Hindenburg Research Issued a Scathing Short Report on Super Micro Computer. This Is What Happened to 3 Other Big Stocks It Targeted.

A short-seller’s report can spell disaster for a stock, especially when it is first released. Questions and doubts can arise about the underlying business, and whether it’s a safe stock to own. In many cases, investors head for the exits and sell rather than hold on and wait to see if the claims are true.

Hindenburg Research is a notable short-seller and it recently released a scathing report on Super Micro Computer. (Short-sellers make money when a stock falls, so investors reading their reports always need to keep that bias in mind.) The company provides businesses with servers and crucial IT infrastructure that has been in hot demand in recent quarters amid the growing excitement surrounding artificial intelligence (AI). And that has allowed its stock to generate significant returns along the way. Unfortunately, the short report has created a cloud of uncertainty around the business and has made investors think twice about buying shares of the tech company.

Short-seller reports can, however, be biased and misleading, and making hasty decisions based on them can prove costly for investors. This is by no means the first time Hindenburg has targeted a high-profile stock. Below, I’ll look at some of the more notable reports it has issued in the past couple of years, and see how the stocks have performed since then.

Clover Health

In 2021, Hindenburg released a report bashing Clover Health Investments (NASDAQ: CLOV), a special purpose acquisition corporation (SPAC) that went public earlier in the year. SPACs have gotten a bad rap in recent years as being risky investments, and Hindenburg wasted no time in going after the company, alleging at the time that the Department of Justice (DOJ) was investigating Clover Health. Last year, the company did end up settling lawsuits related to misleading investors. Clover Health admitted that the DOJ did make inquiries about its business but that they were not out of the ordinary, and that it wasn’t required to disclose them to investors.

Since the short-seller report came out in February 2021, the healthcare stock has crashed by approximately 80%. But it’s likely the stock would have crumbled with or without the short-seller report. SPACs have generally struggled in recent years as their sky-high expectations have failed to materialize.

Clover Health was risky back in 2021 and it remains that way today; in the trailing 12 months, the Medicare Advantage provider has incurred losses totaling $123.7 million. Its incredibly thin gross profit margin of 15% will make it difficult for the company to turn a profit on a consistent basis.

DraftKings

In the era of meme stocks and risky investments in 2021, Hindenburg went after another big-name SPAC, DraftKings (NASDAQ: DKNG). The gambling company represents an intriguing growth stock as many states have been legalizing gambling in recent years. Hindenburg, however, alleged that by merging with SBTech through the SPAC, DraftKings was getting involved with a gaming technology company that had a track record for operating in black markets where gambling was illegal (estimating that as much as half of SBTech’s revenue came from such markets).

The claims weren’t proven in court and DraftKings would end up winning a class action lawsuit which investors had brought against the company related to Hindenburg’s allegations. The judge didn’t see much grounds for the suit as it was based primarily on the Hindenburg report, which relied heavily on anonymous sources.

The report came out in June 2021 and shares of DraftKings have fallen around 30% since then. For the most part, however, investors appear to have moved past the negative press as nothing significant has materialized from the short-seller’s claims; the stock has rallied 16% in the past 12 months. A spokesperson from DraftKings stated that the report was biased and that the company did not see any issues when completing its merger with SBTech. “We conducted a thorough review of their business practices and we were comfortable with the findings.”

DraftKings has been generating good growth numbers but it remains a risky buy as it still struggles with profitability. The positive, however, is that the company cut its operating loss in half last quarter to $32.4 million while growing its top line by 26% to $1.1 billion. It is one of the more popular gambling stocks to buy, but investors should tread carefully with it as it still has a long way to go in being a safe investment.

Block

Last year, Hindenburg went after Block (NYSE: SQ), alleging that the payments company “inflated user metrics” and that “criminal activity and fraud ran rampant on its platform.” Block responded, saying that the findings were “inaccurate and misleading,” stating that it routinely checks for fraud and illicit activity and estimated that just 2.4% of its Cash App transactions in 2022 had to be blocked by its compliance teams. While there was an initial drop in the stock following the short-seller report, shares of Block would end up recovering and they have risen by around 7% since then. This recent short report against Block isn’t all that old, but there haven’t been any developments to suggest that its claims are true.

The bigger problems facing the company today are arguably an influx of competing payment options for consumers, which could limit Block’s growth opportunities, plus its exposure to Bitcoin. Bitcoin-related revenue makes up more than 42% of its top line but the gross profit margin is minimal (less than 3%), making it a questionable and highly speculative area to focus on. Block’s focus on Bitcoin makes it a risky stock to own, one that’s likely going to be mainly attractive to crypto investors.

Investors should take short reports with a grain of salt

Short-sellers can earn considerable profits if a stock they have a short position in falls in value. Investors should always keep this in mind with any short report, as the authors could stand to benefit significantly from a sell-off. Short reports are also often biased and present limited views of the business. The claims can seem disastrous for a business but they may not necessarily be true (and often aren’t).

Shares of Super Micro Computer are down more than 20% since the release of the short report. There could be more headwinds for the stock as investors have been a bit more bearish of late on AI stocks, but overall, investors shouldn’t expect the short report to weigh on the stock in the long run. Ultimately, how it performs will come down to how well the company is able to continue to grow its top and bottom lines.

In the end, investors should always do their own analysis and have their own reasons for investing in a stock, which goes beyond just a single report — regardless of whether it is good or not.

Should you invest $1,000 in DraftKings right now?

Before you buy stock in DraftKings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and DraftKings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and Block. The Motley Fool has a disclosure policy.

Hindenburg Research Issued a Scathing Short Report on Super Micro Computer. This Is What Happened to 3 Other Big Stocks It Targeted. was originally published by The Motley Fool

3 Incredible Dividend Growth Stocks That Can Provide a Lifetime of Passive Income

Passive income is crucial for maintaining your lifestyle in retirement, especially given the uncertain future of Social Security benefits. The Office of Retirement and Disability Policy, part of the Social Security Administration, projects that by 2037, the program’s trust fund reserves might be exhausted, potentially reducing scheduled benefits to 76% of their current levels. This looming challenge underscores the importance of building alternative income streams for retirees.

As a result, many investors turn to dividend stocks as a cornerstone of their retirement income strategy. However, not all dividend-paying companies offer the same potential for stable, growing income.

The most attractive dividend stocks share three key characteristics: payout ratios below 50%, dividend growth rates exceeding 6%, and capital appreciation that keeps pace with the broader market. These traits often indicate thriving businesses with strong cash flows and shareholder-friendly management teams — precisely the type of companies that can provide a reliable, growing income stream for retirees.

Here is a nuts-and-bolts overview of three tier 1 dividend growth stocks that tick these boxes, making them prime contenders for a passive income portfolio with a long-term focus.

1. Lowe’s: The home improvement giant that keeps on giving

Lowe’s Companies (NYSE: LOW) is a leading home improvement retailer, operating over 1,700 stores across North America. The company offers a wide range of products for construction, maintenance, and remodeling, catering to both do-it-yourselfers and professional contractors. Lowe’s business model benefits from the ongoing demand for home improvement and its strong brand recognition.

It has a blistering 15.2% 10-year dividend growth rate, one of the highest among large-cap equities. With a payout ratio of just 36.7%, the company maintains a significant margin of safety for income investors, ensuring the sustainability of its dividend even in the face of economic shocks.

This buffer dramatically reduces the risk of dividend cuts or suspensions, allowing investors to benefit from uninterrupted compounding. Lowe’s has also aggressively reduced its share count by 41% over the past decade, effectively boosting per-share earnings and dividend growth.

The stock’s forward price-to-earnings ratio (P/E) of 20.4 compares favorably to the broader market, as represented by the S&P 500, which trades at 22.5 times 2025 projected earnings. This lower valuation could amplify returns in a marketwide tilt toward value.

Lastly, Lowe’s 1.89% dividend yield is above average for its peer group, a feature that enhances its ability to build an income snowball when held over a 10- to 20-year time span.

2. Lockheed Martin: A defensive play with stable returns

Lockheed Martin (NYSE: LMT) is a global aerospace and defense company, specializing in the design, development, and manufacturing of advanced technology systems. The company’s diverse portfolio includes military aircraft, missile systems, and space technologies. Lockheed Martin’s core business model revolves around long-term government contracts, providing a stable revenue stream and visibility into future earnings.

The company has a solid 7.7% 10-year dividend growth rate, which is unusually generous for a company of Lockheed’s size. With a payout ratio of 45.1%, Lockheed Martin offers prospective income investors a robust safety net, making it highly unlikely the company will reduce or suspend its dividend even during serious economic downturns. This reliability ensures consistent compounding for long-term investors.

Lockheed’s commitment to shareholder returns is further evident in its 22% reduction in share count over the past decade, effectively boosting per-share earnings and ramping up its dividend growth.

The stock’s forward P/E of 19.9 sits slightly below that of the broader market. However, Lockheed Martin’s dividend yield of 2.22% is substantially higher than the S&P 500’s average of 1.35%. This higher-yield, top-tier dividend growth rate and low payout ratio make the stock attractive for investors looking to build a steadily growing passive income stream.

3. Target: Bull’s-eye for dividend growth

Target (NYSE: TGT) is a major retailer, operating a chain of discount stores across the United States. The company offers various merchandise, including clothing, electronics, and groceries. Target’s business model focuses on providing a superior shopping experience through competitive pricing, trendy product offerings, and a strong omnichannel presence.

Target is a dividend growth powerhouse with an incredible 10% 10-year dividend growth rate. The retailer’s 45.4% payout ratio also provides a considerable cushion for income seekers, significantly reducing the risk of a dividend cut even in a challenging economy.

Over the past decade, Target has reduced its share count by 27.7%, boosting shareholder value and supporting its aggressive dividend growth. The stock’s forward P/E of 16.3 represents a significant discount compared to the S&P 500.

Target’s dividend yield of 2.96% is also more than double the S&P 500’s average of 1.35%, offering a compelling income proposition for dividend-focused investors. This relatively high yield, coupled with Target’s scorching dividend growth rate and modest payout ratio, makes it an ideal choice for a passive income portfolio.

Top picks for a passive income portfolio

These three dividend growth stocks –Lowe’s, Lockheed Martin, and Target –offer investors a powerful combination of current income, long-term sustainability, and above-average dividend growth. As a bonus, all three dividend payers have outperformed the benchmark S&P 500 over the prior 10-year period in terms of total returns (including dividends and assuming reinvestment), showcasing the power of the dividend growth strategy and compounding returns.

These elite dividend growers thus scan as top picks for a long-term-focused passive income portfolio.

Should you invest $1,000 in Lowe’s Companies right now?

Before you buy stock in Lowe’s Companies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lowe’s Companies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

George Budwell has positions in Target. The Motley Fool has positions in and recommends Target. The Motley Fool recommends Lockheed Martin and Lowe’s Companies. The Motley Fool has a disclosure policy.

3 Incredible Dividend Growth Stocks That Can Provide a Lifetime of Passive Income was originally published by The Motley Fool

Joseph Wm Foran Takes a Bullish Stance: Acquires $128K In Matador Resources Stock

Disclosed in the latest SEC filing, a significant insider purchase on September 10, involves Joseph Wm Foran, Chairman and CEO at Matador Resources MTDR.

What Happened: Foran’s recent purchase of 2,500 shares of Matador Resources, disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, reflects confidence in the company’s potential. The total transaction value is $128,675.

Matador Resources‘s shares are actively trading at $49.18, experiencing a down of 1.38% during Tuesday’s morning session.

About Matador Resources

Matador Resources Co is an independent energy company engaged in the exploration, development, production, and acquisition of oil and natural gas resources. The majority of the company’s assets are located in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. Along with maintaining a portfolio of oil and natural gas properties, Matador works to identify and develop midstream opportunities that support and enhance its exploration and development business.

Unraveling the Financial Story of Matador Resources

Positive Revenue Trend: Examining Matador Resources’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 31.59% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Key Insights into Profitability Metrics:

-

Gross Margin: Achieving a high gross margin of 46.88%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Matador Resources’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.83.

Debt Management: Matador Resources’s debt-to-equity ratio is below the industry average. With a ratio of 0.44, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 6.42, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 1.86, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 3.71 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Breaking Down the Significance of Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Matador Resources’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Down as Focus Turns to US CPI, Yen Surges: Markets Wrap

(Bloomberg) — Stocks traded mixed ahead of a key inflation report amid concern the Federal Reserve has waited too long to ease monetary policy. Bonds rose.

Most Read from Bloomberg

Worries over slowing growth in major economies have resurfaced with oil trading below $70 and global bond yields retreating to a two-year low this week. Investors’ attention is on the US consumer price index due later Wednesday — expected to show another month of muted increases — and the Fed policy meeting next week.

“Downside volatility” is possible if Wednesday’s inflation print comes in hot, given the market’s expectations for aggressive cuts, said Sameer Samana at Wells Fargo Investment Institute. “A cooler print has more two-way risk as it creates more room for the Fed to cut, but may also indicate the economy is slowing faster than anticipated.”

Traders in the US interest-rate options market are still betting on at least one 50 basis-point Fed rate cut this year — just probably not before the Nov. 5 election. The yield on the two-year Treasury benchmark fell four basis points to 3.56%.

Market responses to Tuesday’s debate between Vice President Kamala Harris and former President Donald Trump were limited. Betting markets shifted in Harris’ favor, a signal that many expect her candidacy to earn a boost from Tuesday’s proceedings. Her odds of winning the election increased on the betting website PredictIt to 56%, compared with 53% before the debate.

The European stocks benchmark ticked higher while S&P 500 futures slipped 0.3%. Stocks in renewable energy producers rose, gaining strength from the debate and Harris’ advocacy of green energy. Meanwhile, Trump’s support of the crypto sector fueled a pullback in the price of Bitcoin, and a gauge of the dollar also retreated.

“Markets may want to wait on new opinion polls in the coming days to take more decisive positions on the election,” ING Groep NV currency strategists including Francesco Pesole wrote in a note to clients. “For now, indications that Harris won this debate, even if by a small margin, can keep a lid on the dollar.”

The threat of far-reaching tariffs is shaping up to be among the biggest risks to markets. While Trump placed tariffs on more than $300 billion of Chinese goods as president and sought to block countries from buying Huawei Technologies Co. equipment for 5G networks, Harris’ stance is lesser known after she joined the ticket late.

“Historically I would have said: don’t waste too much time thinking about a presidential election,” said Ronald Temple, chief strategist at Lazard Asset Management. “But I think it is consequential because you are talking about a huge amounts of tariffs. Right now the market is not pricing a global trade war.”

West Texas Intermediate crude rebounded on Wednesday after plummeting as much as 5% in its previous session. Crude has tumbled by almost a fifth so far this quarter on concerns that slowing growth in the US and China, the leading consumers, will crimp demand at a time of robust and expanding supplies.

Key events this week:

-

US CPI, Wednesday

-

Japan PPI, Thursday

-

ECB rate decision, Thursday

-

US initial jobless claims, PPI, Thursday

-

hsu industrial production, Friday

-

Japan industrial production, Friday

-

U. Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.2% as of 10:16 a.m. London time

-

S&P 500 futures fell 0.3%

-

Nasdaq 100 futures fell 0.4%

-

Futures on the Dow Jones Industrial Average fell 0.4%

-

The MSCI Asia Pacific Index fell 0.4%

-

The MSCI Emerging Markets Index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.3%

-

The euro rose 0.2% to $1.1047

-

The Japanese yen rose 0.7% to 141.43 per dollar

-

The offshore yuan rose 0.3% to 7.1171 per dollar

-

The British pound rose 0.1% to $1.3096

Cryptocurrencies

-

Bitcoin fell 1.7% to $56,574.28

-

Ether fell 2% to $2,329.82

Bonds

-

The yield on 10-year Treasuries declined three basis points to 3.61%

-

Germany’s 10-year yield declined two basis points to 2.11%

-

Britain’s 10-year yield declined six basis points to 3.76%

Commodities

-

Brent crude rose 1.8% to $70.43 a barrel

-

Spot gold rose 0.3% to $2,523.48 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Masaki Kondo, Marcus Wong and Winnie Hsu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Evolution Petroleum Reports Fourth Quarter and Full Year Fiscal 2024 Results and Declares Quarterly Cash Dividend for the Fiscal 2025 First Quarter

– Fiscal Q4 Revenues Up 17% Y/Y to $21.2 Million –

– Fiscal Q4 Net Income Increases to $1.2 Million; Adjusted EBITDA up 72% Y/Y to $8.0 Million –

HOUSTON, Sept. 10, 2024 (GLOBE NEWSWIRE) — Evolution Petroleum Corporation EPM (“Evolution” or the “Company”) today announced its financial and operating results for its fiscal fourth quarter and full year ended June 30, 2024. Evolution also declared a quarterly cash dividend of $0.12 per common share for the fiscal 2025 first quarter.

Financial & Operational Highlights ($ in thousands)

| Q4 2024 | Q4 2023 | Q3 2024 | % Change Q4/Q4 |

% Change Q4/Q3 |

|

| Average BOEPD | 7,209 | 6,484 | 7,209 | 11% | —% |

| Revenues | $21,227 | $18,174 | $23,025 | 17% | (8)% |

| Net Income | $1,235 | $166 | $289 | 644% | 327% |

| Adjusted Net Income(1) | $1,093 | $166 | $978 | 558% | 12% |

| Adjusted EBITDA(2) | $8,037 | $4,672 | $8,476 | 72% | (5)% |

| Cash Flow from Operations | $7,987 | $(447) | 3,364 | NA | 137% |

(1) Adjusted Net Income is a non-GAAP financial measure; see the “Non-GAAP Information” section later in this release for more information, including reconciliations to the most comparable GAAP measures.

(2) Adjusted EBITDA is Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization and is a non-GAAP financial measure; see the “Non-GAAP Information” section later in this release for more information, including reconciliations to the most comparable GAAP measures.

- Participated in 3 new producing wells during the fiscal fourth quarter and 27 in fiscal 2024; 10 wells in progress subsequent to fiscal year-end.

- Returned $4.0 million to shareholders in the form of cash dividends during the fiscal fourth quarter of 2024 and $16.0 million for fiscal year 2024. The Company also declared its 44th consecutive quarterly dividend of $0.12 per common share, payable September 30th.

- Generated record oil revenues in fiscal year 2024.

- Generated record liquids (oil + NGLs1) revenue and production in fiscal year 2024.

- Proved oil reserves increased by 20% fiscal year-over-year.

Kelly Loyd, President and Chief Executive Officer, commented, “Following our record year of natural gas production and revenue in fiscal 2023, this fiscal year we recognized the importance of balancing our portfolio. This helped reduce exposure to natural gas price volatility while increasing our ability to participate in organic growth of reserves and production. As a result, we generated record liquids revenues and production for the year and completed two transformative transactions that added 6.6 MMBOE of proved reserves, with the majority of the locations yet to be booked. We expect these acquisitions to meaningfully contribute to cash flow and further support our dividend-focused policy over the next ten years.

“In Fiscal 2024, we added 300+ drilling locations in the SCOOP/STACK and 80+ drilling locations at Chaveroo, fundamentally strengthening and diversifying our organic growth portfolio. We participated in 22 SCOOP/STACK wells that, on average, are performing well above our original type curve projections. In Chaveroo, we partnered on our first 3 horizontal San Andres wells with early results exceeding our estimates. At Delhi, we worked with ExxonMobil to begin development of Test Site V with the first of 3 initial wells scheduled to be drilled by calendar year-end. This development drilling activity combined with the acquisition of SCOOP/STACK producing reserves enabled us to more than replace production despite the adverse impact of lower natural gas prices during the year.”

_______________________

1) Natural Gas Liquids.

Mr. Loyd concluded, “Looking ahead, we plan to continue executing our plans to deliver long-term shareholder value. We have diversified our asset base of long-lived, low-decline properties through acquisitions of proved developed reserves, bolstered with additional drilling locations, at attractive costs that were designed to support our dividend program, we expect, well into the future.”

Fiscal Fourth Quarter 2024 Financial Results

Total revenues increased 17% to $21.2 million compared to $18.2 million in the year-ago period. The improvement was driven by an increase in oil and NGL revenue, partially offset by lower natural gas revenue.

Lease operating costs (“LOE”) decreased to $11.4 million compared to $11.8 million in the year-ago period. On a per unit basis, total LOE decreased 13% to $17.39 per BOE compared to $20.02 per BOE last year. The decrease was driven by suspended CO2 purchases for the quarter due to maintenance on the pipeline that began in February 2024. CO2 purchases are expected to restart in the early second quarter of fiscal 2025.

Depletion, depreciation, and accretion expense was $5.3 million compared to $3.8 million in the year-ago period. On a per BOE basis, the Company’s current quarter depletion rate increased to $7.51 per BOE compared to $6.01 per BOE in the year-ago period due to an increase in depletable base related to the Company’s SCOOP/STACK acquisitions and capital development expenditures since the prior fiscal year, partially offset by an increase in proved reserves.

General and administrative (“G&A”) expenses decreased to $2.1 million compared to $2.3 million in the year-ago period. On a per BOE basis, G&A expenses were $3.22 compared to $3.84 in the year-ago period. The decrease was primarily due to a reduction in third-party consulting fees.

Net income increased 644% to $1.2 million or $0.04 per diluted share, compared to $0.2 million or $0.00 per diluted share in the year-ago period.

Adjusted EBITDA increased 72% to $8.0 million compared to $4.7 million in the year-ago period. The increase was primarily due to increased revenue and reduced operating costs from the year-ago period.

Production & Pricing

Total production for the fourth quarter of fiscal 2024 increased 11% to 7,209 net BOEPD compared to 6,484 net BOEPD in the year-ago period. Total production for the fourth quarter of fiscal 2024 was comprised of 2,088 barrels per day (“BOPD”) of crude oil, 3,945 BOEPD of natural gas, and 1,176 BOEPD of NGLs. The increase in total production was driven by the closing of the Company’s SCOOP/STACK acquisitions in February 2024 and production from an initial three wells in the Chaveroo oilfield in February 2024.

Average realized commodity price (excluding the impact of derivative contracts) increased 5% to approximately $32.36 per BOE compared to $30.80 per BOE in the year-ago period. Realized oil and NGL prices increased approximately 10% and 20%, respectively, over the prior year period. These increases were partially offset by a decrease of approximately 32% in realized natural gas prices compared to the year-ago period.

Operations Update

During the quarter, the Company’s operators turned-in-line 3 gross wells in the SCOOP/STACK with 10 additional gross wells in progress, and as of today, 7 of these 10 wells are currently producing. Additionally, Evolution has agreed to participate in 3 gross new horizontal wells across the acreage. Since the effective date of the acquisitions, 22 gross wells have been converted to Proved Developed Producing.

In the Chaveroo oilfield, Evolution plans to participate in fiscal 2025 for its full 50% working interest in four horizontal wells in Drilling Block 2. These operations are expected to begin in fiscal Q2 2025. The Company has preliminarily agreed to six additional horizontal wells in Drilling Block 3 that are estimated to begin in fiscal Q4 2025. The Company also purchased acreage in advance for Drilling Blocks 4 and 5, bringing the total number of Proved Undeveloped locations to 18, and expects to systematically participate in future development blocks. Future acreage costs are fixed at $36,000 per additional net horizontal well, spaced at approximately 160 gross acres per well.

Williston Basin production increased during the fiscal quarter due to a full quarter of natural gas and NGL sales from the ONEOK Grassland System, which came back online during the prior quarter.

At Delhi, production was affected during the quarter by field-wide power outages for 7 days combined with downtime from one of the CO2 recycle compressors, reducing CO2 injection volumes for most of the quarter. The compressor was replaced, and full CO2 recycling resumed in July 2024. The CO2 purchase pipeline was taken offline for preventative maintenance at the end of February 2024 and remained down through this quarter. The operator anticipates resuming CO2 purchases in the early second quarter of fiscal 2025.

Balance Sheet, Liquidity, and Capital Spending

On June 30, 2024, cash and cash equivalents totaled $6.4 million and working capital was $5.9 million. Evolution had $39.5 million of borrowings outstanding under its revolving credit facility, which was used to fund the acquisitions of SCOOP/STACK, and total liquidity of $16.9 million, including cash and cash equivalents. In fiscal Q4, Evolution paid $4.0 million in common stock dividends, repaid $3.0 million of borrowings under its revolving credit facility, and paid $2.5 million in capital expenditures.

During the quarter, the Company received cash payments totaling $5.0 million related to purchase price reductions from the SCOOP/STACK properties for net cash flows received during the period between the effective date of November 1, 2023, and the closing date.

Evolution believes its near-term capital spending requirements will be funded from cash flows from operations, current working capital, and borrowings as needed under its revolving credit facility.

Cash Dividend on Common Stock

On September 9, 2024, Evolution’s Board of Directors declared a cash dividend of $0.12 per share of common stock, which will be paid on September 30, 2024, to common stockholders of record on September 20, 2024. This will be the 44th consecutive quarterly cash dividend on the Company’s common stock since December 31, 2013. To date, Evolution has returned approximately $118.4 million, or $3.57 per share, back to stockholders in common stock dividends.

Conference Call

As previously announced, Evolution Petroleum will host a conference call on Wednesday, September 11, 2024, at 10:00 a.m. Central Time to review its fiscal year-end 2024 financial and operating results. To join by phone, please dial (844) 481-2813 (Toll-free) or (412) 317-0677 (International) and ask to join the Evolution Petroleum Corporation call. To join online, click the following link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=782c79My. A webcast replay will be available through September 11, 2025, via the webcast link above and on Evolution’s website at www.ir.evolutionpetroleum.com.

About Evolution Petroleum

Evolution Petroleum Corporation is an independent energy company focused on maximizing total shareholder returns through the ownership of and investment in onshore oil and natural gas properties in the U.S. The Company aims to build and maintain a diversified portfolio of long-life oil and natural gas properties through acquisitions, selective development opportunities, production enhancements, and other exploitation efforts. Properties include non-operated interests in the following areas: the SCOOP/STACK plays of the Anadarko Basin in Oklahoma; the Chaveroo Oilfield located in Chaves and Roosevelt Counties, New Mexico; the Jonah Field in Sublette County, Wyoming; the Williston Basin in North Dakota; the Barnett Shale located in North Texas; the Hamilton Dome Field located in Hot Springs County, Wyoming; the Delhi Holt-Bryant Unit in the Delhi Field in Northeast Louisiana; as well as small overriding royalty interests in four onshore Texas wells. Visit www.evolutionpetroleum.com for more information.

Cautionary Statement

All forward-looking statements contained in this press release regarding the Company’s current expectations, potential results, and future plans and objectives involve a wide range of risks and uncertainties. Statements herein using words such as “believe,” “expect,” “plans,” “outlook,” “should,” “will,” and words of similar meaning are forward-looking statements. Although the Company’s expectations are based on business, engineering, geological, financial, and operating assumptions that it believes to be reasonable, many factors could cause actual results to differ materially from its expectations. The Company gives no assurance that its goals will be achieved. These factors and others are detailed under the heading “Risk Factors” and elsewhere in our periodic reports filed with the Securities and Exchange Commission (“SEC”). The Company undertakes no obligation to update any forward-looking statement.

Our proved reserves as of June 30, 2024, were estimated by Netherland, Sewell & Associates, Inc., DeGolyer & MacNaughton, and Cawley, Gillespie and Associates, Inc., all worldwide petroleum consultants. All reserve estimates are continually subject to revisions based on production history, results of additional exploration and development, price changes, and other factors. Drilling locations are based on the Company’s internal estimates, which may prove incorrect, and actual locations drilled and quantities that may be ultimately recovered may differ substantially from these estimates. Factors affecting the scope of our drilling program will be directly affected by the decisions of the operators of our properties, availability of capital, drilling and production costs, availability of drilling and completion services and equipment, drilling results, agreement terminations, regulatory approvals and actual drilling results, including geological and mechanical factors affecting recovery rates. Estimates of reserves may change significantly as development of our oil and gas properties provides additional data.

Contact

Investor Relations

(713) 935-0122

ir@evolutionpetroleum.com

Evolution Petroleum Corporation

Proved Reserves as of June 30, 2024

Our proved reserves as of June 30, 2024, were estimated by our independent reservoir engineers, Netherland, Sewell & Associates, Inc., DeGolyer and MacNaughton and Cawley, Gillespie and Associates, Inc., all worldwide petroleum consultants.

The SEC sets rules related to reserve estimation and disclosure requirements for oil and natural gas companies. These rules require disclosure of oil and natural gas proved reserves by significant geographic area, using the trailing 12-month average price, calculated as the unweighted arithmetic average of the first-day-of-the-month price for each month within the 12-month period prior to the end of the reporting period, rather than year-end prices, and allows the use of new technologies in the determination of proved reserves if those technologies have been demonstrated empirically to lead to reliable conclusions about reserve volumes. Subject to limited exceptions, the rules also require that proved undeveloped reserves may only be classified as such if a development plan has been adopted indicating that they are scheduled to be drilled within five years.

| Oil | Natural Gas | NGLs | Total Proved Reserves | |||||

| Reserve Category | (MBbls) | (MMcf) | (MBbls) | (MBOE) | ||||

| Proved Developed Producing | 7,746 | 66,627 | 5,065 | 23,917 | ||||

| Proved Non-Producing | 108 | 33 | 9 | 123 | ||||

| Proved Undeveloped | 3,956 | 11,249 | 1,914 | 7,745 | ||||

| Total Proved | 11,810 | 77,909 | 6,988 | 31,785 |

| Oil | Natural Gas | NGLs | Total Proved Reserves | |||||

| Asset | (MBbls) | (MMcf) | (MBbls) | (MBOE) | ||||

| SCOOP/STACK | 1,277 | 12,314 | 787 | 4,116 | ||||

| Chaveroo Field | 2,218 | 636 | 137 | 2,461 | ||||

| Jonah Field | 239 | 25,113 | 318 | 4,744 | ||||

| Williston Basin | 2,798 | 7,135 | 1,653 | 5,640 | ||||

| Barnett Shale | 78 | 32,711 | 2,452 | 7,983 | ||||

| Hamilton Dome Field | 2,182 | — | — | 2,182 | ||||

| Delhi Field | 3,018 | — | 1,641 | 4,659 | ||||

| Total Proved | 11,810 | 77,909 | 6,988 | 31,785 |

| Evolution Petroleum Corporation | |||||||||||||||||||

| Condensed Consolidated Statements of Operations (Unaudited) | |||||||||||||||||||

| (In thousands, except per share amounts) | |||||||||||||||||||

| Three Months Ended | Years Ended | ||||||||||||||||||

| June 30, | March 31, | June 30, | |||||||||||||||||

| 2024 | 2023 | 2024 | 2024 | 2023 | |||||||||||||||

| Revenues | |||||||||||||||||||

| Crude oil | $ | 14,533 | $ | 10,982 | $ | 14,538 | $ | 53,446 | $ | 51,044 | |||||||||

| Natural gas | 3,582 | 4,984 | 5,860 | 21,525 | 63,800 | ||||||||||||||

| Natural gas liquids | 3,112 | 2,208 | 2,627 | 10,906 | 13,670 | ||||||||||||||

| Total revenues | 21,227 | 18,174 | 23,025 | 85,877 | 128,514 | ||||||||||||||

| Operating costs | |||||||||||||||||||

| Lease operating costs | 11,408 | 11,818 | 12,624 | 48,273 | 59,545 | ||||||||||||||

| Depletion, depreciation, and accretion | 5,302 | 3,834 | 5,900 | 20,062 | 14,273 | ||||||||||||||

| General and administrative expenses | 2,114 | 2,263 | 2,417 | 9,636 | 9,583 | ||||||||||||||

| Total operating costs | 18,824 | 17,915 | 20,941 | 77,971 | 83,401 | ||||||||||||||

| Income (loss) from operations | 2,403 | 259 | 2,084 | 7,906 | 45,113 | ||||||||||||||

| Other income (expense) | |||||||||||||||||||

| Net gain (loss) on derivative contracts | (109 | ) | — | (1,183 | ) | (1,292 | ) | 513 | |||||||||||

| Interest and other income | 59 | 95 | 63 | 342 | 121 | ||||||||||||||

| Interest expense | (875 | ) | (54 | ) | (518 | ) | (1,459 | ) | (458 | ) | |||||||||

| Income (loss) before income taxes | 1,478 | 300 | 446 | 5,497 | 45,289 | ||||||||||||||

| Income tax (expense) benefit | (243 | ) | (134 | ) | (157 | ) | (1,417 | ) | (10,072 | ) | |||||||||

| Net income (loss) | $ | 1,235 | $ | 166 | $ | 289 | $ | 4,080 | $ | 35,217 | |||||||||

| Net income (loss) per common share: | |||||||||||||||||||

| Basic | $ | 0.04 | $ | — | $ | 0.01 | $ | 0.12 | $ | 1.05 | |||||||||

| Diluted | $ | 0.04 | $ | — | $ | 0.01 | $ | 0.12 | $ | 1.04 | |||||||||

| Weighted average number of common shares outstanding: | |||||||||||||||||||

| Basic | 32,679 | 32,618 | 32,702 | 32,691 | 32,985 | ||||||||||||||

| Diluted | 32,835 | 32,891 | 32,854 | 32,901 | 33,190 | ||||||||||||||

| Evolution Petroleum Corporation | |||||

| Condensed Consolidated Balance Sheets (Unaudited) | |||||

| (In thousands, except share and per share amounts) | |||||

| June 30, 2024 | June 30, 2023 | ||||

| Assets | |||||

| Current assets | |||||

| Cash and cash equivalents | $ | 6,446 | $ | 11,034 | |

| Receivables from crude oil, natural gas, and natural gas liquids revenues | 10,826 | 7,884 | |||

| Derivative contract assets | 596 | — | |||

| Prepaid expenses and other current assets | 3,855 | 2,277 | |||

| Total current assets | 21,723 | 21,195 | |||

| Property and equipment, net of depletion, depreciation, and impairment | |||||

| Oil and natural gas properties, net—full-cost method of accounting, of | |||||

| which none were excluded from amortization | 139,685 | 105,781 | |||

| Other noncurrent assets | |||||

| Derivative contract assets | 171 | — | |||

| Other assets | 1,298 | 1,341 | |||

| Total assets | $ | 162,877 | $ | 128,317 | |

| Liabilities and Stockholders’ Equity | |||||

| Current liabilities | |||||

| Accounts payable | $ | 8,308 | $ | 5,891 | |

| Accrued liabilities and other | 6,239 | 6,027 | |||

| Derivative contract liabilities | 1,192 | — | |||

| State and federal taxes payable | 74 | 365 | |||

| Total current liabilities | 15,813 | 12,283 | |||

| Long term liabilities | |||||

| Senior secured credit facility | 39,500 | — | |||

| Deferred income taxes | 6,702 | 6,803 | |||

| Asset retirement obligations | 19,209 | 17,012 | |||

| Derivative contract liabilities | 468 | — | |||

| Operating lease liability | 58 | 125 | |||

| Total liabilities | 81,750 | 36,223 | |||

| Commitments and contingencies | |||||

| Stockholders’ equity | |||||

| Common stock; par value $0.001; 100,000,000 shares authorized: issued and | |||||

| outstanding 33,339,535 and 33,247,523 shares as of June 30, 2024 | |||||

| and 2023, respectively | 33 | 33 | |||

| Additional paid-in capital | 41,091 | 40,098 | |||

| Retained earnings | 40,003 | 51,963 | |||

| Total stockholders’ equity | 81,127 | 92,094 | |||

| Total liabilities and stockholders’ equity | $ | 162,877 | $ | 128,317 | |

| Evolution Petroleum Corporation | |||||||||||||||||||

| Condensed Consolidated Statements of Cash Flows (Unaudited) | |||||||||||||||||||

| (In thousands) | |||||||||||||||||||

| Three Months Ended | Years Ended | ||||||||||||||||||

| June 30, | March 31, | June 30, | |||||||||||||||||

| 2024 | 2023 | 2024 | 2024 | 2023 | |||||||||||||||

| Cash flows from operating activities: | |||||||||||||||||||

| Net income (loss) | $ | 1,235 | $ | 166 | $ | 289 | $ | 4,080 | $ | 35,217 | |||||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||||||||||||||

| Depletion, depreciation, and accretion | 5,302 | 3,834 | 5,900 | 20,062 | 14,273 | ||||||||||||||

| Stock-based compensation | 552 | 484 | 549 | 2,137 | 1,639 | ||||||||||||||

| Settlement of asset retirement obligations | (1 | ) | (55 | ) | (19 | ) | (20 | ) | (174 | ) | |||||||||

| Deferred income taxes | (225 | ) | (196 | ) | 766 | (101 | ) | (296 | ) | ||||||||||

| Unrealized (gain) loss on derivative contracts | (170 | ) | — | 1,063 | 893 | (1,994 | ) | ||||||||||||

| Accrued settlements on derivative contracts | (27 | ) | 211 | 94 | 67 | (919 | ) | ||||||||||||

| Other | — | (1 | ) | (3 | ) | — | (4 | ) | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||||||||||

| Receivables from crude oil, natural gas, and natural gas liquids revenues | 1,824 | 1,958 | (2,495 | ) | (2,910 | ) | 18,441 | ||||||||||||

| Prepaid expenses and other current assets | (137 | ) | 288 | (1,151 | ) | (1,562 | ) | (692 | ) | ||||||||||

| Accounts payable and accrued liabilities and other | (440 | ) | (5,343 | ) | (1,629 | ) | 374 | (13,489 | ) | ||||||||||

| State and federal taxes payable | 74 | (1,793 | ) | — | (291 | ) | (730 | ) | |||||||||||

| Net cash provided by operating activities | 7,987 | (447 | ) | 3,364 | 22,729 | 51,272 | |||||||||||||

| Cash flows from investing activities: | |||||||||||||||||||

| Acquisition of oil and natural gas properties | 5,054 | — | (43,788 | ) | (38,734 | ) | (31 | ) | |||||||||||

| Capital expenditures for oil and natural gas properties | (2,546 | ) | (2,727 | ) | (2,648 | ) | (10,899 | ) | (6,961 | ) | |||||||||

| Net cash used in investing activities | 2,508 | (2,727 | ) | (46,436 | ) | (49,633 | ) | (6,992 | ) | ||||||||||

| Cash flows from financing activities: | |||||||||||||||||||

| Common stock dividends paid | (4,003 | ) | (3,992 | ) | (4,003 | ) | (16,040 | ) | (16,106 | ) | |||||||||

| Common stock repurchases, including stock surrendered for tax withholding | (113 | ) | (187 | ) | (818 | ) | (1,144 | ) | (4,170 | ) | |||||||||

| Borrowings under senior secured credit facility | — | — | 42,500 | 42,500 | — | ||||||||||||||

| Repayments of senior secured credit facility | (3,000 | ) | — | — | (3,000 | ) | (21,250 | ) | |||||||||||

| Net cash provided by (used in) financing activities | (7,116 | ) | (4,179 | ) | 37,679 | 22,316 | (41,526 | ) | |||||||||||

| Net increase (decrease) in cash and cash equivalents | 3,379 | (7,353 | ) | (5,393 | ) | (4,588 | ) | 2,754 | |||||||||||

| Cash and cash equivalents, beginning of period | 3,067 | 18,387 | 8,460 | 11,034 | 8,280 | ||||||||||||||

| Cash and cash equivalents, end of period | $ | 6,446 | $ | 11,034 | $ | 3,067 | $ | 6,446 | $ | 11,034 | |||||||||

Evolution Petroleum Corporation

Non-GAAP Reconciliation – Adjusted EBITDA (Unaudited)

(In thousands)

Adjusted EBITDA and Net income (loss) and earnings per share excluding selected items are non-GAAP financial measures that are used as supplemental financial measures by our management and by external users of our financial statements, such as investors, commercial banks, and others, to assess our operating performance as compared to that of other companies in our industry, without regard to financing methods, capital structure, or historical costs basis. We use these measures to assess our ability to incur and service debt and fund capital expenditures. Our Adjusted EBITDA and Net income (loss) and earnings per share, excluding selected items, should not be considered alternatives to net income (loss), operating income (loss), cash flows provided by (used in) operating activities, or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. Our Adjusted EBITDA and Net income (loss) and earnings per share excluding selected items may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDA and Net income (loss) and earnings per share excluding selected items in the same manner.

We define Adjusted EBITDA as net income (loss) plus interest expense, income tax expense (benefit), depreciation, depletion, and accretion (DD&A), stock-based compensation, ceiling test impairment, and other impairments, unrealized loss (gain) on change in fair value of derivatives, and other non-recurring or non-cash expense (income) items.

| Three Months Ended | Years Ended | |||||||||||||||

| June 30, | March 31, | June 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2024 | 2023 | ||||||||||||

| Net income (loss) | $ | 1,235 | $ | 166 | $ | 289 | $ | 4,080 | $ | 35,217 | ||||||

| Adjusted by: | ||||||||||||||||

| Interest expense | 875 | 54 | 518 | 1,459 | 458 | |||||||||||

| Income tax expense (benefit) | 243 | 134 | 157 | 1,417 | 10,072 | |||||||||||

| Depletion, depreciation, and accretion | 5,302 | 3,834 | 5,900 | 20,062 | 14,273 | |||||||||||

| Stock-based compensation | 552 | 484 | 549 | 2,137 | 1,639 | |||||||||||

| Unrealized loss (gain) on derivative contracts | (170 | ) | — | 1,063 | 893 | (1,994 | ) | |||||||||

| Severance | — | — | — | — | 74 | |||||||||||

| Transaction costs | — | — | — | — | 345 | |||||||||||

| Adjusted EBITDA | $ | 8,037 | $ | 4,672 | $ | 8,476 | $ | 30,048 | $ | 60,084 | ||||||

| Evolution Petroleum Corporation | |||||||||||||||||||

| Non-GAAP Reconciliation – Adjusted Net Income (Unaudited) | |||||||||||||||||||

| (In thousands, except per share amounts) | |||||||||||||||||||

| Three Months Ended | Years Ended | ||||||||||||||||||

| June 30, | March 31, | June 30, | |||||||||||||||||

| 2024 | 2023 | 2024 | 2024 | 2023 | |||||||||||||||

| As Reported: | |||||||||||||||||||

| Net income (loss), as reported | $ | 1,235 | $ | 166 | $ | 289 | $ | 4,080 | $ | 35,217 | |||||||||

| Impact of Selected Items: | |||||||||||||||||||

| Unrealized loss (gain) on commodity contracts | (170 | ) | — | 1,063 | 893 | (1,994 | ) | ||||||||||||

| Severance | — | — | — | — | 74 | ||||||||||||||

| Transaction costs | — | — | — | — | 345 | ||||||||||||||

| Selected items, before income taxes | $ | (170 | ) | $ | — | $ | 1,063 | $ | 893 | $ | (1,575 | ) | |||||||

| Income tax effect of selected items(1) | (28 | ) | — | 374 | 230 | (350 | ) | ||||||||||||

| Selected items, net of tax | $ | (142 | ) | $ | — | $ | 689 | $ | 663 | $ | (1,225 | ) | |||||||

| As Adjusted: | |||||||||||||||||||

| Net income (loss), excluding selected items(2) | $ | 1,093 | $ | 166 | $ | 978 | $ | 4,743 | $ | 33,992 | |||||||||

| Undistributed earnings allocated to unvested restricted stock | (22 | ) | (3 | ) | (21 | ) | (96 | ) | (540 | ) | |||||||||

| Net income (loss), excluding selected items for earnings per share calculation | $ | 1,071 | $ | 163 | $ | 957 | $ | 4,647 | $ | 33,452 | |||||||||

| Net income (loss) per common share — Basic, as reported | $ | 0.04 | $ | — | $ | 0.01 | $ | 0.12 | $ | 1.05 | |||||||||

| Impact of selected items | (0.01 | ) | — | 0.02 | 0.02 | (0.04 | ) | ||||||||||||

| Net income (loss) per common share — Basic, excluding selected items(2) | $ | 0.03 | $ | — | $ | 0.03 | $ | 0.14 | $ | 1.01 | |||||||||

| Net income (loss) per common share — Diluted, as reported | $ | 0.04 | $ | — | $ | 0.01 | $ | 0.12 | $ | 1.04 | |||||||||

| Impact of selected items | (0.01 | ) | — | 0.02 | 0.02 | (0.03 | ) | ||||||||||||

| Net income (loss) per common share — Diluted, excluding selected items(2)(3) | $ | 0.03 | $ | — | $ | 0.03 | $ | 0.14 | $ | 1.01 | |||||||||

_____________________________

(1) The tax impact for the three months ended June 30, 2024 and March 31, 2024, is represented using estimated tax rates of 16.4% and 35.2%, respectively. The tax impact for years ended June 30, 2024, and 2023, is represented using estimated tax rates of 25.8% and 22.2%, respectively.

(2) Net income (loss) and earnings per share excluding selected items are non-GAAP financial measures presented as supplemental financial measures to enable a user of the financial information to understand the impact of these items on reported results. These financial measures should not be considered an alternative to net income (loss), operating income (loss), cash flows provided by (used in) operating activities, or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. Our Adjusted Net Income (Loss) and earnings per share may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted Net Income (Loss) and earnings per share in the same manner.

(3) The impact of selected items for the three months ended June 30, 2024, and 2023 was calculated based upon weighted average diluted shares of 32.8 million and 32.9 million, respectively, due to the net income (loss), excluding selected items. The impact of selected items for the three months ended March 31, 2024, was calculated based upon weighted average diluted shares of 32.9 million due to the net income (loss), excluding selected items. The impact of selected items for the years ended June 30, 2024, and 2023 was calculated based upon weighted average diluted shares of 32.9 million and 33.2 million, respectively, due to the net income (loss), excluding selected items.

| Evolution Petroleum Corporation | ||||||||||||||

| Supplemental Information on Oil and Natural Gas Operations (Unaudited) | ||||||||||||||

| (In thousands, except per unit and per BOE amounts) | ||||||||||||||

| Three Months Ended | Years Ended | |||||||||||||

| June 30, | March 31, | June 30, | ||||||||||||

| 2024 | 2023 | 2024 | 2024 | 2023 | ||||||||||

| Revenues: | ||||||||||||||

| Crude oil | $ | 14,533 | $ | 10,982 | $ | 14,538 | $ | 53,446 | $ | 51,044 | ||||

| Natural gas | 3,582 | 4,984 | 5,860 | 21,525 | 63,800 | |||||||||

| Natural gas liquids | 3,112 | 2,208 | 2,627 | 10,906 | 13,670 | |||||||||

| Total revenues | $ | 21,227 | $ | 18,174 | $ | 23,025 | $ | 85,877 | $ | 128,514 | ||||

| Lease operating costs: | ||||||||||||||

| CO2costs | $ | 1 | $ | 1,348 | $ | 1,035 | $ | 4,242 | $ | 7,375 | ||||

| Ad valorem and production taxes | 1,273 | 1,158 | 1,458 | 5,281 | 8,158 | |||||||||

| Other lease operating costs | 10,134 | 9,312 | 10,131 | 38,750 | 44,012 | |||||||||

| Total lease operating costs | $ | 11,408 | $ | 11,818 | $ | 12,624 | $ | 48,273 | $ | 59,545 | ||||

| Depletion of full cost proved oil and natural gas properties | $ | 4,925 | $ | 3,544 | $ | 5,532 | $ | 18,605 | $ | 13,142 | ||||

| Production: | ||||||||||||||

| Crude oil (MBBL) | 190 | 158 | 199 | 709 | 659 | |||||||||

| Natural gas (MMCF) | 2,152 | 2,044 | 2,115 | 8,243 | 9,109 | |||||||||

| Natural gas liquids (MBBL) | 107 | 91 | 104 | 402 | 416 | |||||||||

| Equivalent (MBOE)(1) | 656 | 590 | 656 | 2,485 | 2,593 | |||||||||

| Average daily production (BOEPD)(1) | 7,209 | 6,484 | 7,209 | 6,790 | 7,104 | |||||||||

| Average price per unit(2): | ||||||||||||||

| Crude oil (BBL) | $ | 76.49 | $ | 69.51 | $ | 73.06 | $ | 75.38 | $ | 77.46 | ||||

| Natural gas (MCF) | 1.66 | 2.44 | 2.77 | 2.61 | 7.00 | |||||||||

| Natural Gas Liquids (BBL) | 29.08 | 24.26 | 25.26 | 27.13 | 32.86 | |||||||||

| Equivalent (BOE)(1) | $ | 32.36 | $ | 30.80 | $ | 35.10 | $ | 34.56 | $ | 49.56 | ||||

| Average cost per unit: | ||||||||||||||

| CO2costs | $ | — | $ | 2.28 | $ | 1.58 | $ | 1.71 | $ | 2.84 | ||||

| Ad valorem and production taxes | 1.94 | 1.96 | 2.22 | 2.13 | 3.15 | |||||||||

| Other lease operating costs | 15.45 | 15.78 | 15.44 | 15.59 | 16.97 | |||||||||

| Total lease operating costs | $ | 17.39 | $ | 20.02 | $ | 19.24 | $ | 19.43 | $ | 22.96 | ||||

| Depletion of full cost proved oil and natural gas properties | $ | 7.51 | $ | 6.01 | $ | 8.43 | $ | 7.49 | $ | 5.07 | ||||

| CO2costs per MCF | $ | 0.87 | $ | 0.91 | $ | 0.92 | $ | 0.97 | $ | 0.99 | ||||

| CO2volumes (MMCF per day, gross) | 0.1 | 68.2 | 52.1 | 50.3 | 85.2 | |||||||||

_____________________________

(1) Equivalent oil reserves are defined as six MCF of natural gas and 42 gallons of NGLs to one barrel of oil conversion ratio which reflects energy equivalence and not price equivalence. Natural gas prices per MCF and NGL prices per barrel often differ significantly from the equivalent amount of oil.

(2) Amounts exclude the impact of cash paid or received on the settlement of derivative contracts since we did not elect to apply hedge accounting.

| Evolution Petroleum Corporation | |||||||||||||||||

| Summary of Production Volumes, Average Sales Price, and Average Production Costs (Unaudited) | |||||||||||||||||

| Three Months Ended | |||||||||||||||||

| June 30, | March 31, | ||||||||||||||||

| 2024 | 2023 | 2024 | |||||||||||||||

| Volume | Price | Volume | Price | Volume | Price | ||||||||||||

| Production: | |||||||||||||||||

| Crude oil (MBBL) | |||||||||||||||||

| SCOOP/STACK | 41 | $ | 80.55 | — | $ | — | 30 | $ | 78.71 | ||||||||

| Chaveroo Field | 12 | 79.82 | — | — | 15 | 76.39 | |||||||||||

| Jonah Field | 8 | 72.14 | 9 | 77.87 | 8 | 72.25 | |||||||||||

| Williston Basin | 35 | 74.20 | 34 | 70.31 | 35 | 70.29 | |||||||||||

| Barnett Shale | 2 | 75.70 | 3 | 69.37 | 3 | 73.05 | |||||||||||

| Hamilton Dome Field | 35 | 67.85 | 37 | 60.53 | 35 | 61.21 | |||||||||||

| Delhi Field | 57 | 80.46 | 74 | 73.01 | 73 | 77.08 | |||||||||||

| Other | — | — | 1 | 75.07 | — | — | |||||||||||

| Total | 190 | $ | 76.49 | 158 | $ | 69.51 | 199 | $ | 73.06 | ||||||||

| Natural gas (MMCF) | |||||||||||||||||

| SCOOP/STACK | 319 | $ | 2.70 | — | $ | — | 214 | $ | 2.11 | ||||||||

| Chaveroo Field | 5 | 2.02 | — | — | 7 | 2.29 | |||||||||||

| Jonah Field | 818 | 1.59 | 881 | 3.16 | 843 | 3.94 | |||||||||||

| Williston Basin | 31 | 1.65 | 23 | 2.99 | 20 | 1.36 | |||||||||||

| Barnett Shale | 979 | 1.39 | 1,140 | 1.87 | 1,031 | 1.98 | |||||||||||

| Total | 2,152 | $ | 1.66 | 2,044 | $ | 2.44 | 2,115 | $ | 2.77 | ||||||||

| Natural gas liquids (MBBL) | |||||||||||||||||

| SCOOP/STACK | 20 | $ | 22.16 | — | $ | — | 10 | $ | 25.14 | ||||||||

| Chaveroo Field | — | — | — | — | 1 | 22.86 | |||||||||||

| Jonah Field | 8 | 30.35 | 9 | 25.80 | 9 | 31.93 | |||||||||||

| Williston Basin | 8 | 23.94 | 5 | 15.00 | 4 | 23.96 | |||||||||||

| Barnett Shale | 54 | 31.29 | 61 | 24.52 | 59 | 22.85 | |||||||||||

| Delhi Field | 17 | 31.83 | 16 | 24.65 | 20 | 30.48 | |||||||||||

| Other | — | — | — | — | 1 | 25.87 | |||||||||||

| Total | 107 | $ | 29.08 | 91 | $ | 24.26 | 104 | $ | 25.26 | ||||||||

| Equivalent (MBOE)(1) | |||||||||||||||||

| SCOOP/STACK | 115 | $ | 40.29 | — | $ | — | 76 | $ | 40.56 | ||||||||

| Chaveroo Field | 13 | 77.49 | — | — | 17 | 68.40 | |||||||||||

| Jonah Field | 152 | 13.98 | 165 | 22.60 | 158 | 26.72 | |||||||||||

| Williston Basin | 48 | 59.33 | 43 | 59.57 | 42 | 61.15 | |||||||||||

| Barnett Shale | 219 | 14.86 | 254 | 15.15 | 234 | 15.41 | |||||||||||

| Hamilton Dome Field | 35 | 67.85 | 37 | 60.53 | 35 | 61.21 | |||||||||||

| Delhi Field | 74 | 69.34 | 90 | 64.69 | 93 | 67.21 | |||||||||||

| Other | — | — | 1 | 75.07 | 1 | 25.87 | |||||||||||

| Total | 656 | $ | 32.36 | 590 | $ | 30.80 | 656 | $ | 35.10 | ||||||||

| Average daily production (BOEPD)(1) | |||||||||||||||||

| SCOOP/STACK | 1,264 | — | 835 | ||||||||||||||

| Chaveroo Field | 143 | — | 187 | ||||||||||||||

| Jonah Field | 1,670 | 1,813 | 1,736 | ||||||||||||||

| Williston Basin | 527 | 473 | 462 | ||||||||||||||

| Barnett Shale | 2,407 | 2,791 | 2,571 | ||||||||||||||

| Hamilton Dome Field | 385 | 407 | 385 | ||||||||||||||

| Delhi Field | 813 | 989 | 1,022 | ||||||||||||||

| Other | — | 11 | 11 | ||||||||||||||

| Total | 7,209 | 6,484 | 7,209 | ||||||||||||||

_____________________________

(1) Equivalent oil reserves are defined as six MCF of natural gas and 42 gallons of NGLs to one barrel of oil conversion ratio which reflects energy equivalence and not price equivalence. Natural gas prices per MCF and NGL prices per barrel often differ significantly from the equivalent amount of oil.

| Evolution Petroleum Corporation | |||||||||||||||||

| Summary of Average Production Costs (Unaudited) | |||||||||||||||||

| Three Months Ended | |||||||||||||||||

| June 30, | March 31, | ||||||||||||||||

| Production costs (in thousands, except per BOE): | 2024 | 2023 | 2024 | ||||||||||||||

| Lease operating costs | Amount | per BOE | Amount | per BOE | Amount | per BOE | |||||||||||

| SCOOP/STACK | $ | 1,028 | $ | 9.06 | $ | — | $ | — | $ | 619 | $ | 8.18 | |||||

| Chaveroo Field | 301 | 24.42 | — | — | 161 | 9.12 | |||||||||||

| Jonah Field | 1,834 | 11.99 | 2,218 | 13.45 | 2,313 | 14.63 | |||||||||||

| Williston Basin | 1,227 | 25.53 | 1,149 | 26.83 | 1,413 | 33.69 | |||||||||||

| Barnett Shale | 3,853 | 17.47 | 3,902 | 15.28 | 3,767 | 16.07 | |||||||||||

| Hamilton Dome Field | 1,415 | 40.40 | 1,417 | 38.76 | 1,566 | 45.34 | |||||||||||

| Delhi Field | 1,750 | 23.96 | 3,132 | 35.06 | 2,785 | 30.19 | |||||||||||

| Total | $ | 11,408 | $ | 17.39 | $ | 11,818 | $ | 20.02 | $ | 12,624 | $ | 19.24 | |||||

This press release was published by a CLEAR® Verified individual.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will The DEA Complete Cannabis Rescheduling? Hear From Experts The Day After Harris-Trump Debate

One day after the September Tuesday’s presidential debate, industry experts will break down the cannabis rescheduling process, a crucial issue for investors. Equity research firm Z&A is hosting a webinar on Wednesday at 4:20 PM ET to provide insights into the upcoming regulatory shifts and market implications.

Get Benzinga’s exclusive analysis and top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

DEA’s Rescheduling Process

The conversation comes at a pivotal moment following the end of the public comment period for the DEA to reschedule cannabis from Schedule I to Schedule III. Proposed by the Department of Justice on May 21 2024, the move was met with positive responses, as 75.9% of over 4,000 public comments analyzed by Benzinga Cannabis showed support for rescheduling, mainly due to the medical benefits and alignment with state laws.

DEA Rescheduling Delay

On August 27, 2024, the DEA announced a delay in its final ruling until after the November election.

This triggered sharp declines in cannabis stocks, with the AdvisorShares Pure US Cannabis ETF MSOS dropping over 10%. Major players like Curaleaf Holdings CURLF, Cresco Labs CRLBF, and Cansortium CNTMF saw stock prices plunge by as much as 16%.

Investor’s Angle: Upcoming Panel Post-Debate Chaos

If cannabis is reclassified, the industry could see significant changes such as tax reforms, enhanced research opportunities and the development of new regulatory frameworks.

This is where the insights from experts like Kelly Fair and Morgan Fox become crucial. Fair, a partner at Dentons, specializes in regulatory compliance and corporate governance within the cannabis sector. With nearly two decades of experience, she will provide in-depth perspectives on the technical aspects of the rescheduling process, the role of the DEA and possible legal outcomes.

Meanwhile, Fox, the political director at NORML, will focus on the political landscape. With over 15 years of experience in cannabis policy reform, Fox will explain why descheduling remains the ultimate goal and how rescheduling fits into the bigger picture of cannabis reform.

Co-hosted by senior analyst Pablo Zuanic from Zuanic & Associates, and Anthony Coniglio, CEO of NewLake Capital Partners NLCP, the panel promises to shed light on the future of cannabis regulation, particularly in light of the September 10th presidential debate.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

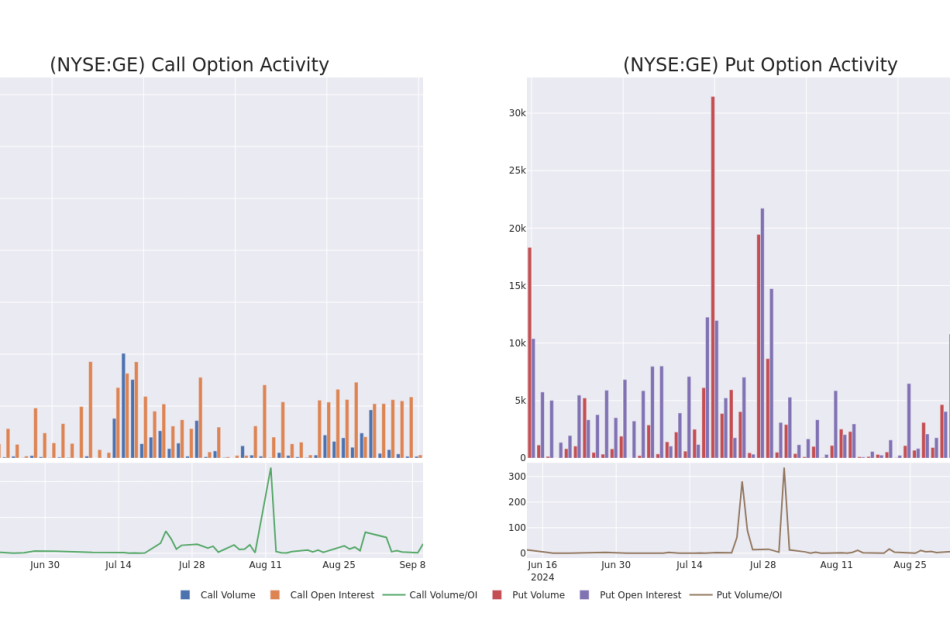

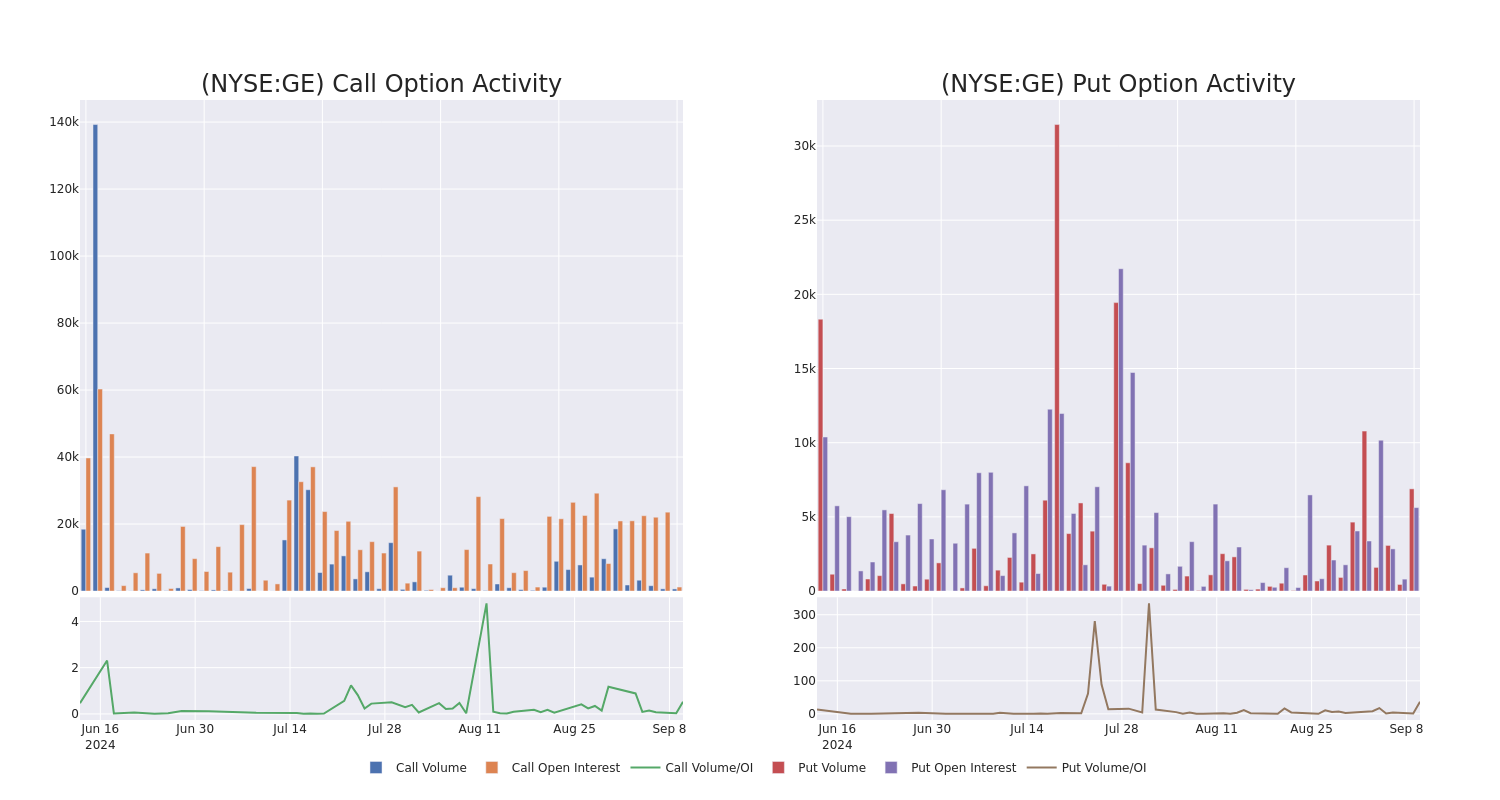

Market Whales and Their Recent Bets on GE Aero Options

Deep-pocketed investors have adopted a bullish approach towards GE Aero GE, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 31 extraordinary options activities for GE Aero. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 51% leaning bullish and 35% bearish. Among these notable options, 29 are puts, totaling $2,018,900, and 2 are calls, amounting to $224,000.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $160.0 and $185.0 for GE Aero, spanning the last three months.

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GE Aero’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GE Aero’s substantial trades, within a strike price spectrum from $160.0 to $185.0 over the preceding 30 days.

GE Aero Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | PUT | SWEEP | BEARISH | 12/20/24 | $12.5 | $12.45 | $12.5 | $170.00 | $366.2K | 899 | 764 |

| GE | CALL | TRADE | BULLISH | 11/15/24 | $3.2 | $2.92 | $3.2 | $185.00 | $192.0K | 778 | 607 |

| GE | PUT | SWEEP | BEARISH | 11/15/24 | $9.15 | $9.1 | $9.15 | $165.00 | $173.8K | 3.8K | 211 |

| GE | PUT | TRADE | BULLISH | 12/20/24 | $12.45 | $12.4 | $12.4 | $170.00 | $101.6K | 899 | 571 |

| GE | PUT | SWEEP | BEARISH | 11/15/24 | $13.9 | $13.5 | $13.9 | $175.00 | $76.4K | 323 | 125 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

Following our analysis of the options activities associated with GE Aero, we pivot to a closer look at the company’s own performance.

Current Position of GE Aero

- Currently trading with a volume of 3,471,300, the GE’s price is up by 0.99%, now at $166.98.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

Expert Opinions on GE Aero

In the last month, 1 experts released ratings on this stock with an average target price of $201.0.

- In a cautious move, an analyst from Bernstein downgraded its rating to Outperform, setting a price target of $201.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for GE Aero, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I Have $640k in a 401(k) – What's the Best Way to Convert to a Roth and Save on Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Converting a 401(k) to a Roth IRA can potentially provide valuable long-term benefits, but it also triggers a tax bill that you’ll need to plan for. While the taxes on a Roth conversion can’t be avoided, savers can reduce the burden through several strategies like gradual conversions and timing adjustments. Those nearing retirement can weigh whether they have enough time left to offset conversion taxes through decades of future tax-free growth.

Do you need help with a Roth conversion or other retirement planning questions? Try speaking with a financial advisor today.

Roth Conversion Mechanics

When moving savings from a traditional IRA or 401(k) to a Roth IRA, savers must pay income tax on the converted amount since this money was originally contributed pre-tax. These conversion taxes are unavoidable, so there’s no way to completely get around paying income taxes on a Roth conversion. Taxes are levied on Roth conversions as if the money were ordinary income, meaning that a large Roth conversion can trigger a large tax payment in the year of the conversion.

Despite the potential for a significant tax bill, the benefit of tax-free growth going forward may make it worthwhile. Depending on an investor’s time horizon, income sources and other factors, the upfront tax hit may pay off over the long term. (If you have additional questions concerning Roth conversions and other retirement planning topics, consider working with a financial advisor.)

Tax Strategies for Roth Conversions

How you carry out your Roth conversion can impact the taxes you’ll pay on it. One way to reduce conversion taxes is to spread the conversion over multiple years rather than all at once. By gradually converting smaller chunks, taxpayers may avoid getting bumped into higher marginal income tax brackets. Spreading a $640,000 conversion over four years, for example, may help utilize more space under lower tax brackets.

Another strategy is to time your conversions for years in which you have lower income from other sources. As with the gradual conversion strategy, this can keep your income from rising into higher tax brackets and potentially limit your tax liability.

Timing is also a key factor in another approach, but this one doesn’t look specifically at your income. Instead, it aims to convert pre-tax balances during market downturns. The idea is that when account values are depressed, you can move a larger percentage of your 401(k) into a Roth IRA without triggering as large of a tax bill. (A financial advisor can help you determine whether a Roth conversion is an appropriate strategy for your plans.)

401(k)-to-Roth Conversion in Action

Imagine you’re a 60-year-old single filer with $640,000 in a 401(k) and an annual income that places you, at the highest, in the 24% federal tax bracket in 2024. Converting the entire 401(k) this year would add $640,000 to your income, pushing you into the top 37% bracket on every dollar over $609,350.

Instead, let’s consider a gradual conversion. Converting just $128,000 of your 401(k) balance per year over five years would push every dollar over $191,950 into the next-highest bracket of 32%, helping you avoid the 35% and 37% brackets in the process. (Actual results will vary based on annual tax bracket changes and the inclusion of state-level taxes.)

Now let’s look at what might happen if you converted your 401(k) in a year when the market was down 10%. The $640,000 balance might decline an equivalent amount, falling to $576,000. While this would still put you in the top 37% bracket, taxes on the converted amount would decline quite a bit. (If you need help running projections like these, consider working with a financial advisor.)

Making the Call

Converting a 401(k) to a Roth IRA may not always be the right move. Before converting, savers should consider their retirement timeline and anticipate whether decades of future Roth growth could outweigh conversion taxes owed now.

Generally speaking, those nearing retirement may not benefit as much as someone who converted earlier in their career when they were in a lower tax bracket. It’s also key to work out projections with a financial advisor mapping out various partial conversion scenarios. This analysis can reveal the optimal pace and amounts to convert each year to maximize outcomes.

Bottom Line

Converting a 401(k) to a Roth IRA triggers unavoidable taxes, but paced-out partial conversions may reduce the burden. Converting in years when income is down or the market has declined significantly may also help lower the overall tax bill. Generally speaking, weighing time horizons and projecting tax bracket impacts can inform conversion decisions. Consulting a financial advisor can be helpful when planning major retirement account moves.

Retirement Planning Tips

-

A financial advisor can help build a long-term retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Use SmartAsset’s retirement calculator to estimate how much money you could have by the time you retire. The tool also shows you how much you may want to save every month to support your lifestyle in retirement.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Vadym Pastukh, ©iStock.com/Kameleon007, ©iStock.com/annebaek

The post I Have $640k in a 401(k). How Do I Avoid Paying Taxes When Converting to a Roth IRA? appeared first on SmartReads by SmartAsset.

Sotera Health Recent Insider Activity

It was reported on September 9, that WARBURG PINCUS CO, Board Member at Sotera Health SHC executed a significant insider sell, according to an SEC filing.

What Happened: CO’s decision to sell 15,000,000 shares of Sotera Health was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The total value of the sale is $225,450,000.

The latest market snapshot at Tuesday morning reveals Sotera Health shares down by 1.55%, trading at $16.54.

About Sotera Health