Chubb's Options: A Look at What the Big Money is Thinking

High-rolling investors have positioned themselves bearish on Chubb CB, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CB often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for Chubb. This is not a typical pattern.

The sentiment among these major traders is split, with 25% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $35,850, and 7 calls, totaling $395,285.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $255.0 to $360.0 for Chubb during the past quarter.

Insights into Volume & Open Interest

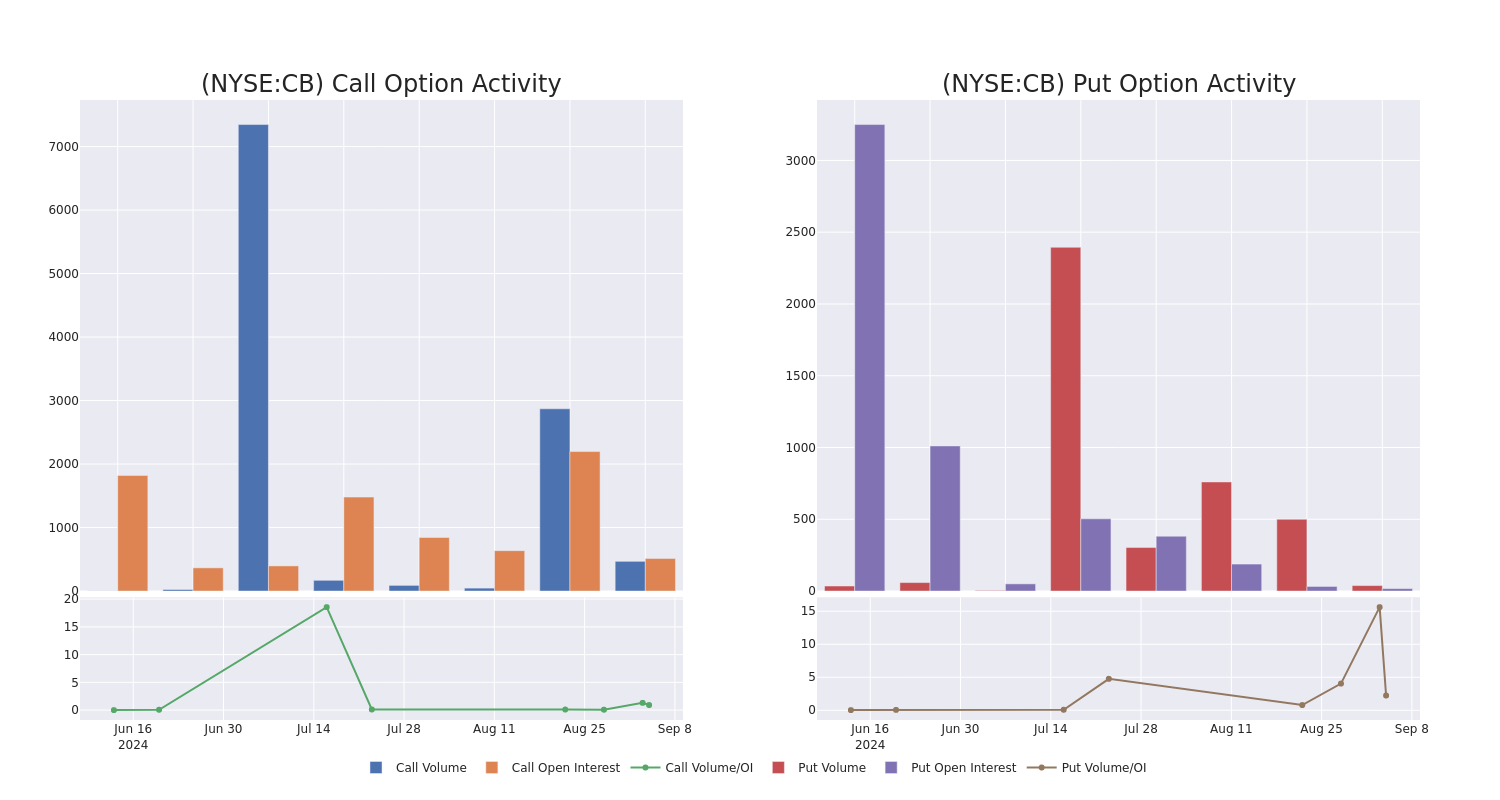

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Chubb’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Chubb’s substantial trades, within a strike price spectrum from $255.0 to $360.0 over the preceding 30 days.

Chubb Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CB | CALL | SWEEP | NEUTRAL | 11/15/24 | $13.1 | $12.1 | $12.55 | $290.00 | $111.6K | 125 | 216 |

| CB | CALL | SWEEP | NEUTRAL | 11/15/24 | $8.1 | $6.9 | $7.55 | $300.00 | $67.1K | 149 | 194 |

| CB | CALL | SWEEP | BEARISH | 01/17/25 | $12.9 | $11.6 | $11.75 | $300.00 | $52.9K | 832 | 45 |

| CB | CALL | TRADE | BULLISH | 01/17/25 | $7.6 | $7.4 | $7.59 | $310.00 | $52.3K | 234 | 70 |

| CB | CALL | TRADE | BEARISH | 11/15/24 | $4.4 | $4.0 | $4.12 | $310.00 | $41.2K | 207 | 106 |

About Chubb

ACE acquired Chubb in the first quarter of 2016 and assumed the Chubb name. The combination made the new Chubb one of the largest domestic property and casualty insurers, with operations in 54 countries spanning commercial and personal P&C insurance, reinsurance, and life insurance.

Present Market Standing of Chubb

- With a trading volume of 1,138,845, the price of CB is down by -0.4%, reaching $291.03.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 42 days from now.

What The Experts Say On Chubb

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $349.0.

- An analyst from Barclays has revised its rating downward to Overweight, adjusting the price target to $349.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chubb options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply