vessel Acquisition. On August 2, 2024, Icon entered into an agreement with an unaffiliated third-party to acquire a Kamsarmax dry bulk carrier, built in November 2007 in Japan, for a purchase price of $17.57 million, to be renamed M/V Bravo (the “Vessel Acquisition“). The Vessel Acquisition is subject to the satisfaction of certain customary closing conditions and is anticipated to conclude with the vessel’s delivery to Icon between September and November of 2024.

Vessel Charter. On August 29, 2024, Icon entered into an agreement with an international commodity trading conglomerate to time charter the M/V Bravo for a period of 11 to 14 months, at a floating daily hire rate linked to the Baltic Panamax Index (the “New Time Charter“). The New Time Charter is subject to the satisfaction of certain customary closing conditions and is anticipated to commence shortly after the completion of the Vessel Acquisition.

Financing Term Sheet. On August 22, 2024, Icon entered into a non-binding term sheet with a leading international financial institution for a new senior secured credit facility in an aggregate amount of up to $91 million (the “New Credit Facility“) of which:

- an aggregate amount of up to $16 million (the “Initial Advance“) is expected to be borrowed to finance a portion of the purchase price of the M/V Bravo, and to leverage Icon’s existing Panamax dry bulk carrier, M/V Alfa; and

- an additional aggregate amount of up to $75 million (the “Upsize Advance“) may be made available to Icon, in whole or in parts, to finance future vessel acquisitions. This amount will remain uncommitted and equally, Icon will not be obliged to borrow it, or any part thereof.

The Initial Advance is expected to contain security and covenants customary for transactions of this type, to have a four-year tenor, and to bear interest at 3.95% over SOFR. The terms of each Upsize Advance will be determined at the time it is requested. No interest or other fees are expected to apply on any amount that remains uncommitted. The New Credit Facility is subject to important conditions, including the negotiation and execution of definitive documentation and the satisfaction of certain customary closing conditions, and is anticipated to conclude on or prior to the completion of the Vessel Acquisition.

About Icon

Icon is an international shipping company that provides worldwide seaborne transportation services for dry bulk cargoes through the ownership, chartering and operation of oceangoing vessels. Icon maintains its principal executive office in Athens, Greece, and its common shares trade on the Nasdaq Capital Market under the symbol “ICON.”

Forward Looking Statements

This communication contains “forward-looking statements.” Statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions that are other than statements of historical fact are forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant risks, uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, the Company cannot provide assurance that it will achieve or accomplish these expectations, beliefs or projections. The Company’s actual results could differ materially from those anticipated in forward-looking statements for many reasons, including as described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC“). As a result, you are cautioned not to unduly rely on any forward-looking statements, which speak only as of the date of this communication.

Factors that could cause actual results to differ materially from those discussed in the forward-looking statements include, among other things: the Company’s future operating or financial results; the Company’s liquidity, including its ability to service any indebtedness; changes in shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, business strategy, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks associated with operations; broader market impacts arising from war (or threatened war) or international hostilities; risks associated with pandemics (including COVID-19); and other factors listed from time to time in the Company’s filings with the SEC. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based. You should, however, review the factors and risks the Company describes in the reports it files and furnishes from time to time with the SEC, which can be obtained free of charge on the SEC’s website at www.sec.gov.

Contact Information

Icon Energy Corp.

Dennis Psachos

Chief Financial Officer

+30 211 88 81 300

ir@icon-nrg.com

www.icon-nrg.com

Exhibit I

Interim Consolidated Statements of Income

| (in thousands of U.S. dollars, except for share data and earnings per share) |

Six-month period ended June 30, 2024 (unaudited) |

| Six-month period ended June 30, 2023 (unaudited) |

|

| Revenue, net | $ | 2,719 | $ | 2,309 |

| Voyage expenses, net | (112) | (79) | ||

| Vessel operating expenses | (903) | (917) | ||

| Management fees | (213) | (136) | ||

| General and administrative expenses | (12) | (6) | ||

| Depreciation expense | (339) | (337) | ||

| Amortization of deferred drydocking costs | (178) | (177) | ||

| Operating Profit | $ | 962 | $ | 657 |

| Finance costs | (3) | (1) | ||

| Interest income | 27 | 34 | ||

| Other income/(costs), net | 1 | (2) | ||

| Net Income | $ | 987 | $ | 688 |

| Accrued dividends on preferred shares | (75) | — | ||

| Net income attributable to common shareholders | $ | 912 | $ | 688 |

| Earnings per common share, basic and diluted | $ | 4.56 | $ | 3.44 |

| Weighted average number of shares, basic and diluted | 200,000 | 200,000 | ||

Condensed Interim Consolidated Balance Sheet Data

| (in thousands of U.S. dollars) | June 30, 2024 (unaudited) |

December 31, 2023(5) |

||

| Assets | ||||

| Cash and cash equivalents | $ | 477 | $ | 2,702 |

| Other current assets | 474 | 320 | ||

| Vessel, net | 8,842 | 9,181 | ||

| Other non-current assets | 1,510 | 679 | ||

| Total assets | $ | 11,303 | $ | 12,882 |

| Liabilities and shareholders’ equity | ||||

| Total current liabilities | $ | 1,147 | $ | 3,713 |

| Total shareholders’ equity | 10,156 | 9,169 | ||

| Total liabilities and shareholders’ equity | $ | 11,303 | $ | 12,882 |

Summarized Cash Flow Data

| (in thousands of U.S. dollars) | | Six-month period ended June 30, 2024 (unaudited) |

| Six-month period ended June 30, 2023 (unaudited) |

| Cash provided by operating activities | $ | 957 | $ | 1,068 |

| Cash used in investing activities | | (2) | – | |

| Cash used in financing activities | | (3,180) | (907) | |

| Net (decrease)/increase in cash and cash equivalents | $ | (2,225) | $ | 161 |

| Cash and cash equivalents at the beginning of the period | | 2,702 | 3,551 | |

| Cash and cash equivalents at the end of the period | $ | 477 | $ | 3,712 |

Non-GAAP Financial Measures Definitions and Reconciliation to GAAP

To supplement our financial information presented in accordance with the United States generally accepted accounting principles (“U.S. GAAP“), we may use certain “non-GAAP financial measures” as such term is defined in Regulation G promulgated by the SEC. Generally, a non-GAAP financial measure is a numerical measure of a company’s operating performance, financial position or cash flows that excludes or includes amounts that are included in, or excluded from, the most directly comparable measure calculated and presented in accordance with U.S. GAAP. We believe non-GAAP financial measures provide investors with greater transparency and supplemental data relating to our financial condition and results of operations and, therefore, a more complete understanding of our business and financial performance than the comparable U.S. GAAP measures alone. However, non-GAAP financial measures should only be used in addition to, and not as substitutes for, financial results presented in accordance with U.S. GAAP. Although we believe the following definitions and calculation methods are consistent with industry standards, our non-GAAP financial measures may not be directly comparable to similarly titled measures of other companies.

Earnings before Interest, Tax, Depreciation and Amortization (“EBITDA”). EBITDA is a financial measure we calculate by deducting interest and finance costs, interest income, taxes, depreciation and amortization, from net income. EBITDA assists our management by carving out the effects that non-operating expenses and non-cash items have on our financial results. We believe this also enhances the comparability of our operating performance between periods and against companies that may have varying capital structures, other depreciation and amortization policies, or that may be subject to different tax regulations. The following table reconciles EBITDA to the most directly comparable U.S. GAAP financial measure:

| (in thousands of U.S. dollars) | | Six-month period ended June 30, 2024 (unaudited) |

| Six-month period ended June 30, 2023 (unaudited) |

| Net income | $ | 987 | $ | 688 |

| Plus: Depreciation expense | | 339 | 337 | |

| Plus: Amortization of deferred drydocking costs | | 178 | 177 | |

| Less: Interest income | | (27) | (34) | |

| EBITDA | $ | 1,477 | $ | 1,168 |

Time Charter Equivalent (“TCE”). TCE is a measure of revenue generated over a period that accounts for the effect of the different charter types under which our vessels may be employed. TCE is calculated by deducting voyage expenses from revenue and making any other adjustments required to approximate the revenue that would have been generated, had the vessel been employed under a time charter. TCE is typically expressed on a daily basis (“Daily TCE“) by dividing it by Operating Days, to eliminate the effect of changes in fleet composition between periods. The following table reconciles TCE and Daily TCE to the most directly comparable U.S. GAAP financial measure:

| (in thousands of U.S. dollars, except fleet operational data and daily figures) |

| Six-month period ended June 30, 2024 (unaudited) |

| Six-month period ended June 30, 2023 (unaudited) |

| Revenue, net | $ | 2,719 | $ | 2,309 |

| Less: Voyage expenses | | (112) | (79) | |

| TCE | $ | 2,607 | $ | 2,230 |

| Divided by: Operating Days | | 182 | 180.9 | |

| Daily TCE | $ | 14,324 | $ | 12,327 |

Daily Vessel Operating Expenses (“Daily OPEX”). Daily OPEX, is a measure of the vessel operating expenses incurred over a period divided by Ownership Days, to eliminate the effect of changes in fleet composition between periods. The following table reconciles Daily OPEX to vessel operating expenses:

| (in thousands of U.S. dollars, except fleet operational data and daily figures) |

| Six-month period ended June 30, 2024 (unaudited) |

| Six-month period ended June 30, 2023 (unaudited) |

| Vessel operating expenses | $ | 903 | $ | 917 |

| Divided by: Ownership Days | | 182 | 181 | |

| Daily OPEX | $ | 4,962 | $ | 5,066 |

Other Definitions and Methodologies

This press release refers to the terms and methodologies described below. Although we believe the following definitions and calculation methods are consistent with industry standards, these measures may not be directly comparable to similarly titled measures of other companies.

Ownership Days. Ownership Days are the total days we owned our vessels during the relevant period. We use this to measure the size of our fleet over a period.

Available Days. Available Days are the Ownership Days, less any days during which our vessels were unable to be used for their intended purpose as a result of scheduled maintenance, upgrades, modifications, drydockings, special or intermediate surveys, or due to change of ownership logistics, including positioning for and repositioning from such events. We use this to measure the number of days in a period during which our vessels should be capable of generating revenues.

Operating Days. Operating Days are the Available Days, less any days during which our vessels were unable to be used for their intended purpose as a result of unforeseen events and circumstances. We use this to measure the number of days in a period during which our vessels actually generated revenues.

Vessel Utilization. Vessel Utilization is the ratio of Operating Days to Available Days.

Average Number of Vessels. Average Number of Vessels is the ratio of Ownership Days to calendar days in a period.

Minimum contracted revenue. The amount of minimum contracted revenue is estimated by reference to the contracted period and hire rate, net of charterers’ commissions but before reduction for brokerage commissions and assuming no unforeseen off-hire days. For index-linked contracts, minimum contracted revenue is estimated by reference to the average of the relevant index during the 15 days preceding the calculation date.

1 EBITDA is a non-GAAP financial measure. For the definitions of non-GAAP financial measures and their reconciliation to the most directly comparable financial measures calculated and presented in accordance with the United States generally accepted accounting principles, please refer to “Exhibit I—Non-GAAP Financial Measures Definitions and Reconciliation to GAAP.”

2 EBITDA, Daily TCE, and Daily OPEX, are non-GAAP financial measures. For the definitions of non-GAAP financial measures and their reconciliation to the most directly comparable financial measures calculated and presented in accordance with the United States generally accepted accounting principles, please refer to “Exhibit I—Non-GAAP Financial Measures Definitions and Reconciliation to GAAP.”

3 For the definitions of fleet operational measures please refer to “Exhibit I—Other Definitions and Methodologies.”

4 For the contracted revenue calculation methodology please refer to “Exhibit I—Other Definitions and Methodologies.”

5 Balance sheet data derives from the audited consolidated financial statements as of that date.

![]()

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.