Prediction: The Federal Reserve Will Cut Rates In September, and This Ultra-High-Yield Dividend Stock Could Soar

A core theme of the economy over the last couple of years is abnormally high inflation. While politicians are often criticized or cheered for the current state of the economy, the Federal Reserve is actually the institution responsible for setting monetary policy.

In an effort to combat inflation, the Federal Reserve raised interest rates 11 times throughout 2022 and 2023. In finance jargon, the “cost” of money is interest. So, essentially, borrowing money becomes more expensive and harder to do when interest rates are increased. The goal here is to tighten money supply — effectively slowing down economic activity. This should (in theory!) bring prices down, resulting in reduced inflation.

Right now, the inflation rate in the U.S. is around 2.9%. While this remains elevated compared to the Fed’s long-term target of 2%, it is a material improvement from the 9% inflation rate from about two years ago. With that in mind, the Fed may finally be ready to start tapering interest rates.

During the Fed’s Economic Symposium a couple of weeks ago, Chairman Jerome Powell strongly alluded that changes to policy are on the way. Candidly, there are only a finite number of things that could mean, and I think rate cuts are coming this month.

Let’s break down one ultra-high-yield dividend stock that I think is poised for newfound growth should rate cuts occur. Now could be a lucrative opportunity to scoop up shares.

How would rate cuts bring some newfound rhythm?

The stock I have on my radar is a real estate investment trust (REIT) called Rithm Capital (NYSE: RITM). The company is an asset manager that focuses on the real estate industry, offering services such as mortgage origination for homes, businesses, and consumers.

As I alluded to above, the cost of borrowing money has become more expensive over the last couple of years. In turn, some areas of economic activity, such as buying a home, doing a home improvement project, or starting a business, have been affected by higher interest rates. Rithm’s business is exposed to these dynamics, leaving its underlying financial trends pretty volatile in parallel with a high-interest-rate environment.

If the Fed does indeed begin to cut rates this month, though, Rithm looks well positioned for some newfound growth. Lowering the cost of capital could inspire greater mortgage refinancing or serve as a tailwind for people looking to buy property. Rithm stands to benefit from these situations, and I think lower rates will ultimately bring some much-needed stability back to the business. But don’t take it from me — Rithm’s CEO is optimistic about the possibility of upcoming rate cuts, too.

During Rithm’s second-quarter earnings call, CEO Michael Nierenberg said: “Looking at the macro picture, we are extremely well-positioned for the future and the expectations, and with the expectations of the Fed lowering rates beginning in September, this bodes very well for our company. This will help lower our borrowing costs and hopefully lead to higher earnings.”

Is now a good time to buy Rithm Capital stock?

As of the time of this writing, Rithm’s share price of $11.50 is not too far off its 52-week high. The effect of the rising stock price can be easily seen in the chart below, reflecting Rithm’s price-to-book (P/B) ratio. Clearly, the company’s P/B of 0.92 is materially higher than the low points of two years ago. But the choppiness in more recent valuation trends over the last couple of months suggests some mixed investor sentiment.

I think there are a couple of related ideas in play here. For much of 2024, economists all over Wall Street were parroting one another calling for multiple rate cuts. Earlier this year, billionaire hedge fund manager Bill Ackman, among others, suggested the Fed would cut rates multiple times this year. Although that is yet to happen, I think the notion of looming rate cuts inspired some positivity among the investment community, and perhaps influenced some buying activity in companies such as Rithm.

However, the chart shows that Rithm’s P/B has fluctuated frequently throughout the summer. While these moves weren’t overly material, I see the more recent price action as indicative of one thing: Uncertainty. Since the Fed hasn’t tapered rates yet, I think some investors have chosen to sit on the sidelines until something happens (or doesn’t happen).

Given that inflation is consistently showing signs of cooling down, Chairman Powell’s recent remarks, and the outlook from Rithm’s own management, I think there’s a good chance a rate cut will finally occur in September (with more to follow). Should that happen, now could be a great time to pounce on Rithm stock and take advantage of its near-9% dividend yield.

Should you invest $1,000 in Rithm Capital right now?

Before you buy stock in Rithm Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rithm Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Prediction: The Federal Reserve Will Cut Rates In September, and This Ultra-High-Yield Dividend Stock Could Soar was originally published by The Motley Fool

Move Over, Nvidia and Broadcom: Wall Street's 2 Newest Stock-Split Stocks Are Taking Center Stage This Week

Although artificial intelligence (AI) has been the talk of Wall Street for much of the last two years, the euphoria surrounding companies enacting stock splits has been an equally important catalyst for the stock market in 2024.

A stock split is a tool publicly traded companies have at their disposal that allows them to cosmetically alter their share price and outstanding share count by the same magnitude. It’s cosmetic in the sense that stock splits have no impact on a company’s market cap or its underlying operating performance.

There are two classes of stock splits, one of which investors gravitate to far more than the other. Reverse-stock splits have a goal of increasing a company’s share price, often to ensure continued listing on a major stock exchange. Comparatively, forward-stock splits reduce a company’s share price, usually with the purpose of making shares more nominally affordable for retail investors and/or employees.

Whereas reverse-stock splits are usually undertaken from a position of operating weakness, companies conducting forward splits are typically out-executing their competition and on the leading edge of the innovative curve within their respective industry. Long story short, investors often flock to companies completing forward-stock splits.

Since 2024 began, 13 exceptional businesses have announced or completed a stock split, 12 of which are of the forward-split variety. While none of these are probably better-known than AI leaders Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO), the attention this week turns to Wall Street’s two newest members of the stock-split club.

Nvidia and Broadcom were Wall Street’s most-anticipated stock splits

The hype surrounding AI is so thick investors could arguably cut it with a knife. Since the start of 2023, shares of Nvidia have skyrocketed by 639%, as of the closing bell on Sept. 3, with Broadcom rising by a not-too-shabby 173%. Such monstrous gains coerced Nvidia to complete a 10-for-1 forward split in early June, while Broadcom conducted its first-ever split, also of the 10-for-1 variety, in mid-July.

The fuel behind Nvidia’s epic run that saw it, at least briefly, become the largest publicly traded company is its top-tier graphics processing units (GPUs). The company’s H100 GPU is the preferred choice in AI-accelerated data centers.

More importantly, demand for the H100 and successor Blackwell platform, which is set to make its debut in the early part of 2025, are backlogged. When demand for a product handily outstrips its supply, the price of that good tends to climb. The H100 GPU typically costs between 100% to 200% more than Advanced Micro Devices‘ MI300X AI-GPU. For Nvidia, this has led to a sizable uptick in its gross margin since 2023 began.

As for Broadcom, it’s stepped up as the preferred provider of AI networking solutions. The Jericho3-AI fabric, which was introduced in the second quarter of 2023, is able to connect up to 32,000 GPUs in high-compute data centers. The goal for Broadcom’s solutions is to reduce tail latency and help businesses get as much computing capacity as possible out of their GPUs.

However, Broadcom has a considerably more diverse revenue stream than Nvidia. It’s one of the leading providers of wireless chips and accessories used in 5G-capable smartphones, and provides a wide assortment of optical components and networking solutions to industrial and automotive companies.

But Nvidia and Broadcom have had their moment in the spotlight as stock-split stocks. This week, two new companies are set to take center stage.

Sirius XM Holdings

One of Wall Street’s newest stock-split stocks, and the only one of the 13 set to complete a reverse split, is satellite-radio operator Sirius XM Holdings (NASDAQ: SIRI).

Sirius XM is the final inning of its merger with Liberty Media’s Sirius XM tracking stock, Liberty Sirius XM Group (NASDAQ: LSXMA)(NASDAQ: LSXMB)(NASDAQ: LSXMK), which is expected to stop trading after the closing bell on Sept. 9. This merger is being undertaken to create a unified class of Sirius XM common stock.

Upon completion of this merger — i.e., following the close of trading on Sept. 9 — Sirius XM will conduct a 1-for-10 reverse-stock split.

Although I did note that reverse splits are usually undertaken from a position of operating weakness, this isn’t the case with Sirius XM, which is in danger of delisting. The company has approximately 3.85 billion outstanding shares, which has held its share price firmly in the mid-single digits for over a decade. Some institutional investors may view stocks with a low share price as too risky. This coming split, which will lift its share price by a factor of 10, should put the company on the radar of bigger-money investors.

Despite no longer growing at a rapid pace, Sirius XM still enjoys a number of competitive advantages. For instance, being the only licensed satellite-radio operator affords a level of subscription pricing power that virtually ensures it stays ahead of the inflationary curve. With Spotify Technology recently increasing its subscription cost, Sirius XM looks like a good bet to follow suit and raise its prices in the months to come.

Sirius XM also generates its revenue in a markedly different fashion than traditional radio operators. Whereas most terrestrial and online radio providers heavily rely on advertising revenue to keep the lights on, Sirius XM brought in roughly 77% of its net sales through the first six months of 2024 from subscriptions.

While an ad-driven operating model works well during lengthy periods of economic expansion, it can lead to turmoil during inevitable downturns in the U.S. economy. Meanwhile, Sirius XM’s subscribers are far less likely to cancel their service than businesses are to reduce their marketing budget when economic uncertainty rears its head. In short, Sirius XM has a safer floor than its peers.

Cintas

The other stock-split stock that’ll be taking center stage this week is corporate uniform and business services leader Cintas (NASDAQ: CTAS).

On May 2, the company’s board approved a 4-for-1 stock split, which is set to take place following the close of trading on Sept. 11. This will mark the sixth time Cintas has split its stock since its August 1983 initial public offering (IPO). With the company’s shares rising by nearly 84,000% since its IPO, or 124,800%, including dividends, a stock split is very much needed.

Although supplying corporate uniforms and various business accessories, such as floor mats and safety kits, isn’t a groundbreaking operating model, Cintas is able to take advantage of the non-linear nature of the economic cycle.

Since World War II ended 79 years ago, only three of 12 U.S. recessions have made it to the 12-month mark, with none enduring longer than 18 months. On the other side of the coin, most economic expansions have stuck around for multiple years, including two periods of growth that topped the 10-year mark. Disproportionately long growth spurts favor companies like Cintas that are tied to the health of the U.S. economy.

Another reason for the nearly parabolic climb in Cintas’s stock is its customer diversity. Cintas claims to serve more than 1 million businesses. This means no single customer is vital to its success, or capable of capsizing the proverbial ship.

Inorganic growth has been another key catalyst for Cintas. Management has overseen a number of acquisitions since this century began, including Zee Medical in 2015 and G&K Services in 2017. In addition to being earnings-accretive, these acquisitions have helped expand Cintas’s product ecosystem, as well as promoted cross-selling opportunities.

This week, it’s all about Sirius XM and Cintas.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Sean Williams has positions in Sirius XM. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Spotify Technology. The Motley Fool recommends Broadcom and Cintas. The Motley Fool has a disclosure policy.

Move Over, Nvidia and Broadcom: Wall Street’s 2 Newest Stock-Split Stocks Are Taking Center Stage This Week was originally published by The Motley Fool

Why Nio Stock Continued to Soar Today

Shares of Chinese electric vehicle (EV) maker Nio (NYSE: NIO) have been flying recently. Nio’s American depositary shares were up by 11.1% as of 3:50 p.m. ET today. That brings its five-day surge to a whopping 38%.

That move was initiated by Nio’s promising second-quarter earnings report last week. And the positive momentum continued today after the company caught an upgrade from one Wall Street analyst and a very bullish label from another.

Nio’s “upside catalyst watch”

When Nio reported its second-quarter results at the end of last week, it showed strong improvement in its gross profit margin compared to the first quarter, and beat analyst expectations with its third-quarter delivery and revenue guidance.

After shipping a record 57,373 EVs in the quarterly period, the company said it expects to deliver between 61,000 and 63,000 EVs in the third quarter. That led J.P. Morgan analyst Nick Lai to upgrade Nio shares and significantly raise his firm’s price target.

Lai now thinks investors should buy Nio stock and sees the stock reaching $8 per share. That’s up from his previous target of $5.30 per share and would represent a gain of nearly 50% from recent levels. His reasoning is that operating cash flow will turn positive for the remainder of 2024, which should eliminate the need for Nio to raise fresh capital. Nio ended the second quarter with about $5.7 billion on its balance sheet.

At the same time, Citigroup analyst Jeff Chung opened a 30-day “upside catalyst watch” on the stock. That designation means he thinks Nio shares are on the verge of moving higher. He also cited the rising gross profit margin as a key reason, reports Barron’s.

Whether it was the encouraging quarterly report or the backing of Wall Street analysts, investors have been jumping into Nio shares. The stock’s move higher can continue if the company keeps showing real progress toward achieving profitability.

Should you invest $1,000 in Nio right now?

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Howard Smith has positions in Nio. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.

Why Nio Stock Continued to Soar Today was originally published by The Motley Fool

Mercy Issues Notice to Anthem Blue Cross Blue Shield

ST. LOUIS, Sept. 10, 2024 /PRNewswire/ — After months of negotiation with Anthem Blue Cross Blue Shield (BCBS), Mercy has provided written notice to end its contracts with Anthem in the state of Missouri. These contracts include all commercial, Medicare Advantage, Affordable Care Act (ACA) marketplace, managed Medicaid plans (Healthy Blue) and HealthLink (which falls under the Anthem BCBS umbrella).

https://www.mercy.net/newsroom/mercy-quick-facts/), one of the 20 largest U.S. health systems and named the top large system in the U.S. for excellent patient experience by NRC Health, serves millions annually with nationally recognized quality care and one of the nation’s largest Accountable Care Organizations. Mercy is a highly integrated, multi-state health care system including more than 50 acute care and specialty (heart, children’s, orthopedic and rehab) hospitals, convenient and urgent care locations, imaging centers and pharmacies. Mercy has over 900 physician practice locations and outpatient facilities, more than 4,500 physicians and advanced practitioners and more than 47,000 co-workers serving patients and families across Arkansas, Kansas, Missouri and Oklahoma. Mercy also has clinics, outpatient services and outreach ministries in Arkansas, Louisiana, Mississippi and Texas. (PRNewsfoto/Mercy)” alt=”Mercy (https://www.mercy.net/newsroom/mercy-quick-facts/), one of the 20 largest U.S. health systems and named the top large system in the U.S. for excellent patient experience by NRC Health, serves millions annually with nationally recognized quality care and one of the nation’s largest Accountable Care Organizations. Mercy is a highly integrated, multi-state health care system including more than 50 acute care and specialty (heart, children’s, orthopedic and rehab) hospitals, convenient and urgent care locations, imaging centers and pharmacies. Mercy has over 900 physician practice locations and outpatient facilities, more than 4,500 physicians and advanced practitioners and more than 47,000 co-workers serving patients and families across Arkansas, Kansas, Missouri and Oklahoma. Mercy also has clinics, outpatient services and outreach ministries in Arkansas, Louisiana, Mississippi and Texas. (PRNewsfoto/Mercy)”>

https://www.mercy.net/newsroom/mercy-quick-facts/), one of the 20 largest U.S. health systems and named the top large system in the U.S. for excellent patient experience by NRC Health, serves millions annually with nationally recognized quality care and one of the nation’s largest Accountable Care Organizations. Mercy is a highly integrated, multi-state health care system including more than 50 acute care and specialty (heart, children’s, orthopedic and rehab) hospitals, convenient and urgent care locations, imaging centers and pharmacies. Mercy has over 900 physician practice locations and outpatient facilities, more than 4,500 physicians and advanced practitioners and more than 47,000 co-workers serving patients and families across Arkansas, Kansas, Missouri and Oklahoma. Mercy also has clinics, outpatient services and outreach ministries in Arkansas, Louisiana, Mississippi and Texas. (PRNewsfoto/Mercy)” alt=”Mercy (https://www.mercy.net/newsroom/mercy-quick-facts/), one of the 20 largest U.S. health systems and named the top large system in the U.S. for excellent patient experience by NRC Health, serves millions annually with nationally recognized quality care and one of the nation’s largest Accountable Care Organizations. Mercy is a highly integrated, multi-state health care system including more than 50 acute care and specialty (heart, children’s, orthopedic and rehab) hospitals, convenient and urgent care locations, imaging centers and pharmacies. Mercy has over 900 physician practice locations and outpatient facilities, more than 4,500 physicians and advanced practitioners and more than 47,000 co-workers serving patients and families across Arkansas, Kansas, Missouri and Oklahoma. Mercy also has clinics, outpatient services and outreach ministries in Arkansas, Louisiana, Mississippi and Texas. (PRNewsfoto/Mercy)”>

“Our focus remains on safeguarding our patients and ensuring they receive the low-cost, high-quality care they deserve with insurance coverage that provides the greatest amount of protection for their health,” said Dave Thompson, Mercy’s senior vice president of population health and president of contracted revenue. “We know this news will be concerning for hundreds of thousands of Mercy patients with Anthem BCBS. We will continue to negotiate in good faith with Anthem in hopes of avoiding any disruption to our patients at the end of the year – particularly those patients in need of prolonged, coordinated care. However, patients and employers considering which health plans to purchase for 2025 should consider whether Mercy, the largest health system in the state, will be in the plan they purchase.”

Mercy hopes to remove much of the red tape that makes it increasingly difficult for patients to navigate Anthem’s system and creates a burden and barrier for patients to receive care when it’s medically necessary.

“These technicalities disrupt patient care and, in some cases, can be life threatening. They are administrative tasks dictated and mandated by Anthem, and they are a barrier to timely, appropriate patient care and can shift the cost of health care away from the insurance provider to those less able to afford it – our patients,” Thompson said. “Our patients have enough to worry about as they are often in the middle of a personal health care crisis. They shouldn’t have to worry about whether their insurance company will approve their coverage. They should be able to solely focus on their health and the health of their family members.”

While Mercy and other organizations providing patient care face the burden of rising costs, managed care companies are reaping enormous profits. In June 2024, Elevance Health, the corporate name for Anthem, reported a 24.12% increase in its year-over-year net income to $2.3 billion and a 24.29% increase in its year-over-year net profit margin. In stark contrast, Mercy’s average cost per inpatient stay for commercially insured patients is 27% below the average for all hospitals in the state and outpatient care for that same population is 16% below the average. As a nonprofit health system, Mercy provided more than half a billion dollars in free care in the most recently available year, fiscal year 2023. This free care includes traditional charity care, unreimbursed Medicaid and other community benefits.

“The cost of providing actual care for patients has risen significantly due to inflation, but Anthem has not kept pace with those rising costs when it comes to reimbursing us for the care we provide to our communities,” said Thompson. “It’s unreasonable for the insurer to increase its premiums to patients and employers and increase its profits while expecting those of us providing health care directly to patients daily to bear the brunt of the higher cost for providing that care.”

Mercy will remain in network for medical services with Anthem through the end of the year and will move out of network with Anthem on Jan. 1, 2025, unless a new agreement is reached. This notice does not impact Mercy retail pharmacy services which will allow Mercy Pharmacy’s retail locations to continue serving Anthem patients with their current in-network coverage.

“We’re innovating to improve access to care while achieving top performance in quality and safety. We are also keeping our costs significantly lower than other health systems,” Thompson added. “Managed care companies can and should support this work to give patients access to medically necessary care and incentivize those who provide effective care and reduce the cost burden to the health care system. We want specific provisions from Anthem to support this work and correct issues our patients have with denials and red tape.”

Mercy encourages patients to share their concerns with Anthem by calling the number on the back of their health insurance cards or by calling Anthem at 1-800-331-1476 to make their voices heard.

Mercy, one of the 20 largest U.S. health systems and named the top large system in the U.S. for excellent patient experience by NRC Health, serves millions annually with nationally recognized care and one of the nation’s largest and highest performing Accountable Care Organizations in quality and cost. Mercy is a highly integrated, multi-state health care system including more than 50 acute care and specialty (heart, children’s, orthopedic and rehab) hospitals, convenient and urgent care locations, imaging centers and pharmacies. Mercy has over 900 physician practice locations and outpatient facilities, more than 4,500 physicians and advanced practitioners and 50,000 co-workers serving patients and families across Arkansas, Kansas, Missouri and Oklahoma. Mercy also has clinics, outpatient services and outreach ministries in Arkansas, Louisiana, Mississippi and Texas. In fiscal year 2023 alone, Mercy provided more than half a billion dollars of free care and other community benefits, including traditional charity care and unreimbursed Medicaid.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mercy-issues-notice-to-anthem-blue-cross-blue-shield-302242941.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mercy-issues-notice-to-anthem-blue-cross-blue-shield-302242941.html

SOURCE Mercy

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

18 new social and affordable housing units to be built in Saint-Eustache

SAINT-EUSTACHE, QC, Sept. 9, 2024 /CNW/ – Today, the governments of Canada and Quebec and the City of Saint-Eustache announced the start of construction on 18 social and affordable housing units in Saint-Eustache. The two buildings, which will be built on Rochon Street, will accommodate minors and young adults in difficulty. The project, selected under the Société d’habitation du Québec’s (SHQ) Programme d’habitation abordable Québec (PHAQ), represents a total investment of $7.3 million.

Benoit Charette, Quebec Minister of the Environment, the Fight Against Climate Change, Wildlife and Parks and Minister Responsible for the Laurentides region, made the announcement on behalf of France-Élaine Duranceau, Quebec Minister Responsible for Housing. He was joined by Pierre Charron, Mayor of Saint-Eustache, and Marie-Claude Renaud, Director of Les Ressources communautaires ACJ+.

The Government of Canada has earmarked nearly $3.6 million for the project under the third Canada-Quebec Rapid Housing Initiative Agreement. The Government of Quebec is contributing nearly $2.2 million through the PHAQ. And the City of Saint-Eustache, for its part, is contributing in the amount of $878,718.

Maison Le Préfix

Maison Le Préfixe will have 6 bedrooms for youth in difficulty. Residents will be able to access personalized services, including support to help learn how to communicate better, manage anger and live in the community. Their parents will have an opportunity to better understand the various dimensions of their role.

Les Habitations Autour de Toit

Les Habitations Autour de Toit will have 12 bachelor apartments that will accommodate young people and adults at risk of homelessness for a 2-year transitional period. The residence will provide support, social-worker and social reintegration services.

Quotes:

“The federal government will continue to work hard toward ensuring that everyone in Quebec and across Canada has a safe and stable place to call home. We’re acting quickly to provide new affordable housing to those who need it most across the country, thanks to programs like the third Canada-Quebec Rapid Housing Initiative Agreement and collaboration from all levels of government.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“This is great news for the Laurentides region. It testifies to our firm commitment to boosting construction of affordable housing across Quebec to make more housing available. Every Quebecer deserves a home that meets their needs. It really shows what the Programme d’habitation abordable Québec can do.

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“I’m proud that this project will soon be completed in my riding. Above all, I’m delighted that it will enable minors and young adults in difficulty to live in a welcoming home and benefit from services adapted to their needs. I congratulate the initiators of the project, Ressources communautaires ACJ+, for having succeeded in deploying their vision of the future through these new homes.”

Benoit Charette, Quebec Minister of the Environment, the Fight Against Climate Change, Wildlife and Parks and Minister Responsible for the Laurentides region

“The City of Saint-Eustache is pleased to host and contribute to these exciting and much-needed projects for the Saint-Eustache community. People in vulnerable situations will receive invaluable support for their personal development in a safe and caring environment.”

Pierre Charron, Mayor of Saint-Eustache

“Les Habitations Autour de Toit and Maison Le Préfixe are the fruit of several years of work. These projects are an example of willpower, determination and perseverance. They’re the compelling expression of a community that’s rallied around important social issues. A huge thank you to all those who believed in us, supported us and helped us turn this dream into reality.”

Marie-Claude Renaud, Director, Les Ressources communautaires ACJ+

“The team at Bâtir son quartier is very proud to support the development of this housing project, which grew out of the commitment and collaboration of Ressources communautaires ACJ+ and all its partners. This joint effort is crucial to actively support young people and people in vulnerable situations on the road to self-sufficiency, thereby ensuring they’ll have a better future built on respect and dignity.”

Edith Cyr, General Manager, Bâtir son quartier

Highlights:

- Some of the households that will move into these units could benefit from the Société d’habitation du Québec’s (SHQ’s) Rent Supplement Program, ensuring that they spend no more than 25% of their income on housing. This additional assistance is covered by the SHQ (90%) and the City of Saint-Eustache (10%).

- The mission of Ressources communautaires ACJ+ is to provide professional guidance, support and counselling services. These services meet each user’s individual needs by taking their specific reality into account.

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

SocietehabitationQuebec

HabitationSHQ

LinkedIn

About Canada Mortgage and Housing Corporation

As Canada’s authority on housing, Canada Mortgage and Housing Corporation (CMHC) contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that by 2030, everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/09/c4446.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/09/c4446.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock sell-off is overdone, Goldman Sachs analyst says

Goldman Sachs isn’t scared off by the latest Nvidia (NVDA) sell-off.

Nvidia shed roughly $400 billion in market value last week after the stock fell nearly 10% on Tuesday. The tech stock was one of the biggest drivers of the S&P 500’s (^GSPC) worst start to September since 1953, according to Bespoke Investment Group, though it recovered some of its losses on Monday.

Despite the selling, Toshiya Hari, a lead analyst at Goldman Sachs, maintained a Buy rating on the chip giant. When asked if the Goldman team thought the sell-off in Nvidia stock was overdone, Hari said, “Yes, we do.”

“The recent performance hasn’t been great, but we do remain positive on the stock,” Hari told Yahoo Finance at the Goldman Sachs 2024 Communacopia and Technology Conference. “First of all, demand for accelerated computing continues to be really strong. We tend to spend quite a bit of time on the hyperscalers — the Amazons, the Googles, the Microsofts of the world — but you are seeing a broadening in the demand profile into enterprise, even at the sovereign states.”

Nvidia’s sell-off began when the company’s better-than-expected earnings print on Aug. 28 just wasn’t good enough for Wall Street. While Nvidia’s revenue beat Wall Street expectations by 4.1%, that was the smallest margin for the company since its fiscal fourth quarter of 2023.

The big debate around Nvidia is whether its earnings momentum is sustainable. Hari said that investors are questioning whether that will be the case not only for 2025 but for 2026 too.

Investor sentiment on artificial intelligence has “swung nearly 180 [degrees]” since early 2023, Goldman’s equity research team wrote in a recent note. Investors’ patience is wearing thin, and they want to be shown — not told about — AI-driven revenue streams and profit margin improvements.

Still, the Goldman team wrote, with a profound generational technology shift such as AI, “it would be futile to pass judgment based on near-term cost and return economics.”

The focus is on the long game: Goldman estimates that generative AI will begin materially contributing to sector growth by the second half of 2025.

“I think their competitive position continues to be really strong,” Hari said of Nvidia. “We do think within merchant silicon, Nvidia is the go-to, and even versus custom silicon, they’ve got the edge in terms of the pace of innovation.”

Nvidia CEO Jensen Huang is set to speak at the conference on Wednesday morning.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

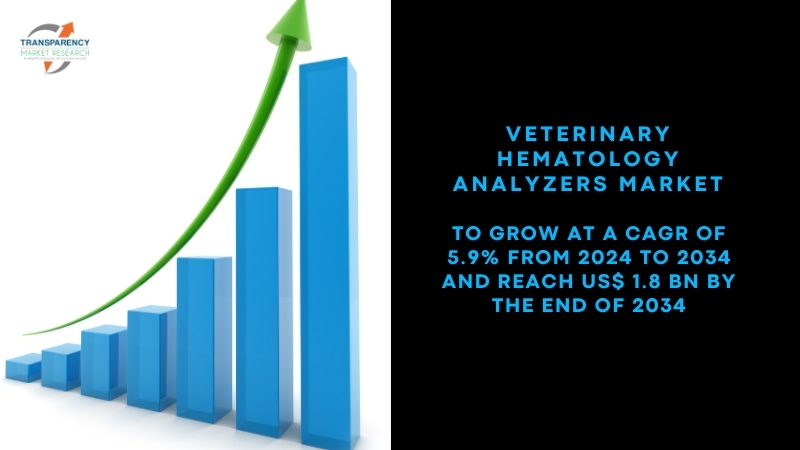

Veterinary Hematology Analyzers Market Size to Achieve US$ 1.8 Billion by 2034, Growing at 5.9% CAGR and Enhancing Animal Disease Diagnosis | Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Sept. 09, 2024 (GLOBE NEWSWIRE) — The global veterinary hematology analyzers market (수의학 혈액학 분석기 시장) was projected to attain US$ 1 billion in 2023. It is anticipated to garner a 5.9% CAGR from 2024 to 2034, and by 2034, the market is likely to attain US$ 1.8 billion.

Veterinarian hematology analyzers are state-of-the-art medical devices that automate the laboratory and veterinary clinic examination of blood samples. These systems use state-of-the-art technologies like as impedance counting, flow cytometry, and spectrophotometry to provide accurate and reliable findings.

Analyzers are used by veterinarians to obtain detailed data on an animal’s blood composition, such as hemoglobin levels and the concentration of different cell types. These variables are used in the diagnosis of illnesses that affect animals, including cancer, infections, immune system problems, and anemia.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/veterinary-hematology-analyzers-market.html

Key Findings of Market Report

- Zoonotic illnesses can naturally spread from humans to other vertebrates or from animals to other vertebrates.

- Bacteria, viruses, fungi, parasites, and other microbes are the means of transmission.

- Hematology analyzers for veterinarians can identify anomalies in blood parameters in real-time.

- This makes it possible for medical practitioners to identify zoonotic diseases quickly, start appropriate treatment, and put important preventative measures in place to stop their spread.

Market Trends for Veterinary Hematology Analyzers

- Hematology analyzers for veterinarians are advanced diagnostic instruments that provide comprehensive details on the biological constituents of blood, including red, white, and platelets.

- These analyzers play a critical role in the diagnosis, monitoring, and treatment of several hematological illnesses in animals. By examining blood samples, veterinary hematology analyzers also help to monitor and safeguard the overall health of the pet population.

- The European Pet Food Industry Federation (FEDIAF), a trade group located in the United Kingdom, reports that the number of pets in Europe increased by 11% in 2022 to 340 million, with the majority being dogs (104 million) and cats (127 million). The number of pets growing as a consequence is driving the growth of the veterinary hematopathology analyzer market.

Global Market for Veterinary Hematology Analyzers: Regional Outlook

- In 2023, North America held the greatest share. The number of hospitals and veterinary clinics is growing, along with the adoption rate of pets, which is driving up market data in the area.

- The 2021–2022 APPA National Pet Owners Survey estimates that 90.5 million households in the United States—or 70% of all households—own a pet. The market share of veterinary hematology analyzers in North America is also being driven by an increase in public awareness of zoonotic illnesses.

Global Veterinary Hematology Analyzers Market: Competitive Landscape

The primary emphasis of major companies in the veterinary hematology analyzers market is on developing sophisticated blood analyzers and completely automated analyzers that improve sample findings to satisfy certain requirements.

The following companies are well-known participants in the global veterinary hematology analyzers market:

- Siemens Healthineers

- IDEXX Laboratories Inc.

- Heska Corporation

- Abaxis, Inc.

- Sysmex Corporation

- Mindray Medical International Ltd.

- Boule Medical AB

- Qreserve Inc.

- Drew Scientific Inc.

- Urit Medical

- Rayto Life and Analytical Sciences Co. Ltd.

- Woodley Equipment Company Ltd.

- Scil Animal Care Company GmbH

- HORIBA Medical

- Diatron MI PLC

- Clindiag Systems Co. Ltd.

- HemoCue AB

Some prominent developments by the players in this market are:

- Mars, Incorporated and SYNLAB Group agreed into an agreement in August 2023 for the acquisition of SYNLAB Vet’s assets. SYNLAB Vet is a European provider of specialized veterinary laboratory diagnostics.

- After the deal closes, SYNLAB Vet will become a part of Mars Petcare, a mission-driven international company that provides veterinarian health and diagnostics, nutrition, technology, and innovation-focused goods and services to pets and pet owners.

- The complete completion of Mars, Incorporated’s acquisition of Heska—a supplier of cutting-edge veterinary diagnostic and specialized solutions—was announced in April 2023.

- Heska is now a part of the Science & Diagnostics business of Mars Petcare, allowing for greater coverage in the areas of technology and diagnostics, as well as faster research and development and increased access to pet healthcare products worldwide.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=4026<ype=S

Global Veterinary Hematology Analyzers Market Segmentation

By Product

- Fully Automatic Analyzers

- Semi-automatic Analyzers

- Cartridge-based

- Others (Direct Sample-based)

By Analysis Parameter

- 2-Part WBC Differential

- 3-Part WBC Differential

- 5-Part WBC Differential

- Others

By End User

- Research Institutes

- Veterinary Diagnostic Centers

- Veterinary Hospitals and Clinics

- Others (Point-of-Care Testing, In-house Testing, etc.)

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

More Trending Reports by Transparency Market Research –

- Dental Syringe Market – The global market for dental syringes (치과용 주사기 시장) was estimated to be worth a market valuation of US$ 343.4 million in 2021. The market is anticipated to advance with a steady 5.1% CAGR from 2022 to 2031 and by 2031, the market is likely to gain US$ 577.8 million.

- Dental Suction Mirror Market – The global dental suction mirror market (치과용 흡입거울 시장) was valued at US$ 49.9 Mn in 2021 and is projected to surpass the value of US$ 79.2 Million by 2031. The global industry is anticipated to expand at a CAGR of 4.8% during the forecast period.

- Microwave Ablation Devices Market – The global microwave ablation devices market (마이크로파 절제 장치 시장) is expected to grow at a CAGR of 12.2% from 2024 to 2034 and reach US$ 1.0 Billion by the end of 2034.

- Micropump Market – The global micropump market (마이크로펌프 시장) is expected to grow at a CAGR of 18.7% from 2024 to 2034 and reach US$ 12.4 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 No-Brainer Dividend Stocks With Yields Above 5% You Can Buy Now and Hold at Least a Decade

There are a million and one ways to make a buck on Wall Street, but some methods are more reliable than others. If you’re an investor looking for a way to beef up your passive income stream or you simply want big gains, buying dividend-paying stocks and holding them is a relatively easy way to make it happen.

Dividend-payers have to manage their cash more carefully than non-dividend-payers, which leads to measurable benefits for investors. During the 50 years from 1973 through 2023, stocks in the benchmark S&P 500 index that paid dividends rose by 9.17% annually on average. Annual returns from non-dividend-payers in the same index are less than half at just 4.27% on average, according to Ned Davis Research and Hartford Funds.

At the moment, shares of W.P. Carey (NYSE: WPC), AT&T (NYSE: T), and Pfizer (NYSE: PFE) offer dividend yields of 5% or better. Here’s why investors can expect them to outperform in the decade ahead.

1. W.P. Carey

W.P. Carey is a large real estate investment trust (REIT) that owns 1,291 properties spread throughout the U.S. and Europe. This REIT takes a hands-off approach with net leases that transfer all the variable costs of building ownership, such as maintenance and taxes, to the tenant.

Shares of W.P. Carey are down from their all-time peak because the company had to sell a lot of underperforming office buildings and slash its dividend accordingly. At recent prices, it offers a 5.7% yield that could grow significantly in the years ahead.

Now that it’s out of the office building space, industrial properties, and warehouses are responsible for a combined 64% of annual rent expectations. The REIT’s tenant list is highly diversified with its four largest tenants responsible for less than 10% of its portfolio.

This year, W.P. Carey expects adjusted funds from operations (FFO) to land in a range between $4.63 and $4.73 per share. This is heaps more than it needs to meet a dividend obligation currently set at $3.48 per share. With a pile of capital from office building sales available to reinvest, investors can reasonably expect this REIT’s bottom line and its dividend payout to rise steadily in the decade ahead.

2. AT&T

AT&T is another dividend payer that recently cut its payout in response to the sale of a large chunk of its overall business. In 2022, the company spun off its unpredictable media assets, so these days, it’s purely a telecommunications business. At recent prices, the stock offers a 5.3% dividend yield.

AT&T’s telecom business is steadily growing along with America’s need for both broadband and mobile internet services. The recent addition of a fixed wireless option helped second-quarter broadband sales rise 7% year over year.

AT&T hasn’t raised its dividend payout since spinning off its media assets. It’s still focused on reducing a debt load that was still $126.9 billion at the end of June.

AT&T could begin raising its dividend again soon. Over the past 12 months, the company generated a very healthy $20.9 billion in free cash flow and needed just $8.2 billion to meet its dividend commitment. That means there’s plenty of profits available to reduce debt and maintain or raise its dividend commitment.

3. Pfizer

Pfizer is still getting hit by rapidly shrinking demand for COVID-19 vaccines and treatments. Its stock price has been beaten down a long way from its previous peak, but the company has continued raising its dividend year after year. At recent prices, it offers a big 5.9% dividend yield.

Second-quarter sales rose just 3% year over year. If we ignore contributions from its COVID-19 products, though, sales surged 14% year over year.

Investments made with its COVID-related windfall give Pfizer a good chance to continue growing at a healthy pace. In 2023, the Food and Drug Administration approved nine new drugs, a new record.

Big Pharma companies are made of many parts that move in different directions. Some of Pfizer’s aging blockbusters are on the way down, but the company has over a dozen products that grew second-quarter sales by more than 10% year over year.

With an unprecedented slew of new drugs to market, and an experienced global salesforce ready to market them, investors can look forward to steadily rising dividend payments from this stock for at least a decade.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

3 No-Brainer Dividend Stocks With Yields Above 5% You Can Buy Now and Hold at Least a Decade was originally published by The Motley Fool

NEW PACIFIC REPORTS FINANCIAL RESULTS FOR THE THREE MONTH AND YEAR ENDED JUNE 30, 2024

VANCOUVER, BC, Sept. 9, 2024 /PRNewswire/ – New Pacific Metals Corp. (“New Pacific” or the “Company”) reports its financial results for the three months and year ended June 30, 2024. All figures are expressed in US dollars unless otherwise stated.

FISCAL 2024 HIGHLIGHT

- The Company filed its independent National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Pre-Feasibility Study for the Silver Sand Project (the “Silver Sand PFS Technical Report”) on August 8, 2024. The Silver Sand PFS Technical Report shows an post-tax net present value (“NPV”) at a 5% discount rate of $740 million with an internal rate of return (“IRR”) of 37% at a base case price of $24.00 per ounce (“oz”) of silver, underpinned by a production of approximately 157 million oz (“Moz”) of silver over 13 years of mine life with average life of mine (“LOM”) all-in sustaining cost (“AISC”) of $10.69/oz silver.

- The Company filed its inaugural NI 43-101 mineral resource estimate for its Carangas Project (the “Carangas MRE”) on September 18, 2023. Total indicated mineral resources of 214.9 million tonnes (“Mt”) containing 205.3 Moz of silver, 1,588.2 thousand oz (“Koz”) of gold, 1,444.9 million pounds (“Mlbs”) of lead, 2,653.7 Mlbs of zinc, and 112.6 Mlbs of copper; or collectively 559.8 Mozs silver equivalent (“AgEq”). Total inferred mineral resources are 45.0 Mt containing 47.7 Mozs of silver, 217.7 Kozs of gold, 297.9 Mlbs of lead, 533.7 Mlbs of zinc, and 16.8 Mlbs of copper; or collectively 109.8 Mozs AgEq.

- Successfully closed a bought deal financing on September 29, 2023. A total of 13,208,000 common shares of the Company were sold under the bought deal financing at a price of $1.96 (CAD $2.65) per common share for total gross proceeds of approximately $25.9 million (CAD $35 million). The underwriter’s fee and other issuance costs for the transaction were approximately $1.4 million.

FINANCIAL RESULTS

Net loss attributable to equity holders of the Company for the three months and year ended June 30, 2024 of $1.48 million and $6.02 million or $0.01 and $0.04 per share, respectively (three months and year ended June 30, 2023 – net loss of $1.86 million and $8.10 million or $0.01 per share and $0.05 per share, respectively). The Company’s financial results were mainly impacted by the following items:

- Operating expenses for the three months and year ended June 30, 2024 of $1.53 million and $6.94 million, respectively (three months and year ended June 30, 2023 – $1.89 million and $8.26 million, respectively).

- Income from investments for the three months and year ended June 30, 2024 of $0.32 million and $1.06 million, respectively (three months and year ended June 30, 2023 – $0.02 million and $0.18 million, respectively).

- Gain on disposal of property, plant and equipment for the three months and year ended June 30, 2024 of $nil and $0.05 million, respectively (three months and year ended June 30, 2023 – $nil and $nil, respectively).

- Provision for credit loss for the three months and year ended June 30, 2024 of $0.27 million and $0.27 million, respectively (three months and year ended June 30, 2023 – $nil and $nil, respectively).

- Foreign exchange gain (loss) for the three months year ended June 30, 2024 of $(0.01) million and $0.08 million, respectively (three months and year ended June 30, 2023 – $0.01 million and $(0.02) million, respectively).

- Working Capital: As of June 30, 2024, the Company had working capital of $21.38 million.

PROJECT EXPENDITURE

The following schedule summarized the expenditure incurred by category for each of the Company’s projects for relevant periods:

|

Cost |

Silver Sand |

Carangas |

Silverstrike |

Total |

|

Balance, July 1, 2022 |

$ 79,594,886 |

$ 6,011,566 |

$ 3,324,120 |

88,930,572 |

|

Capitalized exploration expenditures |

||||

|

Reporting and assessment |

1,008,174 |

88,558 |

– |

1,096,732 |

|

Drilling and assaying |

1,925,695 |

8,289,678 |

977,881 |

11,193,254 |

|

Project management and support |

2,719,120 |

1,424,573 |

256,569 |

4,400,262 |

|

Camp service |

467,690 |

1,005,158 |

174,651 |

1,647,499 |

|

Permit and license |

195,821 |

9,389 |

– |

205,210 |

|

Value added tax receivable |

426,406 |

1,317,819 |

154,401 |

1,898,626 |

|

Foreign currency impact |

(201,972) |

(8,831) |

(24,680) |

(235,483) |

|

Balance, June 30, 2023 |

$ 86,135,820 |

$ 18,137,910 |

$ 4,862,942 |

$ 109,136,672 |

|

Capitalized exploration expenditures |

||||

|

Reporting and assessment |

999,402 |

408,874 |

– |

1,408,276 |

|

Drilling and assaying |

47,217 |

23,894 |

– |

71,111 |

|

Project management and support |

1,765,297 |

1,079,177 |

63,919 |

2,908,393 |

|

Camp service |

249,764 |

241,945 |

36,754 |

528,463 |

|

Permit and license |

33,073 |

9,308 |

– |

42,381 |

|

Value added tax receivable |

112,332 |

31,061 |

979 |

144,372 |

|

Foreign currency impact |

(365,571) |

(78,127) |

(30,039) |

(473,737) |

|

Balance, June 30, 2024 |

$ 88,977,334 |

$ 19,854,042 |

$ 4,934,555 |

$ 113,765,931 |

SILVER SAND PROJECT

For the three months and year ended June 30, 2024, total expenditures of $1.02 million and $3.21 million, respectively (three months and year ended June 30, 2023 – $0.93 million and $6.74 million, respectively) were capitalized under the project.

CARANGAS PROJECT

For the three months and year ended June 30, 2024, total expenditures of $0.47 million and $1.79 million, respectively (three months and year ended June 30, 2023 – $1.75 million and $12.14 million, respectively) were capitalized under the project.

SILVERSTRIKE PROJECT

For the three months and year ended June 30, 2024, total expenditures of $0.02 million and $0.10 million, respectively (three months and year ended June 30, 2023 – $0.22 million and $1.56 million, respectively) were capitalized under the project.

MANAGEMENT DISCUSSION AND ANALYSIS

This news release should be read in conjunction with the Company’s management discussion and analysis and the audited consolidated financial statements and notes thereto for the corresponding period, which have been filed with the Canadian Securities Administrators and are available under the Company’s profile on SEDAR+ at www.sedarplus.ca,on EDGAR at www.sec.gov and on the Company’s website at www.newpacificmetals.com.

ABOUT NEW PACIFIC

New Pacific is a Canadian exploration and development company with three precious metal projects in Bolivia. The Company’s flagship Silver Sand project has the potential to be developed into one of the world’s largest silver mines. The Company is also rapidly advancing its Carangas project towards a Preliminary Economic Assessment. For the Silverstrike project, the Company completed a discovery drill program in 2022.

For further information, please contact:

Andrew Williams, CEO

New Pacific Metals Corp. Phone: (604) 633-1368 Ext. 236

1750 – 1066 Hastings Street, Vancouver, BC V6E 3X1, Canada

U.S. & Canada toll-free: 1 (877) 631-0593

E-mail: invest@newpacificmetals.com

For additional information and to receive the Company news by e-mail, please register using New Pacific’s website at www.newpacificmetals.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain of the statements and information in this news release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include, but are not limited to, statements regarding: the Company’s financial results; anticipated exploration, drilling, development, construction, and other activities or achievements of the Company; inferred, indicated or measured mineral resources or mineral reserves on the Company’s projects, including, but not limited to, the Silver Sand PFS Technical Report; the anticipation that the Company will file a Preliminary Economic Assessment in respect of its Carangas project; the timing of receipt of permits and regulatory approvals; and estimates of the Company’s revenues and capital expenditures.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental risks, operations and political conditions, the regulatory environment in Bolivia and Canada, risks associated with community relations and corporate social responsibility, and other factors described under the heading “Risk Factors” in the Company’s annual information form for the year ended June 30, 2023 and its other public filings. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information.

The forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company’s ability to carry on current and future operations, including: development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the stabilization of the political climate in Bolivia; the Company’s ability to obtain and maintain social license at its mineral properties; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits, including the ratification and approval of the Mining Production Contract with the Corporacion Minera de Bolivia by the Plurinational Legislative Assembly of Bolivia; the ability of the Company’s Bolivian partner to convert the exploration licenses at its Carangas project to administrative mining contracts; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry. Although the forward-looking statements contained in this news release are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements in this news release are qualified by these cautionary statements. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made as of the date of this news release.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada which differ from the requirements of United States securities laws. All mining terms used herein but not otherwise defined have the meanings set forth in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Unless otherwise indicated, the technical and scientific disclosure herein has been prepared in accordance with NI 43-101, which differs significantly from the requirements adopted by the United States Securities and Exchange Commission.

Accordingly, information contained in this news release containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

Additional information relating to the Company, including the Company’s annual information form, can be obtained under the Company’s profile on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov, and on the Company’s website at www.newpacificmetals.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-pacific-reports-financial-results-for-the-three-month-and-year-ended-june-30-2024-302242702.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-pacific-reports-financial-results-for-the-three-month-and-year-ended-june-30-2024-302242702.html

SOURCE New Pacific Metals Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

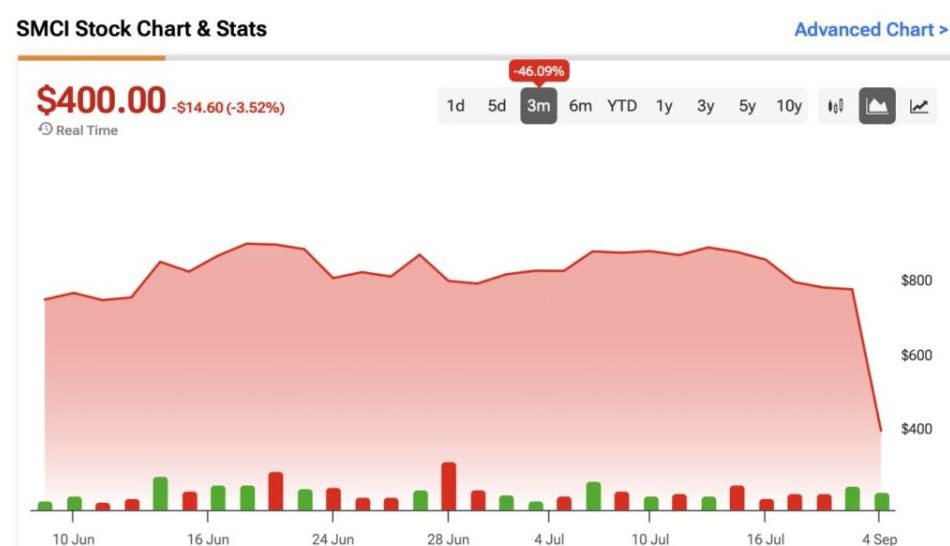

Is Super Micro Computer (NASDAQ:SMCI) Stock a Buy After Recent Short-Seller Allegations?

Super Micro Computer (SMCI), a leading player in data center solutions and AI technologies, has faced significant short-selling pressure following a bearish report alleging misconduct in the company’s operations. Although the drop in share price has made SMCI more attractively valued, I do not see this as a clear buying opportunity. Instead, I am adopting a Hold stance on the company’s shares.

Many investors are attracted to AI-related stocks for their long-term potential, especially given the sizable addressable market in AI servers, as demonstrated by Super Micro Computer. The company has reported revenue growth exceeding triple digits growth in recent quarters. However, the unconfirmed allegations introduce a level of speculation that complicates the assessment of their seriousness.

Therefore, investors should exercise caution—where there’s smoke, there’s often fire. The significant risks surrounding SMCI could easily undermine any bullish outlook.

Understanding the Hindenburg Research Report

To explain my neutral stance on Super Micro Computer shares, it’s important to highlight that the stock has dropped more than 30% since the publication of a report by Hindenburg Research, a short-selling firm (which holds a short position in SMCI). The report accuses the AI-focused company of accounting manipulation, among other claims.

According to Hindenburg, after a three-month investigation, it identified several accounting red flags, including undisclosed related-party transactions, sanctions violations, export control failures, and customer issues.

In simpler terms, this could imply that Super Micro Computer is allegedly selling its products to businesses it is somehow connected to. For example, management might have an ownership stake in these businesses, or the company itself could own a portion of them. These related-party transactions could involve sales between entities that share significant connections.

The situation casts doubt on the quality of Super Micro Computer’s reported sales and earnings. It suggests that demand may not be organic—rather, it could be artificially inflated through these connections.

This raises questions, especially since Super Micro Computer has reported revenue growth of more than 143% and 200% in recent couple of quarters, driven by strong demand for its servers. Given this, artificially inflating sales wouldn’t seem necessary, as the company’s organic growth has already been exceptional.

Should Investors Worry About the SMCI Short Seller Report?

Part of my skepticism about SMCI’s investment thesis now stems from the idea that “where there’s smoke, there’s fire.” It’s important to remember that short-seller reports are designed to drive down a stock’s price. These firms stand to profit if the stock falls, as they’ve taken a position betting on that decline.

While debating the legality of short-selling is complex, the reality is that short-sellers are incentivized to publish negative information about a company, profit from the short position, and capitalize when the stock price drops.

However, what’s most concerning for Super Micro Computer investors is the company’s management response to these allegations. CEO Charles Liang publicly denounced Hindenburg Research’s accusations as false. Yet, what raised eyebrows was the company’s decision to delay its annual report.

This delay could suggest that Super Micro Computer is reviewing its reporting standards or pricing practices, potentially indicating misconduct. The company may need time to adjust its financials to ensure compliance with SEC regulations.

It’s also worth noting that back in August 2020, Super Micro Computer settled with the SEC for $17.5 million over widespread accounting violations. Interestingly, despite this, some senior executives involved in that scandal were later rehired, indicating that fundamental changes may not have taken place.

In a similar vein, Hindenburg Research, known for its accurate identification of fraud in its 2020 accusations against Nikola (NKLA) and its 2023 report on Icahn Enterprises (IEP), has raised concerns about misleading practices leading to SEC charges.

When Might SMCI Present a Buying Opportunity?

Given the current uncertainty, the risk of staying on the sidelines is that if the allegations against Super Micro Computer fail to materialize or have little impact on the company’s fundamentals, it could present a significant buying opportunity at a discount. I maintain a neutral stance on this matter, balancing caution with the potential for long-term gains.

Some Wall Street analysts are already advising this approach. Northland’s Nehal Chokshi, for example, considers all the bearish arguments in the Hindenburg Research report to be unfounded, predicting they will prove “innocuous.”

Regarding the delay in the company’s annual filings, Chokshi believes this is due to “testing the efficacy of incremental internal controls across multiple business functions.” Importantly, although Super Micro Computer reviewing its internal controls, the company has stated it does not expect to restate its financials, which is certainly a positive sign.

Since the stock has sold off by around 35% following the bearish report, shares now trade at a much more attractive valuation, with a forward P/E of 11.5x compared to the levels above 45x seen in March of this year.

If things go well for Super Micro Computer, the allegedly manipulated revenues may not be significant enough to alter the medium- to long-term potential of the company, especially considering the massive addressable market for AI servers, projected to be nearly $430 billion over the next decade.

Is SMCI A Buy, According to Wall Street Analysts?

Following the Hindenburg Research report, several analysts downgraded SMCI stock and lowered their price targets. Despite this, the current consensus remains bullish with a “Moderate Buy” rating and an average price target of $978.50. This suggests a significant upside potential of 145.49% based on the latest share price.

Key Takeaways

Super Micro Computer’s stock has certainly taken a black eye from the misconduct allegations by Hindenburg Research, and it will likely take time to recover investor sentiment. Consequently, I am adopting a Hold stance on the stock. While the company’s delayed annual report raises concerns, it denies the allegations and does not expect to restate its financials. Given the large AI server market opportunity and growth potential, this could still present a buying opportunity if the allegations prove unfounded. Caution is advised, but the long-term potential remains.