Norfolk Southern Board of Directors Appoints Mark R. George President and Chief Executive Officer Through Unanimous Vote of Independent Directors

Board Terminates Alan H. Shaw as President and Chief Executive Officer Due to Violations of Company Policies

Nabanita Nag Terminated as Chief Legal Officer

Company Reaffirms Full-Year 2024 Guidance

ATLANTA, Sept. 11, 2024 /PRNewswire/ — Norfolk Southern Corporation NSC today announced that the Norfolk Southern Board of Directors has by unanimous vote of the independent directors appointed Mark R. George, the company’s Executive Vice President and Chief Financial Officer, as President and Chief Executive Officer, effective immediately. George will also join the Norfolk Southern Board.

George’s appointment follows the Norfolk Southern Board’s unanimous decision to terminate Alan H. Shaw for cause, effective immediately.

This change in leadership comes in connection with preliminary findings from an ongoing investigation that determined Shaw violated company policies by engaging in a consensual relationship with the company’s Chief Legal Officer. Shaw’s departure is unrelated to the company’s performance, financial reporting and results of operations.

Claude Mongeau, Chairman of the Norfolk Southern Board, said, “The Board has full confidence in Mark and his ability to continue delivering on our commitments to shareholders and other stakeholders. Mark has played an integral role in our recent progress and brings decades of financial experience and strong operational expertise. He embodies our corporate values and is a champion of our safety culture. In close partnership with our accomplished COO, John Orr, they will continue to improve NS’ operating performance and close the margin gap with peers.”

“I am honored to take on this role and lead Norfolk Southern,” said George. “I look forward to my continued partnership with John and the entire Thoroughbred team as we further our progress on optimizing operations and serving our customers, while creating a safe and satisfying workplace and delivering enhanced value for our employees, customers, shareholders, and communities.”

In connection with George’s appointment as Chief Executive Officer, Norfolk Southern announced that Jason A. Zampi will serve as acting Chief Financial Officer.

Norfolk Southern also announced that Nabanita C. Nag has been terminated from her roles as Executive Vice President Corporate Affairs, Chief Legal Officer & Corporate Secretary, effective immediately, in connection with the preliminary findings of the Board’s ongoing investigation. Jason M. Morris will serve as acting Corporate Secretary.

Reaffirms 2024 Guidance

Norfolk Southern reaffirms its full-year 2024 guidance provided on July 25, 2024, in conjunction with its second quarter 2024 financial results.

About Mark R. George

Mark R. George is a seasoned executive with over 35 years of professional experience spanning multiple global industries. He most recently served as EVP and Chief Financial Officer of Norfolk Southern since 2019. In this capacity, George oversaw the company’s Finance, Investor Relations, Sourcing, and Corporate Strategy teams. During his time at Norfolk Southern, Mark brought a strategic and business partnership mindset to the CFO office. He has used his expertise across multiple industrial segments to help shape the company’s strategy and drive value for our shareholders. Prior to joining Norfolk Southern, he held successive roles of responsibility across multiple commercial and business segments of United Technologies Corporation and its subsidiaries, including six years in Asia as the regional CFO for the Otis Elevator Company. He held roles of increasing responsibility and ultimately served as the Global CFO for both the Otis Elevator Company and the Carrier Corporation from 2008 to 2019. George is also on the Board of Directors for Trane Technologies plc, where he serves on the Finance and Audit Committees. He also serves on the Board of Directors for Junior Achievement of Georgia. He holds a Bachelor of Science in finance from Connecticut State University and a Master of Business Administration from Rensselaer Polytechnic Institute.

About Norfolk Southern

Since 1827, Norfolk Southern Corporation NSC and its predecessor companies have safely moved the goods and materials that drive the U.S. economy. Today, it operates a customer-centric and operations-driven freight transportation network. Committed to furthering sustainability, Norfolk Southern helps its customers avoid approximately 15 million tons of yearly carbon emissions by shipping via rail. Its dedicated team members deliver more than 7 million carloads annually, from agriculture to consumer goods, and Norfolk Southern originates more automotive traffic than any other Class I Railroad. Norfolk Southern also has the most extensive intermodal network in the eastern U.S. It serves a majority of the country’s population and manufacturing base, with connections to every major container port on the Atlantic coast as well as major ports in the Gulf of Mexico and Great Lakes. Learn more by visiting www.NorfolkSouthern.com.

Cautionary Statement on Forward-Looking Statements

Certain statements in this communication are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements relate to future events and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, costs, levels of activity, or performance to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements may be identified by the use of words like “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “project,” “consider,” “predict,” “potential,” “feel,” or other comparable terminology. The Company has based these forward-looking statements on its current expectations, assumptions, estimates, beliefs, and projections. While the Company believes these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control. These and other important factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as well as the Company’s subsequent filings with the SEC, may cause actual results, performance, or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements herein are made only as of the date they were first issued, and unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/norfolk-southern-board-of-directors-appoints-mark-r-george-president-and-chief-executive-officer-through-unanimous-vote-of-independent-directors-302245784.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/norfolk-southern-board-of-directors-appoints-mark-r-george-president-and-chief-executive-officer-through-unanimous-vote-of-independent-directors-302245784.html

SOURCE Norfolk Southern Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Ethereum, Dogecoin Move Sideways As Inflation Data Dampens Aggressive Rate Cuts Hopes: Why This Analyst Duo Says It Is 'Great Time' To Pile Up On King Crypto

Leading cryptocurrencies were little changed Wednesday overnight as higher-than-expected core inflation data weighed on investors’ decisions.

| Cryptocurrency | Gains +/- | Price (Recorded at 8.30 p.m. EDT) |

| Bitcoin BTC/USD | +0.47% | $57,905.55 |

| Ethereum ETH/USD |

-0.57% | $2,363.63 |

| Dogecoin DOGE/USD | -0.61% | $0.1022 |

What Happened: Bitcoin plunged below $56,000 during morning hours after core inflation for August exceeded estimates, moderating expectations for a 50-basis-point rate cut at next week’s FOMC meeting.

However, a swift recovery saw the leading cryptocurrency nearly touch $58,000 by market close. Bitcoin was still down 0.47% over the past week, and 1.89% since September began.

Ethereum also recovered its morning losses and hovered around the mid-$2,300 mark.

The total cryptocurrency liquidations breached $125 million in the last 24 hours, with the lion’s share of upside bets getting wiped out.

Traders taking bullish long positions on Bitcoin surged compared to those positioning for price declines, as seen by the spike in the Long/Short Ratio.

The Cryptocurrency Fear & Greed Index fell to 31 from 37 a day before, indicating significant FUD in the market.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 8:30 p.m. EDT) |

| Injective (INJ) | +4.61% | $18.94 |

| Sui (SUI) | +4.34% | $0.9557 |

| Monero (XMR) | +3.82% | $173.32 |

The global cryptocurrency market stood at $2.02 trillion, following a marginal increase of 0.15% in the last 24 hours.

Stocks ticked higher on Wednesday. The S&P 500 rose 58.61 points, or 1.07%, to end at 5,554.13, while the tech-focused Nasdaq Composite added 2.17% to close at 17,395.53. Both of these indices clocked their third straight day of gains. The Dow Jones Industrial Average inched 0.31% higher to finish at 40,861.71.

Like cryptocurrencies, stocks fell after inflation data came higher than expected. Investors now anticipitated an 85% chance of a 25-basis-point cut as of this writing, according to the CME FedWatch tool. Next on their radar is the producer price index data, due to be released Thursday.

See More: Best Cryptocurrency Scanners

Analyst Notes: Co-founders of the blockchain analytics platform Glassnode, Jan Happel and Yann Allemanna, who go by their pseudonym Negentropic on X, noted the peak of the Bitcoin Risk Index.

Looks like a great time to accumulate spot BTC,” the handle said, adding that entering during this phase carries a “substantial reward.”

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Joseph Wm Foran Takes a Bullish Stance: Acquires $124K In Matador Resources Stock

A significant insider buy by Joseph Wm Foran, Chairman and CEO at Matador Resources MTDR, was executed on September 11, and reported in the recent SEC filing.

What Happened: In a recent Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, Foran increased their investment in Matador Resources by purchasing 2,500 shares through open-market transactions, signaling confidence in the company’s potential. The total transaction value is $124,925.

At Wednesday morning, Matador Resources shares are up by 1.0%, trading at $49.7.

Unveiling the Story Behind Matador Resources

Matador Resources Co is an independent energy company engaged in the exploration, development, production, and acquisition of oil and natural gas resources. The majority of the company’s assets are located in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. Along with maintaining a portfolio of oil and natural gas properties, Matador works to identify and develop midstream opportunities that support and enhance its exploration and development business.

Unraveling the Financial Story of Matador Resources

Positive Revenue Trend: Examining Matador Resources’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 31.59% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Analyzing Profitability Metrics:

-

Gross Margin: With a high gross margin of 46.88%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Matador Resources’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.83.

Debt Management: Matador Resources’s debt-to-equity ratio is below the industry average at 0.44, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 6.33 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.84 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Matador Resources’s EV/EBITDA ratio, lower than industry averages at 3.67, indicates attractively priced shares.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Transaction Codes To Focus On

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Matador Resources’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Haivision Announces Results for the Three Months and Nine Months Ended July 31, 2024

Operational Restructuring Now Complete, Focus Turns to Higher Revenue Growth

MONTREAL, Sept. 11, 2024 /PRNewswire/ – Haivision Systems Inc. (“Haivision” or the “Company“) HAI, a leading global provider of mission critical, real-time video networking and visual collaboration solutions, today announced its results for the third quarter ended July 31, 2024.

“As we get closer to the end of our Fiscal 2024, I’m proud to say that we have completed our 2-year strategic plan for major EBITDA and profitability transformation,” said Mirko Wicha, Chairman and CEO of Haivision. Successfully transitioning out of low margin businesses, our focus over the next two years will be to return Haivision to organic, double-digit revenue growth.”

Q3 2024 Financial Results

- Revenue of $30.6 million, down from the prior year comparative period, partially the result of delays in the U.S. budget approval, but also reflect our transformation away from the bespoke “integrator” model and our success in the long-term rental program.

- Gross Margins* were 75.0%, a significant improvement from 71.9% for the same prior year period.

- Total expenses were $21.9 million, a decrease of $3.8 million, from the same prior year period.

- Operating profit was $1.1 million, a $1.8 million or 333% improvement from the same prior year period.

- Adjusted EBITDA* was $4.1 million, consistent with the prior year period.

- Adjusted EBITDA Margins* was 13.5%, compared to 12.4% for the same prior year period.

- Net income was $0.4 million, a $1.3 million or 298% improvement from the same prior year period.

Financial Results for the nine months ended July 31, 2024

- Revenue of $99.4 million, down from the prior year comparative period, partially the result of delays in approval of the U.S. federal budget, but also reflects our transformation away from the bespoke integrator model, our success in the long-term rental program and are departure from the house of worship business.

- Gross Margins* were 73.1%, a notable improvement from 69.1% for the same prior year period.

- Total expenses were $67.4 million, a decrease of $7.0 million from the same prior year period.

- Operating profit was $5.2 million, a $7.7 million or 317% improvement from the same prior year period.

- Adjusted EBITDA* was $14.4 million, a $5.3 million or 78% improvement from the same prior year period.

- Adjusted EBITDA Margins* was 14.5%, a signficant improvement when compared to 8.7% for the same prior year period.

- Net income was $2.6 million, a $6.4 million or 243% improvement from the same prior year period.

Key Company Highlights

- Haivision joins consortium with Airbus Defense and Space to develop new technologies for rapid, secure, and reliable communications.

- Haivision MCS awarded US$61.2 million (CAD$82 million) production agreement by U.S. Navy for next-generation combat visualization and video distribution systems.

- Haivision collaborates with Shield AI to bring together full-motion video with AI object detection for defense and ISR applications.

- France Television provides exclusive coverage of the Paris 2024 Olympic surfing competition with Haivision’s private 5G video transmission ecosystem.

- Celebrated its 20-years anniversary as a leader and innovator in mission critical live video.

- Unveiled Hub 360, a cloud-based master control solution that streamlines live production workflows.

- Published its fifth annual Broadcast Transformation Report, highlighting the state of technology adoption in the broadcast industry.

- Awarded “Single/Dual-Stream Encoding Hardware” and “Best On-Prem Encoding/ Transcoding Solution” for the Makito X4 by Streaming Media Readers’ Choice Awards.

- Joined the Panasonic Partner Alliance for live video production workflows with Kairos; joined the Sony Cloud Production Platform for low latency live video in the cloud; and partnered with Grabyo, a London-based live cloud production platform, enabling integrated solution for live multi-camera productions.

- Announced strategic partnerships with CP Communications, Flypack, RF Wireless Systems, and Vidovation to extend mobile video transmitters rental services into North America.

“Haivision MCS’s recent award of a C$82M production agreement by the U.S. Navy, the Airbus Defense development partnership, and our investment in AI development demonstrate our ability to deliver advanced technology solutions for our key markets. Said Dan Rabinowitz, Chief Financial Officer and EVP, Operations. These are but a few example of growth opportunities for the Company. It has clearly been a busy year for Haivision.”

Financial Results

Revenue for the three months and nine months ended July 31, 2024 was $30.6 million and $99.4 million, respectively modest decrease when compared to the prior year comparative period. In this last quarter revenues were impacted by delays in the approval of a U.Ss Federal spending bill which, in turn, delayed certain procurement process; our transition away from the integrator model in the control room space, which offered lower-margined, third-party components; our long-term rental program which will offer a recurring revenue model and enhanced margins in our transmitter business; and our departure from the house of worship market in fiscal 2023.

Gross Margin* for the three months and nine months ended July 31, 2024 was 75.0% and 71.9%, respectively compared to 72.0% and 69.1% for the prior year comparable periods. Gross Margin* were positively impacted by our decision to exit the managed services business; transitioning away from the integrator model in the control room market, decreases in the incremental costs of components procured during the worldwide component shortage, and supply chain improvements.

Total expenses for the three months and nine months ended July 31, 2024 were $21.9 million and $67.4 million, respectively representing decrease of $3.8 million and $7.0 million when compared to from the prior year comparative periods, largely the result of recently completed restructuring efforts.

The result of these Gross Margin* improvements and lower total expenses was operating profits for the three months and nine months ended July 31,, 2024 of $1.1 million and $5.3 million, respectively representing improvements of $1.6 million and $7.7 million when compared to the prior year comparable periods. Adjusted EBITDA* for the three months ended July 31, 2024 was $4.1 million a modest decrease of $0.2 million from the prior year period. However, Adjusted EBITDA* for the nine-month period ended July 31, 2024 was $14.4 million representing a significant increase of $5.3 million (or 58%) from the prior year comparative period. Adjusted EBITDA Margins* for the three months ended July 31, 2024, was 13.5% compared to 12.4% in the prior year comparative period. Adjusted EBITDA Margins* for the nine months ended July 31, 2024, was 14.5% compared to 8.7% in the prior year comparative period.

Net income for the three months ended July 31, 2024, was $0.4 million representing an increase of $1.3 million from the prior year net loss of $0.9 million, and net income for the nine months ended July 31, 2024 was $2.6 million and increase of $6.4 million from the prior year loss of $3.8 million.

*Measures followed by the suffix “*” in this press release are non-IFRS measures. For the relevant definition, see “Non-IFRS Measures” below. As applicable, a reconciliation of this non-IFRS measure to the most directly comparable IFRS financial measure is included in the tables at the end of this press release and in the Company’s management’s discussion and analysis for the three months and nine months ended July 31, 2024.

Conference Call Notification

Haivision will hold a conference call to discuss its second quarter financial results on Thursday, September 12, 2024 at 8:30 am (ET). To register for the call, please use this link https://registrations.events/direct/Q4I3341499 . After registering, a confirmation will be sent through email, including dial in details and unique conference call codes for entry.

Financial Statements, Management’s Discussion and Analysis and Additional Information

Haivision’s unaudited interim consolidated financial statements for the third quarter ended July 31, 2024 (the “Q3 Financial Statements“), the management’s discussion and analysis thereon and additional information relating to Haivision and its business can be found under Haivision’s profile on SEDAR+ at www.sedarplus.ca. The financial information presented in this release was derived from the Q3 Financial Statements.

Forward-Looking Statements

This release includes “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements“) within the meaning of applicable securities laws, including, without limitation, statements regarding the Company’s growth opportunities and its ability to execute on its growth strategy. In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management’s current beliefs, expectations, estimates and projections regarding future events and operating performance.

Forward-looking statements are necessarily based on opinions, assumptions and estimates that, while considered reasonable by Haivision as of the date of this release, are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward-looking statements include, but are not limited to, the risk factors identified under “Risk Factors” in the Company’s latest annual information form, and in other periodic filings that the Company has made and may make in the future with the securities commissions or similar regulatory authorities in Canada, all of which are available under the Company’s SEDAR+ profile at www.sedarplus.ca. These factors are not intended to represent a complete list of the factors that could affect Haivision. However, such risk factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release. Haivision undertakes no obligation to publicly update any forward-looking statement, except as required by applicable securities laws.

Non-IFRS Measures

Haivision’s consolidated financial statements for the third quarter ended July 31, 2024 are prepared in accordance with International Financial Reporting Standards (“IFRS“). As a compliment to results provided in accordance with IFRS, this press release makes reference to certain (i) non-IFRS financial measures, including “EBITDA”, and “Adjusted EBITDA”, (ii) non-IFRS ratios including “Adjusted EBITDA Margin”, and (iii) supplementary financial measures including “Gross Margins” (collectively “non-IFRS measures“). These non-IFRS measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our financial information reported under IFRS. Rather, these non-IFRS measures are used to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors, and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Our management also uses non-IFRS measures to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. For information on the most directly comparable financial measure disclosed in the primary financial statements of Haivision, composition of the non-IFRS measures, a description of how Haivision uses these measures and an explanation of how these measures provide useful information to investors, refer to the “Non-IFRS Measures” section of the Company’s management’s discussion and analysis for the three months and nine months ended July 31, 2024, dated September 11, 2024, available on the Company’s SEDAR+ profile at www.sedarplus.ca, which is incorporated by reference into this press release. As applicable, the reconciliations for each non-IFRS measure are outlined below. Non-IFRS measures should not be considered as alternatives to net income or comparable metrics determined in accordance with IFRS as indicators of the Company’s performance, liquidity, cash flow and profitability.

About Haivision

Haivision is a leading global provider of mission-critical, real-time video streaming and visual collaboration solutions. Our connected cloud and intelligent edge technologies enable organizations globally to engage audiences, enhance collaboration, and support decision making. We provide high quality, low latency, secure, and reliable live video at a global scale. Haivision open sourced its award-winning SRT low latency video streaming protocol and founded the SRT Alliance to support its adoption. Awarded four Emmys® for Technology and Engineering from the National Academy of Television Arts and Sciences, Haivision continues to fuel the future of IP video transformation. Founded in 2004, Haivision is headquartered in Montreal and Chicago with offices, sales, and support located throughout the Americas, Europe, and Asia. Learn more at haivision.com.

|

Thousands of Canadian dollars (except per share amounts) |

|||||||||

|

Three months ended July 31, |

Nine months ended July 31, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

($) |

($) |

($) |

($) |

||||||

|

Revenue |

30,646 |

34,954 |

99,394 |

104,132 |

|||||

|

Cost of sales |

7,665 |

9,826 |

26,709 |

32,133 |

|||||

|

Gross profit |

22,981 |

25,128 |

72,685 |

71,999 |

|||||

|

Expenses |

|||||||||

|

Sales and marketing |

6,744 |

7,823 |

20,378 |

23,339 |

|||||

|

Operations and support |

3,939 |

3,820 |

11,903 |

11,409 |

|||||

|

Research and development |

6,713 |

7,236 |

20,738 |

22,542 |

|||||

|

General and administrative |

3,870 |

4,740 |

12,788 |

14,036 |

|||||

|

Share-based payment |

585 |

449 |

1,627 |

1,545 |

|||||

|

Restructuring costs |

— |

1,546 |

— |

1,546 |

|||||

|

21,851 |

25,615 |

67,434 |

74,417 |

||||||

|

Operating Profit (loss) |

1,131 |

(486) |

5,251 |

(2,417) |

|||||

|

Financial expenses |

206 |

393 |

749 |

1,337 |

|||||

|

Income (loss) before income taxes |

925 |

(880) |

4,502 |

(3,754) |

|||||

|

Income taxes |

|||||||||

|

Current |

887 |

(388) |

2,236 |

(242) |

|||||

|

Deferred |

(397) |

371 |

(378) |

283 |

|||||

|

490 |

(17) |

1,858 |

40 |

||||||

|

Net income (loss) |

435 |

(863) |

2,644 |

(3,795) |

|||||

|

Other comprehensive income (loss) |

|||||||||

|

Foreign currency translation adjustment |

785 |

(2,670) |

203 |

(2) |

|||||

|

Comprehensive income (loss) |

1,221 |

(3,532) |

2,848 |

(3,797) |

|||||

|

Net income (loss) per share: |

|||||||||

|

Basic |

$0.01 |

$(0.03) |

$0.09 |

$(0.13) |

|||||

|

Diluted |

$0.01 |

$(0.03) |

$0.09 |

$(0.13) |

|||||

|

Weighted average number of shares outstanding |

|||||||||

|

Basic |

29,038,392 |

29,004,453 |

29,074,599 |

28,964,172 |

|||||

|

Diluted |

30,162,758 |

29,004,453 |

30,123,314 |

28,964,172 |

|||||

|

Thousands of Canadian dollars |

||||

|

As at |

||||

|

July 31, |

October 31, |

|||

|

$ |

$ |

|||

|

Assets |

||||

|

Current assets |

||||

|

Cash |

13,882 |

8,285 |

||

|

Trade and other receivables |

24,676 |

26,113 |

||

|

Investment tax credits receivable |

2,044 |

2,238 |

||

|

Inventories |

15,581 |

18,930 |

||

|

Prepaid expenses and deposits |

3,828 |

4,043 |

||

|

60,011 |

59,609 |

|||

|

Property and equipment |

3,727 |

3,900 |

||

|

Right-of-use assets |

6,199 |

7,494 |

||

|

Intangible assets |

12,727 |

17,668 |

||

|

Goodwill |

46,309 |

46,219 |

||

|

Non-refundable investment tax credits receivable |

7,313 |

5,602 |

||

|

Deferred income taxes |

3,953 |

3,599 |

||

|

80,228 |

84,482 |

|||

|

140,239 |

144,091 |

|||

|

Liabilities |

||||

|

Current liabilities |

||||

|

Line of credit |

3,402 |

4,685 |

||

|

Trade and other payables |

14,031 |

17,534 |

||

|

Restructuring costs payable |

70 |

240 |

||

|

Purchase price payable |

208 |

204 |

||

|

Income taxes payable |

1,779 |

659 |

||

|

Current portion of lease liabilities |

1,677 |

1,688 |

||

|

Current portion of term loans |

1,138 |

964 |

||

|

Deferred revenue |

12,672 |

12,104 |

||

|

34,977 |

38,078 |

|||

|

Lease liabilities |

5,460 |

6,738 |

||

|

Long term debt |

1,664 |

2,101 |

||

|

Deferred revenue |

3,009 |

3,021 |

||

|

45,110 |

49,938 |

|||

|

Equity |

||||

|

Share capital |

89,900 |

90,902 |

||

|

Retained earnings |

(7,792) |

(9,997) |

||

|

Share-based compensation and other reserves |

4,864 |

5,295 |

||

|

Cumulative translation adjustment |

8,157 |

7,953 |

||

|

95,129 |

94,153 |

|||

|

140,239 |

144,091 |

|||

|

Thousands of Canadian dollars |

||||||||||

|

Three months ended July 31, |

Nine months ended July 31, |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||

|

($) |

($) |

($) |

($) |

|||||||

|

Net Income (loss) |

434 |

(863) |

2,644 |

(3,795) |

||||||

|

Income Taxes |

490 |

(17) |

1,858 |

40 |

||||||

|

Income (loss) before income taxes |

925 |

(880) |

4,502 |

(3,755) |

||||||

|

Depreciation |

828 |

768 |

2,561 |

2,315 |

||||||

|

Amortization |

1,602 |

2,053 |

4,947 |

6,091 |

||||||

|

Financial expenses |

206 |

393 |

749 |

1,337 |

||||||

|

EBITDA(1) |

3,561 |

2,335 |

12,759 |

5.988 |

||||||

|

Share-based payments (LTIP) |

585 |

449 |

1,627 |

1,545 |

||||||

|

Restructuring costs |

— |

1,546 |

— |

1,546 |

||||||

|

Adjusted EBITDA(1) |

4,146 |

4.330 |

14,386 |

9,079 |

||||||

|

Adjusted EBITDA Margin(1) |

13.5 % |

12.4 % |

14.5 % |

8.7 % |

||||||

|

___________________ |

|

Note: |

|

(1) Non-IFRS measure. See “Non-IFRS Measures.” |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/haivision-announces-results-for-the-three-months-and-nine-months-ended-july-31-2024-302245405.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/haivision-announces-results-for-the-three-months-and-nine-months-ended-july-31-2024-302245405.html

SOURCE Haivision Systems Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Schlumberger

Investors with a lot of money to spend have taken a bullish stance on Schlumberger SLB.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SLB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Schlumberger.

This isn’t normal.

The overall sentiment of these big-money traders is split between 70% bullish and 30%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $226,358, and 6 are calls, for a total amount of $273,651.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $27.5 to $75.0 for Schlumberger during the past quarter.

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Schlumberger’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Schlumberger’s significant trades, within a strike price range of $27.5 to $75.0, over the past month.

Schlumberger Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SLB | PUT | SWEEP | BEARISH | 06/20/25 | $11.75 | $11.65 | $11.75 | $50.00 | $111.6K | 3.0K | 96 |

| SLB | CALL | SWEEP | BULLISH | 01/16/26 | $13.75 | $13.55 | $13.75 | $27.50 | $79.7K | 65 | 94 |

| SLB | PUT | TRADE | BEARISH | 02/21/25 | $2.45 | $2.44 | $2.45 | $37.50 | $61.0K | 132 | 256 |

| SLB | CALL | SWEEP | BULLISH | 01/16/26 | $13.65 | $13.45 | $13.65 | $27.50 | $49.1K | 65 | 36 |

| SLB | CALL | TRADE | BULLISH | 01/16/26 | $0.34 | $0.21 | $0.32 | $75.00 | $48.0K | 11.2K | 1.5K |

About Schlumberger

SLB is the largest oilfield service firm in the world, with expertise in myriad disciplines, including reservoir performance, well construction, production enhancement, and more recently, digital solutions. It maintains a reputation as one of the industry’s leading innovators, which has earned it dominant share in numerous end markets.

Following our analysis of the options activities associated with Schlumberger, we pivot to a closer look at the company’s own performance.

Schlumberger’s Current Market Status

- Currently trading with a volume of 15,559,330, the SLB’s price is up by 0.15%, now at $39.65.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 37 days.

Professional Analyst Ratings for Schlumberger

In the last month, 1 experts released ratings on this stock with an average target price of $63.0.

- An analyst from UBS has decided to maintain their Buy rating on Schlumberger, which currently sits at a price target of $63.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Schlumberger, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Glancy Prongay & Murray LLP Reminds Investors of Looming Deadline in the Class Action Lawsuit Against CAE Inc. (CAE)

LOS ANGELES, Sept. 11, 2024 (GLOBE NEWSWIRE) — Glancy Prongay & Murray LLP (“GPM”) reminds investors of the upcoming September 16, 2024 deadline to file a lead plaintiff motion in the class action filed on behalf of investors who purchased or otherwise acquired CAE Inc. (“CAE” or the “Company”) CAE securities between February 11, 2022 and May 21, 2024, inclusive (the “Class Period”).

If you suffered a loss on your CAE investments or would like to inquire about potentially pursuing claims to recover your loss under the federal securities laws, you can submit your contact information at www.glancylaw.com/cases/CAE-Inc/. You can also contact Charles H. Linehan, of GPM at 310-201-9150, Toll-Free at 888-773-9224, or via email at shareholders@glancylaw.com to learn more about your rights.

On August 10, 2022, CAE released its first quarter fiscal 2023 financial results, disclosing that it had incurred “$28.9 million in unfavourable contract profit adjustments in Defense, involving two programs in the U.S.” due to “delays and meeting customer requirements on scope and timing,” along with “staffing shortages [and] supply chain pressures[.]”

On this news, CAE’s stock price fell $4.32, or 16.7%, to close at $21.48 per share on August 10, 2022, thereby injuring investors.

Then, on November 14, 2023, CAE released its second quarter fiscal year 2024 financial results and disclosed that it planned to “retir[e] legacy contracts, which have been most affected by inflationary pressures,” stating that the Company “[is] firmly focused on retiring legacy contracts as soon as possible and to mitigating the cost pressures associated with them.”

On this news, CAE’s stock price fell $0.85, or 3.9%, to close at $21.07 per share on November 14, 2023.

Then, on February 14, 2024, CAE released its third quarter fiscal year 2024 financial results and identified “eight distinct legacy contracts” that are firm, fixed-price in structure and that suffered from severe cost overruns due to supply chain disruptions, inflationary pressures, and availability of labor. The Company stated that “[a]lthough [the contracts] represent only a small fraction of the current business, these contracts have disproportionately impacted overall Defense profitability.”

On this news, CAE’s stock price fell $2.01, or 9.6%, to close at $18.91 per share on February 14, 2024.

Then, on May 21, 2024, CAE disclosed that it had initiated a “re-baselining” of its defense business due to underperforming fixed-price contracts. Further, the Company reported a $568.0 million non-cash impairment of defense goodwill, $90.3 million in unfavorable defense contract profit adjustments, and a $35.7 million impairment of related technology and other non-financial assets related to legacy contracts.

On this news, CAE’s stock price fell $1.03, or 5.2%, to close at $18.80 per share on May 22, 2024, thereby injuring investors further.

The complaint filed in this class action alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors that: (1) several of CAE’s pre-COVID fixed-price Defense contracts had incurred severe cost overruns due to supply chain and labor issues—as the segment was significantly impacted by the pandemic—which dented the segment’s profit and operating margin; (2) the Company had failed to successfully reduce hard costs and achieve a sufficient level of operational efficiency, particularly with respect to such contracts, necessitating a re-baselining of the Defense business and significant associated charges; and (3) as a result, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis at all relevant times.

Follow us for updates on LinkedIn, Twitter, or Facebook.

If you purchased or otherwise acquired CAE securities during the Class Period, you may move the Court no later than September 16, 2024 to request appointment as lead plaintiff in this putative class action lawsuit. To be a member of the class action you need not take any action at this time; you may retain counsel of your choice or take no action and remain an absent member of the class action. If you wish to learn more about this class action, or if you have any questions concerning this announcement or your rights or interests with respect to the pending class action lawsuit, please contact Charles Linehan, Esquire, of GPM, 1925 Century Park East, Suite 2100, Los Angeles, California 90067 at 310-201-9150, Toll-Free at 888-773-9224, by email to shareholders@glancylaw.com, or visit our website at www.glancylaw.com. If you inquire by email please include your mailing address, telephone number and number of shares purchased.

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Contacts

Glancy Prongay & Murray LLP, Los Angeles

Charles Linehan, 310-201-9150 or 888-773-9224

shareholders@glancylaw.com

www.glancylaw.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Roundhouse Continues Strategic Growth with Over $450 Million in Acquisitions and Development Groundbreakings in 2024

Multifamily Developer/Operator Adds 1,530 Class A Units to its Expanding Western U.S. Footprint

BOISE, Idaho, Sept. 11, 2024 /PRNewswire/ — Roundhouse, a vertically-integrated developer and operator of multifamily housing headquartered in Boise, ID, today announced significant expansion and growth milestones across the Western U.S., including over $300 million in acquisitions and $150 million in development groundbreakings year-to-date.

“Roundhouse is committed to providing high-quality housing options across the Western U.S.,” said Casey Lynch, CEO of Roundhouse. “Our recent acquisitions and developments are the result of our strategic focus on high-growth markets and our dedication to building and operating a diverse multifamily portfolio over the long term.”

Roundhouse has recently acquired Cycle Apartments in Fort Collins, Colorado and Clovis Point in Longmont, Colorado. The two acquisitions, totaling 613 units, mark Roundhouse’s first investments in these Northern Colorado markets, which have exhibited strong in-migration since 2010. Walker & Dunlop served as the brokerage firm for both deals.

Additionally, Roundhouse has purchased Eagle’s Landing Apartments in Idaho Falls, brokered by Institutional Property Advisors (IPA), and Sentral First Hill in Seattle, brokered by Eastdil Secured. The company also recently celebrated the groundbreaking of two new apartment communities: Snowfarm in Missoula, MT and Cloudveil in Idaho Falls, ID. These developments are set to begin delivering units next year and, together with recent acquisitions, will add a total of 1,530 units to Roundhouse’s portfolio, further solidifying its presence across the Western U.S.

“We’re excited about the opportunities these new acquisitions and developments represent for our platform, partners, and team members,” said Michael Caldwell, Managing Director, Investments at Roundhouse. “Our ability to identify and capitalize on opportunities in all market environments is a key driver of our success, and we look forward to continuing to add high-quality properties to our portfolio across the Western U.S.”

ABOUT ROUNDHOUSE

Roundhouse manages a portfolio with more than 8,700 units across 56 properties and $2 billion of assets in the Western U.S., with a vertically integrated platform that spans the construction, property management, and investment disciplines. Roundhouse’s mission is to put humanity into housing with a people-centric approach to the resident experience that emphasizes connection with the community, thoughtful design, and respect for the environment. To learn more about Roundhouse and its portfolio, visit rndhouse.com.

Contact: Sarah Cullen

sarah@sidecarpr.com

720-726-6823

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/roundhouse-continues-strategic-growth-with-over-450-million-in-acquisitions-and-development-groundbreakings-in-2024-302244679.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/roundhouse-continues-strategic-growth-with-over-450-million-in-acquisitions-and-development-groundbreakings-in-2024-302244679.html

SOURCE Roundhouse

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Smart Money Move: John Kenny Grabs $100K Worth Of OraSure Technologies Stock

Disclosed in the latest SEC filing, a significant insider purchase on September 10, involves John Kenny, Board Member at OraSure Technologies OSUR.

What Happened: In a recent Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, Kenny increased their investment in OraSure Technologies by purchasing 23,256 shares through open-market transactions, signaling confidence in the company’s potential. The total transaction value is $100,000.

Monitoring the market, OraSure Technologies‘s shares up by 0.48% at $4.23 during Wednesday’s morning.

About OraSure Technologies

OraSure Technologies Inc is a medical devices company that develops, manufactures, and distributes oral fluid diagnostic and collection devices. Its reportable segments are diagnostics and molecular solutions. The diagnostics segment produces rapid oral diagnostic tests and specimen collection devices for infectious diseases such as HIV and HCV. The molecular solutions segment specializes in kits used to collect, stabilize, and transport genetic material samples for molecular testing of both hereditary diseases and infectious diseases, such as COVID-19. The company gets majority of its sales from the molecular solutions business, derived mainly from customers in the United States.

OraSure Technologies: Delving into Financials

Negative Revenue Trend: Examining OraSure Technologies’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -36.41% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 45.44%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): OraSure Technologies’s EPS reflects a decline, falling below the industry average with a current EPS of -0.01.

Debt Management: OraSure Technologies’s debt-to-equity ratio is below the industry average at 0.03, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 11.69 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.15 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 1.91 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Navigating the World of Insider Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of OraSure Technologies’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Paragon 28 Stock Gains From the Latest Launch of Its Right-Angle Drill

Paragon 28, Inc. FNA recently introduced a novel Right-Angle Drill, designed to improve tibia preparation prior to the implantation of the APEX 3D tibia. The Right-Angle Drill will be an addition to the APEX 3D Total Ankle Replacement System.

This recent advancement to the APEX 3D Total Ankle Replacement System should contribute to the long-term success of ankle replacements and ultimately improve surgeon experience and patient outcomes.

Following the launch, shares of Paragon 28 rose 3.1% to $7.72 yesterday. With the company gaining a high level of synergies from its continuously expanding product portfolio within the total ankle replacement industry, we expect market sentiment to remain positive around this development.

About Paragon 28’s Right-Angle Drill

The introduction of the Right-Angle Drill is a critical step toward addressing tibia implant loosening, which is the primary cause of total ankle replacement failure. The drill uses a linear guide to precisely drill vertical holes into the tibia for ideal peg placement and a highly stable tibia implant interface. This drill provides surgeons with more precise preparation and promotes better implant integration, thereby improving long-term outcomes for foot and ankle patients.

More on the News

The total ankle replacement device’s performance is expected to improve with the launch of the Right-Angle Drill. The company has also made a few other instrumental enhancements, including the recently released Polishing Blocks, Square Tip Drill and next-generation Off-Set Impaction Handle.

Paragon 28 will showcase the APEX Right-Angle Drill at the American Orthopaedic Foot & Ankle Society Annual Meeting this week in Vancouver, British Columbia. The company will also showcase the recently launched R3FLEX Stabilization System, along with the SMART28 Case Management Portal. Throughout the meeting, FNA will showcase its other products, including the SMART Bun-Yo-Matic, the FJ2000 Power Console and Burr System, and the PRECISION MIS Bunion System.

Industry Prospects Favor Paragon 28

Per a Global Market Insights (GMI) report, the total ankle replacement market was valued at around $1 billion in 2023 and is expected to reach around $1.6 billion by 2032 at a CAGR of 5.3% during the period.

Key factors expected to spur the market growth include a growing patient preference for joint preservation and restoration, improved surgical outcomes, and ongoing investments in research and development.

Image Source: Zacks Investment Research

Other Recent Developments by Paragon 28

Earlier this month, FNA launched the R3FLEX Stabilization System, designed to restore stability to the ankle syndesmosis after suffering an injury from an ankle fracture or high ankle sprain. The latest innovation is aimed at strengthening the company’s syndesmotic injury repair portfolio.

Last month, Paragon 28 launched the SMART28 Case Management Portal. This cutting-edge platform leverages AI to provide a seamless user experience to coordinate patient-specific surgical plans. It is the first major launch within Paragon 28’s SMART28 ecosystem, a portfolio of solutions and products.

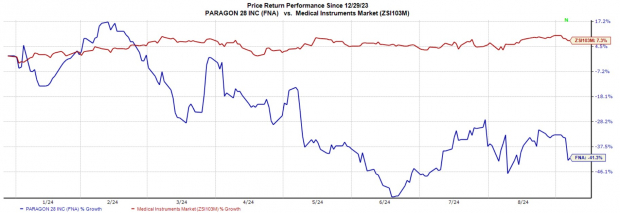

Price Performance of Paragon 28

Year to date, shares of FNA have lost 37.9% against the industry’s 8.4% growth.

FNA’s Zacks Rank and Key Picks

Paragon 28 currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Intuitive Surgical, TransMedics Group and Quest Diagnostics. While Intuitive Surgical and TransMedics currently sport a Zacks Rank #1 (Strong Buy) each, Quest Diagnostics carries a Zacks Rank #2 (Buy).

Intuitive Surgical’s shares have surged 60.5% in the past year. Estimates for the company’s earnings have moved north 5.1% to $1.65 per share for 2024 in the past 30 days.

ISRG’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 8.97%. In the last reported quarter, it posted an earnings surprise of 16.34%.

Estimates for TransMedics’ 2024 EPS have moved up 125% to 27 cents in the past 30 days. Shares of the company have soared 135.2% in the past year compared with the industry’s 14.9% growth.

TMDX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 287.50%. In the last reported quarter, it delivered an earnings surprise of 66.67%.

Estimates for Boston Scientific’s 2024 EPS have increased 1.7% to $2.40 in the past 30 days. In the past year, shares of BSX have risen 55.5% compared with the industry’s 17.9% growth.

In the last reported quarter, BSX delivered an earnings surprise of 6.90%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.18%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.