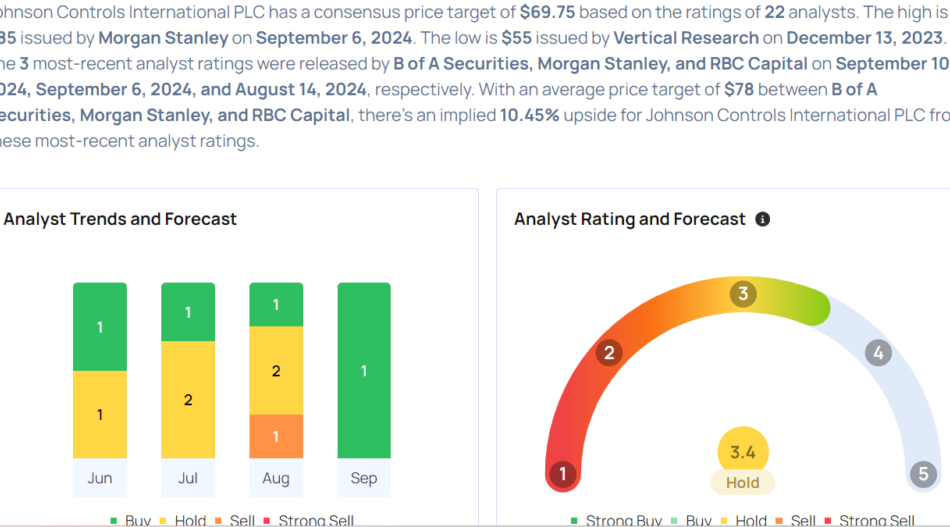

This Johnson Controls International Analyst Turns Bullish; Here Are Top 5 Upgrades For Tuesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

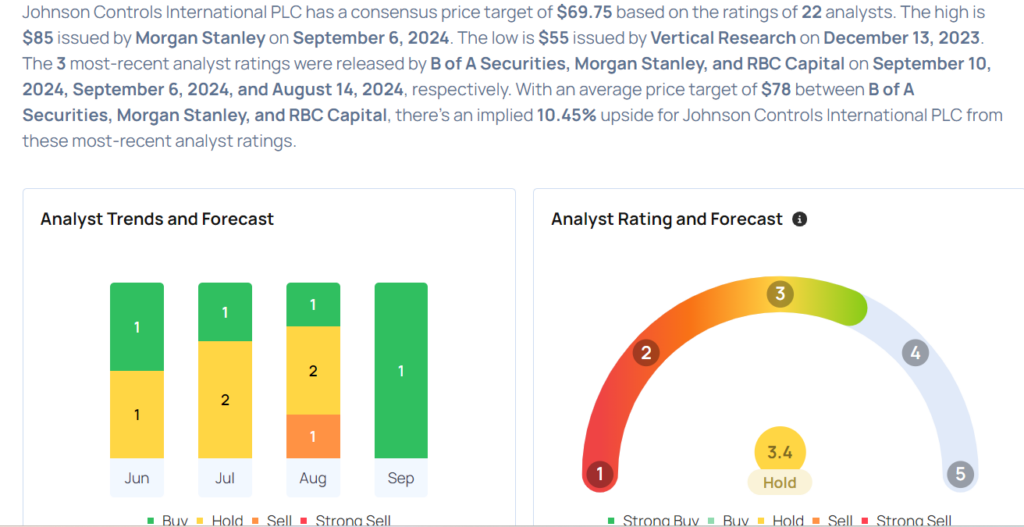

Considering buying JCI stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

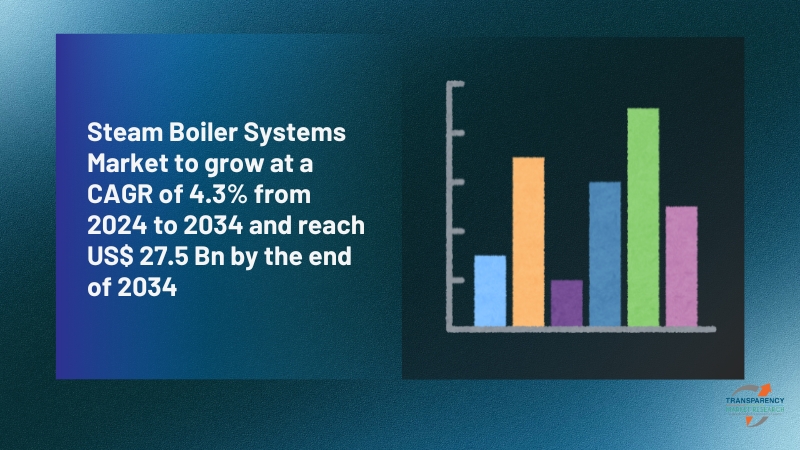

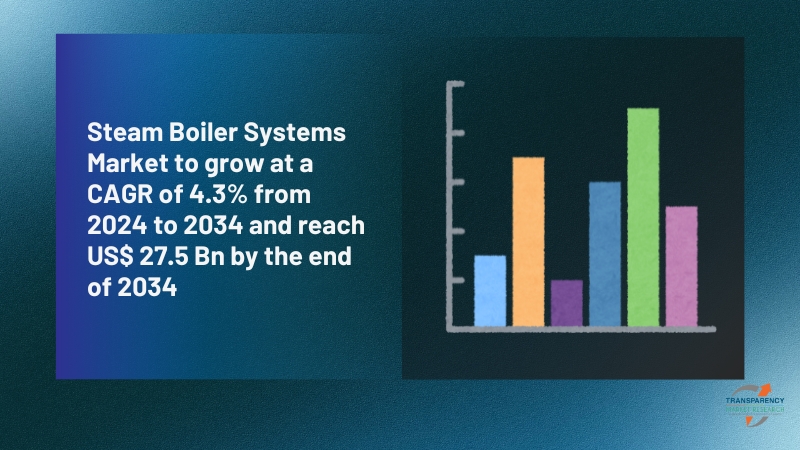

Steam Boiler Systems Market Size to Grow from USD 17.5 Billion in 2023 to USD 27.5 Billion by 2034, at a CAGR of 4.3%| Analysis by Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 09, 2024 (GLOBE NEWSWIRE) — The global steam boiler systems market (merkado ng mga sistema ng steam boiler) was projected to attain US$ 17.5 billion in 2023. It is anticipated to garner a 4.3% CAGR from 2024 to 2034, and by 2034, the market is likely to attain US$ 27.5 billion.

A steam boiler converts water into steam by using the heat from a fuel source. Steam is subsequently utilized for a number of industrial and commercial processes, including heating and power generation. The basic working principle of the boiler is the combustion of fuel in the combustion chamber, which produces hot gases that radiate heat energy into the surrounding water, causing it to boil.

Boiler systems that produce steam include fire tube boilers, water tube boilers, and super heaters. Boilers must be operated safely and effectively, which requires regular maintenance and attention to safety protocols. Numerous sectors, including food and beverage, pharmaceutical and healthcare, oil and gas, pulp and paper, and power generating, employ steam boiler systems.

Click Here to Request Your Complimentary Sample PDF Report! https://www.transparencymarketresearch.com/steam-boiler-system-market.html

Key Findings of Market Report

- Steam boiler systems are used by many sectors for a range of applications because they generate steam.

- The most prevalent uses are in industrial companies and industries that use steam for heating, as well as in power plants.

- Auxiliary boilers can help Combined Cycle Gas Turbine (CCGT) facilities shorten their steam turbines’ cold starting times. Electrode-based electrical boilers are used by large power plants because they provide CCGT facilities with a highly adjustable solution for the operational preparedness of their steam turbines.

- It is anticipated that the market for steam boiler systems would develop in the near future due to the rise in the use of electrical boilers.

Market Trends for Steam Boiler Systems

- When electricity usage goes over average, steam boilers are used to provide power so that industries may continue to run their manufacturing and other operations.

- Steam boilers are becoming increasingly popular in the oil and gas, manufacturing, power generating, paper and pulp, and processing industries because of their high efficiency, reliability, and quick starting time.

- Poor combustion, heat transfer fouling, and improper operation and maintenance all contribute to the boiler’s declining performance over time, including its efficiency and evaporation ratio. Manufacturers in the steam boiler systems market are developing goods that use less energy.

- Additionally, these boilers provide easier maintenance and installation. The RESIDENCE HM condensing boiler, which integrates cutting-edge technology to improve performance and energy efficiency, was introduced in January 2024 by Rialto, a part of Carrier Global Corporation, a supplier of intelligent climate and energy solutions. Accordingly, the income of the steam boiler systems business is driven by R&D of energy-efficient boilers.

Global Market for Steam Boiler Systems: Regional Outlook

- In 2023, North America held the majority of the share. The region’s market dynamics are being driven by fast industrialization and increased investment in electricity generation. In North America, boiler technology research and development is likewise increasing market share.

- In March 2024, AtmosZero, a US-based firm, secured $21 million in a Series A investment round to expedite the commercialization of their Boiler 2.0 technology. The business claims that Boiler 2.0 can be seamlessly integrated with PV power generation and storage.

Global Steam Boiler Systems Market: Competitive Landscape

The major players in the global market for steam boiler systems are providing low-carbon and highly energy-efficient solutions. They are developing smart boiler systems with an intuitive user interface and internet access, which facilitates extensive Internet of Things networking.

The following companies are well-known participants in the global steam boiler systems market:

- Cleaver-Brooks

- ZHENGZHOU BOILER (GROUP)

- Buderus

- Doosan

- Clayton Industries

- Byworth Boilers

- BHEL

- Fulton Boiler Works Inc.

- LARSEN & TOUBRO LIMITED

- Hurst Boiler & Welding

Key developments by the players in this market are:

- The ELSB electric steam boiler was introduced by Bosch Industrial Boilers in 2022 as a new product for the production of steam in commercial and industrial settings. The steam boiler generates 350–7500 kg of steam per hour and contributes to emissions reduction.

- ZHENGZHOU BOILER (GROUP) CO. LTD. was the successful bidder for Quzhou County Zhongchi New Materials Co., Ltd.’s four vertical Carbon Rotary Kiln Waste Heat Boiler projects in 2021.

Access Exclusive Data: Secure Your Premium Report Now! https://www.transparencymarketresearch.com/checkout.php?rep_id=3946<ype=S

Global Steam Boiler Systems Market Segmentation

By Boiler Type

- Horizontal Return Tubular Boiler

- Short Fire Box Boiler

- Compact Boiler

- Horizontal Straight Tube Boiler

- Bent Tube Boiler

- Cyclone Fired Boiler

By Application

- Generators

- Steam Engines (Locomotives)

- Cement Production

- Agriculture

By End User

- Food

- Chemical

- Refineries

- Primary Metal

- Thermal Power Plants

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Explore Transparency Market Research, Inc. Extensive Coverage in Factory Automation Domain:

- Small Engine Market – The global small engine market (소형 엔진 시장) is estimated to flourish at a CAGR of 4.6% from 2023 to 2031. According to Transparency Market Research, sales of small engine are slated to total US$ 10.3 billion by the end of the aforementioned period of assessment.

- Bakery Packaging Machine Market – The bakery packaging machine market (빵집 포장 기계 시장) valued at US$ 2.5 billion in 2022. The market is likely to be worth US$ 3.4 billion by 2031 capturing a 3.4% CAGR from 2022 to 2031.

- Composite Rail Ties Market – The global composite rail ties market (복합 레일 타이 시장) is estimated to grow at a CAGR of 4.4% from 2024 to 2034 and reach US$ 10.4 Billion by the end of 2034.

- Draw Bench Machine Market – The global draw bench machine market (벤치 머신 시장 그리기) is estimated to grow at a CAGR of 4.4% from 2024 to 2034 and reach US$ 566.6 Million by the end of 2034

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Do You Know What It Takes To Be 'Wealthy' When Retired? Here's What The Top 5% Of Retirees Have In Their Nest Eggs

Everyone dreams of a comfortable retirement, where you don’t have to stress about running out of money or pinching pennies. The goal is to enjoy your golden years with enough financial security to live the lifestyle you’ve always imagined. Whether you’re hoping to travel the world, spend time with family or just relax without financial worries, understanding different levels of wealth people over 65 have can help set realistic goals.

Don’t Miss:

Using insights from a recent YouTube video and data from the Federal Reserve, here’s a breakdown of what being “poor,” “middle class” or “wealthy” looks like at this stage of life.

In this context, “wealthy” is defined as being in the 95th percentile of household net worth. This means you have more wealth than 95% of individuals in your age group. This benchmark clearly shows how financially well-off you are compared to the majority.

Three factors come into play to build significant wealth: investment, rate of return and time. If you excel in one area, you can compensate for lesser performance in the others. For example, starting early with investments can lead to substantial growth over time, even with a modest rate of return.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

In the 20th percentile, retirees typically have a net worth of around $10,000. This group might not own a home or a car and may have minimal savings. Their financial focus is often on addressing immediate needs like health care and personal safety, leaving them with limited options for discretionary spending.

The average net worth in the 50th percentile is about $281,000. Individuals in this bracket generally own their homes and have some savings, possibly in a 401(k) or similar account. They can afford to participate in social activities, buy gifts for family and friends and enjoy more flexibility in their financial planning. However, they still need to be cautious about their spending.

Moving to the 90th percentile, retirees have a net worth of approximately $1.9 million. Those in this category can consider luxury vacations, set up college funds for grandchildren and make significant charitable donations. Their financial situation allows for greater comfort and less concern about daily expenses.

See Also: This billion-dollar fund has invested in the next big real estate boom,here’s how you can join for $10.

At the 95th percentile, the net worth is around $3.2 million. Retirees here focus less on everyday financial concerns and more on comprehensive wealth management. They often work with financial professionals for estate planning and may own multiple properties or invest in various assets.

Finally, the 99th percentile features individuals with a net worth of about $16.7 million. This elite group enjoys extensive travel, owns luxury properties and may invest in high-end ventures like vineyards. Financially, they are at the top, living a lifestyle well beyond the average retiree.

Understanding these different levels of wealth can help you set realistic retirement goals. If you aim to improve your financial situation, consulting with a financial advisor can provide guidance tailored to your needs and help you plan effectively for a secure retirement.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Do You Know What It Takes To Be ‘Wealthy’ When Retired? Here’s What The Top 5% Of Retirees Have In Their Nest Eggs originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

IBS Software's iStay Solution Now Offers Stripe Thanks to New Partnership

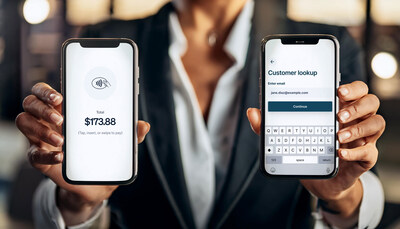

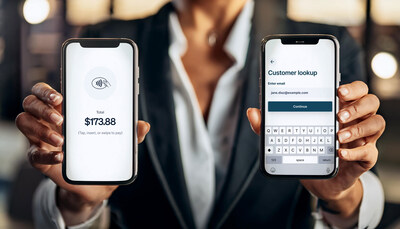

SAN FRANCISCO, Sept. 10, 2024 /PRNewswire/ — IBS Software is partnering with Stripe, a financial infrastructure platform for businesses, to ease friction in the travel industry by providing an increased range of payment solutions for those using IBS Software’s iStay. This technical integration is available immediately for IBS Software customers. iStay and Stripe built this partnership using Stripe’s Connect product, the fastest and easiest way to integrate payments and financial services into the user’s software platform or marketplace.

This partnership enables hospitality groups to improve the traveler experience and personalize key steps of the traveler’s journey – making purchase moments easier and potentially more frequent. In an effort to give travelers more options, the Stripe integration will support both online and in-person payment processing.

For customers, this seamless integration allows them to benefit from modern payment solutions and an abundance of choice when it comes to how they pay for their travel. Businesses will be able to offer features like one-click booking experience and access to popular payment options like installments and buy now, pay later methods. Not only will these options be available at the time of booking, but at multiple points throughout the guest’s journey from in-room dining to tours and activities to parking, all bookable through saved payment methods, reducing friction and time spent on the customer’s side arranging payment during repeat visits.

Through this partnership, IBS Software continues to build out its best-in-class unified iStay platform to ensure the best possible travel experience from booking to the journey back home.

About IBS Software

IBS Software is a leading SaaS solutions provider to the travel industry globally, managing mission-critical operations for customers in the aviation, tour & cruise, hospitality, and energy resources industries. IBS Software’s solutions for the aviation industry cover fleet & crew operations, aircraft maintenance, passenger services, loyalty programs, staff travel and air cargo management. Across the hospitality sector, IBS Software offers a cloud-native, unified platform for hotels and travel sellers, including central reservation (CRS), property management (PMS), revenue management (RMS), call centre, booking engine, loyalty and distribution. For the tour & cruise industry, IBS provides a comprehensive, customer-centric, digital platform that covers onshore, online and on-board solutions. Across the energy & resources industry, we provide logistics management solutions that cover logistics planning, operations & accommodation management. The Consulting and Digital Transformation (CDx) business focuses on driving digital transformation initiatives of its customers, leveraging its domain knowledge, digital technologies and engineering excellence. IBS Software operates from 17 offices across the world.

Further information can be found at www.ibsplc.com Follow us: Blog | Twitter | LinkedIn | Facebook | Instagram

Photo: https://stockburger.news/wp-content/uploads/2024/09/Stripe_IBS_SOFTWARE.jpg

Logo: https://stockburger.news/wp-content/uploads/2024/09/IBS_Software_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ibs-softwares-istay-solution-now-offers-stripe-thanks-to-new-partnership-302242186.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ibs-softwares-istay-solution-now-offers-stripe-thanks-to-new-partnership-302242186.html

SOURCE IBS Software

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LightBox Monthly CRE Activity Index Declines Slightly Against Volatile Market Backdrop

IRVINE, Calif., Sept. 9, 2024 /PRNewswire/ — LightBox, a leading provider of commercial real estate (CRE) information and technology, released its Monthly CRE Activity Index for August, showing a slight decline from July, which was encouraging given last month’s economic volatility.

The Index, an aggregation of daily transactions over the LightBox network, measures shifts in the volume of property listings, appraisals, and environmental due diligence assessments. While August’s Index of 89.9 broke the five-month trend of steady, yet modest, increases that began in March, the reading came in just 2.5 points below July’s 92.4 reading. However, the year-over-year comparison reveals stronger momentum. The current Index is a solid 9 points higher than August 2023’s figure of 80.9, indicating a faster pace of market activity across the board. This strong uptick in velocity is an encouraging sign of the market’s resilience and growth since the tepid pace of CRE deal making last summer.

“The relative strength of the August CRE Activity Index, especially compared to last year, sets the stage for a strong fourth quarter,” observed Manus Clancy, LightBox head of Data Strategy. “With inflation stabilizing near the Fed’s 2% target, interest rate cuts seem imminent, and the recent market forecasts are fueling even more optimism for the months ahead,” Clancy said.

CRE transaction activity has inched up every month since March and despite a small (and expected dip in August), the buyer base is expanding, interest in evaluating opportunities is rising, and recent acquisitions have surfaced across all property types and geographic regions. Although there is much talk of distressed properties as a potential investment opportunity, transaction volume is still relatively low, but on the rise.

While Fed rate cuts won’t solve all of CRE’s problems, past experience shows that when rates decline particularly after a protracted period of historically high rates, CRE activity picks up quickly. “September has a reputation for being bearish,” said Clancy, “but investors seem teed up to pull the trigger on transactions in a way that we haven’t seen yet this year. After the first rate cut, I expect the types of dealmaking we’ve been highlighting in the CRE Weekly Digest podcast will only accelerate.”

About LightBox

At LightBox, we are at the forefront of delivering advanced and precise solutions for commercial real estate intelligence. Our dedication to innovation propels real estate professionals forward by providing them with the essential tools required to navigate complex decisions, minimize risk, and boost productivity across the spectrum of real estate operations. LightBox is renowned for its commitment to promoting excellence and fostering connections in the industry, serving an extensive clientele of over 30,000 customers. Our diverse client base spans commercial and government sectors, including but not limited to brokers, developers, investors, lenders, insurers, technologists, environmental advisors, appraisers, and other businesses that depend on geospatial information. To discover more about how LightBox can illuminate the path to informed real estate solutions, visit us at: www.LightBoxRE.com

Media inquiries: media@lightboxRE.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lightbox-monthly-cre-activity-index-declines-slightly-against-volatile-market-backdrop-302242441.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lightbox-monthly-cre-activity-index-declines-slightly-against-volatile-market-backdrop-302242441.html

SOURCE LightBoxRE

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TISE announces record turnover, profit & EPS for H1 2024

ST PETER PORT, Guernsey, Sept. 10, 2024 /PRNewswire/ —

Headlines

- Record turnover of £6.4 million – up 22.4% year on year

- Profit increased 28.4% year on year to a new high of £3.0 million

- Earnings per share increased to 107.0p; total of £7.0 million returned to shareholders in H1 2024

- 444 new listings contributed to overall public market growth of 5.6% year on year

- Delivery of private markets service to first client, with pipeline of further business

The International Stock Exchange (TISE) has reported record turnover, profit and earnings per share for the first half of 2024.

The International Stock Exchange Group Limited (the Group) has released its latest Interim Report which shows revenues up 22.4% year on year to a new high of £6.4 million, post-tax profit increased 28.4% year on year to £3.0 million, and earnings per share increased to 107.0p during the six-month period ended 30 June, 2024.

Earlier this year, the Group paid a special dividend of £2.00 per share and an ordinary dividend of 45.0p per share, which represented a return of approximately £7.0 million surplus cash to shareholders.

Anderson Whamond, Chair of the Group, said: “I am pleased to report record turnover, profit and earnings per share for the first half of 2024, reflecting the Group’s strengths as a leading European bond market as well as the improved macroeconomic conditions. The Group remains highly cash generative, supporting the payment of two special dividends during the past four years alongside twice-yearly ordinary dividends. Transformed from a local stock and bond market, today TISE is an established operator of public markets with an enlarged portfolio of financial markets and securities services for both public and private companies that positions the Group well for long-term growth.”

There were 444 newly listed securities on TISE during the first half of 2024, which represented an 18.4% increase year on year. This contributed to the total number of listed securities on TISE’s Official List to 4,371 at 30 June 2024, which is a 5.6% increase year on year and the highest total since the Exchange opened for business in 1998.

Across TISE’s leading European professional bond market, the Qualified Investor Bond Market (QIBM), there were 436 newly listed debt securities during the opening six months of 2024, which was ahead of the 369 listed during the equivalent period in 2023. TISE maintained its market leader position in products like private equity debt securities and high yield bonds while continuing to grow its status as a listing venue for securitisations.

Within its equity market, TISE has consolidated its position as the second largest venue for listed UK Real Estate Investment Trusts (REITs). With four new UK REITs listed on TISE during the first half of 2024, double the number listed during the equivalent period in 2023, the total number of UK REITs listed on TISE reached 45 at 30 June 2024.

During the period, TISE continued to deliver its private markets service to the first client company, Blue Diamond Limited, as well as developing a pipeline of other prospective clients. The number of private companies in the UK that have more than 100 employees has grown by 3,096 over the last decade to nearly 19,150, while the number of listed companies has reduced by 271 during the same period. TISE Private Markets gives unlisted companies a more efficient way to trade their shares by providing access to a set of integrated electronic auction trading, settlement and registry management solutions.

Cees Vermaas, CEO of the Group, said: “The progress we have made in executing our strategy has been demonstrated by the sustained growth we have achieved through changing market conditions. We continue to deliver strong financial and operational performance both during the subdued market conditions of recent years and during the first half of 2024, with the return of a brighter economic picture. Our investment into an increasingly scalable and diversified business model means that we are in an excellent position to make the most of the opportunities available to us across both public and private markets.”

A copy of the Group’s Interim Report for the six months ended 30 June 2024 is available here.

![]() View original content:https://www.prnewswire.com/news-releases/tise-announces-record-turnover-profit–eps-for-h1-2024-302243647.html

View original content:https://www.prnewswire.com/news-releases/tise-announces-record-turnover-profit–eps-for-h1-2024-302243647.html

SOURCE The International Stock Exchange (TISE)

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SEI Adds KKR to Alternative Investments Access Platform

Industry Trend for Increased Access to Alternatives Presents Growth Opportunity

OAKS, Pa., Sept. 10, 2024 /PRNewswire/ — SEI® SEIC today announced that investment vehicles from KKR, a leading global investment firm, will be available on SEI’s platform that provides registered investment advisors, broker-dealers, and their clients access to private markets investments. SEI’s e-subscription technology is designed to provide increased access to alternative investments, greater processing efficiency, and an improved advisor and client experience.

With investments in alternative assets projected to grow by $1.2 trillion over the next four years,1 85% of wealth managers expect to increase allocations to one or more alternative asset classes within the next year.2 However, 55% of managers identified operational challenges such as paperwork or administrative tasks as impediments to adopting alternatives across their practice.2

The platform’s technology workflow combines electronic subscription documents, proprietary firm paperwork, custodian forms, and e-signature capabilities to help ensure fast and accurate alternative investment transaction processing.

Kevin Crowe, a Senior Vice President at SEI, said:

“Investor demand for alternative investments continues to increase, and this trend presents tremendous opportunity to broaden access to alternatives for advisors and wealth managers, while delivering the capabilities for enhanced portfolio diversification. With SEI’s unmatched industry position, we build the cross-market connections that can enable this access, and we’re thrilled to add KKR to our platform.”

Currently used by more than 250 wealth management firms and 165 fund managers, SEI’s alternatives platform has processed more than $4.3 billion in alternatives transactions across more than 19,000 subscriptions.3 In December 2023, SEI acquired Altigo, a cloud-based technology platform that provides inventory, e-subscription, and reporting capabilities for alternative investments.

1 “U.S. Alternative Investments 2022: Delivering Alternative Capabilities to Retail Investors,” Cerulli Associates, 2022.

2 “The State of Alternative Investments in Wealth Management 2023,” CAIS, Mercer, November 2023.

3 As of June 30, 2024.

About SEI®

SEI SEIC delivers technology and investment solutions that connect the financial services industry. With capabilities across investment processing, operations, and asset management, SEI works with corporations, financial institutions and professionals, and ultra-high-net-worth families to help drive growth, make confident decisions, and protect futures. As of June 30, 2024, SEI manages, advises, or administers approximately $1.5 trillion in assets. For more information, visit seic.com.

|

Company Contact: |

Media Contact: |

|

Emily Baldwin |

Kerry Mullen |

|

SEI |

Vested |

|

+1 610-676-3262 |

+1 917-765-8720 |

|

ebaldwin@seic.com |

kerry@fullyvested.com |

![]() View original content:https://www.prnewswire.com/news-releases/sei-adds-kkr-to-alternative-investments-access-platform-302242257.html

View original content:https://www.prnewswire.com/news-releases/sei-adds-kkr-to-alternative-investments-access-platform-302242257.html

SOURCE SEI Investments Company

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gingival Recession Treatment Market is Projected to Grow at a 5.4% CAGR, Hitting US$ 5.38 Billion by 2034 | Fact.MR Report

Rockville, MD , Sept. 10, 2024 (GLOBE NEWSWIRE) — The global Gingival Recession Treatment Market is projected to reach US$ 5.38 billion by the end of 2034, up from US$ 3.18 billion in 2024, according to the latest industry analysis by Fact.MR.

Cosmetic dentistry is gaining popularity as individuals are becoming more interested in aesthetic enhancements. As more individuals seek out treatments for healthier smiles, this trend is having a favorable effect on the growth of the gingival treatment market. A smile enhances a person’s overall appearance, which is why gingival recession treatments are in more demand since they efficiently restore the gum lines while also improving appearance overall. Gingival therapy demand is increasingly being driven by aesthetic concerns among women.

North America is projected to hold the leading position throughout the forecast period due to the increasing prevalence of periodontal disorders and the well-established healthcare sector. Western Europe is expected to take second place with a significant share, owing to rising cases among the elderly and the availability of strong reimbursement policies for dental procedures managed by the Conformité Européenne marking.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10299

Key Takeaways from the Market Study:

- The global gingival recession treatment market is forecasted to expand at a CAGR of 5.4% from 2024 to 2034.

- North America is set to account for 41% of the global market share in 2024.

- The United States is estimated to account for 6.2% market share in the North American region in 2024.

- The market in India is forecasted to expand at a CAGR of 9% from 2024 to 2034.

- The market in Japan is analyzed to generate revenue worth US$ 167.3 million by the end of 2034.

- Based on end users, dental clinics are projected to generate revenue worth US$ 2.96 billion by the end of 2034.

- In Western Europe, demand for gingival recession treatment is projected to reach a market value of US$ 1.01 billion by 2034.

- By treatment, revenue from soft tissue grafts is forecasted to reach US$ 2.11 billion by 2034.

“Use of growth factors and biomaterials for effective tissue regeneration is increasing worldwide. Availability of specialized equipment and professionals is driving the adoption of gingival recession treatment in dental clinics,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Gingival Recession Treatment Market: Straumann Group; Dentsply Sirona; Geistlich Pharma; Zimmer Biomet Dental; Colgate-Palmolive; 3M Oral Care; Ivoclar Vivadent; Hu-Friedy; Kuraray Noritake Dental; GC Corporation; BioChange; Grin.

Soft Tissue Graft Treatment Gaining Prominence:

Demand for soft tissue grafts exceeds that for other gingival recession treatments because they effectively repair gum lines and stop the progression of the condition. Known for their ability to create healthy, connected gingiva, free soft tissue techniques facilitate root-covering renewal and reduce recession. This makes them a preferred choice for those seeking long-term, sustainable results. Rising preference for minimally invasive procedures, which promise less pain and faster recovery, is driving the increasing popularity of free soft tissue graft treatments.

Gingival Recession Treatment Industry News:

- In April 2023, Grin introduced new products during the AAO Annual Session that improve record keeping, practice management, and communication. Grin, a comprehensive virtual care platform that connects practitioners and patients, announced the launch of many new products during the American Association of Orthodontics Annual Meeting in Chicago.

- In September 2022, BioChange, an Israeli business that has developed a breakthrough tissue regeneration technology, successfully treated canine periodontitis (Gum Recession Disease). The usage of BioChange’s ReGum resulted in a 100% improvement over the standard-of-care treatment regimen, with considerable regeneration of periodontal tissue. Dr. Ana Nemec, Jerzy Pawel Gawor, and Peter Strøm reported their statistically significant findings in Frontiers in Veterinary Science.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10299

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the gingival recession treatment market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on treatment (free soft tissue grafts, guided tissue regeneration, pedicle soft tissue flaps, laser therapy, growth factors & biomaterials, removable gingival veneers), age group (pediatric, adult, geriatric), indication (anatomical, plaque-induced periodontics, trauma, iatrogenic factors, smoking & tobacco consumption, aging, hormonal changes, gingival biotype), and end user (hospitals, dental clinics), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Segmentation of Gingival Recession Treatment Market Research:

- By Treatment :

- Free Soft Tissue Grafts

- Epithelial Grafts

- Subepithelial CT Grafts

- Guided Tissue Regeneration (GTR)

- Pedicle Soft Tissue Flaps

- Rotational Flaps

- Advancement Flaps

- Laser Therapy

- Growth Factors & Biomaterials

- Removable Gingival Veneers

- Free Soft Tissue Grafts

- By Age Group :

- By Indication :

- Anatomical

- Plaque-Induced Periodontics

- Trauma

- Iatrogenic Factors

- Smoking & Tobacco Consumption

- Aging

- Hormonal Changes

- Gingival Biotype

- By End User :

Checkout More Related Studies Published by Fact.MR Research:

The global psychotic disorder treatment market accounts for US$ 13.6 billion and is projected to surge past a valuation of US$ 24.5 billion by the end of 2032.

The global alexandrite laser treatment market size is calculated at US$ 48.7 million for 2024 and is forecasted to reach US$ 83.2 million by the end of 2034, advancing at a CAGR of 5.5% between 2024 and 2034.

Worldwide demand for Lewy body dementia treatment accounts for a market value of US$ 4.7 billion in 2023. Across the study period (2023 to 2033), the global Lewy body dementia treatment market size is predicted to expand steadily at 6% CAGR and reach US$ 8.45 billion by the end of 2033.

Antibiotic-Associated Diarrhea Treatment Market Forecast, Trend Analysis & Competition Tracking – Global Review 2018 to 2028

Bell’s Palsy Treatment Market Based on Drug Class (Corticosteroids, Anticonvulsants, Antibacterial, Antivirals), Based on distribution channel (Hospital, Retail, Drug Stores, Online) – Global Insights to 2028

Factor XIII Deficiency Treatment Market Based on treatment(fresh frozen plasma and pharmaceuticals product)- Global Review 2018 to 2028

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

YY Group Holding Limited Announces Unaudited First Half 2024 Financial Results

SINGAPORE, Sept. 10, 2024 (GLOBE NEWSWIRE) — YY Group Holding Limited YYGH (“YY Group”, “YYGH”, or the “Company”), a data and technology-driven provider of staffing solutions for the hotel and hospitality industry as well as commercial cleaning and janitorial services, today announced its financial and operating results for the six months ended June 30, 2024, along with recent business developments.

“We are thrilled with the strong growth and operational achievements in the first half of 2024,” said Fu Xiaowei, CEO of YY Group Holding Limited. “Our successful IPO and the expansion into Australia and Vietnam underscore our commitment to broadening our international footprint. We look forward to delivering sustained value to our shareholders as we continue to grow.”

Financial Highlights for the First Half of 2024

- Total Revenues: Increased by 41.0% to $19,259,492 for the six months ended June 30, 2024, compared to $13,659,047 during the same period in 2023.

- Gross Profit: Increased by 32.8% to $2,377,674, up from $1,790,734 for the six months ended June 30, 2023.

- YY App Metrics: Downloads and active users grew by 33.8% and 43.2%, respectively, with total downloads reaching 464,595 and active users reaching 152,650 as of June 30, 2024.

- User Engagement: The number of daily, weekly, and monthly active users rose significantly by 177.2%, 158.5%, and 158.5%, respectively, with daily active users reaching 4,316, weekly active users reaching 9,271, and monthly active users reaching 25,066.

YY Group’s impressive financial performance reflects its sustained growth across its platform and the success of its global expansion efforts.

Business Developments

- Completion of Initial Public Offering (IPO)

On April 22, 2024, YY Group Holding Limited (“the Company”) completed its initial public offering by issuing 1,125,000 Class A Ordinary Shares at a public offering price of $4.00 per share, for aggregate gross proceeds of approximately $4.5 million before deducting underwriting discounts, commissions, and other offering expenses.

On April 24, 2024, the Company also issued a warrant to the underwriter, US Tiger Securities Inc., granting the right to purchase 56,250 of the Company’s Class A Ordinary Shares. This warrant will expire on April 22, 2027.

- Expansion into Australia

On June 14, 2023, YY Circle (AU) Pty Ltd (“YY Circle (AU)”) was incorporated in New South Wales, Australia as a proprietary company limited by shares.

On January 12, 2024, Mr. Samuel Nicolas Astbury, the former director of YY Circle (AU) transferred 100% shares to Mr. Andrew Dvash.

On March 1, 2024, Mr. Andrew Dvash, who is a director of YY Circle (AU) transferred 95% of shares to the Group CEO Mr. Fu Xiaowei.

On May 1, 2024 Mr. Fu Xiaowei transferred all the shares to the Company. YY Circle (AU) became a majority owned subsidiary, with a remaining 5% of the company owned by Andrew Dvash.

- Expansion into Vietnam

On February 6, 2024, YY Circle (Vietnam) Company Limited (“YY Circle (VN)”) was incorporated in Vietnam as a limited liability company with multiple members by shares. YY Circle (VN) commenced business on February 6, 2024 and is principally engaged in the provision of manpower outsourcing service to our customers via the YY App. YY Circle (VN) is a majority owned by our subsidiary YY Circle (SG), with a remaining 5% of the company owned by Tran Hai Lan, who is a director of YY Circle (VN).

Balance Sheets and Cash Flows

As of June 30, 2024, the Company had $1,078,169 cash. Net cash used in operating activities for the six months ended June 30, 2024 was $2,649,324 compared with net cash provided by operating activities of $303,146 for the six months ended June 30, 2023. The movement of $2,952,470 in operating activities was primarily attributable to several key factors. First, there was an increase in operating expenses, driven by higher salaries and wages resulting from annual raises and the hiring of additional staff. The Company also expanded its marketing expenditures to maintain the market share. Following the IPO, the Company has reduced its use of AR factoring which is typically used to hedge the cash flow associated with account receivable. The reduction has resulted in an increase in accounts receivable. Concurrently, the Company engaged more subcontractors to support its business expansion, resulting in shorter payment terms. Additionally, the company made prepayments for IT enhancement costs and consultation fees which contributed to the overall increase in operating outflows during this period.

About Us

At YY Group Holding, we are driven by a vision to shape futures and revolutionize industries. Our journey began with a mission to bridge the gap between talent and opportunity. Over the years, we have transformed into a premier talent acquisition and technology solutions conglomerate, operating across Singapore, Malaysia, and Thailand. Today, we stand as pioneers, serving job seekers, employers, and businesses with cutting-edge solutions that redefine how we connect and thrive.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking statements that are subject to various risks and uncertainties. Such statements include statements regarding the Company’s ability to grow its business and other statements that are not historical facts, including statements which may be accompanied by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including without limitation, the Company’s ability to achieve profitable operations, customer acceptance of new products, the effects of the spread of Coronavirus (COVID-19) and future measures taken by authorities in the countries wherein the Company has supply chain partners, the demand for the Company’s products and the Company’s customers’ economic condition, the impact of competitive products and pricing, successfully managing and, general economic conditions and other risk factors detailed in the Company’s filings with the United States Securities and Exchange Commission (SEC). The forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake any responsibility to update the forward-looking statements in this release, except according to applicable law.

Investor Relations Contact

Phua Zhi Yong

Chief Financial Officer

YY Group Holding

Enquiries@yygroupholding.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Academy Sports Struggles With Lower Sales In Q2; Cuts FY24 Outlook Amid Distribution Challenges

Academy Sports and Outdoors, Inc. ASO shares are trading lower on Tuesday.

The company reported second-quarter adjusted earnings per share of $2.03, which is in line with the analyst consensus estimate. Quarterly sales of $1.549 billion (down 2.2%) missed the street view of $1.574 billion.

“Sales for the second quarter were more challenging than expected, impacted by a tough economy, a temporary distribution center backlog related to going live with a new warehouse management system and by a very active storm season across key portions of our footprint,” said Carl Ford, Chief Financial Officer.

Academy Sports registered a comparable sales decline of 6.9%, comparatively narrower than the decline of 7.5% year over year.

Academy Sports is advancing its strategic goals by and implementing new omni-channel features like DoorDash.

Also Read: How To Earn $500 A Month From Academy Sports And Outdoors Stock Ahead Of Q2 Earnings Report

Academy Sports concluded the quarter with cash and equivalents totaling $324.6 million, net merchandise inventories amounting to $1.366 billion, and net long-term debt of $483.6 million.

The company is also capitalizing on customer enthusiasm for its new loyalty program. Additionally, inventory management improvements have led to a 50 basis point increase in gross margin and a 5% reduction in units per store.

Academy opened one new store during the second quarter. So far, in the first two fiscal quarters, the company has opened three stores and plans to open between 15 and 17 stores in 2024.

Dividend: Academy Sports has declared a quarterly cash dividend of $0.11 per share of common stock. It will pay this dividend on October 17, 2024, to shareholders who are on record as of the close of business on September 19, 2024.

Outlook: Academy Sports projects fiscal year 2024 net sales between $5.895 billion and $6.075 billion, compared to the $6.124 billion estimate. This is a revision from the previous forecast of $6.070 billion to $6.350 billion.

The company expects adjusted EPS to be between $5.75 and $6.50 versus the $6.48 estimate.

The updated outlook for comparable sales is a decrease of 6% to a decrease of 3%, a revision from the previous forecast that ranged from a decline of 4% to an increase of 1%.

Price Action: ASO shares are trading lower by 1.33% to $51.94 at last check Tuesday.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.