Fed Is 'All Clear For Launch' On Cutting Rates As Inflation Falls To Lowest Point In Over 3 Years, Economist Says

Wednesday’s inflation figure of 2.5% for August — the lowest rate since February 2021 — gives the Federal Reserve the go-ahead signal on cutting rates when it meets on Sept. 18, according to economists.

“All clear for launch,” Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance, said on Wednesday.

“The Fed has the green light to cut 25 bps next week, given that the inflation report was in line with expectations.”

Observers may find the inflation rate for August disappointing since it doesn’t justify cutting rates by 50 basis points next week. However, most Fed members already expressed a desire to start lowering rates slowly instead of beginning with a jumbo cut, Zaccarelli said.

Inflation Takeaways

- CPI inflation declined from 2.9% in July to 2.5% in August 2024, coming in below the consensus forecast of 2.6% tracked by TradingEconomics.

- Month over month, inflation rose 0.2% in August, matching both the July figure and forecasts.

- The energy index fell 0.8% in the month, while the shelter index gained 0.5% in August.

- Core inflation, which takes out energy and food items, remained flat at 3.2% year-over-year in August to meet forecasts.

- Core inflation ticked up 0.3% month over month in August, up from 0.2% in July and beating forecasts of 0.2%.

Zaccarelli said the risks going forward are a slowing economy and a worsening labor market. The Fed priced in a 1% cut by the end of the year with only three meetings left in 2024. This implies that rates may get lowered by 0.5% at one of those meetings.

“But if the economy continues to slow — and not drop into an abrupt recession — the Fed will be able to cut at a measured, 25 bps-per-meeting pace,” he said.

The CPI report suggests that the Fed cut rates by 0.25% instead of a “hoped-for” 0.50% as inflation slowly heads toward the Fed’s 2% target, said Quincy Krosby, chief global strategist for LPL Financial.

“The reaction in the ten-year Treasury yield, as it inched higher, underscores that the bond market, where yields have been edging lower, agrees,” she said.

The yield on 10-year Treasuries advanced three basis points to 3.67% on Wednesday.

“Still, the climb lower in two- and 10-year Treasury yields reflected a deflationary tone,” Krosby said. “Today’s print should assuage markets that deflation caused by an economic scare has been avoided, at least for now.”

The falling inflation will allow the Fed to focus more on the employment mandate than its pricing stability mandate for the rest of the year, said Jeffrey Roach, chief economist for LPL Financial.

“Given the stickiness of services inflation, the Fed will likely cut by 25 basis points in the upcoming meeting and reserve the potential for more aggressive action later this year if we have further deterioration in the job market,” he said.

Read Now:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dental Biomaterials Market Size and Share Projected to Surpass USD 13.0 Billion by 2031 at 6.8% CAGR – Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 11, 2024 (GLOBE NEWSWIRE) — Dental biomaterials (歯科用生体材料市場) were estimated to have a market value of US$ 6.6 billion in 2021. Global market size is projected to reach more than US$ 13.0 billion by 2031, exhibiting a CAGR of 6.8% from 2022 to 2031. With the advent of biocompatible materials and/or compositions, and advanced techniques, biomaterials will gain increased application in dentistry in the coming years.

The advancement of materials research, encompassing luting cements, dentin bonding’s, glass carbomers, impression materials, glass ionomers, composites, and ceramics, evidently necessitates a deeper comprehension across various disciplines and the creation of novel design methodologies to achieve superior biologic performance and biocompatibility.

The creation of innovative technologies for a broad range of applications is anticipated to be influenced by advanced biomaterials that draw inspiration from biological systems and processes. A multidisciplinary approach is essential to creating novel biomaterials and technologies for advancing contemporary dentistry.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/dental-biomaterials-market.html

Key Findings of the Market Report

- Bone graft materials will dominate the global market during the forecast period as dental restorations, bone growth, and implant fixtures require bone grafts.

- The implantology segment dominated a large share of the global market in 2021.

- The dental clinics segment held the largest global dental biomaterials market share in 2021.

- Globally, Europe is expected to account for most sales during the forecast period.

- In the coming years, Asia Pacific is likely to experience rapid growth.

Global Dental Biomaterials Market: Growth Drivers

- Recent developments in materials science and technology have led to the creation of novel dental biomaterials that have improved longevity, biocompatibility, and aesthetics. These developments have expanded the range of dental operations and treatments, so dental biomaterials have become more important.

- Many cosmetic dentistry procedures are being carried out, such as dental bonding, veneers, teeth whitening, and dental implants. Due to their long-lasting and natural-looking outcomes, dental biomaterials play an important role in these procedures.

- Throughout the world, tooth loss, gum disease, and dental cavities are prevalent. Biomaterials play a critical role in restorative and reconstructive dental procedures. As long as dental problems continue, biomaterials for dental applications will be in greater demand.

- As governments upgrade dental infrastructure and healthcare spending rises in emerging nations, the market is expected to expand. This subsequent increase in dental biomaterial demand, which frequently involves investments in dental clinics, teaching, and research, increases demand for these materials.

- Consumer acceptability of dental operations has improved due to growing knowledge of the value of oral health and the accessibility of cutting-edge dental treatments. Dental biomaterials are in high demand because patients gravitate toward treatments that provide more comfort, durability, and aesthetics.

Global Dental Biomaterials Market (سوق المواد الحيوية لطب الأسنان) : Regional Landscape

- Dental biomaterials are subject to strict regulations in Europe concerning their approval and use. The safety and quality of dental biomaterials can be greatly enhanced when the materials comply with required laws, such as CE marking (Conformité Européenne) and criteria established by the European Medicines Agency (EMA). Cutting-edge biomaterials are more likely to be used in clinical applications when these rules are followed.

- Europe is home to many dental technology startups, universities, and research organizations that advance the field. Both public and private funding is heavily utilized in European healthcare systems. As healthcare infrastructure is improved, investment in dental care facilities, tools, and supplies is expanding the market for dental biomaterials. Modern biomaterials are also affected by insurance coverage and payment guidelines in dentistry.

- As disposable income rises, social media influence grows, and culture emphasizes looks, cosmetic dental operations are becoming more popular in Europe. The promotion of oral health and education of the public are frequent priorities in European nations. Routine dental exams and oral hygiene are essential for early detection and prevention of dental problems. Both preventive and restorative dental treatment require the use of dental biomaterials.

Global Dental Biomaterials Market: Competitive Landscape

Several key players are expanding their product portfolio and strengthening their geographic reach through strategic acquisitions, mergers, and new product launches.

Key Players Profiled

- Geistlich Pharma AG

- Henry Schein Inc.

- 3M

- Zimmer Biomet

- Dentsply Sirona

- Institut Straumann AG

- BioHorizons IPH, Inc.

- Danaher Corporation (Nobel Biocare Services AG)

- ACE Surgical Supply Company Inc.

- Biomatlante

Key Developments

- In October 2022, Geistlich Pharma North America acquired Lynch Biologics, LLC, which developed and manufactured GEM 21S ®, a revolutionary oral regeneration product using recombinant growth factors. This acquisition will strengthen Geistlich’s regenerative product portfolio, and its growth potential will be significantly increased.

- In December 2022, Henry Schein bought Biotech Dental for a majority stake to expand its product and service offering. A regulatory approval awaits the deal, which will give the US dental giant access to dental implants, clinical software, and a range of oral surgery and orthodontics products.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/dental-biomaterials-market.html

Global Dental Biomaterials Market: Segmentation

Product

- Allografts

- Xenografts

- Synthetic

- Membranes

- Soft Tissue Regeneration

Application

- Implantology

- Periodontology

- Others

End User

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Explore TMR’s Extensive Ongoing Coverage in the Healthcare Domain

Endoscopic Clips Market (내시경 클립 시장) – The endoscopic clips industry was worth US$ 383.7 million in 2022. By the end of 2031, it is expected to reach US$ 632.5 million, growing at a CAGR of 5.8% during the forecast period. The use of robotic-assisted surgery in combination with endoscopic procedures is on the rise.

Advanced Wound Care Management Market (Markt für fortgeschrittenes Wundversorgungsmanagement) – The advanced wound care management market is projected to thrive with a CAGR of 5.5% between 2023 and 2031. Transparency Market Research predicts that the total sales for advanced wound care management will reach approximately US$ 18.2 billion by the end of the aforementioned period of assessment.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DOLLARAMA REPORTS FISCAL 2025 SECOND QUARTER RESULTS

- 4.7% comparable store sales(1) growth

- 14.7% growth in EBITDA(1) to $524.3 million, or 33.5% of sales

- 18.6% increase in diluted net earnings per share to $1.02

MONTREAL, Sept. 11, 2024 /PRNewswire/ – Dollarama Inc. DOL (“Dollarama” or the “Corporation”) today reported its financial results for the second quarter ended July 28, 2024.

Fiscal 2025 Second Quarter Highlights Compared to Fiscal 2024 Second Quarter Results

- Sales increased by 7.4% to $1,563.4 million, compared to $1,455.9 million

- Comparable store sales increased by 4.7%, over and above 15.5% growth in the corresponding period of the previous year

- EBITDA increased by 14.7% to $524.3 million, representing an EBITDA margin(1) of 33.5%, compared to 31.4%

- Operating income increased by 15.3% to $422.9 million, representing an operating margin(1) of 27.0%, compared to 25.2%

- Diluted net earnings per common share increased by 18.6% to $1.02, compared to $0.86

- 14 net new stores opened, compared to 18 net new stores

- 2,104,691 common shares repurchased for cancellation for $263.1 million

“For the second quarter of fiscal 2025, we generated strong results across the board as comparable store sales continue to normalize. Canadian consumers continue to recognize and rely on our compelling value as they deploy their discretionary spending prudently in a challenging economic environment. Our strong traffic trends quarter after quarter also confirm that the breadth of our product offering is allowing us to meet the needs of our consumers,” said Neil Rossy, President and CEO.

Fiscal 2025 Second Quarter Financial Results

Sales for the second quarter of fiscal 2025 increased by 7.4% to $1,563.4 million, compared to $1,455.9 million in the corresponding period of the prior fiscal year. This increase was driven by growth in the total number of stores over the past 12 months (from 1,525 stores on July 30, 2023, to 1,583 stores on July 28, 2024) and increased comparable store sales.

Comparable store sales for the second quarter of fiscal 2025 increased by 4.7%, consisting of a 7.0% increase in the number of transactions and a 2.2% decrease in average transaction size, over and above comparable store sales growth of 15.5% in the corresponding period of the prior fiscal year. The increase in comparable store sales reflects sustained customer demand for consumables offset by softer demand for spring-summer assortment, compared to the same period last year.

Gross margin(1) reached 45.2% of sales in the second quarter of fiscal 2025, compared to 43.9% of sales in the second quarter of fiscal 2024. The increase is mainly due to the positive impact of lower contractual rates with carriers and lower logistics costs.

|

______________________________ |

|

(1) Refer to the section entitled “Non-GAAP and Other Financial Measures” of this press release for the definition of these items and, where applicable, their reconciliation with the most directly comparable GAAP measure. |

General, administrative and store operating expenses (“SG&A”) for the second quarter of fiscal 2025 increased by 7.3% to $212.9 million, compared to $198.4 million for the second quarter of fiscal 2024. Despite an increase in store labour and operating costs, SG&A as a percentage of sales remained flat at 13.6% for the second quarter of fiscal 2025, compared to the second quarter of fiscal 2024.

EBITDA totalled $524.3 million, representing an EBITDA margin of 33.5%, for the second quarter of fiscal 2025, compared to $457.2 million, or an EBITDA margin of 31.4% of sales, in the second quarter of fiscal 2024.

The Corporation’s 50.1% share of Dollarcity’s net earnings for the period from April 1, 2024 to June 10, 2024 and its 60.1% share for the period from June 11, 2024 to June 30, 2024 amounted to $22.7 million. This compares to $11.4 million for the Corporation’s 50.1% share during the same periods last year. The Corporation’s investment in Dollarcity is accounted for as a joint arrangement using the equity method.

Net financing costs increased by $4.8 million, from $36.1 million for the second quarter of fiscal 2024 to $40.9 million for the second quarter of fiscal 2025. The increase is mainly due to a higher average borrowing rate on Fixed Rate Notes (as defined herein) and higher interest expense on lease obligations, partially offset by an increase in interest income resulting from higher invested capital.

Net earnings increased by 16.3% to $285.9 million, compared to $245.8 million in the second quarter of fiscal 2024. Diluted net earnings per common share increased by 18.6% from $0.86 per diluted common share to $1.02 per diluted common share, in the second quarter of fiscal 2025.

Dollarcity Store Count

During its second quarter ended June 30, 2024, Dollarcity opened 23 net new stores, compared to 10 net new stores in the same period last year. As at June 30, 2024, Dollarcity had 570 stores with 338 locations in Colombia, 101 in Guatemala, 74 in El Salvador and 57 in Peru. This compares to 532 stores as at December 31, 2023.

Normal Course Issuer Bid

On July 4, 2024, the Corporation announced the renewal of its normal course issuer bid and the approval from the Toronto Stock Exchange to repurchase up to 16,549,476 of its common shares, representing approximately 6.0% of the public float of 275,824,605 common shares as at June 28, 2024, during the 12‑month period starting on July 7, 2024 and ending no later than July 6, 2025 (the “2024-2025 NCIB”).

During the second quarter of fiscal 2025, 2,104,691 common shares were repurchased for cancellation under the 2024-2025 NCIB and the normal course issuer bid previously in effect, for a total cash consideration of $263.1 million, representing a weighted average price of $125.04 per share, excluding the tax on share repurchases enacted during the second quarter of fiscal 2025.

Dividend

On September 11, 2024, the Corporation announced that its Board of Directors approved a quarterly cash dividend for holders of common shares of $0.0920 per common share. This dividend is payable on November 1, 2024 to shareholders of record at the close of business on October 4, 2024. The dividend is designated as an “eligible dividend” for Canadian tax purposes.

Outlook(2)

The Corporation’s financial annual guidance ranges for fiscal 2025 issued on April 4, 2024, as well as the assumptions on which these ranges are based, remain unchanged:

|

(as a percentage of sales except net new store openings in |

Fiscal 2025 |

|

|

Guidance |

||

|

Net new store openings |

60 to 70 |

|

|

Comparable store sales |

3.5% to 4.5% |

|

|

Gross margin |

44.0% to 45.0% |

|

|

SG&A |

14.5% to 15.0% |

|

|

Capital expenditures |

$175.0 to $200.0 |

These guidance ranges are based on several assumptions, including the following:

- The number of signed offers to lease and store pipeline for the remainder of fiscal 2025, the absence of delays outside of our control on construction activities and no material increases in occupancy costs in the short- to medium-term

- Approximately three months visibility on open orders and product margins

- Continued positive customer response to our product offering, value proposition and in-store merchandising

- The active management of product margins, including through pricing strategies and product refresh, and of inventory shrinkage

- The Corporation continuing to account for its investment in Dollarcity as a joint arrangement using the equity method

- The entering into of foreign exchange forward contracts to hedge the majority of forecasted merchandise purchases in USD against fluctuations of CAD against USD

- The continued execution of in-store productivity initiatives and realization of cost savings and benefits aimed at improving operating expense

- The absence of a significant shift in labour, economic and geopolitical conditions, or material changes in the retail environment

- No significant changes in the capital budget for fiscal 2025 for new store openings, maintenance and transformational capital expenditures, the latter mainly related to IT projects

- The absence of unusually adverse weather, especially in peak seasons around major holidays and celebrations

The guidance ranges included in this section are forward-looking statements within the meaning of applicable securities laws, are subject to a number of risks and uncertainties and should be read in conjunction with the “Forward-Looking Statements” section of this press release.

Forward-Looking Statements

Certain statements in this press release about our current and future plans, expectations and intentions, results, levels of activity, performance, goals or achievements or any other future events or developments constitute forward-looking statements. The words “may”, “will”, “would”, “should”, “could”, “expects”, “plans”, “intends”, “trends”, “indications”, “anticipates”, “believes”, “estimates”, “predicts”, “likely” or “potential” or the negative or other variations of these words or other comparable words or phrases, are intended to identify forward-looking statements.

Forward-looking statements are based on information currently available to management and on estimates and assumptions made by management regarding, among other things, general economic and geopolitical conditions and the competitive environment within the retail industry in Canada and in Latin America, in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that are believed to be appropriate and reasonable in the circumstances. However, there can be no assurance that such estimates and assumptions will prove to be correct. Many factors could cause actual results, level of activity, performance or achievements or future events or developments to differ materially from those expressed or implied by the forward-looking statements, including the factors which are outlined in the management’s discussion and analysis for the second quarter of the fiscal year ending February 2, 2025 and discussed in greater detail in the “Risks and Uncertainties” section of the Corporation’s annual management’s discussion and analysis for the fiscal year ended January 28, 2024, both available on SEDAR+ at www.sedarplus.com and on the Corporation’s website at www.dollarama.com.

These factors are not intended to represent a complete list of the factors that could affect the Corporation or Dollarcity; however, they should be considered carefully. The purpose of the forward-looking statements is to provide the reader with a description of management’s expectations regarding the Corporation’s and Dollarcity’s financial performance and may not be appropriate for other purposes. Readers should not place undue reliance on forward-looking statements made herein. Furthermore, unless otherwise stated, the forward-looking statements contained in this press release are made as at September 11, 2024 and management has no intention and undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. All of the forward‑looking statements contained in this press release are expressly qualified by this cautionary statement.

|

___________________________ |

|

(2) To be read in conjunction with the “Forward-Looking Statements” section of this press release. |

Second Quarter Results Conference Call

Dollarama will hold a conference call to discuss its fiscal 2025 second quarter results today, September 11, 2024 at 10:30 a.m. (ET) followed by a question-and-answer period for financial analysts only. Other interested parties may participate in the call on a listen‑only basis via live audio webcast accessible through Dollarama’s website at www.dollarama.com/en-CA/corp/events-presentations.

About Dollarama

Dollarama is a recognized Canadian value retailer offering a broad assortment of consumable products, general merchandise and seasonal items both in-store and online. Our 1,583 locations across Canada provide customers with compelling value in convenient locations, including metropolitan areas, mid-sized cities and small towns. Select products are also available, by the full case only, through our online store at www.dollarama.com. Our quality merchandise is sold at select fixed price points up to $5.00.

Dollarama also owns a 60.1% interest in Dollarcity, a growing Latin American value retailer. Dollarcity offers a broad assortment of consumable products, general merchandise and seasonal items at select, fixed price points up to US$4.00 (or the equivalent in local currency) in 570 conveniently located stores in El Salvador, Guatemala, Colombia and Peru.

Selected Consolidated Financial Information

|

13-week periods ended |

26-week periods ended |

|||||||

|

(dollars and shares in thousands, except per share amounts) |

July 28, 2024 |

July 30, 2023 |

July 28, 2024 |

July 30, 2023 |

||||

|

$ |

$ |

$ |

$ |

|||||

|

Earnings Data |

||||||||

|

Sales |

1,563,384 |

1,455,936 |

2,969,156 |

2,750,485 |

||||

|

Cost of sales |

856,189 |

817,081 |

1,654,685 |

1,565,888 |

||||

|

Gross profit |

707,195 |

638,855 |

1,314,471 |

1,184,597 |

||||

|

SG&A |

212,946 |

198,360 |

430,112 |

393,958 |

||||

|

Depreciation and amortization |

94,091 |

85,110 |

184,253 |

170,748 |

||||

|

Share of net earnings of equity-accounted investment |

(22,698) |

(11,371) |

(44,788) |

(24,496) |

||||

|

Operating income |

422,856 |

366,756 |

744,894 |

644,387 |

||||

|

Net financing costs |

40,939 |

36,068 |

77,462 |

72,753 |

||||

|

Earnings before income taxes |

381,917 |

330,688 |

667,432 |

571,634 |

||||

|

Income taxes |

95,975 |

84,926 |

165,647 |

145,999 |

||||

|

Net earnings |

285,942 |

245,762 |

501,785 |

425,635 |

||||

|

Basic net earnings per common share |

$1.02 |

$0.86 |

$1.80 |

$1.50 |

||||

|

Diluted net earnings per common share |

$1.02 |

$0.86 |

$1.79 |

$1.49 |

||||

|

Weighted average number of common shares outstanding: |

||||||||

|

Basic |

280,174 |

284,366 |

279,440 |

284,588 |

||||

|

Diluted |

281,149 |

285,243 |

280,427 |

285,789 |

||||

|

Other Data |

||||||||

|

Year-over-year sales growth |

7.4 % |

19.6 % |

8.0 % |

20.1 % |

||||

|

Comparable store sales growth (1) |

4.7 % |

15.5 % |

5.1 % |

16.3 % |

||||

|

Gross margin (1) |

45.2 % |

43.9 % |

44.3 % |

43.1 % |

||||

|

SG&A as a % of sales (1) |

13.6 % |

13.6 % |

14.5 % |

14.3 % |

||||

|

EBITDA (1) |

524,305 |

457,193 |

942,048 |

823,462 |

||||

|

Operating margin (1) |

27.0 % |

25.2 % |

25.1 % |

23.4 % |

||||

|

Capital expenditures |

53,952 |

41,813 |

100,219 |

88,896 |

||||

|

Number of stores (2) |

1,583 |

1,525 |

1,583 |

1,525 |

||||

|

Average store size (gross square feet) (2) (3) |

10,439 |

10,420 |

10,439 |

10,420 |

||||

|

Declared dividends per common share |

$0.0920 |

$0.0708 |

$0.1840 |

$0.1416 |

||||

|

As at |

|||||

|

(dollars in thousands) |

July 28, |

January 28, |

|||

|

$ |

$ |

||||

|

Statement of Financial Position Data |

|||||

|

Cash and cash equivalents |

271,460 |

313,915 |

|||

|

Inventories |

884,307 |

916,812 |

|||

|

Total current assets |

1,230,587 |

1,309,093 |

|||

|

Property, plant and equipment |

975,873 |

950,994 |

|||

|

Right-of-use assets |

2,066,650 |

1,788,550 |

|||

|

Total assets |

6,313,986 |

5,263,607 |

|||

|

Total current liabilities |

618,729 |

677,846 |

|||

|

Total non-current liabilities |

4,509,818 |

4,204,913 |

|||

|

Total debt (1) |

2,276,982 |

2,264,394 |

|||

|

Net debt (1) |

2,005,522 |

1,950,479 |

|||

|

Shareholders’ equity |

1,185,439 |

380,848 |

|||

|

(1) |

Refer to the section entitled “Non-GAAP and Other Financial Measures” of this press release for the definition of these items and, where applicable, their reconciliation with the most directly comparable GAAP measure. |

||||

|

(2) |

At the end of the period. |

||||

|

(3) |

The Corporation revised its prior years square footage information to align with its current and updated methodology. |

||||

Non-GAAP and Other Financial Measures

The Corporation prepares its financial information in accordance with GAAP. Management has included non-GAAP and other financial measures to provide investors with supplemental measures of the Corporation’s operating and financial performance. Management believes that those measures are important supplemental metrics of operating and financial performance because they eliminate items that have less bearing on the Corporation’s operating and financial performance and thus highlight trends in its core business that may not otherwise be apparent when relying solely on GAAP measures. Management also believes that securities analysts, investors and other interested parties frequently use non-GAAP and other financial measures in the evaluation of issuers. Management also uses non-GAAP and other financial measures to facilitate operating and financial performance comparisons from period to period, to prepare annual budgets and to assess their ability to meet the Corporation’s future debt service, capital expenditure and working capital requirements.

The below-described non-GAAP and other financial measures do not have a standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other issuers and should be considered as a supplement to, not a substitute for, or superior to, the comparable measures calculated in accordance with GAAP.

(A) Non-GAAP Financial Measures

EBITDA

EBITDA represents operating income plus depreciation and amortization and includes the Corporation’s share of net earnings of its equity-accounted investment. Management believes EBITDA represents a supplementary metric to assess profitability and measure the Corporation’s underlying ability to generate liquidity through operating cash flows.

|

13-week periods ended |

26-week periods ended |

|||||||

|

(dollars in thousands) |

July 28, 2024 |

July 30, 2023 |

July 28, 2024 |

July 30, 2023 |

||||

|

$ |

$ |

$ |

$ |

|||||

|

A reconciliation of operating income to EBITDA is included below: |

||||||||

|

Operating income |

422,856 |

366,756 |

744,894 |

644,387 |

||||

|

Add: Depreciation and amortization |

101,449 |

90,437 |

197,154 |

179,075 |

||||

|

EBITDA |

524,305 |

457,193 |

942,048 |

823,462 |

||||

Total debt

Total debt represents the sum of long-term debt (including accrued interest and fair value hedge – basis adjustment), short-term borrowings under the US commercial paper program, long-term financing arrangements and other bank indebtedness (if any). Management believes Total debt represents a measure to facilitate the understanding of the Corporation’s corporate financial position in relation to its financing obligations.

|

(dollars in thousands) |

As at |

|||

|

A reconciliation of long-term debt to total debt is included below: |

July 28, |

January 28, |

||

|

Senior unsecured notes (the “Fixed Rate Notes”) bearing interest at: |

$ |

$ |

||

|

Fixed annual rate of 5.165% payable in equal semi-annual instalments, maturing April 26, 2030 |

450,000 |

450,000 |

||

|

Fixed annual rate of 2.443% payable in equal semi-annual instalments, maturing July 9, 2029 |

375,000 |

375,000 |

||

|

Fixed annual rate of 5.533% payable in equal semi-annual instalments, maturing September 26, 2028 |

500,000 |

500,000 |

||

|

Fixed annual rate of 1.505% payable in equal semi-annual instalments, maturing September 20, 2027 |

300,000 |

300,000 |

||

|

Fixed annual rate of 1.871% payable in equal semi-annual instalments, maturing July 8, 2026 |

375,000 |

375,000 |

||

|

Fixed annual rate of 5.084% payable in equal semi-annual instalments, maturing October 27, 2025 |

250,000 |

250,000 |

||

|

Unamortized debt issue costs, including $1,513 (January 28, 2024 – $1,320) for the credit facility |

(8,341) |

(9,049) |

||

|

Accrued interest on the Fixed Rate Notes |

21,625 |

21,460 |

||

|

Long-term financing arrangement |

7,045 |

– |

||

|

Fair value hedge – basis adjustment on interest rate swap |

6,653 |

1,983 |

||

|

Total debt |

2,276,982 |

2,264,394 |

||

Net debt

Net debt represents total debt minus cash and cash equivalents. Management believes Net debt represents a measure to assess the financial position of the Corporation including all financing obligations, net of cash and cash equivalents.

|

(dollars in thousands) |

As at |

|||

|

July 28, |

January 28, |

|||

|

$ |

$ |

|||

|

A reconciliation of total debt to net debt is included below: |

||||

|

Total debt |

2,276,982 |

2,264,394 |

||

|

Cash and cash equivalents |

(271,460) |

(313,915) |

||

|

Net debt |

2,005,522 |

1,950,479 |

||

(B) Non-GAAP Ratios

Adjusted net debt to EBITDA ratio

Adjusted net debt to EBITDA ratio is a ratio calculated using adjusted net debt over consolidated EBITDA for the last twelve months. Management uses this ratio to partially assess the financial condition of the Corporation. An increasing ratio would indicate that the Corporation is utilizing more debt per dollar of EBITDA generated.

|

(dollars in thousands) |

As at |

|||

|

July 28, |

January 28, |

|||

|

$ |

$ |

|||

|

A calculation of adjusted net debt to EBITDA ratio is included below: |

||||

|

Net debt |

2,005,522 |

1,950,479 |

||

|

Lease liabilities |

2,360,970 |

2,069,229 |

||

|

Unamortized debt issue costs, including $1,513 (January 28, 2024 – $1,320) for the credit facility |

8,341 |

9,049 |

||

|

Fair value hedge – basis adjustment on interest rate swap |

(6,653) |

(1,983) |

||

|

Adjusted net debt |

4,368,180 |

4,026,774 |

||

|

EBITDA for the last twelve-month period |

1,979,752 |

1,861,166 |

||

|

Adjusted net debt to EBITDA ratio |

2.21x |

2.16x |

||

EBITDA margin

EBITDA margin represents EBITDA divided by sales. Management believes that EBITDA margin is useful in assessing the performance of ongoing operations and efficiency of operations relative to its sales.

|

13-week periods ended |

26-week periods ended |

|||||||

|

(dollars in thousands) |

July 28, 2024 |

July 30, 2023 |

July 28, 2024 |

July 30, 2023 |

||||

|

$ |

$ |

$ |

$ |

|||||

|

A reconciliation of EBITDA to EBITDA margin |

||||||||

|

EBITDA |

524,305 |

457,193 |

942,048 |

823,462 |

||||

|

Sales |

1,563,384 |

1,455,936 |

2,969,156 |

2,750,485 |

||||

|

EBITDA margin |

33.5 % |

31.4 % |

31.7 % |

29.9 % |

||||

(C) Supplementary Financial Measures

|

Gross margin |

Represents gross profit divided by sales, expressed as a percentage of sales. |

|

Operating margin |

Represents operating income divided by sales, expressed as a percentage of sales. |

|

SG&A as a % of sales |

Represents SG&A divided by sales. |

|

Comparable store sales |

Represents sales of Dollarama stores, including relocated and expanded stores, open for at least 13 complete fiscal months relative to the same period in the prior fiscal year. |

|

Comparable store sales growth |

Represents the percentage increase or decrease, as applicable, of comparable store sales relative to the same period in the prior fiscal year. |

![]() View original content:https://www.prnewswire.com/news-releases/dollarama-reports-fiscal-2025-second-quarter-results-302244562.html

View original content:https://www.prnewswire.com/news-releases/dollarama-reports-fiscal-2025-second-quarter-results-302244562.html

SOURCE Dollarama Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Director Of Crown Crafts Purchased $56K In Stock

A notable insider purchase on September 10, was reported by Zenon S. Nie, Director at Crown Crafts CRWS, based on the most recent SEC filing.

What Happened: In a recent Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, Nie increased their investment in Crown Crafts by purchasing 11,915 shares through open-market transactions, signaling confidence in the company’s potential. The total transaction value is $56,477.

Crown Crafts‘s shares are actively trading at $4.8, experiencing a up of 2.35% during Wednesday’s morning session.

Discovering Crown Crafts: A Closer Look

Crown Crafts Inc operates in the infant and toddler products segment of the consumer products industry through its wholly-owned subsidiaries. The infant and toddler products segment consists of infant and toddler bedding, bibs, soft bath products, disposable products, and accessories. The company serves a diverse range of customers including mass merchants, mid-tier retailers, juvenile specialty stores, value channel stores, grocery and drug stores, restaurants, internet accounts, wholesale clubs, and internet-based retailers. The company’s brands include NoJo, Neat Solutions, Sassy, and Carousel. Its products are marketed under a variety of company-owned trademarks, under trademarks licensed from others, and as private-label goods.

Key Indicators: Crown Crafts’s Financial Health

Negative Revenue Trend: Examining Crown Crafts’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -5.32% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 24.46%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Crown Crafts’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of -0.03.

Debt Management: Crown Crafts’s debt-to-equity ratio is below the industry average. With a ratio of 0.32, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 11.44 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.55 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 5.41, Crown Crafts presents an attractive value opportunity.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes Worth Your Attention

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Crown Crafts’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Proximic by Comscore Releases Inaugural Report on the State of Privacy in Advertising for 2024, Highlighting Industry Shifts and Challenges

NEW YORK, Sept. 11, 2024 (GLOBE NEWSWIRE) — Proximic by Comscore, a division of Comscore Inc. SCOR and a leading provider of audience and content targeting solutions for programmatic activation, today released its inaugural State of Privacy in Advertising Report. The comprehensive report compiles industry-wide survey research, delving into the current and anticipated impacts of rapidly evolving data privacy laws in the digital advertising landscape.

The report reveals that 56% of respondents already face limitations in audience targeting in regions where data privacy laws are in place, and that nearly 40% reported experiencing challenges related to audience data availability in impacted locations. In addition, first-party and contextual data are the cornerstone of audience targeting strategies in regions with recently enacted data privacy laws, with 64% of respondents relying on them as their primary approach.

“Our 2024 State of Privacy in Advertising report highlights both the challenges and opportunities that advertisers face as they navigate today’s privacy landscape,” said Rachel Gantz, Managing Director, Proximic by Comscore. “At Proximic by Comscore, we are committed to helping our partners adapt through privacy-centric, AI-driven solutions that deliver impactful targeting without relying on traditional identifiers.”

Key Highlights of the 2024 State of Privacy in Advertising Report

- The impact of data privacy laws:

- 88% of respondents indicated that they anticipate a moderate to significant impact on their ability to deliver personalized advertising in regions with data privacy laws in place, with 28% already significantly adjusting parts of their advertising strategy.

- Due to the fragmented nature of today’s data privacy laws, 38% of respondents have had difficulty keeping up with the details and implications of each new law, and 34% have experienced challenges trying to apply differing ad strategies across regions with varying laws in place.

- Just under one-third (31%) of respondents have experienced increased costs associated with data privacy compliance efforts.

- Audience targeting is expected to face the greatest impact:

- 61% of respondents expect audience targeting to bear the brunt of privacy law impacts, with 60% adjusting their targeting strategy to accommodate data privacy laws and 59% re-evaluating targeting datasets to comply with new laws.

- Leveraging AI and strategic data partnerships:

- Respondents reported they anticipate AI’s biggest role in maintaining effective targeted advertising while respecting data privacy laws to be improving audience targeting (63% of respondents), followed by improving campaign measurement capabilities (52% of respondents).

- Privacy legislation accelerating shift away from cookie reliance:

- 43% of respondents indicated that recent privacy legislation has accelerated their plans to reduce reliance on cookies.

Proximic by Comscore has long focused on providing privacy-resilient advertising solutions. It offers contextually powered targeting segments with a specific focus on ID-free Predictive Audiences. These highly predictive segments are built from Comscore’s massive consented panel data assets and Proximic’s AI contextual intelligence to enable reach against audience definitions such as purchase intent, interest, and personas without leveraging user identifiers.

About Proximic by Comscore

Proximic by Comscore, a division of Comscore, Inc. SCOR, is a leader in programmatic targeting. Powered by Comscore’s trusted datasets and the industry’s leading natural language processing contextual engine, Proximic by Comscore enables media buyers and sellers to maximize the scale and performance of their campaigns. Through their innovative suite of ID-based and ID-less audience and content targeting segments, Proximic by Comscore supports the evolution of the programmatic ecosystem, enabling clients and partners to continue executing impactful advertising strategies.

Media Contact

press@comscore.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Ford Motor Stock Today?

Ford Motor Company F shares are trading slightly lower in the morning session on Wednesday.

The company is engaged in discussions with Tamil Nadu state in India to explore the possibility of manufacturing vehicles for export, the state’s chief minister, M.K. Stalin, said in a post in X, formerly Twitter.

“Had a very engaging discussion with the team from Ford Motors! Explored the feasibility of renewing Ford’s three decade partnership with Tamil Nadu, to again make in Tamil Nadu for the world,” the post read.

According to Benzinga Pro, F stock has lost over 16% in the past year. Investors can gain exposure to the stock via First Trust Nasdaq Transportation ETF FTXR and Invesco Exchange-Traded Fund Trust II Invesco S&P Ultra Dividend Revenue ETF RDIV.

Ford, which produced the EcoSport and Endeavour SUVs in India, had less than a 2% share of the passenger vehicle market when it ceased production due to prolonged profitability issues, reported Reuters.

At that time, Ford reported over $2 billion in losses over a decade and weak demand for new vehicles, the report noted. The decision to exit followed the failure to finalize a joint venture with local automaker Mahindra & Mahindra, which would have enabled Ford to manufacture cars in India more cost-effectively.

Ford ceased domestic car production in India in 2021 due to difficulties in increasing volumes and ended exports in 2022, effectively withdrawing from the world’s third-largest car market, which Asian competitors dominate.

In 2023, Ford sold one of its two plants in India to Tata Motors, while its remaining facility in Chennai, Tamil Nadu, was closed.

Price Action: F shares are trading lower by 0.97% to $10.22 at last check Wednesday.

Photo via Shutterstock

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automation Anywhere Surpasses Second Quarter Goals with Accelerating Momentum After Successful Autonomous AI Agent Launch and Early Customer Wins

Fourth consecutive quarter of non-GAAP operating income, with more than 70 percent of new and upsell bookings driven by AI-powered automation solutions

SAN JOSE, Calif., Sept. 11, 2024 /PRNewswire/ — Automation Anywhere, a leader in AI-powered automation, announced impressive second quarter results, representing its fourth consecutive quarter of non-GAAP operating income and improving margins. The company also experienced an unprecedented surge in customer demand for autonomous AI agents, with leaders across industries embracing their potential at an accelerating pace and driving a growing pipeline of opportunities.

“The evolving business landscape is driving an unprecedented demand for AI-powered automation and autonomous AI agents to unlock productivity, improve customer experiences, and generate substantial economic value,” said Mihir Shukla, CEO and Co-Founder, Automation Anywhere. “This strategic shift is clearly reflected in our second quarter results. The accelerating adoption of our new system underscores that enterprises recognize the value of autonomous AI agents to assist employees and rapidly unlock ROI from their AI investments.”

In June, the company launched its new AI + Automation Enterprise System that puts AI to work with automation to drive exponential outcomes. Unveiled during Imagine 2024, the offering is infused with the company’s second-generation GenAI Process Models to speed up discovery, development and deployment of complex, end-to-end AI process automations. Included are new autonomous AI Agents to manage and assist with complex cognitive tasks and automate more than ever before across every system in an enterprise. The new platform is helping organizations achieve dramatic efficiency improvements, driving processes that formerly took hours down to minutes, and delivering 3x time-to-value and up to 10x business impact across workflows including customer service operations, finance, IT, and HR. Companies now can automate more mission-critical processes faster, and more responsibly, all with security, compliance and governance built-in.

Key Business Highlights

- Large deals exceeding $200,000 increased 70 percent year-on-year

- More than 70 percent of new and upsell deals were driven by AI-powered automation customers

- Continued to see growth in million-dollar customers, and strong performance in key regions

- Increased momentum with numerous AI Agent customer deal wins since the June product launch, setting a new product launch record

- Growing, healthy cash balance

Additional Highlights of the Quarter

- New GenAI capabilities helped make Document Automation one of the company’s fastest-growing product lines.

- Customer Net Promoter Score (NPS) saw a 12 percent increase into the upper range of strong NPS for SaaS companies, underscoring substantial gains in customer loyalty, and positioning Automation Anywhere as an industry leader in helping customers plan their automation strategies, measure and achieve ROI targets, and continuously improve the value of automation to their bottom line. The company won its 14th customer support award over the past 18 months for outstanding customer service, support and operational excellence, including two coveted Technology & Services Industry Association (TSIA) awards.

- Continued to achieve greater than 75 percent license utilization for large enterprise customers, signaling that customers are deriving significant value and placing the company in the upper tier of SaaS industry performance. The company believes this is a much higher license utilization rate than its competitors.

Second Quarter Announcement Highlights

- Automation Anywhere was recognized by Gartner as a Leader in Automation for a sixth consecutive year in the 2024 Magic Quadrant for Automation. Automation Anywhere was recognized as a Leader for its completeness of vision and ability to execute.

- Automation Anywhere unveiled its new AI + Automation Enterprise System, featuring second-generation GenAI Process Models and AI Agents for complex cognitive tasks. This includes new offerings such as AI Agent Studio for building custom autonomous AI Agents, Automator AI with Generative Recorder and enhanced Autopilot, improved Document Automation, and a conversational Automation Co-Pilot integrated with Amazon Q.

- The company expanded its Microsoft partnership, integrating Azure OpenAI Service within its AI + Automation Enterprise System to build enterprise AI Agents for complex automation use cases and enhance document processing capabilities.

- Jeff Tworek, a seasoned technology sales executive, joined Automation Anywhere as Chief Sales Officer, focused on driving continued growth amid the AI-powered automation boom. This is the second C-level executive to join the company this year and augment the leadership of the company, following the appointment of Tim McDonough as Chief Marketing Officer in April.

Automation Anywhere’s second quarter ended July 31, 2024. As a private company, Automation Anywhere does not disclose detailed financial information.

About Automation Anywhere

Automation Anywhere is a leader in AI-powered process automation that empowers organizations to drive productivity gains, foster innovation, improve customer service, and accelerate business growth. The company’s AI + Automation Enterprise System is powered by specialized AI, autonomous AI agents, and offers process discovery, end-to-end process orchestration, document processing, and analytics — all with a security and governance-first approach. Guided by its vision to fuel the future of work, Automation Anywhere is dedicated to unleashing human potential through AI-powered automation. Learn more at www.automationanywhere.com

Logo:https://new.stockburger.news/wp-content/uploads/2024/09/Automation_Anywhere_Logo.jpg

SOURCE Automation Anywhere, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Linkage Global Inc Announces First Half 2024 Financial Results

TOKYO, Sept. 11, 2024 (GLOBE NEWSWIRE) — Linkage Global Inc (“Linkage Cayman”, or the “Company”), a cross-border e-commerce integrated services provider headquartered in Japan, today announced its unaudited financial results for the six months ended March 31, 2024.

First Half 2024 Financial Highlights

- Net revenues were USD4.80 million for the six months ended March 31, 2024, compared to net revenues of USD9.03 million for the same period of 2023.

- Gross profit decreased by 64% to USD0.71 million for the six months ended March 31, 2024 from USD1.95 million for the same period of 2023. Gross margin was 14.77% for the six months ended March 31, 2024, compared to 21.55% for the same period of 2023.

- Loss from operations was USD0.91 million for the six months ended March 31, 2024, compared to income from operations of USD0.87 million for the same period of 2023.

- Net loss was USD0.90 million for the six months ended March 31, 2024, compared to net income of USD0.55 million for the same period of 2023.

First Half 2024 Financial Results

Revenues

Total revenues decreased by approximately USD4.23 million, or 47%, from approximately USD9.03 million for the six months ended March 31, 2023 to approximately USD4.80 million for the six months ended March 31, 2024.

Revenues from cross-border sales decreased by approximately USD2.18 million, or 34%, from approximately USD6.41 million for the six months ended March 31, 2023 to approximately USD4.23 million for the six months ended March 31, 2024. EXTEND CO., LTD, a Japanese corporation and a subsidiary of the Company, contributed to approximately USD3.50 million, or 73% of the Company’s total revenues, a decrease of 36% for the six months ended March 31, 2024 compared to the same period in 2023. The decrease in cross-border sales was mainly due to the following reasons: (i) China has tightened the inspection policy for goods imported from Japan, which resulted in more goods held up by China customs authorities for two to three months, leading to a decrease in exports to China, and (ii) the depreciation of the Japanese yen against U.S. dollars. The average exchange rate for the six months ended March 31, 2024 and 2023 was at $1=¥148.1735 and $1=¥136.8638, respectively, representing a decrease of 8.26%.

Revenues from integrated e-commerce services decreased by approximately USD2.05 million, or 78%, from approximately USD2.62 million for the six months ended March 31, 2023 to approximately USD0.57 million for the six months ended March 31, 2024, which was mainly due to a decrease in digital marketing services provided. HQT NETWORK CO., LIMITED, a subsidiary of the Company, acts as an authorized agent of Google for digital marketing services. In the six months ended March 31, 2024, Google imposed more stringent criteria for incentives, resulting in reduced amount of incentives. For instance, since 2023, Google stopped providing incentives for qualifying spends made by existing cross-border e-commerce sellers (both enterprises and individuals) that purchase products, e-commerce operation training and software support services and other cross-border e-commerce sellers and suppliers (collectively, the “Merchants”) , and only qualifying spends from new Merchants are counted when calculating incentives. Therefore, revenues from digital marketing services decreased by approximately USD2.13 million, or 94%, from approximately USD2.26 million for the six months ended March 31, 2023 to approximately USD0.13 million for the six months ended March 31, 2024.

In response to the change of Google’s policies, we entered into an advertisement publishing agreement with Huntmobi Holdings Limited, an online advertising agency based in China, for the deployment of ads on certain media or marketing platforms through Huntmobi Holdings Limited, including but not limited to TikTok and Facebook, and we also focused on the growth of other e-commerce related services. Revenues generated from training and consulting services increased by USD0.08 million, or 24%, from approximately USD0.35 million for the six months ended March 31, 2023 to approximately USD0.43 million for the six months ended March 31, 2024.

Cost of Revenues

Cost of revenues decreased by USD3 million, or 42%, from approximately USD7.09 million for the six months ended March 31, 2023 to approximately USD4.09 million for the six months ended March 31, 2024, primarily attributable to a decrease of cost of revenue for cross-border sales and digital marketing services, which is in line with the decrease of sales.

Gross Profit

Gross profit decreased to USD0.71 million for the six months ended March 31, 2024 from USD1.95 million for the same period of 2023, primarily attributable to the decrease of integrated e-commerce services mainly resulting from reduced incentives and more stringent incentive policies of Google. Gross margin was 14.77% for the six months ended March 31, 2024 compared to 21.55% for the same period of 2023.

Operating Expenses

Operating expenses increased by USD0.54 million, or 50%, from USD1.08 million for the six months ended March 31, 2023 to USD1.62 million for the six months ended March 31, 2024.

General and administrative expenses increased by USD0.40 million, or 58%, from USD0.69 million for the six months ended March 31, 2023 to approximately USD1.10 million for the six months ended March 31, 2024. This increase was primarily attributable to an increase of USD0.27 million in professional fees since its initial public offering, and an increase of USD0.18 million in bad debt allowance of accounts receivable.

Selling and marketing expenses decreased by USD0.06 million, or 22%, from USD0.29 million for the six months ended March 31, 2023 to approximately USD0.23 million for the six months ended March 31, 2024. This decrease was primarily attributable to a decrease of freight expenses and salaries due to the decrease in sales.

Research and development expenses remained stable and was USD0.29 million and USD0.30 million for the six months ended March 31, 2023 and 2024, respectively.

Gain from disposal of property and equipment was USD1.97 million and nil for the six months ended March 31, 2023 and 2024, respectively.

Profit/ (loss) from operations

Loss from operations was USD0.91 million for the six months ended March 31, 2024, compared to profit from operations of USD0.87million for the same period of 2023.

Other expenses, net

Other expenses decreased to USD59,728 for the six months ended March 31, 2024 from USD60,073 for the same period of 2023, which was mainly attributable to (i) a decrease of USD22,526 in interest expenses due to a decrease in bank borrowings; and (ii) a decrease of USD27,038 in COVID-19 related government subsidies.

Income tax (provision)/benefit

The Company had an income tax benefit of USD0.08 million for the six months ended March 31, 2024, and incurred income tax provision of USD0.25 million for the same period of 2023, which was primarily attributable to net loss for the six months ended March 31, 2024.

Net (loss)/ income

Net loss was USD0.90 million for the six months ended March 31, 2024, compared to net income of USD0.55 million for the same period of 2023.

About Linkage Global Inc

Linkage Global Inc is a holding company incorporated in the Cayman Islands with no operations of its own. Linkage Cayman conducts its operations through its operating subsidiaries in Japan, Hong Kong, and mainland China. As a cross-border e-commerce integrated services provider headquartered in Japan, through its operating subsidiaries, the Company has developed a comprehensive service system comprised of two lines of business complementary to each other, including (i) cross-border sales and (ii) integrated e-commerce services. For more information, please visit www.linkagecc.com.

Safe Harbor Statement

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “approximates,” “assesses,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s annual reports on Form 20-F and other filings with the U.S. Securities and Exchange Commission.

For more information, please contact:

Investor Relations

WFS Investor Relations Inc.

Connie Kang, Partner

Email: ckang@wealthfsllc.com

Tel: +86 1381 185 7742

| Linkage Global Inc CONDENSED CONSOLIDATED BALANCE SHEETS (In U.S. dollars, except for share and per share data, or otherwise noted) |

|||||||

| As of | |||||||

| September 30, 2023 |

March 31, 2024 |

||||||

| USD | USD | ||||||

| (Unaudited) | |||||||

| ASSETS | |||||||

| Current assets | |||||||

| Cash and cash equivalents | 1,107,480 | 1,483,720 | |||||

| Accounts receivable, net | 2,011,047 | 2,874,998 | |||||

| Deferred offering costs | 1,076,253 | – | |||||

| Inventories, net | 679,732 | 138,012 | |||||

| Prepaid expenses and other current assets, net | 4,771,460 | 8,877,509 | |||||

| Total current assets | 9,645,972 | 13,374,239 | |||||

| Non-current assets | |||||||

| Property and equipment, net | 158,642 | 119,207 | |||||

| Deferred tax assets | 149,129 | 191,004 | |||||

| Right-of-use assets, net | 624,945 | 661,799 | |||||

| Other non-current assets | 54,825 | 55,399 | |||||

| Total non-current assets | 987,541 | 1,027,409 | |||||

| TOTAL ASSETS | 10,633,513 | 14,401,648 | |||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||

| Current liabilities | |||||||

| Short-term debts | – | 98,532 | |||||

| Current portion of long-term debts | 535,226 | 533,244 | |||||

| Accounts payable | 1,142,667 | 822,039 | |||||

| Contract liabilities | 530,488 | 853,417 | |||||

| Amounts due to related parties | 1,413,604 | 1,948,959 | |||||

| Income tax payable | 581,235 | 1,481,629 | |||||

| Accrued expenses and other current liabilities | 309,986 | 304,799 | |||||

| Lease liabilities-current | 187,214 | 174,777 | |||||

| Total current liabilities | 4,700,420 | 6,217,396 | |||||

| Non-current liabilities | |||||||

| Long-term debts | 1,996,326 | 939,926 | |||||

| Lease liabilities-noncurrent | 439,854 | 496,048 | |||||

| Total non-current liabilities | 2,436,180 | 1,435,974 | |||||

| Total liabilities | 7,136,600 | 7,653,370 | |||||

| Commitments and contingencies | |||||||

| Shareholders’ equity | |||||||

| Ordinary shares (par value of US$0.00025 per share; 200,000,000 ordinary shares authorized as of September 30, 2023 and March 31, 2024, respectively; 20,000,000 and 21,500,000 ordinary shares issued and outstanding as of September 30, 2023 and March 31, 2024, respectively) | 5,000 | 5,375 | |||||

| Additional paid in capital | 1,549,913 | 6,367,921 | |||||

| Statutory reserve | 11,348 | 19,214 | |||||

| Retained earnings | 2,052,553 | 1,146,573 | |||||

| Accumulated other comprehensive loss | (121,901 | ) | (790,805 | ) | |||

| Total shareholders’ equity | 3,496,913 | 6,748,278 | |||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 10,633,513 | 14,401,648 | |||||

| Linkage Global Inc UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME/(LOSS) (In U.S. dollars, except for share and per share data, or otherwise noted) |

|||||||

| For the six months ended March 31, |

|||||||

| 2023 | 2024 | ||||||

| USD | USD | ||||||

| (Unaudited) | |||||||

| Revenues | 9,031,327 | 4,798,363 | |||||

| Cost of revenues | (7,085,228 | ) | (4,089,486 | ) | |||

| Gross profit | 1,946,099 | 708,877 | |||||

| Operating expenses | |||||||

| Selling and marketing expenses | (294,240 | ) | (228,956 | ) | |||

| General and administrative expenses | (694,449 | ) | (1,097,010 | ) | |||

| Research and development expenses | (287,971 | ) | (297,811 | ) | |||

| Gain from disposal of property and equipment | 196,503 | – | |||||

| Total operating expenses | (1,080,157 | ) | (1,623,777 | ) | |||

| Operating profit/(loss) | 865,942 | (914,900 | ) | ||||

| Other (expenses)/income | |||||||

| Investment loss | (4,857 | ) | – | ||||

| Interest expenses, net | (83,252 | ) | (60,726 | ) | |||

| Others, net | 28,036 | 998 | |||||

| Total other expenses, net | (60,073 | ) | (59,728 | ) | |||

| Income/(loss) before income taxes | 805,869 | (974,628 | ) | ||||

| Income tax (provision)/benefit | (251,042 | ) | 76,514 | ||||

| Net income/(loss) | 554,827 | (898,114 | ) | ||||

| Net income/(loss) | 554,827 | (898,114 | ) | ||||

| Foreign currency translation adjustment | 16,351 | (668,904 | ) | ||||

| Total comprehensive income/(loss) attributable to the Company’s ordinary shareholders | 571,178 | (1,567,018 | ) | ||||

| Earnings/(loss) per ordinary share attributable to ordinary shareholders | |||||||

| Basic and Diluted | 0.03 | (0.04 | ) | ||||

| Weighted average number of ordinary shares outstanding | |||||||

| Basic and Diluted | 20,000,000 | 20,848,901 | |||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

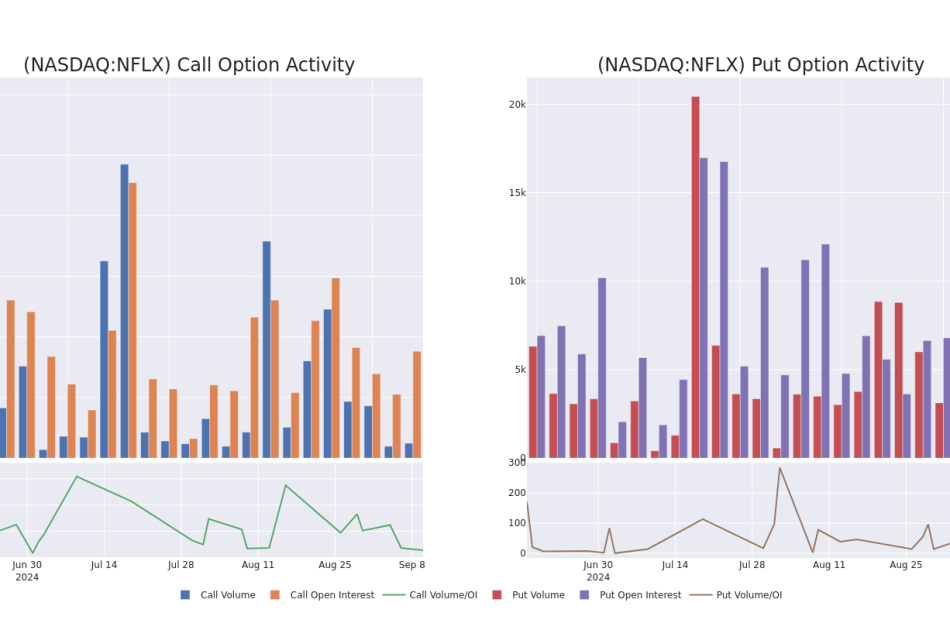

A Closer Look at Netflix's Options Market Dynamics

Financial giants have made a conspicuous bearish move on Netflix. Our analysis of options history for Netflix NFLX revealed 20 unusual trades.

Delving into the details, we found 15% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $330,768, and 14 were calls, valued at $1,003,051.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $1100.0 for Netflix over the last 3 months.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Netflix options trades today is 422.79 with a total volume of 2,053.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Netflix’s big money trades within a strike price range of $400.0 to $1100.0 over the last 30 days.

Netflix Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFLX | CALL | SWEEP | NEUTRAL | 10/18/24 | $13.95 | $13.5 | $13.64 | $725.00 | $152.5K | 111 | 82 |

| NFLX | CALL | TRADE | NEUTRAL | 03/21/25 | $72.9 | $72.05 | $72.5 | $675.00 | $145.0K | 49 | 47 |

| NFLX | PUT | SWEEP | BULLISH | 01/16/26 | $434.0 | $424.0 | $427.96 | $1100.00 | $128.3K | 0 | 3 |

| NFLX | CALL | TRADE | BEARISH | 01/17/25 | $96.3 | $91.3 | $92.8 | $620.00 | $102.0K | 438 | 0 |

| NFLX | CALL | SWEEP | BEARISH | 10/18/24 | $13.85 | $13.45 | $13.64 | $725.00 | $89.8K | 111 | 164 |

About Netflix

Netflix’s relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 275 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Netflix’s Current Market Status

- Currently trading with a volume of 296,115, the NFLX’s price is down by -0.99%, now at $666.98.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 35 days.

What The Experts Say On Netflix

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $825.0.

- Consistent in their evaluation, an analyst from Pivotal Research keeps a Buy rating on Netflix with a target price of $900.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Netflix with a target price of $750.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Netflix options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Li-ion Pouch Battery Market is Projected to Reach US$ 174.48 Billion Growing at a CAGR of 9.7% by 2034 | Fact.MR Report

Rockville, MD , Sept. 11, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and competitive intelligence provider, through its newly published market analysis, reveals that revenue from the Li-ion Pouch Battery Market is projected to reach US$ 69.13 billion in 2024. The market has been forecasted to reach a value of US$ 174.48 billion by the end of 2034, expanding at a CAGR of 9.7% over the next ten years.

In potentially high growth countries, where more flexible options, including cross-border interconnections and natural gas generation, are insufficient, pocket-friendly renewable energy generation practices are becoming increasingly popular. The growth of the Li-ion pouch battery market is being driven by the fact that the Li-ion battery technologies, which have been ruling the storage industry for the past few years have not come across a significant decrease in prices. The importance of automotive lithium batteries is growing as more people are becoming aware of sustainable resources and the availability of raw materials is decreasing on Earth.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10347

Key Takeaways from the Market Study:

- The global market for Li-ion pouch batteries is analyzed to reach a value of US$ 174.48 billion by the end of 2034.

- India is evaluated to reach a market valuation of US$ 6.45 billion in 2024.

- China is projected to contribute a market share of 62% in East Asia in 2024.

- Demand for Li-ion pouch batteries in Japan is estimated to reach US$ 4.68 billion in 2024.

- The market in the South Asia & Pacific region is projected to advance at 10.4% CAGR through 2034.

- The global demand for lithium iron phosphate is approximated to increase at a CAGR of 9.3% through 2034.

“The growth of the Li-ion pouch battery market is being driven by the fact that the lithium-ion battery technologies that have been ruling the storage industry for the past few years and have not seen a significant decrease in cost,” says a Fact.MR analyst.

Leading Players Driving Innovation in Li-ion Pouch Battery Market:

CUSTOM CELLS ITZEHOE GMBH; FDK Corporation; Enertech International Inc.; DNK Power Company Limited; Amperex Technology Limited; Energy Innovation Group Ltd.; Bestgo B Vertical Partners West LLC; Servovision Co. Ltd.; Fruedenberg Group; Leclanché SA; A123 Systems LLC; Toshiba Corporation; Gee Power; EVE Energy Co. Ltd.; SK Innovation Co. Ltd.; EPEC LLC; FluxPower Battery Co., Ltd.; SOLAREDGE e-MOBILITY SpA; Echion Technologies; Panasonic Industrial Corporation; YOK Energy; Shenzhen Ace Battery Co. Ltd.

Electric Vehicle Manufacturers Use Li-ion Batteries Due to Their Extended Energy Storage Features:

Governments from all around the world are working to reduce the amount of pollutants coming from ordinary cars. In addition, the exhaustion of natural resources poses a threat to the environment. As a result, more customers are giving preference to drive electric cars. Electric vehicle manufacturers prefer lithium-ion batteries because they have a longer energy storage life and are also used in hybrid vehicles.

Li-ion Pouch Battery Industry News:

- FDK Corporation in February 2021 declared that it would expand its high-power cylindrical-type primary lithium-ion battery assembly line to increase production capacity by 25%.

- SK Innovation, Hyundai Motors, and Kia joined forces in April 2021 to jointly develop batteries for electric vehicles. Mass production and installation are anticipated to begin in 2024.

- The Toyota Technology and Development Award for lithium-ion batteries for hybrid cars was given to GS Yuasa International Limited in March 2021.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10347

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the li-ion pouch battery market for 2019 to 2023 and forecast statistics for 2024 to 2034.