Workday, Buckle And 2 Other Stocks Executives Are Selling

The Nasdaq 100 closed higher by over 1% during Monday’s session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company’s prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

Workday

- The Trade: Workday, Inc. WDAY Director George J Still Jr sold a total of 7,500 shares at an average price of $255.45. The insider received around $1.9 million from selling those shares.

- What’s Happening: On Aug. 22, Workday reported better-than-expected second-quarter financial results and approved a new buyback program to repurchase up to an additional $1.0 billion of shares of its Class A common stock.

- What Workday Does: Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions.

Buckle

- The Trade: The Buckle, Inc. BKE SVP Leasing Brett P Milkie sold a total of 16,000 shares at an average price of $41.35. The insider received around $661,560 from selling those shares.

- What’s Happening: On Aug. 23, Buckle reported better-than-expected second-quarter revenue results.

- What Buckle Does: Buckle Inc is a retailer of casual apparel, footwear, and accessories.

Paycom Software

- The Trade: Paycom Software, Inc. PAYC CEO and President Chad R. Richison sold a total of 3,900 shares at an average price of $155.46. The insider received around $606,298 from selling those shares.

- What’s Happening: On July 31, Paycom Software posted upbeat quarterly earnings

- What Paycom Software Does: Paycom is a fast-growing provider of payroll and human capital management software primarily targeting clients with 50-10,000 employees in the United States.

MarineMax

- The Trade: MarineMax, Inc. HZO Clint Moore sold a total of 2,500 shares at an average price of $30.03. The insider received around $75,075 from selling those shares.

- What’s Happening: On Sept. 9, Citigroup analyst James Hardiman upgraded MarineMax from Neutral to Buy and raised the price target from $40 to $44.

- What MarineMax Does: MarineMax Inc is a United-States-based company that sells new and used recreational boats under premium brands, and related marine products, like engines, parts, and accessories.

Check This Out:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ONWARD® Medical Reports Half Year 2024 Results and Provides a Business Update

THIS PRESS RELEASE CONTAINS INSIDE INFORMATION WITHIN THE MEANING OF ARTICLE 7(1) OF THE EUROPEAN MARKET ABUSE REGULATION (596/2014)

Up-LIFT Study results published in Nature Medicine

De Novo application submitted to FDA to obtain clearance to market the investigational ARC-EX® System in the United States

Up to EUR 52.5M in growth financing obtained from US-based Runway Growth Capital

Several additional milestones achieved with the investigational ARC-BCI™ System, leveraging brain-computer interface (BCI) technology to restore thought-driven movement

EINDHOVEN, the Netherlands, Sept. 10, 2024 (GLOBE NEWSWIRE) — ONWARD Medical N.V. ONWD, the medical technology company creating innovative therapies to restore movement, function, and independence in people with spinal cord injury (SCI), today announces its Half Year 2024 Financial Results and provides a Business Update.

“We had an excellent first half of 2024, submitting a De Novo application for our ARC-EX System to the FDA, publishing the results of our Up-LIFT pivotal study in Nature Medicine, and obtaining up to EUR 52.5M in growth financing from Runway Growth Capital,” said Dave Marver, CEO of ONWARD Medical. “We also extended our leadership in the brain-computer interface realm, adding an FDA Breakthrough Device Designation (our 10th) and gaining admittance into the FDA’s new TAP program to streamline commercialization. We are leading the way in developing a BCI-enabled therapy to restore movement after SCI.”

Half Year Operating and Financial Results

Clinical and Development

- In January, the Company expanded its HemON clinical feasibility study to explore use of its investigational ARC-IM® System to improve blood pressure regulation after SCI. The addition of Sint Maartenskliniek in the Netherlands prepares the Company for expected initiation in the coming months of its global pivotal trial, Empower BP, to assess the safety and efficacy of ARC-IM Therapy to improve blood pressure regulation after SCI.

- In February, the Company announced it was awarded Breakthrough Device Designation (BDD) by the US Food and Drug Administration (FDA) for the ARC-BCI System, which uses BCI technology combined with its ARC-IM Therapy to restore thought-driven lower limb mobility after SCI. This is the Company’s 10th BDD.

- In March, ONWARD Medical was only the second BCI company admitted into the FDA’s new Total Product Lifecycle Advisory Program (TAP), which is intended to streamline the commercialization of innovative new technologies.

- In April, the Company announced it submitted a De Novo application to the FDA to obtain regulatory clearance to market its non-invasive ARC-EX System in the US. Clearance is expected Q4 2024.

- In May, the Company announced publication of its Up-LIFT pivotal trial results in Nature Medicine. The study achieved all primary and secondary safety and effectiveness endpoints, and ARC-EX Therapy demonstrated significant improvements in upper limb strength, function, and sensation among people with chronic tetraplegia due to cervical SCI.

Science and Intellectual Property

- The Company was issued 30 new patents in the first half of 2024, bringing its total number of issued patents to 270+ and strengthening its first-mover advantage.

Corporate

- In March, the Company completed a €20M equity financing round that strengthened its cash position to support investments in product development, clinical studies, and operational and commercial capabilities; this financing extended the Company’s cash runway into spring 2025.

- The Company now has five banks providing equity research coverage. In April, the Company announced that Stifel, a US-based full-service investment bank, had initiated research coverage. In February, the Company announced that KBC Securities also initiated research coverage. The Company continues to be covered by equity research analysts at Bryan Garnier & Co, Degroof Petercam, and Kepler Cheuvreux.

- In June, the Company signed a debt financing agreement for up to €52.5 million with US-based lender Runway Growth Capital. The initial tranche of this loan was used to retire the Company’s outstanding debt. Future tranches are subject to the Company reaching certain milestones and are expected to be used to fund the Company’s upcoming commercial and clinical activities and to support working capital and general corporate purposes.

Financial

- The Company reported an operating loss of EUR 18.7 million for the first six months of 2024, in line with the EUR 18.8 million loss recorded in the first half of 2023. Increased spending on clinical, regulatory, and quality activities was balanced by reduced external spending on research and development.

- The Company ended the first half of 2024 with a positive cash balance of EUR 32.1 million. The balance at year-end 2023 was EUR 29.8 million. The increase of EUR 2.3 million results from proceeds from the March 2024 equity financing offset by the cash outflows for operating activities.

Half Year 2024 Financial Summary

| In EUR millions For the six-month period ended June 30 |

2024 | 2023 |

| Total Revenues & Other Income | 0.2 | 0.9 |

| Total Operating Expenses | (19.0) | (19.7) |

| Operating Loss for the Period | (18.7) | (18.8) |

| Net Finance Result | 0.2 | (0.5) |

| Income Taxes | 0.3 | (0.0) |

| Net Loss for the Period | (18.3) | (19.3) |

| At | 30 June 2024 | 31 December 2023 |

| Cash position at the end of the period | 32.1 | 29.8 |

| Interest Bearing Loans | (16.0) | (15.3) |

| Equity | 18.3 | 17.9 |

Business Update: Outlook and Upcoming Milestones

ONWARD Medical expects to continue the steady and consistent execution of its strategy in the coming quarters, including preparing for commercialization of its first product.

- The Company expects to obtain FDA clearance to launch its ARC-EX System in the US in Q4 2024. The Company has commenced the hiring of a field sales and service organization and plans to provide more detail about its launch plans during today’s Half Year 2024 Investor Webinar and Business Update.

- The Company expects a peer-reviewed publication in a top-tier medical journal detailing the results of the first 10+ patients implanted with investigational ARC-IM Therapy to address blood pressure instability after SCI.

- The Company is preparing to initiate its Empower BP global pivotal trial for ARC-IM Therapy to address blood pressure instability after SCI. Major associated milestones expected to occur in late 2024 and early 2025 include FDA Investigational Device Exemption (IDE) submission, FDA IDE approval, and first participant enrollment.

- The Company plans to advance clinical and development activities for its ARC-BCI System, leveraging new grant funding from the Christopher & Dana Reeve Foundation, ongoing financial support from the European Innovation Council under the Reverse Paralysis project, the previously announced FDA Breakthrough Device Designation, and acceptance into the FDA’s new TAP program. Several additional ARC-BCI System implants are expected in the second half of 2024 and first half of 2025 as part of the ongoing clinical feasibility study with its partners at .NeuroRestore and CEA-Clinatec.

Conference Call & Webcast

ONWARD Medical will host a conference call with a live webcast today, September 10, 2024, at 2:00 pm CET / 8:00 am EDT. The 2024 Half-Year Report and webcast may be accessed on the Financial Information page of the Company’s website. To join the webcast via Zoom, please register using this link.

*All ONWARD® Medical devices and therapies, including but not limited to ARC-IM®, ARC-EX®, ARC-BCI™, and ARC Therapy™, alone or in combination with a brain-computer interface (BCI), are investigational and not available for commercial use.

About ONWARD Medical

ONWARD® Medical is a medical technology company creating therapies to restore movement, function, and independence in people with spinal cord injury (SCI) and movement disabilities. Building on more than a decade of scientific discovery, preclinical, and clinical research conducted at leading hospitals, rehabilitation clinics, and neuroscience laboratories, the Company has developed ARC Therapy™, which has been awarded ten Breakthrough Device Designations from the US Food and Drug Administration (FDA).

ONWARD ARC Therapy is targeted, programmed spinal cord stimulation designed to be delivered by the Company’s external ARC-EX® or implantable ARC-IM® platforms. ARC Therapy can also be delivered by the Company’s ARC-BCI™ platform, which pairs the ARC-IM System with brain-computer interface (BCI) technology to restore movement after SCI with thought-driven control.

Use of non-invasive ARC-EX Therapy significantly improved upper limb function after SCI in the global pivotal Up-LIFT trial, with results published by Nature Medicine in May 2024. The Company has submitted its regulatory application to the FDA for clearance of the ARC-EX System in the US and is preparing for regulatory submission in Europe. In parallel, the Company is conducting clinical studies with its ARC-IM Therapy, which demonstrated positive interim clinical outcomes for improved blood pressure regulation following SCI. Other ongoing clinical studies focus on using ARC-IM Therapy to address mobility after SCI and gait challenges in Parkinson’s disease as well as using the ARC-BCI platform to restore thought-driven movement of both upper and lower limbs after SCI.

Headquartered in Eindhoven, the Netherlands, ONWARD Medical has a Science and Engineering Center in Lausanne, Switzerland and a US office in Boston, Massachusetts. The Company is listed on Euronext Brussels and Amsterdam ONWD.

For more information, visit ONWD.com, and connect with us on LinkedIn and YouTube.

For Media Inquiries:

Aditi Roy, VP Communications

media@onwd.com

For Investor Inquiries:

Amori Fraser, Finance Director

investors@onwd.com

Disclaimer

Certain statements, beliefs, and opinions in this press release are forward-looking, which reflect the Company’s or, as appropriate, the Company directors’ current expectations and projections about future events. By their nature, forward-looking statements involve several risks, uncertainties, and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties, and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. A multitude of factors including, but not limited to, delays in regulatory approvals, changes in demand, competition, and technology, can cause actual events, performance, or results to differ significantly from any anticipated development. Forward-looking statements contained in this press release regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. As a result, the Company expressly disclaims any obligation or undertaking to release any update or revisions to any forward-looking statements in this press release as a result of any change in expectations or any change in events, conditions, assumptions, or circumstances on which these forward-looking statements are based. Neither the Company nor its advisers or representatives nor any of its subsidiary undertakings or any such person’s officers or employees guarantees that the assumptions underlying such forward-looking statements are free from errors nor does either accept any responsibility for the future accuracy of the forward-looking statements contained in this press release or the actual occurrence of the forecasted developments. You should not place undue reliance on forward-looking statements, which speak only as of the date of this press release. All ONWARD Medical devices and therapies referenced here, including but not limited to ARC-IM®, ARC-EX®, ARC-BCI™ and ARC Therapy™, are investigational and not available for commercial use.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Peter Schiff Warns Fed's Rate Cuts Won't Prevent Recession — Issues Warning About Inflation And Unemployment: 'Game Over'

Renowned economist Peter Schiff has issued a stark warning about the U.S. economy, suggesting that Federal Reserve rate cuts will not stave off a recession.

What Happened: Peter Schiff, a well-known gold advocate and critic of Bitcoin BTC/USD, has issued a warning about the U.S. economy. According to a post on X, Schiff believes that the Federal Reserve’s rate cuts will not prevent a recession.

Schiff stated on Tuesday, “The #Fed’s rate cuts won’t prevent a #recession. In fact, the U.S. economy has likely been in a recession for some time, though it hasn’t been officially confirmed yet.” He further elaborated that while short-term rates may decrease, long-term rates, inflation, and unemployment are expected to rise.

Schiff’s comments suggest that the economic situation is more dire than it appears. He concluded his post with, “Game over,” indicating a bleak outlook for the U.S. economy. This warning comes amid ongoing debates about the effectiveness of the Federal Reserve’s monetary policies.

Why It Matters: Schiff’s warning aligns with recent concerns raised by other financial experts. Garry Evans, chief strategist of global asset allocation at BCA Research also predicted an impending U.S. recession, despite potential Federal Reserve rate cuts. The strategist emphasized that “every single one of us now believes” a recession is imminent, contrary to market optimism.

Moreover, in late July, it was noted that the Federal Reserve’s first rate cut might not significantly impact the market. Despite some fluctuations in the S&P 500, the index remained substantially higher compared to its October 2022 low.

Earlier in June, Mohamed El-Erian, chief economic adviser at Allianz, urged the Federal Reserve to implement rate cuts to prevent economic instability. El-Erian emphasized that the timing and extent of these cuts are crucial.

Read Next:

Image via Pixabay

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Could Nvidia Stock Double in the Next Year?

Nvidia (NASDAQ: NVDA) stock has been on an unprecedented run for a company its size. In 2023, the stock rose nearly 240%. While 2024 hasn’t been nearly as good, it has still been impressive, with Nvidia’s stock rising around 108% so far.

Investors have gotten a bit spoiled by Nvidia’s performance over the past two years, and the status quo may lead some to think Nvidia could double again in the next year. Is this possible?

AI is driving the demand for Nvidia’s GPUs

Nvidia’s rise has been directly tied to the rise of artificial intelligence (AI) computing. Its graphics processing units (GPUs) are instrumental in training AI models, as they can process multiple calculations in parallel. Nvidia’s products are pretty much undisputed as the best choice in the space, so it naturally became the top pick for any company looking to build out its AI computing infrastructure. The key here is that these companies don’t buy one or two GPUs; they connect thousands of these devices to create a machine that can quickly process incredible amounts of information.

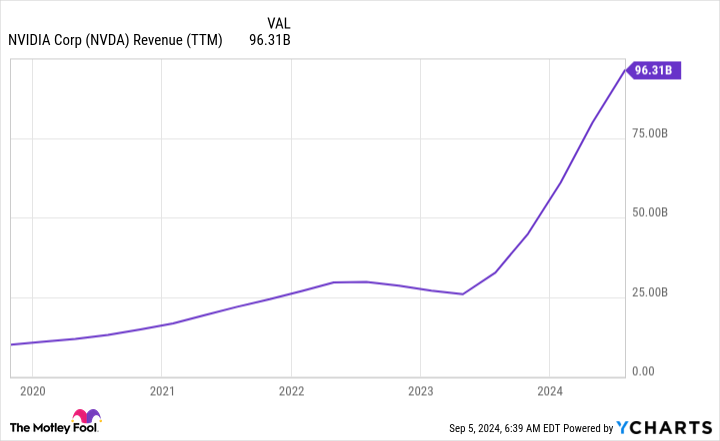

As a result of this demand, Nvidia’s sales have gone through the roof.

In the second quarter of fiscal year 2025 (ending July 28), its revenue rose 122% year over year to $30 billion. Its data center business had the best quarter, with revenue rising 154% year over year to $26.3 billion. One thing to note here is that it also rose 16% quarter over quarter, which shows demand is still ramping up.

The performance isn’t going away, either. In Q3, management expects $32.5 billion in revenue.

Clearly, Nvidia’s business is crushing it, and demand is still increasing. But is this enough to cause the stock to double?

Nvidia has a lot of success already priced into the stock

For Nvidia’s stock to double, the company would need to be worth $5.2 trillion. For context, the world’s largest company is Apple, which is worth under $3.4 trillion.

That’s a tall task in just a year, and it’s unlikely that it could be accomplished in this time.

Why? Because all of Nvidia’s growth is already baked into the stock. If you take a look at Nvidia’s valuation metrics, you can calculate that Wall Street has already baked in around 33% earnings growth from now until the end of its fiscal year.

While Nvidia’s earnings per share (EPS) rose 168% in Q2, this figure is about to face tough comparisons now that it’s overlapping some of fiscal 2024’s strong quarters. Furthermore, a price tag of 50 times trailing earnings and 37 times forward earnings is quite expensive.

It’s more common for a company with a strong pedigree, like Nvidia, to trade for around 30 times forward earnings. So, not only does Nvidia’s stock have a bit to go before returning to that point, it would also need to double its earnings for the stock to double.

When could that be?

At Nvidia’s current stock price, it would need its forward EPS projections to be $7.08 to be worth 15 times forward earnings. Because we set the base valuation at 30 times forward earnings, this would result in the stock price doubling.

Finding far-out earnings projections isn’t easy, and only one Wall Street analyst provides fiscal 2028 (ending January 2028) EPS projections. This analyst sees EPS of $5.45, which is still a ways away from the required $7.08.

If it continues that growth trajectory, Nvidia will reach the mark around fiscal 2029, which is about four and a half years away. While that’s not a double in a year, that performance would still beat the broader market, which tends to double about every seven years.

Nvidia isn’t doubling anytime soon, but that doesn’t mean it can’t be a solid investment now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool has a disclosure policy.

Could Nvidia Stock Double in the Next Year? was originally published by The Motley Fool

What's Going On With Bank Of America Stock On Tuesday?

Bank of America Corporation BAC shares are climbing as the company announces a bold wage hike, driving its minimum hourly rate to $24 and edging closer to a $25 goal by 2025.

“Providing a competitive minimum wage is core to being a great place to work — and I am proud that Bank of America is leading by example,” said Sheri Bronstein, chief human resources officer.

This increase will raise the minimum annual salary for full-time U.S. employees to almost $50,000 and applies to all full-time and part-time hourly roles.

This decision continues Bank of America’s tradition of leading the nation in setting minimum wage standards for U.S. hourly workers.

In the last seven years, Bank of America raised the minimum hourly wage from $15 to $24 in 2024. As a result, the starting salary for full-time U.S. employees will have increased by nearly $20,000 since 2017.

According to Benzinga Pro, BAC stock has gained over 38% in the past year. Investors can gain exposure to the stock via First Trust Nasdaq Bank ETF FTXO and Invesco KBW Bank ETF KBWB.

Price Action: BAC shares are trading higher by 1.60% to $40.10 premarket at last check Tuesday.

Photo via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Celsius Stock The Next Coca-Cola?

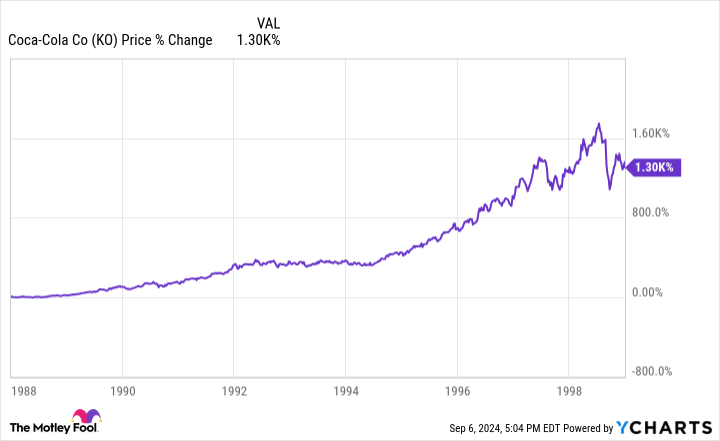

One of Warren Buffett’s best investments was in Coca-Cola. He bought around $1 billion in shares back in 1988, or 6.2% of the company.

This occurred after the market crash of 1987 and gave Buffett a buying opportunity at a cheap price-to-earnings ratio (P/E). It was also right before Coca-Cola rapidly expanded internationally. By 1998, the company’s stock was up over 10x for Buffett, excluding dividends.

When consumer products with a strong brand expand internationally, there’s huge growth potential. If the brand succeeds and becomes a globally known brand, such as Coca-Cola, shareholders generally do quite well — although this isn’t guaranteed.

The key is investing before a huge spurt in international growth. Celsius Holdings (NASDAQ: CELH) is making moves to expand outside of North America and become an international energy-drink brand. Shares are down 66% from their all-time highs.

Is Celsius stock ready to grow tenfold and become the next Coca-Cola?

A big year for international growth

With an energy drink that’s sugar-free and focused on health-conscious consumers, Celsius has taken the U.S. energy-drink market by storm in the last few years. Revenue is now around $1.5 billion and growing at a quick pace every year. It’s the third largest energy-drink brand in the U.S., only behind Red Bull and Monster Beverage.

So far, it hasn’t replicated this success around the globe. Last quarter, Celsius generated $402 million in revenue, and only $19.6 million of this revenue came from outside North America. Management hopes to fix this with focused investments into new markets next year. It has officially launched in countries like the United Kingdom, Australia, and New Zealand, with plans for more in the coming years.

Investors betting on Celsius becoming the next Coca-Cola need to track international revenue growth closely in the coming years. Last quarter, the segment grew revenue 30% year over year. This will need to accelerate to a much faster growth rate if international markets are going to become a meaningful part of this business.

The good thing is that there’s plenty of room to grow Celsius around the world. The bad news is that Celsius hasn’t proven that customers outside the United States want these energy drinks.

Continued growth in the energy-drink category

In the 1990s, more and more people around the world were drinking sodas such as Coca-Cola. This provided a tailwind for volume growth that the company could ride and an extra boost to international expansion. Now, soda consumption has stagnated and is even falling in many places.

What has replaced it? Energy drinks, in many places.

The energy-drink category is expected to grow at 8% per year through 2030, which is a massive tailwind that Celsius can take advantage of. Celsius has a revenue base of just $1.5 billion today, so it’s not unrealistic that the company could eventually generate over $10 billion in revenue 10 years from now if it succeeds with this international expansion.

There is a huge sector tailwind at its back. On top of this, there’s inflation and pricing power that these brands have continuously passed on to consumers with little pushback. This is another driver of revenue growth, along with the sector tailwind and international expansion.

Are shares a buy right now?

Luckily for investors today, Celsius stock is down 66% from its all-time high set earlier this year. This puts the stock at a much cheaper P/E of 31. Previously, it had a sky-high P/E of 50 or more.

If you believe in the international expansion story, there’s a lot to like about Celsius stock at current prices. There’s a broad industry tailwind, the company keeps taking market share, and it’s a rational market with pricing power. Add it all together, and I think it’s likely that Celsius can keep growing revenue at a double-digit rate for the next 10 years.

The stock will do well if this occurs. If you’re an investor who’s bullish on the Celsius growth story, now might be a good time to scoop up some shares on the cheap.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius and Monster Beverage. The Motley Fool has a disclosure policy.

Is Celsius Stock The Next Coca-Cola? was originally published by The Motley Fool

SiriusXM Kicks off New Phase as an Independent Public Company

With Simplified Capital Structure and a Clear Path Forward, North America’s Leading Audio Entertainment Company is Well-Positioned to Continue its Transformation

SiriusXM Updates Free Cash Flow Guidance to Reflect the Impact of the Closing of the Liberty Media Transaction

Company Confirms Quarterly Dividend and Announces $1.166 Billion Stock Repurchase Authorization

NEW YORK, Sept. 10, 2024 /PRNewswire/ — Sirius XM Holdings Inc. SIRI today kicked off a new chapter as an independent public company with a simplified capital structure and strategy for continued success following the closing of its transaction with Liberty Media.

“Today SiriusXM embarks on a new phase in our journey as an independent public company, building on our leading position in audio entertainment,” said Jennifer Witz, Chief Executive Officer of SiriusXM. “We’ve created a strong and profitable business, anchored by a subscription service that fosters deep and loyal connections with our listeners and a growing digital audio advertising platform which extends our reach to fans around the world, and we are excited about the future as we look to expand and strengthen both platforms.”

“As we look ahead, we remain committed to three key objectives: enhancing subscriber value with a focus on content, technology and pricing; growing our advertising offerings to both engage new listeners and deliver effective results for advertisers; and driving efficiency across the organization to continue our strong track record of financial performance. We look forward to building upon SiriusXM’s twenty-year history as the audio platform of choice for millions of North Americans in their vehicles, at home, and on the go, with the goal of creating long-term value for our stockholders.”

Financial Update

SiriusXM reiterated its full-year 2024 revenue and adjusted EBITDA guidance. As the company has stated in past earnings releases, the company planned to update its free cash flow guidance for transaction impacts. The company estimates these costs to be approximately $200 million and include transaction costs, incremental interest expense related to the debt assumed and incurred in connection with the Liberty Media transaction, and cash outflows at Liberty Sirius XM Holdings Inc. prior to the closing.

“As we enter our next phase as an independent company, we expect SiriusXM to continue delivering solid, profitable results,” said Thomas Barry, Chief Financial Officer of SiriusXM. “After completing the transaction, which had the effect of reducing our outstanding common stock by approximately 12% before giving effect to the 1 for 10 adjustment, our capital allocation priorities are consistent: investing in our business, focusing in the near- to mid-term on reducing debt to return to our long-term target leverage, and continuing our capital return posture. In connection with our first day as an independent company, we have reiterated our revenue and adjusted EBITDA guidance and incorporated the impact of the transaction in our updated free cash flow guidance.”

The company’s 2024 financial guidance is as follows:

- Total revenue of approximately $8.75 billion,

- Adjusted EBITDA of approximately $2.7 billion, and

- Free cash flow of approximately $1.0 billion.

The company’s $200 million change to its free cash flow guidance reflects approximately $70 million associated with closing costs and go-forward incremental interest and approximately $130 million associated with historical, year-to-date cash outflows at Liberty Sirius XM Holdings Inc. prior to the closing of the transaction.

Adjusted EBITDA and free cash flow are non-GAAP financial measures. The company has not provided a reconciliation of adjusted EBITDA to projected net income (loss) or free cash flow to net cash provided by operating activities because full-year net income (loss) and net cash provided by operating activities will include special items that have not occurred and are difficult to predict with reasonable certainty prior to year-end. Due to this uncertainty, the company cannot reconcile adjusted EBITDA and free cash flow to their comparable GAAP measures without unreasonable effort.

Capital Return Program

SiriusXM plans to continue its recurring dividend, which adjusted for the 1 for 10 change in the Liberty Media transaction exchange ratio would be approximately 27 cents per quarter.

Upon completion of the Liberty Media transaction, the Board of SiriusXM authorized a $1.166 billion common stock repurchase program. The $1.166 billion common stock repurchase program is a continuation of the stock repurchase program of the former SiriusXM.

This newly authorized amount represents the amount that remained available under former SiriusXM’s $18 billion stock repurchase program that began in December 2012. Shares of common stock may be purchased from time to time on the open market and in privately negotiated transactions, including in accelerated stock repurchase transactions. SiriusXM expects to fund any repurchases through cash on hand, future cash flow from operations and borrowings under its revolving credit facility.

The timing and amount of any shares repurchased will be determined based on SiriusXM’s evaluation of market conditions and other factors and the program may be discontinued or suspended at any time. Repurchases will be made in compliance with all SEC rules and other legal requirements and may be made in part under a Rule 10b5-1 plan, which permits stock repurchases when SiriusXM might otherwise be precluded from doing so.

Target Leverage Ratio

The company also reiterated its long-term target leverage ratio of mid-to-low three times adjusted EBITDA. After appropriate investments in the business and its continuing regular dividend, SiriusXM expects to focus excess cash flows on debt reduction until it reaches this long-term leverage target while continuing to be mindful of strategic investment and capital return opportunities.

SiriusXM Evaluating Non-Cash Goodwill and other Intangible Assets

SiriusXM also announced that, with the completion of the Liberty Media transaction, the company will perform an evaluation of its goodwill and other intangible assets, particularly the goodwill and other intangible assets attributed from the Liberty Media transaction. The company has regularly assessed any asset impairments or impairment indicators of its legacy assets, and, as a result, any such post-transaction charges would primarily relate to goodwill and intangible assets associated with the Liberty Media transaction. The company expects to complete its analysis of this goodwill and the other intangible assets in the third quarter of 2024.

Such impairment charge, if any, would represent a non-cash charge to earnings, and it would not affect the company’s liquidity, cash flows from operating activities or debt covenants, or have any impact on future operations.

Transaction Closing Details

On September 9, 2024, at 4:05 p.m., New York City time, Liberty Media completed its previously announced split-off (the “Split-Off”) of its former wholly owned subsidiary, Liberty Sirius XM Holdings Inc. (“New Sirius”). The Split-Off was accomplished by Liberty Media redeeming each outstanding share of Liberty Media’s Series A, Series B and Series C Liberty SiriusXM common stock, par value $0.01 per share, in exchange for 0.8375 of a share of New Sirius common stock, par value $0.001 per share (the “Redemption”), with cash being paid to entitled record holders of Liberty SiriusXM common stock in lieu of any fractional shares of common stock of New Sirius.

Following the Split-Off, on September 9, 2024 at 6:00 p.m., New York City time, a wholly owned subsidiary of New Sirius merged with and into Sirius XM Holdings Inc. (“Old Sirius XM”), with Old Sirius XM surviving the merger as a wholly owned subsidiary of New Sirius (the “Merger” and together with the Split-Off, the “Transactions”). Upon consummation of the Merger, each share of common stock of Old Sirius XM, par value $0.001 per share, issued and outstanding immediately prior to the merger effective time (other than shares owned by New Sirius and its subsidiaries) was converted into one-tenth (0.1) of a share of New Sirius common stock, with cash being paid to entitled record holders of Old Sirius XM common stock in lieu of any fractional shares of common stock of New Sirius. Concurrently with the merger effective time, Old Sirius XM was renamed “Sirius XM Inc.” and New Sirius was renamed “Sirius XM Holdings Inc.”

As a result of the Transactions, Sirius XM Holdings Inc. is an independent, publicly traded company. Sirius XM Holdings Inc. common stock begins trading on Nasdaq under the ticker symbol “SIRI” on September 10, 2024.

Additional information regarding the Transactions is available in a Current Report on Form 8-K that the company filed yesterday with the U.S. Securities and Exchange Commission.

1 for 10 Adjustment

Upon consummation of the Liberty Media transaction, each share of common stock of Sirius XM issued and outstanding immediately prior to closing and held by the former minority stockholders of the company was converted into one-tenth (0.1) of a share of SiriusXM common stock. As a result, a holder of 100 shares of SiriusXM common stock, which closed on the Nasdaq Global Select Market at $2.67 prior to the transaction closing, received in exchange for such 100 shares 10 shares of SiriusXM common stock.

Share Reduction

Following the closing of the Liberty Media transaction, Sirius XM had approximately 339.1 million shares of common stock outstanding. The former holders of Liberty SiriusXM common stock own approximately 81% of Sirius XM and former Sirius XM minority stockholders own the remaining 19% of the new company.

The Liberty Media transaction resulted in the net reduction of approximately 12% of the company’s outstanding shares before giving effect to the 1 for 10 adjustment. The former holders of Liberty SiriusXM common stock surrendered a portion of their shares in the calculation of the exchange ratio in the new company in exchange for the assumption of certain net liabilities by the new company in the transaction.

About Sirius XM Holdings Inc.

SiriusXM is the leading audio entertainment company in North America with a portfolio of audio businesses including its flagship subscription entertainment service SiriusXM; the ad-supported and premium music streaming services of Pandora; an expansive podcast network; and a suite of business and advertising solutions. Reaching a combined monthly audience of approximately 150 million listeners, SiriusXM offers a broad range of content for listeners everywhere they tune in with a diverse mix of live, on-demand, and curated programming across music, talk, news, and sports. For more about SiriusXM, please go to: www.siriusxm.com.

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements.

The following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: Risks Relating to our Business and Operations: We face substantial competition and that competition is likely to increase over time; if our efforts to attract and retain subscribers and listeners, or convert listeners into subscribers, are not successful, our business will be adversely affected; we engage in extensive marketing efforts and the continued effectiveness of those efforts is an important part of our business; we rely on third parties for the operation of our business, and the failure of third parties to perform could adversely affect our business; we are migrating our billing system and payment processing function to a new service provider; failure to successfully monetize and generate revenues from podcasts and other non-music content could adversely affect our business, operating results, and financial condition; we may not realize the benefits of acquisitions or other strategic investments and initiatives; the impact of economic conditions may adversely affect our business, operating results, and financial condition; and we may be adversely affected by the war in Ukraine. Risks Relating to our Sirius XM Business: A substantial number of our Sirius XM service subscribers periodically cancel their subscriptions and we cannot predict how successful we will be at retaining customers; our ability to profitably attract and retain subscribers to our Sirius XM service is uncertain; our business depends in part upon the auto industry; failure of our satellites would significantly damage our business; and our Sirius XM service may experience harmful interference from wireless operations. Risks Relating to our Pandora and Off-platform Business: Our Pandora ad-supported business has suffered a substantial and consistent loss of monthly active users, which may adversely affect our Pandora and Off-platform business; our Pandora and Off-platform business generates a significant portion of its revenues from advertising, and reduced spending by advertisers could harm our business; our failure to convince advertisers of the benefits of our Pandora ad-supported service could harm our business; if we are unable to maintain revenue growth from our advertising products our results of operations will be adversely affected; changes to mobile operating systems and browsers may hinder our ability to sell advertising and market our services; and if we fail to accurately predict and play music, comedy or other content that our Pandora listeners enjoy, we may fail to retain existing and attract new listeners. Risks Relating to Laws and Governmental Regulations: Privacy and data security laws and regulations may hinder our ability to market our services, sell advertising and impose legal liabilities; consumer protection laws and our failure to comply with them could damage our business; failure to comply with FCC requirements could damage our business; environmental, social and governance expectations and related reporting obligations may expose us to potential liabilities, increased costs, reputational harm, and other adverse effects; and we may face lawsuits, incur liability or suffer reputational harm as a result of content published or made available through our services. Risks Associated with Data and Cybersecurity and the Protection of Consumer Information: If we fail to protect the security of personal information about our customers, we could be subject to costly government enforcement actions and private litigation and our reputation could suffer; we use artificial intelligence in our business, and challenges with properly managing its use could result in reputational harm, competitive harm, and legal liability and adversely affect our results of operations; and interruption or failure of our information technology and communications systems could impair the delivery of our service and harm our business. Risks Associated with Certain Intellectual Property Rights: The market for music rights is changing and is subject to significant uncertainties; our Pandora services depend upon maintaining complex licenses with copyright owners, and these licenses contain onerous terms; failure to protect our intellectual property or actions by third parties to enforce their intellectual property rights could substantially harm our business and operating results; some of our services and technologies may use “open source” software, which may restrict how we use or distribute our services or require that we release the source code subject to those licenses; and rapid technological and industry changes and new entrants could adversely impact our services. Risks Related to our Capital and Ownership Structure: We have a significant amount of indebtedness, and our debt contains certain covenants that restrict our operations; and while we currently pay a quarterly cash dividend to holders of our common stock, we may change our dividend policy at any time. Other Operational Risks: If we are unable to attract and retain qualified personnel, our business could be harmed; our facilities could be damaged by natural catastrophes or terrorist activities; the unfavorable outcome of pending or future litigation could have an adverse impact on our operations and financial condition; we may be exposed to liabilities that other entertainment service providers would not customarily be subject to; and our business and prospects depend on the strength of our brands. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found in Sirius XM Holdings Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the Securities and Exchange Commission (the “SEC”) and available at the SEC’s Internet site (http://www.sec.gov). The information set forth herein speaks only as of the date hereof, and we disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this communication.

Source: SiriusXM

Investor contacts:

Hooper Stevens

212-901-6718

hooper.stevens@siriusxm.com

Natalie Candela

212-901-6672

natalie.candela@siriusxm.com

Media Contact:

Maggie Mitchell

617-797-1443

maggie.mitchell@siriusxm.com

![]() View original content:https://www.prnewswire.com/news-releases/siriusxm-kicks-off-new-phase-as-an-independent-public-company-302243454.html

View original content:https://www.prnewswire.com/news-releases/siriusxm-kicks-off-new-phase-as-an-independent-public-company-302243454.html

SOURCE Sirius XM Holdings Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Calavo Growers Posts Better-Than-Expected Earnings, Joins Tesla, Oracle, Mission Produce And Other Big Stocks Moving Higher On Tuesday

U.S. stocks were mixed, with the Dow Jones index falling around 100 points on Tuesday.

Shares of Calavo Growers, Inc. CVGW rose sharply during Tuesday’s session as the company posted stronger-than-expected results for its third quarter.

Calavo Growers reported quarterly earnings of 57 cents per share, which beat the analyst consensus estimate of 43 cents by 32.56%. The company reported quarterly sales of $179.6 million which beat the analyst consensus estimate of $178.54 million.

The company increased its cash dividend by 10 cents per share to 20 cents per share to be paid on Oct. 30, 2024, to shareholders of record on Oct. 2, 2024

Calavo Growers shares jumped 12.5% to $26.76 on Tuesday.

Here are some other big stocks recording gains in today’s session.

- Mission Produce, Inc. AVO shares jumped 17.1% to $12.52 after the company reported better-than-expected third-quarter financial results.

- Avid Bioservices, Inc. CDMO shares jumped 15.8% to $10.37 following a narrower-than-expected quarterly loss.

- Oracle Corporation ORCL rose 12.5% to $157.33 following upbeat quarterly earnings.

- Centessa Pharmaceuticals plc CNTA gained 12.3% to $16.77 after the company announced interim data from an ongoing Phase 1 trial of ORX750 in acutely sleep-deprived healthy volunteers.

- Boot Barn Holdings, Inc. BOOT rose 12.1% to $156.48 after BTIG raised its price target on the stock from $150 to $165.

- Terns Pharmaceuticals, Inc. TERN gained 11.8% to $10.14. Terns announced a $125 million proposed public offering.

- Viridian Therapeutics, Inc. VRDN jumped 10.8% to $15.72 after the company reported topline data from the THRIVE phase 3 clinical trial of VRDN-001 in patients with active thyroid eye disease.

- InMode Ltd. INMD gained 10.7% to $17.19 after announcing a share repurchase program of up to 7.68 million shares.

- Kornit Digital Ltd. KRNT rose 8.8% to $19.83. Kornit Digital’s board authorized a $100 million share repurchase program.

- Highest Performances Holdings Inc. HPH jumped 8.4% to $1.55.

- Li Auto Inc. LI rose 5.5% to $19.92.

- Wingstop Inc. WING gained 5.3% to $384.32.

- Tesla, Inc. TSLA rose 4% to $224.82, buoyed by positive tidings from China. Vehicle insurance registration data for Tesla vehicles came in at a robust 16,200 for the week ended Sept. 8, CnEVPost reported, citing data provided by Li Auto. This compares to the previous week’s number of 14,400 units and marked the strongest increase since the 17,500 units reported for the third week of June..

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nasdaq, S&P 500 Futures Slip As Traders Eye Presidential Debate, Oracle Rallies Over 8%: Economist Points This Shift In Broader Market Trend Amid Flurry Of Weak Data

The market sentiment seems to fluctuate as the index futures dipped slightly, indicating a lower opening on Tuesday. The CBOE Volatility, aka VIX, rose slightly but held around the 20 level. Oracle Corp.’s ORCL earnings and the management’s comments regarding huge data center needs could buoy the tech space, although the Court of Justice of the European Union’s rulings against two big techs, necessitating payment of huge fines could act as a dampener.

That said, traders are likely to adopt a “wait-and-watch” approach as the market prepares to receive the consumer and producer price inflation reports over Wednesday and Thursday. The first presidential debate between former President Donald Trump and Vice President Kamala Harris, due late Tuesday, will also evince the interest of traders, given the candidates will likely discuss policy measures during the debate.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.29% |

| S&P 500 | -0.11% |

| Dow | -0.07% |

| R2K | -0.24% |

In premarket trading on Tuesday, the SPDR S&P 500 ETF Trust SPY edged up 0.02% to $546.51 and the Invesco QQQ ETF QQQ slipped 0.04% to $454.30, according to Benzinga Pro data.

Cues From Last Session:

Bargain hunting helped reverse sentiment on Wall Street on Monday, as the major averages held above the unchanged line throughout the session, although amid some volatility. The S&P 500 Index had closed the previous week with the biggest loss in about a year-and-a-half amid macro concerns. Monday’s rebound was led by high-profile tech stocks including Nvidia Corp. NVDA. The buying was broad-based with consumer discretionary, industrial, financial, IT and real estate stocks seeing marked strength.

| Index | Performance (+/) | Value |

| Nasdaq Composite | +1.16% | 16,884.60 |

| S&P 500 Index | +1.16% | 5,471.05 |

| Dow Industrials | +1.20% | 40,829.59 |

| Russell 2000 | +0.30% | 2,097.78 |

Insights From Analysts:

Weak economic data has accelerated the nascent rotation from growth stocks to value but particularly to dividend-paying stocks, said WisdomTree Senior Economist and Wharton professor Jeremy Siegel. “This shift reflects the broader anticipation of rate cuts, making bonds less attractive in comparison,” he said. The economist also highlighted significant technical sell signals seen in sectors that were prior market leaders, particularly in tech and semiconductors like Nvidia, which could indicate broader market shifts ahead.

The upcoming consumer and producer price inflation reports and other high-frequency economic data will be crucial in shaping the Fed’s actions, Siegel said. “While the U.S. economy is not in a recession and I do not forecast one, the slowdown necessitates more aggressive interest rate cuts by the Fed to mitigate risks and support economic stability,” he added.

See Also: How To Trade Futures

Upcoming Economic Data:

- The Energy Information Administration will release its short-term energy outlook report at 12 p.m. EDT.

- The Treasury will auction three-year notes at 1 p.m. EDT.

Stocks In Focus:

- Oracle Corp. ORCL climbed over 9% in premarket trading following the company’s quarterly results.

- Dave & Buster’s Entertainment, Inc. PLAY, GameStop Corp. GME and Petco Health and Wellness Company, Inc. WOOF are scheduled to announce their quarterly results after the market close.

- Hewlett Packard Enterprise Company HPE fell about 6% on a convertible stock offering.

- Apple, Inc. AAPL retreated over 1% and Alphabet, Inc. GOOGL GOOG edged down on adverse EU apex court rulings.

Commodities, Bonds And Global Equity Markets:

Crude oil futures declined steeply but gold futures rose modestly and traded shy of the $2,550 level. Bitcoin BTC/USD gained ground and traded just above the $57K level. The 10-year Treasury note yield edged slightly higher at 3.708%.

As Asian stocks took inspiration from Wall Street’s buoyancy overnight, most major markets in the region advanced, although caution remained the watchword ahead of the twin U.S. inflation reports. On the other hand, the Japanese stocks slipped amid a firmer yen, and the South Korean and Taiwanese markets also bucked the uptrend.

Sentiment across the Atlantic was nervous in early trading, with the Euro STOXX 50 Index marginally higher.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Broadcom's Latest Results Confirm Its Noteworthy Role In The New AI Era

Broadcom Inc AVGO topped estimates with infrastructure solutions revenue but came short on the semiconductor solutions front. With its latest results, the supplier of Apple Inc AAPL showed positive revenue growth and perhaps more importantly, proved that the transformation of the acquired VMware around private cloud is well grounded.

Fiscal Third Quarter Highlights

For the quarter ended on August 4th, Broadcom reported revenue grew 47% YoY to $13.07 billion, surpassing FactSet’s and LSEG’s consensus estimate of $12.98 billion. When excluding the contributions from VMware deal that closed in November, revenue only grew 4%. Semiconductor solutions brought in $7.27 billion with revenue growing 5% YoY, but still short of FactSet’s estimate of $7.42 billion. Strengthened by the VMware deal, infrastructure-solutions reported revenue grew as much as 200%, topping FactSet’s consensus estimate of $5.52 billion.

But, Broadcom ended up with a net loss of $1.88 billion, or 40 cents a share.

Adjusted earnings amounted to $1.24, surpassing LSEG’s consensus estimate of $1.20.

Guidance in line with expectations.

For the current quarter, Broadcom guided for revenue of $14 billion.

Fueled by ethernet networking and custom accelerators for AI data centers, Broadcom lifted its prior forecast as it now expects $12 billion in full-year AI revenue from sold AI parts and custom chips. It previously expected $11 billion. For the full year, Broadcom expects adjusted EBITDA to be 64% of revenue.

Broadcom’s contribution is not going unnoticed.

Over the past year, Broadcom stock rose as much as 75%, underlying the fact that the market is seeing the company as a noteworthy contributor to the AI infrastructure in the making. Some example of Broadcom’s work is on the Google-made TPU chip, the custom chip that even Apple used in its AI training work. With this decision, Apple also showed its focus to reduce reliance on the dominating chip player, Nvidia, as when it comes to AI training, Nivida makes the rules with its graphics processing units. Unsurprisingly, Nvidia put a hefty price tag on these highly wanted chips that Microsoft Corporation MSFT, Open AI and Anthropic use for their current models, while Google is among those using them to make its AI offerings and build its system. Therefore, the Apple supplier seems to have a less-obvious but still noteworthy role in the AI dynamics and new era that is in the making and Broadcom is clearly somewhat receiving the acknowledgement for its contribution.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.