Market Whales and Their Recent Bets on GE Aero Options

Deep-pocketed investors have adopted a bullish approach towards GE Aero GE, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 31 extraordinary options activities for GE Aero. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 51% leaning bullish and 35% bearish. Among these notable options, 29 are puts, totaling $2,018,900, and 2 are calls, amounting to $224,000.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $160.0 and $185.0 for GE Aero, spanning the last three months.

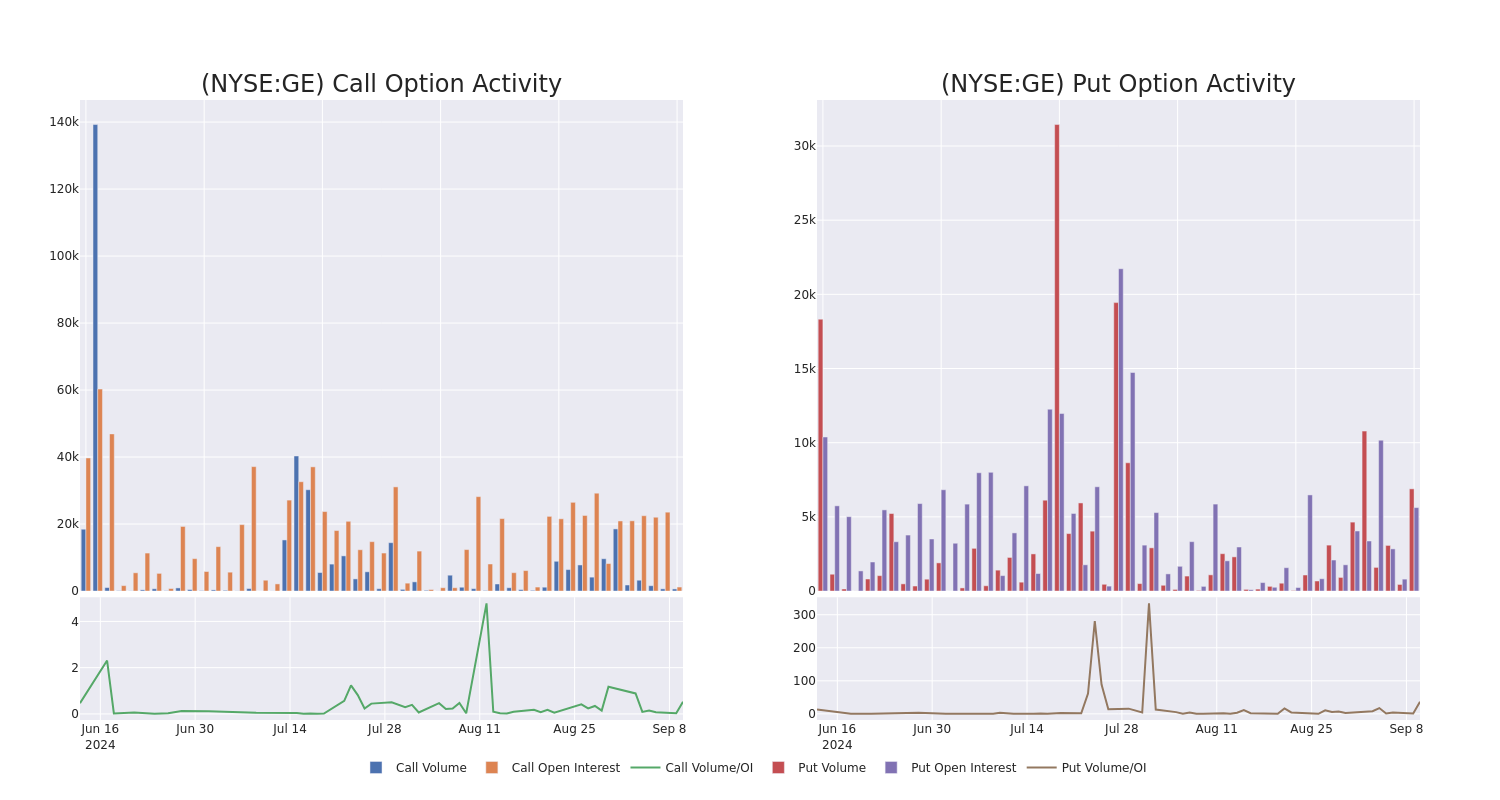

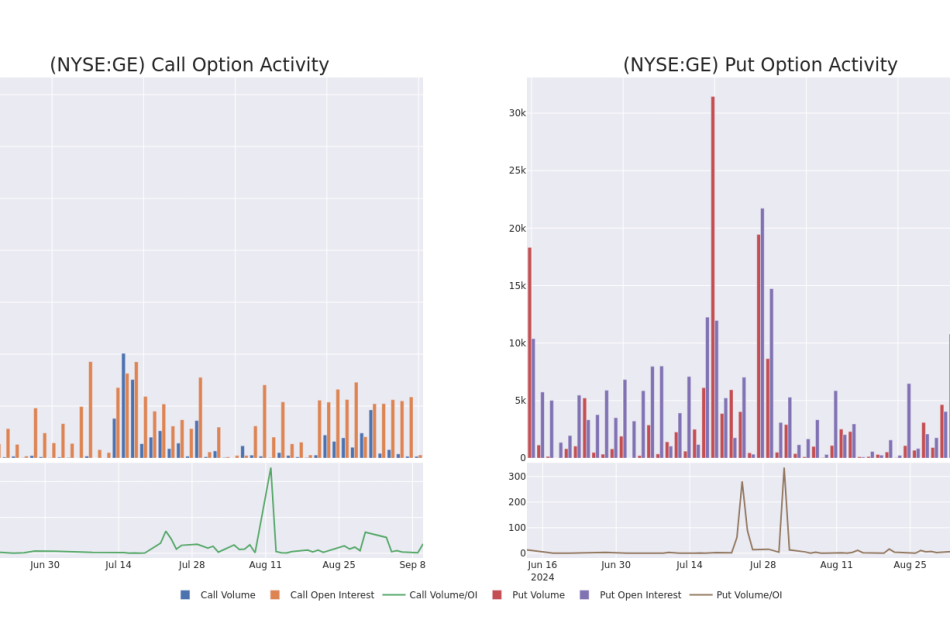

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GE Aero’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GE Aero’s substantial trades, within a strike price spectrum from $160.0 to $185.0 over the preceding 30 days.

GE Aero Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | PUT | SWEEP | BEARISH | 12/20/24 | $12.5 | $12.45 | $12.5 | $170.00 | $366.2K | 899 | 764 |

| GE | CALL | TRADE | BULLISH | 11/15/24 | $3.2 | $2.92 | $3.2 | $185.00 | $192.0K | 778 | 607 |

| GE | PUT | SWEEP | BEARISH | 11/15/24 | $9.15 | $9.1 | $9.15 | $165.00 | $173.8K | 3.8K | 211 |

| GE | PUT | TRADE | BULLISH | 12/20/24 | $12.45 | $12.4 | $12.4 | $170.00 | $101.6K | 899 | 571 |

| GE | PUT | SWEEP | BEARISH | 11/15/24 | $13.9 | $13.5 | $13.9 | $175.00 | $76.4K | 323 | 125 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

Following our analysis of the options activities associated with GE Aero, we pivot to a closer look at the company’s own performance.

Current Position of GE Aero

- Currently trading with a volume of 3,471,300, the GE’s price is up by 0.99%, now at $166.98.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

Expert Opinions on GE Aero

In the last month, 1 experts released ratings on this stock with an average target price of $201.0.

- In a cautious move, an analyst from Bernstein downgraded its rating to Outperform, setting a price target of $201.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for GE Aero, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply