Looking At Okta's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Okta.

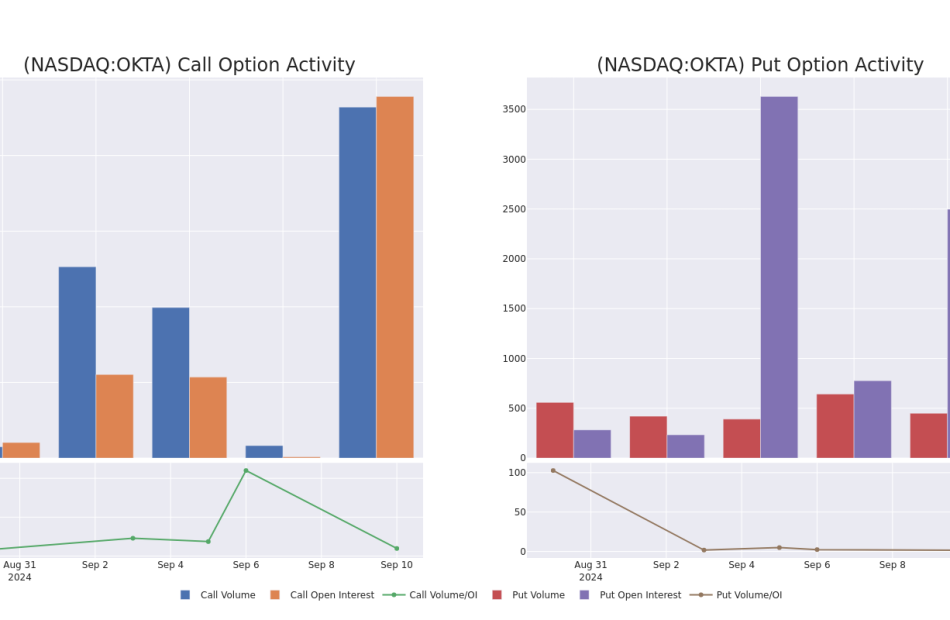

Looking at options history for Okta OKTA we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 66% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $190,898 and 8, calls, for a total amount of $399,069.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $77.5 for Okta over the last 3 months.

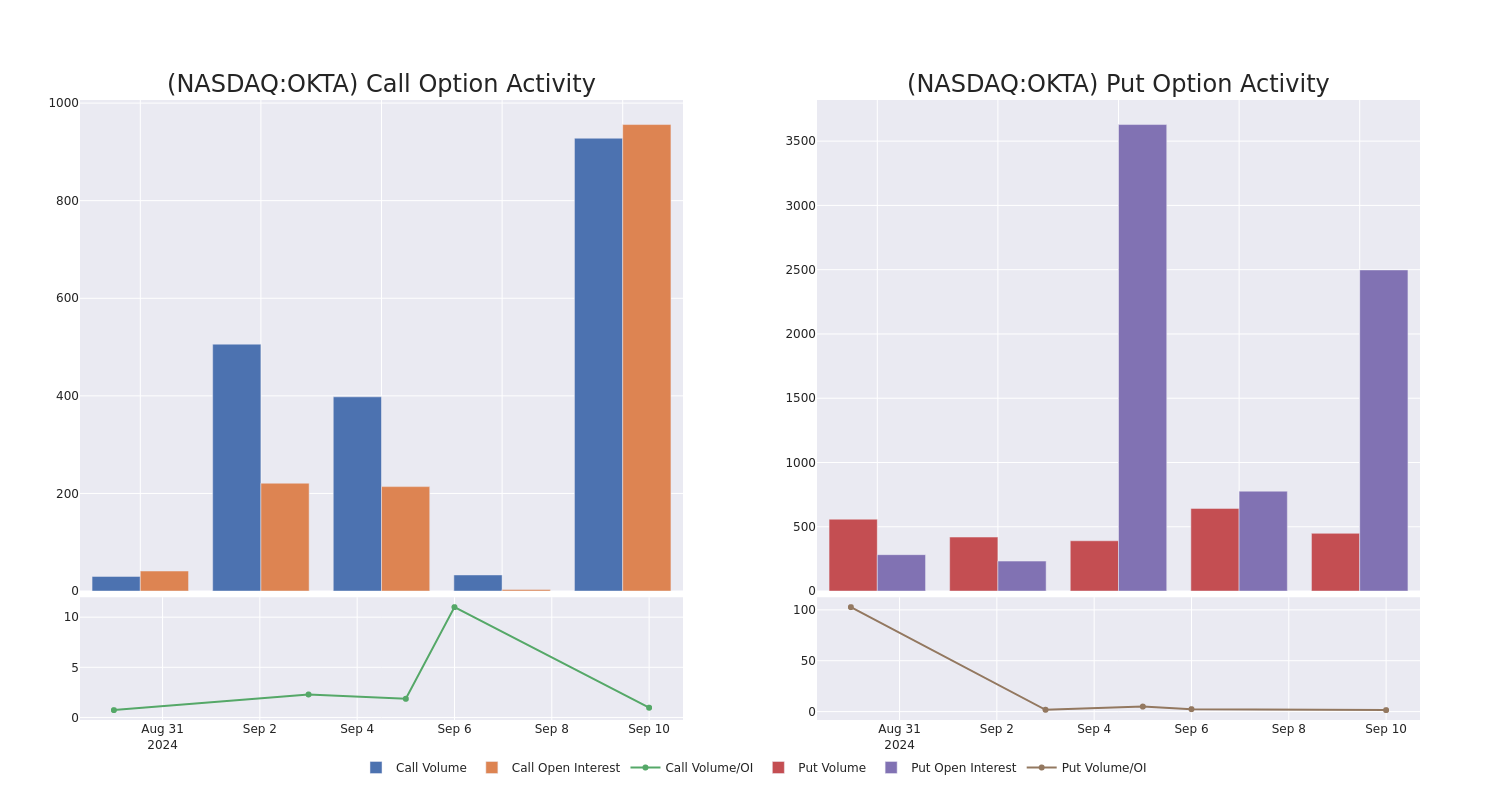

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Okta’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Okta’s whale trades within a strike price range from $60.0 to $77.5 in the last 30 days.

Okta Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OKTA | CALL | TRADE | BEARISH | 02/21/25 | $12.4 | $12.2 | $12.25 | $65.00 | $77.1K | 11 | 112 |

| OKTA | PUT | SWEEP | BULLISH | 11/15/24 | $8.15 | $8.1 | $8.1 | $77.50 | $67.2K | 193 | 143 |

| OKTA | CALL | SWEEP | BEARISH | 02/21/25 | $12.2 | $12.1 | $12.1 | $65.00 | $64.1K | 11 | 165 |

| OKTA | CALL | SWEEP | BEARISH | 02/21/25 | $12.4 | $12.25 | $12.25 | $65.00 | $58.8K | 11 | 49 |

| OKTA | PUT | SWEEP | BULLISH | 11/15/24 | $8.2 | $8.1 | $8.1 | $77.50 | $48.6K | 193 | 60 |

About Okta

Okta is a cloud-native security company that focuses on identity and access management. The San Francisco-based firm went public in 2017 and focuses on two key client stakeholder groups: workforces and customers. Okta’s workforce offerings enable a company’s employees to securely access its cloud-based and on-premises resources. The firm’s customer offerings allow its clients’ customers to securely access the client’s applications.

In light of the recent options history for Okta, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Okta’s Current Market Status

- Trading volume stands at 2,877,202, with OKTA’s price down by -0.38%, positioned at $71.0.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 78 days.

What Analysts Are Saying About Okta

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $101.2.

- An analyst from Citigroup persists with their Neutral rating on Okta, maintaining a target price of $110.

- An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Okta, which currently sits at a price target of $90.

- An analyst from Stifel persists with their Buy rating on Okta, maintaining a target price of $108.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Okta with a target price of $103.

- In a cautious move, an analyst from Truist Securities downgraded its rating to Hold, setting a price target of $95.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Okta with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Circular Fashion Market Size/Share Worth USD 13.8 Billion by 2033 at a 7.8% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Sept. 10, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Circular Fashion Market Size, Trends and Insights By Product Type (Apparel, Accessories, Footwear, Others), By Textile Source (Organic, Recycled, Reused, Natural Materials, Others), By Distribution Channel (Online, Offline, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

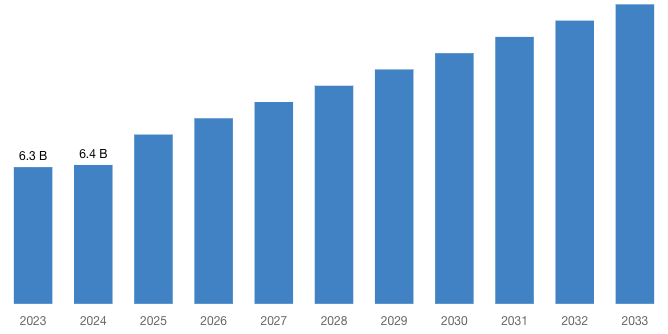

“According to the latest research study, the demand of global Circular Fashion Market size & share was valued at approximately USD 6.3 Billion in 2023 and is expected to reach USD 6.4 Billion in 2024 and is expected to reach a value of around USD 13.8 Billion by 2033, at a compound annual growth rate (CAGR) of about 7.8% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Circular Fashion Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=51752

Circular Fashion Market: Overview

Circular fashion is a sustainable approach to the design, production, consumption, and disposal of clothing and accessories. It aims to create a closed-loop system where materials are continuously reused, recycled, or repurposed, minimizing waste and environmental impact throughout the entire lifecycle of fashion products.

In the upcoming years, the market for circular fashion is expected to increase significantly. The younger generations prefer to purchase products from companies that use circular business strategies. The resale and rental marketplaces have become important venues for interacting with these moral consumers.

Europe is the leader in circular fashion, with the U.K. and Germany leading the way in the adoption of rental and resale. However, given their enormous fashion marketplaces, China and the United States offer significant prospects.

The restricted scope and accessibility of circular offerings in comparison to conventional retail behemoths is one constraint. Well-known companies are hesitantly joining the market since circular challenges the business paradigms of mass manufacturing and consumption.

Today top businesses are incorporating circularity into every step of their supply chain by utilizing sustainable materials, renewable energy sources, effective procedures, and creative business concepts like reselling clothes. The growing demand for eco-friendly products is expected to fuel a strong expansion in the global sustainable fashion industry in the upcoming years.

Request a Customized Copy of the Circular Fashion Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=51752

By product type, the apparel segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The expanding demand for environmentally friendly clothing made of organic cotton, recycled polyester, and regenerated fibres.

The clothing categories, from sporting and formal dress to daily wear, have seen a significant uptake of sustainable fashion. This market is expanding because more and more customers are looking for ethical and environmentally sustainable apparel solutions.

By distribution channel, the online distribution segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The online distribution channel segment is dominating the market considering the changing interests of consumers when it comes to buying, online retail is predicted to have a leading position in the global circular fashion market.

By textile source, the organic fabrics segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Many people are choosing environmentally friendly products that protect biodiversity and minimize pollution.

North America led the Circular Fashion Market in 2023 with a market share of 40.00% and is expected to keep its dominance during the forecast period 2024-2033. The rise in ethical consumerism in North America is the primary driver of the market boom, with the US placing a special emphasis on sustainable practices in apparel, accessories, and footwear.

H&M is a leading player in the circular fashion market. Sustainable collections by H&M use ethical production methods and environmentally beneficial materials. These lines provide customers with the ability to choose environmentally friendly products.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 6.4 Billion |

| Projected Market Size in 2033 | USD 13.8 Billion |

| Market Size in 2023 | USD 6.3 Billion |

| CAGR Growth Rate | 7.8% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Product Type, Textile Source, Distribution Channel and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Circular Fashion report is available upon request; please contact us for more information.)

Request a Customized Copy of the Circular Fashion Market Report @ https://www.custommarketinsights.com/report/circular-fashion-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Circular Fashion report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Circular Fashion Market Report @ https://www.custommarketinsights.com/report/circular-fashion-market/

CMI has comprehensively analyzed the Global Circular Fashion market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict an in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Blister Packaging industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Circular Fashion market and what is its expected growth rate?

- What are the primary driving factors that push the Circular Fashion market forward?

- What are the Circular Fashion Industry’s top companies?

- What are the different categories that the Circular Fashion Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Circular Fashion market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Circular Fashion Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/circular-fashion-market/

Circular Fashion Market: Regional Analysis

By Region, Circular Fashion Market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa. North America led the Circular Fashion Market in 2023 with a market share of 39.1% and is expected to keep its dominance during the forecast period 2024-2033.

The circular fashion market in North America is rapidly gaining momentum, driven by growing consumer awareness of sustainability and environmental impact. Brands and retailers are increasingly adopting circular principles, which focus on reducing waste through recycling, upcycling, and creating durable, reusable products.

The market is supported by innovative business models such as rental services, resale platforms, and take-back programs that extend the life cycle of garments. Government policies and regulations are also encouraging sustainable practices. Tech advancements, such as blockchain for transparency and AI for optimizing supply chains, play a crucial role.

Key players like Patagonia, ThredUp, and Rent the Runway are leading the charge, setting examples for the industry. This shift towards circular fashion not only addresses ecological concerns but also opens up new economic opportunities, making it a significant trend in the North American fashion landscape.

Request a Customized Copy of the Circular Fashion Market Report @ https://www.custommarketinsights.com/report/circular-fashion-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Circular Fashion Market Size, Trends and Insights By Product Type (Apparel, Accessories, Footwear, Others), By Textile Source (Organic, Recycled, Reused, Natural Materials, Others), By Distribution Channel (Online, Offline, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/circular-fashion-market/

List of the prominent players in the Circular Fashion Market:

- H&M

- Zara

- Gap Inc.

- Gucci

- Nike

- Adidas

- Levi Strauss & Co.

- VF Corporation

- Fast Retailing (Uniqlo)

- Prada

- Burberry

- Hermes

- Ralph Lauren

- PUMA

- eBay

- Lululemon

- Eileen Fisher

- Patagonia

- Stella McCartney

- Everlane

- Others

Click Here to Access a Free Sample Report of the Global Circular Fashion Market @ https://www.custommarketinsights.com/report/circular-fashion-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Natural Cosmetics Market: Natural Cosmetics Market Size, Trends and Insights By Product Type (Skincare, Haircare, Makeup, Body Care, Oral Care, Others), By Packaging Type (Bottles & Jars, Tubes, Pencil & Sticks, Poches & Sachets, Others), By Consumer Group (Male, Female, Kids), By Distribution Channel (Online Retail, Retail Stores, Direct Sales, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Duty-free and Travel Retail Market: Duty-free and Travel Retail Market Size, Trends and Insights By Product Type (Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others), By Distribution Channel (Airports, Airlines, Ferries, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Handmade Jewellery Market: Handmade Jewellery Market Size, Trends and Insights By Material (Gold, Diamond, Silver, Others), By Type (Beaded Jewellery, Enameled Jewellery, Handmade Metal Jewellery, Wire Wrapped Jewellery, Hand Stamped Jewellery, Others), By Distribution Channel (Online, Offline), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Educational Tourism Market: Educational Tourism Market Size, Trends and Insights By Age Group (Less Than 15 Years, 16-25 Years, 26-40 Years, 41-55 Years), By Education Type (Primary, Secondary, College, Post-graduation), By Occupation (Students, Teacher, Government Officials, Corporation Managers, Enterprise Owners, Workers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Windsurf Foil Board Market: Windsurf Foil Board Market Size, Trends and Insights By Type (Hydrofoil Wave Boards, Race Boards, Freeride Boards, Entry-Level Boards, Free move Boards, Slalom Boards), By Application (Offshore Foiling, Inshore Foiling, Recreational Foiling, Racing Events Foiling), By Distribution Channel (Online, Offline), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Under Eye Serum Market: Under Eye Serum Market Size, Trends and Insights By Product Type (Creams, Gels, Serums, Others), By Skin Type (Dry Skin, Oily Skin, Combination Skin, Normal Skin, Sensitive Skin), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Sustainable Fashion Market: Sustainable Fashion Market Size, Trends and Insights By Product Type (Apparel, Footwear, Accessories, Jewellery, Bags, Others), By Fabric Type (Recycled Fabrics, Organic Fabrics, Regenerated Fabrics, Natural Fibers, Alternate Fibers, Others), By Distribution Channel (Online, Offline, Brand Outlets, Independent Boutiques, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Sapphire Jewellery Market: Sapphire Jewellery Market Size, Trends and Insights By Type of Jewelry (Rings, Necklaces, Earrings, Bracelets, Pendants, Others), By Sapphire Color (Blue Sapphire, Pink Sapphire, Yellow Sapphire, Padparadscha Sapphire, White Sapphire, Purple Sapphire, Others), By Price Range (High-End/Luxury, Mid-Range, Affordable/Fashion Jewelry), By Distribution Channel (Brick-and-Mortar Retailers, Online Retailers, Specialty Jewelry Stores, Department Stores, Boutique Shops, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Circular Fashion Market is segmented as follows:

By Product Type

- Apparel

- Accessories

- Footwear

- Others

By Textile Source

- Organic

- Recycled

- Reused

- Natural Materials

- Others

By Distribution Channel

Click Here to Get a Free Sample Report of the Global Circular Fashion Market @ https://www.custommarketinsights.com/report/circular-fashion-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Circular Fashion Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Circular Fashion Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Circular Fashion Market? What Was the Capacity, Production Value, Cost and PROFIT of the Circular Fashion Market?

- What Is the Current Market Status of the Circular Fashion Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Circular Fashion Market by Considering Applications and Types?

- What Are Projections of the Global Circular Fashion Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Circular Fashion Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Circular Fashion Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Circular Fashion Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Circular Fashion Industry?

Click Here to Access a Free Sample Report of the Global Circular Fashion Market @ https://www.custommarketinsights.com/report/circular-fashion-market/

Reasons to Purchase Circular Fashion Market Report

- Circular Fashion Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Circular Fashion Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Circular Fashion Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Circular Fashion Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Circular Fashion market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Circular Fashion Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/circular-fashion-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Circular Fashion market analysis.

- The competitive environment of current and potential participants in the Circular Fashion market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Circular Fashion market should find this report useful. The research will be useful to all market participants in the Circular Fashion industry.

- Managers in the Circular Fashion sector are interested in publishing up-to-date and projected data about the worldwide Circular Fashion market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Circular Fashion products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Circular Fashion Market Report @ https://www.custommarketinsights.com/report/circular-fashion-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Circular Fashion Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/circular-fashion-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks falter, dollar defensive after US presidential debate

By Lawrence White

LONDON (Reuters) -U.S. stock futures faltered and the dollar was on the defensive on Wednesday, while bond prices rallied, as markets reacted to a U.S. presidential debate in which Vice President Kamala Harris put Republican Donald Trump on the defensive.

The presidential hopefuls battled over abortion, the economy, immigration and Trump’s legal woes at their combative first debate, leaving investors skittish ahead of U.S. inflation data that could influence the Federal Reserve’s policy moves next week.

U.S. Treasury and Euro zone government bond yields dipped, as Democrat candidate Harris’s robust showing fuelled expectations of a decline in interest rates, whereas investors expect higher spending that would boost rates if Trump wins.

Bond yields move inversely to prices.

Ten-year Treasury yields declined to a session trough of 3.609%, the lowest since June 2023, while Germany’s 10-year yield, the benchmark for the euro zone bloc, fell 2.5 basis points (bps) to 2.12%, a fresh one-month low.

Harris’ late entry in the presidential race after President Joe Biden’s withdrawal in July has tightened the race, and her strong debate performance continued a reversal of trades that were put in place on expectations of a second Trump presidency.

S&P 500 futures eased 0.36% and MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 0.3%.

European shares were the bright spot, with the pan-European STOXX 600 index was edging up 0.07%, boosted by the oil and gas sectors on concerns that Hurricane Francine would disrupt output in the U.S.

Investors were focusing on fiscal policies and plans for the economy from the candidates but the presidential debate was light on details, although betting markets swung in Harris’ favour after the event. In a boost to the Harris campaign, pop megastar Taylor Swift said she would back Harris in the Nov. 5 election.

“With the dust settling on the Trump vs Harris presidential debate, it’s clear that the market saw this debate going to Kamala Harris,” said Chris Weston, head of research at Pepperstone.

“This debate was never going to be an exercise in digging deep into the weeds and into the granularity of the respective policies, and we’re certainly not significantly wiser on that front.”

The dollar index, which measures the U.S. currency against six peers, was down 0.3% at 101.39.

“You’d expect if he (Trump) was doing better, that you’d see a strong dollar coming out of this. So I suppose that’s the way the market is looking at it. It’s a slight lean towards Harris,” said Rob Carnell, ING’s regional head of research for Asia-Pacific.

The yen strengthened more than 1% to 140.71 per dollar, the highest since late December, boosted also by comments from Bank of Japan board member Junko Nakagawa.

Nakagawa reiterated in a speech that the central bank would continue to raise interest rates if the economy and inflation move in line with its forecasts.

Shares of U.S. cryptocurrency and blockchain-related companies declined in premarket trading, tracking losses in bitcoin which fell 2%. Speaking at the Bitcoin 2024 convention in Nashville in July, Trump had positioned himself as the pro-cryptocurrency candidate.

INFLATION WATCH

Investors are now focusing on the U.S. Labor Department’s consumer price index report later on Wednesday for policy clues, although the Federal Reserve has made it clear employment has taken on a greater focus than inflation.

The headline CPI is expected to have risen 0.2% on a month-on-month basis in August, according to a Reuters poll, unchanged from the previous month.

While the Fed is widely expected to cut interest rates next week, the size of the rate cut is still up for debate, especially after a mixed labour report on Friday failed to provide clarity on which way the central bank could go.

“What we needed to see to spur the Fed into greater action would be much more obvious evidence of slowdown/recession, and in particular in the labour market. And I don’t think we saw that in the last payrolls report,” said ING’s Carnell.

Markets are currently pricing in a 65% chance of the U.S. central bank cutting rates by 25 basis points, while a 35% chance is ascribed for a 50 bps cut when the Fed delivers its decision on Sept. 18, CME FedWatch tool showed.

In commodities, oil prices gained after dropping over 3% in the previous session, as a drop in U.S. crude inventories and concern about Hurricane Francine disrupting U.S. output countered concerns about weak global demand.[O/R]

Brent crude futures rose 1.47% to $70.21 a barrel, and U.S. West Texas Intermediate (WTI) crude rose 1.73% to $66.88.

(Reporting by Ankur Banerjee and Lawrence White; Editing by Shri Navaratnam, Jacqueline Wong and Kim Coghill)

Why ExxonMobil Stock Is Slipping Today

Shares of ExxonMobil (NYSE: XOM) were falling this morning and were down 3.1% as of 11:50 a.m. ET Tuesday, wiping out all of their gains and some from the previous day. Although the oil and gas stock typically mirrors movements in crude oil prices, there’s another reason why ExxonMobil was falling today.

Oil price volatility is hurting investor sentiment

Crude oil prices tumbled Tuesday morning after OPEC cut its global oil demand forecast for 2024 to about 2 million barrels per day (BPD), or roughly 80,000 BPD lower than its previous forecast. OPEC also revised its forecast for oil demand for 2025. Brent crude, the global oil price benchmark, slumped more than 3% this morning and slipped below the $70 mark to a low it hasn’t seen in more than a year. As one of the world’s largest oil producers, ExxonMobil’s earnings and cash flows are bound to be hit when oil prices dip.

Meanwhile, ExxonMobil has reportedly pulled out of a race to buy a stake in a promising oil discovery in Namibia, according to Reuters. ExxonMobil is among the several global oil and gas giants eyeing a piece of Galp Energia‘s asset. Galp owns an 80% stake in an oil block in the Orange Basin, a region where several oil large discoveries have been reported in recent years.

What should you do with ExxonMobil stock now?

On one hand, OPEC’s demand for oil is weakening. On the other, speculation is rife that the OPEC+ producers will likely hike production in the coming months. The two factors combined could continue to put pressure on oil prices, and therefore, ExxonMobil stock.

However, the last thing you should do now is panic-sell ExxonMobil stock. ExxonMobil has navigated some of the worst oil storms in the 135 years or so of its existence and has built a fortress of a balance sheet. The oil giant has increased its dividend for 41 consecutive years and should still be able to offer you a bigger dividend this year and beyond even if oil prices drop further. In fact, ExxonMobil is a rock-solid dividend stock to buy on all dips.

Should you invest $1,000 in ExxonMobil right now?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why ExxonMobil Stock Is Slipping Today was originally published by The Motley Fool

Halberd Partnership Secures Contract from Defense Atomics Corporation to Address Brain Injury and PTSD

JACKSON CENTER, Pa., Sept. 11, 2024 (GLOBE NEWSWIRE) — Halberd Corporation HALB, in coordination with Athena Telemedicine Partners (ATP) and Athena GTX, Inc., is pleased to announce a substantial contract award commitment. Defense Atomics Corporation agreed to engage with the Halberd/Athena teams and to fund key advanced research, including the pending FDA IND study utilizing Halberd’s LDX technology and Athena Corporation’s WatchDawg™ monitoring technology.

Defense Atomics Corporation agreed to use its proprietary CRISPR/Nanotechnology Stem Cell treatment for PTSD/TBI in a minimum of 10 paid veterans in a government pilot study of this cutting-edge protocol. Based on Defense Atomics’ success using CRISPR methodology with overseas patients, this study is intended to substantiate the benefits of this technology in conjunction with Halberd/Athena’s LDX PTSD and TBI/Brain Injury protocol.

“While we have observed statistically compelling results in PTSD/TBI management using CRISPR,” says CEO Dr. Gabe Vlad of Defense Atomics Corp., “the ability to significantly integrate our treatment protocols with those of Halberd/Athena’s medication and monitoring technologies is quite attractive. The WatchDawg monitoring allows us to acquire near real time (NRT) objective data with respect to the administration of CRISPR. From the preliminary data, there’s no question that the LDX formulation adds clear adjunctive relief.”

Dr. Mark Darrah, of Athena GTX added: “The early results of WatchDawg in LDX therapy are compelling and show that dovetailing therapies of many different forms with real data in brain health studies may hold the key to FDA clearance.” He added, “It is much harder to argue against near real time data as opposed to mere recollections of subjective observations alone.”

“We look forward to expanded use of LDX, and now that we can actually see the results documented by the WatchDawg technology in military veterans, the benefit in many modalities is limitless,” says CEO of Halberd Corporation, William A. Hartman. Hartman continued, “Having commercial packaging of LDX and potentially CRISPR will allow us to market to physician groups even without formal FDA approval under current compounding laws, particularly with our access to, and relationships with, reputable and qualified compounding facilities. This product is useful for myriad disorders from PTSD, anxiety, depression, anger and addiction, to Chronic Covid, Alzheimer’s, Chronic Kidney Disease (CKD), diabetes, and others. It has been shown to be remarkably without side-effects. These benefits are unique and extremely important to a successful endeavor. We now have a large quantity of commercially available product (LDX), enabling our team to aggressively market LDX to physician groups, hospitals, rehab centers…and something we haven’t discussed and will expand on shortly, animal hospitals and clinics. This finally gives us great potential for real income and a go-to-market capability with actual product. This cannot at this point go directly to consumers, and must go through physicians, which is a potential market. Until then, the physician will be highly incentivized to utilize LDX, so that’s a plus.”

“While CRISPR is limited in FDA usage in the United States,” ATP’s Dr. Richard Goulding explains, “the FDA is looking for well-conceived studies to prove efficacy, particularly in areas where little to no other remedy is offered (Right to Try). LDX alone should be a go-to adjunct to all patients with anxiety and PTSD,” says Dr. Goulding, adding, “we welcome the opportunity to clinically verify it.”

Dr. Vlad added: “I have analyzed the preliminary data offered by the first tranche of patients from the WatchDawg pilot study, and realized that this is clearly the best fit for further research and justification for our CRISPR technology to be used in PTSD and those suffering brain injury. With WatchDawg, we can prove efficacy, or at least support it, all while demonstrating safety and efficacy from initial therapeutic intervention forward. What’s exciting to me is the ability to see, thanks to the WatchDawg monitoring technology, real-time therapeutic effects on the individual. With WatchDawg, we would know immediately when something is working or not working, while quantitatively providing real-time data. That’s a game changer. We have recently been awarded significant cash contracts and are thrilled to be able to have the funds to engage in this exciting trial with our new partners. Helping veterans suffering from suicidal ideation and PTSD has always been my fondest wish, especially since I am myself a veteran.”

Dr. Vlad reports that “Defense Atomics Corp. successfully engineered specialty proprietary stem cells for this endeavor. Essentially what CRISPR does is to collect and utilize the patient’s own blood and performs an extremely unique proprietary gene-editing process combined with stem cells to facilitate their goals. Historical results on patients have been quite compelling. I am committed to funding this study with Halberd/Athena. There are still significant regulatory hurdles to overcome, but we have the right personnel on board now to navigate these hurdles. Obviously, the key is to get the FDA the data and information they need to move this treatment forward. We also want veterans suffering from PTSD to have LDX available to them at low cost, so their medical teams can procure it from our existing charity, Stemofhope.com, since we have a commercial quantity of LDX available and all of the high-tech products utilized in the WatchDawg program monitoring platforms.”

How large is the Market?

Databridgemarketresearch.com reports the global market for Post-Traumatic Stress Disorder (PTSD) treatments experienced steady growth. As of 2022, the market was valued at approximately $750.3 million and is projected to reach about $1.04 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.1%. Grandviewresearch.com estimates the market size at $915.5 million in 2021, with an expected CAGR of 4.7% from 2022 to 2030. The PTSD market’s expansion is driven by factors such as the increasing prevalence of PTSD, rising awareness and diagnosis rates, and ongoing research and development for new treatments. CRISPR tuned into this need. The demand for better therapeutic options also contributes to this growth. This the new partnership is excitingly dialed in on the market projections and technology demands and poised to prove the efficacy of the multiplicity of treatment modalities. Indeed, knowing that some approaches may better suit some patients, this particular combination of efficacious approaches should inevitably enhance the prospects for success.

The global market for Traumatic Brain Injury (TBI) treatments and management devices is even more substantial and growing at a faster rate, as we discover that the number of victims is far greater than we thought. As of 2022, the market for TBI assessment and management devices according the grandviewresearch.com was valued at approximately $3.09 billion and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030.

In terms of TBI treatments, the market as described by databridgemarketresearch.com was valued at around $3.46 billion in 2022 and is projected to reach approximately $5.53 billion by 2030, with a CAGR of 6.2% during the forecast period. Marketdataforecast.com bolstered these numbers reporting that the market could grow from $1.88 billion in 2024 to $2.90 billion by 2029, reflecting a CAGR of 9.12%.

The growth in this market is driven by factors such as the increasing prevalence of TBIs, advancements in medical technology, and rising awareness about alternatives in brain injury treatments. “Additionally, the demand for minimally invasive procedures and growingly more supportive government policies on revolutionary treatments and monitoring technologies are contributing to this expansion. Again, by dialing into these needs and demands we feel the technology of CRISPR and WatchDawg (which of course includes the LDX therapy) packaged together offer an exciting future,” relayed Athena GTX’s CEO, Dr. Mark Darrah.

To get the latest on Halberd’s exciting developments, subscribe by submitting this form.

(https://halberdcorporation.com/contact-us/).

For more information please contact:

William A. Hartman

w.hartman@halberdcorporation.com

support@halberdcorporation.com

www.halberdcorporation.com

Twitter:@HalberdC

About Defense Atomics

Defense Atomics engages in advanced research and development for the defense aerospace industry. It is involved in nanotechnology, aerospace engineering, algorithm design and graphene research and development for aerospace systems, body armor, batteries. It is headed by PhD Dr Gabe Vlad who holds numerous patents and performed advanced research and development for a large number of government contracts mostly focused on aerospace, weapons systems, nanotechnology and other secret/classified systems. Nanotechnology expertise is an integral part of CRISPR technology. His government contacts make him a particularly valuable resource with regard to several of Halberd’s initiatives.

About Athena GTX, Inc.

Athena GTX is a certified DoD small business with Corporate Headquarters in Johnston, Iowa. Athena focuses development on wearables and highly mobile, wirelessly connected monitoring technologies, and transitioning those to key markets to meet unmet needs of first responders worldwide. Wireless Patient Monitoring – Athena GTX connects patient and provider About – Athena GTX® Inc.

About Halberd Corporation.

Halberd Corporation HALB, is a publicly traded company on the OTC Market, and is in full compliance with OTC Market reporting requirements. Since its restructuring in April of 2020, Halberd has obtained exclusive worldwide rights to three issued patents and has filed 22 related provisional, PCT, or utility patent applications to enhance its value to its stockholders and to attract the interests of potential development partners. Halberd’s policy for responding to individual shareholder questions is to be responsive, while refraining from providing information which relates to or could compromise any information pertaining to trade secrets or that may otherwise compromise our competitive advantages. Simultaneously with such disclosure or potential disclosure, Halberd will make the responsive information public through a tweet, press release or some other form of social media/mass media communication.

Safe Harbor Notice

Certain statements contained herein are “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995). The Company’ cautions our readers that statements, and assumptions made in this news release constitute forward-looking statements and makes no guarantee of future performance. Forward-looking statements are based on estimates and opinions of management at the time the statements are made. These statements may address issues that involve significant risks, uncertainties and associated estimates made by management. Actual results could differ materially from current projections or implied results. Halberd Corporation undertakes no obligation to revise these statements following the date of this news release.

(C) 2024, Halberd Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

STAG INDUSTRIAL REFINANCES $1 BILLION UNSECURED CREDIT FACILITY

BOSTON, Sept. 10, 2024 /PRNewswire/ — STAG Industrial, Inc. (the “Company”) STAG today announced that it refinanced its $1 billion senior unsecured revolving credit facility. The refinanced revolving credit facility matures on September 8, 2028, with two six-month extension options, subject to certain conditions and no changes to pricing.

“This transaction was successful and resulted in extending our weighted average debt maturities,” said Matts Pinard, Chief Financial Officer of the Company. “We appreciate the support of our debt capital partners and look forward to working closely with them as we continue to drive growth further.”

Wells Fargo Securities, LLC served as Left Lead Arranger and Bookrunner, with BofA Securities, Inc. serving as a Joint Lead Arranger and Bookrunner. Bank of Montreal, Citibank, N.A, PNC Capital Markets LLC, Regions Capital Markets, TD Bank, N.A., The Huntington National Bank, Truist Bank, and U.S. Bank, N.A. served as Joint Lead Arrangers. Other lenders include Raymond James Bank, N.A., Royal Bank of Canada, and Associated Bank, N.A.

About STAG Industrial, Inc.

STAG Industrial, Inc. is a real estate investment trust focused on the acquisition, ownership, and operation of industrial properties throughout the United States. As of June 30, 2024, the Company’s portfolio consists of 573 buildings in 41 states with approximately 114.1 million rentable square feet.

For additional information, please visit the Company’s website at www.stagindustrial.com.

Forward-Looking Statements

This press release, together with other statements and information publicly disseminated by the Company, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “believe,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “should,” “project” or similar expressions. You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond the Company’s control and which could materially affect actual results, performances or achievements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, the risk factors discussed in the Company’s annual report on Form 10-K for the year ended December 31, 2023, as updated by the Company’s quarterly reports on Form 10-Q. Accordingly, there is no assurance that the Company’s expectations will be realized. Except as otherwise required by the federal securities laws, the Company disclaims any obligation or undertaking to publicly release any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions, or circumstances on which any such statement is based.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/stag-industrial-refinances-1-billion-unsecured-credit-facility-302244021.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/stag-industrial-refinances-1-billion-unsecured-credit-facility-302244021.html

SOURCE STAG Industrial, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TTDKY or NVT: Which Is the Better Value Stock Right Now?

Investors interested in stocks from the Electronics – Miscellaneous Components sector have probably already heard of TDK Corp. TTDKY and nVent Electric NVT. But which of these two stocks is more attractive to value investors? We’ll need to take a closer look to find out.

We have found that the best way to discover great value opportunities is to pair a strong Zacks Rank with a great grade in the Value category of our Style Scores system. The Zacks Rank favors stocks with strong earnings estimate revision trends, and our Style Scores highlight companies with specific traits.

Right now, TDK Corp. is sporting a Zacks Rank of #1 (Strong Buy), while nVent Electric has a Zacks Rank of #3 (Hold). This means that TTDKY’s earnings estimate revision activity has been more impressive, so investors should feel comfortable with its improving analyst outlook. But this is just one piece of the puzzle for value investors.

Value investors also tend to look at a number of traditional, tried-and-true figures to help them find stocks that they believe are undervalued at their current share price levels.

The Style Score Value grade factors in a variety of key fundamental metrics, including the popular P/E ratio, P/S ratio, earnings yield, cash flow per share, and a number of other key stats that are commonly used by value investors.

TTDKY currently has a forward P/E ratio of 16.19, while NVT has a forward P/E of 19.01. We also note that TTDKY has a PEG ratio of 0.58. This popular figure is similar to the widely-used P/E ratio, but the PEG ratio also considers a company’s expected EPS growth rate. NVT currently has a PEG ratio of 1.19.

Another notable valuation metric for TTDKY is its P/B ratio of 2.20. Investors use the P/B ratio to look at a stock’s market value versus its book value, which is defined as total assets minus total liabilities. By comparison, NVT has a P/B of 3.14.

These metrics, and several others, help TTDKY earn a Value grade of B, while NVT has been given a Value grade of C.

TTDKY is currently sporting an improving earnings outlook, which makes it stick out in our Zacks Rank model. And, based on the above valuation metrics, we feel that TTDKY is likely the superior value option right now.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NICE Wins Pinal County Deal: Should You Buy, Hold or Sell the Stock?

Nice NICE shares have risen 4.3% in the past month, outperforming the Zacks Computer & Technology sector’s decline of 2.2%.

The upside can be attributed to Nice’s diverse portfolio, which is helping it gain new customers. Actimize, Evidencentral, CXone and Inform Elite are some of the solutions that have been gaining popularity. NICE’s focus on its Evidencentral platform has been a key catalyst.

Nice recently announced that the Pinal County Attorney’s Office in Arizona would be adopting its NICE Justice digital evidence management solution, part of the AI-driven Evidencentral platform.

The latest development aims to transform how the office handles digital evidence, providing a streamlined, cloud-based system that enhances efficiency and service delivery.

Robust Portfolio Boosts Nice’s Prospects

NICE’s expanding portfolio has been a major growth driver of its success. In August, NICE announced that the Augusta (Georgia) Judicial Circuit DA’s Office would deploy NICE Justice to expedite case processing and enhance digital evidence management.

Nice has a diverse portfolio, which is helping it gain new customers. Its partnerships with AT&T T and Microsoft have been a key catalyst.

NICE recently expanded its collaboration with AT&T to offer a unified incident capture and data analytics solution for NextGen 9-1-1 centers, showcasing it at APCO 2024.

A deepening partnership with Microsoft is noteworthy. NTR-X Compliance Recording and Assurance Solution has secured transactable solution status in Microsoft’s Azure Marketplace.

NICE’s expanding cloud offerings, mainly its CXone platform, are a plus. During the second quarter of 2024, it reported cloud revenues of $482 million, up 26% year over year.

NICE’s policy of frequently updating its portfolio has been a key catalyst as it aids in fending off competitors from other industry players like Five9 FIVN, Salesforce and 8X8, who are also expanding their portfolio in the CX market.

In June, Five9 announced an enhanced collaboration with Salesforce, integrating AI-powered solutions to improve customer experiences in contact centers.

NICE’s Q3 Guidance Positive

Nice’s efforts to enhance its customer experience with its robust cloud solutions are expected to drive top-line growth.

For the third quarter of 2024, NICE projects non-GAAP revenues to be between $676 million and $686 million, calling for 13% year-over-year growth at the midpoint. Non-GAAP earnings are estimated in the $2.62-2.72 per share band, suggesting 18% year-over-year growth at the midpoint.

The Zacks Consensus Estimate for revenues is pegged at $682.67 million, indicating 13.52% growth year over year. The consensus mark for earnings is pegged at $2.68 per share, increased by a penny over the past 30 days, indicating an 18.06 % year-over-year increase.

Here’s What Investors Should do With NICE Stock

Despite Nice’s strong portfolio and growing client base, the foreign exchange headwinds in the APAC market and stiff competition are major concerns.

The forward 12-month Price/Sales ratio for Nice stands at 4.18, higher than its Zacks Computers – IT Services sector’s 2.99, reflecting a stretched valuation.

Nice currently carries Zacks Rank #3 (Hold), which suggests that it may be wise to wait for a more favorable entry point in the stock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Massive Insider Trade At IDEXX Laboratories

A substantial insider sell was reported on September 9, by M. Anne Szostak, Director at IDEXX Laboratories IDXX, based on the recent SEC filing.

What Happened: After conducting a thorough analysis, Szostak sold 500 shares of IDEXX Laboratories. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total transaction value is $234,686.

During Tuesday’s morning session, IDEXX Laboratories shares up by 2.4%, currently priced at $491.85.

All You Need to Know About IDEXX Laboratories

Idexx Laboratories primarily develops, manufactures, and distributes diagnostic products, equipment, and services for pets and livestock. Its key product lines include single-use canine and feline test kits that veterinarians can employ in the office, benchtop chemistry and hematology analyzers for test-panel analysis on-site, reference lab services, and tests to detect and manage disease in livestock. The firm also offers vet practice management software and consulting services to animal hospitals. Idexx gets close to 35% of its revenue from outside the United States.

A Deep Dive into IDEXX Laboratories’s Financials

Revenue Growth: IDEXX Laboratories’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 6.35%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Exploring Profitability:

-

Gross Margin: The company maintains a high gross margin of 61.7%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): IDEXX Laboratories’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 2.46.

Debt Management: IDEXX Laboratories’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.68, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 47.7 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 10.65 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 33.07, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of IDEXX Laboratories’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock is on track to double in coming years as AI follows the path of past tech bubbles, portfolio manager says

-

Nvidia stock has a lot more room to run, according to Dan Niles.

-

The Niles Investment founder compared Nvidia to Cisco prior to the peak of the dot-com bubble.

-

Nvidia shares could double in the next couple of years, he predicted.

Nvidia stock has slid since the company reported earnings last month, but its rally is nowhere close to over.

That’s according to Dan Niles, founder and portfolio manager of Niles Investment Management, who’s still bullish on the artificial intelligence titan for the foreseeable future.

That’s because firms are still willing to shell out on AI spending — and Nvidia looks like it’s following the same pattern as other firms that soared during past tech bubbles, he told CNBC in a recent interview.

“I still believe you have a lot of room for spend,” Niles said of AI. “What I’m saying is that in the short term, I think you’ve got a digestion phase that you just have to go through. I firmly believe that in the next several years, Nvidia’s revenues will again be able to double from current levels, and the stock will be able to double as well.”

Cisco, which dominated the internet bubble in the late nineties, saw its revenue peak at around 15 times what it posted in 1994, while its stock had soared nearly 4,000% from that year through 2000. It plunged during the dot-com crash, with shares plummeting around 85% peak-to-trough.

Nvidia shares, by comparison, have risen around 1,500% over the last six years. Niles suggested that this could mean the chipmaker has more upside ahead before a fallout.

“I’ve lived through ’01, ’02. These things can go on longer than you’ve ever imagined possible,” he added.

In the short term, Niles’ forecast is at the high end among analysts watching Nvidia. But most of Wall Street remains optimistic about the chipmaker in the quarters ahead, especially as the company looks poised to roll out its next-gen Blackwell AI chip.

Analysts have an average price target of $153.24 a share, according to Nasdaq data, implying another 44% upside from its current levels.

The chipmaker has hit a rough stretch in recent weeks, with shares dropping 27% from their peak earlier this summer.

Investors have been dismayed by the delay of the Blackwell chip, but more importantly, many are also questioning whether all of the billions of AI spending by Nvidia’s customers will end up generating a return anytime soon.

Read the original article on Business Insider