Behind the Scenes of IBM's Latest Options Trends

Financial giants have made a conspicuous bearish move on IBM. Our analysis of options history for IBM IBM revealed 28 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 18 were puts, with a value of $1,307,358, and 10 were calls, valued at $1,105,795.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $170.0 and $270.0 for IBM, spanning the last three months.

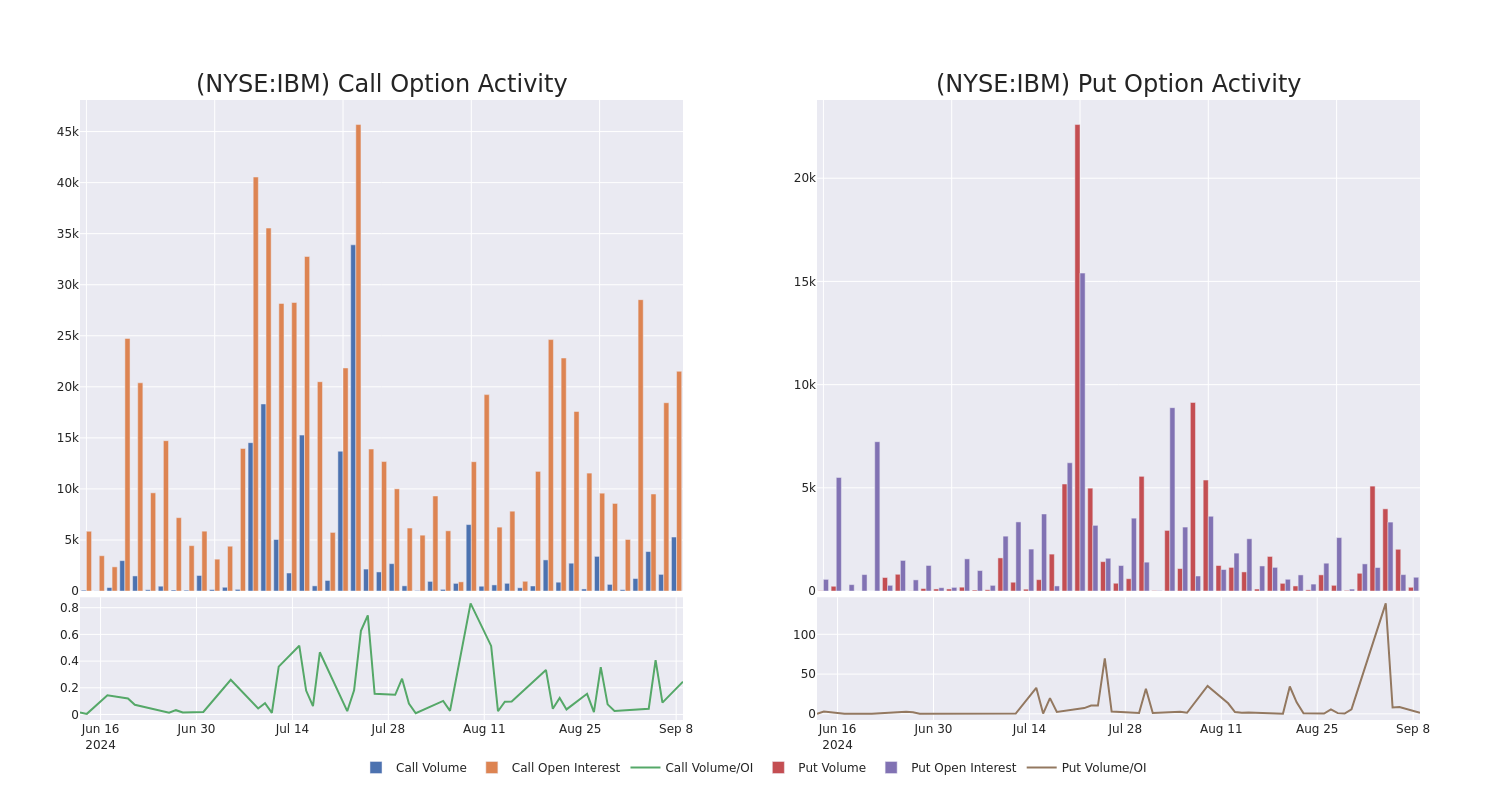

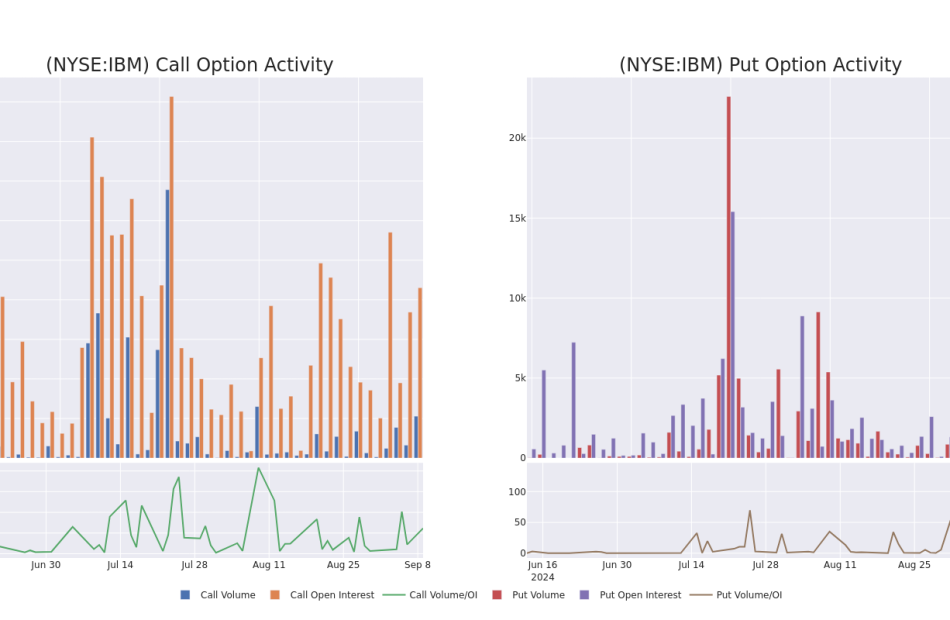

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for IBM’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of IBM’s whale trades within a strike price range from $170.0 to $270.0 in the last 30 days.

IBM Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | CALL | SWEEP | BULLISH | 11/15/24 | $9.5 | $9.45 | $9.5 | $205.00 | $445.5K | 4.4K | 601 |

| IBM | CALL | TRADE | BEARISH | 06/20/25 | $2.14 | $1.93 | $2.01 | $270.00 | $301.4K | 1.8K | 1.5K |

| IBM | PUT | TRADE | BULLISH | 03/21/25 | $38.8 | $37.5 | $37.8 | $240.00 | $162.5K | 0 | 43 |

| IBM | PUT | SWEEP | BEARISH | 09/20/24 | $3.65 | $3.6 | $3.6 | $205.00 | $145.9K | 74 | 443 |

| IBM | CALL | TRADE | BULLISH | 11/15/24 | $8.8 | $8.7 | $8.8 | $205.00 | $117.0K | 4.4K | 786 |

About IBM

IBM looks to be a part of every aspect of an enterprise’s IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients, which includes 95% of all Fortune 500. While IBM is a B2B company, IBM’s outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

Present Market Standing of IBM

- With a trading volume of 3,067,385, the price of IBM is up by 0.88%, reaching $205.32.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 43 days from now.

Expert Opinions on IBM

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $145.0.

- An analyst from UBS has decided to maintain their Sell rating on IBM, which currently sits at a price target of $145.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for IBM, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply