Better Buy in September: ExxonMobil or a 50/50 Split of Devon Energy and Occidental Petroleum?

The price of West Texas Intermediate (WTI) crude oil — the U.S. benchmark — just fell below $70 a barrel, sending ripples throughout the energy sector. Long-term investors may view lower oil prices as an opportunity to scoop up shares of quality energy stocks on sale.

There are plenty of ways to invest in oil and gas, such as an integrated major like ExxonMobil (NYSE: XOM) or exploration and production (E&P) companies like Devon Energy (NYSE: DVN) or Occidental Petroleum (NYSE: OXY).

Here’s what you need to know about these three companies to help you decide which dividend stock is best for you.

The safer play

ExxonMobil is the most valuable U.S.-based energy company. It is one of the largest producers of oil and gas in North America and has a massive downstream business that is bigger from a throughput standpoint than many independent players such as Valero Energy. Exxon makes energy products like gasoline, naphtha, heating oils, kerosene, diesel, aviation fuels, heavy fuels, chemical products, and specialty products.

Exxon generates plenty of excess cash to aggressively buy back its own stock, raise its dividend, and invest in low-carbon opportunities such as carbon capture and storage, hydrogen, and more.

Exxon has paid and raised its dividend every year for 42 consecutive years — a period that includes several industry downturns. Exxon currently yields 3.3% — which is right around the average yield of the energy sector but significantly higher than the S&P 500 yield of 1.2%.

The company has done an excellent job improving its balance sheet by paying down debt, which set the stage for its $60 billion acquisition of Pioneer Natural Resources.

Add it all up, and Exxon is one of the most well-rounded energy stocks to buy now.

Two aggressive E&Ps hovering around 52-week lows

Occidental Petroleum — commonly known as Oxy — and Devon Energy lack Exxon’s downstream assets and diversification. They are also fairly concentrated from a production standpoint, specifically in North American onshore shale plays. These characteristics make both companies more sensitive to the price of oil and gas.

To their credit, Oxy and Devon have built impressive asset portfolios with low production costs and strong margins when oil prices are high. Both stocks will likely outperform Exxon and other integrated majors during expansion periods and underperform the sector during falling oil prices. The following chart shows that Exxon has kept pace with the S&P 500 year to date and has handily beaten the energy sector, whereas Oxy and Devon are now down on the year.

Oxy and Devon pay dividends but aren’t as reliable as Exxon in generating predictable passive income. Oxy slashed its dividend to a penny per share per quarter in 2020 and has since made modest raises to get the dividend back up to $0.22 per share per quarter for a yield of 1.6%.

Devon pays an ordinary dividend and a variable dividend that fluctuates based on its business performance. Since 2019, the annual dividend payments have been as low as $0.35 per share and as high as $5.17 per share in 2022. The following table shows total dividend payments by year for the last five years and the average price of WTI crude oil that year, which provides a rough idea of what to expect in passive income.

|

Metric |

2023 |

2022 |

2021 |

2020 |

2019 |

|---|---|---|---|---|---|

|

Average WTI crude oil spot price |

$77.58 |

$94.9 |

$68.13 |

$39.16 |

$56.99 |

|

Devon Energy dividend payments per share |

$2.87 |

$5.17 |

$1.97 |

$0.68 |

$0.35 |

Data sources: U.S. Energy Information Administration, Devon Energy.

Near-term dividend payments could be lower as Devon works to integrate its $5 billion acquisition of Grayson Mill Energy. Devon’s realized price can also differ from the spot price based on hedging contracts and other factors.

All three stocks are worth buying now

Exxon is a straightforward way to invest in the oil patch and could be the better choice for risk-averse investors, those new to energy stocks, or anyone looking for a stable stream of passive income.

However, a 50/50 split of Oxy and Devon has more upside potential if oil prices do level off, and especially if they go up.

Ultimately, the decision comes down to personal preference, risk tolerance, and the best fit for your portfolio. For some investors, all three stocks could be worth buying now.

Should you invest $1,000 in ExxonMobil right now?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Better Buy in September: ExxonMobil or a 50/50 Split of Devon Energy and Occidental Petroleum? was originally published by The Motley Fool

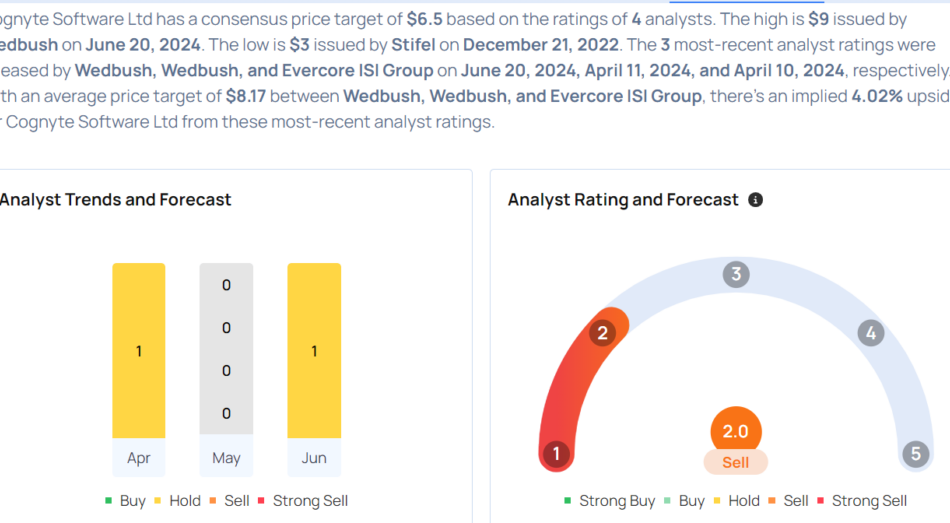

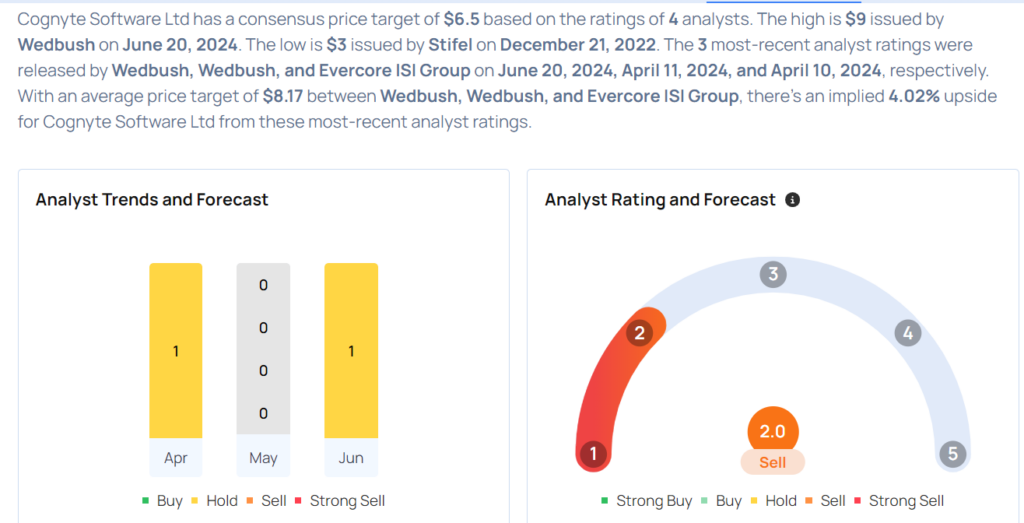

Top Wall Street Forecasters Revamp Cognyte Software Price Expectations Ahead Of Q2 Earnings

Cognyte Software Ltd. CGNT will release earnings results for its second quarter, before the opening bell on Tuesday, Sept. 10.

Analysts expect the Herzliya, Israel-based company to report a quarterly loss at 2 cents per share, versus a year-ago loss of 9 cents per share. Cognyte Software is projected to post revenue of $83.69 million, according to data from Benzinga Pro.

On June 18, Cognyte Software reported first-quarter fiscal 2025 sales growth of 12.9% year over year to $82.714 million, beating the consensus of $82.046 million.

Cognyte Software shares gained 0.8% to close at $7.44 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

Considering buying CGNT stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dynagas LNG Partners LP Reports Results for the Three and Six Months Ended June 30, 2024

ATHENS, Greece, Sept. 10, 2024 (GLOBE NEWSWIRE) — Dynagas LNG Partners LP (NYSE: “DLNG”) (“the “Partnership”), an owner and operator of liquefied natural gas (“LNG”) carriers, today announced its results for the three and six months ended June 30, 2024.

Half year Highlights:

- Net Income and Earnings per common unit (basic and diluted) of $22.5 million and $0.43, respectively;

- Adjusted Net Income(1) of $24.7 million and Adjusted Earnings per common unit(1) (basic and diluted) of $0.50;

- Adjusted EBITDA(1) $57.6 million; and

- 100% fleet utilization(2).

Quarter Highlights:

- Net Income and Earnings per common unit (basic and diluted) of $10.7 million and $0.20, respectively;

- Adjusted Net Income(1) of $12.4 million and Adjusted Earnings per common unit(1) (basic and diluted) of $0.25;

- Adjusted EBITDA(1) $28.6 million;

- 100% fleet utilization(2);

- Declared and paid a cash distribution of $0.5625 per unit on the Partnership’s Series A Preferred Units (NYSE: “DLNG PR A”) for the period from February 12, 2024 to May 11, 2024 and $0.698533750 per unit on the Series B Preferred Units (NYSE: “DLNG PR B”) for the period from February 22, 2024 to May 21, 2024; and

- On June 19, 2024, the Partnership entered into sale and leaseback agreements with subsidiaries of China Development Bank Financial Leasing Co. Ltd. (“CDBL”) for the lease financing of a total amount of $345.0 million for four out of the Partnership’s six LNG carriers. On June 27, 2024, proceeds received under the lease financing agreements, together with available cash, were used to fully prepay outstanding amounts under the $675 million Credit Facility, which was scheduled to mature in September 2024(3).

(1) Adjusted Net Income, Adjusted Earnings per common unit and Adjusted EBITDA are not recognized measures under U.S. GAAP. Please refer to Appendix B of this press release for the definitions and reconciliation of these measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP and other related information.

(2) Please refer to Appendix B for additional information on how we calculate fleet utilization.

(3) For further information, please see “Liquidity/ Financing/ Cash Flow Coverage” below.

Subsequent Events:

- Declared a quarterly cash distribution of $0.5625 on the Partnership’s Series A Preferred Units for the period from May 12, 2024 to August 11, 2024, which was paid on August 12, 2024 to all Series A Preferred unitholders of record as of August 5, 2024; and

- Declared a quarterly cash distribution of $0.714537806 on the Partnership’s Series B Preferred Units for the period from May 22, 2024 to August 21, 2024, which was paid on August 22, 2024 to all Series B Preferred unitholders of record as of August 15, 2024.

CEO Commentary:

We are pleased to report the financial results for the three months ended June 30, 2024.

In the second quarter of 2024, we reported a Net Income of $10.7 million, with earnings per common unit of $0.20. Adjusted EBITDA and Adjusted Net Income reached $28.6 million and $12.4 million respectively.

All six LNG carriers in our fleet are currently operating under long-term charters with international gas companies. These contracts have an average remaining term of 6.4 years. Assuming no unforeseen events, the Partnership expects no vessel availability until 2028. As of September 10, 2024, our estimated contract backlog stands at approximately $1.04 billion, equating to an average of about $173 million per vessel.

We are also pleased to announce new lease financing agreements with China Development Bank Financial Leasing Co. Ltd for four of our LNG carriers. The $345.0 million financing, along with $63.7 million from the Partnership’s existing cash reserves, was used to fully repay amounts outstanding under our previous credit facility of $408.7 million on June 27, 2024, ahead of its schedule maturity in September 2024.

Following a sustained period of strategic deleveraging, we now have substantially reduced our debt levels and secured a more flexible financing structure. With two of our LNG carriers now debt-free, we believe the Partnership is well-positioned for the next phase of growth and development.

Russian Sanctions Developments

Due to the ongoing Russian conflict with Ukraine, the United States (“U.S.”), European Union (“E.U.”), Canada and other Western countries and organizations have announced and enacted numerous sanctions against Russia to impose severe economic pressure on the Russian economy and government.

As of today’s date:

- Current U.S. and E.U. sanctions regimes do not materially affect the business, operations or financial condition of the Partnership and, to the Partnership’s knowledge, its counterparties are currently performing their obligations under their respective time charters in compliance with applicable U.S. and E.U. rules and regulations; and

- Sanctions legislation continually changes and the Partnership continues to monitor such changes as applicable to the Partnership and its counterparties.

The full impact of the commercial and economic consequences of the Russian conflict with Ukraine is uncertain at this time. The Partnership cannot provide any assurance that any further development in sanctions, or escalation of the Ukraine conflict more generally, will not have a significant impact on its business, financial condition or results of operations. Please see the section of this press release entitled “Forward Looking Statements.”

Financial Results Overview:

| Three Months Ended | Six Months Ended | ||||||||||

| (U.S. dollars in thousands, except per unit data) | June 30, 2024 (unaudited) |

June 30, 2023 (unaudited) |

June 30, 2024 (unaudited) |

June 30, 2023 (unaudited) |

|||||||

| Voyage revenues | $ | 37,615 | $ | 37,653 | $ | 75,670 | $ | 74,916 | |||

| Net Income | $ | 10,708 | $ | 14,430 | $ | 22,458 | $ | 24,030 | |||

| Adjusted Net Income (1) | $ | 12,385 | $ | 5,842 | $ | 24,739 | $ | 12,361 | |||

| Operating income | $ | 18,821 | $ | 18,298 | $ | 38,158 | $ | 37,642 | |||

| Adjusted EBITDA(1) | $ | 28,561 | $ | 23,015 | $ | 57,564 | $ | 46,579 | |||

| Earnings per common unit | $ | 0.20 | $ | 0.31 | $ | 0.43 | $ | 0.50 | |||

| Adjusted Earnings per common unit (1) | $ | 0.25 | $ | 0.08 | $ | 0.50 | $ | 0.18 | |||

(1) Adjusted Net Income, Adjusted EBITDA and Adjusted Earnings per common unit are not recognized measures under U.S. GAAP. Please refer to Appendix B of this press release for the definitions and reconciliation of these measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

Three Months Ended June 30, 2024 and 2023 Financial Results

Net Income for the three months ended June 30, 2024 was $10.7 million as compared to $14.4 million for the corresponding period of 2023, which represents a decrease of $3.7 million, or 25.7%. The decrease in Net Income for the three months ended June 30, 2024 was mainly attributable to the decrease in the gain on our interest rate swap transaction which matures on September 18, 2024 and the increase in the loss on debt extinguishment as a result of the full prepayment of outstanding amounts under the $675 million credit facility on June 27, 2024. The above decrease in Net Income was partially counterbalanced by the decrease in interest and finance costs as well as by the decrease in the vessels’ operating expenses and dry-docking and special survey costs attributable to the scheduled dry-docks of the Arctic Aurora, the Lena River and the Yenisei River which were partially completed in the three months ended June 30, 2023.

Adjusted Net Income (a non-GAAP financial measure) for the three months ended June 30, 2024 was $12.4 million compared to $5.8 million for the corresponding period of 2023, which represents a net increase of $6.6 million, or 113.8%. This increase is mainly attributable to the increase in the cash voyage revenues of the Arctic Aurora as explained below, as well as to the decrease of interest and finance costs compared to the corresponding period of 2023, which excludes the effect of the realized gain of $6.1 million on the interest rate swap in the period. Including the effect of the realized gain on our interest rate swap, Adjusted Net Income and Adjusted Earnings per common unit for the three months ended June 30, 2024 amounted to $18.5 million and $0.41, respectively.

Voyage revenues for the three months ended June 30, 2024 were $37.6 million as compared to $37.7 million for the corresponding period of 2023, which represents a net decrease of $0.1 million or 0.26%, which is mainly attributable to the increase in the cash revenues of the Arctic Aurora following its new time charter party agreement with Equinor ASA, which commenced in September 2023, which was netted by the corresponding decrease in its deferred revenue amortization.

The Partnership reported average daily hire gross of commissions(1) of approximately $72,010 per day per vessel for the three-month period ended June 30, 2024, compared to approximately $61,800 per day per vessel for the corresponding period of 2023. The Partnership’s vessels operated at 100% fleet utilization during the three-month period ended June 30, 2024 and at 91.7% fleet utilization during the corresponding period in 2023, due to unscheduled repairs of the OB River.

Vessel operating expenses were $7.7 million, which corresponds to a daily rate per vessel of $14,141 for the three-month period ended June 30, 2024, as compared to $8.1 million, or a daily rate per vessel of $14,824, in the corresponding period of 2023. This decrease is mainly attributable to lower planned technical maintenance on the Partnership’s vessels in the three-month period ending June 30, 2024 compared to the corresponding period in 2023.

Adjusted EBITDA (a non-GAAP financial measure) for the three months ended June 30, 2024 was $28.6 million, as compared to $23.0 million for the corresponding period of 2023. The increase of $5.6 million, or 24.3%, was mainly attributable to the abovementioned increase in cash revenues of the Arctic Aurora and the decrease in the operating expenses.

Net Interest and finance costs were $8.2 million in the three months ended June 30, 2024 as compared to $9.2 million in the corresponding period of 2023, which represents a decrease of $1.0 million, or 10.9%, due to the reduction in interest-bearing debt in the three months ended June 30, 2024, compared to the corresponding period in 2023, which was partly offset by the increase in the weighted average interest rate as compared to the corresponding period of 2023.

For the three months ended June 30, 2024, the Partnership reported basic and diluted Earnings per common unit and Adjusted Earnings per common unit, (a non-GAAP financial measure) of $0.20 and $0.25, respectively, after taking into account the distributions relating to the Series A Preferred Units and the Series B Preferred Units on the Partnership’s Net Income/Adjusted Net Income. Earnings per common unit and Adjusted Earnings per common unit, basic and diluted, were calculated on the basis of a weighted average number of 36,802,247 common units outstanding during the period and in the case of Adjusted Earnings per common unit after reflecting the impact of certain adjustments presented in Appendix B of this press release.

Adjusted Net Income, Adjusted EBITDA, and Adjusted Earnings per common unit are not recognized measures under U.S. GAAP. Please refer to Appendix B of this press release for the definitions and reconciliation of these measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

Amounts relating to variations in period on period comparisons shown in this section are derived from the condensed financials presented below.

(1) Average daily hire gross of commissions is a non-GAAP financial measure and represents voyage revenue excluding the non-cash time charter deferred revenue amortization, divided by the Available Days in the Partnership’s fleet as described in Appendix B.

Liquidity/ Financing/ Cash Flow Coverage

During the three months ended June 30, 2024, the Partnership generated net cash from operating activities of 22.5 million as compared to $8.8 million in the corresponding period of 2023, which represents an increase of $13.7 million, or 155.7% mainly as a result of working capital changes.

As of June 30, 2024, the Partnership reported total cash of $35.6 million. The Partnership’s outstanding financial liabilities as of June 30, 2024 under the CDBL Sale and Leaseback amounted to $345 million, gross of unamortized deferred loan fees, which is repayable within ten years.

On June 19, 2024, the Partnership entered into sale and leaseback agreements with China Development Bank Financial Leasing Co. Ltd. (“CDBL”) for four of its vessels, the OB River, the Clean Energy, the Amur River, and the Arctic Aurora for the amount of $71.2 million, $53.6 million, $73.1 million and $147.0 million, respectively (the “Lease Financing”). On June 27, 2024, the Partnership sold and chartered back on a bareboat basis from CDBL, the OB River, the Clean Energy and the Amur River for a period of five years, and the Arctic Aurora for a period of ten years. The Partnership utilized the proceeds from the Lease Financing, together with $63.7 million of its own funds, to fully repay outstanding amounts under its $675 Million Credit Facility. The applicable interest rate is 3-month term SOFR plus a margin. Following the first anniversary of the bareboat charters, the Partnership has the option at any time to repurchase each vessel at a predetermined price as set forth in each respective agreement and at the end of each bareboat period, the Partnership has the obligation to repurchase the respective vessel at a price equal to 20% of the financing amount for the OB River, the Clean Energy and the Amur River and 15% of the financing amount for the Arctic Aurora. The charterhire principals amortize in 20 consecutive quarterly installments for the OB River, the Clean Energy and the Amur River and 40 consecutive quarterly installments for the Arctic Aurora, all paid in arrears. The Partnership is required to maintain at all times a value maintenance ratio of at least 120% of the charterhire principal for each vessel.

Vessel Employment

As of June 30, 2024, the Partnership had estimated contracted time charter coverage(1) for 100%, 100% and 99% of its fleet estimated Available Days (as defined in Appendix B) for 2024, 2025, and 2026, respectively.

As of the same date, the Partnership’s estimated contracted revenue backlog (2) (3) was $1.04 billion, with an average remaining contract term of 6.4 years.

(1) Time charter coverage for the Partnership’s fleet is calculated by dividing the fleet contracted days on the basis of the earliest estimated delivery and redelivery dates prescribed in the Partnership’s current time charter contracts, net of scheduled class survey repairs by the number of expected Available Days during that period.

(2) The Partnership calculates its estimated contracted revenue backlog by multiplying the contractual daily hire rate by the expected number of days committed under the contracts (assuming earliest delivery and redelivery and excluding options to extend), assuming full utilization. The actual amount of revenues earned and the actual periods during which revenues are earned may differ from the amounts and periods disclosed due to, for example, dry-docking and/or special survey downtime, maintenance projects, off-hire downtime and other factors that result in lower revenues than the Partnership’s average contract backlog per day.

(3) $0.11 billion of the revenue backlog estimate relates to the estimated portion of the hire contained in certain time charter contracts with Yamal Trade Pte. Ltd., which represents the operating expenses of the respective vessels and is subject to yearly adjustments on the basis of the actual operating costs incurred within each year. The actual amount of revenues earned in respect of such variable hire rate may therefore differ from the amounts included in the revenue backlog estimate due to the yearly variations in the respective vessel’s operating costs.

Conference Call and Webcast:

As announced, the Partnership’s management team will host a conference call on Tuesday, September 10, 2024 at 10:00 a.m. Eastern Time to discuss the Partnership’s financial results.

Conference Call details:

Participants should dial into the call 10 minutes before the scheduled time using the following numbers: 877-405-1226 (US Dial-In), or +1 201-689-7823 (US International Dial-In). To access the conference call, please quote “Dynagas” to the operator and/or conference ID 13748719. For additional participant International Toll-Free access numbers, click here.

Alternatively, participants can register for the call using the “call me” option for a faster connection to join the conference call. You can enter your phone number and let the system call you right away. Click here for the “call me” option.

Audio Webcast – Slides Presentation:

There will be a live and then archived webcast of the conference call and accompanying slides, available on the Partnership’s website. To listen to the archived audio file, visit our website http://www.dynagaspartners.com and click on Webcast under our Investor Relations page. Participants to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

The slide presentation on the second quarter ended June 30, 2024 financial results will be available in PDF format 10 minutes prior to the conference call and webcast, accessible on the Partnership’s website www.dynagaspartners.com on the webcast page. Participants to the webcast can download the PDF presentation.

About Dynagas LNG Partners LP

Dynagas LNG Partners LP DLNG is a master limited partnership that owns and operates liquefied natural gas (LNG) carriers employed on multi-year charters. The Partnership’s current fleet consists of six LNG carriers, with an aggregate carrying capacity of approximately 914,000 cubic meters.

Visit the Partnership’s website at www.dynagaspartners.com. The Partnership’s website and its contents are not incorporated into and do not form a part of this release.

Contact Information:

Dynagas LNG Partners LP

Attention: Michael Gregos

Tel. +30 210 8917960

Email: management@dynagaspartners.com

Investor Relations / Financial Media:

Nicolas Bornozis

Markella Kara

Capital Link, Inc.

230 Park Avenue, Suite 1540

New York, NY 10169

Tel. (212) 661-7566

E-mail: dynagas@capitallink.com

Forward-Looking Statements

Matters discussed in this press release may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

The Partnership desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. The words “believe,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,” “potential,” “project,” “will,” “may,” “should,” “expect,” “expected,” “pending” and similar expressions identify forward-looking statements. These forward-looking statements are not intended to give any assurance as to future results and should not be relied upon.

The forward-looking statements in this press release are based upon various assumptions and estimates, many of which are based, in turn, upon further assumptions, including without limitation, examination by the Partnership’s management of historical operating trends, data contained in its records and other data available from third parties. Although the Partnership believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond the Partnership’s control, the Partnership cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors, other important factors that, in the Partnership’s view, could cause actual results to differ materially from those discussed, expressed or implied, in the forward-looking statements include, but are not limited to, the strength of world economies and currency fluctuations, general market conditions, including fluctuations in charter rates, ownership days, and vessel values, changes in supply of and demand for liquefied natural gas (LNG) shipping capacity, changes in the Partnership’s operating expenses, including bunker prices, drydocking and insurance costs, the market for the Partnership’s vessels, availability of financing and refinancing, changes in governmental laws, rules and regulations or actions taken by regulatory authorities, economic, regulatory, political and governmental conditions that affect the shipping and the LNG industry, potential liability from pending or future litigation, and potential costs due to environmental damage and vessel collisions, general domestic and international political conditions, potential disruption of shipping routes due to accidents, political events, or international hostilities, including the recent escalation of the Israel-Gaza conflict and potential spillover effects throughout the Middle East, vessel breakdowns, instances of off-hires, the length and severity of epidemics and pandemics, such as COVID-19 and its variants, the impact of public health threats and outbreaks of other highly communicable diseases, the impact of the discontinuance of the London Interbank Offered Rate, or, LIBOR and its replacement with the Secured Overnight Financing Rate, or SOFR on any of our debt referencing LIBOR in the interest rate, the amount of cash available for distribution, and other factors. Due to the ongoing war between Russia and Ukraine, the United States, United Kingdom, the European Union, Canada, and other Western countries and organizations have announced and enacted numerous sanctions against Russia to impose severe economic pressure on the Russian economy and government. The full impact of the commercial and economic consequences of the Russian conflict with Ukraine are uncertain at this time. Although currently there has been no material impact on the Partnership, potential consequences of the sanctions that could impact the Partnership’s business in the future include but are not limited to: (1) limiting and/or banning the use of the SWIFT financial and payment system that would negatively affect payments under the Partnership’s existing vessel charters; (2) the Partnership’s counterparties being potentially limited by sanctions from performing under its agreements; and (3) a general deterioration of the Russian economy. In addition, the Partnership may have greater difficulties raising capital in the future, which could potentially reduce the level of future investment into its expansion and operations. The Partnership cannot provide any assurance that any further development in sanctions, or escalation of the Ukraine situation more generally, will not have a significant impact on its business, financial condition, or results of operations.

Please see the Partnership’s filings with the Securities and Exchange Commission for a more complete discussion of these and other risks and uncertainties. The information set forth herein speaks only as of the date hereof, and the Partnership disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this communication.

APPENDIX A

| DYNAGAS LNG PARTNERS LP Condensed Consolidated Statements of Income |

||||||||||||

| (In thousands of U.S. dollars except units and per unit data) | Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||

| 2024 (unaudited) |

2023 (unaudited) |

2024 (unaudited) |

2023 (unaudited) |

|||||||||

| REVENUES | ||||||||||||

| Voyage revenues | $ | 37,615 | $ | 37,653 | $ | 75,670 | $ | 74,916 | ||||

| EXPENSES | ||||||||||||

| Voyage expenses (including related party) | (851 | ) | (804 | ) | (1,708 | ) | (1,518 | ) | ||||

| Vessel operating expenses | (7,721 | ) | (8,094 | ) | (15,421 | ) | (15,390 | ) | ||||

| Dry-docking and special survey costs | — | (390 | ) | — | (390 | ) | ||||||

| General and administrative expenses (including related party) | (588 | ) | (523 | ) | (1,114 | ) | (992 | ) | ||||

| Management fees -related party | (1,640 | ) | (1,593 | ) | (3,281 | ) | (3,168 | ) | ||||

| Depreciation | (7,994 | ) | (7,951 | ) | (15,988 | ) | (15,816 | ) | ||||

| Operating income | 18,821 | 18,298 | 38,158 | 37,642 | ||||||||

| Interest and finance costs, net | (8,182 | ) | (9,222 | ) | (16,837 | ) | (18,402 | ) | ||||

| Loss on debt extinguishment | (331 | ) | — | (331 | ) | (154 | ) | |||||

| Gain on derivative instruments | 408 | 5,364 | 1,668 | 5,023 | ||||||||

| Other, net | (8 | ) | (10 | ) | (90 | ) | (79 | ) | ||||

| Other expense | — | — | (110 | ) | — | |||||||

| Net income | $ | 10,708 | $ | 14,430 | $ | 22,458 | $ | 24,030 | ||||

| Earnings per common unit (basic and diluted) | $ | 0.20 | $ | 0.31 | $ | 0.43 | $ | 0.50 | ||||

| Weighted average number of units outstanding, basic and diluted: | ||||||||||||

| Common units | 36,802,247 | 36,802,247 | 36,802,247 | 36,802,247 | ||||||||

| DYNAGAS LNG PARTNERS LP Condensed Consolidated Balance Sheets (Expressed in thousands of U.S. Dollars—except for unit data) |

|||||

| June 30, 2024 (unaudited) |

December 31, 2023 (unaudited) |

||||

| ASSETS: | |||||

| Cash and cash equivalents | $ | 35,565 | $ | 73,752 | |

| Derivative financial instrument | 5,009 | 15,631 | |||

| Due from related party (current and non-current) | 2,277 | 1,350 | |||

| Other assets | 14,202 | 20,817 | |||

| Vessels, net | 781,375 | 797,363 | |||

| Total assets | $ | 838,428 | $ | 908,913 | |

| LIABILITIES | |||||

| Total long-term debt, net of deferred financing costs | $ | 342,513 | $ | 419,584 | |

| Total other liabilities | 31,279 | 39,534 | |||

| Due to related party (current and non-current) | 429 | 1,555 | |||

| Total liabilities | $ | 374,221 | $ | 460,673 | |

| PARTNERS’ EQUITY | |||||

| General partner (35,526 units issued and outstanding as at June 30, 2024 and December 31, 2023) | 118 | 102 | |||

| Common unitholders (36,802,247 units issued and outstanding as at June 30, 2024 and December 31, 2023) | 337,375 | 321,424 | |||

| Series A Preferred unitholders: (3,000,000 units issued and outstanding as at June 30, 2024 and December 31, 2023) | 73,216 | 73,216 | |||

| Series B Preferred unitholders: (2,200,000 units issued and outstanding as at June 30, 2024 and December 31, 2023) | 53,498 | 53,498 | |||

| Total partners’ equity | $ | 464,207 | $ | 448,240 | |

| Total liabilities and partners’ equity | $ | 838,428 | $ | 908,913 | |

| DYNAGAS LNG PARTNERS LP Condensed Consolidated Statements of Cash Flows (Expressed in thousands of U.S. Dollars) |

||||||||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| (unaudited) | (unaudited) | |||||||||||

| Cash flows from Operating Activities: | ||||||||||||

| Net income: | $ | 10,708 | $ | 14,430 | $ | 22,458 | $ | 24,030 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||||||

| Depreciation | 7,994 | 7,951 | 15,988 | 15,816 | ||||||||

| Amortization of deferred financing fees | 359 | 415 | 734 | 862 | ||||||||

| Deferred revenue amortization | 1,700 | (3,668 | ) | 3,400 | (7,297 | ) | ||||||

| Amortization and write-off of deferred charges | 54 | 54 | 108 | 107 | ||||||||

| Loss on debt extinguishment | 331 | — | 331 | 154 | ||||||||

| Gain on derivative financial instrument | (408 | ) | (5,364 | ) | (1,668 | ) | (5,023 | ) | ||||

| Dry-docking and special survey costs | — | 390 | — | 390 | ||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Trade accounts receivable | (126 | ) | (8,128 | ) | 218 | (8,507 | ) | |||||

| Prepayments and other assets | 2,319 | (4,992 | ) | 5,050 | (5,037 | ) | ||||||

| Inventories | (7 | ) | (1,032 | ) | (18 | ) | (1,009 | ) | ||||

| Due from/ to related parties | (515 | ) | (2,218 | ) | (2,053 | ) | (1,014 | ) | ||||

| Deferred charges | (121 | ) | (66 | ) | (121 | ) | (66 | ) | ||||

| Trade accounts payable | (244 | ) | 1,794 | (1,737 | ) | 973 | ||||||

| Accrued liabilities | (135 | ) | (102 | ) | (813 | ) | (828 | ) | ||||

| Unearned revenue | 633 | 9,314 | (7,766 | ) | 8,883 | |||||||

| Net cash from Operating Activities | 22,542 | 8,778 | 34,111 | 22,434 | ||||||||

| Cash flows from Investing Activities | ||||||||||||

| Ballast water treatment system installation | — | — | (27 | ) | (86 | ) | ||||||

| Net cash used in Investing Activities | — | — | (27 | ) | (86 | ) | ||||||

| Cash flows from Financing Activities: | ||||||||||||

| Distributions declared and paid | (3,224 | ) | (2,890 | ) | (6,491 | ) | (5,781 | ) | ||||

| Proceeds from long-term debt and other financial liabilities | 344,975 | — | 344,975 | — | ||||||||

| Repayment of long-term debt | (408,642 | ) | (12,000 | ) | (420,642 | ) | (55,270 | ) | ||||

| Receipt of derivative instruments | 6,107 | 6,132 | 12,235 | 11,733 | ||||||||

| Payment of deferred finance fees | (2,348 | ) | — | (2,348 | ) | — | ||||||

| Net cash used in Financing Activities | (63,132 | ) | (8,758 | ) | (72,271 | ) | (49,318 | ) | ||||

| Net increase / (decrease) in cash and cash equivalents | (40,590 | ) | 20 | (38,187 | ) | (26,970 | ) | |||||

| Cash and cash equivalents at beginning of the period | 76,155 | 52,878 | 73,752 | 79,868 | ||||||||

| Cash and cash equivalents at end of the period | $ | 35,565 | $ | 52,898 | $ | 35,565 | $ | 52,898 | ||||

APPENDIX B

Fleet Statistics and Reconciliation of U.S. GAAP Financial Information to Non-GAAP Financial Information

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||

| (expressed in United states dollars except for operational data) | 2024 | 2023 | 2024 | 2023 | ||||||||

| (unaudited) | (unaudited) | |||||||||||

| Number of vessels at the end of period | 6 | 6 | 6 | 6 | ||||||||

| Average number of vessels in the period (1) | 6 | 6 | 6 | 6 | ||||||||

| Calendar Days (2) | 546.0 | 546.0 | 1092.0 | 1086.0 | ||||||||

| Available Days (3) | 546.0 | 546.0 | 1092.0 | 1086.0 | ||||||||

| Revenue earning days (4) | 546.0 | 500.7 | 1092.0 | 1040.5 | ||||||||

| Time Charter Equivalent rate(5) | $ | 67,333 | $ | 67,489 | $ | 67,731 | $ | 67,586 | ||||

| Fleet Utilization (4) | 100 | % | 91.7 | % | 100 | % | 95.8 | % | ||||

| Vessel daily operating expenses (6) | $ | 14,141 | $ | 14,824 | $ | 14,122 | $ | 14,171 | ||||

| (1) | Represents the number of vessels that constituted the Partnership’s fleet for the relevant period, as measured by the sum of the number of days that each vessel was a part of the Partnership’s fleet during the period divided by the number of Calendar Days (defined below) in the period. | |

| (2) | “Calendar Days” are the total days that the Partnership possessed the vessels in its fleet for the relevant period. | |

| (3) | “Available Days” are the total number of Calendar Days that the Partnership’s vessels were in its possession during a period, less the total number of scheduled off-hire days during the period associated with major repairs or dry-dockings. | |

| (4) | The Partnership calculates fleet utilization by dividing the number of its Revenue earning days, which are the total number of Available Days of the Partnership’s vessels net of unscheduled off-hire days (which do not include positioning-repositioning days for which compensation has been received) during a period by the number of Available Days. The shipping industry uses fleet utilization to measure a company’s efficiency in finding employment for its vessels and minimizing the number of days that its vessels are off-hire for reasons such as unscheduled repairs but excluding scheduled off-hires for vessel upgrades, dry-dockings, or special or intermediate surveys. | |

| (5) | Time charter equivalent rate (“TCE rate”) is a measure of the average daily revenue performance of a vessel. For time charters, we calculate TCE rate by dividing total voyage revenues, less any voyage expenses, by the number of Available Days during the relevant time period. Under a time charter, the charterer pays substantially all vessel voyage related expenses. However, the Partnership may incur voyage related expenses when positioning or repositioning vessels before or after the period of a time charter, during periods of commercial waiting time or while off-hire during dry-docking or due to other unforeseen circumstances. The TCE rate is not a measure of financial performance under U.S. GAAP (non-GAAP measure), and should not be considered as an alternative to voyage revenues, the most directly comparable GAAP measure, or any other measure of financial performance presented in accordance with U.S. GAAP. However, the TCE rate is a standard shipping industry performance measure used primarily to compare period-to-period changes in a company’s performance despite changes in the mix of charter types (such as time charters, voyage charters) under which the vessels may be employed between the periods and to assist the Partnership’s management in making decisions regarding the deployment and use of the Partnership’s vessels and in evaluating their financial performance. The Partnership’s calculation of TCE rates may not be comparable to that reported by other companies due to differences in methods of calculation. The following table reflects the calculation of the Partnership’s TCE rates for the three months ended June 30, 2024 and 2023 (amounts in thousands of U.S. dollars, except for TCE rates, which are expressed in U.S. dollars, and Available Days): |

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| (unaudited) | (unaudited) | ||||||||||||||

| (In thousands of U.S. dollars, except for Available Days and TCE rate) | |||||||||||||||

| Voyage revenues | $ | 37,615 | $ | 37,653 | $ | 75,670 | $ | 74,916 | |||||||

| Voyage Expenses * | (851 | ) | (804 | ) | (1,708 | ) | (1,518 | ) | |||||||

| Time Charter equivalent revenues | $ | 36,764 | $ | 36,849 | $ | 73,962 | $ | 73,398 | |||||||

| Available Days | 546.0 | 546.0 | 1,092 | 1,086 | |||||||||||

| Time charter equivalent (TCE) rate | $ | 67,333 | $ | 67,489 | $ | 67,731 | $ | 67,586 | |||||||

*Voyage expenses include commissions of 1.25% paid to Dynagas Ltd., the Partnership’s Manager, and third-party ship brokers, when defined in the charter parties, bunkers, port expenses and other minor voyage expenses.

| (6) | Daily vessel operating expenses, which include crew costs, provisions, deck and engine stores, lubricating oil, insurance, spares and repairs and flag taxes, are calculated by dividing vessel operating expenses by fleet Calendar Days for the relevant time period. | |

Reconciliation of Net Income to Adjusted EBITDA

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||

| (In thousands of U.S. dollars) | 2024 | 2023 | 2024 | 2023 | |||||||||||

| (unaudited) | (unaudited) | ||||||||||||||

| Net income | $ | 10,708 | $ | 14,430 | $ | 22,458 | $ | 24,030 | |||||||

| Net interest and finance costs (1) | 8,182 | 9,222 | 16,837 | 18,402 | |||||||||||

| Depreciation | 7,994 | 7,951 | 15,988 | 15,816 | |||||||||||

| Loss on Debt extinguishment | 331 | — | 331 | 154 | |||||||||||

| Gain on derivative financial instrument | (408 | ) | (5,364 | ) | (1,668 | ) | (5,023 | ) | |||||||

| Class survey costs | — | 390 | — | 390 | |||||||||||

| Amortization of deferred revenue | 1,700 | (3,668 | ) | 3,400 | (7,297 | ) | |||||||||

| Amortization and write-off of deferred charges | 54 | 54 | 108 | 107 | |||||||||||

| Other expense(2) | — | — | 110 | — | |||||||||||

| Adjusted EBITDA | $ | 28,561 | $ | 23,015 | $ | 57,564 | $ | 46,579 | |||||||

(1) Includes interest and finance costs and interest income, if any.

(2) Includes other expense from provisions for insurance claims for damages incurred prior years

The Partnership defines Adjusted EBITDA as earnings before interest and finance costs, net of interest income (if any), gains/losses on derivative financial instruments, taxes (when incurred), depreciation and amortization (when incurred), dry-docking and special survey costs and other non-recurring items (if any). Adjusted EBITDA is used as a supplemental financial measure by management and external users of financial statements, such as investors, to assess the Partnership’s operating performance.

The Partnership believes that Adjusted EBITDA assists its management and investors by providing useful information that increases the ability to compare the Partnership’s operating performance from period to period and against that of other companies in its industry that provide Adjusted EBITDA information. This increased comparability is achieved by excluding the potentially disparate effects between periods or against companies of interest, other financial items, depreciation and amortization and taxes, which items are affected by various and possible changes in financing methods, capital structure and historical cost basis and which items may significantly affect net income between periods. The Partnership believes that including Adjusted EBITDA as a measure of operating performance benefits investors in (a) selecting between investing in the Partnership and other investment alternatives and (b) monitoring the Partnership’s ongoing financial and operational strength.

Adjusted EBITDA is not intended to and does not purport to represent cash flows for the period, nor is it presented as an alternative to operating income. Further, Adjusted EBITDA is not a measure of financial performance under U.S. GAAP and does not represent and should not be considered as an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance presented in accordance with U.S. GAAP. Adjusted EBITDA excludes some, but not all, items that affect net income and these measures may vary among other companies. Therefore, Adjusted EBITDA, as presented above, may not be comparable to similarly titled measures of other businesses because they may be defined or calculated differently by those other businesses. It should not be considered in isolation or as a substitute for a measure of performance prepared in accordance with GAAP. Any non-GAAP measures should be viewed as supplemental to, and should not be considered as alternatives to, GAAP measures including, but not limited to net earnings (loss), operating profit (loss), cash flow from operating, investing and financing activities, or any other measure of financial performance or liquidity presented in accordance with GAAP.

Reconciliation of Net Income to Adjusted Net Income available to common unitholders and Adjusted Earnings per common unit

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| (In thousands of U.S. dollars except for units and per unit data) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| Net Income | $ | 10,708 | $ | 14,430 | $ | 22,458 | $ | 24,030 | ||||||||

| Amortization of deferred revenue | 1,700 | (3,668 | ) | 3,400 | (7,297 | ) | ||||||||||

| Amortization and write-off of deferred charges | 54 | 54 | 108 | 107 | ||||||||||||

| Class survey costs | — | 390 | — | 390 | ||||||||||||

| Loss on Debt extinguishment | 331 | — | 331 | 154 | ||||||||||||

| Gain on derivative financial instrument | (408 | ) | (5,364 | ) | (1,668 | ) | (5,023 | ) | ||||||||

| Other expense | — | — | 110 | — | ||||||||||||

| Adjusted Net Income | $ | 12,385 | $ | 5,842 | $ | 24,739 | $ | 12,361 | ||||||||

| Less: Adjusted Net Income attributable to preferred unitholders and general partner | (3,233 | ) | (2,894 | ) | (6,509 | ) | (5,788 | ) | ||||||||

| Common unitholders’ interest in Adjusted Net Income | $ | 9,152 | $ | 2,948 | $ | 18,230 | $ | 6,573 | ||||||||

| Weighted average number of common units outstanding, basic and diluted: | 36,802,247 | 36,802,247 | 36,802,247 | 36,802,247 | ||||||||||||

| Adjusted Earnings per common unit, basic and diluted | $ | 0.25 | $ | 0.08 | $ | 0.50 | $ | 0.18 | ||||||||

Adjusted Net Income represents net income before non-recurring expenses (if any), charter hire amortization related to time charters with escalating time charter rates, amortization of deferred charges, class survey costs and changes in the fair value of derivative financial instruments. Net Income available to common unitholders represents the common unitholders interest in Adjusted Net Income for each period presented. Adjusted Earnings per common unit represents Net Income available to common unitholders divided by the weighted average common units outstanding during each period presented.

Adjusted Net Income, Net Income available to common unitholders and Adjusted Earnings per common unit, basic and diluted, are not recognized measures under U.S. GAAP and should not be regarded as substitutes for net income and earnings per unit, basic and diluted. The Partnership’s definitions of Adjusted Net Income, Net Income available to common unitholders and Adjusted Earnings per common unit, basic and diluted, may not be the same at those reported by other companies in the shipping industry or other industries. The Partnership believes that the presentation of Adjusted Net Income and Net income available to common unitholders is useful to investors because these measures facilitate the comparability and the evaluation of companies in the Partnership’s industry. In addition, the Partnership believes that Adjusted Net Income is useful in evaluating its operating performance compared to that of other companies in the Partnership’s industry because the calculation of Adjusted Net Income generally eliminates the accounting effects of items which may vary for different companies for reasons unrelated to overall operating performance. The Partnership’s presentation of Adjusted Net Income, Net Income available to common unitholders and Adjusted Earnings per common unit does not imply, and should not be construed as an inference, that its future results will be unaffected by unusual or non-recurring items and should not be considered in isolation or as a substitute for a measure of performance prepared in accordance with GAAP.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walmart's Stock Mirrors Its Late 90s Explosion With A Recent 46% Year-to-Date Surge Unveiling New Highs And Promising Breakthroughs Beyond $100

- Walmart has re-emerged as a major force in the stock market, reminiscent of its solid 600% increase in the late 90s.

- With the stock nearly surpassing its September 3 all-time high of $77 and up 46% year to date, Walmart is eyeing the $100 mark.

Walmart Inc WMT has recently become a significant player in the stock market, reminiscent of its 600% surge in the late 90s. After a big rally, their shares went through a long consolidation phase, with prices ranging between $13 and $23 from 1999 to 2012.

Since breaking out of this range, Walmart’s stock has risen impressively by 230%. However, this journey hasn’t been without challenges.

The upward trend has experienced volatility, with substantial declines and long periods of stagnation, testing investors’ patience.

This gradual upward movement illustrates the cyclical nature of stock market investments, where significant gains are often preceded by long periods of inactivity or loss.

The dynamics started shifting significantly early this year. In February, a key moment occurred when Walmart’s stock price surpassed the 2023 high, reaching $56.

This breakout indicated a change in market sentiment, leading to increased momentum with fewer and smaller corrections.

The company’s recent earnings releases have boosted the bullish momentum. In May, an earnings announcement pushed the stock up by 7% in a single day.

Similarly, the August earnings release led to a 6% increase in stock value. The stock has since held onto a 6% gain from its price following the August earnings.

Walmart’s stock is close to breaking its September 3 all-time high of $77. So far this year, the stock has gained 46%.

Their next big goal is reaching $100, a key psychological barrier. With current momentum and market conditions, Walmart has the potential to keep rising and aim for new highs beyond $100.

After the closing bell on Monday, September 9, the stock closed at $77.34, trading down by 0.91%.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

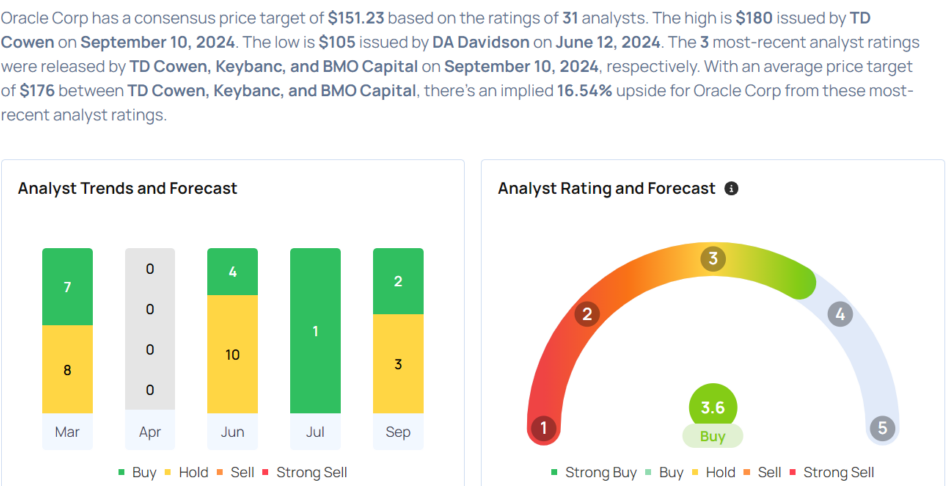

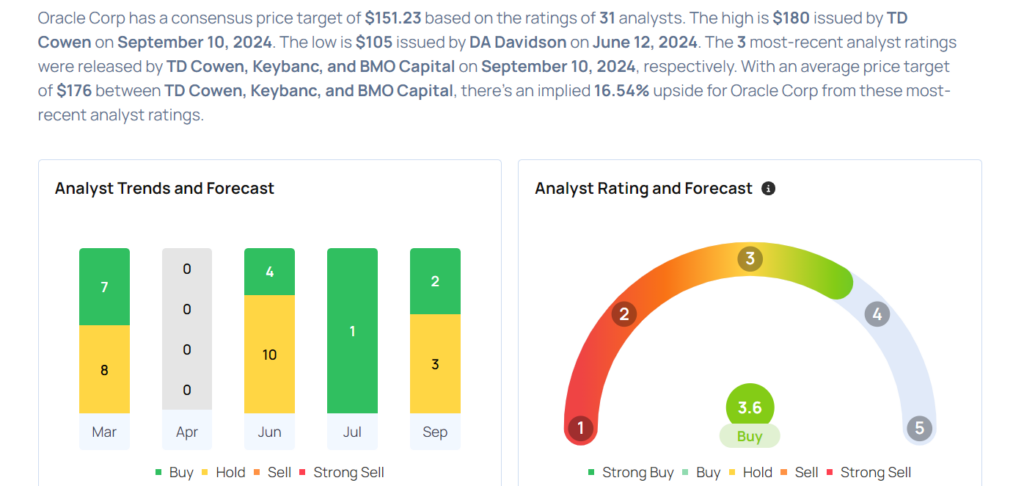

Oracle To Rally Around 29%? Here Are 10 Top Analyst Forecasts For Tuesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- TD Cowen raised the price target for Oracle Corporation ORCL from $165 to $180. TD Cowen analyst Derrick Wood maintained a Buy rating. Oracle shares fell 1.4% to close at $139.89 on Monday. See how other analysts view this stock.

- BTIG boosted the price target for Boot Barn Holdings, Inc. BOOT from $150 to $165. BTIG analyst Janine Stichter maintained a Buy rating. Boot Barn shares gained 3% to close at $139.55 on Monday. See how other analysts view this stock.

- JMP Securities raised Terns Pharmaceuticals, Inc. TERN price target from $15 to $20. JMP Securities analyst Silvan Tuerkcan maintained a Market Outperform rating. Terns Pharmaceuticals shares gained 16.8% to close at $9.12 on Monday. See how other analysts view this stock.

- B of A Securities raised Johnson Controls International plc JCI price target from $76 to $80. B of A Securities analyst Andrew Obin upgraded the stock from Neutral to Buy. Johnson Controls shares gained 1.1% to close at $68.60 on Monday. See how other analysts view this stock.

- BMO Capital cut the price target for Rubrik, Inc. RBRK from $40 to $38. BMO Capital analyst Keith Bachman maintained an Outperform rating. Rubrik shares rose 4.4% to close at $32.06 on Monday. See how other analysts view this stock.

- Redburn Atlantic boosted Costco Wholesale Corporation COST price target from $860 to $890. Redburn Atlantic analyst Daniela Nedialkova downgraded the stock from Buy to Neutral. Costco shares gained 2.3% to close at $896.49 on Monday. See how other analysts view this stock.

- Stifel raised IDEAYA Biosciences, Inc. IDYA price target from $63 to $68. Stifel analyst Benjamin Burnett maintained a Buy rating. IDEAYA Biosciences shares rose 0.7% to close at $36.45 on Monday. See how other analysts view this stock.

- Baird increased the price target for Axon Enterprise, Inc. AXON from $360 to $400. Baird analyst William Power maintained an Outperform rating. Axon Enterprise shares gained 2.8% to close at $364.39 on Monday. See how other analysts view this stock.

- Deutsche Bank boosted Equity Residential EQR price target from $62 to $83. Deutsche Bank analyst Derek Johnston upgraded the stock from Hold to Buy. Equity Residential shares gained 1% to close at $75.10 on Monday. See how other analysts view this stock.

- Loop Capital boosted News Corporation NWSA price target from $38 to $39. Loop Capital analyst Alan Gould maintained a Buy rating. News Corporation shares gained 0.1% to close at $26.60 on Monday. See how other analysts view this stock.

Considering buying ORCL stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

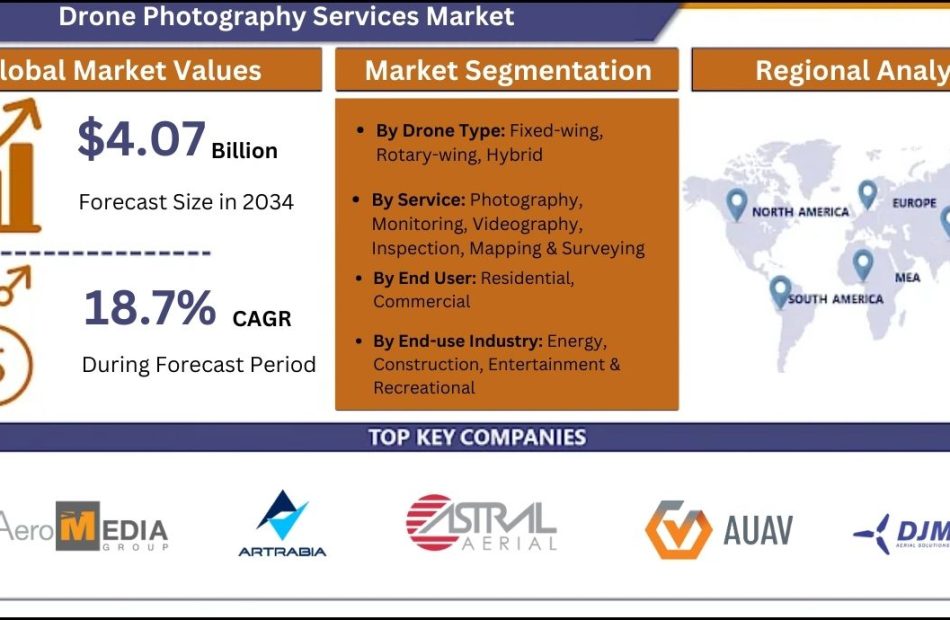

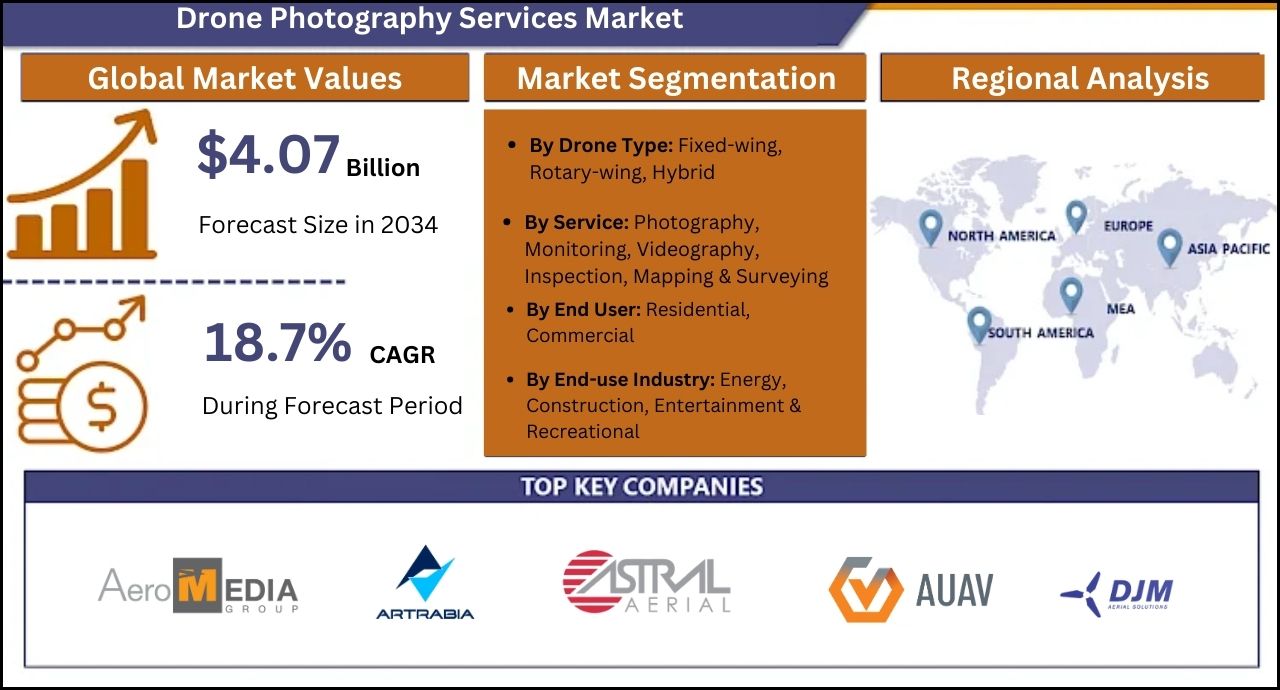

Drone Photography Services Market to Rise at a CAGR of 18.7% to Reach 4.07 Billion by 2034 | Fact.MR

Rockville, MD, Sept. 10, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and competitive intelligence provider, through its recently updated market analysis, reveals that revenue from drone photography services is projected to reach US$ 733.1 million in 2024. The global drone photography services market has been forecasted to climb to a size of US$ 4.07 billion by 2034-end.

Drone photography services are utilized at a noteworthy rate for mapping and surveying purposes for their features in gathering more precise graphical data. They play a significant role in conducting topographic surveys, designing detailed maps, and creating certain complex 3D models.

North America is projected to hold more than one-third share of the global market owing to the presence of a well-established IT infrastructure. Moreover, the presence of a favorable regulatory framework by the Federal Aviation Administration is also stimulating demand for drone services in several industries, such as media, construction, real estate, and agriculture for improving efficiency and minimizing operational prices.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=8213

Key Takeaway from Market Study

- The market for drone photography services is projected to expand at a CAGR of 7% from 2024 to 2034.

- Worldwide demand for drone photography services in the commercial sector is approximated to increase at 5% CAGR and reach a market valuation of US$ 2.73 billion by 2034-end.

- Demand for photography services in South Korea is analyzed to advance at a CAGR of 5% CAGR through 2034.

- Drone photography services in construction projects are forecasted to hold 5% share of global market revenue by 2034.

- Demand for drone technology in Japan is analyzed to accelerate at a CAGR of 5% through 2034.

- North America is evaluated to account for 9% of the global market share by the end of 2034.

“Growing investments by companies in advancements taking place in image analysis and processing tools for more accurate and faster data extraction from drone footage is stimulating demand for drone photography services for several applications, such as disaster response, construction monitoring, and precision agriculture,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Drone Photography Services Market:

Leading companies in this market are AiriNov, 3DroneMapping, Aerial Robotix, DJI, AerialWorks Inc., Yuneec, AERIUM Analytics, CyberHawk, AeroMedia Group, DDC Smart Inspection, Aivia Group, DroneView Technologies LLC, Cloud 9 Creative, Artrabia, Drone Dispatch, Astral Aerial Solutions, Parrot, AUAV, Visual Drone Production LLC, DC Geomatics, Avian UAS, DATA PKT Aviation, PrecisionHawk, DJM Aerial Solutions, Falconviz, and Aeroworks Productions.

Accelerating Demand for Drone Photography in Construction Projects to Ensuring Workers’ Safety and Making Informed Decisions

Global demand for drone photography services for use in the construction sector is analyzed to increase at a CAGR of 18.1% and reach a value of US$ 915.9 million by 2034. Drone technology is utilized in aerial surveying and mapping purposes in construction projects. It enables construction managers to use videos for monitoring on-site work at hazardous locations to ensure the safety of workers. Drone photography also helps in capturing real-time data and images for tracking project progress, making informed decisions, and identifying potential issues.

Drone Photography Services Industry News:

- In July 2024, Visual Drone Production LLC developed new methods for aerial photography with the goal of improving its real estate marketing services in the Southeast United States. These services are intended to offer real estate brokers and owners a competitive advantage by exhibiting their properties from distinctive aerial viewpoints.

- In May 2023, Capgemini and IBM expanded their collaboration to improve their DaaS (Drone-as-a-Service) products. The goal of this partnership is to provide all-inclusive fleet management and monitoring solutions for drones, which are utilized for a variety of purposes, including data collection and inspections.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=8213

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the drone photography services market, presenting historical demand data (2019 to 2023) and forecast statistics for the period (2024 to 2034).

The study divulges essential insights into the market based on drone type (fixed-wing, rotary-wing, hybrid), service (photography, monitoring, videography, inspection, mapping & surveying), end user (residential, commercial), and end-use industry (energy, construction, entertainment & recreational), across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR:

Buckling Pin Relief Valve Market: Size is projected to reach US$ 1.27 billion in 2024. The market has been forecasted to increase to a size of US$ 1.67 billion by the end of 2034, expanding at a CAGR of 2.8% over the next ten years (2024 to 2034).

Electric Grill Market: Size is estimated to reach a value of US$ 2.44 billion in 2024 and further expand at a CAGR of 7.3% to end up at US$ 4.94 billion by 2034-end.

Electric Grill Market: Size is estimated to reach a value of US$ 2.44 billion in 2024 and further expand at a CAGR of 7.3% to end up at US$ 4.94 billion by 2034-end.

Commercial Refrigeration Equipment Market: Size is projected to reach US$ 52.4 billion in 2024. The market has been forecasted to increase to a size of US$ 90.4 billion by the end of 2034, expanding at a CAGR of 5.6% over the next ten years (2024 to 2034).

Bandsaw Machine Market: Size is projected to reach US$ 3.48 billion in 2024. The market has been forecasted to increase to a size of US$ 4.96 billion by the end of 2034, expanding at a CAGR of 3.6% over the next ten years.

Cable Car and Ropeway Market: Size is projected to reach US$ 2.28 billion in 2024. The market has been forecasted to increase to a value of US$ 5.1 billion by the end of 2034, expanding at a CAGR of 8.4% over the next ten years.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Follow Us: LinkedIn | Twitter | Blog

Contact: 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583 Sales Team: sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pet Food Packaging Market Size to Hit USD 7.1 billion by 2032, at a 3.7% CAGR | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 10, 2024 (GLOBE NEWSWIRE) — The global pet food packaging market (애완동물 식품 포장 시장) was projected to attain US$ 5.1 billion in 2023. It is anticipated to garner a 3.7% CAGR from 2024 to 2032, and by 2032, the market is likely to attain US$ 7.1 billion.

The global market offers pre-made, customizable, recyclable bags for packaging dry pet food. Numerous items may be used with these bags. Dry pet food is frequently packaged using composite films (duplex, triplex, and even multi-coated films).

Liquid food is typically packaged in aluminum, composite films, or metalized PET film (PETmet) pouches. For the packaging of semi-moist food products like chunks, kibbles, or soft pellets, stand-up and flat pouches work well.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/pet-food-packaging-market.html

Key Findings of the Market Report

- Companion animals are gaining popularity worldwide, particularly after the COVID-19 pandemic.

- During the pandemic, many people stayed home more, which resulted in a sharp increase in pet adoption. Furthermore, the bond between people and their pets is ever-changing. In contemporary culture, companionship is the most prevalent “job” for dogs.

- More and more people view dogs and cats as family members and friends.

- It is clear in many nations that the connection has evolved. Pet owners now prioritize pet care highly on their list of expenses due to humanization.

- Global pet food sales are being driven by the humanization trend, which is also driving up the market value of pet food packaging.

Market Trends for Pet Food Packaging

- In North America and Europe in particular, suppliers of pet food packaging are becoming increasingly accountable for the handling and disposal of the goods they offer due to regulations supporting sustainability. Recyclable materials are becoming more and more popular among pet food packaging firms as a result of these laws.

- Due to their evolving purchasing patterns, consumers are requesting environmentally friendly packaging options. Pet food manufacturers are responding to this by establishing their own recycling labs to evaluate different paper and paper-based packaging options. Paper is a good substitute for plastics.

- Its usefulness is limited in certain areas, though, especially for perishable goods. Therefore, adding non-paper components such barrier coatings is probably going to improve its functioning and help the pet food packaging market develop in the near future.

Global Market for Pet Food Packaging: Regional Outlook

- In 2022, North America held the majority of the share. The increase in the population of companion animals drives the dynamics of the local market. The developed world’s pet markets mostly focus on North America and Europe.

- According to the American Pet Products Association, dogs are the most common pets in the United States, with 65.1 million homes owning one. The next most popular pets are cats, with 46.5 million households, and freshwater fish, with 11.1 million households.

Global Pet Food Packaging Market: Competitive Landscape

Companies in the pet food packaging sector are providing convenient, cutting-edge designs. They are creating easy-pour containers, resealable bags, and single-serve pouches to make feeding and storing food for pets easier.

These container options also contribute to the product being fresher for longer. The following companies are well-known participants in the global pet food packaging market:

- Berry Global Inc.

- Sonoco Products Company

- Constantia Flexibles

- Mondi plc

- Huhtamaki OYJ

- Smurfit Kappa

- Ardagh Group S.A.

- Goglio S.p.A.

- Silgan Holdings Inc.

- Uniflex

- KM Packaging Services Ltd.

- H.B. Fuller Company

- ProAmpac

- Winpak Ltd.

- Printpack Inc.

- ePac Holdings LLC

Key developments by the players in this market are:

- In December 2023, Plastrela, a Brazilian packaging business, claimed the invention of a recyclable mono-material polyethylene pet food standup bag for its customer, brand owner Adimax.

- Mondi and the pet supply firm Fressnapf worked together in August 2023 to replace the packaging on their products with a new line of high-end, recyclable mono-material options that made use of process color printing technology. The unique Select Gold dry pet food line from Fressnapf I Maxi Zoo will now be packaged in recyclable FlexiBag, BarrierPack, and StandUp pouches from Mondi.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/pet-food-packaging-market.html

Global Pet Food Packaging Market Segmentation

By Packaging Format

- Pouches

- Bags

- Folding Cartons

- Tubs & Cups

- Cans

- Bottles & Jars

By Material

- Paper & Paperboard

- Plastic

- Metal

By Application

- Dry Food

- Wet Food

- Pet Treat

- Frozen

By Pet Type

- Cats

- Dogs

- Birds

- Others (Rabbits, Hamsters, etc.)

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Have a Look at Related Research Reports on Packaging Domain:

Flexible Packaging Market (軟包装市場) – The global flexible packaging market is projected to flourish at a CAGR of 4.9% from 2023 to 2031. As per the report published by TMR, a valuation of US$ 651.0 billion is anticipated for the market in 2031. As of 2023, the market for flexible packaging is expected to close at US$ 443.7 billion.

Hygiene Packaging Market (سوق التغليف الصحي) – The global Hygiene Packaging Market was valued at US$ 49.4 Bn in 2022 and is anticipated to reach US$ 85.5 Bn by 2031, expanding at a CAGR of 6.3% between 2023 and 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Charlie Munger Claimed 'People With High IQs Are Terrible Investors' – According to Him, This Trait Is More Important Than 'Brains'

When you think of investing, it’s easy to get bogged down by technical jargon and complex theories. However, the late Charlie Munger, Warren Buffett’s longtime partner, had a knack for cutting through the noise with straightforward advice.

Don’t Miss:

In a 2005 interview, Munger said something that sticks: “A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains.” So, while intelligence is great, how you handle stress and setbacks might matter even more.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Munger and Buffett are known for their no-nonsense approach to investing, which shows in their thoughts on managing businesses and investing wisely. Buffett’s style of business management is pretty laid-back. According to Munger, “Warren’s way of managing businesses does not take a lot of time. I would bet that something like half of our business operations have never had the foot of Warren Buffett in them.” This reflects a broader truth: sometimes less is more, especially when it comes to micromanaging.

Their approach isn’t just about keeping things simple for simplicity’s sake; it’s about effectiveness. Munger emphasizes the importance of a broad understanding across disciplines. He says, “It’s very useful to grasp all the big ideas in hard and soft science. A, it gives perspective. B, it gives a way for you to organize and file away experience in your head.” This multidisciplinary knowledge helps make better decisions in investing and business management.

See Also: The average American couple has saved this much money for retirement —How do you compare?

However, regarding actual investing, Munger and Buffett have strong opinions about how many stocks you need. They’re not fans of over-diversification. Buffett has famously said, “Three great businesses will be better than 100 average ones.” This means that finding and sticking with a few exceptional investments can often be more rewarding than spreading your money too thin.

Munger adds to this by critiquing modern investment theories. He calls out the flaws in “Modern Portfolio Theory,” stating, “You cannot believe this stuff … It will tell you how to do average.” To him, true investing success doesn’t come from following every theory but from understanding what makes businesses great and sticking to that knowledge.

Trending: This city is the clear winner of Zillow’s 2024 Home Value Forecast — No surprise as the number of millionaires there grew by 75% in the last decade.

If you’re looking to navigate the investment world, consider taking a page from Buffett and Munger’s playbook: focus on a few high-quality investments, manage them wisely, and remember that temperament can be more crucial than raw intelligence. It’s not about having all the answers but about handling the ups and downs with a steady hand.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Charlie Munger Claimed ‘People With High IQs Are Terrible Investors’ – According to Him, This Trait Is More Important Than ‘Brains’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

European Cannabis Producer Cantourage Reports 62% Revenue Increase, Projects Positive EBITDA

Cantourage Group SE reported its financial results for the period from January 1 to August 30, 2024, revealing revenue of EUR 24.9 million ($27.5 million). This marks a 62% increase compared to the same period in 2023, when the company had EUR 15.4 million in revenue. Moreover, revenue for the first seven months of 2024 is higher than Cantourage’s total revenue for the full year 2023, which amounted to EUR 23.6 million.

“Our current business performance clearly shows that we took the right steps in preparation for the partial legalization of cannabis in Germany,” stated Cantourage’s CEO Philip Schetter, according to translation. “In addition to expanding our range of high-quality cannabis products from around the world, we were able to scale our production capacities and strengthen our partnerships with growers and pharmacies just in time. This now enables us to sustainably meet the expected increase in demand. We are confident that the medical cannabis market offers significant opportunities, both now and in the future.”

According to the report, the major drivers for the revenue growth include the continued expansion of its cannabis flower business in Germany and the UK, and also the advancement of its Telecan platform, which provides an online pathway for German medical marijuana patients to access cannabis treatments. The partial legalization of cannabis in Germany in April 2024 also contributed to this upward trend.

Read Also: 25 German Cities Join Cannabis Pilot Trials In 2024 Under New Legalization Law

In August 2024 alone, Cantourage achieved a record monthly revenue of EUR 4.9 million, a 188% increase compared to August 2023 (EUR 1.7 million). This surpasses the company’s previous monthly record of EUR 4.1 million set in June 2024.

The Berlin-based cannabis company is projecting total annual revenue of EUR 37 million to EUR 43 million for 2024, with expectations of continued growth and a positive EBITDA for the year. The company was listed on the Frankfurt Stock Exchange in November 2022 under the symbol “HIGH.”

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

“The news agency Reuters reported a few months ago that there are currently around 4.5 million cannabis consumers in Germany alone. However, the market potential is enormous not only with regard to Germany—we are also currently seeing a continuous opening of cannabis markets in other European countries,” Schetter continued. “For Cantourage, this will—of that we are certain—offer extraordinary growth opportunities in the future. Our flexible business model is predestined to leverage the large market potential in Europe and generate further strong growth for our company. We continue to expect that we will achieve a positive EBITDA for the full year 2024.”

Read Next:

Photo: Courtesy of HTWE via Shutterstock

Market News and Data brought to you by Benzinga APIs